Analysis of Rules under Company Law⇒

♦ The Companies (Compromise, Arrangements and Amalgamations) Second Amendment Rules, 2020:

- The Ministry of Corporate Affairs (MCA) has vide notification dated December 17, 2020 notified the Companies (Compromise, Arrangements and Amalgamations) Second Amendment Rules, 2020.

The Companies (Compromise, Arrangements and Amalgamations) Second Amendment Rules, 2020

⇓

With effect from December 17, 2020

- Through such amendment in the Companies (Compromise, Arrangements and Amalgamations) Rules, 2016 the following clause has been inserted in Rule 2 in sub-rule (1), after clause (d);

“(e) “Corporate action” means any action taken by the company relating to transfer of shares and all the benefits accruing on such shares namely, bonus shares, split, consolidation, fraction shares and right issue to the acquirer.”

- Further, after Rule 26, the following rule shall be inserted, essence of which is as follows;

√ The Company shall within two weeks from the date of receipt of the amount equal to the price of shares to be acquired by the acquirer under Section 236 of the Act, verify the details of the minority shareholders holding shares in dematerialized form.

√ After such verification, the company shall send notice to such minority shareholders by registered post or by speed post or by courier or by e-mail about a cutoff date, which shall not be earlier than one month after the date of sending of the notice , on which the shares of minority shareholders shall be debited from their account and credited to the designated DEMAT account of the company, unless the shares are credited in the account of the acquirer, as specified in such notice, before the cut of date.

√ Copy of such notice served to the minority shareholders shall also be published simultaneously in two widely circulated newspapers in the district in which the registered office of the company is situated and also be uploaded on the website of the company, if any.

√ The company shall inform the depository immediately after publication of the notice regarding cutoff date and submit the certain declarations.

√ For the purpose of effecting transfer of shares through corporate action the Board shall authorize the Company Secretary or in his absence any other person, to inform the depository and to submit the documents as may be required.

√ Upon receipt of information, the depository shall make the transfer of shares of the minority shareholders, who have not, on their own, transferred their shares in favour of the acquirer, into the designated DEMAT account of the company in the cutoff date and intimate the company.

√ After receiving the intimation of successful transfer of shares from the depository, the company shall immediately disburse the price of the shares so transferred, to each of the minority shareholders after deducting the applicable stamp duty, which shall be paid by the company, on behalf of the minority shareholders in accordance with the provisions of the Indian Stamp Act, 1899.

√ Upon successful payment of the minority shareholder, the company shall inform the depository to transfer the shares of such shareholders, kept in the designated DEMAT account of the company, to the DEMAT Account of the acquirer.

√ In case, where there is a specific order of Court or Tribunal or Statutory authority restraining any transfer of such shares and payment of dividend, or where such shares are pledged or hypothecated under the provisions of the Depositories Act, 1996, the depository shall not transfer the shares of the minority shareholders to the designated DEMAT account of the company.

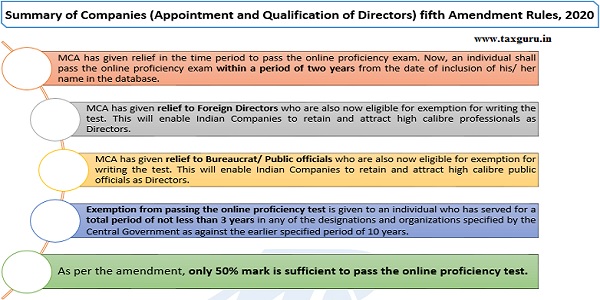

♦ The Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2020:

The Ministry of Corporate Affairs (MCA) vide its notification dated 18th December 2020 amended few provisions of the Companies (Appointment and Qualification of Directors) Rules, 2014.

Companies (Appointment and Qualification of Directors) fifth Amendment Rules, 2020

⇓

With effect from December 18, 2020

♦ The Companies (Share Capital and Debentures ) Second Amendment Rules, 2020:

-

- The Ministry of Corporate Affairs (MCA) has vide notification dated December 24, 2020 has substituted the e-form Form SH 7 where in column no. 3 of e-form SH-7 one more purpose has been added i.e. “Cancellation of unissued shares of one class and increase in shares of another class”.

Companies (Share Capital and Debentures) Second Amendment Rules, 2020

⇓

With effect from December 24, 2020

♦ The Companies (Incorporation) Third Amendment Rules, 2020:

- The Ministry of Corporate Affairs (MCA) vide its notification dated 24th December 2020 amended few provisions of the Companies (Incorporation) Rules, 2014.

Companies (Incorporation) Third Amendment Rules, 2020

⇓

With effect from December 24, 2020

The Ministry of Corporate Affairs (MCA) has given following relaxation to use reserved name upto 60 days from approval of name instead of 20 days from approval of name by payment of specific fees.

| SR. NO. | NO. OF DAYS | FEES | CONDITION |

| 1. | 40 days from the date of approval of name | Rs.1,000 | Payment required to be made before expiry of 20 days from approval of name. |

| 2. | 60 days from the date of approval of name | Rs.2,000 | Payment required to be made before expiry of 40 days from approval of name. |

| 3. | 60 days from the date of approval | Rs.3,000 | Payment required to be made before expiry of 20 days from approval of name. |

♦ The Companies (Meetings of Board and its Powers) Fourth Amendment Rules, 2020:

- The Ministry of Corporate Affairs (MCA) vide its notification dated 30th December 2020 amended the provisions of the Companies (Meetings of Board and its Powers) Rules, 2014.

Companies (Meetings of Board and its Powers) Fourth Amendment Rules, 2020

⇓

With effect from December 30, 2020

- The amendments are made in Rule 4(2) related to “matters that should not be dealt through video conferencing or other audio-visual” in the Companies (Meeting of Boards and its Powers) Rules, 2014:

“For the period beginning from the commencement of the Companies (Meetings of Board and its Powers) Amendment Rules, 2020 and ending on June 30, 2021, the meetings may be held through video conferencing or other audio visual means.

Analysis of Notifications under Companies Act, 2013⇒

♦ Commencement Notification dated 21st December, 2020:

The Ministry of Corporate Affairs (MCA) notified that the provisions of the Companies (Amendment) Act, 2020 will be enforced from December 21, 2020.

Commencement Notification dated 21st December, 2020

⇓

With effect from December 21, 2020

Link: . https://taxguru.in/company-law/17-provisions-companies-amendment-act-2020-wef-21-12-2020.html

Following is the gist of the enforced provisions of the Companies (Amendment) Act, 2020;

|

SECTIONS

|

PARTICULARS |

| Section 1 | The name of the amendment called the Companies (Amendment) Act, 2020. |

| Section 3 | The Penalty provisions wherein the words “with imprisonment for a term which may extend to three years or” shall be omitted; and for the words “twenty-five lakh rupees, or both”, the words “twenty-five lakh rupees” shall be substituted. |

| Sections 6 to 10 (both inclusive) | The decriminalization of the Companies Act, 2013 is the main feature of the Companies (Amendment) Act, 2020. It removes the imprisonment for various offences, substitutes fine by penalty in and reduces the amount of payable as penalty across the board. In certain minor omissions, etc. penal consequences has been omitted. |

| Sections 12 to 17 (both inclusive) | The notice to be given to the Registrar for alteration of share capital; omission of section 66 which pertained to Reduction of share capital; power of company to purchase its own securities; omission of section 71, punishment for contravention and Register of Members, etc. respectively. |

| Clauses (a) and (b) of section 18 | The Exemption of any class of persons from complying with the requirements of the Section 89 relating to declaration of beneficial interest in shares and exempt any class of foreign companies or companies incorporated outside India from the provisions of Chapter XXII relating to companies incorporated outside India. |

| Sections 19 to 21 (both inclusive) | The amendment in investigation of beneficial ownership of shares in certain cases; Annual Return and Proxies respectively. |

| Clause (i) of section 22; | If any company fails to file the resolution or the agreement before the expiry of the period such company shall be liable to a penalty of Rs.10,000 and in case of continuing failure, with a further penalty of Rs.100 for each day after the first during which such failure continues, subject to a maximum of two lakh rupees and every officer of the company who is in default including liquidator of the company, if any, shall be liable to a penalty of ten thousand rupees and in case continuing failure with further penalty of one hundred rupees for each day after the first during which such failure continues, subject to a maximum of fifty thousand rupees. |

| Section 24 | The amendment in the provision relating to Books of account etc., to be kept by the company. |

| Section 26 | The amendment in the provisions relating to the Financial Statement, Board’s Report, etc. |

| Sections 28 to 31 (both inclusive) | The amendment in the provisions relating to copy of financial statement to be filed with Registrar, removal, resignation of auditor and giving of special notice; powers and duties of auditors and auditing standard and Punishment for contravention respectively. |

| Sections 33 to 39 (both inclusive) | The amendment in the provision relating to Number of directorship, vacation of office of director, punishment, Nomination and Remuneration Committee and Stakeholder Relationship Committee, Disclosure of interest by director, investment of company to be held in its own name and Related Party Transactions; respectively. |

| Sections 41 to 44 (both inclusive) | The amendment in the provisions relating to Secretarial audit for bigger companies, Merger and amalgamation of companies, Powers of Tribunal, and consequences of termination or modification of certain agreements respectively. |

| Sections 46 to 51 (both inclusive) | The amendment in the provisions relating to Promoters, Directors, etc. to cooperate with company liquidator, dissolution of company by Tribunal, Section 342 was omitted, Disposal of books and papers of company, information as to pending liquidations and powers of Tribunal to declare dissolution of company void respectively. |

| Section 54 | Amendment in Section 392 relating to the punishment for contravention by companies incorporated outside India. |

| Section 57 | Amendment in Section 405 relating to power of the Central Government to direct companies to furnish information or statistics. |

| Section 61 | Amendment in Section 441 relating to compounding of certain offences. |

| Section 63 | Amendment in Section 450 relating to punishment where no specific penalty or punishment is provided. |

Order ⇒

♦ Companies (Auditor’s Report) Second Amendment Order, 2020:

- The Ministry of Corporate Affairs (MCA) has deferred the applicability of the notified the Companies (Auditor’s Report) Order 2020 (CARO), till April 01, 2021.

Companies (Auditor’s Report) Second Amendment Order, 2020

⇓

With effect from December 17, 2020

Link: https://taxguru.in/company-law/mca-deffers-applicability-caro-2020-fy-2021-22.html

- The notification seeks to amend the Companies (Auditor’s Report) Order, 2020 as follows;

In the Companies (Auditor’s Report) Order, 2020 in paragraph 2, for the figures, letters and word “1st April, 2020”, the figure, letters and words ”1st April, 2021” shall be substituted.

Circulars ⇒

Relaxation of additional fees and extension of last date of filing of CRA 4 for F.Y. 2019-20:

Circular on relaxation of additional fees and extension of last date of filing of CRA 4 for F.Y. 2019-20

⇓

With effect from December 17, 2020

Link: https://taxguru.in/company-law/mca-extends-last-date-filing-form-cra-4-extended-31-12-2020.html

- The Ministry of Corporate Affairs (MCA) released a circular on 1st December, 2020, and provided relaxation of additional fees and extension of the last date of filing of CRA-4 for the financial year 2019-20 under the Companies Act 2013.

- CRA-4 Form is used for filing the cost audit report. Various Stakeholders have sent representations seeking the extension of the last date of filing of CRA-4 due to the impact of the COVID-19 outbreak.

- MCA decided that if the cost auditor submits the cost audit report for the financial year 2019-20 in front of the Board of Directors of the companies by 31st December 2020 then it will not be considered as a violation of rule 6(5) of Companies (cost records and audit) Rules, 2014.

♦ Clarification on passing of ordinary and special resolutions by companies under the Companies Act, 2013:

Circular on clarification on passing of ordinary and special resolutions by companies under the Companies Act, 2013

⇓

With effect from December 31, 2020

Link: https://taxguru.in/company-law/clarification-passing-ordinary-special-resolutions-companies.html

- The Ministry of Corporate Affairs (MCA) in continuation on General Circulars No. 14/2020 dated 8th April, 2020, No. 17/2020 dated 13th April, 2020, No. 22/2020 dated 15th June, 2020 and No. 33/2020 dated 28th September, 2020 decided to allow companies to conduct their EGMs through VC or OAVM or transact items through postal ballot in accordance with the framework provided in the aforesaid Circulars upto 30th June, 2020.

Updates of the Securities Exchange Board of India Rules or Regulation (SEBI):

Circulars ⇒

♦ Relaxation in timelines for compliance with regulatory requirements:

- In view of the situation arising due to COVID-19 pandemic, lockdown imposed by the Government and representations received from Stock Exchanges, SEBI had earlier provided relaxations in timelines for compliance with various regulatory requirements by the trading members/clearing members/ depository participants, via various circulars.

- In view of the prevailing situation due to Covid-19 pandemic and representation received from the Stock Exchanges, it has been decided to extend the timelines for compliance with the following regulatory requirements by the trading members / clearing members, as under:

| SR. NO. | COMPLIANCE REQUIREMENTS FOR WHICH TIMELINES ARE EXTENDED | EXTENDED TIMELINE |

| 1. | Internal Audit for half year ended on September 30, 2020. | December 31, 2020 |

| 2. | System Audit for half year ended on September 30, 2020. | |

| 3. | Half yearly net worth certificate as on September 30, 2020. | |

| 4. | Cyber Security and Cyber Resilience Audit for half year ended on September 30, 2020. | January 31, 2021 |

- In view of the request received from the Depositories, SEBI has decided to extend the timelines for compliance with the following regulatory requirements by depository participants (DPs), as under:

| SR. NO. | COMPLIANCE REQUIREMENTS FOR WHICH TIMELINES ARE EXTENDED | EXTENDED TIMELINE / PERIOD OF EXCLUSION |

| 1. | Submission of half yearly Internal Audit Report by DPs for the half year ended on September 30, 2020. | December 31, 2020 |

| 2. | KYC application form and supporting documents of the clients to be uploaded on system of KRA within 10 working days. | Period of exclusion shall be from March 23, 2020 till December 31, 2020.

A 15-day time period after December 31, 2020 is allowed to Depository / DPs, to clear the back log. |

| 3. | Systems audit on annual basis for the financial year ended March 31, 2020. | December 31, 2020 |

♦ Operational guidelines for Transfer and Dematerialization of re-lodged physical shares:

- SEBI, vide circular dated September 07, 2020, has fixed March 31, 2021 as the cut-off date for re-lodgment of transfer requests and has stipulated that such transferred shares shall be issued only in demat mode.

- In this regard the operational guidelines for crediting the transferred shares into the respective demat account of the investor, with inputs from stakeholders, are as under;

> Guidelines to credit the transferred physical shares in demat mode:

√ Subsequent to processing of the re-lodged transfer request, the RTA shall retain the physical shares and intimate the investor (transferee) about the execution of transfer through Letter of Confirmation. This letter shall be sent through Registered / Speed Post or through email with digitally signed letter and shall, inter-alia, contain details of endorsement, shares, folio of investor (required on Demat request form) as available on the physical shares.

√ The investor shall submit the demat request, within 90 days of issue of Letter of Confirmation, to Depository participant (DP) along with the Letter of Confirmation. RTA shall also issue a reminder at the end of 60 days of issue of Letter of Confirmation, informing the investor to submit the demat request as above.

√ Depository Participant will process the Demat Request on the basis of Letter of Confirmation, as this letter is a confirmation of holding of physical shares on behalf of the investor by RTA.

> In case of the shares that are required to be locked-in as per the SEBI Circular SEBI/HO/MIRSD/DOS3/CIR/P/2018/139, dated November 06, 2018, the RTA while approving / confirming the demat request, shall also incorporate / intimate the Depository about the lock-in and its period. Such shares shall be in lock-in demat mode for 6 months from the date of registration of transfer.

> In case of non-receipt of demat request from the investor within 90 days of the date of Letter of Confirmation, the shares will be credited to Suspense Escrow Demat Account of the Company.

Depositories shall;

√ make necessary amendments to the relevant byelaws, rules and regulations for the implementation of the above directions, as may be applicable; and

√ bring the provisions of this circular to the notice of their participants and also disseminate the same on their websites.

♦ Additional Payment Mechanism (i.e. ASBA, etc.) for Payment of Balance Money in Calls for partly paid specified securities issued by the listed entity:

- SEBI, in its endeavour to protect investors’ interest and reduce investor grievances relating to refund, introduced Application Supported by Blocked Amount (ASBA) as the sole payment mechanism in the IPO and Rights issues.

- Considering that payment through ASBA mechanism is investor friendly and enables faster completion of the process, it has been decided to introduce additional payment mechanism (i.e. ASBA, etc) for making subscription and/or payment of calls in respect of partly paid specified securities through SCSBs and intermediaries such as Trading Members/ Brokers – having three in one type account and Registrar and Transfer agents (RTA).

Additional Channels for making subscription and/or paying call money:

√ For the purpose of making payment of balance money for calls in respect of partly paid specified securities, the additional channels are tabulated below:

| Additional Channels for making subscription and/or paying call money | ||

| Channel I | Channel II | Channel III |

| Online ASBA:

Through an online portal of the SCSB. The SCSBs shall send the application to RTA and block funds in shareholders account. |

Physical ASBA:

Physically at the branch of a SCSB The SCSBs shall send the application to RTA and block funds in shareholders account. |

Additional Online mode:

Using the facility of linked online trading, demat and bank account (3-in-1 type accounts), provided by some of the brokers. |

- Period of subscription: The payment period for payment of balance money in Calls shall be kept open for fifteen days.

- Disclosures in the Letter of Offer: The intermediaries including the issuer company and its RTA shall provide necessary guidance to the specified security holders in use of ASBA mechanism while making payment of calls.

- This circular shall be applicable for all Call Money Notice wherein the payment period opens on or after January 01, 2021.

♦ e-Voting Facility Provided by Listed Entities:

- Under Regulation 44 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, listed entities are required to provide remote e-voting facility to its shareholders, in respect of all shareholders’ resolutions. However, it has been observed that the participation by the public non-institutional shareholders/retail shareholders is at a negligible level.

- Currently, there are multiple e-voting service providers (ESPs) providing e-voting facility to listed entities in India. This necessitates registration on various ESPs and maintenance of multiple user IDs and passwords by the shareholders.

- In order to increase the efficiency of the voting process, pursuant to a public consultation, it has been decided to enable e-voting to all the demat account holders, by way of a single login credential, through their demat accounts/ websites of Depositories/ Depository Participants. Demat account holders would be able to cast their vote without having to register again with the ESPs, thereby, not only facilitating seamless authentication but also enhancing ease and convenience of participating in e-voting process. The same shall be implemented in a phased manner as under:

- Phase – 1:

Following process for e-voting shall be implemented within 6 months of the date of the circular.

√ Direct registration with Depositories – Shareholders can register directly with the depository. Shareholders would be able to access the e-voting page of various ESPs through the websites of the Depositories without further authentication by ESPs for participating in the e-voting process.

OR

√ Through Demat Accounts with Depository Participants – Demat account holders will have the option of accessing various ESP portals directly from their demat accounts. They would be routed to the webpage of the respective Depositories from their demat accounts, which in turn would enable access to the e-voting portals of various ESPs without further authentication by ESPs for participating in the e-voting process.

√ The authentication of shareholders would happen at the depository level and ESPs shall allow the demat account holders to cast their vote based on the validation carried out by the Depository.

√ Depository shall send a confirmatory SMS to the shareholders that the vote has been cast based on the confirmation received from the ESP.

√ The listed entity shall provide the details of the upcoming AGMs requiring voting to the Depository. The depository shall send SMS/email alerts in this regard, to the demat account holders, atleast 2 days prior to the date of the commencement of e-voting.

Phase – 2:

√ In order to further enhance the convenience and security of the e-voting system, the depository shall validate the demat account holder through a One Time Password (OTP) verification process as under.

√ Direct registration with Depositories – Depositories shall allow login through registered Mobile number/E-mail based OTP verification as an alternate to login through username and password.

√ Through Demat Accounts with Depository Participants – A second factor authentication using Mobile/E-mail based OTP shall be introduced before the demat account holders can access the websites of the Depositories through their demat accounts.

The above shall be implemented within 12 months from the completion of the process in phase 1.

- Depository may advise the demat account holders to update their mobile number and email ID in order to access the e-voting facility.

- Depositories shall establish a dedicated helpline to resolve technical difficulties faced by shareholders relating to the e-voting facility. Further, the listed company shall ensure that the ESPs engaged by them also provide a dedicated helpline in this regard.

- In order to enable better deliberation and decision making by the shareholders while casting their votes, ESP Portals shall provide specific weblinks to the following:

√ disclosures by the company on the websites of the stock exchanges

√ report on the websites of the proxy advisors.

- Applicability:

√ The aforementioned facility shall be available to all individual shareholders holding the securities in demat mode.

√ ESPs may continue to provide the facility of e-voting as per the existing process to all physical shareholders and shareholders other than individuals viz. institutions/corporate shareholders.

√ Depositories and Exchanges are advised to bring the circular to the notice of its Depository Participants and listed companies respectively.

√ All listed companies are advised to notify the above process available to demat account holders for e-voting in the notice sent to the shareholders.

Updates of the Reserve Bank of India (RBI)⇒

Notification ⇒

♦ Declaration of dividends by banks:

- In view of the ongoing stress and heightened uncertainty on account of COVID-19, it is imperative that banks continue to conserve capital to support the economy and absorb losses. In order to further strengthen the banks’ balance sheets, while at the same time support lending to the real economy, the Reserve Bank of India (RBI) has decided that banks shall not make any dividend payment on equity shares from the profits pertaining to the financial year ended March 31, 2020.

Introduction of Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF) for Regional Rural Banks (RRBs):

- In order to provide an additional avenue for liquidity management to Regional Rural Banks (RRBs), it has been decided that Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF) will be extended to Scheduled RRBs meeting the following criteria:

√ Implemented Core Banking Solution (CBS)

√ There is a minimum CRAR of nine per cent and

√ Fully compliant with the terms and conditions for availing LAF and MSF issued by Financial Markets Operations Department (FMOD), Reserve Bank of India.

- The names of RRBs which meet the eligibility norms to participate in LAF and MSF (Positive List) and of those RRBs found ineligible (Negative List) will be intimated to the banks concerned. The eligibility status of the banks will be reviewed on an ongoing basis.

♦ 24×7 Availability of Real Time Gross Settlement (RTGS) System:

- Reserve Bank of India (RBI) had announced making available the Real Time Gross Settlement (RTGS) system round the clock on all days. Accordingly, the RBI has decided to make RTGS available round the clock on all days of the year with effect from 00:30 hours on December 14, 2020.

√ RTGS shall be available for customer and inter-bank transactions round the clock, except for the interval between ‘end-of-day’ and ‘start-of-day’ processes, whose timings would be duly broadcasted through the RTGS system.

√ RTGS shall continue to be governed by the RTGS System Regulations, 2013, as amended from time to time. The revised Regulations are available on RBI’s website at: https://www.rbi.org.in/Scripts/Bs_viewRTGS.aspx.

√ Intra-Day Liquidity (IDL) facility shall be made available to facilitate smooth operations. The Intra-Day Liquidity (IDL) availed, if any, shall be reversed before the ‘end-of-day’ process begins.

♦ Extension of time period of 3 months under Section 10A:

- The Central Government notified further period of three months from the 25th December, 2020, for the purposes of the Suspension of initiation of corporate insolvency resolution process.

♦ E-courts initiative in NCLT:

- E-courts initiative in NCLT was conceptualized in year 2017 and now e-filing has been mandatorily started in all the benches of NCLT across the Country. The completion of e-court includes the points/ stages namely e-filing, e-scrutiny, Automatic case number Registration, case allocation, e-casue list generation.

- The competent authority has decided that all the Benches which have implemented e-filing have to start the second phase of e-court which is Automatic Case Number Generation.

- Further, the Competent Authority has decided that Automatic Case Number Generation should be mandatorily started from 1st January, 2021 in all the benches across the country. The automatically number has to be generated from e-filing portal i.e. efiling.nclt.gov.in

Analysis of IBBI Ciculars ⇒

♦ Computation of fee payable for delay in filings under regulation 40B of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016:

- It is clear from the sub-regulation (4) of regulation 40B of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 (CIRP Regulations) that a fee has to be paid for delay after 1st October, 2020. The said regulation reads as under:

- “The filing of a Form under this regulation after due date of submission, whether by correction, updation or otherwise, shall be accompanied by a fee of five hundred rupees per Form for each calendar month of delay after 1st October, 2020.”

- Therefore, it is clarified that fee is payable for the period that lapses between the due date of filing a Form or 1st October, 2020, whichever is later, and the actual date of filing the said Form.

- It appears that a fee, higher than what is payable under the CIRP Regulations, has been paid along with filings of some Forms. These have happened in three situations, namely,

√ fee has been paid for delay in submission of Form, which was on account of technical glitches;

√ fee has been paid twice for filing the same Form; and

√ fee has been paid for the delay from the due date.

- It has been decided to refund the excess fee paid in these three situations.

*****

Disclaimer: The entire contents of this newsletter have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer the relevant existing provisions of applicable laws. The user of this information agrees that the information is not professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. Further, in no event shall I be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information