Dematerialisation of Securities by Private Limited Companies [A giant stride to enhance the integrity of Financial Markets]

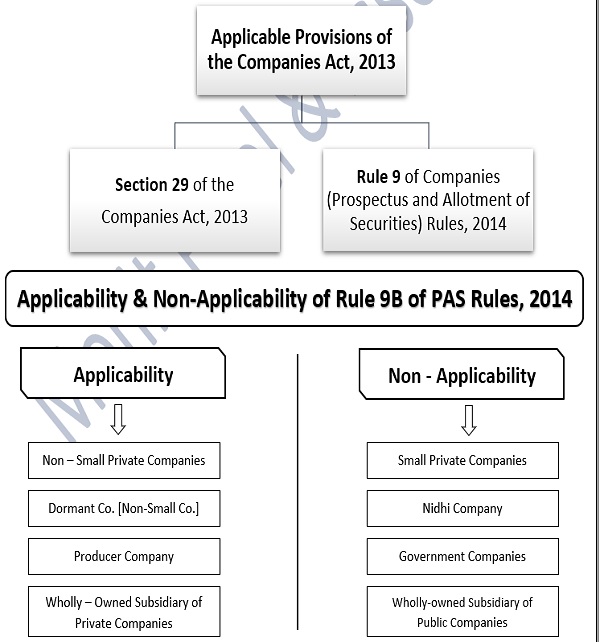

The Ministry of Corporate Affairs [MCA] has introduced the Rules for dematerialisation of Securities by Non-Small Private Limited Companies. MCA on 27th October, 2023 issued a Notification making an amendment in the Companies [Prospectus and Allotment of Securities] Rules, 2014 (‘PAS Rules, 2014’).

MCA has introduced Rule 9B [Issue of securities in dematerialised form by Private Companies] through the Companies [Prospectus and Allotment of Securities] Second Amendment Rules, 2023.

In this Article, we will discuss various key facets of such Amendment Rule.

Applicable Provisions of the Companies Act, 2013 with relation to Demat of Securities by Private Companies

“Small Company” means a Company other than a Public Company, –

a) Paid-up Share Capital of which does not exceed Rs.4 Crore or Such higher amount as may be prescribed;

AND

b) Turnover of which does not exceed Rs.40 Crore or such higher amount as may be prescribed.

- EXEMPTION:

1. A Holding Company or a Subsidiary Company;

2. A Company registered under Section 8;

3. A Company or Body Corporate governed by any Special Act

Key Facets of Rule 9B the Companies [Prospectus and Allotment of Securities] Second Amendment Rules, 2023 |

|

| 1. | Every Non-Small Private Limited Company shall issue its securities only in dematerialized form & Ensure dematerialization of all its existing securities with effect from 30th September, 2024; |

| 2. | ✔ After 30th September, 2024, the Company shall ensure that the entire holding of Promoters, Directors, Key Managerial Personnel shall be in Demat form;

✔ If such holding is not in Demat Form then the Company will not be able to; 1. Issue Securities; 2. Buy-back Securities; 3. Issue Bonus Shares; 4. Right Issue. |

| 3. | If the holding of Shareholders other than Promoters/ Directors/ Key Managerial Personnel is not in Demat form then such Shareholders will not be able to;

1. Transfer or Transmit Shares; 2. Subscribe to any securities of the concerned Private Limited Company. |

| 4. | On or before 30th September, 2024, every Non-Small Private Limited Company shall obtain ISIN for each type of Securities and the same shall be communicated to all Shareholders of the Company; |

| 5. | Every Non-Small Private Limited Company shall facilitate dematerialization of all its existing Securities by making necessary applications to a depository as defined in clause (e) of sub-section (1) of section 2 of the Depositories Act, 1996; |

| 6. | It is important to note that after 30th September, 2024, every Non-Small Private Limited Company shall file E-Form PAS-6 with the Registrar of Companies (ROC) within 60 days from the conclusion of half year irrespective of the fact that whether all shares of the company are in Demat or not; |

| 6. |

|

NSDL/ CDSL FEES DETAILS*

| PARTICULARS | PAID-UP CAPITAL | ||||

| Upto 2.5 Cr. | 2.5 to 5 Cr. | 5 Cr. to 10 Cr. | 10 Cr. to 20 Cr. | Above 20 Cr. | |

| Joining Fees [One Time] (A) | 15,000 | 15,000 | 15,000 | 15,000 | 15,000 |

| Annual Custody Fees# [January 2024 to March 2024] (B) | 1,250 | 2,250 | 5,625 | 11,250 | 18,750 |

| Gross Value (C) [C = A+B] | 16,250 | 17,250 | 20,625 | 26,250 | 33,750 |

| GST@18% (D) | 2,925 | 3,105 | 3,713 | 4,725 | 6,075 |

| Total Amount payable to NSDL/ CDSL (A+B+C+D) | 19,175 | 20,355 | 24,338 | 30,975 | 39,825 |

| NSDL/ CDSL SECURITY DEPOSIT | |||||

| Small Private Limited Company | NIL | ||||

| Non-Small Private Limited Company [+ 18% GST] | 5,000 | 9,000 | 22,500 | 45,000 | 75,000 |

* Note: Details of Fees has been taken from the official website of CDSL & NSDL.

#Annual Custody Fees has been calculated for the last quarter. For entire year, Calculation shall be done accordingly.

CONCLUSION:

The compulsory dematerialisation of the shares of the Non-Small Private Limited Company overall seems to be the move in the right direction and will lead to a more transparent and efficient system of share transfers, more financial inclusivity, better bankability of the shares and reduction of frauds and cost, time effectiveness for investors, financial institutions and issuer companies alike.