Quarterly Return filing & Monthly Payment of Taxes (QRMP) scheme is been launched by Government for small taxpayers under GST system. In thie article we will discuss the Applicability of this Scheme, Salient Features of QRMP scheme, What Registered Person means for this Scheme, When to Register or Opt for this Scheme, When to file Return under QRMP scheme, When to Pay Taxes under QRMP scheme, Late Fees, Interest under QRMP scheme etc.

Applicability:-

Salient Features:-

- Aggregate Turnover <= 5 Crores during preceding Financial Year[1]

- Tax payers who are automatically migrated into QRMP scheme can opt out between 5th December, 2020 to 31st January, 2021.

- QRMP Scheme is GSTIN wise and not PAN Wise.

| Registered Person can opt for any Quarter from 1st day of Second Month of Preceding Quarter to the Last day of the 1st Month of the Quarter. |

| Newly Registered Persons |

| Registered Person Opting Out from Composition Scheme (U/s.10 of CGST Act, 2017) shall be able to opt for QRMP Scheme. |

When to Register:-

- Registered Person can opt in for any quarter from 1st day of second month of preceding quarter to the last day of the 1st month of the quarter.

- Scheme will be effective from 01-01-2021.

- Ex:- A Registered Person intending to avail the scheme for the quarter July to September can exercise his opinion during 1st May to 31st

If he exercise this option on 27th July for the quarter (July to September) in such case, he must have furnished the return for the month of June which was due on 22nd/24th July.

When to file Return:-

- Registered Person would require to furnish Form GSTR-1 & GSTR-3B, for each Quarter by 22nd or 24th day of the month succeeding such quarter.

Details of Outward Supplies:-

- Taxpayer who wants to opt QRMP Scheme can use “Invoice Furnishing Facility” which allows quarterly GSTR-1 filers to upload their invoices every month.

- However, IFF can be used only when a Taxpayer whose turnover is up-to Rs.1.5 Cr.

- IFF can only be used for the 1st and 2nd months of a Quarter only.

- Last month invoices of a Quarter are to be uploaded in GSTR-1 return only.

- There is no requirement to upload invoices in GSTR-1, if the same has been uploaded in IFF.

- Taxpayer has to submit B2B invoices details of sale transactions along with Debit and Credit Notes issued during the month, if any.

- Total Net value of invoices that can be uploaded is restricted to Rs.50 lakhs per month.

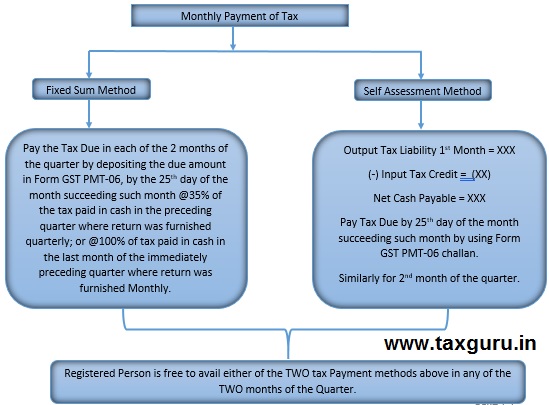

Payment of Tax:-

Cases where no amount may be required to be Deposited:-

1. For the 1st month of a quarter, where the balance in Cash or Credit Ledger is adequate for the Tax liability of the said month.

2. For the 2nd month of the quarter, where the balance in Cash or Credit Ledger is adequate for the Cumulative Tax Liability for the 1st and 2nd month of the Quarter.

3. In both the above cases, where the Tax Liability is NIL.

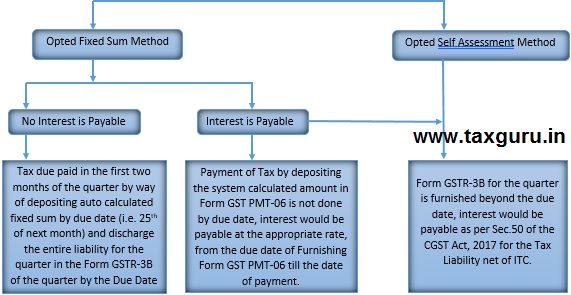

Applicability of Interest:-

Applicability of Late Fee:-

- Late fee would be applicable for delay in furnishing the quarterly return or details of outward supply.

- However no late fee is applicable for delay in payment of tax in first two months of the quarter.

Late Fee under QRMP Scheme:-

If the GSTR-3B is not filed within the due date, then the following late fee shall be paid, subject to a Maximum late fees of Rs.5,000/-

| Act | Late fees for every day of delay | Late fees for every day of delay where Tax Liability is NIL. |

| CGST Act | 25/- | 10/- |

| SGST Act | 25/- | 10/- |

| IGST Act | 50/- | 20/- |

However it is clarified that there is no late fee is applicable for delay in payment of Tax for first 2 months of the quarter in Form GST PMT-06.

[1] In Case of aggregate turnover exceeds Rs.5 Cr during any quarter in current F.Y registered person shall not be eligible for the scheme from next quarter.