Introduction: The Securities and Exchange Board of India (SEBI) has taken a firm stance against so-called ‘finfluencers’ who offer financial advice to ordinary investors. In a recent development, SEBI has banned Mohammad Nasiruddin Ansari, the owner of ‘Baap of Chart,’ from participating in the securities market. This action comes as Ansari is alleged to have misled investors under the guise of financial education, resulting in an order to refund ₹17.20 crore.

Page Contents

Who is Mohammad Nasiruddin Ansari?

Mohammad Nasiruddin Ansari is the sole proprietor of ‘Baap of Chart’ (BoC). He gained prominence by positioning himself as a stock market expert across various social media platforms. Ansari attracted investors and clients by offering a range of “educational courses” related to the securities market. Under the promise of near-certain returns, he influenced individuals to follow his stock recommendations and invest in the securities market.

How did Ansari Operate?

SEBI’s investigation revealed that Ansari provided stock recommendations, both for buying and selling, through ‘Baap of Chart’ on various social media platforms, including YouTube, X (formerly Twitter), Instagram, WhatsApp, and Telegram. To enroll in his educational courses, investors were directed to a website and apps available on Google Play and Apple’s App Store, hosted on a platform provided by Bunch Microtechnologies Pvt Ltd (Bunch). Ansari offered a total of 19 courses related to the securities market, including four that guaranteed returns. Through real-time chat functionality on the Bunch platform, students interacted with “tutors” who shared information and communicated with them.

Payments from investors were funneled into the bank accounts of Ansari, BoC, Golden Syndicate Ventures Pvt Ltd (a company in which Ansari holds a significant stake), and P. Rahul Rao (another significant shareholder of Golden Syndicate Ventures). SEBI also identified four other directors of Golden Syndicate Ventures who were involved in unregistered investment advisory activities: Asif Iqbal Wani, Tabraiz Abdullah, Mansha Abdullah, and Vamshi Jadhav. Funds were credited to the accounts of these individuals as well.

Baap of Chart’s Reach

Nasiruddin Ansari’s ‘Baap of Chart’ had a substantial following. His YouTube channel, @Baapofchart, boasted over 4.43 lakh subscribers and more than 7 crore views. He also operated a Telegram group/channel called ‘Baap Of Chart Option Hedging’ with around 53,000 subscribers. On Instagram and X, ‘baapofchart’ had approximately 59,000 and 78,000 followers, respectively. His WhatsApp channel had more than 13,000 followers.

Ansari continued to provide buy/sell recommendations to members until the first week of October 2023. Apart from online courses, he organized physical workshops in various cities to educate investors about the securities market.

Income from Fraudulent Activities

SEBI’s investigation exposed that Ansari collected Rs 13.78 crore from courses and workshops listed on Bunch’s platform and mobile apps. The entire amount was considered fees received from fraudulent and unregistered investment advisory activities. An additional Rs 3.42 crore was collected through two UPI IDs linked to Ansari’s and BoC’s accounts in Kotak Mahindra Bank. These UPI IDs were publicly advertised on the website and social media channels. In total, Ansari and his associated entities collected Rs 17.2 crore between January 2021 and July 2023, enticing clients with misleading and false information about his courses and workshops and encouraging them to trade in securities.

SEBI’s Findings and Actions

SEBI’s interim order accuses Ansari and ‘Baap of Chart’ of cleverly portraying their advisory activities as educational, when, in fact, they were engaged in fraudulent practices. The order suggests that Ansari sought to attract individuals with unrealistic promises of returns and used theatrics and showmanship to create an illusion of extraordinary profits. SEBI strongly believes that the core of their activities was fraudulent, aimed at luring uninformed viewers to join their classes and trade in the securities market.

Conclusion:

SEBI’s action against Mohammad Nasiruddin Ansari and ‘Baap of Chart’ serves as a warning to those who use financial education as a cover for misleading and fraudulent activities. The market regulator has ordered a ban on Ansari’s investment advisory activities, emphasized the need for investor protection, and directed him to deposit ₹17.20 crore in an escrow account as restitution for the gains from his ‘educational courses.’ This enforcement is part of SEBI’s ongoing efforts to maintain the integrity of the securities market and protect the interests of investors.

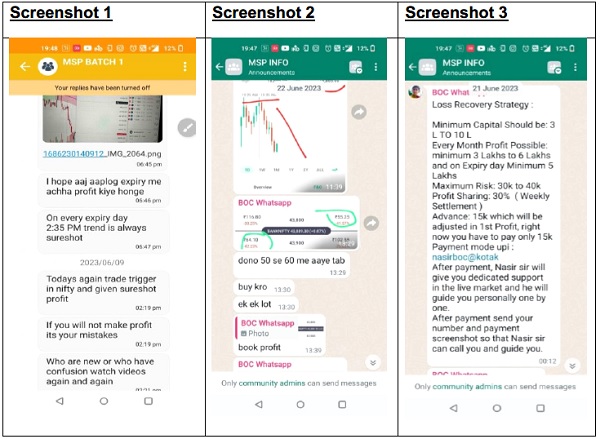

******

Interim Order cum SCN in the matter of unregistered investment advisory activities of Mohammad Nasiruddin Ansari/ Baap of Chart

Oct 25, 2023 | Orders : Orders of Chairperson/Members

WTM/AN/MIRSD/MIRSD-SEC-6/29693/2023-24

SECURITIES AND EXCHANGE BOARD OF INDIA

INTERIM ORDER CUM SHOW CAUSE NOTICE

UNDER SECTIONS 11(1), 11(4), 11B AND 11D OF SECURITIES AND EXCHANGE BOARD OF INDIA ACT, 1992

In respect of:

| Noticee No. |

Name | PAN |

| 1. | Mohammad Nasiruddin Ansari | BYSPA0419E |

| 2. | Rahul Rao Padamati | CRTPP4198Q |

| 3. | Tabraiz Abdullah | BCMPA2384Q |

| 4. | Asif Iqbal Wani | ADHPW0201D |

| 5. | Golden Syndicate Ventures Pvt. Ltd. | AAJCG9452E |

| 6. | Mansha Abdullah | CUJPM4587K |

| 7. | Jadav Vamshi | BJFPJ9368B |

(The above entities are individually referred to by their corresponding names / numbers and collectively referred to as “Noticees”)

In the matter of unregistered investment advisory activities by Mohammad Nasiruddin Ansari / Baap of Chart

A. BACKGROUND

1. On an analysis of certain tweets on Twitter (now X) & Telegram, Mohammad Nasiruddin Ansari (“Md. Nasir / Nasir”) was prima facie observed to be providing recommendations (buy/sell) through social media in the name of “Baap of Chart” (“BoC”) in the garb of providing educational training related to securities market. Pursuant to the same, Securities and Exchange Board of India (“SEBI”) initiated examination against Nasir in order to ascertain whether Nasir is engaged in offering investment advisory services without SEBI registration through social media / other means and thereby, violating inter alia provisions of the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 (“IA Regulations”) and Securities and Exchange Board of India Act, 1992 (“SEBI Act, 1992”). The examination period in the instant matter is from January 01, 2021 – July 07, 2023. However, reference outside this period has been made wherever required.

2. During the course of examination, it was observed that Nasir is promoting himself

as a stock market expert on various social media platforms and luring investors/ clients to enrol for various ‘educational courses’ offered by him and inducing them to invest in securities market by promising them the prospect of making profits with near certainty if the recommendation/ advice is followed. As per the material available on record, BoC is a proprietorship firm with Nasir being the sole proprietor. Further, it was observed that Nasir has uploaded his ‘educational courses’ on website/ apps through the application services provided by Bunch Microtechnologies Private Limited (“Bunch”) wherein he is collecting money for enrolment in the said courses and providing access to his ‘classes’ to investors/ clients. Also, Nasir is found to be providing buy/ sell recommendations in private groups of his investors/ clients. It was observed that the amount collected for ‘educational courses’ was credited into the bank accounts of Nasir, BoC, Golden Syndicate Ventures Pvt. Ltd. (company in which Nasir is a significant shareholder) and P. Rahul Rao (another significant shareholder of Golden Syndicate Ventures Pvt. Ltd.).

3. I have perused and considered the findings of examination and the material available on record. I find that essentially, the issue that requires to be addressed in the present matter is whether Noticees have induced / influenced investors to deal in securities through false/ misleading information and indulged in unregistered investment advisory activities under the garb of providing educational training through sale of courses/ workshop services. The relevant provisions of IA Regulations providing definition of investment advice and investment adviser are reproduced below:

“Definitions.

2. (1) …

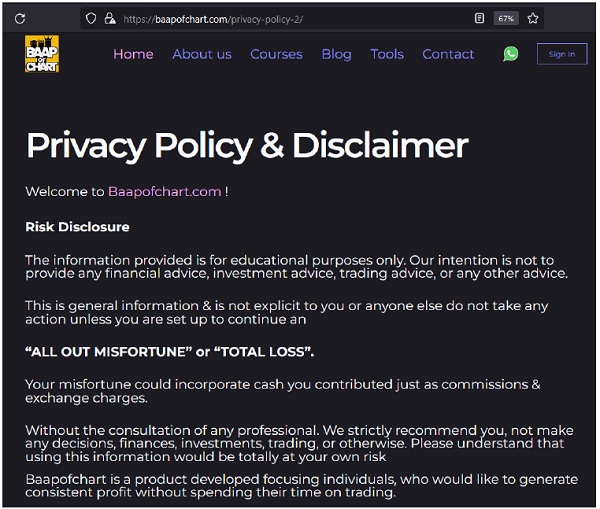

(I) “investment advice” means advice relating to investing in, purchasing, selling or otherwise dealing in securities or investment products, and advice on investment portfolio containing securities or investment products, whether written, oral or through any other means of communication for the benefit of the client and shall include financial planning:

Provided that investment advice given through newspaper, magazines, any electronic or broadcasting or telecommunications medium, which is widely available to the public shall not be considered as investment advice for the purpose of these regulations;

(m) “investment adviser” means any person, who for consideration, is engaged in the business of providing investment advice to clients or other persons or group of persons and includes any person who holds out himself as an investment adviser, by whatever name called;”

4. From the above, I note that to classify a person as Investment Adviser, the following two factors need to be determined:

(i) First, whether the person is providing investment advice or holds out himself as an investment adviser, by whatever name called.

(ii) Second, whether such person is providing the investment advice for a consideration.

C. ACTIVITIES OF THE NOTICEES AND FEES COLLECTED

5. During the course of examination, SEBI vide letter dated January 12, 2023 sought certain information from Nasir. In response to the same, Nasir inter alia provided the following information vide e-mail dated January 21, 2023 (through baapofchart@gmail.com):

Table – 1

|

S. No. |

Details sought | Details provided |

| (i) | Business Activities | Coaching and workshop |

| (ii) | Demat / trading accounts | Zerodha : XA1383 Angel Broking: M290475 Upstox: 151018 Alice blue: PAT279 Choice Broking: KJM006 |

| (iii) | Phone Numbers | 90******07 and 63******36 |

| (iv) | Social Media Accounts | Twitter: @Baapofchart Instagram: @Baapofchart Facebook: @Baapofchart Telegram: @Baapofchart & @XROKCERS5YouTube: @Baapofchart Personal social media: Instagram: Mdnasirboc Facebook: Mdnasirboc YouTube: NasirTalks |

| (v) | Link of the Website being operated | www.baapofchart.com |

| (vi) | Details of directorships/partnerships | Golden Syndicate Ventures Pvt. Ltd. (PAN: AAJCG9452E) Date of Appointment: 27/07/2022 |

| (v) | Details of Shareholding | Golden Syndicate Ventures Pvt. Ltd. 25% Share holding |

6. Further, in the aforesaid e-mail, Nasir denied providing any advice relating to investment in securities markets and providing any buy / sell / hold recommendation in respect of securities.

7. During the course of examination, it was observed that through the videos/ pictures posted on his YouTube Channel/ Twitter, Nasir was luring people to enroll for his ‘educational courses’ offered through a website (https://rjdif.courses.store/)/ apps (https://play.google.com/store/apps/detailsid=co.robin.rjdif&pli=1 & https://apps.apple.com/us/app/baap-of-charts/id1630765942). In this regard, during examination, it was observed that Razor pay is the payment aggregator for the ‘educational courses’/ ‘workshops’ mentioned on the aforesaid website/ apps. Razor pay informed SEBI that Bunch has been onboarded on Razor pay platform and the payments for the aforesaid URLs are routed by Bunch. It further informed that BoC are the content creators of the aforesaid URLs and Bunch has onboarded them as their customers. As per Razor pay, Bunch provides a content marketplace helping creators to create URLs, listing of their content and helps them monetize the same. Bunch informed SEBI that the following entities were the beneficiaries of the amount received through ‘educational courses’ put up on the aforementioned website/ apps:

Table – 2

| S. No. | Name of Content Creators | Bank Account Numbers of Content Creators |

| 1. | Padamati Rahul Rao | 7512208658 & 8125749008 |

| 2. | Baap of Chart | 7946143525 |

| 3. | Golden Syndicate Ventures Pvt. Ltd. | 59231100000012 |

8. Subsequently, further details with respect to the aforesaid website/ apps were inter alia sought from Bunch. Bunch informed SEBI that it is engaged in B2B ed-tech sector, providing white labeled SaaS application services and/ or other online institutes (on social media platforms like Telegram) management services to educators/ tutors/ content creators. Bunch further informed that as part of the onboarding process, the tutor may opt for creation of an application and/ or web page to list his courses. The tutor lists his courses on the application created for/ services provided to him by Bunch and the tutor’s students can purchase such courses from the application/ online institute. Payments made by students on the application/ online institutes for purchasing courses are facilitated through Razorpay. I note that Nasir listed the ‘educational courses’/ ‘workshops’ on the website/ apps created on the platform provided by Bunch and collected amount from clients/ investors for providing access to such ‘educational courses’/ ‘workshops’. The details of amount collected and the beneficiary bank accounts are discussed later in this Order. I note that apart from ‘educational courses’ provided online by Nasir through Bunch platform, Nasir also organizes physical workshops in various cities for ‘educating’ his clients/ investors about securities markets.

9. Therefore, to assess BoC/ Nasir’s conduct, I must evaluate if his activity was in fact one of rendering advice and inducing to trade couched as offline and online education, as well as his method of receiving consideration for the same and the terms thereof.

OFFLINE ACTIVITIES

10. As per the examination, Nasir conducts offline workshops pertaining to securities market. In a video posted on September 13, 2022 on the YouTube channel of Nasir (@Baapofchart) for one such offline workshop, it was mentioned on screen “ 80,000/- Profit in live trading with 500+ students”. A snapshot of the same is provided below:

ONLINE ACTIVITIES

WEBSITES AND MOBILE APPS

11. During the course of examination, it was observed that following websites/ apps were being promoted by Nasir/ BoC on their aforesaid social media:

11.1 https://rjdif.courses.store/

11.2 https://play.google.com/store/apps/details?id=co.robin.rjdif&pli=1

11.3 https://apps.apple.com/us/app/baap-of-charts/id1630765942

11.4 https://baapofchart.com/

11.5 https://bocalgo.com/

12. With respect to website/ apps mentioned at 11.1-11.3 above, the following was observed during the course of examination:

12.1. Razorpay was the payment aggregator for these website/ apps. Accordingly, information was sought from Razorpay about the entities operating the said website/ apps. Razorpay informed SEBI that Bunch Micro technologies Private Limited (“Bunch”) was the merchant for the aforementioned links. Razorpay further informed that Bunch has onboarded “Baap of Chart” who are content creators associated with the provided URLs.

12.2. In view of the information received from Razorpay, information was sought from Bunch about the entities operating the aforementioned links and the payments made to such entities for the amount collected by Razorpay from the said URLs. In response to the same, Bunch informed SEBI that it provides application services to educators/ tutors/ content creators (“tutor”) and as part of onboarding, tutor may opt for creation of an application and/ or web page to list their courses and the tutor’s students can purchase such courses from the application / online institute. The payments made by the students on the application/ online institutes for purchasing courses are facilitated through Razorpay. In the instant matter, courses/ workshops are being offered by Nasir/ BoC through the services offered by Bunch. Further, Bunch inter alia provided the names of beneficiaries of the bank accounts wherein payments for the courses on said website/ apps are being credited:

Table – 3

| S. No. | Names of Beneficiaries |

| 1. | Baap of Chart |

| 2. | Padamati Rahul Rao |

| 3. | Golden Syndicate Ventures Pvt. Ltd. |

| 4. | Mohammad Nasiruddin Ansari |

12.3. As already stated at paragraph 5 above, Nasir admitted that he is a director of Golden Syndicate Ventures Pvt. Ltd. (“GSVPL/ Golden Syndicate”) and has 25% shareholding in GSVPL.

12.4. Upon perusal of the website (https://rjdif.courses.store/), it was observed that 19 courses/ workshop relating to securities market were being sold by Nasir. The details of courses are provided below:

Table – 4

| S. No. | Name of the course/workshop | Actual Price (INR) | Offer Price (INR) |

| 1 | The secrets of data reading | 51,000 | 6,000 |

| 2 | D 30 strategy | 10,000 | 5,001 |

| 3 | MSP-(Make Sureshot Profit) | 33,000 | 6,000 |

| 4 | 360 Degree Expiry Strategy | 15,000 | 5,100 |

| 5 | Advance Hedging Course | 9,000 | 2,400 |

| 6 | Bengluru Workshop (1st instalment) | 9,000 | 6,000 |

| 7 | 200X Option Buying Strategy | 6,000 | 1,500 |

| 8 | Banknifty 325 Premium Strategy (3months) | 18,000 | 12,000 |

| 9 | Banknifty 325 Premium Strategy | 9,000 | 6,000 |

| 10 | Banknifty Shaktiman Strategy | 6,000 | 3,300 |

| 11 | Scalping Trading full 4 days Course | 9,999 | 6,600 |

| 12 | Scalping Trading Course (Day 05) | 5,001 | 2,400 |

| 13 | Scalping Trading full 5 days Course | 18,000 | 9,000 |

| 14 | Scalping Trading Course (Day 04) | 5,001 | 2,400 |

| 15 | Scalping Trading Course (Day 03) | 5,001 | 2,100 |

| 16 | Scalping Trading Course (Day 02) | 5,001 | 2,400 |

| 17 | 325 Premium Strategy 3 to 4 strategies in one video | 2,400 | – |

| 18 | 325 Option Buying Strategy | 1,100 | – |

| 19 | BOC 145 Premium Strategies with Trading Psychology | 5,000 | 1,500 |

12.5. In respect of some of the aforesaid courses, the following statements were observed in their description:

Table – 5

| S. No. | Name of the course | Statement in the description of the course |

| 1 | 200X Option Buying Strategy | You can make consistent profit. |

| 2 | 325 Premium Strategy | 3 to 4 Strategies in one Video | You can make money in all types of markets |

| 3 | MSP-(Make Sureshot Profit) | With MSP, you can recover all losses with a 99% guarantee |

| 4 | Bank Nifty Shaktiman Strategy |

Get a chance to earn 200-300% Profit |

12.6. It is observed that Nasir is assuring or promising, with unnaturally high degree of certainty, returns/ profit/ guaranteed recovery from losses by adhering to the recommendations made in the aforesaid courses.

12.7. During the examination, Bunch informed SEBI that in the courses offered on its platform, chat functionality is provided wherein tutor can connect with students and share information/ documents/ content and communicate in real time. For the courses sold on this platform, a private group is created for the clients/ investors who purchased the courses. Bunch informed that these are closed chat groups in which the tutor determines who may or may not participate. Further, Bunch also informed that tutor has the freedom to create chat groups as it requires and may as required delete, add or modify any parameters of the chat (such as title of the chat group, permitted participants, content or topics discussed on the chat, deletion of chats etc.). In this regard, a few messages posted on such group by the tutor (Baap of Chart having email id – baapofchart@gmail.com used/ operated by Nasir) are as follows: 12.7.1 Add one lot in 18450 ce cmp 200 rest we will see in live

12.7.2 In 325 u can close position cost to cost who was one sided bullish can book profit

12.7.3 Given good point , u can book long position

12.7.4 Book small profit in pe

12.7.5 Buy 18700 pe 2 lots at cmp of 8th June

(emphasis supplied)

12.8. Also, as can be seen from the above messages, he is providing buy/ sell/ hold recommendations in securities to his clients/ investors under the garb of providing courses related to securities market.

13. With respect to website/ apps mentioned at 11.4 & 11.5 above, the following was observed:

13.1. On the website of BoC (https://baapofchart.com/), Nasir is offering courses mentioned at S. Nos. 2-4 at Table – 4 above and seeking fees for such courses as mentioned in the said Table – 4 above. From the description of courses provided on the said website, it is observed that Nasir claims that the strategies taught in his courses would result in assured profits. For instance, in the course D 30 Strategy Option Buying, it is stated that D 30 means daily 30-point sure shot profit. Similarly, for the course 360-Degree Expiry Strategy, it is mentioned that Minimum Capital should be 30k to make 1 L Every Expiry. It is observed that payment is sought for such courses through UPI IDs (nasirboc@kotak or bocalgo@Kotak) and as per the website, upon sending screenshot of payment to their email ID (baapofchart@gmail.com), the clients will be added to groups for respective courses.

13.2. Similarly, on the website https://bocalgo.com/, Nasir is seeking payment for the strategies through UPI ID- bocalgo@kotak and it is stated on the website that upon receipt of payment, strategy link will be provided to clients. As per the website, the following are the charges for the strategies sold by Nasir:

Table – 6

| S. No. | Strategy Name | Charges (INR) |

| 1. | Jackpot Positional | 3400 for one month plus 5% profit sharing |

| 2. | Jackpot Intraday | 3300 for one month plus 5% profit sharing |

| 3. | Jackpot Intraday Option Selling | 3000 for one month plus 5% profit sharing |

Further, as per the website, all three strategies are sold together for INR 9000 plus 5% profit sharing.

13.3. As the aforementioned two UPI IDs were publicized on the said websites for collecting fees from clients/ investors, details of the bank accounts linked with these two UPI IDs were sought from Kotak Mahindra Bank (“Kotak Bank”). As per the information provided by Kotak Bank, the aforesaid UPI IDs are linked to the following accounts:

Table – 7

| Sr. No. | UPI ID | Account Number and Name of the Bank | Name of the Account Holder | PAN |

| 1 | nasirboc@kotak | 2714680394 – Kotak Mahindra Bank | Mohammad Nasiruddin Ansari | BYSPA0419E |

| 2 | bocalgo@Kotak | 7946143525 – Kotak Mahindra Bank | Baap of Chart | BYSPA0419E |

13.4. It is observed that Bank Account number 2714680394 is in the name of Nasir. Further, as per the details provided by Kotak Bank for account number 7946143525, the account was opened in the name of BoC on February 02, 2022 which is declared to be a sole proprietorship and Nasir is the sole proprietor/ authorized signatory of BoC. Further, at the time of opening the said bank account, Nasir submitted a Certificate of Registration from Labour Department, Government of Telangana which provides that BoC is registered under Telangana Shops & Establishments Act, 1988 on February 02, 2022 wherein Nasir is shown as an employer and BoC is declared to be in the business of IT Services and Solutions. Further, Nasir is the authorized signatory for operating the Kotak Bank Account number 7946143525. In view of the aforesaid, I note that both the UPI IDs, wherein fees is collected from clients/ investors, are linked to Nasir.

INVESTMENT ADVISORY ON PRIVATE GROUPS/ WHATSAPP

14. During the course of examination, vide e-mail dated June 29, 2023, SEBI received a complaint against Nasir/ BoC alleging the following:

14.1 Complaint against Md Nasir aka Baap of charts who is looting the retail traders by showing assured returns.

14.2 Md Nasir claims to provide assured returns with 100 percent guarantee else he will refund 3 times the amount paid.

14.3 Sure shot 30000 returns with 100000 capital in options with minimum 50k returns on the expiry day.

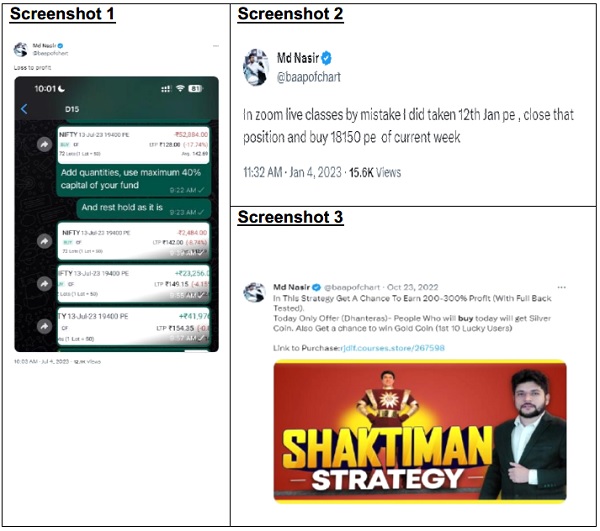

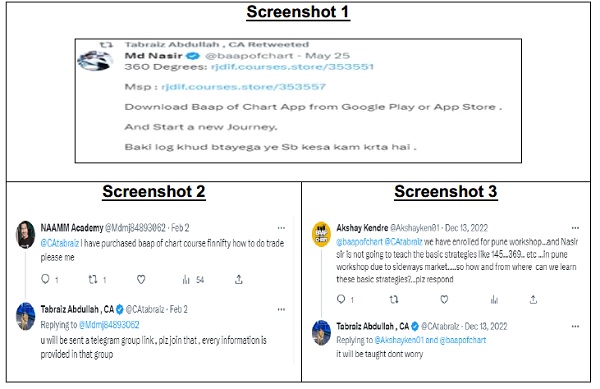

15. The complainant alleged that he paid INR 6000 for strategy. In pursuance of the same, he provided the following screenshots of private/ whatsapp groups operated by Nasir/ BoC:

16. From the aforesaid screenshots, it is observed that Nasir is inducing clients/ investors by assuring profits/ returns of a minimum INR 3,00,000 and extending to 6,00,000 per month and also giving recommendation to buy. Further, it is also stated that upon payment for courses, Nasir will give dedicated support and guide everyone personally for live market transactions. In view of the above, I note that under the garb of providing courses related to securities market, Nasir is giving recommendations to the clients in private groups and luring investors/ clients to invest in securities market by assuring returns.

ACTIVITIES ON SOCIAL MEDIA

17. The YouTube channel of Nasir (@Baapofchart) has more than 4.43 lakh subscribers and more than 7 crore views. As per the examination report, upon analysis of certain videos posted on the said YouTube channel, it was observed that videos were in the nature of promising quick and consistent returns through trading. For reference, some of the videos are highlighted below:

17.1. Bas 5 minutes me Sureshot Profit Kro | 3 Pm Strategies (posted on January 06, 2023) – In the said video, Nasir explained one strategy which he claims to have an accuracy of 80-90% and if hedged, the accuracy increases to 90%. A screenshot of the said video is provided below:

17.2 The video mentioned above, as downloaded, can be viewed by scanning the QR code mentioned below: –

17.3. Power of Trading | How to make 5 to 10 Lakhs every Month (posted on July 31, 2022) – In this video, Nasir mentioned that they will be learning how to earn 5 to 10 lakhs every month easily with 85% accuracy for which he explained two strategies viz. ‘145 Strategy’ and ‘325 Strategy’ which he said works almost 100% of the times. He further stated that by following these strategies, by investing an amount of INR 1 lakh, there will be a minimum profit of INR 1 lakh. In the said video, he guarantees that investors will earn more profit than their salaries by adopting these strategies and if a loss is suffered even after following these strategies, “investors can slap him during the workshop”. A screenshot of the said video is provided below:

17.4. On June 29, 2022, Nasir posted a video on YouTube wherein he asked for the following amounts for providing price or target or hold recommendation along with a guarantee that by taking only one trade, the below mentioned costs would be recovered:

Table – 8

| S. No. | Duration | Price (INR) |

| 1. | 1 Month | 1,500 |

| 2. | 3 Months | 2,400 |

| 3. | 1 Year | 12,000 |

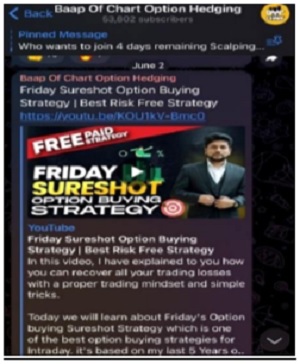

18. Md. Nasir is also operating a Telegram Group/ Channel “Baap Of Chart Option Hedging” (https://t.me/XROKCERS5) which has around 53,000 subscribers. Upon perusal of the said channel during the course of examination, it was observed that Nasir had posted links to the various videos and subscription plans. Some of the instances are provided below:

18.1. One of the videos was titled Risk Free Option Buying Strategy and the screenshot of the same is provided below

18.2. Another video was titled Friday Sureshot Option Buying Strategy | Best Risk Free Strategy. In the description to the said video, Nasir states that he has explained how one can recover all the trading losses with a proper trading mindset and simple tricks and the screenshot of the same is provided below

18.3. In a message posted on the said Telegram Channel, a 3 month Telegram subscription at INR 12,000 was offered which included learning in live market and a link to the website (https://rjdif.courses.store/280948) was also provided. A screenshot of the said message is provided below

19. On the Instagram account “baapofchart”, there are around 59,000 followers. During the course of examination, it was inter alia observed from the photos posted on the said account that BoC provided “Super 30 Strategy for per week sucure 4% Profit”. Further, for a 2 day online session, BoC stated that “On only 2 setup anyone can make consistent profit with confidence”. Screenshots of the said messages are provided below

20. On the twitter profile of Nasir (https://twitter.com/baapofchart), there are around 78,000 followers. Upon perusal of the tweets of the said profile during the course of examination, the following was observed (screenshots provided):

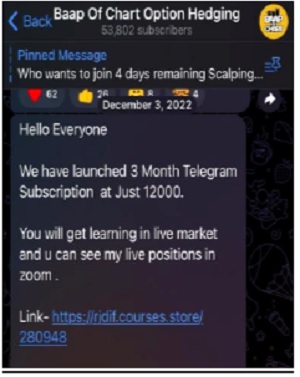

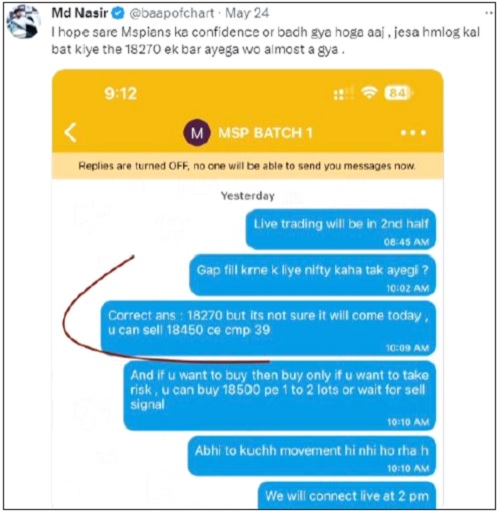

20.1. Nasir posted a screenshot from a private group wherein he recommended “Add quantities, use maximum 40% capital of your fund” “And rest hold as it is”.

20.2 Nasir posted a message wherein he referred to zoom live classes and recommended closing a position and buying of securities.

20.3 Nasir posted a screenshot of Shaktiman Strategy wherein he offered “a

chance to earn 200-300% profit” while giving the sense of a favorable odds with the inducement “with full back testing” and posted the link to purchase the same (rjdif.courses.store/267598).

20.4. In the below screenshot of a group ‘MSP Batch 1’ posted by Nasir on twitter, it is observed that Nasir is giving recommendations to his clients/ investors on options trading:

21. From the aforesaid messages/ screenshots posted by Nasir on social media, it was observed during the examination that Nasir was luring persons to subscribe to so called ‘educational courses’/ ‘workshops’ offered by him, with the objective of inducing them to deal in securities by claiming that they would make profits by adhering to the advice/ strategy rendered in his “educational courses”. I note that investment in securities market are subject to risks. It cannot be said with certainty that adopting any strategy would ensure recovery of losses or assure profits.

22. In light of the aforesaid content published on social media, messages sent on closed user groups and complaint received from investor, I prima facie conclude that Nasir/ BoC are engaged in providing investment advisory services for consideration to the investors of securities market.

COURSE CONTENT ON BUNCH PLATFORM

23. During the course of examination, Bunch provided SEBI with links to the content from some of the courses sold by Nasir on the website. Upon perusal of the videos available on aforementioned links, the following was inter alia observed:

23.1. In ‘325 Premium Strategy’, Nasir declares that if strategy is followed for 90 days, he can give an ‘agreement’ (sic) that there will be profit to ‘students’/ ‘investors’.

23.2. In ‘Intraday 200X Strategy’, Nasir claims that there is 80-90% accuracy which gives profit by 11 AM. He further declares that the capital will be doubled in 60 days for sure and that this strategy works every day. The said video, as downloaded, can be viewed by scanning the QR code mentioned below: –

23.3. In ‘D30 Strategy’, Nasir states that it is a daily sureshot strategy of option buying wherein 2-3 set ups will be given to investors and anyhow investors will get 30 points in Nifty and 90 points in Bank Nifty. He further declares a course condition that if investors suffer loss after completing the course, fees will be refunded to ‘investors’/ ‘students’.

23.4. In ‘Shaktiman Strategy’, Nasir states that this strategy is an option buying strategy for Nifty and declares that this strategy will provide profit no matter how market performs. He further gives a challenge that if investors follow the strategy for 3 months, there will be no loss and if there is loss, the fees will be refunded.

23.5. From the aforesaid videos/ course content, I note that Nasir was luring persons with such ‘open challenges’/ ‘agreements’ of sureshot profit from his ‘strategies’/ ‘courses’ and refund of fees in cases of loss.

GOLDEN SYNDICATE VENTURES PVT. LTD.

24. As discussed in para 12.2 above, apart from bank account of BoC/ Nasir, amount collected from the courses listed on Bunch platform was also deposited in the bank accounts of GSVPL (HDFC Bank A/c No. 59231100000012) and Padamati Rahul Rao (Kotak Mahindra Bank A/c Nos. 7512208658 and 8125749008).

25. A search was carried out on the website of Ministry of Corporate Affairs (“MCA”) wherein it was observed that GSVPL was incorporated on July 27, 2022, registered with RoC-Hyderabad and its CIN is U80210TG2022PTC165221. As per details available on the said website, the following persons are directors of GSVPL:

Table – 9

| S. No. | Name of Directors of GSVPL |

| 1. | Mohammad Nasiruddin Ansari |

| 2. | Rahul Rao Padamati |

| 3. | Asif Iqbal Wani |

| 4. | Tabraiz Abdullah |

| 5. | Mansha Abdullah |

| 6. | Vamshi Jadhav |

26. Further, as per the information available on the website of MCA, the following persons are the shareholders of GSVPL:

Table – 10

| S. No. | Name of Shareholder of GSVPL | Percentage of Shareholding |

| 1. | Mohammad Nasiruddin Ansari | 25% |

| 2. | Rahul Rao Padamati | 24% |

| 3. | Asif Iqbal Wani | 24% |

| 4. | Mansha Abdullah | 15% |

| 5. | Tabraiz Abdullah | 9% |

| 6. | Jadav Vamshi | 2% |

| 7. | Jyoti Mamgain | 1% |

27. During the course of examination, the role of directors/ shareholders of GSVPL, apart from Nasir, was also examined which is discussed in the following paragraphs.

27.1. Rahul Rao Padamati (“Rahul”)

27.1.1. As stated above, Rahul is a director of GSVPL and holds 24% shares of GSVPL. Upon perusal of the documents provided by HDFC Bank for the bank account of GSVPL, it is observed that Rahul is one of the authorized signatories for the said bank account and his e-mail ID (rahul.xxxxx.xx79@gmail.com) is provided in the account opening form. As discussed later in this Order, an amount of approx. INR 9 Crore was credited into the said bank account of GSVPL.

27.1.2. Further, payments were received in the two Kotak Mahindra Bank accounts of Rahul for the courses/ workshops sold by Nasir/ BoC through Bunch platform. Upon examination of the account statements of the said Kotak Bank accounts, it is observed that more than INR 2.60 Crore were received in the bank accounts of Rahul for the fees of ‘courses’ sold on the Bunch platform.

27.2. Tabraiz Abdullah (“Tabraiz”)

27.2.1. As stated above, Tabraiz is a director of GSVPL and holds 9% shares of GSVPL. Upon perusal of the documents provided by HDFC Bank for the bank account of GSVPL, it is observed that Tabraiz is one of the authorized signatories for the said bank account wherein an amount of approx. INR 9 Crore was credited for the courses/ workshops sold by Nasir/ BoC through Bunch platform. Further, it is observed that monies have been transferred from the account of GSVPL to Tabraiz.

27.2.2. During the course of examination, the twitter profile of Tabraiz (https://twitter.com/CAtabraiz) was examined and it was observed that Tabraiz is actively involved in promoting BoC through retweeting the tweets of Nasir relating to BoC and answering the queries of clients of BoC. Some of the screenshots are provided below:

27.3. Asif Iqbal Wani (“Asif”)

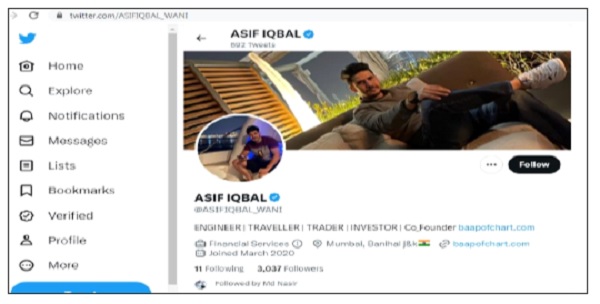

27.3.1. As stated above, Asif is a director of GSVPL and holds 24% shares of GSVPL. Upon perusal of the documents provided by HDFC Bank for the bank account of GSVPL, it is observed that Asif is one of the authorized signatories for the said bank account wherein an amount of approx. INR 9 Crore is credited for the courses/ workshops sold by Nasir/ BoC through Bunch platform. Further, it is observed that monies have been transferred from the account of GSVPL to Asif.

27.3.2. During the course of examination, the twitter profile of Asif (https://twitter.com/ASIFIQBAL_WANI) was examined and it was observed that Asif has inter alia mentioned on his profile that he is a cofounder of baapofchart.com. A screenshot is provided below:

27.4. Mansha Abdullah (“Mansha”) and Jadav Vamshi (“Vamshi”) – Aside from the direct receipt of monies by directors or into accounts of which the aforementioned directors are authorized signatories, I note from the bank statements of GSVPL, Nasir and BoC that amounts received from investors/ clients have also been transferred to the bank accounts of two other directors of GSVPL (Mansha and Vamshi) in many instances. As per the information available on record, Mansha and Vamshi are also shareholders of GSVPL holding 15% and 2% respectively. Accordingly, it may be reasonable to infer that Mansha and Jadav had indirectly received monies (from GSVPL) collected from investors/ clients through unregistered investment advisory services.

27.5. The aforesaid facts and circumstances lead to a prima facie conclusion that Rahul, Tabraiz, Asif, Mansha and Vamshi did not just play a passive role as directors of the company – Golden Syndicate – but were either directly or indirectly recipients of fees collected or marketed/ promoted the business of the company. In view of all of the above, it is prima facie concluded that all of the Noticees were actively engaged in the business of unregistered investment advisory services and collected fees/ amounts from ‘students’/ ‘investors’.

FEES/ PAYMENT COLLECTED BY NASIR/ BOC/ RAHUL

28. For the courses/ workshops listed on the Bunch platform (as discussed in para 12 above), the details of the payment received were sought from Bunch. In this regard, Bunch informed that its engagement with Nasir/ BoC started from May 2022 onwards and provided the following details of the amounts collected by Nasir from courses/ workshops listed on Bunch’s platform (https://rjdif.courses.store/ and mobile apps available on Google Play Store/ Apple Store):

Table – 11

| Sr. No. | Account Number |

Name of the Bank | Name of the entity | Amount collected in INR |

| 1 | 59231100000012 | HDFC | Golden Syndicate Ventures Pvt Ltd | 8,98,66,080.59 |

| 2 | 7512208658 | Kotak Mahindra Bank | Padamti Rahul Rao | 2,42,15,164.97 |

| 3 | 7946143525 | Kotak Mahindra Bank | Baap of Chart (Mohammad Nasir) |

83,08,662.69 |

| 4 | 8125749008 | Kotak Mahindra Bank | Padamati Rahul Rao | 18,96,796.10 |

| 5 | NA | NA | Collected in offline mode(*) |

1,35,74,872 |

| Total | 13,78,61,576.35 | |||

* Nasir Directly collected the total course price from clients/ investors as informed by Bunch

29. As the aforesaid amount was collected through the payment gateway provided by Bunch for ‘educational courses’, collated by Bunch for all the courses availed by ‘students’ and identifiable directly with such courses, the complete amount is considered as fees received from fraudulent and unregistered investment advisory activities.

30. In addition to the above, as discussed in para 13 above, the two UPI IDs relating to Kotak Mahindra Bank were publicized on the website/ social media for collecting fees from clients/ investors and amounts were collected in the said bank accounts (2714680394 and 7946143525) belonging to Nasir/ BoC. In view of the above, account statements for the said accounts were sought from Kotak Mahindra Bank for the period January 2021 to June 2023. Upon examination of the said account statements, following is observed:

Table – 12

| S. No. | Account Number | Date of Account Opening | No. of UPI/ IMPS Transactions (excluding own transfers/ reversal of charges, etc.) | Amount Deposited through such UPI/ IMPS Transactions (INR) |

| 1 | 2714680394 | June 08, 2020 | 2487 | 1,42,24,810.97 |

| 2 | 7946143525 | February 10, 2022 | 3268 | 1,99,90,228.77 |

| Total | 3,42,15,039.74 | |||

31. During the examination, it was observed that apart from the credit transactions having clear narration and use of words such as training, Jackpot Algo, Stock tips, etc., the majority of transactions in the said accounts were exactly same or similar to the price of packages/ courses/ workshop offered through websites or mobile apps. However, own transfer, reversal of charges, etc. were excluded from the amount credited in these two Kotak bank accounts for the purpose of computation of the fee collected.

32. In view of the above, it is prima facie concluded that Noticees have collected an amount of INR 17,20,76,616.09 (Rupees Seventeen Crore Twenty Lakh Seventy Six Thousand Six Hundred Sixteen and Nine Paisa) during the period January 2021 – July 2023 by luring clients/ investors through misleading/ false information to purchase his courses/ workshops, adding them in their closed groups and inducing/ influencing them to deal in securities. Further, as already discussed, Noticees are providing investment advisory services in the name of such workshops/ courses. As per the available records, Noticees are not registered with SEBI in any capacity. Therefore, I note from the available information that Noticees have collected an amount of INR 17,20,76,616.09 (Rupees Seventeen Crore Twenty Lakh Seventy Six Thousand Six Hundred Sixteen and Nine Paisa) during the examination period by indulging in unregistered investment advisory activities.

C. ALLEGED VIOLATIONS OF SEBI ACT, IA REGULATIONS

33. The provisions of law attracted in the present case are Section 12(1) of the SEBI Act and Regulations 2(1)(l), 2(1)(m) & 3(1) of the IA Regulations. The text of the said provisions is reproduced below:

“SEBI Act

Registration of stock brokers, sub-brokers, share transfer agents, etc.

12. (1) No stock broker, sub-broker, share transfer agent, banker to an issue, trustee of trust deed, registrar to an issue, merchant banker, underwriter, portfolio manager, investment adviser and such other intermediary who may be associated with securities market shall buy, sell or deal in securities except under, and in accordance with, the conditions of a certificate of registration obtained from the Board in accordance with the regulations made under this Act:

IA Regulations

Application for grant of certificate.

3. (1) On and from the commencement of these regulations, no person shall act as an investment adviser or hold itself out as an investment adviser unless he has obtained a certificate of registration from the Board under these regulations:”

34. It is prima facie observed, based on the facts and circumstances already discussed in previous paragraphs, that Noticees are engaged in business of providing investment advice to their clients/ investors for consideration by inducing them to subscribe to their courses/ workshops and adding them to closed groups wherein recommendations are given to the investors/ clients. Further, investors/ clients were assured that upon payment of consideration/ subscription amount, Nasir will give them dedicated support/ personal guidance one by one and will call them for such guidance. Such activities of the Noticees are covered under the definitions of ‘investment advice’ and ‘investment adviser’ as defined under regulation 2(1)(l) and 2(1)(m) of IA Regulations respectively.

D. ALLEGED VIOLATION OF PFUTP REGULATIONS

35. As has been concluded prima facie that the Noticees acted as Investment Advisors without registration. As also observed in the previous paragraphs of this Order, the Noticees recklessly and misleadingly offering assured returns to their clients / investors under the guise of educational courses to induce them to invest in stock market. Nasir in his videos repeatedly refers to his experience of making profits because of the strategies he has adopted and encourages his “students” (customers/ investors) to adhere to his strategies because of the certainty or near-certainty of his recommendations/ strategies.

36. During the examination, it was observed from the website of BoC (https://baapofchart.com/) that Nasir is presented as a “stock market wiz” who has developed BoC which is a proprietary algorithm “clocking a profit accuracy of 95%” and designed BoC to give “profits day after day eliminating any chance of overall loss”. Further, on another YouTube Channel (@NasirTalks), Nasir has posted a ‘YouTube shorts video on November 08, 2022 (https://youtube.com/shorts/dBF3f7edZVc?si=fHc2GVDulgMbbdQm) wherein he inter alia states that he makes a minimum of 20-30% profit every month by following his strategies. To examine the veracity of the statements made by Nasir on BoC website with respect to his trading and his claims on social media, the trading details of Nasir over a period of 2.5 years (January 2021 – July 2023) were sought from the exchanges. Based on the information received from exchanges and depositories, it is noted that contrary to Nasir’s statement vide his email dated January 21, 2023 (noted at para 5 above), as on the said date he had 7 active trading accounts. Further, as per the details provided by exchanges/broker, active trading took place primarily in 2 accounts (in two other accounts, there were only one single transaction in each account). Based on the aforesaid information, the profit/ loss details made pursuant to trading in equity and derivative segments executed by Nasir for the period of 2.5 years are provided below:

Table – 13

| S. No. | Name of the Broker | Net Profit / Loss of Nasir in Equity and Derivative Segments (INR) |

| 1 | Zerodha Broking Ltd | (2,64,57,896.62) |

| 2 | Angel One Ltd | (25,02,931.40) |

| Total | (2,89,60,828.02) | |

37. As can be observed, contrary to Nasir’s claims that he had been making profits of 20-30%, he infact incurred a net trading loss amounting to INR 2,89,60,828.02 (Rupees Two Crore Eighty Nine Lakh Sixty Thousand Eight Hundred Twenty Eight and Two Paisa) for the period January 01, 2021 – July 07, 2023. Through his offline/ online “classes” as well as his videos and messages on social media, Nasir presents himself as a stock market expert and claims BoC recommendations has 95% accuracy whereas Nasir could not make any overall profit in his personal capacity through trading in securities over a period of 2.5 years. Nasir, who claims to provide strategies for trading that would lead to 200300% profit/ assured or near-assured returns, has actually incurred a net loss of INR 2,89,60,828.02 through trading in securities and has concealed such facts from the investors in his videos/ workshops/ groups. Therefore, the claim of certainty or near-certainty on returns on his trading calls/ ‘educational videos’ is not supported by his individual record of trading in the securities market. Such mis-selling/misleading/ false statements have the effect of inducing investors to invest in the securities market based on the misleading/ false messages that he issues. It is pertinent to mention here that in a research paper dated January 25, 2023, SEBI had analysed the trading by individual investors with regard to net profit/ loss incurred by them in the equity F&O segment for the period FY 19 and FY 22. It was inter alia observed that 89 % of the individual traders (i.e. 9 out of 10) incurred losses in equity F&O segment during the said period.

38. As mentioned at Table – 6 above, Noticees are selling strategies for trading as ‘educational content’ for trading in securities market and the charges for the courses/ strategies include provision for profit sharing with Noticees. A reasonable inference can be drawn that Noticees are luring/ inducing investors to deal in the securities market by claiming that his strategies are such that profits are a certainty or near-certainty if adopted. Further, as already discussed in preceding paragraphs, Noticees were giving recommendations to clients/ investors in private groups/ WhatsApp groups and it can be reasonably inferred that by referring to profit sharing, Noticees are providing buy/ sell/ hold recommendations to clients/ investors on trading in the securities market. Therefore, it is prima facie concluded that under the garb of ‘educational courses’/ ‘strategies’, Noticees are providing investment advisory services by luring/ inducing them with false/ misleading claims and therefore have indulged in fraudulent activity in violation of the provisions of SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 (“PFUTP Regulations”). The possible provisions attracted in this regard are Regulations 3 (a) – (d), 4(1), 4(2)(k) & 4(2)(s) of the PFUTP Regulations read with Section 12A of the SEBI Act. The text of the said provisions is reproduced below:

“Prohibition of manipulative and deceptive devices, insider trading and substantial acquisition of securities or control.

12A. No person shall directly or indirectly –

(a) use or employ, in connection with the issue, purchase or sale of any securities listed or proposed to be listed on a recognized stock exchange, any manipulative or deceptive device or contrivance in contravention of the provisions of this Act or the rules or the regulations made thereunder;

(b) employ any device, scheme or artifice to defraud in connection with issue or dealing in securities which are listed or proposed to be listed on a recognised stock exchange;

(c) engage in any act, practice, course of business which operates or would operate as fraud or deceit upon any person, in connection with the issue, dealing in securities which are listed or proposed to be listed on a recognised stock exchange, in contravention of the provisions of this Act or the rules or the regulations made thereunder;

“PFUTP Regulations

Definitions

2. (1) In these regulations, unless the context otherwise requires,-

(c) “fraud” includes any act, expression, omission or concealment committed whether in a deceitful manner or not by a person or by any other person with his connivance or by his agent while dealing in securities in order to induce another person or his agent to deal in securities, whether or not there is any wrongful gain or avoidance of any loss, and shall also include–

(1) a knowing misrepresentation of the truth or concealment of material fact in order that another person may act to his detriment;

(2) a suggestion as to a fact which is not true by one who does not believe it to be true;

(3) an active concealment of a fact by a person having knowledge or belief of the fact;

(4) a promise made without any intention of performing it;

(5) a representation made in a reckless and careless manner whether it be true or false;

(6) any such act or omission as any other law specifically declares to be fraudulent;

(7) deceptive behaviour by a person depriving another of informed consent or full participation;

(8) a false statement made without reasonable ground for believing it to be true;

(9) the act of an issuer of securities giving out misinformation that affects the market price of the security, resulting in investors being effectively misled even though they did not rely on the statement itself or anything derived from it other than the market price.

And “fraudulent” shall be construed accordingly; …

3. Prohibition of certain dealings in securities

No person shall directly or indirectly-

(a) buy, sell or otherwise deal in securities in a fraudulent manner;

(b) use or employ, in connection with issue, purchase or sale of any security listed or proposed to be listed in a recognized stock exchange, any manipulative or deceptive device or contrivance in contravention of the provisions of the Act or the rules or the regulations made there under;

(c) employ any device, scheme or artifice to defraud in connection with dealing in or issue of securities which are listed or proposed to be listed on a recognized stock exchange;

(d) engage in any act, practice, course of business which operates or would operate as fraud or deceit upon any person in connection with any dealing in or issue of securities which are listed or proposed to be listed on a recognized stock exchange in contravention of the provisions of the Act or the rules and the regulations made there under.

4. Prohibition of manipulative, fraudulent and unfair trade practices

(1) Without prejudice to the provisions of regulation 3, no person shall indulge in a manipulative, fraudulent or an unfair trade practice in securities markets.

(2) Dealing in securities shall be deemed to be a manipulative fraudulent or an unfair trade practice if it involves any of the following:—

…….

(k) disseminating information or advice through any media, whether physical or digital, which the disseminator knows to be false or misleading in a reckless or careless manner and which is designed to, or likely to influence the decision of investors dealing in securities;

(s) mis-selling of securities or services related to securities market;

Explanation- For the purpose of this clause, “mis-selling” means sale of securities or services relating to securities market by any person, directly or indirectly, by-

(i) knowingly making a false or misleading statement, or

(ii) knowingly concealing or omitting material facts, or

(iii) knowingly concealing the associated risk, or

(iv) not taking reasonable care to ensure suitability of the securities or service to the buyer;”

E. CONCLUSION

39. Regulation 3 of the IA Regulations, inter alia, provides that, no person shall act as an investment adviser or hold itself out as an investment adviser, unless he has obtained a certificate of registration from SEBI. The activities of Noticees as brought out from the various materials described above including their websites, apps, bank accounts, complaint, etc., seen in the backdrop of the aforesaid regulatory provisions, show that Noticees were acting as Investment Advisers without SEBI registration.

40. Among the Noticees, prima facie, the face of the business of advisory activity is Md. Nasir (Noticee No. 1). The business brand is also built around his sole proprietorship – “Baap of Chart”. The company, of which he is both a significant shareholder and a director – Golden Syndicate Ventures Pvt. Ltd. appears to be the primary body corporate which he has used to further the business activity. While Tabraiz Abdullah and Asif Iqbal Wani (both directors of Golden Syndicate) appear to have actively marketed the advisory activity, the bank accounts of other directors – Rahul Rao on the one hand, and Jadav Vamshi/ Mansha Abdullah on the other hand have, respectively, directly and indirectly (through Golden Syndicate) received fees from the advisory activity.

41. Md. Nasir/ BoC has gone to great lengths to lend a cloak of legitimacy to their activity by describing the advisory activity as being educational in nature where strategies are provided to clients in return for fees. One would be tempted to believe that the Noticees merely adopted a unique approach for educating investors about trading in the securities market. But a closer look at the activities of the Noticees prima facie reveal that that may not be the case. The videos and messages posted by Nasir contain recommendations on strategies to adopt for trading in the securities market. They contain specific recommendations on the specific days of a week and specific times of a day during which certain securities must be traded (refer para 17.2 above). Some of the messages offer personalized guidance to the customers/ clients for live market transactions (refer para 15 above). Significantly, the messages and videos are also replete with assurances that following the strategies of trading would result in unnaturally high probability of clients’ profits to the point of being near-certainty despite it being well known by market participants that market investments are subject to risks and profits from trading in securities cannot be assured. The nature of the guarantees don’t end there. Md. Nasir, in his videos, quotes the specific odds of the success of his strategies (refer paras 17 and 23 above). For some classes, the fee includes a profit sharing percentage (refer para 13.2 above). The theatrics and showmanship in the trailer videos on YouTube issued by Md. Nasir/ BoC appear to be aimed at creating illusion of unnatural returns by drawing in gullible and uninformed viewers to join his ‘classes’ thereby inducing them to trade in the securities market.

42. I note from the website (https://bocalgo.com/disclaimer/) of Noticees that they have provided a disclaimer on their websites that they are not registered with SEBI as investment adviser and that the information provided by the Noticees are for educational purposes only. In addition to the above, Noticees have provided the following disclaimer on BoC website (https://baapofchart.com/privacy-policy-2/#):

43. As can be seen from the screenshot recorded above, the assertions made in the ‘disclaimer’ are, at the very least, ambiguous. Even while claiming that the information provided is for educational purpose only, the webpage markets the product as being focused towards individuals who like to generate “consistent profit”. It appears, prima facie, that such disclaimers are an attempt by the Noticees to absolve themselves of any liability by seemingly warning the clients and casting on them the responsibility to be cautious of the service that they have availed. Such disclaimers cannot by any stretch of imagination discharge persons from the duty to comply with the law prohibiting unregistered investment advisory activity or the law prohibiting fraudulent and manipulative practices in the securities market. Infact, the double disclaimer that the Noticee was not registered as an investment advisor and that the information provided was for educational purposes only, lays bare the fact that the Noticees were aware that the recommendations/ advise provided by the Noticees could be regarded as ‘investment advice’ and that they would need registration for being in the business of providing ‘investment advice’. In any case, as already discussed earlier, the ‘courses’ marketed and sold cannot be construed as being educational in nature. They are replete with specific advice on trading in the securities market and are supported with unnaturally high degree of assurance of profits (80 – 90%) that can be made by following the advice whereas as already mentioned in previous paragraphs, empirically 90% of retail traders incurred losses in equity F&O segment.

44. Prima facie, at its very core, the impugned activity is fraudulent. It appears that the Noticees sought to make a quick buck by inducing persons to invest in the securities market making bogus claims and assurances of astronomical profits if trades are executed relying on their advise/ recommendations. Describing such advise/ recommendations as ‘educational courses’ appears to be a futile attempt to whitewash the illegality involved. As noted from the aforementioned bank accounts of the Noticees, there are multiple credit entries which when seen together with the content on the social media posts/ closed groups created on Bunch platform (elaborated earlier in this Order) leads to the prima facie conclusion that the credit entries in the aforesaid bank accounts were in return for the investment advice given by the Noticees to their clients. There is no record of the Noticees having been registered with SEBI as intermediary in any capacity. In view of all of the above, prima facie, I conclude that the Noticees are engaged in the business of providing investment advice to persons for consideration without obtaining registration from SEBI in contravention of section 12(1) of the SEBI Act read with regulation 3(1) of IA Regulations. Considering the facts and circumstances narrated above, I also prima facie conclude that the Noticees have violated regulations 3 (a)-(d), 4(1), 4(2)(k) & (s) of PFUTP Regulations read with section 12A of the SEBI Act.

45. Based on the examination carried out of the statements of bank accounts linked with courses offered on Bunch media platforms/ websites that prima facie at least INR 17,20,76,616.09 (Rupees Seventeen Crore Twenty Lakh Seventy Six Thousand Six Hundred Sixteen and Nine Paisa) have been collected through such fraudulent and unregistered investment advisory activities.

F. NEED FOR INTERIM DIRECTIONS

46. SEBI has a statutory duty to protect the interest of investors in securities market and to promote the development of, and to regulate, the securities market. Section 11 of the SEBI Act empowers SEBI to take such measures as it thinks fit for fulfilling its legislative mandate. The IA Regulations have been formulated with the main objective of regulating investment advisory activities to safeguard the interests of investors. Registration of such investment advisory activity with SEBI is mandatory under regulations. The IA Regulations, inter alia, seek to make investment advisers accountable for their advice by requiring them to comply with the criteria set out in the relevant provisions of the IA Regulations. In order to ensure protection of investors’ interest who desire to receive investment advice from various Investment Advisors, it is imperative that any person carrying out investment advisory activities has to necessarily obtain registration from SEBI and has to conduct its activities in accordance with the provisions of the relevant SEBI Regulations.

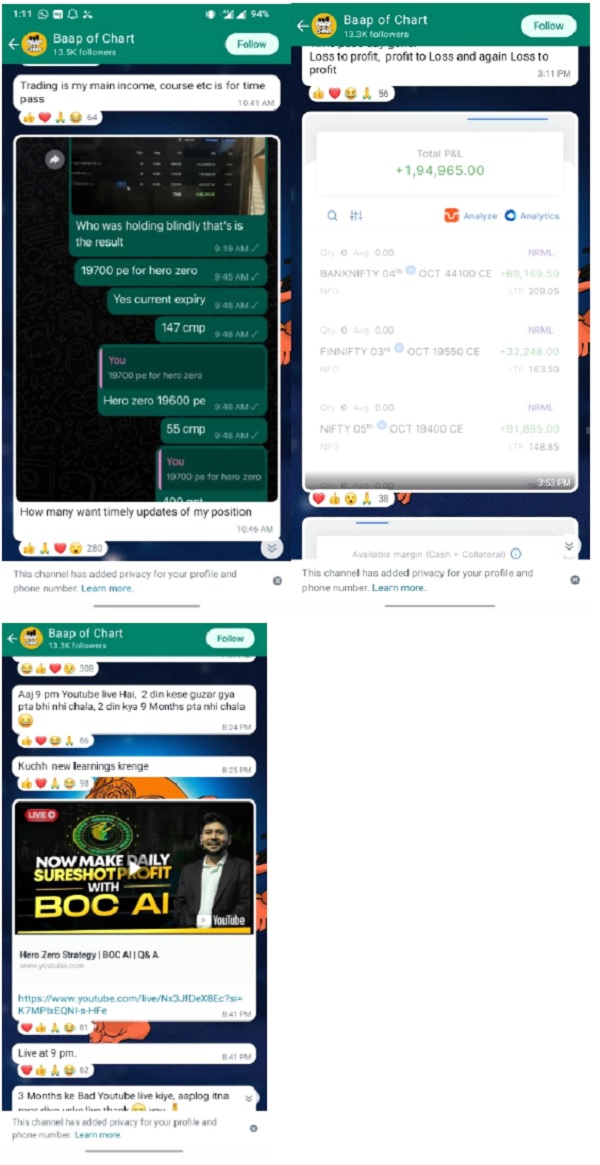

47. In the instant case, the Noticees are prima facie seen to be misleading, soliciting and inducing the investors to deal in the securities market on the basis of investment advice without having the requisite registration / certificate as mandated under the IA Regulations. Further, as per the material available on record, the sale of courses/ offline workshops/ private groups/ social media accounts of Noticees continue to be active as on date and thereby continuing to mislead, induce and solicit money from investors/ clients for their unregistered and fraudulent investment advisory activity. On September 05, 2023, Nasir posted a video on YouTube channel titled Teachers Day Special Gift for All Students | Make Every Week 1 to 2 Lakhs and on September 24, 2023, a video titled The Hero Zero Strategy | Make 1 Lakhs wit 10k Capital was posted on the YouTube Channel. Further, I note that on his twitter (X) profile, Nasir has shared the link of his WhatsApp channel (whatsapp.com/channel/0029Va…) on October 01, 2023. Upon perusal of the said WhatsApp Channel, I note that there are more than 13,000 followers and Nasir continues to give buy/ sell recommendations to the members even till the first week of October 2023. On the said WhatsApp channel, Nasir is sharing screenshots of his purported profits from trading in securities market to lure investors and declaring that trading is my main income, course etc. is for time pass. This is despite the factual record of him having suffered a loss of approximately INR 3 Crore in trading in securities market during the last 2.5 years which he has concealed from his clients/ investors. Also, on WhatsApp channel, Nasir has shared links to his YouTube channel Q&A session Hero Zero Strategy | BOC AI | Q&A wherein he is declaring Now Make Daily Sureshot Profit with BOC AI. The screenshots from YouTube and WhatsApp channels are provided below. Therefore, the Noticees continue to lure and induce investors to invest in securities market and collect money from them through ‘educational courses’.

–

48. It is noted that registration and regulation of intermediaries provides assurance of quality and standards to their clients / investors. They are subject to regulatory purview of SEBI which inter alia monitors their compliance with the law. Registration of such investment advisers is also subject to satisfaction of ‘fit and proper’ norms. The requirements under IA Regulations are aimed at the protection of the investors in the securities market. Therefore, turning a blind eye to unqualified and unregulated investment advisory services can cause irreparable damage to the integrity of securities market. Such services may adversely impact the orderly development of securities market apart from hurting the interests of the investors in the market.

49. Considering the facts and circumstances of the present matter and on the basis of the prima facie findings, it is necessary to take urgent preventive action in this matter and to take immediate steps to prevent the noticees from collecting any more fees from the public and from indulging in unregistered investment advisory activities. As per material available on record, monies are being received in the aforementioned bank accounts at least till the examination period, and the bank accounts and social media channels are still active. The aforesaid prima facie demonstrates that persons may still be lured to deal in the securities market due to the activities of the Noticees which poses a threat to the integrity of the securities market.

50. The next question to be addressed is which of the Noticees are liable for immediate or interim order. As elaborated in previous paragraphs of this Order Nasir prima facie is the face of the alleged fraudulent and unregistered investment advisory activity. His sole proprietorship- ‘Baap of Chart’ and the brand recall associated with the same name is central to the allegations made out in this Order. Therefore, it is necessary, in the interest of investors and the integrity of the securities market, for interim directions to be passed against Nasir, not just in his personal capacity but also in his capacity as sole proprietor of ‘Baap of Chart’. Further, though Nasir is prima facie the face of these activities, the Noticee Nos. 2 and 5 appear to have been direct recipients of the amount/ fees collected from such fraudulent and unregistered investment advisory activities in their bank accounts. Noticee Nos. 1 and 2 i.e. Nasir and Rahul are also both significant shareholders and directors of Golden Syndicate which is the company whose accounts have been credited with fees collected. Considering the direct role these persons have played in the perpetuation of the unregistered and fraudulent activity, I am of the view that it is necessary to pass interim directions against Noticee Nos. 1, 2 and 5 whereas a notice to show cause against all the Noticees may be issued for their alleged role in the prima facie fraudulent and unregistered investment advisory activity. Further, as already observed, Noticees have prima facie violated securities laws by engaging in fraudulent and unregistered investment advisory activities, it is imperative to issue directions against all the Noticees to cease and desist from continuing with such violations.

51. I have noted from para 32 above that prima facie, an amount of INR 17,20,76,616.09 (Rupees Seventeen Crore Twenty Lakh Seventy Six Thousand Six Hundred Sixteen and Nine Paisa) has been accumulated during a period of just over 2 years from carrying out investment advisory activities which are both unregistered and fraudulent. In view of receipt of fees for ‘educational courses’ directly in their bank accounts, prima facie it is concluded that the aforesaid Noticee Nos. 1, 2 and 5 are jointly and severally liable for alleged unlawful gains as mentioned in para 32 above as an interim measure. Considering that the Noticee Nos. 1, 2 and 5 have wantonly engaged in perpetrating fraudulent activity, I cannot ignore the risk that the said Noticees may divert the alleged unlawful gains before directions for disgorgement / refund, etc., if any, are passed. Further, I note that in his videos/ social media posts on ‘courses’ of BoC, Nasir repeatedly emphasizes on providing access to live trading during his courses. Therefore, non-interference at this stage would result in irreparable injury to interests of the securities market and the investors. Considering the factual matrix of the case and the prima facie conclusion of fraudulent and unregistered investment advisory activities, I am convinced that the balance of convenience lies in passing interim directions against the Noticee Nos. 1, 2 and 5 inter alia for preventing the continuation of any further fraudulent or unregistered activities in the interest of investors, and for impounding and retaining such quantified alleged illegal gains.

ORDER

52. In view of the above, in order to protect the interests of investors and the integrity of the securities market, I, in exercise of the powers conferred upon me under sections 11(1), 11(4), 11B and 11D read with section 19 of the SEBI Act, hereby issue by way of this interim ex-parte order, the following interim directions:

52.1 Noticees shall cease and desist from acting as or holding themselves out to be investment advisors, whether using ‘Baap of Chart’ or otherwise. They shall cease to solicit or undertake such activity or any other unregistered or fraudulent activity in the securities market, directly or indirectly, in any manner whatsoever;

52.2. Noticee Nos. 1, 2 and 5 are restrained from buying, selling or dealing in securities either directly or indirectly, in any manner whatsoever until further orders. If Noticee Nos. 1, 2 and 5 have any open position in any exchange traded derivative contracts, as on the date of this Order, they can close out / square off such open positions within 3 months from the date of this Order or at the expiry of such contracts, whichever is earlier. The said Noticee Nos. 1, 2 and 5 are permitted to settle the pay-in and pay-out obligations in respect of transactions, if any, which have taken place before the close of trading on the date of this Order;

52.3. The proceeds in the bank accounts of the Noticee Nos. 1, 2 and 5, to the extent of illegal gains mentioned in para 32 above shall be impounded, jointly and severally. Further, the Noticee Nos. 1, 2 and 5 are directed to open an escrow account with a scheduled commercial bank and deposit the impounded amount mentioned therein within 15 days from the date of service of this Order. In the said escrow account, a lien shall be created in favour of SEBI. Further, the monies kept therein shall not be released without permission from SEBI;

52.4. Noticee Nos. 1, 2 and 5 are directed not to divert any fund raised from investors, kept in bank account(s) and / or in their custody, until further orders.

52.5. Noticee Nos. 1, 2 and 5 are directed not to dispose of or alienate any assets, whether movable or immovable, or any interest or investment or charge on any of such assets held in their name, jointly or severally, including money lying in bank accounts except with the prior permission of SEBI until the impounded amount is deposited in the escrow account;

52.6. Noticee Nos. 1, 2 and 5 are directed to provide a full inventory of all assets held in their names, jointly or severally, whether movable or immovable, or any interest or investment or charge on any of such assets, including details of all bank accounts, demat accounts and mutual fund investments, immediately but not later than 15 days from the date of receipt of this Order;

52.7. The banks where Noticee Nos. 1, 2 and 5 are holding bank accounts, individually or jointly, are directed to ensure that till further directions, except for compliance of direction at para 52.3 above, no debits are made in the said bank accounts without the permission of SEBI. The banks are directed to ensure that all the above directions are strictly enforced. On production of proof of deposit of entire amount mentioned in para 32 above, SEBI shall communicate to the banks to defreeze the accounts of the Noticee Nos. 1, 2 and 5. Debit freeze on the bank accounts of the Noticee Nos. 1, 2 and 5 shall be removed only upon deposit of all illegal gains due from Noticee Nos. 1, 2 and 5, as mentioned in para 32 above. Further, the depositories are directed to ensure, that till further directions, no debits are made in the demat accounts of Noticee Nos. 1, 2 and 5 held individually or jointly;

52.8. The registrar and transfer agents are also directed to ensure that till further directions, the securities / mutual funds units held in the name of Noticee Nos. 1, 2 and 5 jointly or severally, are not transferred / redeemed;

52.9. Noticees are directed to immediately withdraw public access to all advertisements, representations, literatures, brochures, materials, publications, documents, communication, etc., in relation to their investment advisory activities/ workshops or any other unregistered activity in the securities market until further orders. The aforesaid information/ data shall continue to be retained by Noticee for the purpose of quasi-judicial proceedings;

53. This order shall come into force with immediate effect and shall be in force until further orders.

54. The prima facie observations contained in this Order are made on the basis of the material available on record. In light of the alleged violations of the provisions of SEBI Act, PFUTP Regulations and IA Regulations by the Noticees as stated in this Order, this Order shall be treated as a show cause notice under Sections 11(1), 11(4), 11B, 11D, 11B(2) and 11(4A) read with Sections 15EB and 15HA of the SEBI Act calling upon all the Noticees to show cause as to why, in addition to direction for imposition of monetary penalty, suitable directions including the following, should not be passed against them:

54.1 Directions to Noticees to jointly and severally disgorge the money

collected from clients/ investors through unregistered IA activities.

54.2. Directing them to refrain from accessing the securities market and prohibiting them from buying, selling or otherwise dealing in securities for an appropriate period.

54.3. Direction to restrain them from associating themselves with the securities market, either directly or indirectly, in any manner for an appropriate period.

55. The Noticees may, within a period of 21 days from the date of receipt of this Order, file their reply / objections, if any, to this Order and may also indicate whether they desire to avail an opportunity of personal hearing on a date and time to be fixed in that regard.

56. This order is without prejudice to the right of SEBI to take any other action that may initiated against the aforementioned entity in accordance with law.

57. A copy of this Order shall be served upon Noticees, Stock Exchanges, Banks, Registrar and Transfer Agents and Depositories for necessary action and compliance with the above directions. Further, a copy of this Order shall be sent to Bunch Microtechnologies Private Limited to ensure compliance with paras 52.1 and 52.9 of this Order.

Place: Mumbai

Date: October 25, 2023

Sd/-

ANANTH NARAYAN G.

WHOLE TIME MEMBER

SECURITIES AND EXCHANGE BOARD OF INDIA