This Office has received communication from the 0/0 the Stamp and Registration Office, Government of Gujarat, Gandhinagar, Gujarat 382016 vide their letter dated 04.04.2022 informing that their office has issued letter to the company on 30.05.2020, 10.07.2020, 09.09.2020, 05.11.2020 and 10.12.2020 and Notice dated 05.08.2021, 13.09.2021, 07.10.2021 and 01.11.2021 and 01.01.2022 regarding payment of adequate Stamp Duty levy on the company upon implementation of Merger/Amalgamation Scheme. However, no reply received to their office in the matter so far. Accordingly, this office has issued Notice to the company/KMPs for compliance of Section 232 of the Act, but the Notice issued to the company and One of the KMP Mr. Dheeraj Das Nagar have returned back by postal authorities with remarks “LEFT” in this office on 23.02.2022 and 19.02.2022 respectively. It appears that the Company was not maintaining its registered office in compliance of the Section 12 of the Companies Act, 2013, which is a violation of Section 12 (1) / Section 12(4) of the Act and which attracted penal provisions of Section 12(8) of the Companies Act, 2013.

Presenting Officer responded that Adjudication order/letter/Notices dated 18.02.2022, 23.06.2022 and 20.07.2022 issued by this office to the company have received-back undelivered to this office. The company has changed its office w.e.f. 16.08.2022 to the present registered office. It appears that the company was not capable for receiving and acknowledging the communication and Notices to 15.08.2022. It revealed that the company was not maintaining its registered office in compliance of the Section 12 of the Companies Act, 2013. However, the letter dated 20.09.2022, and 23.12.2022 duly served to the registered office of the company at 207, Iscon Avenue, 2nd Floor, Opp Choice Restaurant, C.G. Road, Ahmedabad, Gujarat-38009, it expressed that the registered office of the Company for that time prior to 15.08.2022 was not capable of receiving and acknowledging the communication and Notices and the company was not maintaining its registered office in compliance of the Section 12 of the Companies Act, 2013, which is a violation of Section 12 (1) / Section 12(4) of the Act as no supporting documentary evidence produced before the Adjudicating Authority to justify cause for maintaining registered office from the aforesaid period.

The Presenting Officer further submitted that it is observed from the last Annual Return as at 31.03.2022 that the paid-up capital of the company is Rs. 698,670/- and Turnover is Nil. Further, after 01.04.2022, the company is not Holding or Subsidiary of any company. And company is not registered under Section 8 or a company or body corporate governed by any special Act. Hence, as per the Ministry’s Notification No. G.S.R. 700(E) dated 15.09.2022, in light of Companies (Specification of definition details) Amendment Rules, 2022 with respect to the provisions of Section 2(85) of the Companies Act, 2013, the Company does fall under the ambit of “small company”. Therefore, the provisions of imposing lesser penalty as per the provisions of Section 446B of the Companies Act, 2013 shall be applied to the company.

Having considered the facts and circumstances of the case and submissions made by the Presenting Officer and submission made by Mr. Devesh Khandelwal, Ld. PCS and after taking into accounts the aforesaid factors, the undersigned has reasonable cause to believe that the company and its Officers have failed to comply with the provisions of Section 12(1) of the Companies Act, 2013 during the period from 30.05.2020 (letter issue by the Stamp Authority) to 15.08.2022 ( prior to filing of INC-22 regarding Notice for change of registered office address). Therefore, I hereby imposed a penalty on company and Officers in default as per table below for violation of section 12(1) of the Companies Act, 2013.

GOVERNMENT OF OF INDIA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES.

GUJARAT, DADRA & NAGAR HAVELI

ROC Bhavan, Opp. Rupal Park,

Nr. Ankur Bus Stand, Naranpura, Ahmedabad (Gujarat) – 380013.

Tel. No.: 079-27438531, Fax : 079-27438371

Website : www.mca.gov.in E-mail : -roc.ahmedabad@mca.gov.in

Order No. ROC-GJ/ ADJ-Order/Sec.454 (3)/ NATIONAL INFRA /2022-23/6855 to 6859 DATED: 17 JAN 2023

ORDER FOR PENALTY UNDER SECTION 454 OF THE COMPANIES ACT, 2013 READ WITH COMPANIES (ADJUDICTION OF PENALTIES) RULES, 2014 and COMPANIES (ADJUDICATION OF PENALTIES) AMENDMENT RULES, 2019 FOR VIOLATION OF SECTION 12(1) OF THE COMPANIES ACT, 2013

IN THE MATTER OF

M/S. NATIONAL INFRASTRUCTURE CORPORATION PRIVATE LIMITED

(U45201G12007PTC051523)

Date of hearing – 10.01.2022

PRESENT:

1. Shri R.C. Mishra (ROC), Adjudicating Officer

2. Mr. Indrajit Vania (DROC), Presenting Officer

Company/ Officers/Directors/KMP/Authorised Representative: Mr. Devesh Khandelwal, PCS, Authorised representative of the Company/Officers through Board resolution dated 10.08.2022

Appointment of Adjudication Authority:-

1. The Ministry of Corporate Affairs vide its Gazette Notification No. A-42011/112/2014-Ad.II dated 24.03.2015 has appointed the undersigned as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (hereinafter known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 (Notification No. GSR 254(E) dated 31.03.2014) for adjudging penalties under the provisions of Act.

Company:

2. M/s. NATIONAL INFRASTRUCTURE CORPORATION PRIVATE LIMITED is a company registered under the provisions of the Companies Act, 1956/2013 in the State of Gujarat, having CIN U45201GJ2007PTC051523 and presently having its registered office situated at “207, Iscon Avenue, 2nd Floor, Opp Choice Restorant, C G Road, Ahmedabad, Gujarat-380009,India”.

3. This Office has received communication from the 0/0 the Stamp and Registration Office, Government of Gujarat, Gandhinagar, Gujarat 382016 vide their letter dated 04.04.2022 informing that their office has issued letter to the company on 30.05.2020, 10.07.2020, 09.09.2020, 05.11.2020 and 10.12.2020 and Notice dated 05.08.2021, 13.09.2021, 07.10.2021 and 01.11.2021 and 01.01.2022 regarding payment of adequate Stamp Duty levy on the company upon implementation of Merger/Amalgamation Scheme. However, no reply received to their office in the matter so far. Accordingly, this office has issued Notice to the company/KMPs for compliance of Section 232 of the Act, but the Notice issued to the company and One of the KMP Mr. Dheeraj Das Nagar have returned back by postal authorities with remarks “LEFT” in this office on 23.02.2022 and 19.02.2022 respectively. It appears that the Company was not maintaining its registered office in compliance of the Section 12 of the Companies Act, 2013, which is a violation of Section 12 (1) / Section 12(4) of the Act and which attracted penal provisions of Section 12(8) of the Companies Act, 2013.

4. Sections 12(1), 12(4) and 12(8) of the Act are reproduced as under:-

Section 12(1)- A company shall, within thirty days of its incorporation and at all times thereafter, have a registered office capable of receiving and acknowledging all communications and notices as may be addressed to it.

Section 12(4)- Notice of every change of the situation of the registered office, verified in the manner prescribed after the date of incorporation of the company, shall be given to the register within thirty days of the change, who shall record the same.

Section 12(8)- If any default is made in complying with the requirements of this section, the company and every officer who is in default shall be liable to a penalty of one thousand rupees for every day during which the default continues but not exceeding one lakh rupees.

Show Cause Notice, reply and personal Hearing:-

5. An Adjudication Notices vide No. ROC-GJ/ 07/Sec.454 (3)/ NATIONAL INFRA./ STA(V)/2022-23/2439 to 3441 dated 23.06.2022 were issued to the company and its officers in default for violation of Section 12(1) of the Act. But, no reply received from the company/Officers of the Company in the matter. The aforesaid Adjudication Notice dated 23.06.2022 addressed to the company has also received-back undelivered in this office on 25.06.2022 by the Postal Authority with remarks “LEFT”. Thereafter, a “Written Notice” vide No. ROC-GJ/ADJ-96/STA(V)/u/s 454/National Infrastructure/2021-22/3583 to 3585 dated 20.07.2022 were issued to the company and its KMPs in default in pursuant to Section 454(4) of the Companies Act, 2013 read with Rule 3 of Companies (Adjudication of Penalties) Rules, 2014 in light of Ministry’s General Circular No. 01/2020 dated 02.03.2020 and a hearing was fixed for 12.08.2022. The aforesaid Adjudication Notice dated 20.07.2022 addressed to the company has also received-back undelivered in this office on 01.08.2022 by the Postal Authority with remarks “LEFT”. However, on the schedule date of hearing i.e. on 12.08.2022, the company has requested for adjournment of the hearing date after 19.08.2022 due to Raksha-Bandhan festival through e-mail dated 12.08.2022.

6. It is observed from the MCA21 portal record that the company has filed INC-22 vide SRN F23450851 dated 01.09.2022 regarding Notice for change of registered office from “60/11/1 Nanchand Mavaji Das Chali, Near Ramji Mandir, Chaman Pura, Asarwa, Ahmedabad, Gujarat-380016,India” to “207, Iscon Avenue, 2nd Floor, Opp Choice Restaurant, C G Road, Ahmedabad, Gujarat-380009,India” w.e.f. 16.08.2022. However, before, imposing penalty in the aforesaid matter, the onus of Adjudicating Officer to give a reasonable opportunity of being heard to company/ Officers in default in pursuant to Section 454(4) of the Companies Act, 2013 read with Rules made thereunder. Accordingly, next date of hearing fixed for 29.09.2022 intimated to the company vide letter No. ROC-GJ/ADJ-96/STA(V)/u/s 454/National Infrastructure/2021-22/4720 to 4722 dated 20.09.2022.

7. On the scheduled date of hearing i.e. 29.09.2022, Mr. Devesh Khandelwal, PCS Authorised representative of company/KMPs have appeared and sought adjournment for furnishing documentary evidence for maintenance of registered office in the matter. Accordingly, date of hearing adjourn to 10.10.2022 in the interest of justice. On Scheduled date of hearing i.e. on 10.10.2022, Ld. PCS requested for adjournment of hearing to produce further documentary evidence for proof of the company being a small company, so the company shall take advantage of Section 446B of the Companies Act, 2013. Accordingly the date of hearing adjourned to 04.11.2022 and further to 10.01.2023 for better endeavors to serve the concept of ease of doing business in the best interest of Companies Act, 2013.

8. On the Scheduled date of hearing i.e. 10.01.2023, Mr. Devesh Khandelwal appeared before the Adjudicating Authority /undersigned and submitted Certificate issued by M/s A Gattani And Associate, Chartered Accountant purporting that the company does not have any holding /subsidiary company as on 01st April,2022. Ld. PCS also produced supporting documents viz. Securities Transferor Form /SH-4 dated 01.04.2022 in their support. Ld. PCS further submitted that the company is properly maintained registered office and is capable of receiving and acknowledging all communications and notices as required under section 12(1) of the Companies Act, 2013 and he pleaded for not charging any penalty.

9. Presenting Officer responded that Adjudication order/letter/Notices dated 18.02.2022, 23.06.2022 and 20.07.2022 issued by this office to the company have received-back undelivered to this office. The company has changed its office w.e.f. 16.08.2022 to the present registered office. It appears that the company was not capable for receiving and acknowledging the communication and Notices to 15.08.2022. It revealed that the company was not maintaining its registered office in compliance of the Section 12 of the Companies Act, 2013. However, the letter dated 20.09.2022, and 23.12.2022 duly served to the registered office of the company at 207, Iscon Avenue, 2nd Floor, Opp Choice Restaurant, C.G. Road, Ahmedabad, Gujarat-38009, it expressed that the registered office of the Company for that time prior to 15.08.2022 was not capable of receiving and acknowledging the communication and Notices and the company was not maintaining its registered office in compliance of the Section 12 of the Companies Act, 2013, which is a violation of Section 12 (1) / Section 12(4) of the Act as no supporting documentary evidence produced before the Adjudicating Authority to justify cause for maintaining registered office from the aforesaid period.

10. While adjudging quantum of penalty under section 12(8) of the Act, the Adjudicating Officer shall have due regard to the following factors, namely;

a. The amount of disproportionate gain or unfair advantage, whenever quantifiable, made as a result of default.

b. The amount of loss caused to an investor or group of investors as a result of the default.

c. The repetitive nature of default.

11. With regard to the above factors to be considered while determining the quantum of penalty, it is noted that the disproportionate gain or unfair advantage made by the noticee or loss caused to the investor as a result of the delay on the part of the notice to redress the investor grievance are not available on the record. Further, it may also be added that it is difficult to quantify the unfair advantage made by the noticee or the loss caused to the investors in a default of this nature.

12. The Presenting Officer further submitted that it is observed from the last Annual Return as at 31.03.2022 that the paid-up capital of the company is Rs. 698,670/- and Turnover is Nil. Further, after 01.04.2022, the company is not Holding or Subsidiary of any company. And company is not registered under Section 8 or a company or body corporate governed by any special Act. Hence, as per the Ministry’s Notification No. G.S.R. 700(E) dated 15.09.2022, in light of Companies (Specification of definition details) Amendment Rules, 2022 with respect to the provisions of Section 2(85) of the Companies Act, 2013, the Company does fall under the ambit of “small company”. Therefore, the provisions of imposing lesser penalty as per the provisions of Section 446B of the Companies Act, 2013 shall be applied to the company.

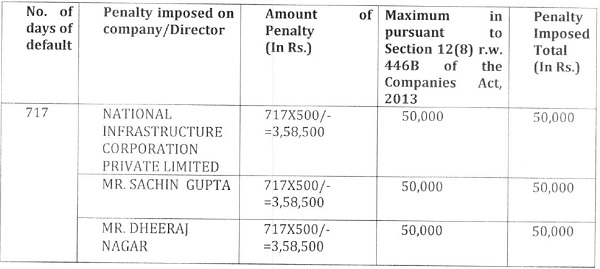

ORDER

1. Having considered the facts and circumstances of the case and submissions made by the Presenting Officer and submission made by Mr. Devesh Khandelwal, Ld. PCS and after taking into accounts the aforesaid factors, the undersigned has reasonable cause to believe that the company and its Officers have failed to comply with the provisions of Section 12(1) of the Companies Act, 2013 during the period from 30.05.2020 (letter issue by the Stamp Authority) to 15.08.2022 ( prior to filing of INC-22 regarding Notice for change of registered office address). Therefore, I hereby imposed a penalty on company and Officers in default as per table below for violation of section 12(1) of the Companies Act, 2013. I am of the opinion that penalty is commensurate with the aforesaid failure committed by the Noticees:

(Default calculated 717 days during the period from 30.05.2020 (letter issue by the Stamp Authority) to 15.08.2022 ( prior to filing of INC-22 regarding Notice for change of registered office address )

2. The noticee shall pay the amount of penalty individually for the company and its officers from their personal sources/income by way of e-payment available on Ministry website www.mca.gov.in under “Pay miscellaneous fees” category in MCA fee and payment Services under Rule 3(14) of Companies (Adjudication of Penalties) (Amendment) Rules, 2019 within 60 days from the date of receipt of this order and copy of this adjudication order and Challan/SRN generated after payment of penalty through online mode shall be filed in INC-28 under the MCA portal without further reference.

3. Appeal against this order may be filed in writing with the Regional Director, North Western Region, Ministry of Corporate Affairs, ROC BHAVAN, OPP. RUPAL PARK, NR. ANKUR BUS STAND, NARANAPURA, AHMEDABAD (GUJARAT)-380013 within a period of sixty days from the date of receipt of this order, in Form ADJ setting forth the grounds of appeal and shall be accompanied by the certified copy of this order. [Section 454(5) & 454(6) of the Companies Act, 2013 read with the Companies (Adjudication of Penalties) Rules, 2014 as amended by Companies (Adjudication of Penalties) (Amendment) Rules, 2019].

4. Your attention is also invited to Section 454(8)(i) and 454(8) (ii) of the Companies Act, 2013, which state that in case of non-payment of penalty amount, the company shall be punishable with fine which shall not less than Twenty Five Thousand Rupees but which may extend to Five Lakhs Rupees and officer in default shall be punishable with Imprisonment which may extend to Six months or with fine which shall not be less than Twenty Five Thousand Rupees by which may extend to one Lakhs Rupees or with both.

The adjudication notice stands disposed of with this order.

(R. C. Mishra, ICLS)

Registrar of Companies & Adjudicating Officer

Ministry of Corporate Affairs,

Gujarat, Dadra & Nagar Haveli

(R. C. Mishra, ICLS)

Registrar of Companies & Adjudicating Officer

Ministry of Corporate Affairs,

Gujarat, Dadra & Nagar Haveli