Summary: Section 203 of the Companies Act, 2013 mandates the appointment of Key Managerial Personnel (KMP) for listed companies and public companies with a paid-up capital of ₹10 crore or more. KMP includes positions like Managing Director, CEO, CFO, and Company Secretary, emphasizing their critical role in managing day-to-day operations and ensuring corporate governance. However, private companies are generally not required to appoint KMP unless they voluntarily opt to do so. An exception exists under Rule 8A of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, which mandates private companies with a paid-up capital of ₹10 crore or more to appoint a whole-time Company Secretary. Such appointments must adhere to Section 203 provisions regarding selection and remuneration. Key conditions include ensuring whole-time KMP cannot hold similar positions in other companies simultaneously (except subsidiaries) and filling any vacancy within six months. Non-compliance attracts penalties: ₹5,00,000 for companies, ₹50,000 for directors or KMP, and an additional ₹1,000 per day of default, capped at ₹5,00,000. While private companies are not universally obligated under Section 203, those meeting the capital threshold must ensure compliance. For voluntary KMP appointments, private companies should align with the governance standards and procedural requirements set by the Act to enhance operational efficiency.

INTRODUCTION:

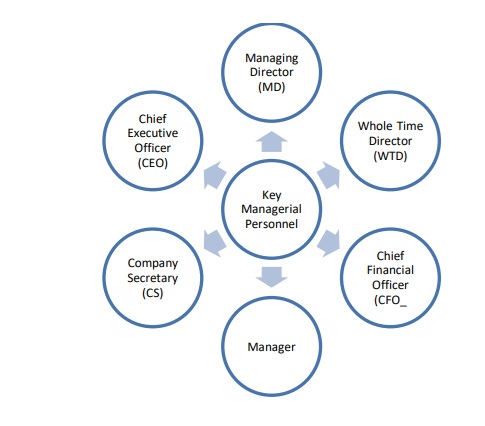

Key Managerial Personnels (KMP) are essential to the management and for the smooth and efficient operations of a Company and they play a significant role in ensuring compliance and corporate governance. They are the individuals who are in charge of the day-to-day management of the company and include top-level executives responsible for strategic decisions.

While Section 203 is the primary operational provision, the definition in Section 2(51) serves solely to define the meaning of the expression of Key Managerial Personnel (KMP).

APPLICABLE SECTION AND PROVISION:

Section 203 of the Act read with rule 8 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 provides that, Every Listed company and every other public company having a paid-up share capital of ten crore rupees or more shall have whole-time key managerial personnel (The word “whole time” indicates that the KMP must contribute all their time to the company.) comprising of

(i) Managing Director, or Chief Executive Officer or Manager and in their absence, a whole-time director;

(ii) Company Secretary; and

(iii) Chief Financial Officer

Although, Section 203 does not require a private company to appoint a KMP, nor does it prevent private companies from voluntarily appointing KMPs to enhance the efficiency of their business management.

There is an exception for a Private Limited Company as per Rule 8A of Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014. Every private company having paid-up share capital of Indian Rupees Ten Crore or more shall have a whole -time Company Secretary.

Therefore, the appointment and remuneration to the Company secretary shall be in accordance with Section 203 of Companies Act, 2013. In such case a Private Limited Company shall comply with the provision of the section.

Hamlin Trust & Ors. Vs. LSFIO Rose Investments & Ors.

OTHER POINTS TO BE TAKEN CARE OF WHEN KMP IS APPOINTED BY PRIVATE COMPANY VOLUNTARILY:

Whole-time KMP shall not hold office in more than one company except in its subsidiary company at the same time.

Vacancy shall be filled-up by the Board at a meeting within a period of six months from the date of creation of such vacancy. (cannot fill the vacancy by circulation)

PUNISHMENT FOR CONTRAVENTION:

If any company makes any default in complying any provisions of section 203, the penalty will be levied in following manner:

| Offender | Initial Penalty | Further Penalty |

|---|---|---|

| Company | ₹5,00,000 | Not applicable |

| Director and KMP | ₹50,000 | ₹1,000 per day of default, subject to a maximum of ₹5,00,000 |

CONCLUSION:

As stated above, every company falling under the scope of Section 203, read with Rule 8, is required to appoint Key Managerial Personnel (KMP) as defined in that section, in accordance with its provisions. However, Private Limited Companies are not obligated to comply with its provisions, nor are they required to appoint a KMP unless it voluntarily chooses to do so subject to exception as mentioned under Rule 8A of The Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014.

Thus, Private Companies having a paid-up share capital of Indian Rupees Ten Crore shall be obligated to appoint a Whole-time Company Secretary. Such Companies shall also be required to comply with the provisions of Section 203 for appointment and remuneration of the Company Secretary.

****

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement.