The NFRA initiated investigations into the statutory auditors of CDGL based on the Securities and Exchange Board of India’s (SEBI) investigation regarding diversion of funds from subsidiary companies of Coffee Day Enterprises Limited (CDEL) to Mysore Amalgamated Coffee Estate Limited (MACEL). The auditors’ failure to meet auditing standards and provisions of the Companies Act 2013 and lack of competence and due diligence were identified during the investigation. The auditors also demonstrated a potential conflict of interest and lack of independence from CDGL, violating the Code of Ethics issued by the Institute of Chartered Accountants of India (ICAI).

The auditors attempted to mislead NFRA and tampered with the audit file. They failed to exercise professional judgment and skepticism during the audit, leading to the failure to identify material misstatements amounting to Rs 1615.04 crores. The auditors also failed to report the complete absence of Internal Financial Control over Financial Reporting in CDGL.

NFRA found the Audit Firm and audit team members guilty of professional misconduct and imposed the following penalties and sanctions, effective from 30 days after the Order’s issuance:

a) M/s ASRMP & Co. was fined Rs Two Crores and debarred for four years from being appointed as an auditor or internal auditor for any company or body corporate. The first two years of the debarment would run concurrently with the previous debarment order dated 12.04.2023 for Coffee Day Global Limited for FY 2018-19.

b) CA A. S. Sundaresha was fined Rs Ten Lakhs and debarred for ten years from being appointed as an auditor or internal auditor for any company or body corporate. The first five years of the debarment would run concurrently with the previous debarment order dated 12.04.2023 for Coffee Day Global Limited for FY 2018-19.

c) CA Madhusudan U A was fined Rs Five Lakhs and debarred for five years from being appointed as an auditor or internal auditor for any company or body corporate.

Government of India

National Financial Reporting Authority

*****

7th Floor, Hindustan Times House,

Kasturba Gandhi Marg, New Delhi

Order no. 24/2023 | Dated: 28.07.2023

In the matter of M/s ASRMP & Co., CA A. S. Sundaresha and CA Madhusudan U A, under Section 132(4) of the Companies Act 2013

1 This Order disposes of the Show Cause Notice (`SCN’ hereafter) number NF-23/14/2022 dated 22nd November 2022, issued to M/s ASRMP & Co., Firm No: 018350S, Statutory Auditor (`Firm’ hereafter) and CA A. S. Sundaresha, ICAI Membership no- 019728 (`EP’ hereafter) and CA Madhusudan U A, ICAI Membership no- 238953 (`Madhusudan’ hereafter) (All are collectively called as ‘Auditors’ hereafter), who are members of the Institute of Chartered Accountants of India (`ICAI’ hereafter) and were members of Engagement Team for the statutory audit of Coffee Day Global Limited (`CDGL’ or ‘the company’ hereafter) for the Financial Year (`FY’ hereafter) 2019-20.

2 This Order is divided into the following sections:

A. Executive Summary

B. Introduction & Background

C. Major lapses in the Audit

D. Other non-compliances with Laws and Standards

E. Omission and Commission by the Audit Firm

F. Points of Law raised by the Auditors.

G. Finding on the Articles of Charges of Professional Misconduct by the Auditors

H. Finding on the Additional Articles of Charges of Professional Misconduct by the Audit Firm

I. Penalty & Sanctions

A. EXECUTIVE SUMMARY

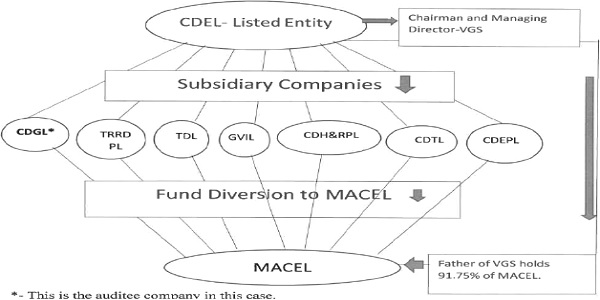

3 Pursuant to Securities and Exchange Board of India (` SEBF hereafter) sharing in April 2022 its investigation regarding diversion of funds worth Rs 3,535 crores from seven subsidiary companies of Coffee Day Enterprises Limited (`CDEL’ hereafter), a listed company, to Mysore Amalgamated Coffee Estate Limited (`MACEL’ hereafter), an entity owned and controlled by the promoters of CDEL, NFRA initiated investigations into the professional conduct of the statutory auditors under Section 132(4) of the Companies Act 2013 (`Act’ hereafter). Coffee Day Global Limited is a subsidiary of CDEL.

4 Post suicide by group Chairman, CDEL appointed Mr. Ashok Kumar Malhotra, retired Deputy Inspector General of Central Bureau of Investigation and Agastya Legal LLP to investigate inter alia the books of accounts of CDEL and its subsidiaries. In response to the show cause notice issued to them, the Auditors submitted that they had access to this investigation report, which detailed the movement of funds from subsidiaries of CDEL to MACEL and the use of pre signed blank cheques for such purpose. The Auditors had given a Disclaimer of Opinion in the Independent Auditor’s Report based on their inability to obtain sufficient appropriate audit evidence regarding recoverability of Rs 1105.10 crores from MACEL.

5 NFRA’s investigations inter alia revealed that the CDGL’s Auditors for the FY 2019-20 had failed to meet the relevant requirements of the Standards on Auditing (` SA’ hereafter) and provisions of the Companies Act 2013 and also demonstrated a serious lack of competence and due diligence on the part of the Auditors. They failed to evaluate their potential conflict of interest and maintain their independence from CDGL by having audit and non-audit relationships with a large number of Coffee Day Group companies and the promoters’ family members and thus violated the Code of Ethics issued by ICAI as the professional fees received from Coffee Day Group Entities/Promoters was more than 40% of their total fees. They also attempted to mislead NFRA by adding and altering documents in their audit file which amounted to tampering with the Audit File. The Auditors failed to exercise professional judgement & skepticism during audit of CDGL where there was (a) Fraudulent diversion of funds to MACE’, worth Rs 1105.10 crores; (b) Evergreening of loans through structured circulation of funds among group companies; (c) Fraudulent repayment of loan of Rs 130.55 crores by ‘Kumar Hegde’ to M/s Classic Coffee Curing Works (CCCW) and in turn repayment of loan by CCCW to CDGL- by Roundtripping of CDGL’s own funds to MACEL, from MACEL to Kumar Hegde, from Kumar Hegde to CCCW, and finally fund came back from CCCW to CDGL; (d) Sale of Fresh & Ground (`F&G’ hereafter) business involving diversion of Rs 103.20 crores (received from Japanese Investor) to MACEL and Misstatement of sale price by Rs 185.57 crores; and (e) Provisions made for doubtful advance of Rs 24.52 crores. Despite the fraud being revealed after the suicide of the group chairman, Shri VG Siddhartha, and the reports of investigations by Mr. Ashok Kumar Malhotra, retired DIG of CBI, the Auditors displayed no professional skepticism or due diligence. The Auditors also failed to obtain sufficient appropriate audit evidence during audit of (a) Deferred Tax Assets involving misstatement of Rs 244 crores; and (b) Misstatement of Rs 26.19 crores in related party disclosure relating to purchase of coffee beans from MACEL. Thus, total material and pervasive misstatements amounted to Rs 1615.04 crores, which the Auditors did not identify and report in their Independent Auditor’s Report. The Auditors failed to report that Internal Financial Control over Financial Reporting was completely absent in CDGL.

6 Based on investigation and proceedings under section 132 (4) of the Companies Act 2013 and after giving the Auditors opportunity to present their case, NFRA found the Audit Firm and audit team members, guilty of professional misconduct and imposes through this Order the following monetary penalties and sanctions with effect from a period of 30 days from issuance of this Order:

a) Monetary penalty of Rs Two Crores only upon M/s ASRMP & Co. In addition, this Firm is debarred for a period of four years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate. The first two years out of the four years debarment ordered, would run concurrently with the period of debarment ordered vide NFRA order dated 12.04.2023 in the case of Coffee Day Global Limited for FY 2018-19.

b) Monetary penalty of Rs Ten Lakhs only upon CA A. S. Sundaresha. In addition, he is debarred for a period of ten years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate. The first five years out of the ten years debarment ordered, would run concurrently with the period of debarment ordered vide NFRA order dated 12.04.2023 in the case of Coffee Day Global Limited for FY 2018-19.

c) Monetary penalty of Rs Five Lakhs only upon CA Madhusudan U A. In addition, he is debarred for a period of five years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate.

B. INTRODUCTION & BACKGROUND

7 National Financial Reporting Authority (‘NFRA’ hereafter) is a statutory authority set up under section 132 of the Companies Act 2013 (`Act’ hereafter) to monitor implementation and enforce compliance of the auditing and accounting standards and to oversee the quality of service of the professions associated with ensuring compliance with such standards. NFRA has the powers of a civil court and is empowered under section 132 (4) of the Act to investigate for the prescribed classes of companies’ the professional or other misconduct and impose penalty for proven professional or other misconduct of the individual Chartered Accountants or firms of Chartered Accountants.

8 The Statutory Auditors, whether individual Chartered Accountants or firm of Chartered Accountants, are appointed by the members of companies as per provision of section 139 of the Act. The Statutory Auditors, including the Engagement Partners (`EPs’ hereafter) and the Engagement Team that conduct the Audit are bound by the duties and responsibilities prescribed in the Act, the rules made thereunder, the Standards on Auditing (`SA’ hereafter), including the Standards on Quality Control (`SQC’ hereafter) and the Code of Ethics, the violation of which constitutes professional or other misconduct, and is punishable with penalty prescribed under section 132 (4) (c) of the Act.

9 On receipt of information from SEBI vide letters dated 01.04.2022 & 29.04.2022 sharing its investigation regarding diversion of funds worth Rs 3,535 crores (as on 31-07-2019) from seven subsidiary companies of Coffee Day Enterprises Limited (CDEL), a listed company, to Mysore Amalgamated Coffee Estate Limited, an entity owned and controlled by the promoters of CDEL, NFRA started investigation into the role of the statutory auditor under its powers in terms of section 132 (4) of the Companies Act 2013.

10 Late V. G. Siddhartha (`VGS’ hereafter) was Chairman & Managing Director of CDEL till 29.07.2019. VGS and his family reportedly owned around 10,000 acres of coffee estates through various entities owned by VGS and operated and managed by MACEL, whose 91.75% shares were held by Late S.V. Gangaiah Hegde, father of VGS. Coffee Day Global Limited (`CDGU hereafter) is a subsidiary company of CDEL and the sole buyer of coffee beans produced by MACEL.

11 As per the investigations made by the SEBI, the outstanding balance payable by MACEL to subsidiary companies of CDEL was Rs. 842 crores as on 31 March 2019, which had increased to Rs. 3,535 crores on 31 July 2019, detailed as under in Table-1:

Table-1 (Rs in crores)

| Sr. No | Names of the Subsidiary Companies of CDEL from which funds diverted to MACEL |

Outstanding balance as on | |

| March 31, 2019 | July 31, 2019 | ||

| 1 | Coffee Day Global Ltd (CDGL) | 65 | 1,112 |

| 2 | Tanglin Retail Reality Developments Pvt Ltd (TRRDPL) | 789 | 1,050 |

| 3 | Tanglin Developments Ltd (TDL) | -12 | 620 |

| 4 | Giri Vidhyuth (India) Ltd. (GVIL) | – | 370 |

| 5 | Coffee Day Hotels and Resorts Pvt Ltd (CDH&RPL) | – | 155 |

| 6 | Coffee Day Trading Ltd (CDTL) | – | 125 |

| 7 | Coffee Day Econ Pvt Ltd (CDEPL) | – | 103 |

| Total | 842 | 3,535 | |

12 The linkage of the entities described in above table is depicted in the chart given below: Chart-1

13 As per the Financial Statements (`FS’ hereafter) of MACEL, Rs 3,535 crore was further transferred from MACEL to the personal accounts of VGS, his relatives and entities controlled by him and/or his family members, whose outstanding balances payable to MACEL were Rs 3,401.66 crores as on 31-03-2020. On examination of FS of MACEL, it transpired that MACEL did not have any business transactions with the 6 of the 7 subsidiary companies (the 7th company is CDGL) and MACEL was used as a conduit to transfer funds from CDEL’s subsidiaries to the personal accounts of VGS, his relatives and entities controlled by him and/or his family members, as loans and advances that were never returned to MACEL/CDEL.

14 The modus operandi of the alleged diversion of funds discovered by the SEBI during its investigation was that “VGS used to ask the Authorized Signatories to sign a bunch of cheques which were kept in his possession and used them as and when required’. Such pre signed blank cheques of bank accounts of various Coffee Day Group companies were used for the diversion of funds.

15 CDGL, one of the 7 subsidiaries of CDEL, contributed the largest share of revenue and profits of CDEL, and is engaged in the business of retailing of coffee and other products under the brand name ‘Coffee Day’; sale of coffee beans and other related products and services in respect of coffee vending machines; and selling coffee beans to domestic and overseas customers. Although an unlisted Public Company, CDGL had total equity of Rs 1440.45 crores as on 31-03-2019, revenue from operations Rs 1794.29 crores during 2018-19 and borrowing/deposit of Rs 801.95 crores as on 31.03.2019, thus falls under the jurisdiction of NFRA in terms of Rule 3 of NFRA Rules 2018 which includes unlisted Public Companies having paid-up capital of not less than rupees five hundred crores or having annual turnover of not less than rupees one thousand crores or having, in aggregate, outstanding loans, debentures and deposits of not less than rupees five hundred crores as on the 31st March of immediately preceding financial year.

16 M/s ASRMP & Co. was the statutory auditor of CDGL for FY 2019-20. This Firm is in practice since 01.04.2018. The audit plan mentions that CA A. S. Sundaresha was ‘Signing Partner’; and CA Madhusudan U A was ‘Engagement Partner’. The Financial Statements and Independent Auditor’s Report have been signed by CA A. S. Sundaresha.

17 The Audit File of CDGL for Financial Year 2019-20, was called for, to examine the role of the Auditors. Based on an examination of the Audit File and other materials on record, NFRA issued a Show Cause Notice (`SCN’ hereafter) dated 22.11.2022 under section 132(4) to the Auditors, charging them for the following professional misconduct:

a) Failure to disclose a material fact known to them which is not disclosed in a financial statement, but disclosure of which is necessary in making such financial statement where the Statutory Auditors are concerned with that financial statement in a professional capacity.

b) Failure to report a material misstatement known to them to appear in a financial statement with which the Statutory Auditors are concerned in a professional capacity.

c) Failure to exercise due diligence and being grossly negligent in the conduct of professional duties.

d) Failure to obtain sufficient information which is necessary for expression of an opinion or its exceptions are sufficiently material to negate the expression of an opinion, and

e) Failure to invite attention to any material departure from the generally accepted procedures of audit applicable to the circumstances.

18 The Auditors sought an extension of time of 45 days for submitting response to SCN, which was allowed. The Firm vide letter dated 02.02.2023 submitted its reply to SCN. CA A. S. Sundaresha vide letter dated 02.02.2023 and CA Madhusudan U. A. vide letter dated 05.02.2023 submitted that the reply of the firm may be considered as their reply as they were not giving separate replies. Madhusudan vide letters dated 01.06.2023 & 16.06.2023 and Ms ASRMP & Co. vide letter dated 08.06.2023 have sent in their further written responses. The SCN gave an opportunity of personal hearing to the Auditors, which they did not avail. Accordingly, this Order is based on examination of the facts of the matter, charges in the SCN, written replies of the Auditors and other materials available on record.

General submissions by the Auditors

19 The Auditors have stated that they had provided a ‘Disclaimer of Opinion’ on the Financial Statements and also in respect of Internal Financial Control over Financial Reporting, in accordance with SA 700 and SA 7052. They further stated that facts available with them today after various investigations were not available with them at the time of conclusion of audit, except investigation report of Mr. Ashok Kumar Malhotra and Agasthya Legal LLP. According to them, adequacy of opinion is a matter of professional judgement and they believe that based on the facts and evidence available with them during the course of audit, the “Disclaimer of opinion” is justified in the given case.

20 We have considered this submission. Before going on to the Disclaimer of Opinion and the standards, we note that the death of VGS in July 2019 and the subsequent investigation report were in the knowledge of the Auditors at the time of Audit, so the stand taken about ignorance of facts does not hold. The chapter “Basis of Disclaimer of Opinion” in the Independent Auditor’s Report issued by the Auditors on 09.11.2020 on standalone financial statements states:

“We draw attention to Note No.34 of the standalone Ind AS financial statements which describe the details in respect of amounts due from M/s. Mysore Amalgamated Coffee Estates Limited (MACEL) to the extent of Rs.1,105. 10 Crores. As explained to us the company is in the process of recovery of the dues from related parties and taken necessary action as stated in the said notes. In the absence of any conclusive evidence demonstrated by the company for recoverability of the same, we are unable to comment on the recoverability, requirement or otherwise of provision on those receivables and consequential impact on these financial statements”.

In respect of compliance with accounting standards, they reported that “We are unable to comment whether the standalone Ind AS financial statements comply with the Accounting Standards specified under Section 133 of the Act, because of the matters described in the Basis for Disclaimer of Opinion section above” .

In the “Basis of Disclaimer of Opinion” section in their audit report on Internal Financial Control over Financial Reporting, they reported that “We are unable to obtain sufficient appropriate audit evidence on which to base our opinion on the effectiveness of Company’s internal financial controls with reference to standalone financial statements over the assessment of the recoverability and requirement or otherwise of provision in respect of amount due from M/s. Mysore Amalgamated Coffee Estates Limited (MACEL) of Rs.1105.10 Crores. Consequent to the material weakness in such internal controls, the possible effects on the financial statements of undetected misstatements could be both material and pervasive”.

21 At this stage, the provisions of para 27 of SA 705 are important to note. These provide that the

Auditor is required to report all matters having material effect on the financial statements. The relevant para of the Standard states that “Even if the auditor has expressed an adverse opinion or disclaimed an opinion on the financial statements, the auditor shall describe in the basis for opinion section the reasons for any other matters of which the auditor is aware that would have

required a modification to the opinion, and the effects thereof’. Its explanatory material at para A24 further explains this matter as “An adverse opinion or a disclaimer of opinion relating to a

specific matter described within the Basis for Opinion section does not justify the omission of a description of other identified matters that would have otherwise required a modification of the

auditor’s opinion. In such cases, the disclosure of such other matters of which the auditor is aware may be relevant to users of the financial statements”! Thus it is clear that in case an Auditor gives disclaimer of opinion for one matter, it does not mean that the Auditor is free of the responsibility of reporting other material deficiencies/ misstatements in the financial

statements. It is important that the Auditors report all material misstatements so that the impact of all misstatements on the financial statements is known and the users of financial statements are not under the misleading impression that the financial statements carry only the reported misstatements. Therefore, the submission of the Auditors is not accepted. The SCN has detailed the charges for matters which were not reported by the Auditors in the Independent Auditor’s Report.

22 The Auditors have submitted that the Standards on Auditing (SAs) are a guidance to an Auditor to act professionally while arriving at an opinion and have referred to para 5, A47 and A52 of SA 2004. We notice that the legal mandate to adhere to the Standards is clearly laid down in section 143(9) &143(10) of the Acts. The fundamental principles of SAs are contained in the Requirements section of the SAs and are represented by use of word “shall”. Further, section 143(9) of the Act also provides that “every auditor shall comply with the auditing standard”. (Emphasis supplied). Thus, there is no scope for deviation from the SAs.

23 The Auditors have also mentioned that complete investigation report of SEBI has not been provided to them. In this regard, the relevant extracts of the SERI report that were relied upon in the SCN, have been provided to the Auditors and thus there is no merit in this objection.

C. MAJOR LAPSES IN THE AUDIT

After considering the general issues raised by the Auditors in their reply, we now move on to the major lapses found in their Audit for which they were charged.

C.1 Continuation of Audit engagement disregarding Independence requirements

24 SQC 16 establishes standards and provide guidance regarding a firm’s responsibilities for its system of quality control for audit and reviews of historical financial information, and for other assurance and related services engagements. SQC 17 requires the Audit Firm to establish policies and procedures designed to provide it with reasonable assurance that the firm, its personnel and, where applicable, others subject to independence requirements (including experts contracted by the firm and network firm personnel), maintain independence where required by the Code of Ethics. SA 200 requires8 the auditor to comply with relevant ethical requirements, including those pertaining to independence, relating to financial statements audit engagements. SA 2209 requires the Auditor to form a conclusion on compliance with independence requirements that apply to the audit engagement.

25 The Auditors were charged with non-compliance with requirements relating to independence of auditors as per SQC 1, SA 200 and SA 220. The Auditors have three related audit firms. These three audit firms have provided a large number of audit and non-audit services to the Coffee Day Group (CCD Group) and promoters and founding partner was associated with the group since a long time. This has created self-interest and familiarity threat. The SCN charged the Auditors for not evaluating their independence from CDGL before continuing with this audit engagement. This is also evidenced from the fact that total billing for services rendered to the CCD group in FY 2019-20 by the said three Audit firms has substantially increased from 31% of total fee in FY 2018-19 to 41.68% of total fee in FY 2019-20, which has exceeded the threshold of 40% given in the code of ethics’°. The SCN further charged that evaluation of independence of audit team members was also not done.

26 The Auditors were required to evaluate the significance of self-interest threat and take safeguards to reduce self-interest threat to an acceptable level. However, there is no evidence in the Audit File regarding performance of any procedure to reduce the self-interest threat to an acceptable level. Also, the requirement of taking a confirmation of Independence from the Firm’s personnel, which was the requirement of their own manual, was not evidenced in the Audit file. Further, there was no evaluation done for continuing with the audit from the perspective of independence and thus, this was violative of the requirements on Independence as per SQC 1, SA 200 and SA 220.

27 In Reply to the SCN, the Auditors have admitted that in FY 2019-20, the Firm has surpassed the prescribed fee limits marginally, considering the fees of M/s ASRMP & Co. and M/s Sundaresha & Co. The Auditors further argued that M/s ASRMP & Co. and M/s Sundaresha & Associates have no common partners, and a relative (Megha Sundaresha Andani-daughter) of CA A. S. Sundaresha is a partner in M/s Sundaresha & Associates but both the firms act independently and are not related parties. They stated the Audit Firm had taken the measures to mitigate the risk involved while complying with the independence requirements.

28 It is important to understand the inter relationship of these three audit firms. As per information obtained from the audit firms, CA A. S. Sundaresha has sole proprietorship firm, namely M/s Sundaresh & Co. He was also the promoter and founder of M/s Sundaresha & Associates, a partnership firm in practice since 10.11.1997, but he had retired from this firm w.e.f. 31.03.2017. After his retirement, his daughter CA Megha Sundaresh Andani is one of the five partners of this Audit Firm with 72% share in the profit of this firm. Thereafter, CA A. S. Sundaresha established another partnership firm namely, M/s ASRMP & Co. w.e.f. 01.04.2018, which was appointed as the statutory auditor of CDGI, from FY 2018-19. CA A. S. Sundaresha had 81% share in the profit of M/s ASRMP & Co., which had four partners. His share in profit increased to 87% after retirement of one partner. All these firms operate from the same office address.

29 From the information obtained from CDGL, we note that CA Pradeepa Chandra C. (Partner of M/s Sundaresha & Associates) worked at M/s ASRMP & Co, Statutory Auditor of CDGL, and on behalf of M/s ASRMP & Co., he made a presentation before the Audit Committee meeting held on 07.02.2019 and 24.05.2019. These presentations related to review of quarterly results of CDGL by the Auditor, scope of engagement, audit approach, observations of the Auditor on the Statutory Audit of the annual financial statements for FY 2018-19 and applicability of Ind AS 116 for FY 2019-20. A perusal of the Audit File shows that these presentations were authored by CA Megha Sundaresha Andani, partner of M/s Sundaresha & Associates. This clearly shows sharing of resources between these two audit firms and their interrelationship.

30 The inter- relationship among the three firms is corroborated by another fact that CA Pradeepa Chandra C. (Partner of M/s Sundaresha & Associates) was involved in the statutory audit of CDGL for FY 2019-20 and named as external reviewer in the Audit file. However, nothing is mentioned in the Audit File as to what was reviewed by him. Further, the audit plan refers to two partners (referred as ‘senior partner’, and ‘partner), whereas the engagement team consisted of only one partner of M/s ASRMP & Co. and second partner belongs to M/s Sundaresha & Associates. This matter is further discussed in section -E of this order. CA Pradeepa Chandra C. and CA Chaitanya G. Deshpande (both Partners of M/s Sundaresha & Associates) were also involved in the statutory audit of CDGL for FY 2018-19 and were named as external reviewers in the Audit Files of CDGL for 2018-19. The totality of facts, the sharing of human resources and sharing of office address, all indicate their close inter-relationship and lack of independence.

31 It is equally important to understand the relationship of these audit firms with Coffee Day Group and its promoters. M/s Sundaresha & Associates and M/s ASRMP & Co. were statutory auditors of inter alia six Coffee Day Group companies (except CDI-I&RPL- as per serial no-5 in Table-1). These companies were involved in the diversion of Rs 3,380 crores i.e., 95.62% of total diverted amount of Rs 3,535 crores. Further, during the Financial Year 2019-20, M/s Sundaresha & Associates provided audit and non-audit services to 28 Coffee Day group entities, M/s Sundaresh & Co. provided audit and non-audit services to 27 Coffee Day entities including promoter’s family members and M/s ASRMP & Co. provided audit and non-audit services to three Coffee Day Group companies. The relationship of three related audit firms with Coffee Day Group indicates the creation of self-interest and familiarity threat. This indicates that M/s ASRMP & Co. had blatantly continued with the audit engagement of CDGI, for FY 2019-20 despite the conflict of interest as noted above. As pointed out earlier, the two firms of CA A. S. Sundaresha received fees from CCD group which constituted 44. 86% of their total fees and was above the threshold allowed under the Code of Ethics. This has been admitted by the Auditors.

32 Responding to the Independence threat, the Auditors claimed that they had confirmations of independence from particular personnel, but did not maintain the same engagement wise, as such these were not available in the audit file. They attached the independence confirmation of three engagement team members along with the reply to SCN. We treat these documents as an afterthought and for the reason recorded in Section -C.2 of this Order, the same are not accepted. The Auditors response is silent on the independence of CA Pradeep Chandra C., the so-called external reviewer.

33 Responding to the charge on non-evaluation of continuation of engagement, the Auditors replied that “Inadvertently client acceptance/continuation form has not been kept, as CA Sundaresha A S, who was associated with Coffee Day Group from a very long time. However, we have conducted the audit due diligently and framed our audit opinion on the financial statements”. This evasive reply indicates the non-performance of such evaluation, which was mandated by SQC 1 and SA 220, which the Auditors have not complied with.

34 The Auditors further stated that their Audit Firm (M/s ASRMP & Co) has an independence policy, which was a part of the Quality Control Manual (QCM). On perusal of this QCM we find that it is the same as that of M/s Sundaresha & Associates. The first para of the QCM states “These Independence Policies (“Policy” or “Policies) are applicable, without exception, to all partners and employees (“firm personnel’) of Sundaresha & Associates (“the Firm’)”. (Emphasis Supplied). Reference of related firm’s name in the QCM of this Audit Firm shows that QCM was prepared by copying the QCM of related audit firm. This further indicates that the Auditors had not given due importance to the important matter of independence of auditor even during preparation of Quality Control Manual.

35 The Auditors have claimed to have complied with the Independence requirements by reducing self-interest and familiarity threat. They further stated that their firm & partners do not have any financial interest in any of the CCD group companies; did not quote lower fees to obtain new engagements; did not have close business relationship with CCD group; nor have they stored any confidential information in their server to be used for any personal gain. Further, no partner or their family are Directors or Officers in CCD group companies; that CCD group Directors and Officers did not have significant influence over their engagement; and that their audit team will be regularly rotated. The Auditors further stated that they did not enter into any contingent fee arrangement with an auditee, ensured fees are not overdue except CCD group (Coffee Day Group) fees which is partially due on account of financial constraint faced by the group. The Auditors have stated that they have complied with the Standards on Auditing and provisions of the Act.

36 The replies of the Auditors regarding steps taken to reduce the self-interest threat and familiarity threat are general statements without detailing the specific steps taken to reduce such threats, despite the three audit firms having audit and non-audit relationships with many Coffee Day Group entities including promoters. The facts detailed above and the response of the Auditors show that they failed to exercise due professional care and did not perform sufficient appropriate procedures to evaluate their independence from Coffee Day Group and its promoters before continuance of audit engagement of CDGL from FY 2019-20. A similar finding at para 33 of our order dated 12.04.2023 regarding statutory audit of CDGL for FY 2018-19, showed that M/s ASRMP & Co. accepted the audit assignment in gross violation of the principles of Independence mentioned in the Standards on Auditing.

37 An Auditor’s independence from the entity being audited safeguards the auditor’s ability to form an audit opinion without influence that might compromise that opinion. Independence enhances an auditor’s ability to act with integrity, to be objective and to maintain an attitude of Professional Skepticism. An auditor is required to be independent, and without any bias with respect to the client to ensure impartiality, which is necessary for the dependability of his findings. Public confidence, in the work of Statutory Auditors of PIEs would be impaired by any evidence of independence being lacking, or the existence of circumstances, which are likely to adversely influence such independence.

38 In this case, the Auditors failed to perform appropriate audit procedures to evaluate and maintain their independence from CDGL. In spite of the Auditors having an independence threat, they continued as Statutory Auditor of CDGL for FY 2019-20, disregarding and grossly violating the principles of Independence mentioned in the Standards on Auditing and the Code of Ethics. In view of the above, it is proved that the Auditors have violated SQC 1, SA 200 and SA 220.

39 In cases relating to violation of independence requirements, the PCAOB’1 has penalized audit firms and their partners. In Marcum Bernstein & Pinchuk LLP case, PCAOB observed “an accountant is not independent of an audit client if, at any point during the audit and professional engagement period, the accountant is not, or a reasonable investor with knowledge ofall relevant facts and circumstances would conclude that the accountant is not, capable of exercising objective and impartial judgment on all issues encompassed within the accountant’s engagement.”….. “…..MarcumBP failed to implement, effectively apply, and appropriately monitor quality control policies and procedures sufficient to provide reasonable assurance concerning the Firm’s independence”. In this case, PCAOB censured audit firm, imposed monetary penalty and required audit firm to undertake a review of its policies, procedures, staffing, and training with respect to auditor independence.

40 Similarly, in AWC (CPA) Limited, WONG Chi Wai, CPA, and WONG Fei Cheung, CPA, PCAOB observed “As the engagement partner, Albert Wong was responsible for AWC’s compliance with independence requirements. Although Albert Wong knew at the time of the Kandi 2012 Audit that Mui had accepted a Power-of-Attorney from Kandi in order to handle the New York State agency matter, he failed to evaluate whether Mui’s activities on Kandi’s behalf constituted prohibited non-audit services that would impair Mui’s independence, as well as AWC’s and its associated persons. Albert Wong took, or omitted to take, actions during the Kandi 2012 Audit, that he knew, or was reckless in not knowing, would directly and substantially contribute to the Firm’s violation of independence requirements, in contravention of PCAOB Rule 350″. For misconducts including independence violations, the PCAOB censured the audit firm & partner, revoked the audit firm’s registration & barred partner from being an associated person of a registered public accounting firm, and imposed a civil money penalty on the audit firm and the partner.

C.2 Tampering of Audit File and related lapses – SA 230, Audit Documentation

41 The Auditors were charged with tampering of the Audit File to mislead NFRA and making the Audit File unreliable, as audit workings have been done in editable Excel files without any security features to prevent alteration of audit documentation. The Audit File has, inter alia, 97 Excel files, out of which 74 Excel files were modified between 22-06-2022, the date NFRA asked for the Audit File, and 05-08-2022, the date Audit File was submitted to NFRA. Further, three Excel Files namely “Audit Planning & Review”, “F&G sale details” and “Deferred Assets” were created after 22.06.2022, the date on which NFRA asked for the Audit File. Such modifications and additions in the Audit File are not permissible as per para 16 of SA 230. As per para 14 of SQC-1, para 14 of SA 200 and para 9 of SA 220, the Audit Firm and the engagement team are required to adhere to ethical principles like integrity & professional behavior.

42 The SCN pointed out that the Audit File is required to be assembled within 60 days of signing of audit report. In this case, the Audit report was signed on 09.11.2020. Accordingly, the Audit File was required to be assembled by 08.01.2021. However, the same was not done. NFRA’s request dated 22.06.2022 for the audit file was sent through email and speed post. The letter was returned by postal department with remarks ‘no such firm on the address’, and the email was not responded to. Thereafter their email ID and postal address were ascertained from ICAI, which intimated the same email ID and postal address. In the postal address there was a change of floor number from 3rd floor to 1st floor. On being reminded vide letter dated 19.07.2022 to submit Audit File, they responded on 21.07.2022 that they had shifted office from 3rd floor to 1st floor in the same building and email dated 22.06.2022 had gone into the SPAM folder. Vide letter dated 21.07.2022 they provided some information and sought 30 days’ time for submission of the Audit File after mentioning that since earlier letter was not served on them, they would be submitting the Audit File within 30 days of our letter dated 19.07.2022 and they requested to grant time till 18.08.2022. Their request was considered, and time was allowed up to 05.08.2022 when they submitted Audit File without FS and Audit Report, which were submitted on 06.08.2022.

43 Both emails dated 22.06.2022 & 19.07.2022 were sent on same email ID , but it was claimed by the Auditor that the first email went to the SPAM folder and the second email was delivered correctly. We note that their letter dated 21.07.22, states that their address had changed from 3rd floor to 1st floor, but their letter head carries the address of the 3rd floor. It appears from this, that Diligence and Integrity, are absent in the Auditors’ conduct and the entire chain of correspondences/events, was a deliberate ploy to delay the submission of the Audit File and gain some time to make changes in the Audit File as pointed out in the preceding paras. It is thus evident that the Audit File was not assembled within the prescribed time and the Auditors made deliberate attempts to deceive NFRA by violating fundamental principles of professional behavior in total disregard of SA 200, SA220, SA 230 and SQC 1 and by tampering of the Audit File till 05.08.2022.

44 The Auditors were charged for not maintaining the audit documentation with due diligence. The audit work paper, ‘Audit procedure’ is a list of audit procedures claimed to have been performed for the period ended 31.03.2020. A plain reading of this audit work paper shows that this work paper was prepared by copying the audit work papers of the previous FY 2018-19, as at many places reference of one year old reporting date i.e., 31.03.2019 (instead of 31.03.2020) is given, such as:-

a) At serial no. 1, it is recorded “requested for balance confirmation certificate as on 03.2019″,

b) At serial no. 2, it is recorded “Obtained cash certificate stating balance as on 31-3-19 for all divisions”,

c) At serial no. 4 & 5 , it is recorded that rate prevailing as on 03.2018/31.03.2019 were taken for closing stock,

d) At serial no. 5 -FNG closing stock & sr. no 8 -closing stock Xpress- quantity of closing stock is same as in FY 2018-19,

e) At serial no. 6 – PPE division closing stock -it is mentioned that the physical verification of these stocks was conducted on the 30th of March 2019 in locations of Chikkamagaluru and Hassan,

f) At serial no. 10 it is mentioned that loan to partnership firm matched with FS. In sharp contradiction, the FS of FY 2019-20 show no such loan as on 31.03.2020,

g) At serial no. 15 there is reference of forex gain of Rs 4 crores as on 03.2019. In sharp contradiction, forex gain in FY 2019-20 was NIL.

h) In audit work paper titled ‘CARO’, it is mentioned that company has converted CCD (compulsory convertible debentures) into equity shares during the year, whereas such conversion was made in previous FY 2018-19 and no such conversion was done in FY 2019-20.

i) In Excel sheets ‘AS compliance’ and `AAS compliance’, the title ‘Audit for FY 2018-19’ is mentioned.

All of the above indicate that the Auditor has merely copied the audit work paper of FY 2018-19, without caring about their correctness or relevance.

45 As per para 8 of SA 230, Auditors are required to prepare audit documentation that is sufficient to enable an experienced auditor, having no previous connection with the audit, to understand: (a) The nature, timing, and extent of the audit procedures performed to comply with the SAs and applicable legal and regulatory requirements; (b) The results of the audit procedures performed, and the audit evidence obtained; and (c) Significant matters arising during the audit, the conclusions reached thereon, and significant professional judgments made in reaching those conclusions. As per para 9, 10 & 14 of SA 230, Auditors are required to document, inter alia, the name of person & date of performing audit procedures, name of person performing review, date & extent of review and discussion of significant matters with management & Those Charged. With Governance (TCWG) etc. An examination of the Audit File in the instant case, shows that the names of the engagement team members & date of performing audit procedures are not mentioned in any of the audit work papers. The names of the team members who reviewed the audit work and the extent of is not evidenced either. Thus, the Auditors were charged with violation of SA 200, SA 220, SA 230 and SQC 1.

46 While denying these charges, the Auditors have replied that maintenance of editable Excel file is not prohibited in SA 230 and modification of audit file is allowed as per para 16 of SA 230; that they have only formatted those files to make it pleasant to view and that the workings maintained in loose sheets were compiled in Excel format after receipt of the notice from NFRA and ; that some of the Excel files were merged and new Excel files were created for ease of review by NFRA. They claimed that during this process the date modified could have changed to the latest date. They further stated that the contents of the Audit File have not been changed and that details of date of conducting the work by article assistants are available in a time sheet maintained separately. In respect of creation of three Excel Files namely “Audit Planning & Review”, “F&G sale details” and “Deferred Assets” after the date NFRA asked for Audit File, the Auditors have submitted that the information of some files were clubbed and moved to separate files for ease of review by NFRA.

47 We have considered the reply. In terms of SA 230, modification in the audit file is allowed only to clarify any existing audit documentation arising from comments received during monitoring inspections performed by internal or external parties (para A24 of SA 230). The Auditor is required to document the specific reason of making the changes, when and by whom they were made and reviewed (para 16 of SA 230). On examination of the Audit File, we could not find any recorded reason or document justifying the modification as required under para 16 of SA 230. It is evident from the reply of the Auditors that they modified the existing audit work papers and created new work papers. Once modifications are made in Excel files, it is impossible to find out what was modified. Further, creation of new Excel file from the workings in loose sheets itself is a proof of tampering of audit documentation. We note that a large number of audit documents were modified and at least three new audit work papers were created after NFRA called the Audit File for examination. After being confronted in the SCN, the Auditors have given an evasive reply stating that only formatting was done and that the contents were not changed.

48 Regarding non-receipt of NFRA communication, the Auditors replied that CA A S Sundaresha has updated his system and that emails were configured to Outlook, hence they were able to receive the second email from NFRA; that their letter head contains old address as 3rd floor instead of 1st floor as the stationary containing old address was printed in bulk and now, they have got new stationary with correct address. The least we can say is that these are delaying tactics applied by the Auditors.

49 The Auditors accepted the error in marking the work papers of the audit procedures carried out during FY 2019-20, as ‘Audit for FY 2018-19’ and attributed it to inadvertence on their part. These are extremely important documents in an Audit and it is surprising to see the Auditors stating that they have applied due diligence while preparing these documents and inadvertently the year was kept as 2018-19. This indicates that the Auditors were casual in their audit work and did not perform the same with the required level of diligence.

50 The Auditors further stated that a combined reading of audit plan, area wise audit procedure and time sheets will provide the details of nature, timing and extent of audit procedures performed. Similarly, combined reading of completion memorandum and review summary provides their observations, significant matters, and conclusions. They stated that the date of performing audit is captured in the time sheet of each article assistant and maintained separately. We do not accept this reply as these records have not been maintained as part of audit file as required under SA 230. We further note that the Auditors could not give any reply in respect of non-availability of timing of audit procedures claimed to have been performed by other engagement team members including the EP.

51 Along with reply to SCN, the Auditors have also submitted 13 additional working papers (143

pages) for consideration and stated that they have inadvertently missed certain evidence as they were not aware about NFRA’s expectations in relation to verification of Audit File. In this connection, one has to look into SA 230 which emphasizes the importance of timely preparation of audit documentation and its archival within a reasonable time after the issuance of the audit report. We highlight below some of the paras of the Standard:-

a) Paragraph 7 of SA 230: The auditor shall prepare audit documentation on a timely basis. The explanatory material to the Standard at Para Al, inter alia, states that Documentation prepared after the audit work has been performed is likely to be less accurate than documentation prepared at the time such work is performed.

b) Paragraph 8 of SA 230: The auditor shall prepare audit documentation that is sufficient to enable an experienced auditor, having no previous connection with the audit, to understand: (a) The nature, timing, and extent of the audit procedures performed to comply with the SAs and applicable legal and regulatory requirements; (b) The results of the audit procedures performed, and the audit evidence obtained; and (c) Significant matters arising during the audit, the conclusions reached thereon, and significant professional judgments made in reaching those conclusions.

c) Paragraph 9 of SA 230: In documenting the nature, timing and extent of audit procedures performed, the auditor shall record: (a) The identifying characteristics of the specific items or matters tested; (b) Who performed the audit work and the date such work was completed; and (c) Who reviewed the audit work performed and the date and extent of such review.

d) Paragraph 14 of SA 230: The auditor shall assemble the audit documentation in an Audit File and complete the administrative process of assembling the final Audit File on a timely basis after the date of the auditor’s report.

e) Paragraph 16 of SA 230: In circumstances where the auditor finds it necessary to modify existing audit documentation or add new audit documentation after the assembly of the final audit file has been completed, the auditor shall, regardless of the nature of the modifications or additions, document:(a) The specific reasons for making them; and (b) When and by whom they were made and reviewed.

f) The explanatory material to the Standard at Para A21 states that SQC 112 requires firms to establish policies and procedures for the timely completion of the assembly of audit files. An appropriate time limit within which to complete the assembly of the final Audit File is ordinarily not more than 60 days after the date of the auditor’s report.

g) The explanatory material to the Standard at Para A22 states that the completion of the assembly of the final Audit File after the date of the auditor’s report is an administrative process that does not involve the performance of new audit procedures or the drawing of new conclusions.

52 Similar requirements exist in para 7, 14, A21 & A22 of ISA 230 (UK & Ireland), para 7, 14, A21 & A22 ASA 230 (Australia) and para 15 of AS 1215 (PCAOB, U.S.)

53 Even internationally, as seen from the following paragraphs, alteration, backdating of work papers/reviews, substitution or addition of the new work papers, placing blank audit papers so as to perform audit procedures (commonly referred to as Audit File Tampering) subsequent to issuance of audit report or the assembly of final Audit File by the Auditors are not accepted, as they would leave scope for large scale production of additional documents as an afterthought upon commencement of disciplinary proceedings.

54 In the Matter of KPMG Assurance and Consulting Services LLP and Sagar Pravin Lakhani (Engagement Partner) relating to tampering of audit file, PCA0B13 (Public Company Accounting Oversight Board — Audit Regulator of United States of America), observed that “PCAOB standards require that [a]udit documentation must contain sufficient information to enable an experienced auditor, having no previous connection with the engagement . . . [do determine who performed the work and the date such work was completed as well as the person who reviewed the work and the date of such review” …. “PCAOB standards further require an auditor to archive a complete and final set of audit documentation as of a date not more than 45 days after the report release date (i.e., the documentation completion date). Any documentation added after the documentation completion date must indicate the date the information was added, the name of the person who prepared the additional documentation, and the reason for adding it.” … “Accordingly, KPMG India violated QC § 20 and QC § 30 by failing to implement, communicate, and monitor adequate policies and procedures to provide the Firm with reasonable assurance that its personnel complied with PCAOB audit documentation standards—including standards concerning documentation of the date audit work was completed, of the date audit work was reviewed, and of any changes to the work papers after the documentation completion date”. For this misconduct, a civil money penalty in the amount of $1,000,000 was imposed on KPMG Assurance and Consulting Services LLP, and a civil money penalty in the amount of $75,000 was imposed on Sagar Pravin Lakhani besides suspending Lakhani from being an associated person of a registered public accounting firm for a period of one year, censuring both and requiring KPMG India to undertake and certify the completion of certain improvements to its system of quality control.

55 In another similar case of Deloitte Canada” relating to tampering of audit file, PCAOB observed “PCAOB standards require auditors to prepare audit documentation that accurately reflects when audit work was completed and reviewed.————- In November 2016, the Firm updated its work paper system and removed Firm personnel’s ability to manually select sign-off dates. Under the new system, when an auditor entered a sign-off; the current date was automatically generated At the time the Firm adopted its new system, personnel from the Firm’s National Office were aware of a risk that individuals could override the new system by changing their computer date settings to backdate work paper sign-offs. Despite that awareness, the Firm did not take sufficient steps—through written policies, guidance, training, or otherwise—to address that risk During the 16 month period following the adoption of the new work paper system, Firm personnel overrode the system and backdated their work paper sign-offs in at least six issuer audits and two quarterly reviews subject to PCAOB standards. This conduct occurred while teams were assembling a complete and final set of work papers for retention, or earlier, in these engagements. Additionally, some auditors on these engagements deleted and replaced sign-offs in order to ensure that reviewer sign-offs were dated after preparer sign-offs. Collectively, this conduct obscured the dates on which work had actually been completed and reviewed”. For this misconduct, PCAOB had imposed a civil money penalty of $350,000 on the firm besides censuring the firm, requiring it to take corrective actions to establish, revise, or supplement, as necessary, its quality control policies and procedures.

56 There have been many other instances of such wrong doings being penalized by the PCAOB, e.g., KPMG Singapore- Tan Joon Wei (2021), BDO-Mexico (2019), and Deloitte Brazil (2016) etc.

57 We further note that while submitting the Audit File’ to NFRA, through a duly notarized affidavit dated 05.08.2022 signed by CA A. S. Sundaresha., partner of the Firm, it was averred that “The Audit File for the financial year 2019-20 as defined in Para 6(b) of SA 230 has been submitted”…. “It is certified that the above information is true and complete in all respects, and nothing has been concealed”. The Auditors arc expected to know what constitutes “Audit File” as per SA 230 and accordingly, all audit work papers were expected to be available in the Audit File submitted to NFRA. The submission by the Auditors of additional documents now, subsequent to the submission of Audit File, to defend the charges in the SCN, points to the incorrect averments made in the affidavit submitted by the Firm.

58 Therefore, considering the provisions of the auditing standards and the affidavit filed by the Firm, the submission of the Auditors regarding the additional documents cannot be accepted and in light of the facts, circumstances and analysis above, we find them to be an afterthought to cover up the deficiencies in the Audit. Further, this also constitutes tampering of the Audit File. This is unbecoming behavior on the part of Professionals. Besides our Standards, the case laws quoted above show that internationally Regulators treat the integrity of the Audit file as sacrosanct and any kind of tampering is viewed seriously attracting significant sanctions.

59 In view of above analysis, we find that the Auditors have violated the provisions of SQC 1, SA 200, SA 220 and SA 230.

C.3 Lapses in audit relating to fraudulent diversion of funds to MACEL

60 The Auditors were charged with failure to exercise professional judgement and skepticism” while performing audit of fraudulent diversion of funds to MACEL. The Auditors were also charged for not reporting fraudulent diversion of funds to MACEL. As per FS of CDGL, it is a subsidiary company of Coffee Day Enterprises Limited. CDGL was sole buyer of coffee beans produced by MACEL. Relevant salient features of Standalone Financial Statements of CDGL are as under:

Table -4 (Rs in crores)

| Sr No | Particulars | 2019-20 | 2018-19 |

| 1 | Net worth | 1002.24 | 1440.45 |

| 2 | Profit | (346.74) | 48.69 |

| 3 | Borrowings from Bank & Financial Institutions. | 1111.30 | 801.90 |

| 4 | Fixed deposits | 0.11 | 415.13 |

| 5 | Revenue from operations | 1507.33 | 1794.29 |

| 6 | Purchases of raw coffee | 304.25 | 430.03 |

| 7 | Interest cost | 206.61 | 77.06 |

| 8 | 1 Interest income | 12.21 | 24.66 |

61 The SCN pointed out that as per Note no-42 to Standalone Financial Statements (SFS) on related party disclosures, transactions with MACEL are disclosed as under:

Table- 5 (Rs in crores)

| Sr No | Particulars | 2019-20 | 2018-19 |

| 1 | Purchase of clean and raw coffee | 28.71 | 70.90 |

| 2 | Advance paid to MACEL | 1418.31 | 394.21 |

| 3 | Interest received on advance paid | 0.00 | 5.10 |

| 4 | Repayment of advance by MACEL | 378.03 | 266.54 |

| 5 | Balance outstanding on 31” March (classified as supplier advance in 2018-19 and Other advance in 2019-20). | 1105.10 | 64.82 |

| 6 | Trade payables | 21.09 | 0.00 |

62 The Audit committee of CDGL, in its meeting held on 24.05.2019, had approved purchase of coffee beans up to Rs 80 crores from MACEL. CDGL purchased coffee beans worth RS 28.71 crores only but advanced Rs 1418.31 crores to MACEL for purchases. MACEL subsequently repaid Rs 378.03 crores which indicates that the advance was not intended for purchase of coffee beans, but was a mere diversion of funds. This huge advance was an unusual transaction, being 49 times the value of purchase of coffee beans (Table 5). It shows that CDGL diverted Rs 1105.10 crores to MACEL during FY 2019-20. The Auditors were required to exercise Professional Judgement and Professional Skepticism to evaluate the appropriateness of disbursal Professional skepticism is defined at para 13(1) of SA 200 as – ‘An attitude that includes a questioning mind, being alert to conditions which may indicate possible misstatement due to error or fraud, and a critical assessment of audit evidence’. Para 15 of SA 200 provides that ‘The auditor shall plan and perform an audit with professional skepticism recognising that circumstances may exist that cause the financial statements to be materially misstated’. of such advance. There is no evidence in the Audit File that the Auditors had done any evaluation or questioned Those Charged With Governance (TCWG) on this matter.

63 All of the above was pointed out in the SCN along with the fact that aforesaid advance of Rs 1418.31 crores was violative of Section 188 of the Act read with Rule 15 of the Companies (Meetings of Board and its Powers) Rules 2014 which mandate prior approval of the company to enter into purchase of goods from related parties amounting to 10% or more of turnover of CDGL. CDGL was required to pass a resolution in the general meeting for grant of supplier advance of Rs 1418.31 crores to MACEL as it exceeded 10% of its turnover of Rs 1507.33 crores. Further, as per section 188 of the Act, approval of the Board of Directors was also required for entering into such transactions. There is no evidence in the Audit File that the Auditors verified whether CDGI. complied with these statutory provisions. On the contrary, the Auditors reported in audit report (para xiii of CAR017) that the company had complied with section 188 of the Act.

64 The Auditors were also charged for non-compliance with para 5 of SA 315, whereby the Auditors were required to perform risk assessment procedures to provide a basis for the identification and assessment of risks of material misstatement at the financial statements and assertion levels. There was no evidence in the Audit file that they had performed such procedures to identify risk of material misstatement due to suspected fraudulent diversion of funds to MACEL. SA 240 prescribes the Auditor’s responsibilities relating to fraud in audit of financial statements. Para 10 of SA 240 provides that the objectives of auditor are to identify and assess the risk of material misstatement in the financial statements due to fraud, obtain audit evidence and respond to identified or suspected risk. Para 12 of SA 240 requires the auditor to maintain professional skepticism recognizing the possibility of existence of material misstatement due to fraud. Para 32 (c) of SA 240 further requires auditor to evaluate the business rationale (or lack thereof) of the significant transactions that are outside the normal course of business or otherwise appear unusual and evaluate whether such transactions may have been entered into to engage in fraudulent financial reporting or to conceal misappropriation of funds. There is no evidence in the Audit File that the Auditors performed any audit procedure to comply with SA 240. The Auditors had failed to comply with above referred paras of SA 240 in respect of supplier/other advance given to MACEL. There is no evidence in the Audit File that any questions were asked from the Audit Committee, TCWG and Management about these suspicious fraudulent transactions. The Auditors did not perform audit with professional skepticism & judgement at all.

65 The SCN drew the attention of the Auditors to their statutory duty to report the offence of fraud to the Central Government under Section 143 (12) of the Act. Grant of omnibus approval by Audit Committee for abnormal amount of supplier advance to MACEL and its subsequent payment in the garb of supplier advance without any business rationale were clear indications of diversion of funds, which amounts to fraud on the company. The Statutory Auditors not only failed to report the same to the Central Government, but mis-reported under the Companies (The Auditors Report) Order 2016 that no material fraud by or on the company had been noticed or reported during audit. Accordingly, the Auditors were charged with violation of section 143 (12) of the Act and CARO.

66 Besides the above, it was pointed out that diverting funds fraudulently to MACEL (an entity owned and controlled by promoters’ family) attracts section 420 of the Indian Penal Code’8, resulting in a predicate offence for money laundering under section 3 of the Prevention of Money Laundering Act 2002 (PMLA)I9. The Auditors did not report this violation in Independent Auditor’s Report and did not consider its impact on the Financial Statements while making conclusions and were therefore charged to have violated SA 250 “Consideration of Laws and Regulations in an Audit of Financial Statements”.

67 The Auditors have denied the charges and replied that they did not conclude any fraud in the transactions because advance to MACEL was given for purchase of coffee as a general trade practice on similar lines with other planters, from whom coffee is being purchased regularly. Since CDGL was following the same procedure over a period of decade, the question of considering the transaction as suspicious does not arise. Regarding section 188 of the Act, the Auditors have submitted that the transaction with MACEL is in the ordinary course of business and accordingly not covered under section 188 of the Act. The Auditors further pointed out that the account was maintained as a current account, and the maximum balance at any point of time during the year was reported as gross transactions with MACEL. Accordingly, the company adopted the most appropriate disclosure; that they relied on the balance confirmations obtained from the company; and that the interest is charged on the advance paid to planters including MACEL. They replied that providing an advance cannot be concluded as fraud, as they had obtained balance confirmations from MACEL. They could not get Sufficient Appropriate Audit Evidence (`SAAE’ hereafter) regarding recoverability of outstanding dues from MACEL, hence provided disclaimer of opinion. According to the Auditors, transactions with MACEL were subject to critical assessment of audit evidence and based on audit procedures, the amount advanced to MACEL is not regarded as fraud and there is no misstatement in disclosure of related party transactions. According to the Auditors the question of reporting fraud under section 143(12) of the Act & CARO does not arise and there in no non-compliance with SA 200, SA 315 and SA 240.

68 In this backdrop, it is necessary to evaluate whether transactions with MACEL were fraudulent or not. The annual purchase of coffee beans of CDGL was Rs 304.25 crores in 2019-20 and Rs 430.03 crores in FY 2018-19, which shows that the volume of past purchases of coffee beans by CDGL did not warrant purchases of coffee beans of Rs 1418.31 crores (the amount of supplier advance given to MACEL). Further, during FY 2018-19, MACEL had revenue from operations of Rs 1.70 crores and a negative net-worth of Rs 223 crores on 31.03.2019, indicating that MACEL had neither the level of operations nor the financial strength to justify the release of such a huge advance of Rs 1418.31 crores. Further, the reported purchase of coffee beans from MACEL in the previous year was only Rs 70.90 crores, which is indicative of the unjustified volume of these advances. The Auditor’s plea that section 188 of the Act is not applicable for transactions undertaken in the ordinary course of business, does not hold as such an exemption to the provisions of section 188 of the Act, is available only if the transaction is conducted on an “Arm’s length basis”. There was no underlying agreement with MACEL for the advance, there were no records of it being backed by any security, and there was no assessment of the arm’s length basis for this transaction. The nature and facts of this advance and the absence of rationale & documentation clearly indicate that these transactions cannot be treated to have been entered into on an arm’s length basis and the size of the transaction indicates that it cannot be said to have been entered into in the ordinary course of business of CDGL. Thus, in light of the foregoing we find that the advance of Rs 1418.31 crores to MACEL was in fact a fraudulent diversion of funds to facilitate the promoters.

69 Post suicide by group Chairman, CDEL (the listed entity) appointed Mr. Ashok Kumar Malhotra, retired Deputy Inspector General of Central Bureau of Investigation and Agastya Legal LLP to investigate inter alia, the books of accounts of CDEL and its subsidiaries. The Auditors have admitted to having access to this investigation report. This investigation report has details of the movement of funds from subsidiaries of CDEL to MACEL and use of blank cheques for such purpose. VGS expired in July 2019 and the Statutory Auditor’s Report in the instant case, was issued on 09.11.2020. Thus, the Auditors had ample time to evaluate these transactions and report this fraud to the Central Government under section 143(12) of the Act. The Auditors chose to overlook this crucial evidence and did not conclude fraudulent diversion of funds to MACEL nor did they report this fraud to Central Government as required u/s 143 (12) of the Act.

70 The above analysis, establishes the Auditors failure to question and report the diversion of funds by CDGL by way of huge amount of advance to MACEL, a promoter owned and controlled entity, without any justification of operating necessity, without the Board approval and without any agreement. Such fraudulent diversion of funds, had serious repercussion on the financial health of the company in terms of liquidity, repayment of loans, payment to creditors and distribution of profits to the shareholders etc. The importance of the same can be understood from the fact that there is a separate Standard on Auditing (SA 240) prescribing the Auditor’s responsibilities relating to fraud in an audit of financial statements besides the Auditors having a statutory duty to report fraud to the Central Government under section 143(12) of the Act and CARO 2016. The Auditors should have performed the audit with professional skepticism and questioned such diversion of funds which also amounted to fraud, but the Audit work papers do not evidence the same. Had they applied professional skepticism, they would have detected this fraudulent diversion of funds and reported it in their audit report. The staggering numbers would warrant the attention of a diligent Auditor. But by not showing due diligence and professional skepticism, when there was ample evidence of fraudulent transactions, they turned a blind eye to their statutory duty to report fraudulent diversion of funds to the Central Government u/s 143 (12) and in their CARO Report.

71 Regarding PMLA, the Auditors replied that money advanced to MACEL was in the ordinary course of business; that related party transactions have been disclosed in the Financial Statements; that there is no concealment; and therefore, question of fraud does not arise. According to them, section 420 of IPC and section 3 of PMLA are not applicable in this case. We note that CDGL had given loans of Rs 1418.31 crores to a promoter owned entity viz MACEL, in the garb of Supplier Advance for coffee beans, even though the actual purchase of coffee beans from MACEL was Rs 2.52 crores only. Therefore, release of such an exorbitant amount to MACEL cannot be considered to be in the ordinary course of business. MACEL subsequently repaid significant part of this advance i.e., Rs 378.03 crores which indicates that the advance was not intended for purchase of coffee beans, but for diversion of funds. This was adequate proof of diversion of funds to promoter owned entity MACEL. Diversion of funds, structured circulation of money and round tripping of funds (as discussed above and under Charge-C-4) are ample proof of cheating and dishonesty. Through these fraudulent circular transactions, CDGL’s funds have ultimately gone to the promoter-controlled entity. Therefore, this is a clear case of money laundering as per PMLA, which the Auditors failed to report in the Independent Auditor’s Report. Therefore, the charge that the Auditors have violated SA 250 is proved.

72 The Auditors were also charged with failure to identify misstatement of Rs 26.19 crores in disclosures relating to Related Party Transactions (`RPT’ hereafter) resulting in non-compliance with SA 55020 and section 143(3)(e) of the Act. Analysis of FS of MACEL & CDGL revealed a difference of Rs 26.19 crores between transactions relating to sale of coffee beans by MACEL to CDGL, which is the sole buyer of coffee beans produced in the plantations of MACEL. As per Profit and Loss Statement of MACEL, total Revenue from operations was Rs 3.26 crores only. Out of this, sale of coffee to CDGL was Rs 2.52 crores only. Whereas, as per FS of CDGL, it purchased ‘clean and raw coffee’ from MACEL worth Rs 28.71 crores. Intercompany difference of Rs 26.19 crores (Rs 28.71 crores – Rs 2.52 crores) raised a serious doubt about the correctness of the Financial Statements of CDGL. On scrutinizing the outstanding balance of supplier advance given to MACEL, it was seen that a similar difference exists, as MACEL had disclosed an advance of Rs 1577.99 crores received from CDGL of which MACEL had repaid Rs 493.99 crores; whereas CDGL had disclosed these figures as Rs 1418.31 crores & 378.03 crores respectively. This also reflects complete absence of internal financial controls in reconciliation of inter-group transactions and balances.

73 In the related party disclosures listed in its FS, CDGL claimed that all such transactions and balances were on an “Arm’s length basis”. In this connection, Para 23 of Ind AS 24, Related Party Disclosures states that “Disclosures that related party transactions were made on terms equivalent to those that prevail in arm’s length transactions are made only if such terms can be substantiated”. There is no work paper in the Audit File that the Auditors performed any audit procedure to examine whether related party transactions and balances were at arm’s length. The Auditors did not report non-compliance with Ind AS 24 by CDGL.

74 Regarding Related Party Disclosures about coffee purchased from MACEL, the Auditors have replied that MACEL acts as coffee pooler to CDGL as a general trade practice adopted by CDGL over several years as a matter of convenience. This is the reason that all the purchases of coffee from MACEL including the pooled coffee have been shown as related party purchase from MACEL instead of showing against each of the end supplier. We find from the Financial Statements of MACEL that sale of coffee by MACF,L to CDGL was Rs 2.52 crores only. Whereas, as per the Financial Statements of CDGL, it purchased ‘clean and raw coffee’ from MACEL worth Rs 28.71 crores. The intercompany difference of Rs 26.19 crores (Rs 28.71 crores – Rs 2.52 crores) raised serious doubt about the correctness of the Financial Statements of CDGL. Ind AS 24 has no provision that transactions can be clubbed in the name of one Related Party. Such clubbing would be misleading to the users of the Financial Statements. The reasons for the management to do this are not far to seek, as this provided the basis for the management to fraudulently advance unusually large amount to MACEL portraying it as a large supplier of coffee beans.

75 Regarding Related Party Transactions relating to the advance to MACEL, the Auditors replied that the maximum limit of advance at any point of time during the year was reported as against gross transactions with MACEL as the same was maintained as a running current account. We note from para 18 of Ind AS 24 that ‘the amount of the transactions’ in full is required to be disclosed. Therefore, reporting of only the highest debit and credit balance with MACEL instead of gross transaction amount was not in conformity with Ind AS 24, leading to one more misstatement in Related Party Disclosure. The Auditors failed to perform their duties as required under para 25(a) of SA 550 in this regard.

76 The Auditors further stated that during the year there was no new type of transaction with any related party and that they had tested those transactions with related parties as having been carried out on an ‘Arm’s length’ basis; that there was no adverse indication, hence nothing was recorded in Audit File; that terms & conditions of RPTs are mentioned at note no. 38(E) of FS; and that all RPTs were conducted in ordinary course of business. Accordingly, they claimed to have complied with section 143(3)(e) of the Act and SA 550. We do not find any merit in this reply. The Auditors did not obtain sufficient appropriate audit evidence about such management assertion as required by para 24 of SA 550. Para A5 of SA 230, Audit Documentation provides that oral explanations by the auditor, on their own, do not represent adequate support for the work performed by the auditor or conclusions reached, but may be used to explain or clarify information contained in the audit documentation. Since nothing was recorded in the Audit File regarding performing such tests, we find the reply of the Auditors an afterthought to cover up their gross failure in performing audit of important and sensitive area of related party transactions.

77 The PCAOB21 in matters of diversion of funds to related parties on the pretext of purchase of material, observed that “The transactions—between one of the Issuer’s wholly-owned Chinese subsidiaries (“Subsidiary’) and a Chinese purchasing agent (“Agent”)—involved the Subsidiary’s transfers of loan proceeds to the Agent as prepayments to buy equipment and materials that the Agent never delivered. The loans were obtained from Chinese lenders for the purpose of making these purchases. While the Agent returned a portion of the prepayments—some in unusual same-day, round-trip transfers—it did not return most of them”…. “By failing to adequately respond to the known fraud risks, Marcum’s engagement team breached its duty to perform the Audits with the due professional care and professional skepticism required by PCAOB standards. The team also failed to adequately understand the business rationale (or the lack thereof) for the significant unusual transactions and failed to obtain sufficient appropriate audit evidence to support Marcum ‘s opinion on the Issuer’s financial statements”. For this misconduct, PCAOB censured Audit firm Marcum LLP (“Marcum”); imposed a civil money penalty of $250,000 on Marcum; prohibiting Marcum from audit works for a period of three years. PCAOB also imposed a penalty of $25,000 on the Engagement partner John E. Klenner besides barring him from being an associated person of a registered public accounting firm.

78 Similarly, failures to perform audit procedures and exercise professional skepticism in related party transactions and internal control over financial reporting have invited serious action by audit regulators in other jurisdictions too. For example, in case of Cheryl L. Gore, CPA and Stanley R. Langston, CPA, PCAOB22 had observed that “Gore failed to obtain sufficient appropriate audit evidence and to perform sufficient procedures concerning whether Issuer A’s financial statements accurately disclosed its related party transactions”………….. “Gore failed to

exercise due professional care, including professional skepticism, and failed to obtain sufficient appropriate audit evidence in connection with Issuer A’s identification, accounting, and disclosure of related party relationships and transactions…….. Gore failed to perform any of these procedures during the 2016 Audit””. This case resulted in debarment and imposition of monitory penalty on the auditors.