Government of India

National Financial Reporting Authority

*****

7th Floor, Hindustan Times House,

Kasturba Gandhi Marg, New Delhi

Order No. NF-23/05/2021 Date: 19.05.2023

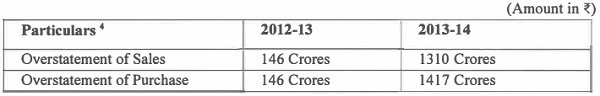

In the matter of CA Rakesh Puri, ICAI Membership No. 092728 under Section 132(4) of the Companies Act 2013 read with Rule 11(6) of National Financial Reporting Authority Rules 2018

1. This Order disposes of the Show Cause Notice (‘SCN’ hereafter) of even no. dated 18th August 2022, issued to CA Rakesh Puri, partner of Mis Y. D. & Company (ICAI Firm registration no. 018846N), Ludhiana, who is a member of the Institute of Chartered Accountants of India (‘ICAI’ hereafter) and was the Engagement Partner (‘EP’ hereafter) for the statutory audit of Sun and Shine Worldwide Limited, Ahmedabad (‘SSWL’ or ‘the company’ hereafter) for the Financial Years (‘FY’ hereafter) 2012-13 and 2013-14.

2. This Order is divided into the following sections:

A. Executive Summary

B. Introduction & Background

C. Major lapses in the audit

D. Other lapses in the audit

E. Article of Charges of Professional Misconduct by the Engagement Partner (EP)

F. Penalty & Sanctions

A. EXECUTIVE SUMMARY

3. The National Financial Reporting Authority (‘NFRA’ hereafter) received information from Securities and Exchange Board of India (‘SEBI’ hereafter) pertaining to overstatement in reporting of Sales and Purchase figures to the tune oft 1417 crores in the Financial Statements of Sun and Shine Worldwide Limited (SSWL), Ahmedabad for the FYs 2012-13 and 2013-14. Accordingly, an investigation under Section 132(4) of the Companies Act 2013 (‘Act’ or ‘CA-2013’ hereafter) was initiated by NFRA for professional misconduct, if any, by the Engagement Partner (EP) CA Rakesh Puri in the audit of SSWL and the audit files were called for from the EP, who had performed the statutory audit of the SSWL for five years from 2010-11 to 201415.

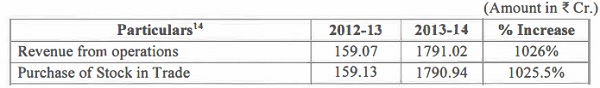

4. The SSWL1 was dealing in the Commodity Futures Trading during the period covered by the audit i.e., during the FYs 2012-13 and 2013-14. Being a listed company at Bombay Stock Exchange (‘BSE’ hereafter), SSWL falls under NFRA’s domain2• There was a sharp rise (1026%) in the reported revenue of the company from ₹ 159.07 crores in FY 2012-13 to ₹ 1791.01 crores in FY 2013-14.3 Based on prima facie evidence of deficiencies in the audit conducted by the EP, a Show Cause Notice (SCN) was issued to the EP and his written replies were considered after giving him an opportunity for personal hearing and making any additional submissions.

5. The lapses in Audit identified in this Order relate to the EP’s failure in determining whether the accounting policy of the company conformed to the required standards, failure in applying sufficient audit procedure as per Standards on Auditing (‘SAs’ hereafter), failure to question the management represenations with professional skepticism, and failure in identifying and reporting material mistatements in the financial statements.

6. The Order finds that the Financial Statements of SSWL for both the FYs 2012-13 and 2013-14 were materially misstated wherein the amount of Revenue from Operations, in the Profit and Loss Statement was overstated by a very large amount as shown in the table below. Revenue from Derivative contracts was recorded by SSWL on the basis of daily carried over amount of the unsettled contracts without their actual closure or settlement on the exchanges which resulted in the aforesaid overstatement of revenue. Further, this erroneous accounting and misleading presentation also affected the corresponding ‘Expenses’ i.e., Purchase of Derivative contracts, in the Profit and Loss Statement, giving a false and inflated impression of the SSWL’s scale of operation. The EP failed to perform audit procedures to identify these manipulations in the accounts showing his gross negligence, non-adherence to the standards of auditing and failure in questioning the management on such erroneous reporting, which resulted in giving a misleading picture to the investors and stakeholders.

From December 2012 onwards, around the same time that SSWL started reporting its inflated purchase and sales figures, the price of the SSWL scrip on BSE jumped to ₹ 42 and from then onwards the price kept on increasing, reaching around ₹ 85 in February 2014 and thereafter the price started declining, again falling to ₹ 25 .55 in August 2014. The SSWL published its financial statements which contained manipulated sales and purchase figures till March 2014. This Order observes that such accounting manipulation had serious adverse effect on public interest, as reflected in the share price movements, and holds that the failure of the EP to properly audit such figures is a clear evidence of his gross negligence and professional misconduct.

It is relevant to mention that SEBI has charged SSWL and its Directors with violating various provisions of SEBI Act, 1992 and of Securities Contracts (Regulations) Act, 1956 and after conducting of investigation, passed an order on 14.09.2021 restraining them from accessing the securities market for specified time and levying penalty up to ₹ 20 lakhs.

7. Finding the EP, CA Rakesh Puri guilty of the charges levelled against him in the SCN issued to him by NFRA, and after giving due consideration to the reply of the EP to the SCN, this Order imposes the following sanctions on the EP:

i. Imposition of a monetary penalty off Five Lakhs upon CA Rakesh Puri;

ii. CA Rakesh Puri is debarred for Five years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate.

B. INTRODUCTION & BACKGROUND

8. NFRA is a statutory authority set up under section 132 of the Act to monitor implementation and enforce compliance of the auditing and accounting standards and to oversee the quality of service of the professions associated with ensuring compliance with such standards. NFRA is empowered under section 132 ( 4) of the Act to investigate into professional or other misconduct committed by any member or firm of chartered accountants in respect of the prescribed classes of bodies corporate or persons, to exercise the powers vested in a civil court while trying a suit and impose penalty for professional or other misconduct of the individual members or firms of chartered accountants.

9. The statutory auditors, both individual and firm of chartered accountants, are appointed by the members of the companies under section 139 of the Act. The statutory auditors, including the audit firm, the Engagement Partners and the Engagement team that conduct the audit, are bound by the duties and responsibilities prescribed in the Act, the rules made thereunder, the Standards on Auditing, including the Standards on Quality Control (SQC) and the Code of Ethics, the violation of which constitutes professional misconduct, and is punishable with penalty prescribed under section 132 (4) (c) of the Act.

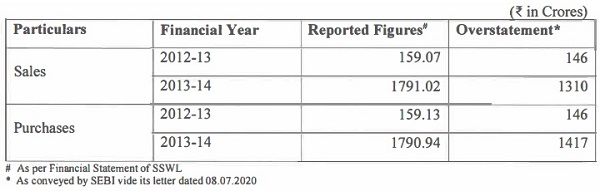

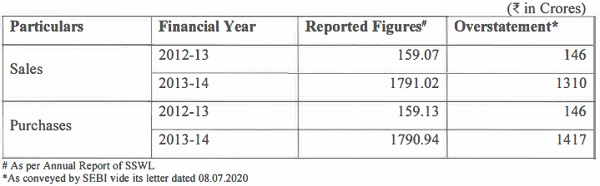

10. The SSWL, which was in the business of Commodity Futures Trading during the FYs 2012-13 and 2013-14, is listed at BSE and therefore falls under NFRA’s domain. NFRA took up investigation of SSWL under section 132 (4) (a) of the Act on receipt of a letter dated 08.07.2020 from SEBI pointing out overstatement in the reported sales and purchase figures in the financial statements of SSWL as mentioned below:

11. SSWL was required to prepare its Financial Statements (‘FS’ hereafter) for the FYs 2012-13 and 2013-14 in accordance with applicable provisions of the Companies Act 1956 (‘CA-1956’ hereafter) and the Accounting Standards (‘AS’ hereafter) notified under the Companies (Accounting Standards) Rules, 2006.

12. M/s D. & Co. was the statutory auditor of SSWL for FYs 2012-13 & 2013-14 and CA Rakesh Puri was the EP for these audit engagements. Vide NFRA letter dated 09.08.2021, the Audit File along with other information were called from the EP, who submitted these on 31.08.2021. As part of the investigation, a Questionnaire dated 04.02.2022 was also sent to the EP and his response was received on 26.04.2022. Another letter dated 15.06.2022 was sent to the EP requiring him to certify the completeness of Audit File submitted to NFRA through an affidavit, which was received on 25.06.2022.

13. On examination of the Audit Files, it was prima facie observed that even though the audit had been conducted in complete disregard of the SAs and the CA 1956, the EP had issued an unmodified audit opinion in the Independent Auditor’s Report on behalf of the Audit Firm stating that ” …. .financial statements give the information required by the Act in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India …. “.

14. Accordingly, action under sub-section ( 4) of section 132 of the Act read with Rule 11 of the NFRA Rules 2018 was initiated, and an SCN was issued on 18.08.2022 to CA Rakesh Puri asking him to show cause why action should not be taken against him for Professional Misconduct in respect of his performance as the EP on behalf of Mis Y.D. & Co., for the Statutory Audit of SSWL for the FYs 2012-13 and 2013-14. The EP was charged with professional misconduct of:

a. failure to disclose a material fact known to him, which is not disclosed in a financial statement, but disclosure of which is necessary in making such financial statement, where he is concerned with that financial statement in a professional capacity;

b. failure to report a material misstatement known to him to appear in a financial statement with which the EP is concerned in a professional capacity;

c. failure to exercise due diligence, and being grossly negligent in the conduct of professional duties;

d. failure to obtain sufficient information which is necessary for expression of an opinion, or its exceptions are sufficiently material to negate the expression of an opinion; and

e. failure to invite attention to any material departure from the generally accepted procedures of audit applicable to the circumstances.

15. The EP was required to reply to SCN by 17.09.2022, but on his request, was granted extension till 30.09.2022. The EP submitted his reply vide his letter dated 29.09.2022.

16. It is seen from the reply that the EP has been evasive and has not specifically responded to the allegations of non-compliance with the statutory requirements. He has not accepted his lapses in respect of the charges in the SCN, but submitted that due care was taken in performance of the said audit; that the applicable accounting and auditing standards were complied with; and that the audit opinion was framed after taking professional judgement based on the information and records available and circumstances prevailed at that time.

17. An opportunity of personal hearing was given to the EP, who appeared before the Executive Body, NFRA on 17.10.2022 when the submissions made by him during the hearing were placed on record. During the personal hearing, the EP reiterated his written submissions as mentioned in his reply vide letter dated 29.09.2022 and further explained his replies.

18. We have perused the written and oral responses of the EP and all other material on record and now proceed to deal with the charges levelled in the SCN. The major lapses in audit on the part of the EP relating to evaluation of the accounting policy for revenue recognition has been discussed in Part ‘C’ of this order. Other lapses viz., improper audit planning, failing to understand the nature of the entity, non-verification of account balances of debtors and creditors, non-communication with the Those Charged with Governance (‘TCWG’ hereafter) and non-appointment of Engagement Quality Control Review partner (‘EQCR’ hereafter) have been discussed in Part ‘D’ of this order.

Part C

C.1 Failure in evaluation of Accounting Policy relating to Recognition of Revenue

19. The EP was charged5 with lack of due diligence and professional scepticism in evaluating the Accounting Policy of the company in recognition of purchase and sales.

SSWL was reportedly engaged in the Commodity Market Futures Trading. As per standard market practice6 for commodity futures trading, conveyed by SEBI, the trade is closed either by taking the delivery or by taking a reverse position or by automatic closure on the last day of expiry of the Futures Contract. However, the SSWL showed in its account the purchase and sales every day, without any actual sale / purchase transaction. This modus operandi has been explained by SEBI vide its order dated 14.09.2021in the same case7, where Mr. Anil Mistry, ex-Director of SSWL provided explanation for the business of the Company and its accounting as under –

- “The Company had started to deal in Commodity Future first time on 14/09/2012 wherein company bought 70 Lots of FUT COPPER 30-NOV-12. Further, at the end of the day of 14/09/2012 none of Lots were sold by the company and the open position was carried forward to the next Here company has treated buying of 70 Lots of FUT COPPER 30-NOV-12 as Purchase aggregating to Rs. 3,23,08,822.00 (Including Brokerage) and since it was not sold on the same day, the position was carried forward and the same was treated as sales aggregating to Rs. 3,20,35,500.00.

- Further, on the end of next daye., on 15/09/2012, company has got Daily MTM Bill/Ref no. DLYMTM/9-1509 from broker where in 70 Lots of FUT COPPER 30-NOV-12 which were carried forward from previous day was brought forward and the same was treated as Purchase in the books of the company i.e., Purchase aggregating to Rs. 32035500.00 and since it was not sold on that day also it was carried forward and treated in the books as sales aggregating to Rs. 31969000. 00.

- Further, on the end of the next working daye. on 17/09/2012, company has got Daily MTM Bill/Ref no. DLYMTM/11-1709 from broker where in 70 Lots of FUT COPPER 30-NOV-12 which were carried forward from previous day was brought forward and the same was treated as Purchase in the books of the company i.e. Purchase aggregating to Rs. 3, 19, 69,000.00 and correspondingly since it was not sold on that day the position was carriedforward which was treated as sales aggregating to Rs. 3,17,20,500.00.

- The same process of accounting was going on till the date of actual settlement of open position of 70 Lots ofFUTCOPPER 30-NOV-12. That is how turnover of the company was built up and Purchase aggregating to Rs. 159.13 Crores and Sales aggregating to Rs. 159. 07 Crores were recorded in the books of accounts of the company.

- The accountant of the company had recorded all the MTM Bills in the books of accounts of the company with assumptions that all the transactions are entered by the company are on day to day basis and those needed to be recorded in the books of accounts of the company.

- However, on the floor of the commodity exchange the actual purchase and sales were reflected as Rs. 13.31 Cores and Rs. 13.27 Crores respectively for the financial year 2012-13. There is a deviation in the amount of purchase and sales on account of recording of carried forward and brought forward positions on day to day The similar accounting entries were passed in the books of accounts of the company for the financial year 2013-

- There is no change in the profit I loss of the company by recording above accounting entries in the book of accounts the company. Further, there was no bogus transaction of sales I Purchase recorded by the company in their books. All the entries recorded in the books of the company are based on Daily MTM Bills of broker Indo Thai Commodities Private Limited.”

By adopting such strange and flawed accounting policy, the company artificially inflated its reported values of purchase and sales of commodity futures. The resulting overstatement8 of reported sales and purchases figures, as compared to the actually executed trade values, which were verified by SEBI from the exchanges where the trades were executed and from the broker of the SSWL through which the trades were executed, are as under:

# As per Annual Report of SSWL

*As conveyed by SEBI vide its letter dated 08.07.2020

In reply to the NFRA questionnaire dated 04.02.2022, the EP submitted that he had analysed the accounting policy on derivatives in accordance with the provisions of Guidance Note (‘GN’ hereafter) issued by ICAI in 2015 on derivative accounting. However, in his reply to the SCN, the EP submitted that he had obtained guidance from the Guidance Note on Accounting for Equity Index and Equity Stock Futures and Options as issued in 2003.

20. We have gone through the replies of the EP and observe that:

a) The EP has been inconsistent in his replies. It is not clear how he obtained guidance from the GN on derivative accounting issued in 2015} which was not even in existence at the time of audit.

b) The GN issued in the year 2003 was applicable for Equity Derivative Instruments and not for the Commodity Future Contracts. It was withdrawn with effect from 01.04.2009. Therefore, the EP’s reliance on the GNs was misplaced.

c) The GNs of 2015 and 2003 were neither documented in the audit file, nor was there any policy of management stating that SSWL had used any such guidance in the accounting of commodity futures contracts.

We observe that the GN issued in 2003 deals with computation of Mark-to-Market Margin by the Client. Para 31 of GN states that ” …… For computation of ‘Mark-to-Market Margin’, all outstanding contracts, whether Long or Short, of a Clearing Member in an equity index/stock futures contract are deemed to have been settled at the Daily Settlement Price ……… “. Para 31 of the guidance note evidently uses daily deemed settlement only for the purpose of computation of margin money and it can by no means be interpreted to mean that the trades were settled on daily basis without actual settlement of the trade transactions.

The EP has stated in his reply that:

“Looking to the daily settlement practice of the exchanges, broker has to issue the contract note on daily basis as buy and sell of the future contract. Since as per the guidance note all contracts deemed to have been settled at the Daily settlement Price, therefore, as each contract is backed by the delivery it is deemed to be treated a purchase and sale on daily basis (as per my understanding since there is no clearcut guidelines for commodity exchange is available till date) and accordingly based on Guidance Note company has booked sale and purchase a shown in the daily contracts issued by the broker/exchange. “

Such a stand taken by the EP is completely untenable. The EP has not produced any circular from the exchange or SEBI in support of his contention that purchase and sales had to be booked on daily basis even when there was no actual sale or purchase during the day. In fact, SEBI in its letter to NFRA dated 08.07.2020 has questioned such flawed practice by SSWL and given a finding in its order9 dated 14.09.2021 that by adopting such accounting practice, SSWL perpetrated fraud on investors and the securities market. Further, the EP has not shown any provision in the Guidance Note which requires to recognize revenue on the basis of deemed sale or purchase even if there was no actual sale or purchase. The EP has incorrectly cited a provision that is applicable to computation of mark to market margin requirements and not to revenue recognition.

As per AS 9, issued in 1985, which deals with Revenue Recognition, the key criterion for determining when to recognise revenue from a transaction involving the sale of goods is that the seller has transferred the propertv in the goods to the buver for a consideration. The transfer of property in goods, in most cases, results in or coincides with the transfer of significant risks and rewards of ownership to the buyer. The position taken by the EP militates against this fundamental characteristics of revenue recognition.

In the extant case, the SSWL recognised the revenue corresponding to the closing position of Futures Commodity Contract on daily basis without actual settlement of such contract. The risk and reward of the contract remained with the company. The EP failed to consider the basic principle of the transfer of “risk and reward” while auditing the SSWL’s accounting policy on in revenue recognition.

21. The EP also argued that there was no guidance available for accounting of commodity future contracts. We find that this is incorrect. AS 30, Financial Instruments: Recognition and Measurement, was issued by the ICAI in 2007. It was recommendatory in nature for the first two years commencing on or after 1.4.2009 and mandatory on or after 1.4.2011. Subsequently, in the wake of the financial crisis and the attendant modifications in the accounting standards undertaken by the accounting standard setting bodies, the status of AS 30 was modified. The preparers of the financial statements were encouraged to follow the principles enunciated in AS 30, subject to the condition that if there were any other notified standards or regulatory requirements, then they would prevail over the accounting treatment contained in AS 30. Accordingly, there was no dearth of guidance on accounting treatment of financial instruments, and it was open to the SSWL to consider relevant provisions of AS 30 in the accounting treatment of commodity futures contracts. Hence, the contention of the EP that no guidance was available for the accounting of commodity futures contracts, is not tenable. In this regard, it is relevant to note the requirement of Para 16 of AS 1 “Disclosure of Accounting Policies” which states that The primary consideration in the selection of accounting policies by an enterprise is that the financial statements prepared and presented on the basis of such accounting policies should represent a true and fair view of the state of affairs of the enterprise as at the balance sheet date and of the profit or loss for the period ended on that date. By choosing an accounting policy that presented an outlandish picture of its operations, the SSWL failed in its duties to present a true and fair position of its operations and the EP failed in his duties to conduct proper audit checks.

22. The EP has claimed in his reply that he had obtained the accounting policy from the management but there is no evidence in the audit file to demonstrate that the EP had obtained from the company its accounting policy on revenue recognition and evaluated whether it was complying with the fundamental principles of accounting standards and whether it was capable of presenting a true and fair view of the affairs of the company. The EP has in this regard referred to his two letters to the Audit Committee, which do not form the part of the audit file, and therefore are rejected as an afterthought.

These lapses led to EP’s failure in challenging the overstatement of purchase and sales figures and ultimately led to failure in presenting a true and fair position of financials of the company for the FYs 2012-13 and 2013-14. We note from the SEBI Order in the case that from December 2012 onwards, around the same time that SSWL started reporting its inflated purchase and sales figures, the price of the SSWL scrip on BSE jumped to ~ 42 and from then onwards the price kept on increasing, reaching around ~ 85 in February 2014 and thereafter the price started declining, again falling to~ 25.55 in August 2014. The SEBI Order noted that SSWL published its financial statements which contained manipulated sales and purchase figures till March 2014. We observe that such accounting manipulation had serious adverse effect on public interest, as reflected in the share price movements, and we hold that the failure of the EP to properly audit such figures is a clear evidence of his gross negligence and professional misconduct.

The statement of the EP that, “I have followed the principle of Institute …. so that there will not be any mis-statement and there will not be any over/under statement of profit/loss and the statement of Affair (Balance Sheet) reflects the true and fair view” cannot be accepted in light of what has been discussed above. As pointed out earlier, there was overstatement of sales up to the extent of 1310 crores (i.e., overstatement by 1099% in FY 2012-13 & 272% in FY 2013-14), which is a material misstatement as per Para 13 (i) of SA 20010.

We note that Public Company Accounting Oversight Board11 (‘PCAOB’ hereafter), the US Regulator, charged S.W. Hatfield, C.P.A. (the “Firm”) for its failure to evaluate the correctness of revenue during the audit of Epicus Communications Group, Inc. (“Epicus”), and noted that the “auditor failed to perform procedures to evaluate whether Epicus’s departure.from GAAP in recognizing revenue caused Epicus ‘s financial statements to be materially misstated, which violated PCAOB auditing standards, including AU §§ 150 and 230”. PCAOB for this misconduct among others, censured the Firm and revoked its registration permanently and Scott W. Hatfield, the Engagement Partner, was permanently barred from associating with any registered public accounting firm.

C.2. Lack of Audit Documentation with respect to Revenue Recognition

C.2.i. Non evaluation of risk of fraud in revenue recognition

23. SA 24012 deals with the auditor’s responsibilities relating to fraud in an audit of FS. Para 26 of SA 240 requires the auditor to evaluate, based on a presumption that there is risk of fraud in revenue recognition, which type of revenue transactions lead to such risk.

Further, Para 47 of SA 240 specifies the documentation to be done when the auditor concludes that such presumption is not applicable along with the reasons for such conclusion.

Observing that the EP had prima facie failed to adopt such audit procedures, he was charged13 with the failure to comply with Para 26 and 47 of SA 240.

24. We fmd that the EP was the auditor of the SSWL for five years from 2010-11 to 2014-15. Yet he failed to notice the abnormal increase in the reported revenue of the company during the FYs 2012-13 and 2013-14, represented by a sharp spike followed by a sharp decline in the year 201415. This is depicted by the following chart which is prepared as per data shared by SEBI with NFRA:

The dramatic rise in revenue up to 1026% reported by the SSWL in the year 2013-14 was a clear and adequate indication of the possibility of fraud in revenue recognition. In spite of this, the EP failed to presume existence of the fraud risk in the revenue recognition, as required by SA 240. If he had any other rationale for absence of such presumption, then he had to record the same, however the EP did not document any such judgement.

25. The EP has stated in his reply to the SCN that “In the present case, the rise in the revenue figure does not create a risk of fraud as the transactions are through the recognised commodity exchange and registered broker and all transactions are made through banking channel and hence it is not presumed any risk Even you should appreciate that even SEBI has not found any such kind of indication offraud which has occurred in the company. The said facts are properly documented on page no. 184 to 185 of the show cause notice.” The reply of the EP is not supported by the facts and is liable to be rejected in view of the following;

The EP ignored to investigate the exponential rise in revenue to the tune of 1026% that evidently posed significant risk of material misstatement in the revenue of SSWL and would therefore have alarmed any prudent person to the risk of fraud in recognition of revenue, however the EP failed to consider such alarming signals.

b. There is no documentation in the Audit File evidencing verification of such transactions from any broker or exchange or through bank reconciliation. On the contrary we find that the information obtained by SEBI from the broker as well as the stock exchanges (ICEX, NCDEX and MCX- the stock exchanges on which the trading was claimed by the Company) clearly indicated the extent of variation between the actual amount of the trade executed and the trade reported by the Company, but the EP failed to perform this basic audit test. Such lapses on the part of the EP are grave as he failed to identify, assess and document the basic premises to verify the revenue. The following table depicts the glaring difference between the trading figures reported by the company vis-a-vis stock exchange and broker.

#As per Financ1al Statement ofSSWL. There 1s difference in the reported figures quoted by SEBI v1s-a-v1s the figures reported through the annual report available in the public domain. We have relied on the figures available in the annual reports.

## As conveyed by SEBI vide its letter dated 08.07.2020

c. The contention of the EP that he did not presume the risk in revenue underlines the open admission of his gross negligence and lack of due diligence in the face of such contradictions between the reported and actual state of affairs in the Company, which the auditor failed to identify and report and therefore his defence of his actions is baseless. Such a huge increase in revenue as indicated above warranted a risk assessment and therefore, the EP had to document the rationale behind non-presumption of the risk in revenue in compliance with Para 47 of SA 240.

C.2. ii. Failure to check contract notes of the commodity trades.

26. The EP was charged15 with failure to check/ verify the contract notes with the sole broker, Indo- Thai Commodities Private Limited.

In the extant case, commodity futures contract notes were the basic documents for the crossverification of actual existence of commodity futures transactions. Accordingly, the EP was required to verify the revenue transactions with the underlying contracts notes issued by the broker.

27. We find that in the statement submitted to SEBl16, the EP had stated that the sample of contract notes was selected by SSWL and not by the EP or by his team. The statement of the EP is quoted as below:

“I had checked the contract notes on a sample basis. The sample was selected by the company, and I had not sought any specific sample I trade related contract notes. “

We did not find any audit documentation in the Audit File regarding contract notes. Notwithstanding the same, if the reply of the EP to SEBI is to be believed, then there were glaring procedural deficiencies, as the contract notes were selected by the company and not by the EP. The sampling approach of the EP was also not in compliance with the Para 7 and 8 of SA 53017, which specify appropriate sample size and its selection method. Para 7 of SA 530 states that, “The auditor shall determine a sample size sufficient to reduce sampling risk to an acceptably low level.”

Para 8 of SA 530 states that, “The auditor shall select items for the sample in such a way that each sampling unit in the population has a chance of selection.”

As the sampling was not done by the EP, he failed in his responsibility to ensure an appropriate sample size reflecting the population and reduce the sampling risk to an acceptable level.

28. The EP further stated in his reply to NFRA that “We have verified the Contract note and in my statement to SEBI, it has also been informed. So far, the sampling of the Contract note is concern, we have given certain dates to the accounting persons and over and above those dates we told them to provide the contract notes on some random basis so that at least it will cover a significant number of transactions. After verification, my audit concern person has collected all the contract notes (a copy of the same are attached herewith) and verified the same with the accounts”.

We note that there is clear contradiction between his reply to SEBI and the replies furnished to NFRA, which establishes that the EP is trying to cover up his non-performance of required audit procedures. Further, there is no mention of the contract notes in the audit file. The EP submitted copies of some contract notes along with reply to SCN, which are rejected as an afterthought. Accordingly, we hold the EP responsible for failure to comply with the provisions of SA 530 that led to non-verification of the artificially inflated revenue figures of the company.

Part D

D.1 Improper Audit Planning and Non-understanding of the nature of the entity D.1.i. Improper planning of audit

29. The EP was charged18 with improper planning of the audit, as the same was not in accordance with Para 3 and 7 of SA 30019 The EP was also charged with the failure to document audit plan as required by Para 11 of SA 300.

Para 3 of SA 300 requires the auditor to plan the audit in such a manner that it is performed effectively.

Para 7 of SA 300 is regarding overall audit strategy including identifying the characteristics of the engagement, facilitating the EP to define its scope and planning of nature, timing and extent of audit procedures required to be performed to achieve the objective of audit.

Para 11 of SA 3 00 requires the auditor to document the overall audit strategy, the audit plan and any significant changes made during the audit engagement to such plans.

30. The EP was also charged20 with non-compliance with SA 31521. As per Para 11 of SA 315, the EP was required to understand the nature of the business of SSWL by gaining understanding of relevant industry, applicable regulatory structure etc. at macro level and gaining an understanding of nature of the entity, its operations, its ownership, its governance & capital structure and applicable financial reporting framework etc. at the entity level. However, no audit documentation reflecting the work of the EP to understand the nature of the business of the entity was found in the audit file.

31. The EP responded to the charge by referring to some of the WPs and stated that ” … I strongly believe that while doing the audit of the entity the SA 300 has been complied with to the best possible manner so that there will not be any material misstatement of the financial report and an opinion will be framed after taking the professional judgements”.

32. The scope of SA 300 and 315 is quite comprehensive and stipulates that the auditor plan the audit commensurate to the nature and complexity of the business of the entity and identify and assess the risk of material misstatement. This should cover planning of the time duration, assessment of risks specific to the entity and designing of the audit procedures to mitigate such assessed risks.

In contrast to such requirement, we note that the WPs referred by the EP were merely a general checklist used for the work to be performed during the audit. Such list was generic and the auditor did precious little to even customise such list as per the nature of business of SSWL. The EP neither made efforts to assess the risks specific to SSWL, nor did he design the audit procedures to mitigate such risks. Therefore, the WP(s) referred to by the EP were completely devoid ofthe requirements of SA 300 and SA 315.

This is further substantiated by an example, the WPs referred to by the EP have a requirement of test checking of Cost of Raw Material Consumed & Cost of Stores and Spares, but SSWL was dealing in Commodity future contracts, where there could not be any scope for Raw Material or Stores and Spares etc. Hence, the checklist was a stereotype and a cut and paste job. Obviously, such documents were of no help to the EP’s case.

33. The EP also responded that, “Point no 2 on page no. 96 and 156 of the show cause notice clearly indicate that the nature of business was discussed and based on that discussion, we have prepared our audit planning and prepared working paper (which is available on page no. 182 to 183 of the show cause notice) which clearly shows that as per our audit procedure we keep close watch on the transactions and policies which are either new or there is a change during the year and hence, in this case also 1 have understood the whole activity of the Company and only after taking professional judgement based on information and discussion 1 have framed my opinion “.

34. The WPs referred to by the BP on page no 96 and 156 of the SCN is again a checklist document containing a line item “Provide us details of business being carried on by the company. Is there any change in the business if any please provide details of the same “, without any response to this item having been recorded by the BP. It is further written in the WP that the details were checked and verified by CA Rakesh Puri, but there is no information recorded about the business being carried out by the company, therefore it is not clear what contents were checked and verified by the EP. We further note that there are no supporting documents to show what information was gathered for obtaining an understanding of the nature of business of SSWL; and the details checked and verified by the EP do not have date and signature of the person who checked and verified making the whole exercise of preparing the WPs an eyewash.

The BP has also referred to Page no 182 and 183 of the SCN in support of his understanding regarding the transactions being carried out by SSWL and policies adopted by it. However, it is observed that these WPs were not found in the audit file, rather provided as an Annexure to the replies submitted by the BP in response to NFRA Questionnaire. Therefore, these WPs are an afterthought and cannot be accepted.

35. The saying that good planning is success half done is quite relevant in the conduct of audit as well. As per SA 300 and 315, the BP was duty bound to understand the business of the entity, assess the specific risks to the entity and plan his audit to mitigate such risks. However, as discussed above, there is no evidence or documentation in the audit file to show that the EP took any steps to understand the business of SSWL and to plan the audit.

36. We note that PCAOB22, the US Regulator, charged L.L. Bradford & Company, LLC (the “Firm”) for its failure to develop an appropriate audit plan for the audit ofWeb:XU Inc.’s (“WebXU”) and concluded that the “the Firm violated PCAOB rules and auditing standards with respect to an audit and a quarterly review of one issuer audit client. Specifically, the Firm in conducting its audit of the financial statements of WebXU for the year ended December 31, 2011, failed to properly assess the risks of material misstatement. As a result, the Firm failed to properly identify significant risks in connection with the 2011 WebXU audit. The Firm also failed to properly establish an overall strategy for the audit and develop an audit plan that included planned risk assessment procedures and planned responses to the risks of material misstatement. In addition, the Firm failed to perform sufficient audit procedures that addressed the risks of material misstatement. ” PCAOB for this misconduct among others, censured the Firm, revoked its registration permanently, and imposed a civil money penalty of $12,500 upon the firm.

D.1. ii. Failure to ensure existence of preconditions for the audit

3 7. The BP was charged23 with not visiting the premises of SSWL during the entire audit period and for not having any interaction I meeting with any of the directors. Further he was charged for not participating in any of the board / audit committee meeting, and he used to get the documents for conduct of the Audit through post and issued his audit certificate on that basis only.

38. The existence of preconditions for audit is quite important, as it establishes the responsibility of the management and TCWG for the successful conduct and facilitation of audit. One of the important preconditions as prescribed vide Para 6 of SA 21024 requires the auditor to ensure that management acknowledges its responsibility to provide the auditor with:

i. Access to all information of which management is aware that is relevant to the preparation of the financial statements such as records, documentation and other matters;

ii. Unrestricted access to persons within the entity from whom the auditor determines it necessary to obtain audit evidence.

Further, as per Para 8 of SA 210, if the preconditions for an audit are not present, then in ordinary circumstances, the auditor shall not accept such audit engagement. Therefore, by this Para, the SAs have emphasized to not to accept the engagement if the preconditions do not exist.

Considering the above, the EP and the audit firm were required, before accepting the audit, to assess whether the limitations of lack of time and financial constraints in accessing the premises of the entity could present a restrictive precondition and impose significant limitations on the EP to perform audit functions including check of internal controls, authenticity of the credentials of the company and active communication with the management and TCWG.

39. The EP responded that, “Since, I am based at Ludhiana and the company is based at Ahmedabad, the visit to the place of company is very much time consuming and the financial position of the Company is not very sound and even my fees is also so low that even I cannot bear the travelling expenses. Moreover, since the transactions of the company are also not very signi)7cant and to save the cost, we have used the technology and shared the details on email and if required through post “.

The EP further stated “Since, I have not visited the entity, I have not met with any of the Director but Interact with Mr. Anil Mistry, Director of the Company either on phone or through correspondence on e- mail. (The said point is stated in question 9 on page no. 19 of show cause notice) Even I have written letters to the Audit Committee before conclusion of the audit drawing the signcant changes or matter of attention which are required. One of such correspondence is available on page no. 184 and 185 of the show cause notice”.

40. Evidently, the EP allowed himself to work under conditions of scope limitation. The contention of the EP that low quantum of audit fee i.e., … and non-bearing of travelling expenses by the company cannot be an excuse for non-performance of the statutory duty. We did not find any document which shows that any communication occurred between the EP and Mr. Anil Mistry, the Director of the Company. Absent any interaction with the key management, audit committee etc., it is difficult to accept that the EP had understood the business of the entity and its internal controls. The EP’s reference to the two letters written by him to the Audit Committee on 1.8.2013 and 31.7.2014 to claim that he understood the business of the entity cannot be accepted as these letters were written at the time of submitting the draft financial statements and cannot be taken as evidence of any significant interaction with TCWG, Moreover, these are not a part of the audit file, not much credence can be attached to them.

41. If the EP felt that the limitations had been imposed on performing of the audit by constraints such as travel cost etc., then the EP could have chosen not to accept such audit engagement in accordance with SA 210, which he failed do. Accordingly, the reply and explanation of the EP is not acceptable and we hold him guilty of having violated SA 210.

D.2 Non verification of balances of debtors and creditors

42. The EP was charged25 with non-verification of balances of debtors and creditors as per the provisions of Para 2 and 12 of SA 50526 relating to External Confirmations as mentioned below:

a. The EP had reportedly asked27 SSWL to collect external confirmation of balances of debtors and creditors and accordingly letters were dispatched to relevant parties by SSWL, but no confirmations were received. Contrary to such exercise by the EP, he was required to perform external confirmation independent of SSWL in accordance with Para 2 of SA 505, which he failed to do.

b. The EP failed to document the external confirmation process is evident from the fact that no documentation was found in the Audit File regarding such letters to the parties.

c. The EP did not adhere to Para 12 of SA 505 by not adopting alternative procedures in case of non-receipt of confirmations from debtors and creditors.

43. Responding to the charges in the SCN, the EP stated that “We perform the external confirmation independently only, in this case also we have prepared the confirmation and only sent the seal covers to dispatch to parties. Since we have not received the confirmation, we have perform the alternative audit procedure and verified the subsequent transaction, which found to be satisfactory. In this case as so.ft copy of accounting software is kept as a working.file, the same has not been documented.

Since, it a standard format of the account confirmation, we do not keep a copy of the same. Moreover, a list of parties was normally maintained by firm to whom confirmation letters were sent. However, in the present case as the number of parties are very few, it was sent to all such parties.”

44. We have examined the replies of the EP. Trade receivables accounted for 20.57% in FY 201213 and 13.58% in FY 2013-14 of the total assets of the Comp~y, hence constituted a material class of account balances. However, aside from the fact that there was no audit documentation of the external confirmation, the EP’s claim that he depended on SSWL for independent confirmations shows complete ignorance of Para 7 and A31 of SA 50028 read with Parn2 of SA 505, which emphasise that audit evidence obtained directly by the auditor is more reliable than audit evidence obtained indirectly or by inference. Accordingly, the procedure claimed to have been adopted by the EP was devoid of independence, as he left the responsibility of obtaining confirmations to the entity and not to himself.

45. The contention of the EP that “Since, it a standard format of the account confirmation, we do not keep a copy of the same” is unacceptable. As para 8 of SA 23029 relating to audit documentation does not prescribe any relaxation for audit documentation, and requires that there should be sufficient audit evidence to enable an experienced auditor to understand the result of the audit procedures performed and the audit evidence obtained.

46. Further, the contention of the EP that he performed alternative audit procedures is also not evidenced from the audit file. His contention that records of such alternative audit procedure was kept in a softcopy of accounting software is also not acceptable as no such softcopy was documented as part of the audit file made available to NFRA and is in sharp contrast to his affidavit that he had submitted complete audit file to NFRA. His later submission that he is having accounting software backup, which was not compiled with the Audit File is also not acceptable, as he was duty bound to compile his audit file within 60 days after the date of auditor’s report as per the requirement of SQC I 3° and SA 23 0.

47. In view of above, the reply and explanation of the EP cannot be accepted, and we conclude that:

i. The EP neither adopted the Audit Procedure of external confirmation of balances of the debtors and the creditors, nor adopted the alternate Audit Procedures. It is only when the EP was questioned through NFRA questionnaire and the SCN, he came up with some replies in support of his carrying out these procedures. As no Audit Documentation was found in support of his stand, his replies are deemed an afterthought and cannot be accepted.

ii. The EP’s claim that the external confirmation was done through the SSWL, shows his complete disregard for it being done independently of the entity and does not add the required credibility and value to the Audit.

iii. By failing to make independent verification, the EP lost the benefit of external confirmation, through which he could have sensed the degree of grave misstatement in purchase and sales. Proper application of Audit Procedures based on Standards on Auditing could save the EP from improper reporting on the Financials of SSWL.

48. We note that PCAOB31, the US Regulator, matter, charged the public accounting firms Price Waterhouse, Bangalore, Lovelock & Lewes, Price Waterhouse & Co., Bangalore, Price Waterhouse, Calcutta, and Price Waterhouse & Co., Calcutta (collectively, “PW India”) for its failure to obtain external confirmation during the audit of Satyam and noted that the “For both the 2006 and 2007 audits, the Satyam engagement team did not maintain control of the accounts receivable conifirmation request process, and instead relied on Satyam’s management to send conifirmation requests. The Satyam engagement team received no responses to these confirmation requests but made no attempt to follow up on the nonresponses with second confirmation requests”. PCAOB for this misconduct among others, censured the Audit Firm, imposed a civil money penalty of $1,500,000 jointly and severally on Price Waterhouse, Bangalore, and Lovelock & Lewes.

D.3 Non-communication with Those Charged with Governance (TCWG)

49. The EP was charged32 with the failure to adhere to Para 7 and 8 of SA 26033, vide which he was required to determine TCWG. Further, the EP was also charged for non-compliance with Para 5 ( d) of SA 260, which requires an effective two-way communication between the EP and TCWG, which helps the EP to obtain from TCWG relevant information and convey his observations arising from the audit to the TCWG. While going through the audit file, complete vacuum was observed on the part of the EP regarding such communication.

50. In his reply to NFRA, the EP stated that he used to send a letter to the Audit Committee and presume that the points drawn in the letter were confrmed and no further adjustment and details were required if nothing was heard. The said policy of the EP is in contravention of Para 5 (d) of SA 260, which requires an effective two-way communication between the auditor and the TCWG. Responding to the charges in the SCN, the EP referred to Para 8 of the SA 260 and stated that “as per Para 8, Audit Committee is TCWG and the communication sent by me to audit committee is in compliance with SA 260 only. So far further sending communication to Board, it is considered that since, Audit committee is one of the major committee for accounts and financial statement, they are duty bound to consider the same and inform the management about the same. “

The EP Further stated that “The two-way communication does not mean that for each and every letter TCWG will respond to the auditor. It is a matter of circumstances and interest which is to be informed by each other for the better conduct of the audit. The relevant para of SA are reproduced herewith (A2 and A3 of SA 260)”

51. We have examined the reply of the EP and note that the audit committee is only a sub-group of TCWG and not TCWG in itself. As per Para 6 (a) of SA 260, TCWG is defined as the person(s) or organization(s) (e.g., a corporate trustee) with responsibility for overseeing the strategic direction of the entity and obligations related to the accountability of the entity. This includes overseeing the financial reporting process. For some entities, those charged with governance may include management personnel, for example, executive members of a governance board of a private or public sector entity, or an owner-manager. Therefore, communication of the EP with TCWG was not in accordance with provisions of SA considering the following:

a. As per para 7 of SA 260, the EP was required to determine TCWG in the first place. For the same, the EP could seek help from paragraphs A5-A12 of SA 260 which elaborates determination of TCWG depending on the diversity of governance structures of different organisations. However, no such working on the part of the EP to determine TCWG was found in the audit file.

b. Further, in case of communicating with the audit committee, Para 8 of SA 260 also required the EP to determine if governing body was also required to be communicated with. There is no audit documentation in the audit file regarding any such process performed by the EP.

c. Even the communication with the audit committee, referred to in the reply of the EP, was not part of the audit file, but the EP made the same available at the time of replying to NFRA questionnaire. Further, the EP is misquoting the referred communication as Management Representation Letter and also as communication with the TCWG, which reflects his poor understanding of the Standards on Auditing.

d. In view of the above, the reply and explanation of the EP are not acceptable.

52. We note that PCAOB34, the US Regulator, charged the public accounting frrm L.L. Bradford & Company, LLC (Audit Firm) for its failure to communicate with the audit committee during the audit of WebXU lnc.’s (“WebXU”) and noted that the “Firm also violated a PCAOB rule that requires a registered public accounting firm to communicate, in writing, to the audit committee…………. ” PCAOB for this misconduct among others, censured the Firm, revoked its registration, and imposed a civil money penalty of $12500.

D.4 Non-appointment of Engagement Quality Control Reviewer (EQCR)

53. The EP was charged35 with failure to adhere to the Para 19 (a) of SA 22036 which requires appointment of EQCR for the statutory audit of a listed company. Since SSWL is a listed company, the EP was required to determine that EQCR was appointed.

In response to above charge, the EP stated that “Appointment of EQCR is only required for which the frm has determined that an engagement quality control review is required As discussed earlier since, there is no significant transactions, no EQCR was appointed. Obviously, such reply reflects the EP’s poor understanding of the provisions of Standards on Audit. As per para 19 (a) of SA 220, in case of a listed company, appointment of EQCR is compulsory. Further, the contention of the EP that there were no significant transactions in the company is false because he himself has claimed to have verified revenue to the tune of ~ 1,791.01 crores for FY 2013-14. Secondly, presuming there were no significant transactions cannot be an excuse for non-adherence to the audit procedures because the standards require appointment ofEQCR in case of a listed company. Therefore, we cannot accept the explanation of the EP in this regard.

54. We note that PCAOB37, the US Regulator, charged the public accounting firm Stein & Company, LLP (Audit Firm) for its failure to ensure the engagement quality review in the audit of Health Talk Live, Inc. (“Health Talk”) and concluded that the “The Firm improperly issued the audit report without obtaining an engagement quality review and concurring approval of issuance and thus violated Auditing Standard No. 7, Engagement Quality Review (”AS 7”).” PCAOB for this misconduct among others, censured the Firm, and imposed a civil monetary penalty of $5000.

E. Article of Charges of Professional Misconduct by the Engagement Partner (EP)

55. As discussed in the foregoing paragraphs, the Engagement Partner (EP) has made a series of serious departures from the Standards and the Law, in his conduct of the audit of SSWL for FY s 2012-13 and 2013-14. Based on above discussion, it is proved that the EP had issued unmodified opinion on the Financial Statements without any basis. The poor quality of Audit, the cover up in terms of submission of additional documents that did not exist in Audit File, incomplete documentation and attempt to mislead through false and evasive replies further compound the professional misconduct on the part of the EP. Based on the foregoing discussion and analysis, we conclude that the EP has committed Professional Misconduct as defined under Section 132 ( 4) of the Companies Act 2013 in terms of section 22 of the Chartered Accountants Act 1949 (‘CA Act’ hereafter) as amended from time to time, and as detailed below:

i. The EP committed professional misconduct as defined by clause 5 of Part I of the Second Schedule of the CA Act, which states that an EP is guilty of professional misconduct when he ”fails to disclose a material fact known to him which is not disclosed in a financial statement, but disclosure of which is necessary in making such financial statement where he is concerned with that financial statement in a professional capacity”.

This charge is proved as the EP failed to disclose in their report the material noncompliances by the Company as explained in Para 19 to 22 above.

ii. The EP committed professional misconduct as defined by clause 6 of Part I of the Second Schedule of the CA Act, which states that an EP is guilty of professional misconduct when he ”fails to report a material misstatement known to him to appear in a financial statement with which he is concerned in a professional capacity”.

This charge is proved as the EP failed to disclose in audit report the material misstatements made by the Company as explained Para 19 to 22 above.

iii. The EP committed professional misconduct as defined by clause 7 of Part I of the Second Schedule of the CA Act, which states that an EP is guilty of professional misconduct when he “does not exercise due diligence or is grossly negligent in the conduct of his professional duties”.

This charge is proved as the EP failed to conduct the audit in accordance with the SAs and applicable regulations, failed to report the material misstatements in the financial statements arising from overstatement of purchase and sales figures and failed to report noncompliances made by the Company, as explained in Para 19 to54 above.

iv. The EP committed professional misconduct as defined by clause 8 of Part I of the Second Schedule of the CA Act, which states that an EP is guilty of professional misconduct when he ‘Jails to obtain sufficient information which is necessary for expression of an opinion or its exceptions are sufficiently material to negate the expression of an opinion”.

This charge is proved as the EP failed to conduct the audit in accordance with the SAs and applicable regulations as well as due to his total failure to report the material misstatements and non-compliances made by the Company in the financial statements, as explained in the Para 19 to54 above.

v. The EP committed professional misconduct as defined by clause 9 of Part I of the Second Schedule of the CA Act, which states that an EP is guilty of professional misconduct when he ‘Jails to invite attention to any material departure from the generally accepted procedure of audit applicable to the circumstances”.

This charge is proved since the EP failed to conduct the audit in accordance with the SAs as explained in the Para 19 to54 above.

F. Penalty & Sanctions

56. It is the duty of an auditor to conduct the audit with professional scepticism and due diligence and report his opinion in an unbiased manner. Statutory audits provide useful information to the stakeholders and public, based on which they make their decisions on their investments or do transactions with the public interest entity38

57. Without a credible Audit, Investors, Creditors and Other Users of Financial Statements would be handicapped. The entire corporate governance system would fail and result in a breakdown in trust and confidence of investors and the public at large if the professionals in charge of audit do not perform their job with professional scepticism and due diligence and adhere to the standards.

58. Section 132(4) of the Companies Act, 2013 provides for penalties in a case where professional misconduct is proved. The seriousness with which proven cases of professional misconduct are to be viewed, is evident from the fact that a minimum punishment is laid down by the law.

59. The EP in the present case was required to ensure compliance with SAs to achieve the necessary audit quality and lend credibility to Financial Statements. As we have explained in this order, substantial deficiencies in Audit, abdication of responsibility and inappropriate conclusions on the part of CA Rakesh Puri establish his professional misconduct. Revenue reported by an entity is the most important item in the financial statements, on the basis of the same, the stakeholders make their decisions. Despite the management showing exponential rise in the revenue and presence of other factors, the EP failed to design sufficient appropriate audit procedures to test the veracity of such exponential growth, which resulted into misleading and presenting a rosy picture to the stakeholders.

60. Section 132(4Xc) of the Companies Act 2013 provides that National Financial Reporting Authority shall, where professional or other misconduct is proved, have the power to make order for

(A) imposing penalty of (I) not less than one lakh rupees, but which may extend to five times of the fees received, in case of individuals; and (II) not less than ten lakh rupees, but which may extend to ten times of the fees received, in case of firms;

(B) debarring the member or the firm from–(I) being appointed as an auditor or internal auditor or undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate; or (II) performing any valuation as provided under section 247, for a minimum period of six months or such higher period not exceeding ten years as may be determined by the National Financial Reporting Authority.

61. As per information furnished by CA Rakesh Puri vide letter dated 20.04.2023, fees received by him from M/s Y.D. & Co. for the FYs 2012-13 and 2013-14 was … for each year.

62. Considering the proved professional misconduct and keeping in mind the nature of violations, principles of proportionality and deterrence against future professional misconduct, we, in exercise of powers under Section 132(4)(c) of the Companies Act, 2013, hereby order:

I. Imposition of a monetary penalty of Z Five Lakhs upon CA Rakesh Puri;

II. In addition, CA Rakesh Puri is debarred for Five years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate;

63. This order will become effective after 30 days from the date of issue of this order.

Sd/-

(Dr Ajay Bhushan Prasad Pandey)

Chairperson

Sd/-

( Praveen Kumar Tiwari)

Full-Time Member

Sd/-

(Smita Jhingran)

Full-Time Member

Authorised for issue by the National Financial Reporting Authority,

Date: 19.05.2023

Place: New Delhi

(Vidu Sood)

To,

CA Rakesh Puri,

ICAT Membership No-092728,

M/s Y.D. & Co.,

Chartered Accountants,

ICAI Firm Registration Number: 018846N

Ludhiana- 141002

Email: carakeshpuri67@gmail.com

Copy To: –

(i) Secretary, Ministry of Corporate Affairs, Government of India, New Delhi.

(ii) Securities and Exchange Board of India, Mumbai.

(iii) Secretary, Institute of Chartered Accountants of India, New Delhi.

(iv) Sun and Shine Worldwide Limited (earlier known as Robinson Worldwide Trade Limited and presently functioning in the name of Johnson Pharmacare Limited)

(v) M/s Y.D. & Co., Ludhiana,141012, ydcoca@gmail.com

(vi) IT-Team, NFRA for uploading the order on the website of NFRA.

Notes:

1 SSWL ‘s CIN is LS I I 00GJI 994PLC022388 and it was earlier known as Robinson Worldwide Trade Limited and presently functioning in the name of Johnson Pharmacare Limited.

2 Vide Rule 3(l}(a) of National Financial Reporting Authority Rules, 2018

3 The revenue figures are taken from the Annual Report of SSWL.

4 As conveyed by SEBI vide its letter dated 08.07.2020.

5 Vide Para 4.2 A of the SCN

6 As elaborated on page no 4 of Relevant finding in the matter of the FS of SSWL conveyed by SEBI vide letter dated 08.07.2020.

7SEBI order dated 14.09.2021 is available at the website of SEBI and accessible through the link

https://www.sebi gov in/enforcement/orders/sen 2021/final order in the matter of sun and shine worldwide ltd 52571.html (see para

2.9 at the page number 5 of the order)

8 As per point no 2 of SEBI letter no IVD/ID18/SK/PV/OW/l 1448/2020 dated 08.07.2020.

9 See para 2lofpage number 40 of the SEBI order dated 14.09.2021.

10 SA 200 “Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Standards on Auditing”

11 PCAOB release No. 105-2009-003 dated 08.02.2012.

12 SA 240 “The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements”

13 Vide Para 4.2B (b) of the SCN

14 As per Annual Report of SSWL

15 Vide Para 4.28 (c) of the SCN

16 As mentioned in the reply to question no. 6 on page no. 8 of Relevant fnding in the matter of the Financial Statements ofSSWL conveyed by SEBI vide letter dated 08.07 2020.

17 SA 530 “Audit Sampling”

18 Vide Para 4.1.l of the SCN

19 SA 300 “Planning an Audit of Financial Statements”

20 Vide Para 4.1.2 of the SCN

21 SA 315 “Identifying and Assessing the Risk of Material Misstatement Through Understanding the Entity and its Environment”

22 PCAOB release No. 105-2015-41 dated 03 12.2015.

23 Vide Para4.l.3 of the SCN

24 SA 210 “Agreeing the Terms of Audit Engagements”

25 Vide Para 4.3 of the SC N

26 SA 505 “External Confirmations”

27 As reply by the EP vide Page no. 2 of his reply dated 26.04.2022 in response to NFRA questionnaire.

28 SA 500 “Audit Evidence”

29 SA 230 “Audit Documentation”

30 As per Para 75 of SQC l “Quality Control for Firms that Perform Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Engagements” and Para 14 read with Para A2 l of SA 230 “Audit Documentation”.

31 PCAOB release No. 105 2011-002 dated 05.04.2011.

32 Vide Para 4.4 of the SCN

33 SA 260 “Communication with Those Charged with Governance”

34 PCAOB release No. 105-2015-041 dated 03.12.2015.

35 Vide Para4.5 of the SCN

36 SA 220 “Quality Control for an Audit of Financial Statements”

37 PCAOB release No. 105-2015-040 dated 03.12.2015.

38 As defined in Rule 3 ofNFRA Rules 2018