Arjuna (Fictional Character): Krishna, in the year 2016 there were a lot of changes in the financial world of the country. After demonetization income tax raid at many places, issues in banks came to notice. Further a big change in the indirect tax laws i.e. GST is coming. So there were big changes are likely to come in the year 2017 in the financial world.

Krishna (Fictional Character): Arjuna, the government has received more money into the bank accounts than expected. In the country, there is huge black money i.e. tax evaded money. Therefore government is finding the reason as to how this much money came into the bank accounts. Data analysis is done for finding the tax evaders. In 1.14 Lakh bank accounts, 4 Lakh crore rupees were deposited. As per income tax department these are suspicious accounts. It is expected that income tax department will send notices to them and enquire them. Further income tax return of the financial year 2014-15 has not been filed by 67 lakh taxpayers having large transactions. Therefore the year 2017 is dangerous for tax evaders.

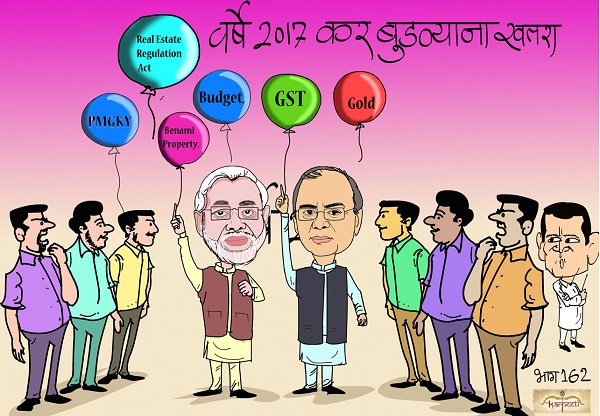

Arjuna: Krishna, in the year 2017 which things are expected in Income Tax?

Krishna: Arjuna,

- It is expected that mainly government will find tax evaders and do further proceedings

- The government has given last chance for tax evaders in the form of “Pradhan Mantri Garib Kalyan Yojna.” The last date for applying in the scheme is 31st March 2017.

- Government for resolving old disputes in Income Tax has extended the date of “https://taxguru.in/goods-and-service-tax/6-major-decisions-taken-by-gst-council-so-far.htmlDirect Tax Dispute Resolution Scheme” to 31st January 17.

- It is expected the rate of income tax will be reduced in the upcoming budget.

- It is expected that basic exemption limit of income tax will be increased

- Now onwards provisions for exemptions on transactions carried through bank and restrictions on cash transactions may come

Arjuna: Krishna, In Indirect taxes which major change is expected in the year 2017?

Krishna: Arjuna, In Indirect taxes, mainly excise, customs, service tax, vat comes. However, the government is trying to levy one single tax i.e. GST in place all these taxes. The government has made planning for levying GST in 2017 from 2016 itself. The government has started registrations of GST for VAT dealers from November 16 and now they have started GST registrations for service tax taxpayers also. From the government planning, it is seen that GST will be implemented from April 17 or September 17. Due to this, the rates of goods and services will be changed. After implementation of GST, tax evasion will be reduced.

Arjuna: Krishna, what are things expected in the year 2017 in the finance world?

Krishna: Arjuna,

- Due to demonetization and changes in direct and indirect tax laws, the method maintaining books of accounts will be changed. Maximum transactions will be incurred from the bank accounts. Everyone will have to keep the log of transactions made through credit cards, debit cards, Paytm, vaults, etc.

- Every year financial budget of the upcoming financial year is presented on 28th February and Railway budget is presented on 27th However this year both budgets i.e. railway and financial for the year 2017-18 will be presented 1st February only.

- In the year 2017, Benami Property Act will be implemented. It will affect many citizens.

- Real Estate Regulation Act will also be passed and implemented in the year 2017. Due to provisions of this act restrictions will come to builders. Builders will have to do financial transactions according to provisions of the act only.

- It is expected that in this year increase in loan amount for the small home, small industries and reduction in the rate of interest may come for them.

Arjuna: Krishna, from the things, happened in the year 2016 and expected changes in the upcoming year 2017, what one should learn?

Krishna: Arjuna, every year come and goes by giving a lot of things. Everyone should go through the good and bad things in the forgone year and accordingly should plan for the upcoming year. In the financial world, there are a lot of changes made in the year 2016. Similarly, it is expected in 2017 also. If everyone understands them one will not suffer. But the one who has not followed tax laws in the forgone year will have to suffer in this year. New Year has come if maximum transactions are carried through the bank then it will be joyful. Saal Do Hazar “Satra” main Tax Evaders ko “Khatra.”