PM Modi demonetised Rs. 1000/- & Rs. 500/- denomination currency notes with a view to eradicating Black money from our economy, end rampant corruption, contain the use of counterfeit & fake currency and to put a full stop on cash funding by our neighbour countries to the terrorist outfits. It is undisputed that the intention of the Government needs full appreciation. The secrecy of the move speaks volumes of the commitment, honesty, and tenacity of the government. But, the early results do not reflect the solemn aspirations of the government although is too early to judge the success of this historic move.

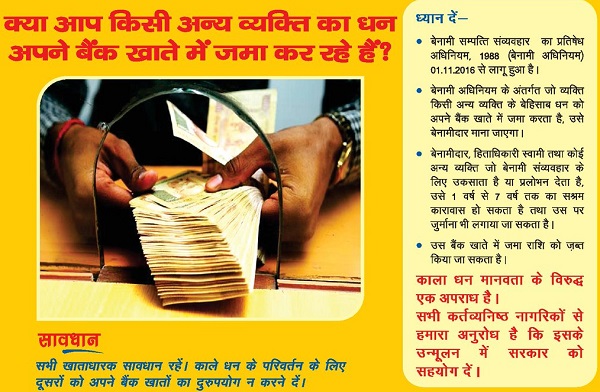

When PM Modi addressed the nation and announced demonetisation, the whole country was taken aback. The big businessman, the politicians, and the bureaucrats were nonplussed and panicky. Mobile phones started ringing incessantly and the tax consultants went awry answering the various queries of their ‘fat’ clients. Almost the whole country was awake planning to do away with the ‘unwanted’. It is reported that on the night on which demonetisation was announced by the PM, a record number of cars with blue & red lights were seen on the national & regional highways impliedly transporting the ‘unwanted’. Sedatives, tranquillisers, sleeping pills & antidepressants were in heavy demand for the next fortnight. But gradually the situation eased out and all were comfortable after the initial ‘adjustments’. Gold bullion was sold in tons at a fancy price of Rs. 61000/- per 10 gm in demonetised currency as against the official rate of Rs. 30500/- per 10 gm. A lot of the demonetised currency was sucked up by this route. A number of other escape routes were also invented. With the connivance of the Bank officials fake current accounts in the name of Tom, Dick & Harry were opened and the demonetised currency was deposited in huge quantities. This money was then transferred to the accounts of the beneficiaries, mostly bullion merchants. The employees of the factories were deployed in queues for conversion of the demonetised currency into the new currency. Jan Dhan accounts which had zero balance were flooded with money and with the connivance of the bank officials the money was transferred to the beneficiary accounts. Not only this, there were contacts throughout the country who converted the demonetised currency into the new currency at a discount of 15-30%. The result of these illegal moves is that the old currency has been almost wiped out of the system. Unofficial sources claim that 14 lac crores of demonetised currency, out of 14.75 lac crores of currency estimated by the government to be in the market, have been deposited in the banks till date. Moreover, there are still 12 more days when this demonetised currency can still be deposited in the banks. Even the remaining old currency can be deposited in the Reserve Bank of India till March 31, 2017. The Pradhan Mantri Garib Kalyan Deposit Scheme (PMGKDS), 2016 has opened windows for declaring black money from December 17, 2016, to March 31, 2017 shall attract the residual old currency. Resultingly, the government expectation that not more than 12 lac crores shall be deposited in the banks thereby giving a windfall gain of 2.75 lac crores to their exchequer appears to be totally belittled.

Even after the government announced the stringent measure of demonetisation, Searches by ED, Police & Income Tax department throughout the country have unearthed hundreds of crores worth gold, old & new currency. Police have intercepted vehicles and railway passengers and have unearthed unaccounted cash being transferred for conversion from old to the new currency. Despite, limited availability of new currency, the rich & mighty have been able to amass sizeable volumes of new currency. Thus the very purpose of demonetisation seems frustrated. It appears that we Indians are so much obsessed with the parallel economy that we cannot live without it. It does not appear that demonetisation would eradicate black money from our economy.

It is time to ponder about the reasons as to why there is a parallel economy running in our country and why there is a generation of black money despite strict government controls. Perhaps there are a number of factors that go into the root of the matter. The foremost is the ‘Sab Chalta Hein’ attitude of our countrymen. People who have done ‘wrongs’ in the past have not faced the ire of the department by appeasing the concerned and by abuse of the process of law. The searches & surveys under the Income Tax Act have not proved to be a deterrent to the generation of black money. The provisions of prosecution of erring assessees have not been resorted to as mandated under the act. The frequent disclosure schemes launched regularly in the past have helped & rescued the tax evaders. It is indeed paradoxical that out of a population of more than 130 crores, only 2.87 crore individuals file income tax returns and only 1.25 crore taxpayers paid tax which implies that the remaining population does not even earn 20000/- per month. It is all the more astonishing that there were only 5430 individual assessees who had paid income tax above Rs. 1 crores for the AY 2012-13. The high rates of Vat also act as a deterrent to accounted sales & purchases, especially when the profit margins in the wholesale business are as low as 1-2%. The present Labour Laws also promote fabrication in accounts & virtually promotes a parallel economy. Until & unless Income Tax Act is simplified, the rates rationalised & reduced, officialdom blasted, Inspector Raj shattered, Information Technology strengthened to detect tax evasion and above all corruption contained, black money shall continue to get generated, distributed and be in vogue as ever.

As to whether Demonetisation would contain & reduce corruption, the answer is simple and self-evident. Corruption has not been curbed after demonetisation. In fact, the officers have doubled their ‘Nazrana/Shukrana’ to compensate the loss due to demonetisation. The demand these days is either in new currency or gold bullion. Corruption will end when the ‘Transfer Industry ‘ of the state governments is curbed, when Vigilance & Lokayukta takes proper action against dubious officers, CBI & CVC takes regular action against corrupt officials and the interaction between officers & assessees is minimised. Time has come where Information Technology should be used for assessments & detection/unearthing of black money. The discretions given to the officers should be minimised.

No step of the government shall curb & contain corruption and black money until our nationalistic feelings overcome our greed. Time has come when feelings of patriotism & nationalism should be inculcated in the young students so that the new creed undergoes a complete change in future to enable eradication of corruption & black money.

(Author – Inder Chand Jain, Agra, Mobile:9319215672, Email: inderjain2007@rediffmail.com)

Mr Jain your article is correct and giving facts.But you have missed the elections in our country. Water flows from high to low. It is an open secret that an MLA spends 3 to 4 crore and an MP spends 10 to 15 crore in election.So Corruption starts from here. So Modi should create example to the nation that his all rallies are being paid by

Paid by cheque. Every party show its funds to public. And every politician should deposit it’s allowed amount to election commission to provide election material and time on TV. There should be fixed and equal to every candidate. Only then people will start changing.

Corruption is in our Blood…We believe… We believe in bribing God to get redeemed, our Sins absolved and miracles to happen. Or maybe our Gods do listen to us that way only…

So getting rid of corruption completely is a mirage.

But it will make a difference as use of currency for anything expensive will carry a greater risk with every produce digitally accounted for. With e-property book as expected where will one use the cash. Hoarding it in Gold or diamonds will be the only option. But then to liquidate it will also not be easy.

Let’s wait and see how much better it gets in the long run.

And if the Govt eventually gets rid of all the big notes including the 2000 one in the near future I am sure it will be greatly beneficial.

Govt must tally the amount of illegal notes changed under particular ID’s on or after 9th November 2016 with their actual particulars/addresses.As all the banks ,mobile operators and other similar agencies have used the IDs submitted by the customers/subscribers for opening bank accounts or obtaining mobile connections/sims ,for changing the illegal tenders with new notes themselves and network of spurious elements/gagester/mafia

not even 5% black money will be eradicated.This scheme is failure

The nexus between the corrupt administration and corrupt businessmen has proliferated into tonnes of black money and it is the the salaried class which is more tax compliant is rendered a casuality and deserves a simplified scheme of assessment .The Banking transaction tax was removed by the then Finance Minister just before the general elections and now he canvasses for the same. . The politicians crying hoax taking the hardships of the common man should be exposed and the errant bank officials who have made money into a tradeable commodity should be prosecuted.

Completely agree with you sir, nothing has changed after demonetization and in addition govt has not amended section 13 of Income tax giving political parties and big bulls to convert black into white money that too legally…

Hi Indrajit Ji,

Your last para makes utmost sense to start me and every individual in India should do to inculutate the feeling of Indian Nation and building it

Absolutely correct .