Case Law Details

Shri Kamanahalli Pilla Reddy Nagesh Vs ITO (ITAT Bangalore)

Conclusion: Even though the agricultural land was converted for non-agricultural purposes, but cultivation of land continued till the date of sale of the land. Thus, the land should have been treated as agricultural land and exempt from capital gain in view of section 2(14).

Held: AO made addition of Rs.2.06 crores as long term capital gain arising from sale of land. Assessee claimed that the said land was situated beyond the Municipal limits 10 kms. and therefore, it was not a capital asset as per section 2(14). However, AO held that, the land was converted for nonagricultural purposes before execution of sale deed, therefore, it was a capital asset u/s 2(14) and it could not be exempted u/s 10(1). Accordingly, the same was brought into taxation as capital gain. It was held that the main reason for treating the land as non-agricultural was that the land was converted for usage of non-agricultural purposes. However, the assessee filed revenue records wherein it was stated that the land still continued to be agricultural land wherein crops like Ragi & Paddy were cultivated by the assessee. Further, it was brought on record by assessee that the land revenue was paid as applicable to agricultural land only. The land got converted by assessee for non agricultural purposes and conversion permission was granted on the condition that the land should be used for non-agricultural purposes within two years, otherwise original character of the land i.e., agricultural in nature would be restored. Assessee has not used the land for non-agricultural purposes even after conversion of the land for non-agricultural purposes. Tribunal observed that though the said land was converted for non-agricultural purposes, but cultivation of land continued till the date of sale of the land. Thus, the land should have been treated as agricultural land and exempt from capital gain in view of section 2(14). As the revenue failed to bring anything on record to controvert the tribunal’s observation, the exemption u/s 10(1) was allowable as the sale did not amount to capital asset.

FULL TEXT OF THE ORDER OF ITAT BANGALORE

Present appeal is filed by assessee against order dated 28.03.2019 passed by Ld. CIT(A)-9, Bangalore for A.Y. 2014-15 on the following grounds of appeal:

“1. The orders of the authorities below in so far as they are against the appellant, are opposed to law, equity, weight of evidence, probabilities, facts and circumstances of the case.

2. The learned CIT[A] is not justified in upholding the assessment order passed u/s. 143[3] of the Act despite the fact that no valid notice u/s.143[2] of the Act was served upon the appellant taking recourse to the provisions of sec. 292B of the Act and holding that the appellant was not entitled to raise the said challenge under the facts and circumstances of the appellants case.

3. Without prejudice to the above, the learned CIT[A] is not justified in upholding the assessment of Rs. 2,01,92,432/-as Long Term capital gains in the hands of the appellant in individual capacity under the facts and circumstances of the appellant’s case.

4. The learned CIT[A] ought to have appreciated that the property sold by the appellant was received upon partition of the bigger HUF of which the appellant was a coparcener earlier and thus, the said property received upon partition belonged the appellant’s branch of HUF of which the appellant was the karta, which also stood disrupted and therefore, the assessment of capital gains on the sale of the said property in the hands of the appellant in Individual capacity was misconceived.

5. Without prejudice to the contention that the property sold does not belong to the appellant in individual capacity but to the erstwhile HUF of the appellant, the learned CIT[A] ought to have granted deduction of brokerage paid a sum of Rs. 75,000/- while computing capital gains under the facts and in the circumstances of the appellant’s case.

6. Without prejudice to the contention that the property sold does not belong to the appellant in individual capacity but to the erstwhile HUF of the appellant, the learned CIT[A] ought to have granted deduction towards indexed cost of improvement of Rs. 29,90,446/- being the expenditure incurred towards the construction of the compound by the erstwhile joint family of the appellant, which the appellant is otherwise entitled to as per law under the facts and in the circumstances of the appellant’s case.

7. Without prejudice to the contention that the property sold does not belong to the appellant in individual capacity but to the erstwhile HUF of the appellant, the learned CIT[A] ought to have granted deduction u/s.54B of the Act of Rs. 1,66,75,000/- being the extent of agricultural lands purchased by the erstwhile joint family of the appellant, which the appellant is otherwise entitled to as per law under the facts and in the circumstances of the appellant’s case.

8. Without prejudice to the right to seek waiver with the Hon’ble CCIT/DG, the appellant denies himself liable to be charged to interest u/s.234-A and 234B of the Act, which under the facts and in the circumstances of the appellant’s case and the levy deserves to be cancelled.

9. For the above and other grounds that may be urged at the time of hearing of the appeal, your appellant humbly prays that the appeal may be allowed and Justice rendered and the appellant may be awarded costs in prosecuting the appeal and also order for the refund of the institution fees as part of the costs.”

2. Facts of the case are that the A.O. made addition of Rs.2.06 crores as long term capital gain arising from sale of land situated at Survey No.40, Chikkanahalli Kammanahalli, Sarjapur hobli, Anekal Taluk, Bengaluru. The assessee claimed that the said land is situated beyond the Municipal limits 10 kms. and therefore, it is not a capital asset as per section 2(14) of the Act. According to the Ld. A.R., the sale of agricultural land outside municipal limit is to be treated as agricultural land and should be exempted u/s 10(1) of the Act. However, the A.O. held that, the land was converted for nonagricultural purposes before execution of sale deed, therefore, it is a capital asset u/s 2(14) of the Act, and it cannot be exempted u/s 10(1) of the Act. Accordingly, the same was brought into taxation as capital gain.

On appeal, the Ld. CIT(A) confirmed the above finding of the A.O.

Against this, the assessee is in appeal before us.

The Ld. A.R. submitted that, the assessee entered into sale agreement on 15/4/2013 to sell subjected property and the land was got converted as per condition laid down by the purchaser in sale agreement. As per this condition in sale agreement, the Ld.AR submitted that, the assessee got converted the said land for non-agricultural purposes on 16.9.2013 by order of Dy. Commissioner of Bangalore district OM No.ALN(S)-SR/37/13-14 dated 16.9.2013, and, the assessee entered into sale deed on 18.9.2013. It was submitted that the conversion of said property for non-agricultural purpose was only to fetch good price and not any other intention. The Ld.AR submitted that, the property was sold within a period of 2 days after the order of conversion, and the land was not subjected to use for non-agricultural purpose on any day and the sole intention of conversion was to get good price that cannot be reason to hold that the land sold by assessee is non-agricultural land.

Further, it was submitted that, land has been used by the assessee till the date of transfer as agricultural land and also assessee declared income from agriculture in its return of income which was not accepted by the department.

Further, the Ld.AR drew our attention to the record of rights, wherein it was classified as non-agricultural land and the land was subjected to cultivation, wherein assessee cultivated cashew nut and Neilgiri. He also submitted that the endorsement issued by the Dy. Tahsildar, Sarjapur Hobli, Anekal vide no. Sanaaka/MNK/MSC/20/2014-15 dated 13.1.2015, the land is situated 10 kms away from the local municipality. He relied on the following judgements:-

a) Shri M.R. Pattabhiram (HUF), in WTA No.34-36/Bang/2014 dated 16.10.2015.

b) Shri M.R. Anandaram (HUF), ITAT Bengaluru Bench in ITA Nos.1169 to 1172/Bang/2015 & CO Nos.220 to 223/Bang/2015

c) Hon’ble Jurisdictional High Court of Karnataka in the case of CIT Vs. Smt. K. Leelavathy (2012) 21 taxmann.com 148 (Kar) dated 2.1.2012

d) Smt. K. Leelavathi, ITA No.997 & 998 (Bang) 2010.

The Ld.AR submitted that though the property was within limits of BMRDA, that itself cannot be treated as the land is situated within the municipality or local authority in terms of section 2(14)(iii)(a) of the Act. For this purpose, he relied on the order of the Tribunal in the case of WTA No.34-36/Bang/2014 dated 16.10.2015 in the case of M.R. Pattabhirama (HUF).

3. On the other hand, the Ld. D.R. submitted that the land was converted for non-agricultural purpose before sale and the sale of converted land for non-agricultural purpose should be liable for tax as it is not an agricultural income in terms of section 2(14) of the Act.

We note that assessee has filed following additional grounds.

It is submitted that no new facts needs to be adjudicated and accordingly application dated 28.04.2022 stands allowed.

“1. The Appellant begs to submit the following additional grounds of Appeal for Adjudication in addition to the grounds of Appeal already urged in the Appeal Memorandum.

2. Additional Ground

The Ld.AO has erred in holding a sum of Rs. 2,01,92,432/-as income from Capital Gains on the sale of Agricultural Lands situated at Sy.No. 40, Chikkanahalli Kamanahalli, Sarjapur Hobli, Anekal Taluk, Bangalore jointly sold by the Appellant along with his family members vide Sale Deed dtd: 18-092013 without appreciating the fact that the Land sold were the Agricultural Lands not liable for Capital Gain Tax.

3. The Appellant submits that the additional ground is absolutely necessary for Adjudication for the cause of advancement of substantial justice and equity since the adjudication id required in accordance with Law and facts of the case.

4. The Appellant submits that the admission of additional grounds does not cause any prejudice to the revenue since the matter in appeal needs to be adjudicated on merits of the case in accordance with law. On the otherhand if the additional grounds are not admitted the Appellant would be put to hardship and denial of justice admissible in accordance with law.

5. The Appellant begs to place reliance on the following decisions

i. The Hon’ble Supreme Court in the case of National Thermal Power Corporation Ltd v/s. CIT 229 ITR 383 (SC)

ii. The Hon’ble Supreme Court in the case of CIT v/s. Kelvinator of India Ltd (2010) 320 ITR 561 (SC)

6. Therefore the Appellant respectfully prays that this Hon’ble Bench be pleased to admit the Additional Grounds of Appeal for adjudication in the interest of equity and substantial justice.”

4. It is also submitted by the Ld.AR that in the event the additional grounds is considered, assessee would not press on the main grounds raised in the grounds of appeal. He also submitted that assessee had also raised additional grounds vide application dated 28.04.2022.

5. The Ld.AR at the outset submitted that on identical facts in case of co-owner Shri K.P. Manjunatha Reddy vs. ITO in ITA No. 977/Bang/2019 vide order dated 25.03.2022, the Coordinate Bench of this Tribunal held the land sold not to be liable for capital gain being an agricultural land.

The Ld.DR however submitted that the issue may be remanded to the Ld.AO to verify the same.

6. We have perused the submissions advanced by both sides in the light of records placed before us.

7. We note that on identical facts, Coordinate Bench of this Tribunal in co-owner’s case observed and held as under:

“4. We have heard the rival submissions, perused the materials available on record and gone through the orders of the authorities below. In this case, the assessee sold property situated at Survey No.40, Chikkanahalli Kammanahalli, Sarjapur hobli, Anekal Taluk, Bengaluru and claimed it as an agricultural land. However, the A.O. observed that the land was subjected to conversion before sale agreement on 15.4.2013 and the assessee got converted the said land for non-agricultural purposes on 16.9.2013 by order of Dy. Commissioner of Bangalore district OM No.ALN(S)-SR/37/13-14 dated 16.9.2013. Later, the assessee entered into sale deed on 18.9.2013. However, assessee furnished Record of rights issued by revenue authorities that land was subjected to cultivation, wherein assessee cultivated cashew nuts and Neilgiri in the assessment year under consideration. The assessee also produced the certificate from Dy. Tahsildar, Sarjapur Hobli, Anekal, wherein he has stated that the land is situated 10 kms. away from the municipal limits. These facts support the case of assessee to hold that land is an agricultural land and only to facilitate to get good price, the assessee converted the land and at the time of entering into sale agreement, land was not converted into nonagricultural land. The assessee also declared agricultural income from the said land as an agricultural income at Rs.9 lakhs, which was accepted by the department and there was no disturbance on this count. The situation of land within the BMRDA limits cannot be considered as the land is situated within the limit of municipality and moreover, BMRDA is not a municipal or local authority in terms of section 2(14)(iii)(a) of the Act. This proposition is verified by the order of the Tribunal in the case of M.R. Pattabhiram (HUF) Vs. ACWT in WTA Nos.34 to 36/Bang/2014 dated 16.10.2015, wherein Tribunal held as under:

7. The next is came up for our consideration, is whether the CWT(A), right in holding the impugned lands are urban lands and the BIAPPA is municipality or notified area as defined in section 2(14)(iii) of the Act. The Id. Authorised representative brought to the notice of the bench that the issue in this appeal is covered by assessee own case in ITA.No. 262/B/2013.We find that the co-ordinate bench of this tribunal in assessee own case in ITA No. 2628/2013 for the assessment year had considered whether the impugned lands situated at Akkalenahalli- Mallenahalli Village pertaining to the assessee which are subject matter of appeal before us are urban lands as defined in section 2(14)(iii) of the Income tax Act, 1961 and are capital assets and the gain from transfer of these lands are liable for capitalain tax. The ITAT had examined the issue whether the lands in question are capital assets, situated within the municipal limits of BIAPPA and the BIAPPA is a municipality or notified area. The Tribunal after considering the relevant details has come to the conclusion that the impugned lands are not capital assets within the meaning of section 2(14). The relevant portion is reproduced hereunder.

8.It is now for us to consider as to whether the order passed by the co-ordinate bench of this Tribunal in the case of M.R. Seetharam (HUF) in ITA No.16154/BangI2012 dt.13.6.2014 is applicable to the facts of this case.

The land in question, which are sold by the assessee and subjected to the charge of LTCG by the authorities below, became the properties of the assessee’s virtue of a family settlement of land purchased by Late Sri M.S. Ramaiah in 1951. In the said family settlement in 1970, the assessee and other family members including M.R. Seetharam were allotted lands belonging to the said family. The lands sold by the assessee, some other family , members, as well as the lands sold by M.R. Seetharam are contiguous in nature and possess the same physical attributes. Admittedly these lands were converted for nonagricultural purposes, but no development was eft:I-Tied out by the assessee in respect of the said land. Agricultural activities were continued thereon right up to the date of sale thereof on 8.2.2008 and the same has been accepted by the Income Tax Department while determining the assessee’s income and computing the taxes thereon. In fact no development activities have taken place on these lands even after six years after the date of sale and this was evident from the physical inspection undertaken by the Members of the Co-ordinate bench prior to the passing of the appellate order in the case of M.R.Seetharam (HUF). Considering the fact that the assessee’s lands are contiguous to the lands of M.R.Seetharam (HUF) and have the same physical properties, they are identical to the lands which formed the subject matter of the order in the case of M.R. Seetharam and therefore we are in no doubt that the order passed in the case of M.R. Seetharam (HUF) in ITA No.1654/Bang/2012 dt.13.6.2014 is applicable to the appeal in the case on hand.

9.1 We now proceed to examine and take up for consideration the issues and reasons cited / raised by revenue in written submissions dt.12.9.2014 as to why the order of the co-ordinate bench of this Tribunal in the case of M.R. Seetharam (HUF) is not to be applied to the case in hand:-

” 1. Various factual and legal aspects of the order delivered in case of M R Seetharam (ITA No.1654/Bang/2012) need to be deliberated upon once again, especially in the context of the above mentioned appeals and only after such deliberation the Ld. Bench may arrive at a conclusion in case of the above mentioned appeals.”

The above reason being general in nature no finding or adjudication is called for thereon.

” 2. The issues involved in the above mentioned appeals (viz. status of land-agricultural or non-agricultural, status of BIAPPA etc.) have huge revenue implications given the fact that the sale considerations are high due to the lands being located in the vicinity of the Bangalore Airport.”

Revenue must bear in mind the sacrosanct principle that the Tribunal should not concern itself with the possible implications on Revenue that the orders passed by it may have. The Tribunal is expected to pass orders which, in its opinion, are correct in law, based on facts and circumstances, irrespective of implications on the revenue or for that matter on the assessee’s case also.

” 3. Apart from the above mentioned assessees, many other assessees have sold lands in this area which is arguably one of the areas with very high commercial potential due to its location being near the Bangalore International Airport. Thus, the judgement in the above mentioned cases is going to affect taxation of many high value land transactions in this prime area of Bangalore.”

These issues do not and should not have any bearing on the Tribunal arriving at a decision which is in accordance with law.

” 4. Most importantly the judgment in the above mentioned cases would decide a very important question-“what is the definition of a converted land in the state of Karnataka.” ” The order of this Tribunal will confine itself to deciding the taxability or otherwise of the gains arising from the sale of the lands in question in accordance with the provisions contained in the Income Tax Act, 1961. If Revenue expects this Tribunal to decide the question framed in the above cited reason, then such expectation is either borne out of ignorance or mischievous in nature. If mischievous, then Revenue would be well advised to avoid such tongue-in-check arguments.

9.2 On careful consideration of the above four reasons cited by Revenue (supra), we are of the considered view that none of them survive as they are wholly extraneous in arriving at a decision in accordance with the provisions of law.

10.0 We now proceed to carefully consider the several other issues raised by Revenue and examine these in the light of the order passed by the co-ordinate bench of this Tribunal in. the case of M.R. Seetharam (HUF) (supra). On a careful reading of the above, we draw the following conclusions as regards the decision rendered in the order in the case of M.R. Seetharam (HUF): –

10.1: There is no dispute as regards the fact that the lands in question stood converted, as on the date of sale, in the records of the land revenue authorities of the State Government, as but for this fact, the sale of the lands in question to corporates could not have taken place in the State of Karnataka. Thus the fact that the lands sold are therefore non-agricultural as on the date of sale is also not in dispute.

10.2 The assessee admittedly obtained an order of conversion to put the land to use for non-agricultural purposes. One of the mandatory conditions stipulated in the conversion order was that the lands should be put to non-agricultural use before a period of two years from the date of the said order of conversion, failing which the permission granted would automatically lapse’ and stand cancelled. The assessee has taken this as one of the reasons to support the proposition that the land continued to be agricultural lands as the permission was not acted upon within the given time and that the lands in question continued to be used only for agricultural purposes. The co-ordinate bench of this Tribunal at para 7.2.6 of its order in the case of M.R. Seetharam (HUF) (supra), citing the mandatory condition in the conversion order, observed that –

“…. 10. The land should be used for the said purpose within two years from the date of this order [ Refer pages 8(‘ to 92 (including English transaction) of paper book of A.R.] ” only for the limited purpose of stating that the Assess* Officer is not correct in taking a stand that once the agricultural land is converted for nonagricultural purposes, the land cannot be treated as agricultural land even though it continues to be used only for agricultural purposes. The fact that the mandatory condition was not complied with by the assessee was not the reason by the co-ordinate bench of this Tribunal held that the lands sold are agricultural lands and not capital assets u/s. 2(14) of the Act.

10.3 The co-ordinate bench of this Tribunal has proceeded to hold that the lands sold are agricultural lands and not capital assets u/s.2( 14) of the Act on the basis of its findings rendered from paras 7.2.7 to 7.3.10 of its order in the case of M.R.Seetharam (HUF) (supra) and has come to the following important conclusions :-

(i) The lands in question do not cease to be agricultural lands merely because it stood converted in the records of the land revenue authorities of the state government.

(ii) The land continued to be agricultural land for the limited purpose of determining whether the same falls under the definition of capital asset under section 2(14) of the Act in view of the following facts :-

(a) The said land was put to use as agricultural land by the assessee right up to the date of sale and the assessee has also been declaring the agricultural income earned therefrom in the returns of income filed before the Department in this period;

(b) The assessee did nothing to change the physical character of land from agricultural to non-agricultural even after obtaining the permission to convert;

(c) The land continued to be agricultural land in actual physical condition even after a period of six years after its sale.

(d) The assessee obtained permission to convert the land merely to facilitate its sale to corporate entity as the sale would otherwise not been possible.

10.4.1 The co-ordinate bench of this Tribunal only after satisfying itself that the above facts were present in the case of M.R. Seetharam (HUF) (supra) held that the lands sold are agricultural lands and not capital assets under section 2(41) of the Act. In coming to this decision, the coordinate bench of this Tribunal placed reliance of these earlier decisions of different co-ordinate benches of the Bangalore Tribunal, in the following cases :-

(i) H.S. Vijaykumar V ACIT, Hassan ( ITA No.108/Bang/2009 dt.28.11.2006).

(ii) T. Suresh Gowda & Others (ITA Nos.1464 & 1465/Bang/2008; 177, 178, 262 & 305/Bang/2009 dt.30.12.2009).

The Tribunal also placed reliance on the decision of the Hon’ble jurisdictional High Court of Karnataka in the case of –

iii) CIT V. Smt. K. Leelavathy reported in (2012) 21 t’dxmann.com 148 (Kar) dt.2.1.2012.

10.4.2 In all the above three cited cases (supra) the facts are that the respective assessees sold their Agricultural lands, after getting the same converted for non-agricultural use, to persons who were not going to continue any agricultural activity. Further, in all the above three cases, the assessee’s therein :-

(i) continued to carry on agricultural activities on the land in question up to the date of sale;

(ii) did not act upon the conversion by carrying out any non-agricultural activity on the said lands; and

(iii) obtained the conversion order merely to facilitate sale to non-agriculturists.

In fact in the case of H.S. Vijaykumar (supra), the assessee therein sold the land to a corporate entity as in the case on hand. All the requirements which led the coordinate bench of this Tribunal to hold that the lands sold are agricultural lands and not capital assets under section 2(14) of the Act in the case of M.R. Seetharam (HUF) (supra) are also found in the case on hand before us.

10.4.3 The co-ordinate bench of this Tribunal in the case of M.R. Seetharam (HUF) (supra) has also placed reliance on the decision of the Hon’ble jurisdictional High Court of Karnataka in the case of CIT V Smt. K. Leelavathy (supra), ;which upheld the decision of the Tribunal in that case. The Hon’ble Court had occasion to analyse the provisions of section 2(14) r. w. sections 45 and 48 of the Act. The two questions of law which were raised by the Revenue in the case of Smt. K. Leelavathy (supra) were as under :-

“1: Whether the appellate authorities were correct in holding that the land which is the subject matter of sale is agricultural land as on the date of sale without taking into consideration the conversion of land to nonagricultural purpose and consequently recorded a perverse finding ?

2.Whether the appellate authorities were correct in holding that though the land is converted into nonagricultural, in view of the cultivation of the land till the date of sale, the land should be treated as agricultural land and the same is exempt from capital gains in view of section 2(14) read with sections 45 and 48 of the Act ? “

10.5The Hon’ble Court after considering the averments of both parties and the orders of the authorities below held as under :

“5. We find from the record that the Appellate Commissioner as well as the Tribunal followed an earlier ruling of the Tribunal rendered on December 30, 2009, in the case of T.Suresh Gowda [ITA NO.262/Bang/2009] wherein it appears, the question was resolved by looking into the date of permission for conversion as the cut-off line to decide as to whether the land was an agricultural land or otherwise.

6. It appears, the Tribunal had opined that the land retained its agricultural character till the date of order permitting non-agricultural use and, thereafter, it is not an agricultural land and, therefore, can be treated as capital asset.

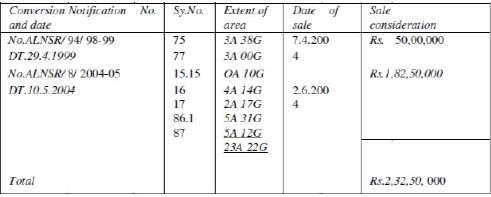

7. The Appellate Commissioner as well as the Tribunal has applied this norm and while they did hold that the sale transaction in respect of the following extent of land:

| Conversion Notification No. and date | Sy. No. |

Extent of area |

Date of sale |

Sale consideration |

| No.ALNSR/94/98-99 | 75 | 3A 38G | 7.4.2004 | Rs. |

| DT.29.4.1999 | 77 | 3A 00G | 50 00 00 | |

| No.ALNSR/8/2004-05 | 15.15 | OA 10G | 2.6.2004 | Rs.1,82,50,000 |

| DT.10.5.2004 | 16 | 4A 14G | ||

| 17 | 2A 17G | |||

| 86.1 | 5A 31G | |||

| 87 | 5A 12G | |||

| 23A 22G | ||||

| Total | Rs.2,32,50,000 |

In respect of the sale transaction dated June 2,2004, it was taken as a sale of capital asset as this sale was after the date of permission for non-agricultural use granted by the Asst. Commissioner, viz., after May 1072004, whereas the earlier sale transaction dated April 7, 2004, is held to be in respect of an agricultural land. We do not find the reasoning and the principle enunciated by the Tribunal for making a distinction as to whether the land was agricultural land or otherwise in the case of T. Suresh (supra) apply to the present case to be obnoxious or violating any statutory provisions and, therefore, we d not find any illegality in the finding recorded by the Appellate Commissioner and the Tribunal.”

The Hon’ble High Court has answered both the substantial questions before it (supra) in favour of the assessee and against Revenue. An analysis of the above two -substantial questions of law and the conclusion / finding of the Hon’ble High Court would, in our considered view, go to mean that land which was converted from agricultural to nonagricultural and continued to be used as agricultural land till the date of sale, should be treated as agricultural land and the same is exempt and not exigible to tax from capital gains in view of section 2(14) r. w. sections 45 and 48 of the Act despite the fact that the land in question was a converted land as on the date of sale. The co-ordinate bench of this Tribunal in its order in the case of M.R. Seetharam (HUF) (supra) has only followed this proposition- of law laid down by the Hon’ble jurisdictional High Court of Karnataka, vindicating the stand of the Tribunal in tire cases of H.S. Vijaykumar V ACIT, Hassan (supra), T. Suresh Gowda & Others (supra) and Smt. K. Leelavathy.

10.6 It is important to take note of the fact that the decisions rendered by the various co-ordinate benches of this Tribunal in the cases of H.S. Vijayshankar (supra), T. Suresh Gowda & Others (supra) and M.R. Seetharam (HUF) (supra) and that of the Hon’ble jurisdictional High Court in the case of Smt. K. Leelavathy (supra) is only for the limited purpose of determining whether a land is agricultural land or a capital asset u/s.2 (14) of the Act wend not to determine the definition of converted land in the state of Karnataka and other issues pertaining to the status of land as sought for by the Revenue in its written submisSions. We also find that the decision in the case of Madhav Bhandhopanth Kulkarni 2003(5 Kar. L 113, relied on b; Revenue, is not germane to decide the issue before us.

10.7 In the order of the co-ordinate bench in the case of M.R. Seetharam (HUF) (supra), the co-ordinate bench of this Tribunal at paras 7.343 to 7.3.10 of its order has also found merit in the arguments put forth by the learned Authorised Representative therein that owing to the peculiar features of the law prevailing in the state, an agriculturist in the state of Karnataka has to necessarily get his agricultural land converted if he has to sell the same to a non-agriculturist and hence is placed at a disadvantage as compared to an agriculturist in Tamil Nadu, Andhra Pradesh, etc. who can directly sell their agricultural lands to non-agriculturists without getting the same converted. In this regard the co- ordinate bench of the Tribunal at paras 7.3.8 to 7.3.10 of its order has observed and held :-

” 7.3.8. Finally, the most important aspect which requires to be considered is that agriculture is a State subject and different States have different reforms (laws) as to who can purchase/own agricultural lands in the respective States. To illustrate further, in Karnataka, non-agriculturists and industrial companies are M.ohibited from purchasing of lands which are classifiedas ‘agricultural’ in the revenue records. If an agriculturist intends to sell his agricultural lands to a company/non-agriculturist for the use of non-agricultural purposes, he must possess a conversion order obtained from the revenue authorities to utilise the subject land for nonagricultural purposes. However, the same law/rule is not prevalent in the neighbouring States of Tamil Nadu, Andhra Pradesh or in Maharashtra, Delhi etc. In other words, the agriculturists of the’ said States are free to sell their lands as shown in the revenue records to non-agriculturists/Corporates without obtaining a conversion order.

7.3.9. Thus, it is evident from the fact that the agriculturists in other States can sell their agricultural lands without getting the same converted whereas the agriculturists in Karnataka cannot do so due to the Land Reforms Act prevailing in the State. As such an agriculturist in Karnataka is on a different footing from his counterparts in other States. If one were to conclude that since the present assessee had obtained a conversion order to enable it to sell its lands to a non-agriculturist (a Corporate), the subject land ceased to be a nonagricultural and, thus, become a Capital asset, though the subject land remains an agricultural land, the assessee then stands discriminated in the eyes of law vis-er-vis its counter-parts in other States. Had the State Reforms Act permitted the assessee to sell its agricultural &ands without conversion to a Corporate as in the case of other States (supra), the assessee would not then be required to get the land converted merely to facilitate its sale to a corporate and the gains arising from such sale would not have been exigible to Capital Gains tax which is the subject of a Central Act (Income-tax Act),In the instant case as mentioned earlier even after conversion, assessee was carrying on agricultural operation and conversion was done only to facilitate sale of subject property to a corporate entity/ non agriculturist. In substance, the Income-tax Act — a Central Act — is to be administered in such a manner to ensure that an assessee is not subjected to suffer due to different State laws.

7.3.10. Taking into account all the aspects as discussed in the fore-going paragraphs and also in conformity with the judicial pronouncements on the issue (supra), we are of the view that though the subject land was converted into nonagricultural purposes, cultivation of the land for agricultural purposes till the date of sale was continued unabated and as such, the land should have been treated as agricultural land and, thus, exempt from capital gains in view of s. 2 (14) of the Act. It is ordered accordingly.”

The extracted portion at paras 7.3.8 to 7.3.10 of the order in the case of M.R. Seetharam (HUF) (supra) indicates that the co-ordinate bench of this Tribunal came to the conclusion that mere conversion of land from agriculture to non-agriculture could not be taken as the sole criteria to hold it as a capital asset under section 2(74) of the Act and that if that land is used for agricultural purposes till the date of sale, despite the fact that it’ is converted to non-agricultural use are agricultural lands and not capital assets under section 2(14) of the Act.

Whether BIAPPA can be treated as a Municipality and consequently the issue falls within the purview of section 2( 14)(iii)(a) of the Act.

11. Another issue that requires to be addressed is whether BIAPPA is to be treated as a municipality as contemplated by the provisions of section 2(14) of the Act. The co-ordinate bench of this Tribunal in its order in the case of M.R. Seetharam (HUF) (supra), agreeing with the view taken by the Hon’ble High Court of Kerala in the case of CIT V Murali Lodge reported in (1992) 194 ITR 125 (Ker), has held that BIAPPA is not a Municipality, but a mere planning body. The relevant portion of its order at paras 8.3 to 8.3.5 is extracted hereunder:-

” 8.3. We have carefully considered the reasoning of the authorities below and also the divergent contentions of either of the party on the issue. Indeed, BIAAPA performs only planning and zoning functions, but, does not perform any other municipal functions as canvassed by the Revenue. Other major municipal/panchayat functions are required to be performed only by an elected body, namely, the respective municipality/panchayat within the ambit of the area covered by BIAAPA, but, not BIAAPA which is, admittedly, a mere planning authority. We are also differ with the interpretation of the CIT (A) that municipality need not necessarily be an elected body. In this ‘context, we refer to the Article 243P(e) of the Constitution of India which explicitly defines `Municipality’ means an Institution of self-Government constituted under Article 243Q and Article 243R requires that all the seats in a Municipality shall be filled by persons chosen by direct election from the territorial constituencies in the Municipal area and, thus, clear that a municipality has to necessarily be an elected body whereas BIAAPA was not an elected body, but, an appointed body and, therefore, BIAAPA does not qualify to be considered as a Municipality.

8.3.1. To strengthen the above view, it is appropriate to refer to the judgment of the Hon’ble Kerala High court in the case of CIT v. Murali Lodge reported in (1992) 194 ITR 125 (Ker). The issue before the Hon’ble Court was Whether the land in question situated within Guruvayur Township can be treated as a capital asset within the definition of section 2(14) of the I.T. Act? After having comprehensively, dealt with the issue of ‘Whether the local authority is a Municipality?’ as under: “(On page 127) ……………………………………………………………………… From the plain and unambiguous language employed in the section [2(14)(iii)(a)], it is clear that, if the agricultural land is situated outside the jurisdiction of a municipality then no tax on any profits or gains arising from the transfer of such land will be chargeable under the head ‘capital gains’. The question, therefore, is: Whether the agricultural land of the assessee sold in public auction can be said to be situated in an area which is comprised within the jurisdiction of a municipality. The case of the Revenue is that it is, because the Guruvayur Township is a municipality within the meaning of that word in the section. On the other hand, counsel for the assessee submits that the Guruvayur Township, though a local authority cannot be said to be a municipality and, therefore, the agricultural land in dispute cannot be said to be situated in an area which is comprised within the jurisdiction of a municipal*. The word ‘municipality’ used in the section considered in the light of the various expressions used in the brackets, namely, ‘whether known as a municipality, municipal corporation, notified area committee, town area committee, town committee, or by any other name’ must be held to take in its fold a township also, counsel for the Revenue submits. Of the various words included in the brackets, learned counsel for the Revenue laid emphasis on the words ‘by any other name’. These words, counsel argues, take colour from the preceding words, and, if that be the position, the Guruvayur Township also can be called a municipality. May be that the Guruvayur township can be called a local authority. But all local authorities cannot be called municipalities. Only those local authorities which have all the trappings of a municipality can be treated as a municipality within the meaning of the section. Therefore, to find a solution to the problematic dispute, we have to give a meaning to the word ‘municipality’ which stands undefined in the Act. Generally understood, ‘municipality’ means a legally incorporated or duly authorised association of inhabitants of a limited area for local governmental or other public purposes [Black’s Law dictionary]. The above definition more or less is reflected in the provisions contained in Chapter III of the Kerala Municipalities Act, 1960. The council constituted under section 7 with the assistance of the standing committee of the council, chairman, commissioner, etc., will administer the provisions of the Act. The council consists of such number of members as are prescribed. They are called councilors. They are elected by the residents of the area coming within the jurisdiction of the municipality. The chairman and vice-chairman of the municipality are elected by the members of the council. The commissioner is appointed by the Government in consultation with the council. It is the duty of the `Commissioner to carry into effect the resolutions of the council unless it be that the said resolution is suspended or cancelled by the Government. The municipality contemplated under section 2(14)(iii)(a) must be one which satisfied the above requirements. All the local authorities included in the brackets must satisfy the above requirements to be known as a ‘municipality’. The position, however, would have been different had the section contained a definition which takes in its fold the local authorities included • in the brackets, namely, municipal corporation notified area committee, town area committee, town committee or such other similar local authority’. In that event, the Guruvayur Township can be said to be a municipality. The plan language employed in the section, however, makes it clear that the intention of the Legislature is not to treat every local authority as a municipality; but, on the other hand, only those local authorities which have all the trappings of a municipality as stated above can be said to be municipalities within the meaning of the section.

The Guruvayur Township, constituted under the Guruvayur Township Act, considered in this backdrop, cannot be said to be a municipality. The Guruvayur Township is not an autonomous body like a municipality.

It is constituted by the Government by a Notification issued under the Guruvayur Township Act. To put it differently, the members of township committee are not elected representatives of the residents of the area. That ‘the Central Government also has understood the position thus is obvious from the draft notification dated February 8, 1991, published in the Gazette issued under section 2(14)(iii)(b) of the Income-tax Act

8.3.2. We have, with due regards, perused the judgment of the Hon’ble P & H High Court in the case of CIT v. Sint. Rani Tara Devi (supra) as relied on by the learned DR. The only issue before the Hon’ble Court was: Whether the land owned by the assessee which was acquired under the provisions of the Land Acquisition Act, was an agricultural land or a capital asset within the meaning of s. 2 (14) of the Act in order to determine the taxability of amount of compensation received by the assessee? After taking into account the relevant facts of the case, the Hon’ble Court was of the view that it was to be regarded as a capital asset within the meaning of s. 2 (14) of the Act for the following reasons:

“(i) that the acquired land was situated between the developed sectors of Panchkula on one side and on the other side, it was 1 KM from the district headquarters;

(ii) that the land was extensively developed area and nearer to colleges, hospitals, district headquarters etc.,

(iii) with regard to the assessee’s claim that in terms of s 2(14) an agricultural land was excluded from the capital asset, if it was not a land situated in an area which was comprised within the jurisdiction of municipality etc., it was held by the Court that Haryana Urban Development Authority was a local authority in terms of s. 3 of the Haryana Urban Development Authority Act, 1977 and, thus the local authority in terms of s. 3(31) of the General Clauses Act means a Municipality.Therefore, conversely, the expression ‘Municipality’ in s. 2 (14) of the Act would include a local authority; &

(iv) in view of the above, it was held the land, subject matter of acquisition, was a capital asset falling within the scope of clause (iii) of s. 2 (14).

8.3.3.In this connection, we would like to point out that the said land was situated between the developed sectors of Panchkula on one side and on the other-side it was within a radius of 1 KM from the District headquarters, colleges, hospitals etc., whereas in the present case, the subject property was surrounded by lush green agricultural lands. Therefore, we are of the view that the case law relied on by the Revenue is not directly applicable to the issue on hand.

8.3.4. Further, while deciding the issue against the assessee, the Hon’ble Court had distinguished the judgment of Hon’ble Kerala High Court in Murali Lodge’s case (supra) in an identical issue, with the following observations:

“29. With respect, we are unable to agree with the view expressed by the Kerala High Court in the aforesaid judgment. The expression ‘by any other name’ appearing in item (a) of clause (iii) of section 2(14) has to be read ejusdem generis with the earlier expressions i.e., municipal corporation, notified area committee, town area committee, town committee. The Court has also not considered the scope and ambit of section 3 (31) of the Generdl Clauses Act defining local authority.”

8.3.5. At this juncture, we would like to point out that there are two views on the issue, one in favour of the assessee as held by the Hon’ble Kerala High Court fin Murali Lodge’s case] and other against the assessee as ruled by the Hon’ble P & H High Court (supra). Apparently, there is no judgment rendered by the Hon’ble jurisdictional High Court on this issue. In the given circumstances, following the judgment of the Hon’ble Supreme Court in the case of CIT v. Vegetable Products Limited reported in 88 ITR 192 (SC), we hold that where two views are possible on an issue, the view in favour of the assessee has to prevail. Accordingly, in conformity with the judgment of the Hon’ble Kerala High Court in Murali Lodge’s case (supra) which is directly applicable to the present case, we hold that the authorities below were not justified in holding that the subject land could not be treated as agricultural lands and that the proceeds received from its sale was exigible to tax under the head `capital gains’. It is ordered accordingly.”

We are also in agreement with the view taken by the coordinate bench in the case of M.R. Seetharam (HUF) (supra) that BIAPPA is not a Municipality but a mere planning body.

12. With respect to the issue raised by the learned Departmental Representative on the acceptance of additional evidences filed in the case of M.R. Seetharam (HUF) (supra), it is clear from the records of that case that these evidences were not filed by the assessee, suo moto but were filed at the instance of the bench.

13. As regards the issue raised by the learned Departmental Representative with reference to the physical inspection of the lands in question by the Members of the co-ordinate bench, the inspection, carried out in the presence of the learned Departmental Representative of revenue and the learned Authorised Representative of the assessee, was done to satisfy themselves about the physical characteristics of the lands in question. On inspection thereof having been satisfied that no non-agricultural activity had taken place even after six years of its sale, the Members of the co-ordinate bench were convinced that the lands were agricultural in nature (i.e. having orchards, etc.) as on the date of sale. The presence or absence of the present owners at the time of the inspection, in our view, is immaterial in coming to a satisfaction about the physical characteristics of the land in question. It was apparent from the physical inspection that there were mango orchards and coconut groves with thousands of fruit/nut bearing trees and not “…. some fruit bearing trees” as mentioned by Revenue in its written submissions.

14. In the light of the above discussion of the facts and circumstances of the case at paras 2.1 to 13 of this order (supra), we are of the considered view that the conclu’sions reached by the co-ordinate bench of this ‘ Tribunal in the case of M.R. Seetharam (HUF) (supra) squarely applies to the facts of the case on hand. We, therefore, following the decisions of the co-ordinate benches of this Tribunal in the cases of H.S. Vijayakumar (supra), T. Suresh Gowda and Others (supra), M.R. Seetharam (HUF) (supra) and the Hon’ble Karnataka High Court in the case of Smt. K. Leelavathy (supra) hold as under :-

(i) The lands in question, which were sold in the case on hand, are agricultural lands and not capital assets under section 2(14) of the Act, and

(ii) BIAPPA is not a Municipality as contemplated in section 2 (14) of the Act. We, accordingly, direct the Assessing Officer to delete the addition made to the income of the assessee under the head ‘Capital Gains’ on sale of the said agricultural lands in question, in the order of assessment for Assessment Year 2008-09.

8. A similar issue came up for consideration before the coordinate bench of this tribunal in bunch of Wealth-tax cases in WTA No.16/B/2014 to 29/B/2014, wherein the ITAT under similar set of facts held that the impugned lands are not urban lands exigible for wealth tax. The relevant portion is reproduced below.

“Since the Tribunal, in the assessee’s own case in income tax proceedings with regard to the same subject matter, has taken the stand and held the land to be agricultural land and definition of capital asset in the Income-tax Act is similar to the definition of ‘urban land’ under wealth-tax Act, we respectfully follow the order of the coordinate bench of the Tribunal and hold the said land to be not urban land exigible to wealth — tax.’

9. Therefore, respectfully following the co-ordinate bench decisions in assessee own case in ITA.No. 262/B/20I3 and also coordinate bench decision in WTA. No. 16/B/2014 to 29/B/2014, we hold that the impugned lands are not urban lands within the meaning of section 2(ea) of the Wealth tax Act, 1957 and not exigible to wealth-tax. Accordingly, we set aside the CWT(A) order and delete the additions made by the assessing Officer.”

5. Further, similar issue came for consideration before this Tribunal in the case of Shri D. Dasappa Vs. Deputy Commissioner of Income-tax in ITA Nos.2222 & 2223/Bang/2016 dated 9.2.2022, wherein Tribunal held as under:-

“16. We have heard both the parties and perused the material on record. The assessee sold the agricultural land for Rs.1,95,00,000 by Sale Deed Sale Deed dated 16.7.2007 entered into between 1. Sri. T Prasanna Kumar Gowda (aka T. Prasanna Gowda) S/o. Sri. M Thimme Gowda 2. Smt. K Leelavathi W/o. Sri. M Thimme Gowda & 3. Sri. Dasappa, S/o. Late Sri. Singrigowda (The Vendors) and M/s. Goodlife Shelters Pvt Ltd., having its Registered Office at 25/6, AG 6 Brigade Majestic First Main, Gandhinagar, Bangalore-560009. The description of schedule of properties has already been extracted in the earlier part of this order.

17. According to the AO, it is clear from the description of schedule of properties that the lands are converted from agricultural to non agricultural residential purpose. Therefore the nature of the lands is non agricultural when the transfer took place. Further, as per section 80 of the Karnataka Land Reforms Act, 1964, the agricultural land cannot be transferred to a non agriculturist. Hence, in view of the above status of law in Karnataka an agricultural land can be transferred only to an agriculturist. The above mentioned lands were transferred to GSPL It means that the lands were transferred to a person who is other than agriculturist also because of the fact that the lands transferred were converted from agricultural to non agricultural residential purpose.

18. According to the AO, the above land was duly converted as non-agricultural land and sale of above land constitutes capital asset in terms of section 2(14) of the Act. Further the assessee placed following evidence with regard to agricultural income earned from the above property and also produced details of RTC which have been reproduced in the earlier part of this order.

19. Thus, the assessee made a plea that the said land was subject of cultivation from AY 2006-07 to 201213. However, the AO disputed that the income disclosed by the assessee as agricultural income is derived from the land sold by the assessee situated at Manchanayakanahalli and on the other hand, the land sold by the assessee was situated at Devarakaggalahalli. No bills and vouchers for carrying out the agricultural activities. The land was sold to GSPL for the purpose of housing project. was urban land and on transfer liable for capital gains tax. The plea of the assessee that though the said land was converted into non-agricultural land, the cultivation of land continued till date and income disclosed from the said land was outrightly rejected by the AO on the ground that the income disclosed by the assessee was situated at Manchanayakanahalli whereas the land sold was situated at Devarakaggalahalli. In our opinion, the AO cannot reject the claim of assessee without due verification. The land was converted by the assessee to sell it to a corporate entity so as to get better price and conversion is only to facilitate the sale and gains arising from such sale could not have been liable for capital gain.

20. It is not in dispute that the assessee has been owning the said land since long period and all the surrounding lands were also subject to agricultural activities and the said land was not put any nonagricultural purpose within the period of two years from the date of conversion order, the conversion itself becomes questionable. In fact, the land which was hitherto agricultural land does not automatically become a capital asset on the mere fact of conversion to non-agricultural purpose. The land even though converted for nonagricultural purpose continues to be agricultural land and does not become capital asset u/s. 2(14) if agricultural activities are being carried out on such land and no piece of land was used for non-agricultural purpose.

21. In the present case, even though the subject property was converted into non-agricultural land by the competent authority, the assessee continued agricultural operations in converted land and there was no evidence regarding non-agricultural activities brought on record by the AO. On the other hand, the assessee has filed copies of RTC which were obtained much after the date of sale of the land which shows that the crops Ragi and Paddy were cultivated in the said land. In such circumstances, it is not possible to hold that the land was non-agricultural land liable for capital gains tax. In other words, the AO unilaterally decided that the land was not subject matter of agricultural operations without any basis. Had he brought any material to suggest that the said land was not subject to agricultural operations by brining on record evidence to suggest that land was not used for agricultural purposes, then our decision would have been different. In our opinion, similar issue came for consideration before this Tribunal in ITA No.1169 to 1172/Bang/2015, order dated 27.5.2016 in the case of Shri M.R. Anandaram (HUF) & Ors. wherein it was held as under:-

“9. But in the instant case, the issue in dispute is with regard to chargeability of the capital gain on the impugned transaction. Our attention was drawn to the order of the Tribunal in the connected cases i.e., Shri M.R. Seetharam v. ACIT in ITA No.1654/Bang/2012 dated 13.6.2014, in which the Tribunal has held that the agricultural land was transferred to buyer and the issue was raised, whether capital gain has accrued on such transactions. The Tribunal has held that though the subject land was converted into non-agricultural land purpose, but cultivation of land continued till the date of sale. Thus, the land should have been treated as agricultural land and exempt from capital gains in view of section 2(14) of the Act. While holding so, the Tribunal has also observed that had the State Reforms Act permitted the assessee to sell its agricultural lands without conversion to a corporate as in the case of other States, the assessee would not then be required to get the land converted merely to facilitate its sale to a corporate and the gains arising from such sale could not have been exigible to capital gains tax which is the subject of a Central Act. The Tribunal has also observed in that case that, even after conversion the assessee was carrying on agricultural operation and conversion was done only to facilitate sale of subject property to a corporate entity/non-agriculturist. The relevant observations of the Tribunal rendered in that case are extracted hereunder for the sake of reference:-

7.2. We have carefully considered the rival submissions, perused the relevant materials on record and also the various judgments of judiciary on a similar issue relied on by either of the party. The assessee-HUF had sold lands situated at Akklenahalli and Mallennahalli villages of Devanahalli Taluk to an extent of 6 acres and 1 gunta for a total consideration of Rs.45,58,12,500/- vide a registered Sale Deed dated 12.4.2007 and, accordingly, admitted an income of Rs.14,17,87,795/- as Capital Gains from the above transaction in its original return of Income furnished to the Department. Subsequently, in its revised return of Income dated 15.6.2009, the assessee had admitted income of Rs.22,90,570/-, on the ground that the capital gains which arose on the sale of the said lands was wrongly offered in the original return in as much as the same was exempt from tax being agricultural lands and hence excluded from the definition of ‘capital asset’ as per the provisions of s. 2 (14)(iii) of the Act.

7.2.1. The prime issues for consideration before us are two-fold, namely:

(i) Whether the land can be treated as agricultural land even after conversion of agricultural land for non-agricultural/residential purpose?

(ii) Whether the authorities below were justified in treating ‘BIAAPA’ as a municipality?

7.2.2. Before analysing the arguments of the assessee on the issue, we shall now proceed to deal with the sequence of events which apparently took place, chronologically, as under:

7.2.3. The assessee had in its possession certain acres of agricultural lands, out of which, lands to the extent of 6 acres and 1 gunta situated at Akkalenally and Mallenahally converted as non- agricultural vide Conversion order No.ALN(D) SR 30/2004-05 dated 19.7.2004 [source: Page 88 to 92 of PB AR] were sold to M/ s. ETL Corporate Services Private Limited for a sum of Rs.45.58 crores. The subject property was a part of around 600 acres of lands known as ‘Gokula Farm’ which was originally purchased by Late Sri M.S.Ramaiah, the father of Sri M.R. Seetharam – HUF – way back in 1951 [Source: Page 6 of Sale Deed dt.12.4.2007]. The same has been jointly cultivated by the family, comprising of 10 children of Late M.S.Ramaiah. These lands were, subsequently, partioned in 1970 and after the death of Sri M.S. Ramaiah, the lands were further portioned [Refer: Para 3.2. of the Asst. order]. Even though, the subject property, among others, was converted as non-agricultural lands way back in 2004, agricultural activities, deriving agricultural income from the said lands, were continued unabatedly by the assessee and incomes admitted by it from such operations were accepted by the revenue from the AYs 2004-05 to 2009-10, the details of which are as under:

| Asst. year | Agrl. Income [in Rs.] |

| 2004-05 | 22,00,000 |

| 2005-06 | 22,00,000 |

| 2006-07 | 16,50,000 |

| 2007-08 | 16,50,000 |

| 2008-09 | 16,50,000 |

| 2009-10 | 16,50,000 |

7.2.4. Though the said land was converted into nonagricultural purposes in the year 2004-05 and one of the mandatory conditions specified in the conversion order dated 19.7.2004 was that if the converted land was not used for the purpose for which it was converted within a period of two years from the date of conversion, the order of conversion stands cancelled. Apparently, the assessee had continued the agricultural operations in the converted lands also which is evident from the fact that incomes derived from such agricultural operations on the said lands declared by the assessee in its returns of Income were accepted by the revenue for the AYs 2004-05 to 2009-10 (supra). No evidence was brought on record by the Revenue to suggest that the subject lands were utilized for any other purposes other than that of cultivation after conversion. This is evident from the fact that the incomes derived from such lands duly declared by the assessee which were accepted by the revenue.

7.2.5. Incidentally, the subject property was inspected on 10-4-2014 by us accompanied by the learned DR, the AO and the learned AR of the assessee. During the course of inspection, we have noticed that the subject property was a part of large track of land having agricultural operations which consist of fully grown up fruits-yielding trees such as mangoes, sapota, coconut, jack-fruit, apple, guava etc., appear to be existing in the subject property even on the date of sale. This clearly attributes the assessee’s assertion that even on the date of transfer, the subject land was held to be agriculture. In this regard, we would like to refer to the Certificate of Senior Assistant Director of Horticulture (Zilla Panchayat) Devanahalli, Government of Karnataka, dated 23.4.2014 wherein it has been certified as under:

“This is to certify that M.R.Seetharam, s/o (of) Late M. S. Ramaiah residing at Gokula House, Dr M. S. Ramaiah Road, Gokula, Bangalore, have, in their land situated in Akkelenahalli – Mallenahalli Village, Kasaba Hobli, Devanahalli Taluk bearing Sy Nos. 29, 30/1, 30/2, 37/1p, 37/4p, 37/6p, 37/7p, 37/10p, 37/13p, 37/ 16p, fruit yielding mango, sapota, coconut, cashew, coco, jack-fruit, rose apple, guava trees aged 25 – 30 years.”

7.2.6. Ostensibly, neither the AO nor the CIT (A) had disputed the fact in clear terms that even after the conversion of the land for non- agricultural purposes, the assessee has been carrying on agricultural operations and also admitting incomes from such lands in its returns of income. The AO’s stand that once the agricultural lands were converted into non-agricultural, even though agricultural activities continued; the lands cannot be termed as agricultural land is, in our view, not the correct proposition of law. This is apparent from the fact that one of the mandatory conditions contained in the conversion order that “10. The land should be used for the said purpose within two years from the date of this order [Refer: Pages 88 to 92 (including English translation) of PB AR]”.

7.2.6. As a matter of perception, s. 2(14) defines ‘capital asset’. Capital asset does not include agricultural land. However, agricultural land situated within any municipality, notified area committee, town area committee, town committee will cease to be an agricultural land. Whether the subject land is agricultural or otherwise is essentially a question of fact. In coming to a definite conclusion, a number of tests will have to be undertaken as laid down by the Hon’ble Supreme Court in the case of Sarifabibi Mohamed Ibrahim v. CIT reported in 204 ITR 631 (SC). The tests prescribed by the Hon’ble Supreme Court as under:

(i) Whether the land was classified in the revenue records as agricultural and whether it was subject to the payment of land revenue?

(ii) Whether the land was actually or ordinarily used for agricultural purposes at or about the relevant time?

(iii) Whether such user of the land was for a long period or whether it was of a temporary character or by any stop gap arrangement?

(iv) Whether the income derived from the agricultural operations carried on in the land bore any rational proportion to the investment made in purchasing the land?

(v) Whether the permission under Land Revenue Code was obtained for the non-agricultural used of the land, if so, when and by whom [the vendor or the vendee]; whether such permission was in respect of the whole or a portion of the land; if the permission was in respect of a portion of the land and if it was obtained in the past, what was the nature of the user of the said portion of the land on the material date;

(vi) Whether the land, on the relevant date, had ceased to be put to agricultural use, if so, whether it was put to an alternative use; whether such ceaser and / or alterative user was of a permanent or temporary nature;

(vii) Whether the land, though entered in the revenue records, had never been actually used for agriculture, that is, it had never been ploughed or tilled; whether the owner meant or intended to use it for agricultural purposes?

(viii) Whether the land was situated in a developed area; whether its physical characteristics, surrounding situation and use of the lands in the adjoining area were such as would indicate that the land was agricultural?

(ix) Whether the land itself was developed by plotting and providing roads and other facilities;

(x) Whether there were any previous sales of portions of the land for non-agricultural use?

(xi) Whether permission under Tenancy and Agricultural Lands Act was obtained because the sale or intended sale was in favour of non-agriculturist, if so, whether the sale or intended sale to such non-agriculturist was for nonagricultural or agricultural user?

(xii) Whether the land was sold on yardage or on acreage basis? &

(xiii) Whether an agriculturist would purchase the land for agricultural purposes at the price at which the land was sold and whether the owner would have ever sold the land valuing it as a property yielding agricultural produce on the basis of its yield?”

7.2.7. In view of the norms prescribed by the Hon’ble Supreme Court in its judgment (supra), we are of the view that the facts making in the present case, the issue requires to be decided as to whether the subject land was an agriculture land. The land in question was inherited by the assessee (HUF), among others, as the same having been purchased by his father as an investment. As could

be seen from earlier documents of purchase which explicitly exhibit that the subject land had put to exclusive use for agricultural purposes only and in fact a grove [orchard] had been grown with fruits-yielding trees such as mangoes, sapota, coconuts, jack-fruits, etc., Incidentally, the surrounding lands were also subjected to agricultural activities as in the case of the property under dispute. Though the present assessee became the legitimate owner of the subject property on inheritance/in a partition/family arrangement as the case may be, the nature of the land use had not, however, undergone any change.

Whether the lands which were used as agricultural lands even after its conversion loose its character of agricultural lands?

7.3. The stand of the AO was that once the agricultural lands were converted into non-agricultural, even though agricultural activity continues, the lands cannot be considered as agricultural lands. Countering the AO’s assertion, the learned AR had argued that as per the mandatory conditions mentioned in the Certificate of conversion, if the subject land was not put to nonagricultural use within a period of two years from the date of conversion order, the conversion itself will become null and void. In this connection, the learned AR had placed strong reliance on the judgment of the Hon’ble Jurisdictional High Court in the case of CIT v. Smt. K.Leelavathy (supra).

7.3.1. It is a fact that the land which was hitherto agricultural land does not automatically become a capital asset upon a mere fact of its conversion to non-agricultural purpose. The land even though converted for nonagricultural purpose, continues to be agricultural land and does not become a capital asset u/s 2 (14) of the Act, if agricultural activities were being carried out on such a land as on the date of its sale despite a fact that the land stands converted for non-agricultural purpose.

7.3.2. In the present case, as already discussed, even though the subject property was converted for nonagricultural purpose vide Conversion Order dated 19.7.2004, the assessee continued the agricultural operations in the converted lands which was evident on our site visit and also from the fact that incomes derived from such agricultural operations on the said lands declared by the assessee in its returns of income which were accepted by the Revenue for the AYs 2004-05 to 2009-10.

7.3.3. At this juncture, we would like to refer to the findings of the earlier Bench of this Tribunal in the case of H.S.Vijaya Kumar v, ACIT, Hassan in ITA No.108/Bang/05 dated 28.11.2006. After taking into account the rival submissions of an almost identical issue to that of the present issue under dispute, the Tribunal has held as under:

“6.4. In this case also various conditions imposed by the Deputy Commissioner, Hassan were not fulfilled by the assessee prior to the sale of the said land. It is observed that permission has been accorded for residential purposes and whereas the sale has been made to Indian Oil Corporation for putting up a service station. This contradiction itself goes to show that the permission accorded does not militate against the land becoming nonagricultural land. The first appellate authority also went by the fact that the land was sold on yardage basis to Indian Oil Corporation. This single circumstance in our considered opinion does not change the character of the land for the reason that no layout plan was obtained, nor the land had been subject to any change in physical characteristics. A person can obtain higher amount by adopting a particular methodology of valuation and this by itself does not result in an asset becoming a capital asset. Non-payment of land revenue for a period of one month and 10 days from 8.2.99 to 20.3.99 cannot also be a circumstance which can be held against the assessee. This is too short period and it is not the case of the revenue that land revenue has (have) not consciously levied agricultural land tax. No adverse inference can be drawn. The ld. Counsel for the assessed tried to demonstrate that as per the Karnataka Land Revenue Act, 1964, section 83(2) read with sec. 95(2) mandates that the land holder should continue to pay the land revenue even after conversion. We need not go into this aspect for the reason that the period is too short a period and it is not a case where the revenue authorities have refused to levy land revenue by showing the reason. of conversion or for the reason that the assessee has refused to pay such land revenue. The AO has recorded a finding that the land revenue records to show that ragi and horse gram were grown on the said land. The reasons recorded by the assessing officer as well as the CIT (A), to our mind, are not relevant for coming to the conclusion as to whether a particular asset is a capital asset within the meaning of sec. 2 (14) of the Income-tax Act. The issue whether a particular land is agricultural land or not has been the subject matter of dispute in many a cases. In each of the judgments broad outlines have been given and it is suffice to say that the unanimous view of all the Hon’ble Courts is that the issue should be decided on the facts and circumstances of the case. As we find that the facts of the case clearly point out that the land in question continued to be agricultural land and was put to use as such, prior to sale to Indian Oil Corporation, despite the permission obtained from the concerned authorities, we accept the contention of the assessee and hold that agricultural land in question are not a capital asset and, thus, the levy of capital gains is bad in law.

6.5. Before parting, we feel that mere evidences of Government Notification or orders on a likely use of a particular land would not ipso facto affect or on the same day change the character of the land. For example, the Government has notified many areas for setting up of special economic zones or industrial parks or for infrastructural developments such as road ways and railways. After identifying particular areas, the Government notifies that a particular area would be used for non-agricultural purposes. It is thereafter only that the acquisition start and accordingly the land of farmers are acquired. It would be travesty of justice, if a view has to be taken that when once a Notification is given by the Government, the agricultural land becomes nonagricultural land i.e., even prior to the issue of acquisition notices. As long as there is no change in the physical characteristics of the land in question, we cannot be held that there is a conversion. “

7.3.4. The jurisdictional High Court in the case of CITG v. Smt K. Leelavathy reported in (2012) 21 taxmann.com 148 (Kar) dated 2.1.2012 had an occasion to analyse the provisions of s. 2 (14) read with sections 45 and 48 of the Act. Briefly, the substantial questions of law raised by the Revenue before the Hon’ble Court was that –

“1. Whether the appellate authorities were correct in holding that the land which is the subject-matter of sale is agricultural land as on the date of sale without taking into consideration the conversion of land to non-agricultural purpose and consequently recorded a perverse finding? &

2. Whether the appellate authorities were correct in holding that though the land is converted into nonagricultural, in view of the cultivation of the land till the date of sale, the land should be treated as agricultural land and the same is exempt from capital gains in view of section 2(14) read with sections 45 and 48 of the Act?”

7.3.5. After taking into account the submissions of the either of the party and also the perusal of the orders of the authorities below, the Hon’ble Court had held as under:

“5. We find from the record that the Appellate Commissioner as well as the Tribunal followed an earlier ruling of the Tribunal rendered on December 30, 2009, in the case of T. Suresh Gowda [ITA NO. 262/ Bang/ 2009] wherein it appears, the question was resolved by looking into the date of permission for conversion as the cut-off line to decide as to whether the land was an agricultural land or otherwise.

6. It appears, the Tribunal had opined that the land retained its agricultural character till the date of order permitting non- agricultural use and, thereafter, it is not an agricultural land and, therefore, can be treated as capital asset.

7. The Appellate Commissioner as well as the Tribunal has applied this norm and while they did hold that the sale transaction in respect of the following extent of land:

In respect of the sale transaction dated June 2,2004, it was taken as a sale of capital asset as this sale was after the date of permission for non-agricultural use granted by the Asst. Commissioner, viz., after May 10,2004, whereas the earlier sale transaction dated April 7, 2004, is held to be in respect of an agricultural land. We do not find the reasoning and the principle enunciated by the Tribunal for making a distinction as to whether the land was agricultural land or otherwise in the case of T. Suresh (supra) apply to the present case to be obnoxious or violating any statutory provisions and, therefore, we do not find any illegality in the finding recorded by the Appellate Commissioner and the Tribunal.” .

7.3.6. In the case of M. ThimmeGowda [(i) Sri M. ThimmeGowda, (ii) Sri M.N. Manjunath, (iii) Sri Dasappa, (iv) Sri T. Suresh Gowda, (v) Sri T. PrasannaGowda v. Department of Income-tax, the earlier Bench of this Tribunal, in its findings in ITA 1464, 1465/B/08; 177,178,262 & 305/B/09 dated 30.12.2009, had dealt with an identical issue to that of the present issue under consideration. The main issue before the earlier Bench was: Whether the land sold by the assessee was agricultural in nature or not? .After duly analysing the rival submissions and also various judgements of judiciary as mentioned in its findings and also deliberating upon the sections 80 and 84 of the Karnataka Land Reforms Act, 1961, the earlier Bench had recorded its findings as under:

“37

………………………………………………………………………………………………………. (On page 22) ………………………………………………………………………………….

Coming to the instant case of the assessee, it is not disputed that in the revenue records, the entry is not changed, it continues as agricultural land. According to the revenue, the intention and purpose of the sale is for the use of Tibetan Childrens’ Village for the setting up of educational institutions and other related purposes. According to the assessee, the land in his hands had retained the agricultural character till the date of sale, for the reason that the assessee was doing agricultural activity. We have hereinabove in para 34 mentioned that the department had estimated the agricultural income at Rs.53 lakhs for 2004-05 and estimated agricultural income of the group at Rs.56 lakhs. Therefore, it is difficult to come to the conclusion that in the hands of the assessee, the character of the land had changed. Merely because the original owners had made application to change the character of the land from agricultural to non- agricultural and certificate was issued to that effect. Even for the revenue, there is no case that the land has been used for the intended purpose.