Section 51 of the CGST/SGST Act 2017, Section 20 of the IGST Act, 2017, Section 21 of the UTGST Act, 2017 provide for Tax Deduction at Source( TDS) . GST Council in its 28th Meeting held on 21-07-2018 recommended the introduction of TDS From 01.10.2018.

Following would be the deductors of tax in GST under section 51 of the CGST Act, 2017 read with notification No. 33/2017-Central Tax dated 15.09.2017:

(a) a department or establishment of the Central Government or State Government; or

(b) local authority; or

(c) Governmental agencies; or

(d) an authority or a board or any other body,-

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government, with fifty-one per cent. or more participation by way of equity or control, to carry out any function; or

(e) a society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of1860);

The Details of situation where TDS is applicable or Not and the applicability is elaborated through Standard Operating Procedure published by CBEC.

Now w.e.f 01.10.2018 any eligible payment received from the above mentioned persons where contract price exceeding ` 2.50 Lakhs , [1% CGST & 1% SGST/UTGST ( In case of Intra State Supply of Goods / Services)] or [2% IGST ( In case of Inter State Supply of Goods / Services) ] TDS will be deducted.

After deduction all the above persons (i.e. Deductor) are required to file GSTR-7 before 10th of Succeeding month ,therefore, the GST TDS Deducted during October 2018 need to be paid & return to be filled before 10th of November 2018.

As far as Deductee is concerned, the deductee need to Accept/ Reject the TDS/TCS Credit on the GSTIN portal by filling TDS / TCS online.

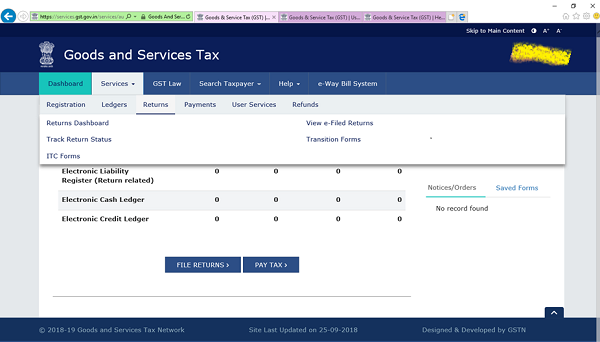

Therefore, for availing the GST TDS Deducted by the above eligible deductors , all the deductee need to follow file the TDS/TCS Credit Received which is elaborated below.

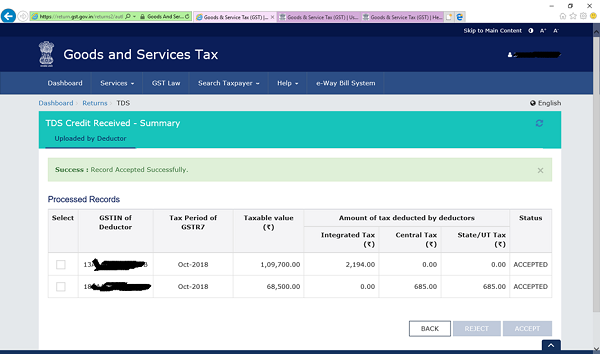

Please select the TDS which you want to accept , after selection then press Accept

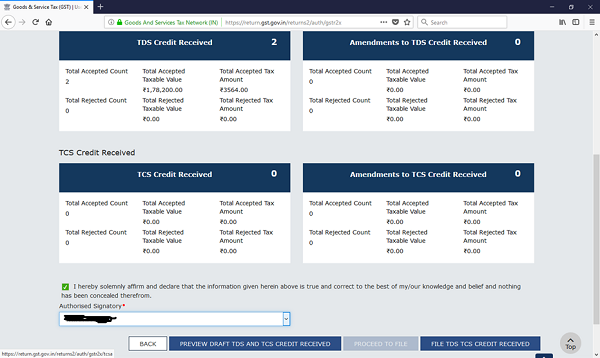

After acceptance the TDS Amount will be reflected under TDS Received , Then Press PROCEED TO FILE ,

After PROCEED TO FILE, proceed s for filling of TDS/TCS Received

The Amount Will appeared in CASH Ledger ,Which can be utilized for payment of balance amount for the reporting period.

(Author may be contacted at cadebasissahoo@gmail.com)

in gst server tcs credit . from 2021-22 can i cliam in fy 2022-23.

in gst server tcs credit . from 2018-19 & 2019-20

can i cliam in fy 2020-21.

Customer is deducting TDS on GST , how do I get the details against which invoice amount has been deducted.

Dear Sir,

Our Govt. customer wrongly upload other party GSTIN instead of our GSTIN in GSTR7 and also other party accept GST TDS.

Pl. advice how we short out.

Hello Sir,

we have Manpower contractor to govt Department. some dept already filing gst tds but some dept still not filed.can i take gst tds or when all dept filed after take.

Please explain

IN GST PORTAL – TDS CREDIT RECEIVED ACCEPTED BUT THAT AMOUNT NOT REFLECTED IN GST ELECTRONIC CASH LEDGER . HOW TO GET THAT AMOUNT

Dear Sir/Madam,

we are not getting GST TDS or TCS Credit tab in Return Dashboard. The GST TDS Credits are reflecting under our GSTR-2A and there is no option to Accept or Reject the credit amount. Hence, Credit was not utilised since Mar-2019. Please guide me for filing and claiming the same from Mar-2019.

Thanks in Advance.

Sir I Need help regards GST TDS Credit.

in the month of Jul 19 GSTR3B Return Due Date is 20th Aug 19 but Still our TDS GST Not Reflated in our portal . we asked about cencern auhority about the same they are not yet filling GSTR7 Return .

so question is that can we take the GST TDS Credit or the month of July 19 after filling the GSTR3B of July 19.

Pl help

In case a deductee accept late the tds return file by deductor. After accepting late can a deductor generate the gstr7a.

After filing a return gstr7 by deductor. A deductee accept the tds received late can a deductor generate the Gstr7A .we have try but we are unable to print is not in the portal.. What shall a deductor do

Dear Sir,

In GST TDS pl confirm, if we are deductor and deduct a TDS on GST and filled a GSTR7 and similarly if deductee not accept or reject the TDS/TCS credit or filled return. then in that case can we download the GSTR7A certificate or not. Because we are unable to take a print and not show in portal. pl confirm

7. In table 6.2 of GSTR-3B TDS credit received should be declared or we need to only utilize the input received in the portal.

1) How can I deducted gst tds if deductee is not register.

2) If deductee is not accepted tds how can I give him form no GST7A and if i did not give GST7A I am liable to pay late payment for not give GST7A to deductee .

Hi sir,

I have doubt in this, Is there any time limit to accept the TDS amount, If we receive TDS for Jan month till what time we can accept those TDS.

I am clearly understood Tq sir

Awsome sir,i’m clearly understood as well as my senior appreciate because Explain it

Sir,

What to do when TDS Credit is being reflected in GSTR2A but the same is not being reflected in GSTR7A for the purpose of accepting the TDS Credit.Please provide a solution so that I can accept the TDS Credit and claim that TDS amount.

Ashok Sharma Advocate

The process of downloading TDS Certificate is very cumbersome and unnecessary clicks and steps.

I have to file return for the month of October 2018 and in this month at least three persons have deducted TDS under GST and one person has filed the return whose credit is being reflected. Can I accept that TDS credit and file my return and for others, can I take credit in the month of November 2018) later on when they file the TDS Return or I have to wait for filing the return for the month of October 2018. I personally feel that I should take credit for the TDS certificate which are appearing and take credit of the remaining TDS in the following months when they appear. Please reply.

THANK YOU SIR FOR YOUR BRIEF EXPLANATION.

As per Rule TDS certificates to be downloaded by the deductor within 5 days of filing GSTR-7. Whether it can be downloaded before acceptance by the deductee. Further in our one case of deductor, when we go for downloading GSTR-7A from his portal ( Deductor) from menu user service> download certificates> TDS certificate, there is a requirement of ‘GSTIN of Deductor’, while it should be ‘ Deductee”. Kindly guide on the query.

Thanks

Dear Sir,

I have a small doubt where if any Government Party not filed the Return and others filed. In this situation can I file the Return of TDS and TCS

Then what is the purpose of showing TDS details in GSTR2A ? Further whether i have to show in GSTR3B under tds Section please clarify?

D/SIR

GST TDS credit ACCEPTANCE FUNCTIONING FACILITY NOT WORKING IN MY GST PORTAL PLS GUIDE .