The CBDT Vide its notification no 21/2022 dated 30/03/2022 has notified the Income-tax Return (ITR) Forms (‘New ITR Forms’) for the Assessment Year 2022-23 [Forms SAHAJ ITR-1, ITR-2, ITR-3, SUGAM ITR4, ITR-5, ITR-6, ITR-V and ITR- Ack] . There are many changes in the ITR forms which are consequential to the amendments made by the Finance Act 2021 and Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020.

This article tries to bring some key changes in ITR 1 to 6 for AY 2022-23 as compared to earlier ITRs

The Key changes are as follows :

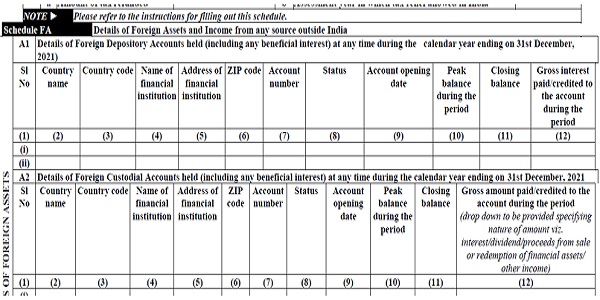

1. Schedule- FA( Foreign Asset) : From Accounting Year to Calendar year [ITR 2, 3, 5 & 6].

Background

Under ITR [2,3,5 & 6] a resident taxpayer to disclose his Foreign Assets in Schedule FA. The reporting requirement is mandatory only for a taxpayer who is a resident in India. Schedule FA is not required to be filed up by a taxpayer who is ‘not ordinarily resident’ or is a ‘non-resident’. Under this schedule disclosure of various foreign assets such as Foreign Depository Account, Immovable Property, trusts created outside India, etc., is required.

The requirement to disclose arises if the person had held them at any time during the ‘relevant accounting period. The ‘accounting period’ is not defined in the Act. However, the instructions issued by the CBDT for filing of ITR Forms had provided the meaning of the term.

Further , The CBDT has clarified that a taxpayer shall be required to report foreign assets only if such assets have been held at any time during the “previous year” (of India) as also during the ‘relevant accounting period’ (on the foreign tax jurisdiction).

For example, Mr. X has acquired share of Google LLC in January 2021 and sold it in February 2021. For the previous year 2021-22, the relevant accounting period will be 01-01-2021 to 31-12-2021. The transaction of purchase of Share falls in the relevant Accounting Period. Thus, Mr X is required to report such Foreign Asset in ITR though the same is not held in the previous year 2021-22.

New ITR Form

The new ITR Forms have replaced the expression “accounting period” with “calendar year ending as on 31st December 2021 meaning thereby the assessee shall furnish the details of all foreign assets held between 01-01-2021 and 31-12-2021 in return to be filed for the assessment year 2022-23. This change eradicates all scope of ambiguity on the reporting period

Example :

| Previous Year: | 01-04-2021 to 31-03-2022 | |

| Calendar Year: | 01-01-2021 to 31-12-2021 | |

| Date of purchase of shares of Amazon Inc USA. | Feb, 2021 | Feb, 2022 |

| Is the assessee required to furnish the details regarding the foreign assets acquired In AY 2022-23 ? | YES ( Note-1) | NO( Note-2) |

Note-1: The assessee is required to furnish the details of Amazon Inc share in ITR applicable for Assessment Year 2022-23 even if he has not held the foreign asset in the relevant previous year ( FY 21-22).

Note-2: The shares of Amazon were acquired within the previous year but after the end of the relevant calendar year. Thus, the assessee is not required to furnish the details of Amazon Inc share in ITR applicable for Assessment Year 2022-23. The disclosure requirement for such investment shall arise in the Assessment Year 2023-24 only.

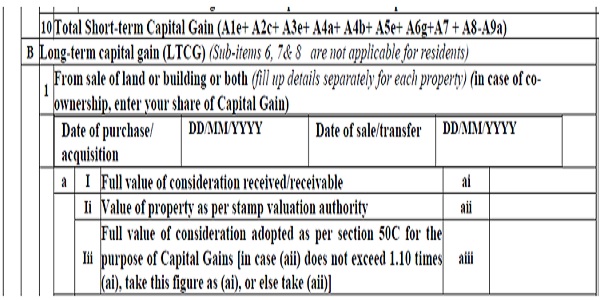

2. Schedule of Capital Gains : Additional disclosures [ITR 2, 3, 5 & 6]

2.1 : Date of purchase and sale of land/building.

If there is any income arising from the transfer of land or building is taxable under the head of ‘Capital Gains’. It will be mandatory to furnish the date of purchase and date of sale of such land or building in the ITR.

This additional disclosure would enable the taxman to verify the eligibility of the assessee to claim of exemption under Section 54, 54EC and 54F of the Income-tax Act, 1961 (‘the Act’).

2.2 : Disclosure of Fair Market Value (FMV) of capital assets and consideration received in a slump sale transaction:

As per amended provision of section 50B vide Finance Act 2021 in case of a slump sale, the Fair Market Value (FMV) of undertaking or division transferred shall be deemed as the full value of the consideration received or accruing as a result of the transfer of such capital asset.

CBDT vide its Notification NO 68 dated 24-05-2021 has inserted a new Rule 11UAE. It provides that the higher of the following on the date of slump sale shall be deemed as Full value of consideration:

- Fair Market Value of the capital assets transferred by way of slump sale; or

- Fair Market Value of the consideration received or accruing due to transfer by way of slump sale.

The new ITR forms require reporting of the FMVs calculated as per Rule 11UAE.

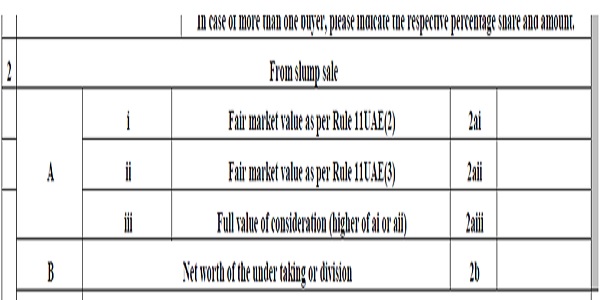

2.3 : Year-wise details of the cost of improvement to land/building:

It is required to give year-wise details of the cost of improvement (if any) incurred on the land/building transferred during the relevant year. The new ITR forms ask for the following additional details from the taxpayers:

a) Cost of improvement;

b) Year of improvement; and

c) Cost of improvement with indexation.

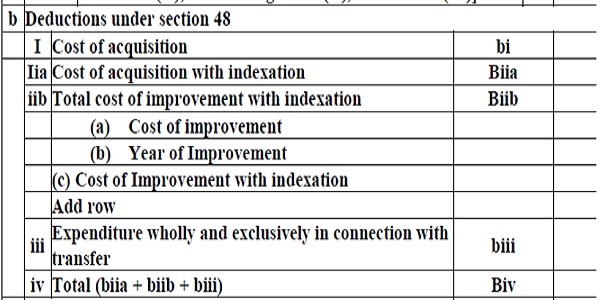

2.4: Separate disclosure of cost of acquisition and indexed cost of acquisition:

Earlier the assessee was required to disclose only the indexed cost of acquisition of property transferred. Now as per new ITR Forms assesse required to mention both the ‘cost of acquisition’ and the ‘indexed cost of acquisition’

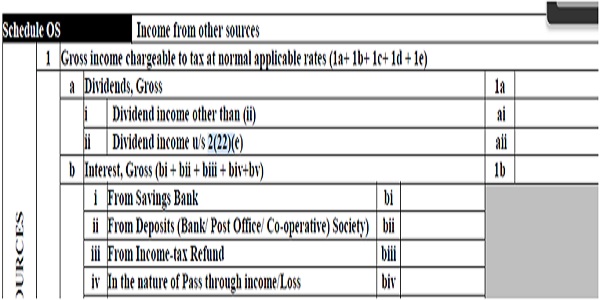

3. Schedule-OS (Other Sources).: Dividend income taxable as per section 2(22)(e) [ITR 2, 3, 5 & 6].

Background : Deemed Dividend U/s 2(22)(e):

As per Section 2 clause ( 22)( e) of Income tax act , Dividend includes ,any payment by way of loan or advance, by a closely held company, to a shareholder who is the beneficial owner of 10% or more equity capital of the company, or to a concern in which the shareholder has a substantial interest is deemed to be a dividend to the extent it is covered by the accumulated profits, excluding capitalised profits.

Until last year, there was no separate disclosure of dividend income taxable under Section 2(22)(e).

New ITR Form :

As per New ITR, separate disclosure is required for such type of dividend i.e. deemed Dividend U/s 2(22)( e) of Income Tax Act 1961.

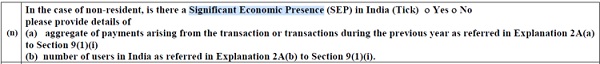

4. Disclosures in respect of Significant Economic Presence[ITR 3, 5 & 6] _ In case of only Non Resident.

Due to amendment in Finance Act 2020 i.e. w.e.f AY 01-04-2022, and as per Explanation 2A to Section 9(1)(i) , It provides that ‘Significant Economic Presence’ (SEP) of a non-resident in India shall constitute a business connection in India. For this purpose, ‘Significant Economic Presence’ shall mean:

a) Transaction in respect of any goods, services or property carried out by a non-resident with any person in India, including the provision of download of data or software in India if the aggregate of payments arising from such transaction or transactions during the previous year exceeds Rs. 2 crores; or

b) Systematic and continuous soliciting of business activities or engaging in interaction with 3 lakh users in India.

New ITR Form

In the new ITR forms, the non-resident has to confirm if there is a Significant Economic Presence (SEP) in India or not. If there is a SEP in India, the above-mentioned details of transactions and assesee have to be provided in the ITR Form.

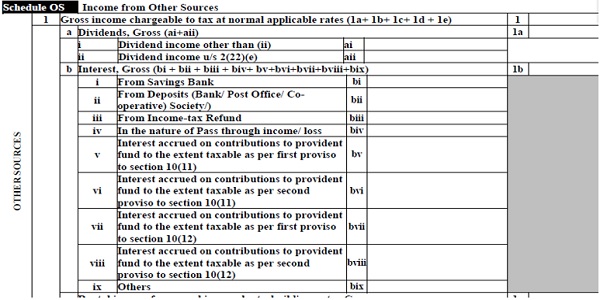

5. Schedule OS (Other Sources): Reporting of interest accrued on Provident Fund to which no exemption is available. [ITR 2 & 3]

Background

The Finance Act 2021 has amended Sections 10(11) and 10(12) to provide that no exemption shall be allowed in respect of interest income accrued during the previous year in the recognised and statutory provident fund to the extent it relates to the amount or the aggregate of amounts of the contribution made by the employee exceeding Rs. 2,50,000 in any previous year on or after 01-04-2021.

The interest income accruing in respect of the employee’s contribution over Rs. 2,50,000 shall be taxable under the head of “income from other sources”.

However, if such person has contributed to a fund in which there is no contribution by the employer, the limit of Rs. 2,50,000 shall be increased to Rs. 5,00,000. The method for the computation of such interest income has been prescribed in Rule 9D.

In This respect EPFO office issued one guideline/ clarification on dated 05/04/2022 , regarding manner of calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit.

New ITR Form

In the new ITR forms, the Schedule OS (Other Sources) has been amended to incorporate the reporting requirement of such interest income from PF Contribution.

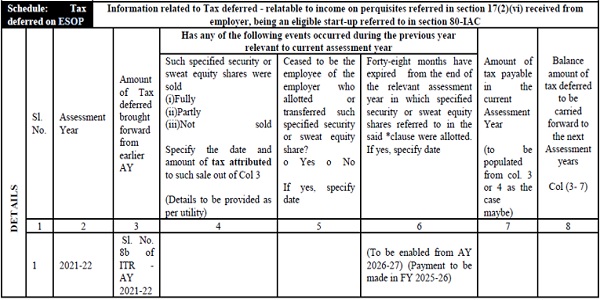

6. New Schedule: Tax deferred on ESOP: [ ITR 2 & 3]

Background : Section 17(2)(vi) & Section 192(1C)

An employee can defer the payment or deduction of tax in respect of shares allotted under ESOP (specified securities or sweat equity shares) by an eligible start-up referred under Section 80-IAC.

The tax is paid or deducted in respect of such ESOPs within 14 days from the earliest of the following period:

- After the expiry of 48 months from the end of assessment year relevant to the financial year in which ESOPs are allotted;

- From the date of sale of shares allotted under ESOP or

- From the date the assessee ceases to be an employee of the organisation.

In old ITR vide Sl No. 3b vide Part B of Schedule TTI (Computation of tax liability on total income) in ITR Forms of AY 2021-22 shows the disclosure of the tax amount deferred in this respect.

New ITR Form

The New ITR Forms have inserted a “Schedule: Tax Deferred on ESOP”. The Schedule seeks the following disclosures:

- Amount of tax deferred in ITR filed for AY 2021-22;

- Date of sale of specified securities and amount of tax attributable to such sale;

- Date on which he ceased to be an employee of the organisation;

- Amount of tax payable in current assessment year;

- Balance amount of tax deferred to be carried forward to next assessment years.

Since the maximum period of 48 months from the end of assessment year relevant to the financial year in which ESOPs are allotted is not yet over, the employee shall be liable to pay tax deferred in the assessment year 2021-22 in the previous year 2025-26.

The new Schedule has been inserted to keep track of the amount of tax deferred by the employee and the year it should be taxed.

The tax payable in the current assessment year is inserted in a new row introduced in Schedule Part B – TTI (Computation of tax liability on total income).

7. Schedule –TTI: Limiting the rate of surcharge on dividend income[ITR 2, 3 & 5]

Background

The Finance Act 2020 abolished the Dividend Distribution Tax(DDT) consequently shareholders or unit-holders are liable to pay tax on dividend income. As the dividend income is taxable in the hands of the investors, the Finance Act 2020 and Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 removed the enhanced surcharge on the dividend income.

Thus, in case of Individual, HUF, AOP, BOI, or AJP the surcharge on tax on dividend income shall be levied at the rate of 10% if it exceeds Rs. 50 lakh but does not exceed Rs. 1 crore and at the rate of 15% when it exceeds Rs. 1 crore.

New ITR Form

The consequential changes have been made in Schedule Part B – TTI (Computation of tax liability on total income) to limit the rate of surcharge on dividend income taxable under Section 115AD and other dividend income.

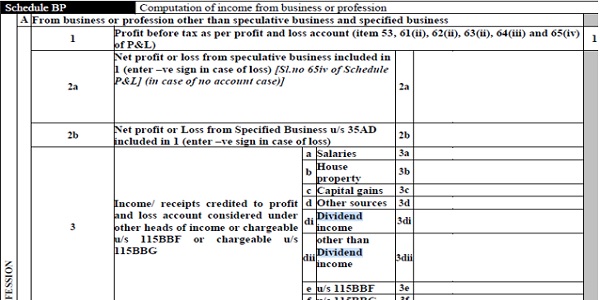

8. Schedule-BP: Exclusion of ‘Dividend income’. [ITR 3, 5 & 6]

Background

Schedule BP (Computation of income from business or profession) provides for the exclusion of certain incomes/receipts, which are credited to the profit and loss account but are taxable under other heads of income. This list includes income/receipt taxable under:

a) House Property

b) Capital Gains

c) Other Sources

d) Section 115BBF (income from patent)

e) Section 115BBG (income from transfer of carbon credits)

New ITR Form

The new ITR Forms specifically added “DIVIDEND” in the list to exclude it from the Schedule BP if it is credited to the Profit and Loss account.

This categorical exclusion of dividend income from Schedule BP is in line with Section 56(2)(i), which provides that the dividend income is taxable under the head of “income from other sources”.

9. Schedule- 80-IA & 80-IB : Changes due to sun set clause: [ITR 3, 5 & 6]

Background:

An assessee deriving profit from the eligible business can claim a deduction under Section 80-IA / Section 80-IB. There are specific sun set clauses are available in respect of each eligible business.

Due to the sun-set date, the deduction under this section is not available for certain businesses, like, telecommunication services, cross-country natural gas distribution network, multiplex theatres, convention centre, etc.

NEW ITR FORM:

Schedule 80-IA and 80-IB have been amended to remove the rows allowing deduction under the above obsolete provisions.

10. Part-A – OI : Other Information : Disclosure of interest paid to Deposit-taking NBFCs or Systemically Important Non-deposit Taking NBFCs ( U/s 43B).

Background

Section 43B specifies that certain expenditures are allowed as deduction only on actual payment, even if the assessee follows the mercantile system of accounting.

However, these expenditures are allowed as deduction in the year of accrual if the payment thereof is made either in the previous year itself or in the subsequent year on or before the due date specified for the filing of return of income.

Section 43B (da) was amended vide Finance act 2019 to includes any sum payable by the assessee as interest on any loan or advances from a Deposit-taking NBFCs or Systemically Important Non-deposit Taking NBFCs.

New ITR Form

The new ITR Forms have inserted a new row in Part A-OI “Other Information” requiring the assessee to disclose the amount of interest on any loan or advances from a Deposit-taking NBFCs or Systemically Important Non-deposit Taking NBFCs which was disallowed in the earlier year, but it is allowable during the previous year.

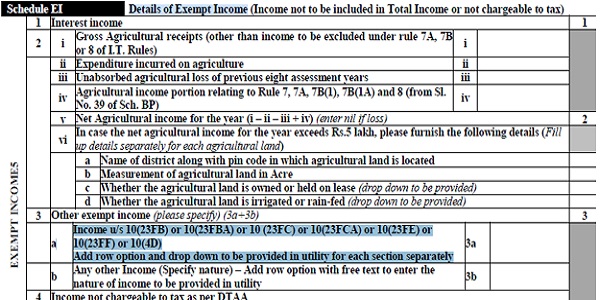

11. Schedule EI (Details of Exempt Income): Additional disclosure required of income exempt under certain clauses of Section [ ITR 5 &6 ]

The New ITR Form requires disclosure of the following income in Schedule EI (Details of Exempt Income):

a) Section 10(23FB): Exemption to Venture Capital Fund or Venture Capital Company

b) Section 10(23FBA): Exemption to Investment Fund

c) Section 10(23FC)/10(23FCA): Exemption to Business Trust

d) Section 10(23FE): Exemption to wholly owned subsidiary of ADIA or Sovereign wealth fund or pension fund

e) Section 10(23FF): Capital gains from transfer of shares of a company resident in India on account of relocation of offshore funds

f) Section 10(4D): Exemption to Specified Fund.

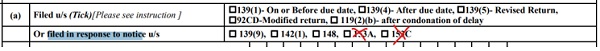

12. Withdrawal of Option U/s 153A & 153C [ ITR 1 TO 6]

Background:

Provision prior to 01-04-2021: Prior to amendment in Finance Act 2021, where the search is initiated under Section 132 or books of account, other documents, or any assets are requisitioned under Section 132A, an assessment was made in the case of the assessee, or any other person, under Sections 153A, and 153C.

The Finance Act, 2021 had introduced a sun-set clause and accordingly, the provisions of Section 153A/153C were made inapplicable from 01-04-2021.

Provision after 01-04-2021: Where the search is initiated or requisition is made on or after 01-04-2021, the assessments, reassessments or re-computation is made under Section 147, and the notice for the same is issued under Section 148.

Hence, the assessee shall now file his return in such cases in response to notice under section 148 in new ITR forms.

New ITR Form

The new ITR Forms remove the check-boxes of Sections 153A and 153C from the field of filing status of return income.

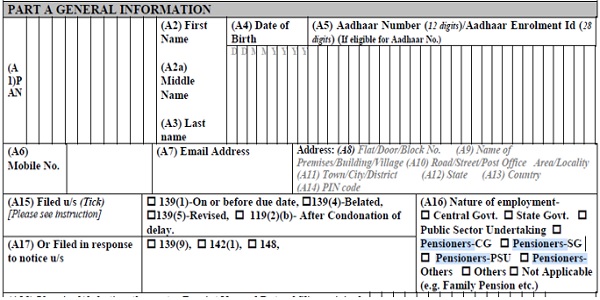

13. Part-A: general Information: Nature of employment for pensioners [ITR 1 & 4].

An individual receiving pension had to choose the option of ‘Pensioners’ in Part A general Information, Now ITR provide following option

1. Pensioners – CG,

2. Pensioners – SC,

3. Pensioners – PSU and

4. Pensioners – Others.

14. Part-A: GENERAL INFORMATION: Filling Status: Disclosure for alternative tax regime opted under Section 115BA/115BAA/115BAB [ ITR 6].

The following disclosures are required in ITR 6 in respect of the alternative tax regime of Section 115BA/115BAA/115BAB:

- Where the domestic company has opted for the alternative tax regime, it has to furnish the AY in which said option is exercised for the first time and the date of filing of the relevant form (10-IB/ 10-IC/ 10-ID) with acknowledgement number;

- Where the domestic company is choosing to opt for alternative tax regime this year, it has to furnish the date of filing of the relevant form (10-IB/ 10-IC/ 10-ID) with acknowledgement number.

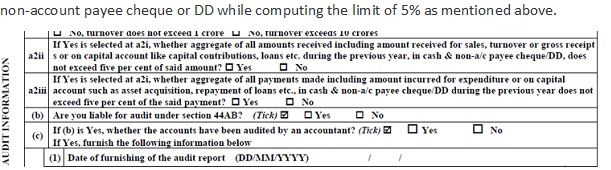

15: Part-A: Audit Information: Additional information sought from the assessee not opting for the presumptive tax scheme [ ITR 3,5 &6]

Background

The audit under Section 44AB is mandatory if the total sales, turnover or gross receipt from the business during the previous year exceeds Rs. 1 crore.

However, if the cash receipt and cash payment do not exceed 5%, the audit shall be mandatory if the turnover of the business assessee exceeds Rs. 10 crores during the financial year.

For the purpose of computing the limit of 5%, payment or receipt by cheque drawn on a bank or by a bank draft, which is not an account payee, shall be deemed to be the payment or receipt in cash only.

The previous ITR Forms did not consider the receipt or payment through non-account payee cheque or DD.

New ITR Form

The following additional disclosures are required regarding Audit Information:

- Whether total sales, turnover or gross receipt is between Rs. 1 crore and Rs. 10 crores. If not, is it below Rs. 1 crore or exceeds Rs. 10 crores?

- The new ITR forms require aggregation of receipts and payment in cash and non-account payee cheque or DD while computing the limit of 5% as mentioned above.

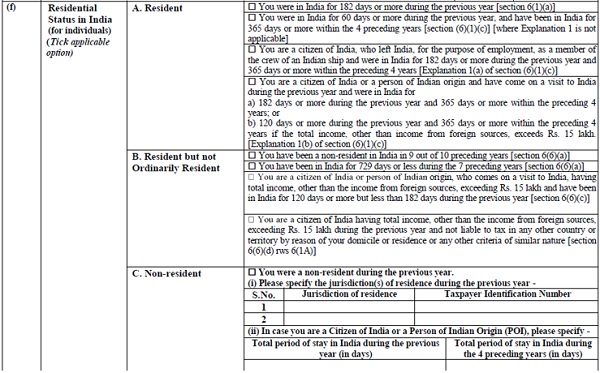

16. Part-A General: residential Status: More selection criteria provided to choose. [ ITR 2&3].

New ITR forms give a suitable description of different clauses due to which the residential status is determined

The assessee has to choose the relevant option in support of his selection of a residential status.

The following options are available for selection:

- Resident and Ordinarily Resident

- You were in India for 182 days or more during the previous year [Section 6(1)(a)];

- You were in India for 60 days or more during the previous year, and have been in India for 365 days or more within the 4 preceding years [section (6)(1)(c)] [where Explanation 1 to section 6 is not applicable];

- You are a citizen of India, who left India, for the purpose of employment, as a member of the crew of an Indian ship and were in India for 182 days or more during the previous year and 365 days or more within the preceding 4 years [Explanation 1(a) of section (6)(1)(c)];

- You are a citizen of India or a person of Indian origin and have come on a visit to India during the previous year and were in India for:

- 182 days or more during the previous year and 365 days or more within the preceding 4 years; or

- 120 days or more during the previous year and 365 days or more within the preceding 4 years if the total income, other than income from foreign sources, exceeds Rs. 15 lakh.

[Explanation 1(b) of section (6)(1)(c)]

- Resident but not Ordinarily Resident

- You have been a non-resident in India in 9 out of 10 preceding years [section 6(6)(a)];

- You have been in India for 729 days or less during the 7 preceding years [section 6(6)(a)];

- You are a citizen of India or person of Indian origin, who comes on a visit to India, having total income, other than the income from foreign sources, exceeding Rs. 15 lakh and have been in India for 120 days or more but less than 182 days during the previous year [section 6(6)(c)];

- You are a citizen of India having total income, other than the income from foreign sources, exceeding Rs. 15 lakh during the previous year and not liable to tax in any other country or territory by reason of your domicile or residence or any other criteria of similar nature [section 6(6)(d) read with section 6(1A)].

- Non-Resident

If individual declares that he is a non-resident in India during the previous year, he has to disclose the following information (same as in old ITR Forms):

- Jurisdiction(s) of residence during the previous year and Taxpayer Identification Number;

- If he is a Citizen of India or a Person of Indian Origin (POI), he has to specify:

- Total period of stay in India during the previous year (in days); and

- Total period of stay in India during the 4 preceding years (in days).

17. New Schedule IF: Information regarding investment in unincorporated entities [ ITR 6]

The new ITR Form 6 inserted a new Schedule IF (Information regarding investment in unincorporated entities) that requires the companies to disclose the following information in respect of the investment made in the unincorporated entity:

- Name of the entity;

- Type of the entity;

- PAN of the entity;

- Whether the entity is liable for the audit?;

- Whether section 92E is applicable to the entity?;

- Share in the profit of the entity;

- Amount of share in the profit; and

- Capital balance on 31stMarch in the entity.

Author SAYS: “2.4: Separate disclosure of cost of acquisition and indexed cost of acquisition: Earlier the assessee was required to disclose only the indexed cost of acquisition of property transferred. Now as per new ITR Forms assessee required to mention both the ‘cost of acquisition’ and the ‘indexed cost of acquisition’.”

Going by past experience, personally don’t believe that even had the Instructions been issued or have since been issued, no definite guidance would have been given/available as to how to fill-in the new FORM, as per, among others if any applicable, the above said changes in the tax return Form.

In my view, – rather firm conviction, – by necessary inference as warranted, – taxpayer in a given case, as expected of not wrongly, is obligated to decide and fill-in the Form on the strength of his own or consulting tax expert’s advice in this regard.

courtesy

The Instructions for preparing the tax Return forms have not been released till 21.7.2022 although the Return Form mentions these ‘Instructions’ at several places . The notified Forms are thus incomplete and invalid . Ca Sanjay Jain 9811589067

Problem in filing ITR 2 A.Y. 2022-23.

NO PLACE TO CLAIM EXEMPTION U/S 80TTB

IN ONE PLACE MENTION OF ONLY “SAVINGS BANK INTEREST WHEN TAB IS TURNICHD YES PROMPTING FOR SCHEDULE 80TTB TO FILL WHICH DID NOT FIND. PLEASE HELP.