Introduction

Financial technology (Fintech) is a term used to describe financial services which are predominantly technology driven or applying technology to improve financial services. With the revolution of internet and heavy penetration of smart phones, access to technology has become extremely affordable. This has further boosted the growth of financial technology which has grown explosively. In the initial days, technology was restricted to the back office of banks or trading firms, and merely for accounting and book-keeping. However, this perspective has totally changed in today’s era. The domain of “Fin-Tech” now has broad variety of technological interventions from personal to commercial finance.

Fintech now includes a variety of financial activities, powered by technology such as instant money transfers, QR code-based payments from Smart phones, bypassing a bank to apply for loans, raising money for a business start-up, or managing your investments, without the assistance of any person.

Page Contents

Definition of FinTech

Gartner defines “Fintechs” as startup technology providers that approach financial business in innovative (sometimes disruptive) ways through emerging technologies. Fintechs can fundamentally change the way in which a financial services institution’s products and services are created, are distributed and generate revenue. The term may also refer to the technologies these providers offer.

The Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system, divides fintech into five broad categories:

(i) payments, clearing and settlement;

(ii) deposits, lending and capital raising;

(iii) insurance;

(iv) investment management; and

(v) market support

Fintech has made most inroads in the area of payments and less in the others. One example is the e-payment system M-Pesa, which operates in Kenya, Tanzania and elsewhere, and is one of the biggest fintech success stories since its emergence just a decade ago. In India, Paytm was offered unique services through a mobile phone enabled digital wallet, through which one could transact, make fund transfers, obtain points and cash back etc.

Common drivers of FinTech innovation

Innovation in financial services is not a new phenomenon. Over the past few decades, innovations have included credit cards in the 1960s, debit cards and cash dispensing terminals such as automated teller machines (ATMs) and telephone banking in the 1970s and 1980s, and new financial products in the wake of deregulation of bond and capital markets in the 1990s. At the turn of the century, internet banking brought new benefits of branchless banking and the ability to conduct remote banking activities, which do not require face-to-face interaction between the customer and the banks. With the advent of cell or mobile devices, such technology again signalled the entrance of new participants such as mobile telephony, internet-based operators, and both hardware and software providers. With these changes came predictions that direct finance would replace costly and inefficient indirect finance and financial intermediation.

Digitization of Finance

Digital disruptions have heavily impacted a variety of habits and behaviors in the professional world. Technology combined with smartphones/ mobile devices and the internet provides numerous benefits to the customers as well as to financial establishments. With tighter regulations and changing customer demands, the financial applications and systems have become nimbler and progressive.

The following are few of the key components of digital transformation of Finance.

- High Standardization:

- Finance functions integrated with technology systems with standardized processes and data lead to a high standardization.

- Highly Automated functions:

- Adoption of new technology tools lead to higher process automation for services such as money remittance, KYC verification, etc.

- Insight-driven functions:

- Digitalization has modified financial models in such a way that the resources concentrate more on deriving insights rather than focusing only on transactions.

- Improved customer experience:

- Availability of data, strong analytics and lightweight payment interfaces improve customer experience.

- Better Service Delivery:

- The legacy systems integrated with new technologies have changed the financial operating model. The structured processes have improved service delivery.

Innovations which we are seeing in this space

Organizations are innovating and using technology in targeting, expanding services, re-configuring delivery channels, delivering proactive advice, integrating payments. Internationally, financial and tech giants are revolutionizing the financial services arena. Technology driven companies are entering the Finance space. Apple Card, G-Pay (by Google), Amazon Pay are few such examples.

On the other hand, FinTechs are already experimenting with new mobile applications and voice-enabled gadgets to enhance both delivery and contextual personalization. As technologies continue to evolve, the fintech sector will continue to accelerate its investments in innovation and digital enhancements. From KYC to online payments, from bank reconciliation to applying loans, Fintechs are trying best to integrate their transactions with that of business. Fintechs have also started adopting targeted customer policy based on lifestyles, values, aspirations, mind sets and underserved needs. Financial institutions are expected to go beyond personalization by segment, to develop individualized communication and experiences for the segment of one, thanks to the power of Big Data and Analytics. Data availability, openness and advanced analytics have enabled these digital innovations.

On the other end, application programming interface (API), which is a which is a software intermediary that allows two applications to talk to each other, are accelerating innovation and collaboration leading to expanded fintech ecosystems that could include more than just financial services to make a consumer’s lifestyle better. FinTechs are really emphasizing on providing best consumer value proposition.

Few other innovations which is driving this space are the evolution of Chatbots to connect customers, seamless transaction to kiosks and express branches, distributed ledger technology for digital currency, RPA-robotic process automation to provide automated and digital workforce to manage complex and repeated tasks, continue to disrupt financial services.

What is Industry 4.0?

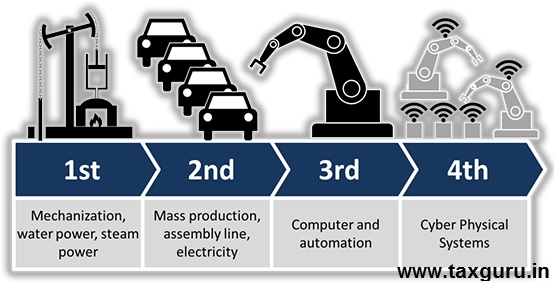

Industry 1.0 was made possible through water and steam powered systems. The industry eventually progressed to mass production and electrical systems in the 2nd Industrial Revolution. The 3rd Industrial Revolution saw the rise for computer integration and automation. The 4th Industrial Revolution (Industry 4.0) is the new phase in the Industrial Revolution that focuses heavily on interconnectivity, automation, machine learning, and real-time data. Machines and factories are now moving towards Cyber-Physical Systems or “Smart Factories”, which is due to this change. The Fourth Industrial Revolution represents a fundamental change in the way we live, work and relate to one another. These advances are merging the physical, digital and biological worlds in ways that create both huge promises. The speed, breadth and depth of this revolution is forcing us to rethink how organisations develop and create value.

A term coined by the German Government during their promotion of computerisation of manufacturing, Industry 4.0 concerns four principles:

Interoperability

the ability of machines to connect and communicate with each other via the Internet of Things (IoT) or the Internet of People (IoP).

Information Transparency:

the ability of information systems to create a virtual copy of the physical world by enriching digital plant models with sensor data.

Technical assistance:

first, the ability of assistance systems to support humans by making informed decisions and solving urgent problems on short notice. Second, the ability to physically support humans by conducting a range of tasks that are unpleasant or unsafe for their human co-workers

Decentralised decisions

the ability to make decisions on their own and to perform tasks as autonomously as possible.

Emerging Technologies

Emerging technologies and the industrial revolution 4.0 has changed the way day to day operations are run. It is necessary for finance professionals to understand these technologies and the impact on Finance These new ABCDs (Artificial Intelligence, Blockchain, cloud computing, cyber security, data analytics, Internet of Things, RPA etc) are discussed in brief below:

a. Artificial Intelligence

Artificial intelligence (AI) is an area of computer science that emphasizes the creation of intelligent machines that work and react like humans. Some of the activities computers with artificial intelligence are designed for include:

- Speech recognition

- Learning

- Planning

- Problem solving

In other words, it is Advanced computer systems that can simulate human capabilities or the task of getting computers and machines to do tasks that require intelligence when done by humans.

Examples in Finance include, Pattern Recognition in Banking, automated data entry, automated profiling and credit scorecard etc.

b. Blockchain

Block chain refers to the transparent, thrustless, and publicly accessible ledger that allows us to securely transfer the ownership of units of value using public key encryption and proof of work methods.

The technology uses decentralized consensus to maintain the network, which means it is not centrally controlled by a bank, corporation, or government. In fact, the larger the network grows and becomes increasingly decentralized, the more secure it becomes.

At its most basic level, blockchain is literally just a chain of blocks, but not in the traditional sense of those words. When we say the words “block” and “chain” in this context, we are actually talking about digital information (the “block”) stored in a public database (the “chain”).

Examples in Finance include, reduction in payments and reconciliation, KYC authentication, automated and real time clearing and settlement.

c. Cyber Security

Cyber security or information technology security are the techniques of protecting computers, networks, programs and data from unauthorized access or attacks that are aimed for exploitation.

Major areas covered are:

√ Application security encompasses measures or countermeasures that are taken during the development life cycle to protect applications from threats that can come through flaws in the application design, development, deployment, upgrade or maintenance.

√ Information Security – protects information from unauthorized access to avoid identity theft and to protect privacy. Major techniques used to cover this are: a) Identification, authentication & authorization of user, b) Cryptography.

√ Disaster recovery planning is a process that includes performing risk assessment, establishing priorities, developing recovery strategies in case of a disaster. Any business should have a concrete plan for disaster recovery to resume normal business operations as quickly as possible after a disaster.

√ Network security includes activities to protect the usability, reliability, integrity and safety of the network. Effective network security targets a variety of threats and stops them from entering or spreading on the network. Network security components include: a) Anti-virus and anti-spyware, b) Firewall, to block unauthorized access to your network, c) Intrusion prevention systems (IPS), to identify fast-spreading threats, such as zero-day or zero-hour attacks, and d) Virtual Private Networks (VPNs), to provide secure remote access.

d. Cloud Computing

“Cloud computing is a model for enabling ubiquitous, convenient, on-demand, network access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services) that can be rapidly provisioned and released with minimal management efforts or service provider interaction.”

Cloud Computing means the use of computing resources as a service through networks, like internet. It is the use of various services, such as software development platforms, servers, storage, and software, over the different networks, often referred to as the “cloud.” Ex: Google apps.

It is a combination of hardware and software computing resources delivered as a network service. The location of physical server and devices is not known to end user. Service customers of cloud computing use “what they need on internet” and “pay only for what they use”.

Examples in Finance include subscription-based apps such as Zoho Books, Quicbooks etc.

e. Data Analytics & Big Data

Data Analytics is defined as the science of examining raw and unprocessed data with the intention of drawing conclusions from the information thus derived. It involves a series of processes and techniques designed to take the initial data and having sanitized the data, removing any irregular or distorting elements and transforming it into a form appropriate for analysis so as to facilitate decision-making.

In simple terms, data analytics refers to the science of examining raw data with the purpose of drawing conclusions about that information.

From an accountant’s perspective Data Analytics is a generic term for Computer Assisted Audit Tools and Techniques (CAATTs) and covers the collection of tools, techniques and best practices to access and analyse digital data. Data Analytics empowers auditors to use technology to audit digital data thereby giving access to 100% of the data and to analyse data to infer insights from information. Data Analytics enables auditors to optimise audit time and add value.

Examples in Finance includes credit modelling, Fraud preventive planning, risk-based planning, market demand forecast, preparing market models etc.

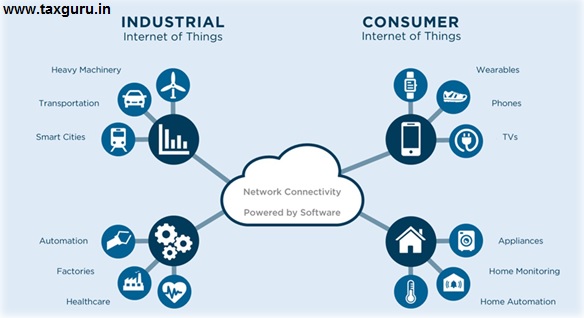

f. Internet of Things

The internet of things, or IoT, is a system of interrelated computing devices, mechanical and digital machines, objects, animals or people that are provided with unique identifiers (UIDs) and the ability to transfer data over a network without requiring human-to-human or human-to-computer interaction.

Examples in Finance includes, Inventory and Asset tracking, fraud prevention, optimising and tracking capacity management etc.

g. Robotic Process Automation

Robotic process automation is the term used for software tool that automates human activities that are manual, rule-based and repetitive. They work by replicating the actions of a human interacting with software applications to perform tasks such as data entry, process standard transactions.

It is a computer coded software, programs that perform repeated tasks based on rules defined, and can work across functions and applications.

Example: A process of reviewing the approved time sheet and raising the invoice in the ERP to the appropriate client and sending an email to the client and following up as a part of receivable management could be automated as the process is standardised and reasonably repetitive.

Examples in Finance include, automated repeated transactions or activities. robot driven accounting, auto reconciliation etc.

Pragmatic Assessment of Disruptive Potential in Financial Services

World Economic Forum and Deloitte Global’s latest report, Beyond Fintech: A pragmatic assessment of disruptive potential in financial services, studies the transformative role of fintech and other disruptive forces on the financial services industry as a whole, and seven sectors including payments, digital banking, lending, insurance, market infrastructure, investment management, and equity crowdfunding.

Three core takeaways highlighted by the study are the following:

1. Platforms Rising:

The rise of customer choice will have profound implications on the design and distribution of products and will likely force companies to shift roles. Platforms that offer the ability to engage with different financial institutions from a single channel may become the dominant model for the delivery of financial services. The rise of these platforms, such as open banking, will likely reshape financial services from clearly defined organizations to interchangeable entities. This may require that platform owners are capable ecosystem managers, balancing the needs of the product manufacturers with customer demand.

2. Financial Regionalization:

Differing regulatory priorities, technological capabilities, and customer needs are challenging the narrative of increasing financial globalization and making way for regional models of financial services suited to local conditions. Even global firms may need distinct strategies to cultivate regional competitive advantage and integrate with local ecosystems. Meanwhile, fintechs will likely face serious obstacles to establishing themselves in multiple jurisdictions, even as technology lowers barriers to entry. Incumbents may become attractive partners for fintechs seeking to enter new markets as they look for opportunities to rapidly acquire scale.

3. Systemically Important Techs:

Efforts by incumbent financial institutions to emulate the core capabilities of large technology firms will likely lead to an increasing reliance on those same large technology firms. For example, as financial institutions seek to enhance customers’ digital experiences and unlock data and revenues from customer platforms, they are increasingly dependent on large techs’ cloud-based infrastructure to scale and deploy processes and to harness Artificial Intelligence as a service.

Disruptive forces that have the potential to shift the competitive landscape of the financial ecosystem:

Cost commoditization:

Financial institutions are embracing new technologies to accelerate commoditization of cost drivers.

Profit redistribution:

The location of profit pools within and between value chains are shifting with new technologies.

Experience ownership:

Distributors will enjoy a position of strategic strength as owners of customer experience; manufacturers are expected to become hyper-scaled and hyper-focused.

Platforms rising:

Financial institutions are shifting to multiple-provider platforms as a channel to distribute and trade across geographies.

Data monetization:

Financial institutions are starting to use a combination of data strategies to follow the lead of tech firms in data monetization.

Bionic workforce:

New technologies such as Artificial Intelligence will mean major shifts to financial institutions’ workforces.

Systemically important techs:

Financial institutions of all sizes rely on large tech firms’ capabilities.

Financial regionalization:

Diverging regulatory priorities and customer needs is making way to tailored regional models of financial services.

Credits & Acknowledgment

- Introduction of FinTech from the University of Hong Kong

- FinTech by Harvard University

- World Economic Forum and Deloitte Global’s latest report

- Data Security council – Future of Banking

*****

About the Author : CA Narasimhan Elangovan, is a practicing Chartered Accountant and partner KEN & Co., Bengaluru, India. He is an International Speaker, Digital transformation catalyst, and an author. He believes in the power of technology to solve everyday problems. He can be reached at narasimhan@ken-co.in)

Disclaimer: The views and apps discussed in this article are only for information purposes and are the personal views of the author. The author does not have any interest in any of the applications discussed and neither endorses any application. Readers are advised to take caution before choosing any of the applications. This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. No part of this material shall be construed as a solicitation of services or an invitation of any sort whatsoever from KEN & Co or to create a professional relationship.