1. Introduction:

In an era where regulatory compliance and corporate transparency are paramount, the Ministry of Corporate Affairs (MCA) has introduced a significant procedural refinement: the Extract of Auditor’s Report (Standalone) as a linked webform under the MCA V3 portal. This new development, interlinked with Form AOC-4, is designed to streamline the submission of statutory audit findings and enhance the regulatory oversight of companies’ financial reporting.

As per the statutory mandate of Section 143(2) of the Companies Act, 2013, read with Rule 12 of the Companies (Accounts) Rules, 2014 and Rule 11 of the Companies (Audit and Auditors) Rules, 2014, every company is now required to submit an extract of the statutory auditor’s report. This extract is no longer merely a part of the Annual Report—it is now a mandatory digital submission, and its significance extends beyond procedural formality.

Let us explore this form, its legal grounding, step-by-step compliance process, and key updates introduced in the Instruction Kit issued by MCA.

2. Legal Framework and Applicability

| Legal Provision | Key Summary |

| Section 143(2) | Every auditor shall make a report to the members of the company on the accounts examined by him, and on every financial statement required by the Act. The report must state whether the accounts give a true and fair view. |

| Rule 12 of the Companies (Accounts) Rules, 2014 | Mandates the filing of financial statements, including consolidated and standalone accounts in Form AoC-4. |

| Rule 11 of the Companies (Audit and Auditors) Rules, 2014 | Requires disclosures in the auditor’s report related to pending litigation, provisioning, internal controls, and any fraud identified. |

3. Purpose of the Extract of Auditor’s Report (Standalone)

The webform Extract of Auditor’s Report (Standalone) aims to simplify and digitize the process of filing the statutory auditor’s comments separately as a linked form to AOC-4 or AOC-4 NBFC. This ensures:

– Granular visibility into the auditors’ remarks

– Standardized disclosures across companies

– Digitally authenticated submissions using DSCs

– Easier detection and analysis of audit qualifications by regulators

4. When and How to File

Once Form AOC-4 is submitted, the following sequence of linked forms must be followed:

i. AOC-4 CFS (if applicable)

ii. AOC-1

iii. AOC-2

iv. CSR-2

v. Extract of Auditor’s Report (Standalone)

vi. Extract of Auditor’s Report (Consolidated)

vii. Extract of Board’s Report

This linked form cannot be filed independently—it must follow the parent form’s successful submission.

5. Field-Level Instructions: Key Highlights from the MCA Instruction Kit

| Field | Instructions |

| Number of qualifications, reservation or adverse remark or disclaimer | Enter number (max 20); attach details if more |

| Type of remark | Options: Qualification, Reservation, Adverse, Disclaimer |

| Auditor’s comments | Mandatory if remarks > 0 |

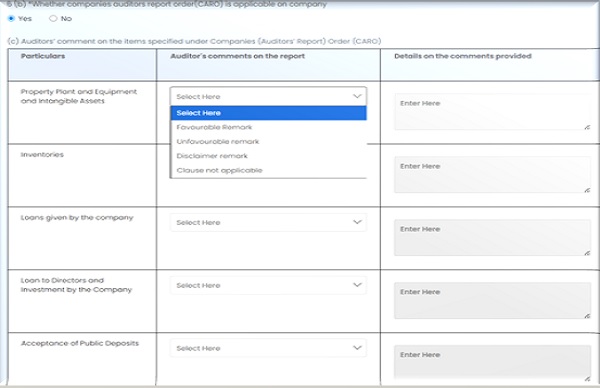

| CARO applicability | Mandatory Yes/No |

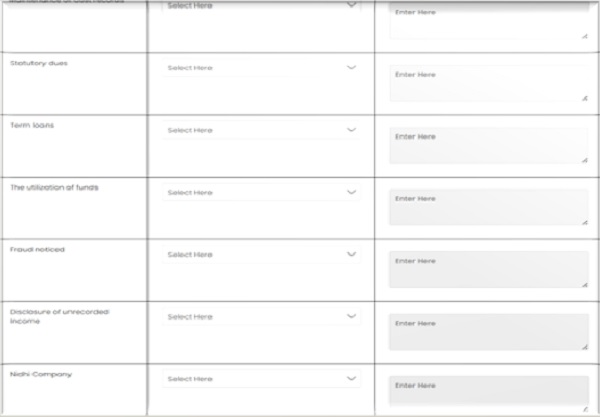

| Auditor’s comment under CARO | Options: Favorable, Unfavorable, Disclaimer, Clause not applicable |

| Details on the CARO remark | Mandatory for Unfavorable or Disclaimer |

| Optional Attachments | Up to 5 files, max 2MB each (PDF, Excel, JPG) |

| DSC Requirement | Valid DIN or PAN required for digital signatory |

6. Complete Format for Extract of Auditor’s Report (Standalone)

Below is the official tabular structure that companies must adopt while preparing the extract for filing:

| Clause No | Description |

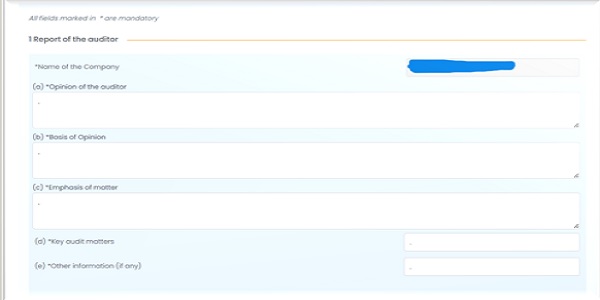

| 1 | Report of the auditor |

| 1(a) | Opinion of the auditor |

| 1(b) | Basis of Opinion |

| 1(c) | Emphasis of the matter |

| 1(d) | Key audit matters |

| 1(e) | *Other information (if any) |

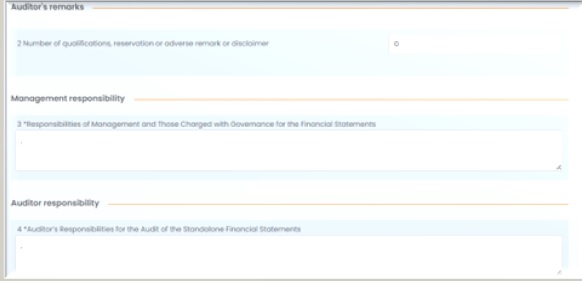

| 2 | Number of qualifications, reservations or adverse remarks |

| 3 | Responsibilities of Management and Those Charged with Governance for the Standalone Financial Statements |

| 4 | Auditor’s Responsibilities for the Audit of the Standalone Financial Statements |

| 5(a) | State other matters as per Rule 11 of the Companies (Audit and Auditors) Rules, 2014 |

| 5(b) | State any other matters, if any |

| 6(a) | Report on Other Legal and Regulatory Requirements |

| 6(b) | Whether the Companies Auditors Report Order (CARO) is applicable, and if so, the comments in the Auditor’s Report |

| 6(c) | Auditors’ comments on the items specified under section 197(16) |

| 6(d) | Reporting on the Internal Financial Controls |

Screenshots of the Extract of Auditor’s Report (Standalone)

i. Clause 1:

ii. Clause 2 to 4:

iii. Clause 5 & 6(a):

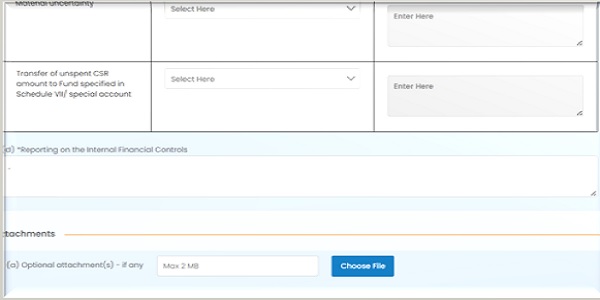

iv. Clause 6(b) & 6(c):

–

–

v. Clause 6(c) & 6(d):

7. Step-by-Step Filing Guide

i. Log in to the MCA V3 Portal using Business User credentials.

ii. Navigate to e-Filing > Annual Filing > AOC-4.

iii. Complete and submit Form AOC-4.

iv. On successful submission, proceed to the linked forms.

v. Click on “Extract of Auditor’s Report (Standalone)”.

vi. Fill in the following key sections:

√ Number of remarks (qualifications/adverse opinions).

√ Select the type of each remark (Qualification, Reservation, Adverse, Disclaimer).

√ Provide the auditor’s comment for each.

√ State whether CARO is applicable.

√ If yes, select the CARO remark type (Favourable, Unfavourable, Disclaimer, Not Applicable).

√ Provide details for Unfavourable/Disclaimer CARO remarks.

vii. Upload optional attachments (if needed).

viii. Ensure a valid DSC is used for signing.

ix. Click Submit.

8. Key Technical Points for Submission

√ Drafts can be saved using “Save”.

√ Use Application History to revisit saved drafts.

√ Character limit in text boxes: 5000 characters.

√ Processing Type: Governed by parent form (AOC-4).

√ Fee: No additional fee for this linked form.

9. Common Mistakes to Avoid

√ Entering zero remarks but leaving the CARO section enabled.

√ Using expired DSCs or mismatched PAN/DIN.

√ Uploading unsupported file formats.

√ Submitting without checking the signing authority rights.

10. Conclusion

The Extract of Auditor’s Report (Standalone) is a progressive step in India’s move towards real-time, traceable, and transparent compliance. It is more than a form—it’s a compliance checkpoint that ensures auditors’ insights are captured formally and directly.

For Company Secretaries, CFOs, and Auditors, understanding this process is now essential. Coordination between companies and their statutory auditors must be seamless and timely to avoid resubmissions or non-compliance.

By adhering to this system, companies not only comply with the Companies Act, 2013, but also demonstrate a higher standard of governance and transparency to their stakeholders.