NFRA’s investigations inter alia revealed that the TDL’s Auditors for the FY 2018-19, had failed to meet the relevant requirements of the Standards on Auditing (‘SA’ hereafter) in a number of significant aspects and demonstrated a serious lack of competence. They failed to evaluate their potential conflict of interest and failed to maintain their independence from TDL by having audit and non-audit relationships with a large number of Coffee Day Group companies and the promoters’ family members; made an attempt to deceive NFRA by adding more documents to as well as altering the documents in their Audit File which amounted to tampering with the Audit File. The Auditors also failed to exercise Professional Judgement & Skepticism and perform risk assessment procedures to identify, assess and respond to the Risk of Material Misstatements due to fraud in respect of (a) loan transactions of Rs 2614.35 crores with MACEL (b) land advance of Rs 275 crores given to Mrs Vasanthi Hegde (mother of the then chairman of CDEL), (c) land advance of Rs 200 crores given to another individual for lands inter alia owned by Mrs Vasanthi Hegde (which was reportedly repaid) and (d) land advance of Rs 140 crores given to another related party; failed to evaluate understatement of loan by Rs 474 crores fraudulently given to MACEL and evergreening of loans through structured circulation of funds among group companies; failed to evaluate loan of Rs 507.05 crores fraudulently given to Giri Vidhyuth (India) Limited (a subsidiary company); and failed to evaluate loan transactions of Rs 1743.42 crores fraudulently entered into with Tanglin Retail Reality Developments Private Limited (another subsidiary company). The Auditors failed to perform sufficient appropriate audit procedures in respect of recognition of interest income of Rs 75.58 crores from MACEL, without any contract/agreement with MACEL, which did not recognize this interest expense in its Financial Statements. Thus, the total material and pervasive misstatements amounted to Rs 1471.63 crores, despite which the Auditors falsely reported that the Financial Statements of TDL for the FY 2018-19 gave a true and fair view. They also falsely reported that TDL had effective Internal Financial Control over Financial Reporting despite the complete absence of the same.

Based on investigation and proceedings under section 132 (4) of the Companies Act and after giving them opportunity to present their case, NFRA found the Audit Firm and Engagement Partner, guilty of professional misconduct and imposes through this Order the following monetary penalties and sanctions with effect from a period of 30 days from issuance of this Order:

i. Imposition of a monetary penalty of Rs One crore upon M/s Sundaresha & Associates. In addition, M/s Sundaresha & Associates. is debarred for a period of two years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate;

ii. Imposition of a monetary penalty of Rs Five Lakhs upon CA C. Ramesh. In addition, CA C. Ramesh is debarred for a period of five years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate.

Government of India

National Financial Reporting Authority

*****

7th Floor, Hindustan Times House,

Kasturba Gandhi Marg, New Delhi

Order No. NF-23/14/2022 Dated: 26.04.2023

In the matter of M/s Sundaresha & Associates and CA C. Ramesh, under Section 132(4) of the Companies Act 2013.

1 This Order disposes of the Show Cause Notice (‘SCN’ hereafter) no. NF-23/14/2022 dated 10th November 2022, issued to Mis Sundaresha & Associates, Firm No: 008012S (‘Firm’ hereafter) and CA C. Ramesh, ICAI Membership no- 022268 (‘EP’, hereafter) (the Audit Firm and the EP are collectively called as ‘Auditors’ hereafter) who is a member of the Institute of Chartered Accountants oflndia (‘ICAI’ hereafter) for the statutory audit ofTanglin Developments Limited (‘TDL’ or ‘the company’ hereafter) for the Financial Year (‘FY’ hereafter) 2018-19.

2 This Order is divided into the following sections:

A. Executive Summary

B. Introduction & Background

C. Major lapses in the Audit

D. Other non-compliances with Laws and Standards

E. Omissions and commissions by the Audit Firm

F. Points of Law raised by the Auditors.

G. Articles of Charges of Professional Misconduct by the Auditors

H. Penalty & Sanctions

A. EXECUTIVE SUMMARY

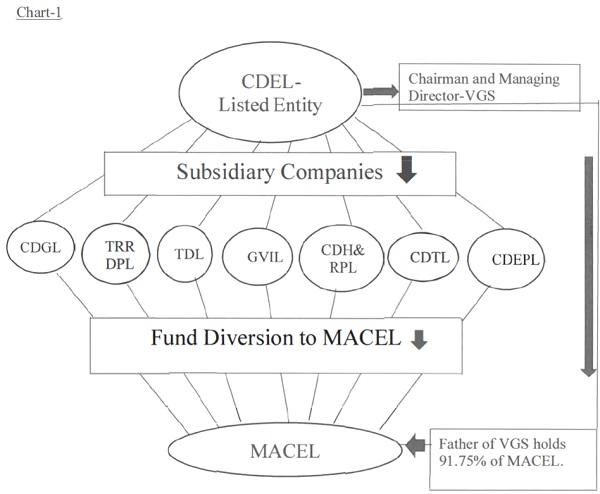

3 Pursuant to Securities and Exchange Board oflndia (‘SEBI’ hereafter) sharing in April 2022 its investigation regarding diversion of funds worth Rs 3,535 crores from seven subsidiary companies of Coffee Day Enterprises Limited (‘CDEL’ hereafter), a listed company, to Mysore Amalgamated Coffee Estate Limited (‘MACEL’ hereafter), an entity owned and controlled by the promoters of CDEL, NFRA initiated investigations into the professional conduct of the statutory auditors under Section 132(4) of the Companies Act 2013 (‘Act’ hereafter). Tanglin Developments Limited is a subsidiary company of CDEL.

4 NFRA’s investigations inter alia revealed that the TDL’s Auditors for the FY 2018-19, had failed to meet the relevant requirements of the Standards on Auditing (‘SA’ hereafter) in a number of significant aspects and demonstrated a serious lack of competence. They failed to evaluate their potential conflict of interest and failed to maintain their independence from TDL by having audit and non-audit relationships with a large number of Coffee Day Group companies and the promoters’ family members; made an attempt to deceive NFRA by adding more documents to as well as altering the documents in their Audit File which amounted to tampering with the Audit File. The Auditors also failed to exercise Professional Judgement & Skepticism and perform risk assessment procedures to identify, assess and respond to the Risk of Material Misstatements due to fraud in respect of (a) loan transactions of Rs 2614.35 crores with MACEL (b) land advance of Rs 275 crores given to Mrs Vasanthi Hegde (mother of the then chairman of CDEL), (c) land advance of Rs 200 crores given to another individual for lands inter alia owned by Mrs Vasanthi Hegde (which was reportedly repaid) and (d) land advance of Rs 140 crores given to another related party; failed to evaluate understatement of loan by Rs 474 crores fraudulently given to MACEL and evergreening of loans through structured circulation of funds among group companies; failed to evaluate loan of Rs 507.05 crores fraudulently given to Giri Vidhyuth (India) Limited (a subsidiary company); and failed to evaluate loan transactions of Rs 1743.42 crores fraudulently entered into with Tanglin Retail Reality Developments Private Limited (another subsidiary company). The Auditors failed to perform sufficient appropriate audit procedures in respect of recognition of interest income of Rs 75.58 crores from MACEL, without any contract/agreement with MACEL, which did not recognize this interest expense in its Financial Statements. Thus, the total material and pervasive misstatements amounted to Rs 1471.63 crores, despite which the Auditors falsely reported that the Financial Statements of TDL for the FY 2018-19 gave a true and fair view. They also falsely reported that TDL had effective Internal Financial Control over Financial Reporting despite the complete absence of the same.

5 Based on investigation and proceedings under section 132 (4) of the Companies Act and after giving them opportunity to present their case, NFRA found the Audit Firm and Engagement Partner, guilty of professional misconduct and imposes through this Order the following monetary penalties and sanctions with effect from a period of 30 days from issuance of this Order:

i. Imposition of a monetary penalty of Rs One crore upon M/s Sundaresha & Associates. In addition, M/s Sundaresha & Associates. is debarred for a period of two years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate;

ii. Imposition of a monetary penalty of Rs Five Lakhs upon CA C. Ramesh. In addition, CA C. Ramesh is debarred for a period of five years from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate.

B. INTRODUCTION & BACKGROUND

6 The National Financial Reporting Authority (‘NFRA’ hereafter) is a statutory authority set up under section 132 of the Companies Act 2013 (‘ Act’ hereafter) to monitor implementation and enforce compliance of the auditing and accounting standards and to oversee the quality of service of the professions associated with ensuring compliance with such standards. NFRA has the powers of a civil court and is empowered under section 132 ( 4) of the Act to investigate for the prescribed classes of companies 1 the professional or other misconduct of individual members or firms of Chartered Accountants acting as their statutory auditors and impose penalty for proven professional or other misconduct of such individual members or firms of Chartered Accountants.

7 The Statutory Auditors, individuals and firm of Chartered Accountants, are appointed by the members of companies as per provision of section 139 of the Act. The Statutory Auditors, including the Engagement Partners (‘EPs’ hereafter) and the Engagement Team that conduct the Audit are bound by the duties and responsibilities prescribed in the Act, the rules made thereunder, the Standards on Auditing (‘SA’ hereafter), including the Standards on Quality Control (‘SQC’ hereafter) and the Code of Ethics, the violation of which constitutes professional or other misconduct, and is punishable with penalty prescribed under section 132 (4) (c) of the Act.

8 On receipt of information from SEBI vide letters dated 01.04.2022 & 29.04.2022 sharing its investigation regarding diversion of funds worth Rs 3,535 crores (as on 31-07-2019) from seven subsidiary companies of Coffee Day Enterprises Limited, a listed company, to Mysore Amalgamated Coffee Estate Limited, an entity owned and controlled by the promoters of CDEL, NFRA started investigation into the role of the statutory auditors under its powers in terms of section 132 (4) of the Companies Act 2013.

9 Late V. G. Siddhartha (‘VGS’ hereafter) was Chairman & Managing Director of CDEL till 29.07.2019. VGS and his family reportedly owned around 10,000 acres of coffee estates through various entities owned by VGS and operated and managed by MACEL, whose 91.75% shares were held by Late S.V. Gangaiah Hegde, father ofVGS.

10 As per the investigations made by the SEBI, the outstanding balance payable by MACEL to subsidiary companies of CDEL was Rs 842 crores as on 31 March 2019, which had increased to Rs 3,535 crores on 31 July 2019, detailed as under in Table-I:

11 The linkage of the entities described in above table is depicted in the chart given below:

12 As per the Financial Statements (`FS’ hereafter) of MACEL, Rs 3,535 crore received from the subsidiaries of CDEL was further transferred from MACEL to the personal accounts of VGS, his relatives and entities controlled by him and/or his family members, whose outstanding balances payable to MACEL were Rs 3,238.95 crores as on 31.03.2019. On examination of FS of MACEL, it transpired that MACEL did not have any business transactions with the 6 of the 7 subsidiary companies except CDGL, and was used as a conduit to transfer funds from CDEL’s subsidiaries to the personal accounts of VGS, his relatives and entities controlled by him and/or his family members, as loans and advances that were never returned to MACEL/CDEL,

13 The modus operandi of the alleged diversion of funds discovered by the SEBI during its investigation was that “VGS used to ask the Authorized Signatories to sign a bunch of cheques which were kept in his possession and used them as and when required”. Such pre- signed blank cheques of bank accounts of various Coffee Day Group companies were used for the diversion of funds.

14 TDL is engaged in setting up a fully integrated Information Technology Park (“Industrial Park”) and campuses for software development at Bangalore and Mangalore. It had three subsidiaries viz., Giri Vidhyuth India Limited, Tanglin Retail Reality Developments Private Limited and Way2Wealth Securities Private Limited but prepared Separate Financial Statements opting not to prepare Consolidated Financial Statements in accordance with the exemption available as per para 4(a) ofIND AS 110 – ‘Consolidated Financial Statements’. TDL, a subsidiary of the listed entity CDEL, did not have any business relations with MACEL, a related party. VGS was the Chairman of CDEL. MACEL is a company owned (91.75%) by Late S.V. Gangaiah Hegde, father of VGS. Thus, these are related parties within the ambit of Ind AS 24. As per Rule 3 of NFRA Rules 2018, NFRA has powers to investigate Auditors of unlisted Public Companies having paid-up capital of not less than rupees five hundred crores or having annual turnover of not less than rupees one thousand crores or having, in aggregate, outstanding loans, debentures and deposits of not less than rupees five hundred crores as on the 31st March of immediately preceding financial year. TDL, an unlisted Public Company having borrowings/deposits of Rs 2,477.53 crores as on 31.03.2018, falls under the jurisdiction ofNFRA.

15 M/s Sundaresha & Associates was the statutory auditor of TDL for the Financial Year 2018-19 and CA C. Ramesh signed the Financial Statements of TDL and the Independent Auditor’s Report. NFRA called from the Statutory Auditor the Audit File ofTDL for Financial Year 201819 to examine the role of the Auditors and for investigation under section 132(4)(b)(i) of the Act. Based on the examination of the Audit File and other material on record, NFRA issued a Show Cause Notice (‘SCN’ hereafter) to the Auditors on 10.11.2022 asking them to show cause by 10.12.2022 why provisions of section 132(4)(c) of the Companies Act 2013 should not be invoked for professional misconduct of:

a) Failure to disclose a material fact known to them but not disclosed in a financial statement, and disclosure of which was necessary in making such financial statement where the statutory auditors are concerned with that financial statement in a professional capacity.

b) Failure to report a material misstatement known to them to appear in a financial statement with which the statutory auditors are concerned in a professional capacity.

c) Failure to exercise due diligence and being grossly negligent in the conduct of professional duties.

d) Failure to obtain sufficient information which is necessary for expression of an opinion or its exceptions are sufficiently material to negate the expression of an opinion, and

e) Failure to invite attention to any material departure from the generally accepted procedures of audit applicable to the circumstances.

16 The Auditors sought an extension of time of 45 days for submitting response to SCN, which was allowed. The Audit Firm vide letter dated 18.01.2023 submitted its reply to SCN. The EP vide letter 19.01.2023 submitted that the reply of the firm may be considered as his reply and that he was not giving separate reply.

17 In the interest of natural justice, the opportunity of personal hearing was also given to the Auditors on 17.03.2023 at 2:30 PM. However, the Firm and CA C. Ramesh vide letters dated 28.02.2023 withdrew their requests for personal hearing and further requested NFRA to decide the case based on their written submission. Accordingly, this Order is based on examination of the facts of the matter, charges in the SCN, written replies of the Auditors and other materials available on record.

General submissions by the Auditors

18 The Auditors have submitted that Standards on Auditing are not reference material to decide on charges of professional misconduct against an auditor and are a guidance to an auditor to act professionally while arriving at an opinion and have referred to para 5, A4 7 and A52 of SA 200. We find this argument strange. The legal mandate to adhere to the Standards is clearly laid down in section 143(9) &143(10) of the Act2• Section 143(9) of the Act provides that “every auditor shall comply with the auditing standard” (Emphasis supplied). The fundamental principles of SAs are contained in the Requirements section of the SAs and are represented by use of the word “shall”, indicating unequivocally their mandatory character. Further, ICAI in its Implementation Guide on Reporting Standards issued in Nov 2010 had opined in response to question no-12 relating to the auditor’s responsibility paragraph that “A key assertion that is made in this paragraph is that the audit was conducted in accordance with the Sas. SA 2003, which in a way is the ”parent standard” on auditing, prohibits the auditor from representing compliance with SAs in the auditor’s report unless the auditor has complied with the requirements of this SA and all other SAs relevant to the audit. This is a very broad and onerous assertion for an auditor to make. If during a subsequent review of the audit process, it is found that some of the audit procedures detailed in the SAs were not in fact complied with, it may tantamount to the auditor making a deliberately false declaration in his report and the consequences for the auditor could be very serious indeed”. In this case, the Auditor in its Independent Auditor’s Report dated 20.05.2019 has inter alia asserted that “We conducted our audit in accordance with the Standards on Auditing specified under section 143(10) of the Act”. Thus, there is no scope for deviation from the SAs and we reject the argument as baseless and unacceptable.

C. MAJOR LAPSES IN THE AUDIT

C.1 Acceptance of audit engagement disregarding Independence requirements

19 The Auditors were charged with non-compliance with requirements relating to independence of auditor as per SQC 1, SA 200 and SA 2204• Mis Sundaresha & Associates had provided audits as well as non-audit services to 27 entities of the Coffee Day Group. CA Megha Sundaresha Andani, daughter of CA A. S. Sundaresha, had 72% share in the profits of Mis Sundaresha & Associates, which had five partners. Her father CA A. S. Sundaresha is proprietor of Mis Sundaresh & Co. that had provided audit and non-audit services to 29 entities belonging to Coffee Day Group including its promoters. CA A. S. Sundaresha also had 81 % share in the profits of another partnership firm Mis ASRMP & Co., which had four partners. Further, Mis Sundaresha & Associates was actively participating in making audit presentation etc. in respect of statutory audit of CDGL, whereas Mis ASRMP & Co. was the statutory auditor of CDGL. Further, CA Pradeep Chandra C., Partner of Mis Sundaresha & Associates represented as partner of Mis ASRMP & Co. in the Audit Committee meeting ofCDGL. All these audit firms operated from the same office address.

20 The SCN referred to SA 2005 that requires the auditor to comply with relevant ethical requirements, including those pertaining to independence relating to financial statements audit engagements. Para 18 of SQC 1 requires the Audit Firm to establish policies and procedures designed to provide it with reasonable assurance that the firm, its personnel and, where applicable, others subject to independence requirements (including experts contracted by the firm and network firm personnel), maintain independence where required by the Code. Para 28 of SQC 1 states, inter alia, that “The firm should establish policies and procedures for the acceptance and continuance of client relationships and specific engagements, designed to provide it with reasonable assurance that it will undertake or continue relationships and engagements only where it: (i) ——– , (ii) ———— and (iii) Can comply with the ethical requirements”.

21 The SCN also referred to SA 2206 that requires the Engagement Partners (EP hereafter) to form a conclusion on compliance with independence requirements that apply to the audit engagement. In doing so, auditors are required to:

i. Obtain relevant information from the firm and, where applicable, network firms, to identify and evaluate circumstances and relationships that create threats to independence;

ii. Evaluate information on identified breaches, if any, of the firm’s independence policies and procedures to determine whether they create a threat to independence for the audit engagement; and

iii. Take appropriate action to eliminate such threats or reduce them to an acceptable level by applying safeguards, or, if considered appropriate, to withdraw from the audit engagement, where withdrawal is permitted by law or regulation. The engagement partner shall promptly report to the firm any inability to resolve the matter for appropriate action.

22 The SCN noted that in the Independent Auditor’s Report dated 20.05.2019, the Auditors have reported that, “We are independent of the company in accordance with the code of ethics issued by the Institute of chartered Accountants of India (!CAI) together with the ethical requirements that are relevant to our audit of the Ind AS financial statements under the provisions of the Act and the rules thereunder, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the !CAI ‘s code of ethics”.

23 The SCN also noted that as per the Audit Manual of the Firm, there is a requirement of taking Independence confirmation from Firm personnel. Similarly, the EP was required by the Audit Manual of the Firm to evaluate acceptance/continuation of audit engagement and prepare Client/Engagement Acceptance and Continuance Form; however, there is no evidence in the Audit File that the Audit Firm and the engagement team had complied with these Independence requirements as per SQC-1, SA 200 and SA 220.

Auditors’ Reply & Our Findings

24 The Auditors denied this charge stating that they had complied with the Independence requirements by reducing self-interest threat & familiarity threat; that their firm & partners do not have any financial interest in any of the CCD group companies; that they did not quote lower fees to obtain new engagements; and that they did not have close business relationship with CCD group nor have they stored any confidential information in their server to be used for any personal gain. They further stated that no partner or their family are Directors or Officers in CCD group companies; that CCD group Directors and Officers did not have significant influence over their engagement; that their audit team will be regularly rotated and that they did not provide any prohibited service under section 144 of the Act etc. They also stated that they had ensured that total fees from auditee did not exceed prescribed limits and where the amount formed large portions of total fees they had taken the following safeguards to mitigate the risk:

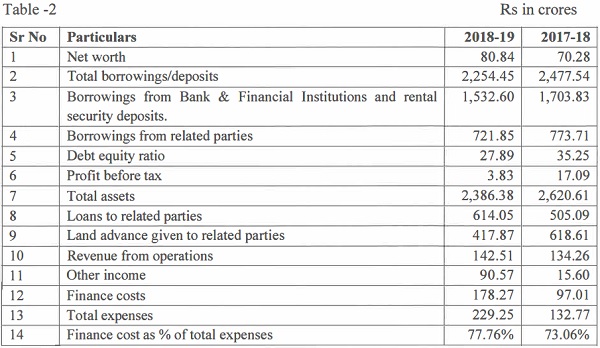

a) Firm has exposure to various clients, adding new clients and providing additional services to existing clients without compromising on non-allowed services over the years,

b) The remuneration of partners is not linked to earning of any single client and

c) They have sufficient resources and cost can be covered even on loss of any client which forms significant portion of their fees.

25 The Auditors have also replied that they did not enter into any contingent fees arrangement with an auditee, and ensured that fees are not overdue except from the CCD group (Coffee Day Group), which is partially due on account of financial constraint faced by the group. They have replied in response to charge relating to fraudulent loan transactions with TRRDPL that they are independent of M/s ASRMP & Co. They argued that they have complied with the Standards of Auditing and provisions of the Act.

26 We have considered the reply. It is important to understand the inter relationship of the three audit firms. As per information obtained from the audit firms, CA A. S. Sundaresha has a sole proprietorship firm, namely M/s Sundaresh & Co. He was also the promoter and founder of M/s Sundaresha & Associates, a partnership firm in practice since 10.11.1997, but he had retired from this firm w.e.f. 31.03.2017. After his retirement, his daughter CA Megha Sundaresh Andani is one of the five partners of this Audit Firm with 72% share in the profit of this firm. CA A. S. Sundaresha has also established another partnership firm namely, M/s ASRMP & Co. w.e.f. 01.04.2018, which was appointed as the statutory auditor ofCDGL from FY 2018-19. CA A. S. Sundaresha has 81 % share in the profit ofM/s ASRMP & Co., which had four partners. All these firms operate from the same office address.

27 We note from the information obtained from CDGL that CA Pradeepa Chandra C. (Partner of M/s Sundaresha & Associates) worked at M/s ASRMP & Co, Statutory Auditor of CDGL, and gave presentation on behalf of M/s ASRMP & Co. in the Audit Committee Meeting (‘ ACM’ hereafter) of CDGL held on 07.02.2019 and 24.05.2019. These presentations related to review of quarterly results of CDGL by the Auditor, scope of engagement, audit approach and observations of the Auditor on the Statutory Audit of the annual financial statements for FY 2018-19. Further, the presentation given on 24.05.2019 was prepared by CA Megha Sundaresha Andani, partner ofM/s Sundaresha & Associates. (As per properties of PDF document containing the presentation).

28 The inter- relationship among the three firms is corroborated by another fact that CA Pradeepa Chandra C. and CA Chaitanya G. Deshpande (both Partners of M/s Sundaresha & Associates) were involved in the statutory audit ofCDGL for FY 2018-19, of which M/s ASRMP & Co. was the statutory auditor. As per the Audit File of CDGL for FY 2018-19, the above said two partners of M/s Sundaresha & Associates were involved in 4 7 out of 67 audit areas identified in the audit plan. Out of these 47 audit areas, 44 were not reviewed by any partner of M/s ASRMP & Co. This shows that they were not only supervising the day to day audit work being performed by the article assistants but were practically doing a major part of the audit. This also shows that the audit of CDGL was performed not merely by M/s ASRMP & Co. but by M/s Sundaresha & Associates also. But to hide this fact, both partners ofM/s Sundaresha & Associates were named as external reviewers in the audit file of CDGL, a fact that has also been pointed out in our order dated 12.04.2023 in the case of CDGL. These facts together with the fact that all three firms operate from the same office address, indicate their close inter-relationship and lack of independence.

29 It is equally important to understand the relationship of these audit firms with Coffee Day Group and its promoters. As per information furnished by these firms and other information available on record, M/s Sundaresha & Associates and M/s ASRMP & Co. were statutory auditors of inter alia six Coffee Day Group companies ( except CDH&RPL- as per serial no-5 in Table-I). These companies were involved in the diversion of Rs 3,380 crores i.e., 95.62% of total diverted amount of Rs 3,535 crores. Further, during the Financial Year 2018-19, M/s Sundaresha & Associates provided audit and non-audit services to 27 Coffee Day group entities, M/s Sundaresh & Co. provided audit and non-audit services to 29 Coffee Day entities including promoter’s family members and M/s ASRMP & Co. provided audit and non-audit services to four Coffee Day group companies. This indicates that M/s Sundaresha & Associates had accepted the audit engagement of TDL from FY 2018-19 despite serious conflict of interest. The relationship of three related audit firms with Coffee Day Group indicates creation of self-interest and familiarity threat. The Auditors of CDGL had admitted that CA A. S. Sundaresha is associated with Coffee Day Group for a very long time, therefore there is familiarity threat. It is evident that the replies of the Auditors regarding steps taken to reduce the self-interest threat and familiarity threat are mere general statements without detailing the specific steps taken to reduce such threats, despite the three audit firms having audit and non-audit relationships with a large number of Coffee Day Group entities including promoters.

30 As per The Code of Ethics 20097 (‘the Code’ hereafter), a professional accountant is required to comply with the fundamental principles i.e. a) Integrity, b) Objectivity, c) Professional Competence and Due Care, d) Confidentiality, and e) Professional Behaviour. The conceptual framework approach of the Code states that the circumstances in which professional accountants operate may give rise to specific threats to compliance with the fundamental principles. It is impossible to define every situation that creates such threats and specify the appropriate mitigating action. Para 100.6 of the Code states that a professional accountant has an obligation to evaluate any threats to compliance with the fundamental principles when the professional accountant knows, or could reasonably be expected to know, of the circumstances or relationships that may compromise compliance with the fundamental principles. Para 100.9 of the Code states that compliance with the fundamental principles may potentially be threatened by a broad range of circumstances which inter alia includes self interest threat and familiarity threat. Chapters 2 of the Code provide examples of circumstances that may create threats for professional accountants in public practice. Para 120.2 of the Code states that relationships that the Code of Ethics. In view of this, the charge stands proved that the Auditors have violated SQC 1, SA 200 and SA 220.

C.2 Tampering of Audit File and related lapses – SA 230, Audit Documentation

34 The Auditors were charged with tampering with the Audit File to deceive NFRA and making the Audit File unreliable, as audit workings have been done in editable Excel files without any security feature to prevent alteration of audit documentation. The Audit File has, inter alia, 14 Excel files, out of which 13 Excel files were modified between 18.08.2022, the date NFRA asked for the Audit File, and O 1.09.2022, the date the Audit File was submitted to NFRA. Further, the Excel file namely ‘Related Party Transaction Workings’, was created on 30-08-2022, after NFRA asked the Auditors to submit the Audit File. Such modifications and additions in the Audit File are not permissible as per SA 230 and amount to tampering. Further, as per SQC-1, SA 200 and SA 220, the Audit Firm and the Engagement Team are required to adhere to ethical principles like integrity & professional behavior. The Audit File is required to be assembled within 60 days of the signing of the audit report. In this case, the audit report was signed on 20.05.2019; accordingly, the Audit File was required to be assembled by 19.07.2019. However, the Auditors continued tampering with the Audit File till 01-09-2022 even after 39 months of signing the Independent Auditor’s Report.

35 Further, as per para 8 of SA 230, the Auditors were required to prepare audit documentation that is sufficient to enable an experienced auditor, having no previous connection with the audit, to understand: (a) The nature, timing, and extent of the audit procedures performed to comply with the SAs and applicable legal and regulatory requirements; (b) The results of the audit procedures performed, and the audit evidence obtained; and ( c) Significant matters arising during the audit, the conclusions reached thereon, and significant professional judgments made in reaching those conclusions. As per para 9, 10 & 14 of SA 230, the Auditors were required to document in the Audit File, inter alia, the record of name of person & date of performing audit procedures, name of person performing review, date & extent of review and discussion of significant matters with management & Those Charged With Governance (‘TCWG’ hereafter) etc. An examination of the Audit File shows that the names of the engagement team members & date of performing audit procedures are not mentioned in any of the audit work papers nor are the names of the team members who reviewed the audit work and the extent of review. No information about engagement team is available in the Audit File. Accordingly, the Auditors were charged with failure to comply with para 14 of SA 200, para 9 of SA 220, para 14, A21 of SA 230 and para 14 & 75 of Standard on Quality Control-I.

Auditors’ Reply & Our Findings

36 The Auditors denied this charge stating that there has been no tampering of the Audit File. They submitted that maintenance of editable Excel file is not prohibited in SA 230 and modification of audit file is allowed as per para 16 of SA 230; that they have only formatted those files to make it pleasant to view & for easy referencing; that the workings maintained in loose sheets were compiled in Excel format after receipt of NFRA notice, and during this process the date modified could have been changed to the latest date; and that cosmetic changes had been made for better presentation but the contents of the Audit File have not been changed.

37 Having considered the reply, we observe that in terms of SA 230, modification in the audit file after the assembly period is allowed only to clarify any existing audit documentation arising from comments received during monitoring inspections performed by internal or external parties (para A24 of SA 230). In such cases, the Auditor is required to document the specific reason of making them, when and by whom they were made and reviewed (para 16 of SA 230). On examination of the Audit File, we could not find any recorded reason or document justifying the modification as required under para 16 of SA 230.

38 It is evident from the reply of the Auditors that they modified the existing audit work papers and created new work papers. Once modifications are made in Excel files, it is impossible to find out what was modified. Further, creation of new Excel file from the workings in loose sheets itself is a proof of tampering of audit documentations. We note that a large number of audit documents were modified and at least one new audit work paper was created after NFRA called the Audit File for examination. After being confronted in the SCN, the Auditors have given an evasive reply that only cosmetic changes were made and that the contents were not changed.

39 Further, the Auditors have submitted 12 additional documents (109 pages) and requested to consider these stating that they had inadvertently missed certain evidences in their Audit File as they were not aware ofNFRA’s expectations in relation to verification of the Audit File.

40 Acceptance of the Auditors submission at this stage is fraught with the risk of relying on documents that may not have been considered during the audit and will open the floodgates for other auditors to take similar pleas in future proceedings. It is important to look into SA 230, which emphasizes the importance of timely preparation of audit documentation and its archival within a reasonable time after the issuance of the audit report. We highlight below some of the paras of the SA 230: –

a) Paragraph 7 of SA 230: The auditor shall prepare audit documentation on a timely basis. The explanatory material at Para Al states that Documentation prepared after the audit work has been performed is likely to be less accurate than documentation prepared at the time such work is performed.

b) Paragraph 8 of SA 230: The auditor shall prepare audit documentation that is sufficient to enable an experienced auditor, having no previous connection with the audit, to understand: (a) The nature, timing, and extent of the audit procedures performed to comply with the SAs and applicable legal and regulatory requirements; (b) The results of the audit procedures performed, and the audit evidence obtained; and (c) Significant matters arising during the audit, the conclusions reached thereon, and significant professional judgments made in reaching those conclusions.

c) Paragraph 9 of SA 230: In documenting the nature, timing and extent of audit procedures performed, the auditor shall record: (a) The identifying characteristics of the specific items or matters tested; (b) Who performed the audit work and the date such work was completed; and (c) Who reviewed the audit work performed and the date and extent of such review.

d) Paragraph 14 of SA 230: The auditor shall assemble the audit documentation in an Audit File and complete the administrative process of assembling the final Audit File on a timely basis after the date of the auditor’s report.

e) Paragraph 16 of SA 230: In circumstances where the auditor finds it necessary to modify existing audit documentation or add new audit documentation after the assembly of the final audit file has been completed, the auditor shall, regardless of the nature of the modifications or additions, document: (a) The specific reasons for making them; and (b) When and by whom they were made and reviewed.

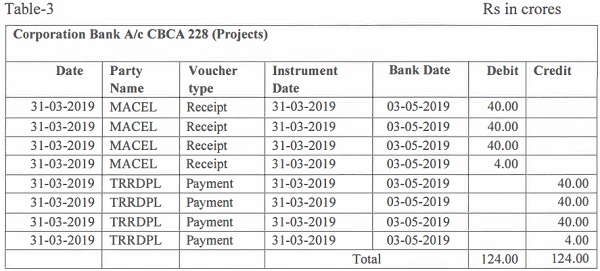

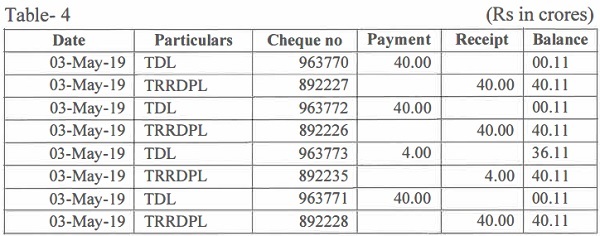

f) The explanatory material to the Standard at Para A21 states that SQC 19 requires firms to establish policies and procedures for the timely completion of the assembly of audit files. An appropriate time limit within which to complete the assembly of the final Audit File is ordinarily not more than 60 days after the date of the auditor’s report.

g) The explanatory material to the Standard at Para A22 states that the completion of the assembly of the final Audit File after the date of the auditor’s report is an administrative process that does not involve the performance of new audit procedures or the drawing of new conclusions.

41 Similar requirements exist in para 7, 14, A21 & A22 ofISA 230 (UK & Ireland), para 7, 14, A21 & A22 ASA 230 (Australia) and para 15 of AS 1215 (PCAOB, U.S.)

42 Even internationally, as seen from the following paragraphs, alteration, backdating of work papers/reviews, substitution or addition of the new work papers, placing blank audit papers so as to perform audit procedures ( commonly referred to as Audit File Tampering) subsequent to issuance of audit report or the assembly of final Audit File by the Auditors are not accepted, as it would leave scope for large scale production of additional documents as an afterthought upon commencement of disciplinary proceedings.

43………… In the Matter of KPMG Assurance and Consulting Services LLP and Sagar Pravin Lakhani (Engagement Partner) relating to tampering of audit file, PCAOB 10 (Public Company Accounting Oversight Board – Audit Regulator of United States of America), observed that “PCAOB standards require that [a]udit documentation must contain sufficient information to enable an experienced auditor, having no previous connection with the engagement … [t]o determine who performed the work and the date such work was completed as well as the person who reviewed the work and the date of such review”…. “PCAOB standards further require an auditor to archive a complete and.final set of audit documentation as of a date not more than 45 days after the report release date (i e., the documentation completion date). Any documentation added after the documentation completion date must indicate the date the information was added, the name of the person who prepared the additional documentation, and the reason for adding it. ” … “Accordingly, KPMG India violated QC§ 20 and QC§ 30 by failing to implement, communicate, and monitor adequate policies and procedures to provide the Firm with reasonable assurance that its personnel complied with PCAOB audit documentation standards including standards concerning documentation of the date audit work was completed, of the date audit work was reviewed, and of any changes to the work papers after the documentation completion date”. For this misconduct, a civil money penalty in the amount of $1,000,000 was imposed on KPMG Assurance and Consulting Services LLP, and a civil money penalty in the amount of $75,000 was imposed on Sagar Pravin Lakhani besides suspending Lakhani from being an associated person of a registered public accounting firm for a period of one year, censuring both and requiring KPMG India to undertake and certify the completion of certain improvements to its system of quality control.

44 In another similar case of Deloitte Canada11 relating to tampering of audit file, PCAOB observed “PCAOB standards require auditors to prepare audit documentation that accurately reflects when audit work was completed and reviewed. Prior to November 2016, Deloitte Canada’s electronic work paper system (“system” or “work paper system”) allowed Firm personnel to document their performance and review of work by manually selecting preparer and reviewer sign-off dates for each work paper. In November 2016, the Firm updated its work paper system and removed Firm personnel’s ability to manually select sign-off dates. Under the new system, when an auditor entered a sign-off, the current date was automatically generated. At the time the Firm adopted its new system, personnel from the Firm’s National Office were aware of a risk that individuals could override the new system by changing their computer date settings to backdate work paper sign-offs. Despite that awareness, the Firm did not take sufficient steps through written policies, guidance, training, or otherwise to address that risk. During the 16 month-period following the adoption of the new work paper system, Firm personnel overrode the system and backdated their work paper sign-offs in at least six issuer audits and two quarterly reviews subject to PCAOB standards. This conduct occurred while teams were assembling a complete and final set of work papers for retention, or earlier, in these engagements. Additionally, some auditors on these engagements deleted and replaced sign-offs in order to ensure that reviewer sign-offs were dated after preparer sign-offs. Collectively, this conduct obscured the dates on which work had actually been completed and reviewed”. For this misconduct, PCAOB imposed a civil money penalty of $350,000 on the firm besides censuring the firm, requiring it to take corrective actions to establish, revise, or supplement, as necessary, its quality control policies and procedures, including monitoring procedures, to provide the Firm with reasonable assurance that personnel comply with PCAOB audit documentation requirements, including those concerning the dating of the completion of work performed and the dating of the review of work papers and also directed the firm to ensure that all Firm professionals involved in any “audit,” have received four (4) hours of additional training concerning compliance with PCAOB audit documentation standards.

45 There have been many other instances of such wrong doings being penalized by the PCAOB, e.g., KPMG Singapore-Tan Joon Wei (2021), BOO-Mexico (2019), and Deloitte Brazil (2016) etc.

46 We further note that while submitting the Audit File12 to NFRA, through a duly notarized affidavit dated 30.08.2022 signed by CA Pradeepa Chandra C., a partner of the Audit Firm, it was averred that “The Audit File for the financial year 2018-19 as defined in Para 6(b) of SA 230 has been submitted” …. “It is certified that the above information is true and complete in all respects, and nothing has been concealed’. The Auditors are expected to know what constitutes an “Audit File” as per SA 230 and accordingly, all audit work papers were expected to be available in the Audit File submitted to NFRA. The submission by the Auditors of additional documents now, subsequent to the submission of Audit File, to defend the charges in the SCN, points to the incorrect and misleading averments made in the affidavit submitted by the Firm.

47 Therefore, considering the provisions of the auditing standards and the affidavit filed by the Firm, we do not find any merit in the submission of the Auditors regarding the additional documents and we treat the same as an afterthought to cover up their deficiencies in the Audit and as additional evidence of tampering of the Audit File.

48 The Auditors also replied that the dates of conducting the audit are available in the time sheet maintained separately by each article assistant. In respect of non-availability of the timings of the audit procedures claimed to have been performed by other engagement team members including the EP, the Auditors replied that their documentation in the Audit File is required only if it is critical to the audit procedure performed and when may have an impact on the audit opinion. The Auditors added that they did not carry out any audit procedure for which timing was critical to audit opinion and referred to FAQ 25 of Implementation guideline to SA 230 issued by ICAI, which provides guidance for audit documentations and states:

“Recording the identifying characteristics serves a number of purposes. For example, it enables the engagement team to be accountable for its work and facilitates the investigation of exceptions or inconsistencies. Identifying characteristics will vary with the nature of the audit procedure and the item or matter tested For example:

- For a detailed test of entity-generated purchase orders, the auditor may identify the documents selected for testing by their dates and unique purchase order numbers.

- For a procedure requiring selection or review of all items over a specific amount from a given population, the auditor may record the scope of the procedure and identify the population (for example, all journal entries over a specified amount.from the journal register).

- For a procedure requiring systematic sampling from a population of documents, the auditor may identify the documents selected by recording their source, the starting point and the sampling interval (for example, a systematic sample of shipping reports selected from the shipping log for the period April 1 to September 30, starting with report number 12345 and selecting every 125th report).

- For a procedure requiring inquiries of specific entity personnel, the auditor may record the dates of the inquiries and the names and job designations of the entity personnel.

- For an observation procedure, the auditor may record the process or matter being observed, the relevant individuals, their respective responsibilities, and where and when the observation was carried out”.

49 A perusal of the above shows that nowhere it has been stated by the ICAI that the timing of performing audit procedures is to be documented only if it is critical to the audit opinion. In this regard, the reply of ICAI to question no- 23 of above guidelines is also relevant. It states as follows:

“Q23. What should the auditor record in documenting the nature, timing and extent of audit procedures performed?

A 23. The auditor should record:

- The identifying characteristics of the specific items or matters tested;

- Who performed the audit work and the date such work was completed; and

- Who reviewed the audit work performed and the date and extent of such review.

SA 220 (Revised) requires the auditor to review the audit work performed through review of the audit documentation. The requirement to document who reviewed the audit work performed does not imply a need for each specific working paper to include evidence of review. The requirement, however, means documenting what audit work was reviewed, who reviewed such work, and when it was reviewed”.

50 Thus, it is clear that even the ICAI had also advised to document the timing of performing audit procedures in the Audit File. Therefore, the reply of the Auditors is misconceived. We cannot also give credence to the claim that the dates of conducting the audit by article assistants are available in time sheet maintained separately, because these records have not been maintained as part of the Audit File as required under SA 230.

51 The clear evidence of the Auditors tampering with the Audit File without valid reasons displays unprofessional behavior unbecoming of a professional auditor. We have already seen in the cases decided by PCAOB that internationally any attempt to tamper with the audit file is taken very seriously by the auditing regulators and entails significant regulatory sanctions.

52 In view of the above analysis, we conclude that the charge that the Auditors have violated SQC 1, SA 200, SA 220 and SA 230 is proved.

C.3 Failure to understand the audited entity, to perform risk assessment procedure to identify, assess & respond to Risk of Material Misstatement due to fraud, and to prepare Audit Plan

53 The Auditors were charged that they did not understand TDL, the audited entity, did not perform risk assessment procedure to identify & assess Risk of Material Misstatement (‘RoMM’ hereafter), did not respond to such RoMM and did not prepare audit plan evidencing noncompliance with SA 300, SA 315 & SA 33013. They were required to obtain an understanding of the nature ofTDL including its operations, its ownership and governance structures, the types of investments that TDL was making and how it was financed, to understand the classes of transactions and account balances. The Auditors were required to establish an overall audit strategy to set the scope, timing and direction of the audit to guide the development of the audit plan. There is no evidence in the Audit File that they had performed these basic audit procedures.

54 The SCN noted that TDL had a very high debt equity ratio of 27.89, huge related party transactions, very high borrowing costs, and had given very high land advances to related parties, as evident from Table -2 as under:

56 The SCN noted that the Auditors were required14 to perform risk assessment procedures to provide a basis for the identification and assessment of RoMM at the financial statements & assertion levels and to respond to identified RoMM but there was no evidence in the Audit File that they had performed such procedures to identify & respond to RoMM despite the unusual balances as mentioned in Table-2. Thus, they were charged with non-compliance with SA 300, SA 315 and SA 330.

Auditors’ Reply & Our Findings

57 While denying this charge, the Auditors have stated that the audit was well planned and attached a copy of the audit plan along with reply to SCN. They stated that they had conducted audit of TDL during FY 2017-18 also and were reappointed as statutory auditors for FY 2018-19 to 202122. They claimed to have obtained the Memorandum of Association (‘MOA’ hereafter) to understand the framework of the company while performing the statutory audit for FY 2017-18 and thereafter changes to MOA were tracked in the minutes of the company. According to them, there was no change in the nature of operations, ownership, governance structures, types of investment and how it was financed during the year. Transactions during the year have been subjected to audit. Regarding high debt equity ratio, they replied that loans were taken on the basis of market value ofTDL’s assets, which was approx. Rs 2600 crores, whereas cost of assets built over last 15 years was substantially low. They mentioned that it is not unusual for an infrastructure company to make large amount of land advance for purchase of land.

58 The Auditors further submitted that they had obtained an understanding of TDL by having discussion with management and TCWG (Those Charged With Governance) over the years. They claimed to have undertaken analytical & substantive procedures and also tested controls. They claimed to have undertaken some procedures to reduce RoMM like obtaining documentation of land advance, verification of large loans & utilization thereof, confirmation from bankers & related parties and valuation report of tech park etc. According to them, Ro MM arises due to test check nature of audit, whereas they had covered most material loans and transactions. They finally stated that they had complied with SA 300, SA 315 and SA 330.

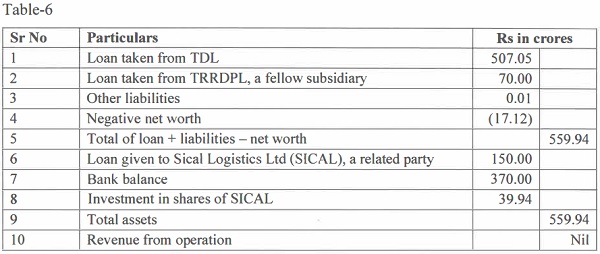

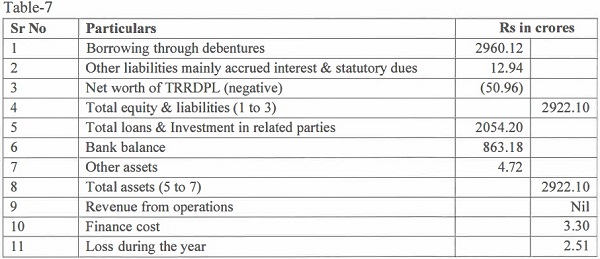

59 Having considered the reply, we observe from Table-2 that the balance sheet size of TDL had reduced by Rs 234.23 crores i.e., from Rs 2620.61 crores in FY 2017-2018 to Rs 2386.38 crores in FY 2018-19, the Finance cost had increased substantially from Rs 97.01 crores to Rs 178.27 crores, other income had increased substantially from Rs 15.60 crores to Rs 90.57 crores and debt equity ratio reduced from 35.25 to 27.89. This is indicative of a major shift in the manner of borrowings and the manner of investments by TDL during FY 2018-19. Despite this major change, the Auditors contended that there was no change in the types of investment and how it is financed during FY 2018-19. This proves that they did not perfom sufficient risk assessment procedure to identify and assess RoMM. Further, risk assessment procedures are required to be performed every year by understanding the company and its environment. There is no evidence in the Audit File about performing any risk assessment procedure at planning stage during the Audit for the FY 2018-19. Further, as per the Memorandum of Association submitted alongwith reply to SCN, TDL was not authorized to give loans to MACEL, GVIL and TRRDPL as financing activities are not covered in the Objects clause of the MOA. TDL was only authorized to invest surplus money (short term investment) in investments, shares or stocks of a company (as per clause 3(8)(11) ofMOA), which is not the case in TDL. The Auditors failed to understand this major non-compliance by TDL.

60 There is no audit plan available in the Audit File. The Auditors were required to plan the nature, timing and extent of direction and supervision of engagement team members and the review of their work. As per SQC-1, the Audit Firm was required to communicate the identity & role of Engagement Partner to TDL and assign appropriate staff with necessary competence to perform the audit of TDL. Appropriate staff was not assigned for the audit of TDL as details of engagement team are not available in the Audit File. The Auditors have attached a copy of audit plan along with reply to SCN stating that they maintained a combined audit plan for TDL and GVIL in a single Excel workbook. As audit plan is not available in the Audit File submitted to NFRA and there is no evidence of maintenance of such a combined audit plan either in TDL audit file or in GVIL audit file, this reply is not accepted. Further, the submission of the Auditors regarding discussion with management and TCWG over the years is not supported with any audit evidence in the Audit File. With respect to the submission about analytical and substantive procedures having been performed by the Auditors by collecting documents mentioned above, it is observed that these documents were not available in the Audit File and were submitted later alongwith the reply to SCN. Therefore, these additional documents cannot be treated as audit evidences for the reasons mentioned earlier in this Order.

61 As per SA 300, an auditor is required to establish an audit strategy including nature, timing and extent of planned risk assessment procedure. As per SA 315, an auditor is required to perform risk assessment procedures to provide a basis for identification and assessment of RoMM at the financial statement and assertion level. As per SA 330, an auditor is required to respond to the assessed RoMM. These are mandatory logical sequential audit procedures required for effective performance of an audit engagement. which the Auditors failed to perform. They failed to even understand TDL so as to perform an effective audit.

62 From the above analysis, we find that the Auditors failed to perform these basic audit procedures in this case, and thus violated SA 300, SA 315 and SA 330.

C.4 Lapses in audit of fraudulent loan transactions with MACEL (Rs 2614.35 crores), fraudulent understatement of loans (Rs 474 crores) and evergreening of loans through structured circulation of funds

63 It was charged that the Auditors failed to exercise Professional Skepticism15 and Judgement16 while auditing loan transactions, which were not only fraudulently given to MACEL but also fraudulently understated at year end by receipt of cheques without adequate bank balance with MACEL. These cheques were realised in next year i.e., FY 2019-20 by evergreening of loans done through structured circulation of funds amongst the Coffee Day Group entities. Thus, the Auditors failed to report fraudulent loan transactions of Rs 2614.35 crores with MACEL, fraudulent understatement of loans of Rs 474.00 crores given to MACEL and evergreening of loans through structured circulation of funds. Accordingly, the Auditors were charged with failure to comply with SA 200, SA 240, SA 250, SA315, SA 330, Section 143(1), 143(12) & 179(3) of the Act and The Companies (Auditors Report) Order 2016 (CARO).

64 MACEL, an entity owned by family members of promoters ofTDL, has no business relationship with TDL. Loan transactions of Rs 2614.35 crores with MACEL were more than the balance sheet size of TDL i.e., Rs 2386.38 crores, therefore, these were unusual transactions. Disbursal of loans to MACEL was an indication of fraudulent diversion of funds. The Auditors were required to exercise Professional Skepticism and Judgement to evaluate the appropriateness of disbursal of such large amount of loans to a group entity without any business relationship/transaction, examine terms & conditions of such loans including tenure of loans & rate of interest etc. The Auditors were also required to evaluate the purpose and utilisation of loans given to MACEL. There is no evidence in Audit File that the Auditors had done any evaluation and asked any question to TCWG on this matter.

65 As per section 179(3) of the Act, the Board of Directors (BOD) has to exercise its powers to borrow funds & grant loans by resolutions passed at meetings of the Board. There is no record in Audit File that the Board of Director of TDL had passed any resolution to borrow funds & grant loans to MACEL.

66 On 31.03.2019, MACEL had issued four cheques of total amount of Rs 124 crores from its Corporation Bank account and four cheques of total amount of Rs 350 crores from its Kamataka bank account to TDL without having adequate bank balances and bank credit limits. Analysis of subsequent clearance of these cheques in FY 2019-20 shows that smaller funds were rotated among group companies for clearance of these cheques. Thus, loan receivable from MACEL worth Rs 462.32 crores were converted to loan payable to MACEL worth Rs 11.68 crores in the Financial Statements ofTDL as on 31-03-2019. By virtue of these cheques an asset of Rs. 462.32 crores was converted into a liability of Rs. 11.68 crores in the balance sheet as on 31.03.2019. This was a material misstatement on the Asset side of the Balance Sheet signed by the Auditors.

67 Rotation of smaller funds to project settlement of larger funds was evidence of serious financial manipulation and crisis in MACEL as well as TDL. Diversion of funds in a circular manner coupled with accounting manipulation and fraud were clear evidence that a fraud had been committed in TDL. One of the important substantive audit procedures is to examine the Bank Statements with reference to the major transactions and verify subsequent clearance of cheques received but not credited till 31.03.2019. There is no evidence in Audit File that the Auditors performed any procedure to verify clearance of these cheques, which is evidence that the Auditors did not perform audit of bank transactions.

68 SA 24017 provides that the objectives of auditor are to identify and assess the risk of material misstatement in the FS due to fraud, obtain audit evidence and respond to identified or suspected risk. It requires the auditor to maintain professional skepticism recognizing the possibility of existence of material misstatement due to fraud, to evaluate the business rationale ( or lack thereof) of the significant transactions that are outside the normal course of business or otherwise appear unusual and evaluate whether such transactions may have been entered into to engage in fraudulent financial reporting or to conceal misappropriation of funds. There is no evidence in the Audit Files that any audit procedure was performed to comply with SA 240. There is no evidence in the Audit File that the Auditors asked any question to TCWG and Management about these fraudulent transactions, indicating that the Auditors did not perform audit with professional skepticism as required under SA 200.

69 Cheques worh Rs 474 crores received up to 31.03.2019 but not credited in bank accounts constituted 19.86% of TDL’s total assets of Rs 2386.38 crores. This indicated a Risk of Material Misstatement due to fraud. The Auditors were required to perform audit procedures as per SA 315 and SA 330. There is no evidence in the Audit File that the Auditors performed such audit procedures to identify and respond to RoMM due to fraudulent reduction of related party loans, fraudulent diversion of funds and evergreening of loans through structured circulation of funds.

70 The Auditors had a statutory duty to report the fraud to the Central Government under section 143(12) of the Act. Diversion of funds to MACEL, understatement of loans to MACEL and evergreening of loans were indicators of commission of fraud in TDL. However, the Auditors did not comply with section 143(12) of the Act. On the contrary, the Auditors reported18 that no material fraud by or on the company had been noticed or reported during the course of audit.

71 The Auditors were also charged with non-compliance with SA 250 as they failed to report violation of Prevention of Money Laundering Act 2002 (‘PMLA’ hereafter)19. Diverting funds fraudulently to MACEL (an entity owned and controlled by promoters’ family) is covered in section 420 of the Indian Penal Code20, which is a predicate offence for money laundering under section 3 of the PMLA. The Auditors did not report this violation in Independent Auditor’s Report and also did not consider its impact on the FS while making conclusions, thereby violating SA 250.

72 As per section 143(1) of the Act, the Auditor was also required to inquire whether these transactions were represented merely by book entries and were prejudicial to the interest of the company. As explained above, loans/advances to MACEL did not have any economic or business rationale and were done through rotation of smaller amounts to legitimize transactions of larger amounts, hence were merely book entries. The Auditor did not report these fictitious accounting entries and was thus charged to have violated section 143(1) of the Act.

Auditors’ Reply & Our Findings

73 The Auditors admitted that there was no specific approval for funds advanced to MACEL, but argued that this is covered in a blanket approval of Rs 10,000 crores given through special resolution in Extra-ordinary General Meeting held on 23.01.2019 and board resolution passed on 21.01.2019. In this connection, we observe that while passing the special resolution, the shareholders of TDL had authorised the Board of Directors (‘Board’ hereafter) of TDL to invest/lend up to Rs 10,000 crores. However, there is no record that any specific resolution was subsequently passed by the Board ofTDL to lend money to MACEL or any other entity. Further, the loan given to MACEL was not for its main object i.e., Infrastructure business as defined in MOA. Thus, loans given to MACEL were unauthorised transactions.

74 The Auditors argued that there was no diversion of funds by referring to definition of diversion in Black’s Law Dictionary i.e. “A deviation from the natural course of things esp. unauthorised alteration of a watercourse to the prejudice of a lower riparian owner, or the unauthorised use of funds”. (Emphasis supplied). Further, they also cited para 2.2.1 of RBI master circular on wilful defaulter i.e.

“2. 2.1 Diversion of funds, referred to at para 2.1 (b) above, would be construed to include any one of the undernoted occurrences:

(a) utilisation of short-term working capital funds for long term purposes not in conformity with the terms of sanction;

(b) deploying borrowed funds for purposes/activities or creation of assets other than those for which the loan was sanctioned;

(c) transferring funds to the subsidiaries/Group companies or other corporates by whatever modalities;

(d) routing of funds through any bank other than the lender bank or member of consortium without prior permission of the lender;

(e) investment in other companies by way of acquiring equities/debt instruments without approval of lenders;

(I) shortfall in deployment of funds vis-a-vis the amounts disbursed/drawn and the difference not being accounted for.” (Emphasis supplied).

75 We note that the definition of diversion quoted by the Auditors as per Black’s Law Dictionary includes ‘the unauthorised use of funds’. Similarly, diversion of funds defined in RBI’s master circular includes ‘transferringfunds to the subsidiaries/Group companies or other corporates by whatever modalities’. This charge in the SCN relates to transfer of funds to a promoter owned entity MACEL- without proper authorisation. Accordingly, such transactions meet the definitions of diversion of funds quoted by the Auditors. We further observe that the charge of fraudulent diversion of funds is with reference to the intent of the company management/ promoters as funds were transferred from TDL to MAC EL without any business purpose of TDL, without any contract/agreement and without obtaining any security. This indicates fraudulent intention. of promoters to siphon off money from public space to the promoters.

76 The Auditors have tried to portray these transactions as current account transactions and not as loans. However we note that this submission is contradictory to their own reply (page no 38 of reply) relating to utilization of borrowings, wherein they have stated that the loan taken from IFCI Ltd was used for giving loan to MACEL. Further, TDL in its Financial Statements had shown ‘balance with MACEL’ as ‘Loan’.

77 The Auditors have further stated that loan of Rs 2614 crores was not given to MACEL and maximum amount outstanding at any point oftime was Rs 912 crores.- They stated that TDL had provided credit to MACEL, and the latter had repaid the amount. We observe that the Auditors have admitted that TDL had no business relationship with MACEL. Despite that TDL had given loans worth Rs 2,614 crores to MAC EL ( as per Financial Statements of MACEL ). Further, the repayment of loans given to MACEL was done by evergreening of loans as discussed in subsequent paras. We are of the view that repayment of such a fraudulently disbursed loan does not legitimise non compliances committed during its disbursal.

78 The Auditors further stated that loan taken from financial institution was advanced to MACEL and the related cost was reimbursed by MACEL. They claimed that the Loan taken by TDL was used for the purpose for which it was availed and fund was routed through banking channel, therefore cannot be alleged as fraudulent diversion of funds. In this connection, we observe that there is no record in the Audit File about the purpose ofloans taken from the financial institutions viz IFCI, therefore this part of the reply is an afterthought of the Auditors. It is unacceptable that TDL borrowed funds from financial institutions for the purpose of diversion to promoter owned entity MACEL without any business purpose. Further, routing of fund through banking channel does not provide it immunity from fraud. In fact, big corporate frauds like this one, happen through banking channel only.

79 Regarding understatement and evergreening of loans, the Auditors have replied that they did not have access to the books and bank statements of MACEL, TRRDPL and CDGL. They argued that as Statutory Auditor of TDL, they would not be aware that cheques to TDL were issued without sufficient balance in MACEL. They stated that all the cheques were realized and none of the cheques bounced. They checked the clearance of cheques and they are not required to delve into the examination of source of funds for clearance of those cheques. They further stated that even if it was a well thought out plan by the company, the evergreening of loans could not have been identified by us as auditors of TDL with regular audit procedures and they are not auditor of MACEL to verify MACEL’s books or statements. The Auditors further argued that discovery of evergreening ofloans can emerge only from an investigation of all group companies and are not capable of being detected within the scope of work of a statutory auditor of TDL.

80 We note the Auditors’ claim to have verified subsequent clearance of cheques in TDL’s bank account. We reproduce below excerpts from the Bank Reconciliation Statement (BRS) of TDL, as available in the Audit File. The rotation of funds of equal, round amounts on the same day (03.05.2019) is too obvious to be not noticed by anybody, more so by an auditor.:

81 Further, this circulation of funds among MACEL, TDL and TRRDPL can be easily observed from the bank statement of MACEL as depicted hereunder:

82 Tables 3 and 4 depict that MACEL had issued four cheques of total amount of Rs 124 crores on 31st March 2019. In next year, on 03.05.2019, MACEL paid Rs 40 crores to TDL starting a series of sham transactions in a circular manner by rotating the funds among TDL, MACEL & TRRDPL for clearance of the four cheques of total amount of Rs 124 crores. Such as MACEL paid Rs 40 crores to TDL, which then paid Rs 40 crores to TRRDPL, which then paid Rs 40 crores to MACEL, which then paid Rs 40 crores to TDL, which then paid Rs 40 crores to TRRDPL, which then paid Rs 40 crores to MACEL, which then paid Rs 4 crores to TDL, which then paid Rs 4 crores to TRRDPL, which then paid Rs 4 crores to MACEL, which then paid Rs 40 crores to TDL, which then paid Rs 40 crores to TRRDPL, which then paid Rs 40 crores to MACEL. There was no economic rationale in these transactions, which were designed to fabricate the books of accounts. This indicates fraudulent intent of TDL/MACEL to understate related party balances in the books of TDL in FY 2018-19, and thereafter evergreening ofloans was done through structured circulation of funds. This fraud could have been detected by the Auditors from the bank statement of TDL had they applied professional skepticism during the course of audit.

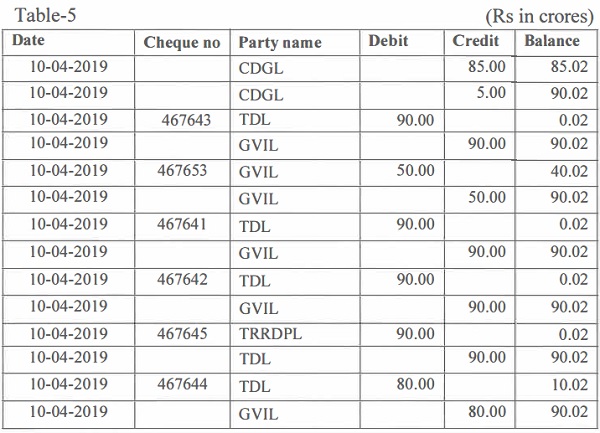

83 Similar fraudulent rotation of funds among related parties were observed when cheques of Rs 350 crores issued by MACEL to TDL (in FY 2018-19) were cleared on 10-04-2019. A glimpse of the same is depicted in the bank statement of MACEL given hereunder in Table 5:

84 As depicted in Table 5, MACEL had issued four cheques of Karnataka Bank of total amount of Rs 350 crores to TDL on 31.03.2019, which were cleared on 10.04.2019 in a series of sham transactions by rotating smaller funds among TDL, MACEL and GVIL to legitimize transactions of Rs 350 crores. Such as on 10.04.2019, CDGL paid Rs 90 crores to MACEL, which then paid Rs 90 crores to TDL, which then paid Rs 90 crores to GVIL, which then paid Rs 90 crores to MACEL, which then paid Rs 50 crores to GVIL, which then paid Rs 50 crores to MACEL, which then paid Rs 90 crores to TDL, which then paid Rs 90 crores to GVIL, which then paid Rs 90 crores to MACEL, which then paid Rs 90 crores to TDL, which then paid Rs 90 crores to GVIL, which then paid Rs 90 crores to MACEL, which then paid Rs 90 crores to TRRDPL, which then paid Rs 90 crores to TDL, which then paid Rs 90 crores to MACEL, which then paid Rs 80 crores to TDL, which then paid Rs 80 crores to GVIL, which then paid Rs 80 crores to MACEL. Fraudulent understatement ofloans by Rs 350 crores given to MACEL and evergreening ofloans through structured circulation of funds is clearly evident from above bank statement. This fraud could have been detected by the Auditors from the bank statement of TDL during the course of audit had they applied the professional skepticism expected of them.

85 Further, we do not agree with the submission of the Auditors that statutory auditor is not required to delve into source of funds, specially when circulation of funds was clearly visible from the bank statements. The Auditors’ argument is that while looking at ‘Credit’ column in the bank statement for verification of realization of cheques, they are not required to look at source of funds i.e., ‘Debit’ column on the same page of bank statement. This argument is not logical. An Auditor is required to perform audit with professional skepticism (SA 200). Evergreening of loans through structured circulation of funds was visible from bank statements of TDL. Therefore, the Auditors were required to evaluate this evergreening of loans while verifying realization of cheques received in 2018-19. We note that the Auditor has failed to exercise professional skepticism and due diligence while verifying bank statements. Therefore, we are of the view that the Auditors’ inert passivity in the face of visible evergreening of loans and understatement of related party borrowings does not insulate them from their gross failure in performance of this audit.

86 The Auditors have argued that discovery of evergreening of loans can emerge only from an investigation of all group companies and is not capable of being detected within the scope of work of a statutory auditor of TDL. There is no merit in this argument as the Auditors were having access to the books of accounts and bank statements ofTDL, GVIL, CDGL and TRRDPL, therefore they were in a position to detect this evergreening of loans had they picked up the telltale signs, as illustrated in the preceding paragraphs and tables. As discussed, Rs 40 crores was rotated among MACEL, TDL and TRRDPL. Similarly, Rs 90 crores was rotated among MACEL, CDGL, TDL, TRRDPL and GVIL. The Audit Firm had audited TDL & GVIL (a subsidiary company ofTDL) whereas CDGL & TRRDPL (a subsidiary company ofTDL) were audited by M/s ASRMP & Co., a related audit firm of the Auditors. Two partners of this Audit Firm Mis Sundaresha & Associates (CA Pradeep Chandra C. and CA Chaitanya G. Deshpande) were part of the team which conducted audit ofCDGL. Therefore, evergreening ofloans through structured circulation of funds was evident and could easily be detected by the Auditors, had the audit been performed with professional skepticism.

87 Thus, it is clear that there was a well-thought-out plan to bring down related party loans by just passing accounting/book entries on or before 31.03.2019 to show that loans had been repaid by the related party. Thus, the actual loans outstanding from MACEL of Rs 462.32 crores as on 31.03.2019 was fraudulently shown as loan due to MACEL of Rs. 11.68 crore resulting in understatement ofloan to MACEL by Rs 474.00 crores (Rs. 462.32 crore plus Rs 11.68 crores).

88 MACEL’s account was maintained as current account with regular receipt and payment and no specific approval of the Board was obtained before disbursal of funds. No agreement was entered into with MAC EL for such huge transactions. Grant of huge amount ofloans without any written

agreement & without approval of the Board, to an entity owned by the promoters’ family & not having any business relationship with TDL, were proof of fraudulent transactions. In light of glaring lack of evidence to support a valid business reason for such transfer of funds and clear indications that TD L’s funds were being misappropriated, resulting in a material misstatement of the Financial Statements, fraud, and the Auditors’ failure to perform requisite additional auditing procedures and question such transactions, we conclude that the Auditors did not exercise the necessary professional skepticism to determine whether these transactions posed a risk of material misstatement due to fraud and failed to obtain sufficient appropriate audit evidence in respect of these circular transactions. The Auditors failed to report this fraud to the Central Government u/s 143(12) of the Act.

89 The Auditors denied that provisions of PMLA apply in this case and stated that all related party transactions had been disclosed in the FS, there was no concealment and accordingly the question of fraud does not arise. Funds are transferred to group companies and sources of funds are identified and verified. While citing section 420 of the Indian Penal Code (IPC) they stated that there was no cheating & dishonesty and there was no delivery of property or destruction of valuable security, accordingly section 420 of IPC is not applicable. While citing section 3 of PMLA they stated that amount received from group companies/lenders was advanced to MACEL, source & application of funds are clear, all transactions were done through banking channel and Bankers have not flagged these transactions as suspicious therefore section 3 of PMLA is not applicable. While citing para 16 of SA 250, they stated that they had obtained management representation relating to laws and regulations in relation to audit of FS. Accordingly, there is no violation of SA 250.

90 We observe that disclosure of related party transactions in the Financial Statements and its routing through banking channel does not provide immunity to such transactions from PMLA. The fact is that Rs 474 crores was diverted to promoter owned company-MACEL and attempts were made to conceal this diversion by fraudulently understating this balance in the financial statements. Total fraudulent transactions with MACEL during the year were Rs 2614.35 crores. There was large scale evergreening of loans through structured circulation of funds involving many group companies. All this was done without proper authorization by the Board of Directors, without entering into any agreement and without obtaining any security. Money has ultimately moved to promoter owned company-MACEL. These are ample proof of cheating and dishonesty. Therefore, this is a clear case of money laundering as per PMLA, which Auditors failed to report in the Independent Audit Report.

91 The Auditors’ contention that section 143(1) of the Act provides certain rights to auditor and does not cast any duty on the auditor is not acceptable as the auditor is required by section 14 3 (1)(b) to inquire whether the transactions of the company which are represented merely by book entries are prejudicial to the interest of the company. Obviously, the Auditors have failed to comply with these provisions in this case.