Roppen Transportation Services Private Limited had inadvertently failed to file the required e-form MGT-14 for a special resolution passed at an Extraordinary General Meeting held on 16.05.2018. As a result, the company violated Section 117(1) and 117(3) of the Companies Act, 2013 for a period of 1415 days, and penalties are imposed accordingly. The order directs the company and its officers in default to pay the penalties within 30 days and file e-Form INC-28 with the office of RoC, Hyderabad, as proof of payment.

Please note that the penalty for non-filing of Form MGT-14 is imposed under Section 117(2) of the Companies Act, 2013. The section states that if a company fails to file the resolution or agreement specified in sub-section (1) within the specified period, it will be liable to a penalty of ten thousand rupees. In case of continuing failure, an additional penalty of one hundred rupees for each day after the first day of non-compliance may be imposed, subject to a maximum of two lakh rupees.

Furthermore, every officer of the company who is in default, including the liquidator, if any, may also be subject to a penalty of ten thousand rupees. Similar to the company’s penalty, a further penalty of one hundred rupees for each day of continuing failure may be imposed on the officers, up to a maximum of fifty thousand rupees.

F.NO. ROCH/U60100TG2015PTC097115/TELANGANA/117 OF 2013/2023/296 To 301

BEFORE THE REGISTRAR OF COMPANIES, HYDERABAD

FOR THE STATE OF TELANGANA

2ND FLOOR CORPORATE BHAWAN, THATTIANNARAM, G.S.I. POST, BANDLAGUDA,

NAGOLE, HYDERABAD-500 068

PETITION NO. ADJ. 117/ OF 2023

IN THE MATTER OF SECTION — 117 OF COMPANIES ACT 2013

AND

IN THE MATTER OF

M/S. ROPPEN TRANSPORTATION SERVICES PRIVATE LIMITED

A Company incorporated under the Companies Act, 2013, CIN: LI60100TG2015PTC097115, having its Registered office situated at 3rd Floor, Sai Prithvi Arcade, Megha Hills, Sri Rama Colony, Madhapur, Hyderabad — 500081, Telangana, India.

ORDER UNDER SECTION 454 FOR THE VIOLATION OF SECTION 117 READ WITH SECTION 62(11(A) OF COMPANIES ACT, 2013

1. Whereas M/s. ROPPEN TRANSPORTATION SERVICES PRIVATE LIMITED (hereinafter referred as ‘Company’) is registered in the State of Telangana vide CIN No: U60100TG2015PTC097115 on 05.01.2015, having its registered office address at 3rd Floor, Sai Prithvi Arcade, Megha Hills, Sri Rama Colony, Madhapur, Hyderabad — 500081, Telangana, has filed an suo moto application along with its officers in default u/s 117 (2) for adjudication of violation of section 117 (1) and 117(3) r/w read with section 62(1)(a) r/w section 454 of the Companies Act, 2013 (the Act) seeking necessary orders.

2. It is submitted by the applicants that at its Extra Ordinary General Meeting held on 16.05.2018 the company has passed a Special Resolution for Issue and offer of 2,950 Series Al Compulsorily Convertible Preference Shares and that the company inadvertently and accidentally failed to file e-form MGT-14 with Registrar of Companies for the special resolution passed in this regard due to non-availability of proper Compliance Officer. Accordingly, the aforesaid default was committed by the Petitioner company and its officers-in-default by failing to file e-form MGT-14 and thereby violated the provisions of section 117(1) and 117(3) of the Companies Act, 2013 during the period 15.06.2018 to 11.05.2022 and therefore liable for penalty u/s. 117(2) of the Companies Act, 2013, Further, the applicant company has filed GNL-1 vide SRN F00404319 dated 11.05.2022 and has prayed to pass an order for adjudicating the offence committed u/s 117 (1) and 117(3) of the Companies Act, 2013.

3. Whereas Section 117 (2) of the Companies Act, 2013 contemplates the following:

“(2) if any company fails to file the resolution or the agreement under sub-section (1) before the expiry of the period specified therein, such company shall be liable to a penalty of ten thousand rupees and in case of continuing failure, with a further penalty of one hundred rupees for each day after the first during which such failure continues, subject to maximum of two lakh rupees and every officer of the company who is in default, including liquidator of the company, if any, shall liable to a penalty of ten thousand rupees and in case of continuing failure, with a further penalty of one hundred rupees for each day after the first during which such failure continues, subject to maximum of fifty thousand rupees.”

4. A reasonable opportunity of being heard was given to the applicants on 14th March 2023 under Sub-section 4 of Section 454 of the Companies Act, 2013. Ms. P.V. Sindhuja, Company Secretary in practice attended the personal hearing on behalf of the applicants on 14th March 2023 and orally made the submissions. She further made the request that lesser penalty should be imposed on the company and its directors.

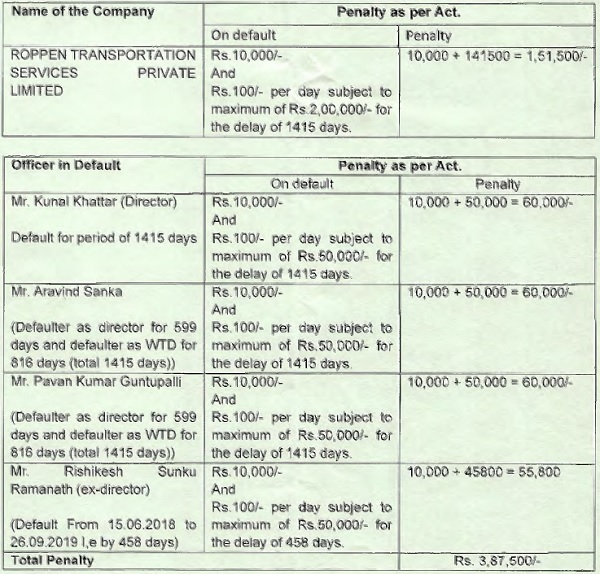

5. After considering the submissions made in the application and by the Authorized Representative, and the facts of the case it is proved beyond doubt that the company and the officers of the company have defaulted in complying the provisions under Section 117 (1) and 117(2) of the Act and with a delay of 1415 days. In this regard, the company, and its officers in default (within the meaning of section 2 (60) of the Companies Act, 2013) are hereby directed to pay the following penalty from their own sources.

6. Having considered the facts and circumstances of the case besides oral submissions made by the representative of applicants at the time of hearing and after taking into the account the factors mentioned in the relevant Rules, I hereby impose a penalty on the company and its officers in default as per table below for the violation of Provision of Section 117 of the Companies Act, 2013 for the delay of 1415 days.

7. The penalty as indicated above, shall be paid within 30 days from the date of issue of this order by the defaulters (out of their own resources) and file e-Form INC-28, with the office of RoC, Hyderabad with copies of challan in proof of payment.

8. In this regard your attention is also drawn to the provisions of Section 454(5) and (6) which contemplates that:

“(5) Any person aggrieved by an order made by the adjudicating officer under sub-section (3) may prefer an appeal to the Regional Director having jurisdiction in the matter.

(6) Every appeal under sub-section (5) shall be filed within sixty days from the date on which the copy of the order made by the adjudicating officer is received by the aggrieved person and shall be in such form, manner and be accompanied by such fees as may be prescribed.”

9. In this regard your attention is also drawn to the provisions of Section 454(8) (i) and (ii) of the Companies Act, 2013 which read as follows:

(i) Where company fails to comply with the order made under sub-section (3) or sub-section (7), as the case may be, within a period of ninety days from the date of the receipt of the copy of the order, the company shall be punishable with fine which shall not be less than twenty-five thousand rupees, but which may extend to five lakh rupees

(ii) Where an officer of a company or any other person who is in default fails to comply with the order made under sub-section (3) or sub-section (7), as the case may be within a period of ninety days from the date of the receipt of the copy of the order, such officer shall be punishable with imprisonment which may extend to six months or with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees, or with both.

Issued under my hand and seat on this the 08th of May 2023.

(JOSEKUTTY V.E)

REGISTRAR OF COMPANIES, HYDERABAD

FOR THE STATE OF TELANGANA