Highlights of Webinar on BEN-2 by The ICSI ON 12th July and On 20th July.

1. The indirect holding is mandatory for the consideration of significant beneficial owner (SBO).

2. If the SBO is HUF than the karta deemed to hold 100% shares of HUF so karta is treated as SBO and 10% holding is calculated together with direct and indirect holding of karta.(but the problem is this ..the rules clearly provides that the SBO is not the member whose name enters in the register of member of the reporting company ,while clubbing direct and indirect holding of karta than this provision violates).

3. If there is partnership firm is a member of reporting company than SBO should be the partners of the firm holding majority stake.(The problem arise that the partnership firm only become the member of section 8 company only.)

In the following figure in A ltd m/s xyz holds 10% shareholdings and both the partners holds 50 % in that firm so no SBO is required but if any partner holds more than 50 % say 51% than he will be considered as SBO.

4. No proportionate shareholding is specified in new rules 2019 as there was a provision in the rules of SBO notified in 2018.

5. The date for receiving Declaration (BEN-1) from SBO is between 8 th February till 5 may 2019.

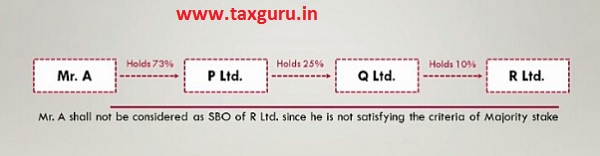

6. When there is chain of investment than the individual should be considered SBO if he is holding majority stake in such company .in the following example Mr A is only under obligation to report in BEN_1 to P ltd as SBO and p ltd should file BEN-2. He is not considered as SBO in R ltd because of the lack of holding majority stake.

7. In case of trust who is the member of reporting company than the trustees/beneficiaries/author (as the case may be) are responsible to file BEN-1 to the reporting company. The reporting is to be done as per the type of the trust ,if it is private trust the beneficiaries will Be Considered as SBO and if it is revocable trust the author will be SBO, further in case of charitable trust trustees are considered as SBO

8. If there is any overseas holding company having any subsidiary in India than such holding company is not eligible for exemption under section 90 as holding reporting company .The subsidiary company needs to file BEN- 2 as per the provisions of section 90.

9. The SBO has the sole responsibility to declare his holding directly or indirectly in reporting company.

10. Number of SBOs to be mentioned basis which the rows in the table on SBOs will be reflected (Max 9)

11. A system generated SBO ID shall be generated and shared for each SBO (it seems that the SBO ID will be sent via email on the registered email id reflected for the reporting entity)- SBO ID will not be required where the declaration is being given. The same is likely to be allotted on change in declaration of SBO.

12. Mention the number of members through whom indirect holding or right in reporting company is being exercised by the SBO

13. Max no. of members that can be entered has to be less than 10

14. Once the number is entered in the table, the e-form will accordingly ask the complete details of the SBO through such members divided into 5 parts (A to E).

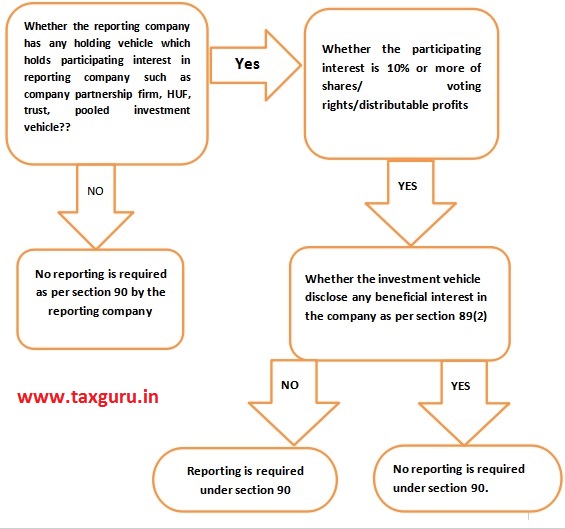

15. In case a reporting entity has more than 9 SBOs then, there are two options available: File a different e-form altogether, or Provide the details in the same format and attach under optional attachment.

16. In nut shell, if in a body corporate if there is any investment vehicle which is a company, firm, HUF, Trust, pooled investment vehicle and if yes than such investment vehicle holds 10 % or more shares/ voting rights/ distributable profits, we start considering the rules of section 90 and if there is any individual holding majority stake in such investment vehicle than such individual has to report to the company in BEN-1 and reporting company after receiving the same file BEN-2 within 30 days of receiving BEN-2..Only individual is SBO nor any other company or firm or HUF

DISCLAIMER: THE ARTICLE IS BASED ON THE RELEVANT PROVISIONS AND AS PER THE INFORMATION EXISTING AT THE TIME OF THE PREPARATION.IN NO EVENT I SHALL BE LIABLE FOR ANY DIRECT AND INDIRECT RESULT FROM THIS ARTICLE. THIS IS ONLY A KNOWLEDGE SHARING INITIATIVE.

THE AUTHOR CAN BE REACHED AT VINAYAK.CHARU@GMAIL.COM and at 6283643738

In first eg.,… don’t we have to check whether X is holding 10 % or more in reporting co. ( by calculating 10 *51%).

if a person is a partner no need of checking majority stake