Significant Beneficial Ownership Rules (SBO Rules) dated 8th February, 2019

Every significant beneficial owner shall file a declaration in Form No. BEN-I to the company in which he holds the significant beneficial ownership within thirty days in case of any change in his significant beneficial ownership.

‘significant beneficial owner‘ in relation to a reporting company means an individual referred to in sub-section (1) of section 90, who acting alone or together, or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting company, namely:-

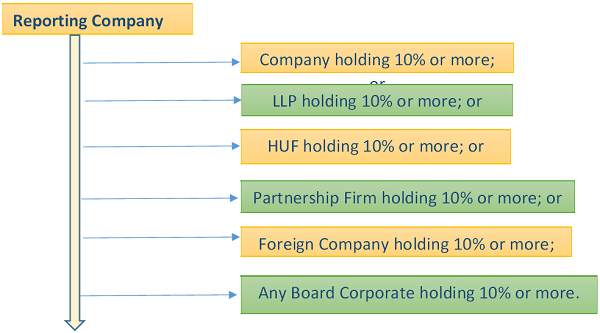

If any of the above is holding 10% or more in the Indian Company, then SBO Rules shall apply to such company.

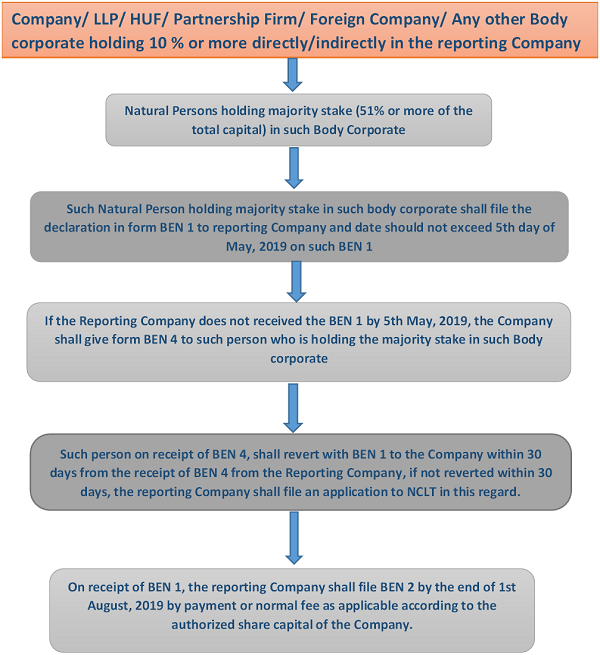

Disclosure under Section 90 in regard to significant Beneficial Ownership:

About the Author

Author Divya Goel, ACS is working as Assistant Manager- Company Secretary with Neeraj Bhagat & Co. Chartered Accountants, a Chartered Accountancy firm helping foreign companies in setting up business in India and complying with various tax laws applicable to foreign companies while establishing their business in India. Author can be reached at info@neerajbhagat.com.

Author Divya Goel, ACS is working as Assistant Manager- Company Secretary with Neeraj Bhagat & Co. Chartered Accountants, a Chartered Accountancy firm helping foreign companies in setting up business in India and complying with various tax laws applicable to foreign companies while establishing their business in India. Author can be reached at info@neerajbhagat.com.

If only individuals are holding shares more than 10% in a company still ben -2 form is required to file. No company trust or partnership holding any shares.

No.As they don’t have any indirect interest and in the register of members their name is already there.

If the SBO has made four transactions on different dates and given declaration accordingly. So, how to report the change in the shareholding in Form BEN-2. Whether the company has to file four separate Form BEN-2 or one form is sufficient?

1) A Pvt Ltd having 40% shares in the name of Trust. Trust is revocable. Who will be the beneficial owner in this case. Settlor or Trustees?

2) A Pvt Ltd already filed form MGT 5 and MGT 6 with ROC where Trustees are the registered owner of the shares? Whether we need to file BEN 2 in this case? if yes then who will be the beneficial owner in this case?

1) Holding Co A Ltd having 2 individual shareholders holding 50:50. Whether A ltd needs to get BEN 1 from those two individual shareholders? Both are husband wife.

2) Above A Ltd having 4 subsidiary company. Now in this case whether company needs to get BEN 1 from above two individuals? Pls reply

A is the holding of B C D and E(SUBSIDIARY), In Company A Shareholder who holds 20% shares transferred his shares to some one and left with 12%, in this case does Company A or that share holder who transferred the share is required to give declaration in BEN-1 to its Subsidiaries??

H ltd. is a company incorporated under companies act 1956. P Ltd. holds 99.9% of shares in H Ltd. and P Ltd. is a company strike off by the ROC Concerned or by the company itself by filing the relevant form STK-2. Now how will BEN 2 will be filled by H Ltd.

A Inc (A company incorporated in USA) holds 99.99% in X Pvt. Ltd. (An Indian Private Limited Company). P holds 10% in A Inc. and Q holds 30% in A Inc. Do X Pvt Ltd needs to file BEN-2 after taking BEN-1 from P and Q?

AIF holds 99.99% in a private limited company, and an individual holds 0.001% of equity shares. The shareholding pattern of a pvt limited company is ok or we should have another member . kindly advise

B Ltd (Public Co.) is the reporting company and in B Ltd. 65% shares are held by V Ltd. (Private Co.) and 98 % shares of V Ltd. are held by Turst.

Now Is B Ltd required to file BEN-2. if yes than who shall give BEN-1 to B Ltd.

Kindly Guide on the same.

In a company A ltd has 3 members, B ltd having 63% shares, C ltd having 36.5% shares & X1 having 0.5% shares subsequently B ltd has 3 members X1 having 52% shares, X2 having 41% shares & X3 having 7% shares and in C ltd there are 2 members X1 and X2 having 50% each shareholding, in the given case who is reporting company, SBO & who has to file BEN-2 and Is B ltd or C ltd has also file BEN-2?

Hi , In ABC Pvt Ltd ( Indian Company) 100 % share Holding is held by Another Indian Company PQR pvt Ltd .In PQR Pvt Ltd 28 % is held by X ( Indian) Whether BEN-2 need to be filed , If yes whether by 1)Declaration of holding Reporting Company or 2) Declaration under Section

Madam,

A ltd shares are Held by X1(51%) and X2(49%).

B ltd shares are held by A Ltd(51%) and Foreign Company(49%)…This is scenario…

In this case Does X1 need to file Ben 1 in B Ltd ?

Mr A is Karta of HUF which holds 5.63% of shares in XYZ Pvt Ltd. Mr A also holds 24% direct shares in XYZ Ltd. Mr A hence already filed the Ben1 and XYZ filed the BEN2 with Mr A as SBO. Now two scenarios 1) Mr A transfers his entire shareholding to another shareholder so what filing needs to be done 2) Along with first scenario HUF sells the entire shareholding to an individual, Mr A files revised Ben1 to company XYZ denoting change in holding to 0%. What does company XYZ need to file? ROC website not accepting return with revised holding as NIL.

A ltd is a company whose share are held by B ltd(foriegn company) and B ltd is held by C ltd (foreign company)and C ltd is a public limited foreign company ,

so, how to file BEN-2 and from whom the BEN-1 should be optained

Mr.A is holding 85% in the reporting company XYZ Ltd. B PVT Ltd is holding 0.1% and C PVT Ltd is holding 0.2% in the reporting company XYZ Limited. Mr.A is a shareholder of both B PVT Ltd and C PVT Ltd and holding 98% each in the shares of said companies. In this case whether he has to report BEN-1?

Which date is to be entered in Part 3(E)(j) of Form BEN-2 “Date of acquiring of Significant Beneficial Interest”.

We will be awaited for your kind attention and reply.

An Indian company holding 97% in foreign company and 2 individuals holding 40% each in Indian company and 1.5% each in the above foreign company.

Whether BEN-2 is applicable??

If yes, who shall file BEN-2 and to which company BEN-1 shall be given by the individual shareholders?

Thank you so much in advance for helping everyone individually..

Co. X is a 100% subsidiary of Co. Y(Foreign Co.).

In Co. Y there are 3 Individual’s holding more than 10% and One Individual holding more than 50%.

Should BEN -1 be obtained from all 4 individual’s or only from last individual holding more than 50%?

Thanks in Advance.

CA.Jitesh.

VZ Pvt Ltd holds 65% shares in BT Ltd Company and rest of the shares are held by public shareholders.

Further, a Trust holds 98% of VZ Pvt Ltd company and balance shares are held by individual.

Are provisions of SBO Rules applicable in the instant case? Also, which company would be required to file Form BEN-1 and BEN-2 in the given case?

ABC PVT LTD COMPANY HAVING OUTSIDE HOLDING OF 72.62% ,INCLUDING MAJORITY SHAREHOLDING FROM OTHER FOREIGN ENTITY,INCLUDES 97.32% FROM FOREIGN ENTITY,AGAIN ITS HOLDING FROM FOREIGN ENTITY UPTO 99.60%,INDIRECTLY ITS HOLD 35.89%,WHAT SHOULD I DO ?,BEN1 AND BEN2 IS APPLICABLE OR NOT?

Madam,

My Company is foreign subsidiary company in this case BEN-1 is required to be obtained and Filed BEN-2 with ROC… and which option is to be selected in BEN-2 forms??/

One company ABC ltd has a share holder PQR Ltd which hold 51% .

In PQR Ltd none one is holding more than 5 % individually and no share holders are acting in concert.

Is Ben2 required to be filed?

In a company ABC PVT ltd there is HUF & Firm holding 5% & 1% shares respectively. MR. A who is karta of that HUF and also have 25% PSR in that Firm. MR. A who also holds 50% shares in the company (ABC pvt ltd). Is company requires to file BEN 2? and who is SBO?

A Private Limited Company having 3 Directors and holding 4.42%, 7.90% and 3.89% respectively, other then directors there are 6 body corporate who holds stake in the company and Trust are the shareholders of that Body corporate. trust and trustee are the directors of the Private Limited company. now how to take the BEN-1 and file the BEN-2.

A pvt ltd. ( a reporting company ) has a partnership firm as its member holding 20% of share capital. Now, partnership firm has 3 partners ( X1, X2 & X3) . Each partner also has direct holding in reporting co. i.e A pvt. Ltd.

X1 ( 1.80%), X2(0.04%) & X3(20.04%). Will all partners become SBO by virtue of their indirect and direct holding in reporting co.? Should we take 20 % ( the entire holding of partnership firm ) as the indirect holding of each partner?

M Pvt Ltd is the reporting company, wherein 16% shares are held by S Pvt Ltd, 18% by Mr. Ram (Individual), 18% by Mr. Shyam (Individual), 16% by V Pvt Ltd and 16% by P Ltd.

Further, in S Pvt Ltd, 39.65% shares are held by V Pvt Ltd and 51.19% are held by Trust.

Will SBO Rules be applicable on M Pvt Ltd in relation with Trust? Further will Form Ben-2 be required to file?

BBB Limited is Holding 11 % of Paid – Up Capital of AAA Limited (Reporting Company).

VVV Limited is holding 65 % of Paid – Up Capital of BBB Limited, rest Paid Up Capital of BBB Limited is held by Individual & Others.

98% Paid – up Capital of VVV Limited is held by UUU Limited, rest 2% is held by Individual.

22% Paid Up Capital of UUU Limited is held by RAM (Individual), 30 % Held By BBB Limited, 27 % Held By PPP Limited and 19 % is held by VVV Limited.

45 % Paid Up Capital of PPP Limited is held by VVV Limited.

In this case which Company is required to provide BEN – 1 and which Compnay is required to file BEN – 2.

Please do the needful and Oblige

BBB Limited is Holding 11 % of Paid – Up Capital of AAA Limited (Reporting Company).

VVV Limited is holding 65 % of Paid – Up Capital of ABC Limited, rest Paid Up Capital of BBB Limited is held by Individual & Others.

98% Paid – up Capital of VVV Limited is held by UUU Limited, rest 2% is held by Individual.

22% Paid Up Capital of UUU Limited is held by RAM (Individual), 30 % Held By BBB Limited, 27 % Held By PPP Limited and 19 % is held by VVV Limited.

45 % Paid Up Capital of PPP Limited is held by VVV Limited.

In this case which Company is required to provide BEN – 1 and which Compnay is required to file BEN – 2.

Please do the needful and Oblige.

explained very nice on BEN-2 and replies to query

Dear ,

Please tell me which date to be mentioned in these:

1)Date of entry of name in register u/s 88

2)Date of acquiring Significant Beneficial Interest

3) Date of declarations under sub-section (1) of Section 90

4)Date of receipt of the declaration by the company

please reply urgently.

A pvt. Ltd. ( Reporting Co.) has 3 members:

X1 (10% shareholding )

X2 (10% shareholding) &

B pvt. Ltd. having 80% shareholding .

Now B pvt ltd.has 4 individual members :

X1 ( 30% shareholding)

X2 ( 30% sharehoding)

X3 ( 20% shareholding)

X4 ( 20% shareholding)

None of the individual member has majority stake in the body corporate B pvt. ltd. but all are family members related to each other. Are they deemed to be acting together?

X1 and X2 are brothers having both having direct and indirect holding in A pvt. ltd. Do they all qualify as Significant beneficial owners through their indirect holding in A pvt. ltd. through its member i.e. B pvt. Ltd. ?

A pvt. Ltd. ( Reporting Co.) has 3 members:

X1 (10% shareholding )

X2 (10% shareholding) &

B pvt. Ltd. having 80% shareholding .

Now B pvt ltd.has 4 individual members :

X1 ( 30% shareholding)

X2 ( 30% sharehoding)

X3 ( 20% shareholding)

X4 ( 20% shareholding)

None of the individual member has majority stake in the body corporate B pvt. ltd. but all are family members related to each other. Are they deemed to be acting together?

X1 and X2 are brothershave both having direct and indirect holding in A pvt. ltd. Do they all qualify as Significant beneficial owners through their indirect holding in A pvt. ltd. through its member i.e. B pvt. Ltd. ?

A pvt. Ltd. ( Reporting Co.) has 3 members:

X1 (10% shareholding )

X2 (10% shareholding) &

B pvt. Ltd. having 80% shareholding .

Now B pvt ltd.has 4 individual members :

X1 ( 30% shareholding)

X2 ( 30% sharehoding)

X3 ( 20% shareholding)

X4 ( 20% shareholding)

None of the individual member has majority stake in the body corporate B pvt. ltd. but all are family members related to each other. Are they deemed to be acting together?

X1 and X2 are brothers having both direct and indirect holding in A pvt. ltd. Do they all qualify as Significant beneficial owners through their indirect holding in A pvt. ltd. through its member i.e. B pvt. Ltd. ?

Hi,

A PVT Ltd company is a 100% subsidiary of Foreign company and having no individual shareholder. Whether BEN-2 needs to be filed.

In point i of BEN-2, percentage of shares will be calculated of only Equity shares or also preference shares?

If a foreign company holds 51.22% and foreign individual is holding 24.39% in an Indian company with local resident holding the balance of 24.39%, does the SBO apply here and if yes who has to do it.

Company “ABC Pvt. Ltd” is being held 100 % by foreign company “PQR Inc.”.

Foreign company “PQR Inc.” is being held 100 % by another foreign company “XYZ Inc.”

“XYZ Inc.” further being held by 100% by another foreign company “APC Inc.” which is a publicly held company and no single individual has majority stake in “APC Inc.”

Pls advice, who shall be SBO in this case. and in case SBO is non identifiable, still Ben-2 is to be filed?

IN SPL LTD , F LTD HOLDS 23.61% , B LTD HOLDS 23.61%

IN P LTD , SPL LTD HOLDS 11.17% AND B LTD HOLDS 11.12%

IN F LTD , B LTD HOLDS 30.41%

IN B LTD , G(HUF) HOLDS 20.61%.

Kindly Advice.

IN SPL LTD , F LTD HOLDS 23.61% , B LTD HOLDS 23.61%

IN P LTD , SPL LTD HOLDS 11.17% AND B LTD HOLDS 11.12%

IN F LTD , B LTD HOLDS 30.41%

IN B LTD , G(HUF) HOLDS 20.61%.

Kindly Advice.

X Ltd has issued fully convertible debentures to Y Ltd and Z Ltd (1,50,000 each). Y and Z have individual shareholders having majority shareholding in them as per section 90 and the applicable rules. In such case what would be the nature of indirect holding or exercise of right in the reporting company when BEN 1 is being given by Y and Z to X Ltd – By Virtue of shares / voting rights in shares / rights on distributable dividend or any other distribution / exercise of control / exercise of significant influence ?

if there are only individual in a co. and they all are also directors and they all have more than 10% holding of shares then what about the form BEN2

n the following situation please help in identifying SBO-

ABC Private limited has 5 shareholders A holding 2.03% shares B also 2.03% C (Foreigner individual) holding 26.27% D (Foreigner individual) holding 26.33% and PTE ltd(Foreign company) holding 43.34% shares in ;PTE ltd there are 3 shareholders A holding 34 % C 33% and D 33% ..

Kindly advice on the applicability of ben2 on the reporting company ABC Pvt.

Dear Madam,

In A pvt ltd the shareholders are individuals, Company, HUF and Partnership firm – Company B holds 29%, HUF hold 10% and Firm holds 2% in A Pvt Ltd. Is A pvt ltd required to file Form BEN-2.

ABC PVT LTD

HAVE 2 SHARE HOLDERS (BOTH ARE NATURAL PERSON)

i.e

THERE IS NO LAYERS OF INVESTMENT IN RELATION TO INVESTMENT IN ABC P LTD

MR A HOLDS 50% OF TOTAL SHARE

MR B HOLDS 50% OF TOTAL SHARE

MR A & MR B ARE BROTHER

1) MR A & MR B REQUIRE TO SUBMIT BEN 1 WITH ABC P LTD

2) MR A & MR B ARE NATURAL PERSON, COMPANY NEEDS TO FILE BEN-2 FORM WITH ROC

can anyone help me in getting PDF of Form BEN-1 in which the SBO has to give declaration. Or i can use a word document for that?

Thanks in advance.

In the following situation, please help in identifying SBO-

“A Pvt. Ltd. having 2 shareholders- Mr. B (25%), C Pte Ltd. (Foreign company holding 65%). Now there are 2 individual shareholders in company C Pte Ltd.- Mr. D & Mr. E, both holding 50 % each in Company C Pte Ltd.

Whether this form Ben 2 applicable on reporting company A Pvt. Ltd.?

A pvt ltd has 6 Shareholders in total. (2 being DIRECTORS themselves having 19% & 32% shareholding, 2 are WIVES of Directors holding 7% & 5% Shares & B pvt ltd & C pvt ltd holding 18% & 19% shares of A pvt ltd respectively) .

What will be the number of Members through whom indirect holding or right in

reporting company is being exercised?

Kindly Advice as to BEN1 also.

Dear Mam,

While Considering the Majority Stake, it is required to Considered Individual Holding Only or, Individual + PACs with Individual also need to be considered??

If shareholder is company, HUF, LLP or Partnership firm

thanks for clarity as per the article if any shareholder holding 10% or above shall file ben-1 with company.