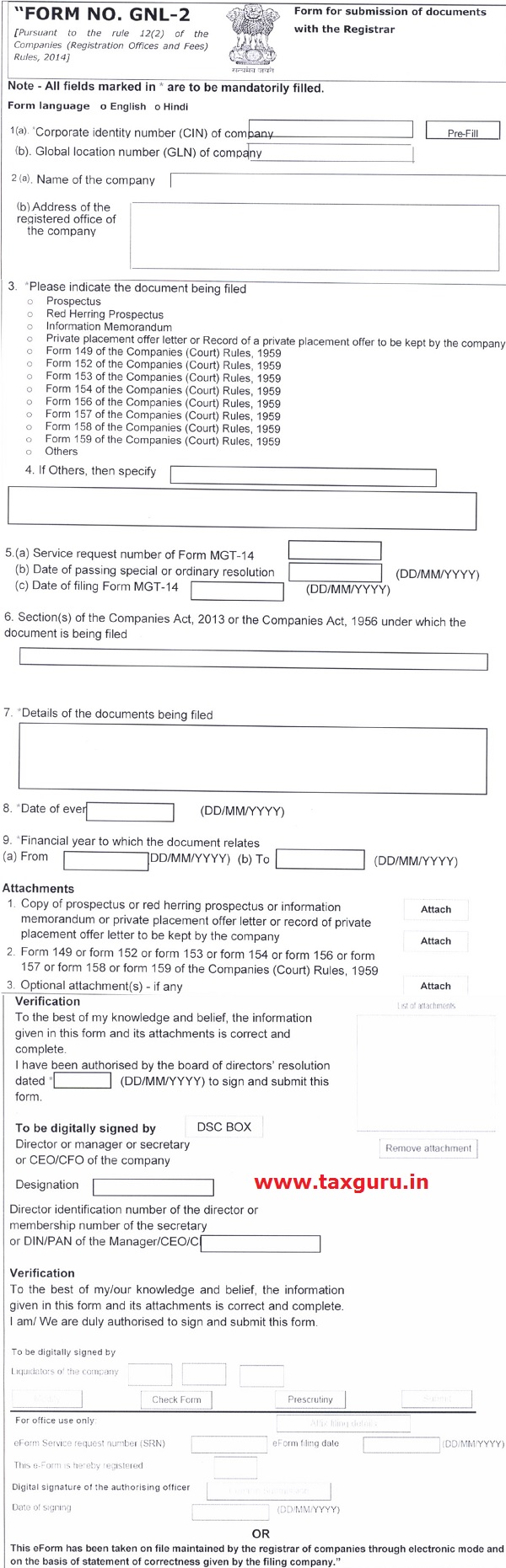

MCA has released revised form No. GNL-2 vide Companies (Registration Offices and Fees) Amendment Rules, 2020. A Company can file certain documents with the Registrar of Companies by filing this e-Form GNL-2 and in case there is no e- Form prescribed for filing any document with Registrar, then company or liquidator can file such documents through this e-Form.

Government of India

MINISTRY OF CORPORATE AFFAIRS

Notification

New Delhi, 18th February, 2020

G.S.R. 127(E).-In exercise of the powers conferred by sections 396, 398, 399, 403 and 404 read with sub-sections (1) and (2) of section 469 of the Companies Act, 2013 (18 of 2013), the Central Government hereby makes the following rules further to amend the Companies (Registration Offices and Fees) Rules, 2014, namely:-

1. (1) These rules may be called the Companies (Registration Offices and Fees) Amendment Rules, 2020.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. For form No.GNL-2, the following form shall be substituted, namely,-

[F.No. 01/16/2013 CL-V (Pt-I)]

K.V.R. Murti, Joint Secretary.

Note: The principal rules were published in the Gazette of India, Part II, Extra ordinary, Section 3, Sub-section (i) vide number G.S.R. 268(E), dated the 31st March, 2014 and subsequently amended by:

| Serial Number | Notification Number | Notification Date |

| 1. | G.S.R. 297(E) | 28-04-2014 |

| 2. | G.S.R. 122(E) | 24-02-2015 |

| 3. | G.S.R. 438 (E) | 29-05-2015 |

| 4. | G.S.R. 493(E) | 06-05-2016 |

| 5. | G.S.R. 48(E) | 20-01-2018 |

| 6. | G.S.R. 435(E) | 07-05-2018 |

| 7. | G.S.R.616 (E) | 05-07-2018 |

| 8. | G.S.R.797 (E) | 21-08-2018 |

| 9. | G.S.R.905(E) | 20-09-2018 |

| 10. | G.S.R.143 (E) | 21-02-2019 |

| 11. | G.S.R.329(E) | 24-04-2019 |

| 12. | G.S.R.340(E) | 30-04-2019 |

| 13. | G.S.R.527(E) | 25-07-2019 |

| 14. | G.S.R. 749(E) | 30-09-2019 |