Acceptance of Deposits

Section 73 to 76 of the Companies Act 2013 (herein after called the Act) read with Rules made under Chapter V of the Companies Act, 2013

Acceptance of deposit

Deposit is one of the sources available with company to raise funds for meeting its short term and long term fund requirements.

Section 73 to 76 of the Companies Act 2013 (herein after called the Act) read with Rules made under Chapter V of the Companies Act, 2013 regulate the invitation and acceptance of deposits.

In this article I will present the brief discussion on the ROC filing, time limits of filing and consequences.

As companies Act 2013, “deposit” includes any receipt of money by way of deposit or loan or in any other form, by a company, but does not include such categories of amount as may be prescribed under Rule 2(c) of the Companies (Acceptance of Deposit) Rules, 2014.

I am taking only few transactions here which are Exempted deposits out of the transactions as specified in Rule 2(1)(c) of Acceptance of deposits. These transactions are general and coming in to day to day operation of the Company:

1.Amount received by a Company from any other company [which is normally termed as Inter Corporate Deposits (ICD)].

2.Amount received pursuant to an offer towards subscription to any securities, including share application money or advance, pending allotment

Exception: If the securities not allotted within 60 days from the date of receipt of the application money or advance and such amount is not refunded to the subscribers within 15 days from the date of completion of 60 days,

3.Any amount received as a loan or facility from any Bank or FI.

4.Amount brought in by promoters as unsecured loans in stipulation of any lending Financial Institution or Banks subject to: –

(a)Loan is brought in pursuance of stipulation imposed by lending institutions on promoters to contribute such finance; and

(b)Loan is provided by the promoters themselves and/or by their relatives.

(c)Exemption available only till loans are repaid and not thereafter.

5.Business advances (amount received in the course of, or for the purposes of, the business of the company):

For supply of goods or provision of services provided that such advance is appropriated against supply of goods or provision of services within a period of 365 days. However, if the advance is subject matter of any legal proceedings before any court of law the limit of 365 days would not be applicable.

In connection with consideration for an immovable property, provided that such advance is adjusted as per agreement or arrangement.

Security deposit for performance of contract for supply of goods or provision of services.

Advance under long term projects for supply of capital goods.

6. Bonds / debenture secured by first charge on any assets (excluding intangible assets) or convertible into shares within 5 years.

7. Any amount received from a person who is:-

- a director of the company (both Public and Private) or

- a relative of the director of the Private company

Provided that the director of the company or relative of the director of the company give declaration in writing that amount is not given out of fund borrowed by him from other and company shall disclose the details of money so accepted in the Board’s report.

Applicability;-

Provisions under section 73 to 76 of the Companies Act 2013 and the companies acceptance of Deposits Rules, 2014 shall apply to all companies Except:-

- Banking Companies

- NBFCs registered with RBI

- Notified companies, by central Government after consultation with RBI.

Company can accept the deposits from members as well as from public in accordance to section 73 to 76 of companies Act 2013,

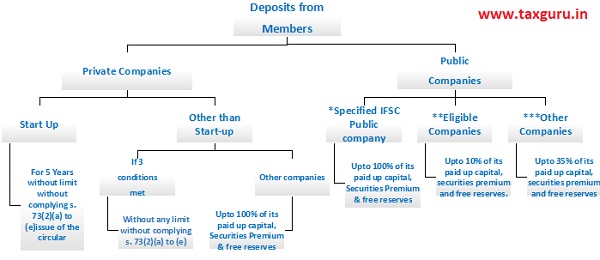

1. Below mentioned chart describe the ceiling limit within which companies can accept deposits from its members.

*Specified IFSC Public company

An unlisted public company which is licensed to operate by RBI or SEBI or IRDA from the International Financial Services Centre located in an approved multi services SEZ set up under the Special economic Zones Act,2005.

**Eligible Companies

- A public company having a net worth of not less than Rs.100 Crore or

- Turnover not less than Rs. 500 Crore

***Other Companies

- A public company other than

- Specified IFSC Public company

- Eligible Company

Compliances for accepting deposits from members by Private Companies which are covered under the Exemption Notification:-

company shall be required to:-

- Take an approval of member by Passing Ordinary resolution in General Meeting.

- Company shall provide security by way of creating charge on the excluding intangible assets of the company for the repayment of the amount of deposit and interest thereon for an amount which shall not be less than the amount remaining unsecured by the deposit Insurance.

- Company shall accept the deposit or renew any deposit whether secured or unsecured only if intending depositor given application containing a declaration that deposit is not made out of borrowed fund.

- Furnish a deposit receipt to the depositors within 21 days from the date of receipt of money or realisation of cheques.

- Company shall maintain register of deposit and make entries within 7 days from the date of issuance of the deposit receipt and such entries authenticated by a directors and company secretary of the company.

- No company shall accept deposits from members which are repayable on demand or upon receiving a notice within a period of less than 6 months or more than 36 months from the from the date of acceptance or renewal of such deposit.

Exception – company may, accept or renew such deposits subject to the condition that Such deposits shall not exceed 10% paid up share capital and free reserves and securities premium account of the company, and Such deposits are repayable not earlier than 3 months from the date of such deposits or renewal.

- No company shall invite or accept or renew any deposit in any form, carrying a rate of interest or pay brokerage thereon at a rate exceeding NBFC norms.

- Form DPT-3 to be filed by company annually on or before 30thJune, of every year and furnish the information contained therein as on the 31st day of the march of that year duly audited by auditor of the company.

Compliances for accepting deposits from members by Public company (including Specified IFSC Public company and Eligible Companies):-

company shall be required to:-

- Take an approval of member by Passing Ordinary resolution in General Meeting.

- Issue a circular in Form DPT-1 to its members and File a copy of the circular and statement with the Registrar within 30 days before the date of issue of the circular. Certificate of statutory auditors is required to be attached with DPT-1.

- The company shall execute a deposit trust deed in Form DPT-2 at least seven days before issuing the circular in Form DPT-1.

- Deposit sum which shall not be less than 20% of the deposits maturing during a financial year and the financial year next following, and keep in a scheduled bank in a separate bank account to be called as deposit repayment reserve account.

- In case of issue of secured deposits, provide security, way of a charge on its assets excluding intangible assets of the company for the repayment of the amount of deposit and interest thereon for an amount which shall not be less than the amount remaining unsecured by the deposit Insurance.

- Furnish a deposit receipt to the depositors within 21 days from the date of receipt of money or realisation of cheques.

- Company shall maintain register of deposit and make entries within 7 days from the date of issuance of the deposit receipt and such entries authenticated by a directors and company secretary of the company.

- No company shall accept deposits from members which are repayable on demand or upon receiving a notice within a period of less than 6 months or more than 36 months from the from the date of acceptance or renewal of such deposit.

Exception – company may, accept or renew such deposits subject to the condition that Such deposits shall not exceed 10% paid up share capital and free reserves and securities premium account of the company, and Such deposits are repayable not earlier than 3 months from the date of such deposits or renewal.

- No company shall invite or accept or renew any deposit in any form, carrying a rate of interest or pay brokerage thereon at a rate exceeding NBFC norms.

- Form DPT-3 to be filed by company annually on or before 30thJune, of every year and furnish the information contained therein as on the 31st day of the march of that year duly audited by auditor of the company.

Compliance as per the Companies Act 2013 for accepting deposits from Public:-

1. Pass special resolution and file the same with ROC before making any invitation to the Public.

2. Obtain credit rating and file with ROC along with DPT 3

3. Create Charge within 30 days of such acceptance on its assets of an amount not less than the amount of deposits accepted

4. Issue a circular in Form DPT-1 in English language and in vernacular language and shall place such circular on its website, if any.

5. The company shall execute a deposit trust deed in Form DPT-2 at least seven days before issuing the circular.

6. Furnish receipt within 21 days of amount received to the depositor. Deposit sum which shall not be less than 20% of the deposits maturing during a financial year and the financial year next following, and keep in a scheduled bank in a separate bank account to be called as deposit repayment reserve account.

7. Government Company shall not accept or renew any deposit, if Total Deposits exceeds 35% of paid up capital and free reserves and securities premium account.

8. No company shall invite or accept or renew any deposit in any form, carrying a rate of interest or pay brokerage thereon at a rate exceeding NBFC norms.

9. An eligible company can accept deposits from public only to the extent of 25% of its paid-up capital and free reserve and securities premium account.

Penal rate of Interest:-

A company shall have to pay an interest of 18% p.a. for the overdue period of deposits, matured and claimed but remaining unpaid.

Punishment for contravention:-

If any company Accepts or invites or allows or causes any other person to accept or invite on its behalf any deposit in contravention of the manner or the conditions prescribed under section 73 or section 76 or rules made thereunder or Fails to repay the deposit or part thereof or any interest due thereon within the time specified under section 73 or section 76 or rules made thereunder or such further time as may be allowed by the Tribunal under section 73

| On the Company | In addition to the payment of the amount of deposit or part thereof and the interest due, a fine of minimum INR. 1 crore or twice the amount of deposit so accepted, whichever is lower, which may extend to INR.10 crore; and |

| On the officers of the Company | Who is in default: imprisonment up to seven years and with a fine of not less than INR 25 lakh which may extend to INR.2 crore: or both

And If it is proved that the officer of the company who is in default, has contravened such provisions knowingly or wilfully with the intention to deceive the company or its shareholders or depositors or creditors or tax authorities, he shall be liable for action under section 447 (fraud). |

Author of this article is CS YOGESH GUPTA & can be reached at [email protected] or 7742681270

Reference- https://taxguru.in/company-law/acceptance-deposits-companies-members.html

Can a pvt ltd company accept money from an individual to run business ? What is procedure to get back money given by an individual to a pvt ltd Co. ?Is there s penalty on the Company for taking such a money and not Returning the same.?

1) whether there is a need to create DRR if deposit accepted for 6m or less.

2)When does sec 76A apply and rule 21 of deposit apply.

Sir Any chitti companys elegibale for collectiing recuring deoposit or fixed deposit from public with put permission from reserve bank if the company viloet this what was the punsishment

. pls advice sir

Hi yogesh,

few questions

1. can private company accepts interest free deposits from its members under the scheme?

2. can private company design a scheme and pay maturity premium to members?

3. can private company extend option of conversion of deposits to equity at the time of maturity?