This article deals with the concept of beneficial owner, registered owner of shares & wholly Owned Subsidiary.

Before moving forward we will throw a light on the meaning of the two words: Registered Owner, Beneficial Owner & Wholly Owned Subsidiary:

a) Registered owner – A person whose name is registered in the Register of Members as the as the holder of shares in that company but who does not hold the beneficial interest in such shares is commonly called as the registered owner of the

b) Beneficial owner – Whereas a person who actually holds the beneficial interest in the shares but whose name is not registered in the Register of Members is commonly called as the beneficial owner/legal

c) Wholly Owned Subsidiary- A wholly owned subsidiary is a company that is completely owned by another company. The company that owns the subsidiary is called the parent company or holding company. The parent company will hold all the shares of the subsidiary.

Now the question arise how a wholly owned subsidiary can be created as minimum no of members must be 2 in case of private company and 7 in case of public company & to make a wholly owned subsidiary entire share capital shall be held by single entity??

Under the Companies Act, 2013

First proviso to section 187:

The first proviso of section 187 allows a holding company to hold the shares of its wholly-owned subsidiary in the name of nominees, other than in its own name for the purpose of meeting the minimum number of members as per the Act.

- To satisfy the requirement of minimum number of members (i.e.) 2 (Two) in case of a private limited company and 7 (Seven) in case of a public limitedcompany

- To incorporate or to have a wholly owned

Provisions of Section 89

Section 89

Mandatory Declarations to be made:

Section 89 read with rule 9 of the Companies (Management and Administration) Rules, 2014 deals with declaration of beneficial interest in the shares held. It generally includes three following steps:

- The person or a company (as the case may be), who holds the beneficial interest in any share shall submit the declaration in Form MGT 4 along with the covering or request letter to the company in which they hold the beneficial interest within thirty days from the date of acquisition or change in beneficial

- The person or the company (as the case may be), whose name is to be entered into the register of members of the company shall submit the declaration in Form MGT 5 within thirty days from the date of acquisition or change in beneficial interest to the company

- On receipt of declaration in Form MGT 4 & 5 by the company, the same shall be placed before the board for approval. The company shall also intimate the Registrar of Companies (‘ROC’) in e-Form MGT 6 within thirty days from the date of receipt of declaration in Form MGT 4 &

Example for understanding to this section easily:

1. A wants to hold 100% shareholding in X Pvt. Ltd, but he can’t do so as he will have to take care the limit of minimum number of members, so in that case he will need at least one more person to fulfill minimum Requirement i.e. 2 (at least)

Now he can present a person say Mr. B, on his behalf whose name shall be presented on register of members but indirectly he will be the owner(beneficial owner) and will be controlling company.

In this case

Mr. B is Registered Owner

Mr. A is Beneficial Owner

X Pvt. Ltd. Is Company

Same example can also be taken for Public Company (where there must be at least 7 members).

In place of X Pvt. Ltd., any company can be there.

In this section responsibility arises on 3 persons namely:

1- Registered owner

2- Beneficial owner

3- Company

Intimation to Registrar:

Under this section Registered owner/ Beneficial owner/ Company is required to intimate to ROC after entering his name in register of members or change therein the declaration so filed.

1- Registered owner shall file with COMPANY, a declaration in form MGT-4 within 30 days of entering his name in register of members or change therein as the case may be.

2- Beneficial owner shall file with COMPANY, a declaration in form MGT-5 within 30 days of entering his name in register of members or change therein as the case may be.

3- Company Shall file with ROC, a return in form MGT-6 within 30 days of receiving such declaration.

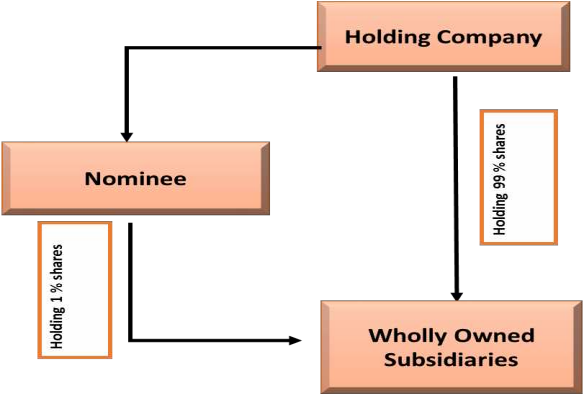

Given below is the diagram illustrating a situation of a holding company appointing a nominee to meet the statutory minimum limit of two members in a wholly-owned private subsidiary company.

FAQs

Looking at the provisions above the following questions may be discussed:

Question:

In case the beneficial holder and registered holder are two different people, then who is entitled to receive dividend under section 123 of the Act?

Answer:

Section 123 (5) states “No dividend shall be paid by a company in respect of any share therein except to the registered shareholder of such share or to his order or to his banker and shall not be payable except in cash.” As stated prima facie the right to receive dividend lies with the registered holder of the shares.

Question:

Can the beneficial holder receive dividend by any chance?

Answer:

Yes, referring to the provision stated above the beneficial holder can receive dividend from the company by virtue of the order given by the registered holder. It is also worth mentioning that being the beneficial holder, the profits, benefits, and advantage shall be ultimately derived by the beneficial owner although the person receiving them at the first instance may be the registered holder.

Question:

In case the beneficial holder and registered holder are two different people, who is entitled to receive the bonus shares /right shares (if any) declared by the company?

Answer:

As per section 63 of the Act the members (i.e. registered holders are entitled to receive the bonus shares issued by the company. Similarly section 62 uses the word “to the existing shareholders of the company” which again signifies that the registered holder shall be entitled to receive the right shares offered by the company.

Question:

Can name of a trust be entered in the register of members of the company?

Answer:

Under the erstwhile Companies Act, 1956, section 153 specifically stated that trust cannot become a member of a company. However, under the Act a trust can become a member if there is a specific provision to the same effect in the articles of association of the company.

Question:

In case of transfer in abeyance, who is entitled to receive dividend?

Answer:

In case a transfer has not been registered in the books of a company, then the transferor shall be entitled to receive dividend if he is a registered holder as on the record date.

Case studies on giving declaration u/s 89 of the Act

1. Mr. A becomes the registered holder of shares of JKL Ltd whose beneficial holder is M/s XYZ Ltd, a Partnership Firm.

Since a beneficial interest is created therefore, the declaration as prescribed u/s 89 of the Act shall be given by Mr. A and M/s XYZ Ltd and subsequently by JKL Ltd.

2. Mr. A is the registered owner of 500 shares of JKL Ltd whose beneficial holder is M/s XYZ Ltd, a Partnership Firm. Again Mr. B is the registered owner of 1000 shares of JKL Ltd whose beneficial holder is M/s XYZ Ltd, a Partnership Firm. Mr. A transfers 500 shares to Mr. B.

The requirement to give declaration arises only in case of a change in beneficial ownership. Therefore, in the above case since the beneficial owner remains the same, no declaration is required to be given. However, since the registered owner of the shares is transferring the shares to another registered owner of the shares, therefore, the Share Transfer deed is to be executed and thereafter form SH-4 needs to be sent to the Company which is sufficient to show the change in the register of members.

3. Mr. A is the registered owner of 500 shares of JKL Ltd whose beneficial holder is M/s XYZ Ltd, a Partnership Firm. Mr. A transfers 500 shares to Mr. X whose beneficial interest shall lie with M/s BBC Ltd,.

In the instant case there is change in the beneficial interest of the shares held by Mr. A, therefore, declaration as prescribed u/s 89 shall be given by Mr. X and M/s BBC Ltd, a and thereafter by ABC Ltd.

Author of this article is CS Yogesh Gupta & can be reached at csyogeshgupta@gmail.com and 7742681270]

Very Good article.

MGT-4 shall be submitted by registered owner and MGT-5 by beneficial owner.In the above Article its reverse.Correct me if I am wrong