Summary: The GST Council introduced a special procedure under Section 148 of the CGST Act, 2017, to address past discrepancies in Input Tax Credit (ITC) claims for FY 2017-18 to 2020-21. Amendments in Sections 16(5) and 16(6) of the CGST Act, effective retrospectively, allow taxpayers to avail ITC under specific conditions. These changes, implemented through Notification No. 22/2024 and Circular No. 237/31/2024, aim to rectify orders issued under Sections 73, 74, 107, or 108 for ITC violations related to Section 16(4). Taxpayers must submit electronic rectification applications on the GST portal within six months of the notification. The respective authority will then decide on the application and issue a rectified order within three months. Rectification forms such as GST DRC-08 and GST APL-04 have been updated to support these changes. Scenarios include pending demand notices, ongoing appeals, or no appeals filed. Businesses should carefully review these provisions to ensure compliance and resolve past ITC disputes effectively. These steps provide procedural clarity and consistent implementation, encouraging taxpayers to utilize this mechanism for resolving issues under GST law.

Analysis of a Special Procedure for the Rectification of Orders Notified Under Section 148 of the CGST Act, 2017 (Relief from demand raised due to wrong availment of ITC for FY 2017-18, 2018-19, 2019-20 and 2020-21 in Contravention of Section 16(4))

Analysis of a Special Procedure for the Rectification of Orders Notified Under Section 148 of the CGST Act, 2017

(Relief from demand raised due to wrong availment of ITC for FY 2017-18, 2018-19, 2019-20 and 2020-21 in Contravention of Section 16(4))

The Goods and Services Tax (GST) Council, in its 53rd meeting held on June 22, 2024, recommended relaxation in the condition of Section 16(4) of the Central Goods and Services Tax (CGST) Act, 2017 (hereinafter referred to as “the Act”) for the initial years of GST implementation, i.e., financial years 2017-18, 2018-19, 2019-20, and 2020-21.

The Council proposed that the time limit to avail input tax credit (ITC) in respect of any invoice or debit note under Section 16(4) of the Act, through any return in FORM GSTR-3B filed up to November 30, 2021, for the aforementioned financial years, be deemed to be November 30, 2021.

Additionally, it recommended a conditional relaxation of the provisions of Section 16(4) in cases where registered persons, whose registrations had been canceled, filed returns for the period from the effective date of cancellation to the date of revocation of such cancellation, provided these returns were filed within 30 days of the revocation order. To implement these changes, the Council proposed a requisite retrospective amendment to Section 16(4) of the CGST Act, effective from July 1, 2017.

In response to these recommendations, the Central Government has inserted sub-sections (5) and (6) into Section 16 of the Act through Sections 118 and 150 of the Finance (No. 2) Act, 2024.

Sub-section (4), sub-section (5) and sub-section (6) of section 16 of the Act are reproduced below:

“(4)A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the thirtieth day of November following the end of financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier.

Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019.

(5) Notwithstanding anything contained in sub-section (4), in respect of an invoice or debit note for supply of goods or services or both pertaining to the Financial Years 2017-18, 2018-19, 2019-20 and 2020-21, the registered person shall be entitled to take input tax credit in any return under section 39 which is filed upto the thirtieth day of November, 2021.

(6) Where registration of a registered person is cancelled under section 29 and subsequently the cancellation of registration is revoked by any order, either under section 30 or pursuant to any order made by the Appellate Authority or the Appellate Tribunal or court and where availment of input tax credit in respect of an invoice or debit note was not restricted under sub-section (4) on the date of order of cancellation of registration, the said person shall be entitled to take the input tax credit in respect of such invoice or debit note for supply of goods or services or both, in a return under section 39,––

(i) filed upto thirtieth day of November following the financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier; or

(ii) for the period from the date of cancellation of registration or the effective date of cancellation of registration, as the case may be, till the date of order of revocation of cancellation of registration, where such return is filed within thirty days from the date of order of revocation of cancellation of registration, whichever is later.”

Further, Section 150 of the Finance (No.2) Act, 2024 (reproduced below), provides that no refund of any tax paid or the input tax credit reversed shall be granted due to retrospective insertion of sub-section (5) and (6) of section 16 of the Act.

“150. No refund shall be made of all the tax paid or the input tax credit reversed, which would not have been so paid, or not reversed, had section 118 been in force at all material times.”

Implementation of Amendments: GST Council’s Recommendations and CBIC’s Action

The Goods and Services Tax (GST) Council, in its 54th meeting held on October 8, 2024, recommended the establishment of a mechanism to implement the newly inserted sub-sections (5) and (6) of Section 16 of the CGST Act, 2017. Additionally, the Council suggested notifying a special procedure under Section 148 of the Act for the rectification of orders. It also recommended issuing a circular to provide procedural clarity and address various issues related to the implementation of these provisions.

In response, the Central Board of Indirect Taxes and Customs (CBIC) issued Notification No. 22/2024-Central Tax on October 8, 2024, and Circular No. 237/31/2024-GST on October 15, 2024. These documents detail the mechanism for implementing these amendments and provide a special procedure for rectifying orders related to the wrong availment of Input Tax Credit (ITC).

Scope and Applicability

- Orders issued under Sections 73, 74, 107, or 108 of the CGST Act for ITC demands due to violations of Section 16(4).

- Taxpayers who are now eligible for ITC under Sections 16(5) or 16(6).

- Cases where no appeal have been filed against the said orders.

Procedure for Rectification

1. Application Filing:

- Taxpayers must submit an electronic application for rectification on the GST portal within six months of the notification’s issuance (i.e., by April 8, 2025).

- Applications should include details such as GSTIN, order specifics, and ITC demand particulars, as outlined in Annexure A of Notification No. 22/2024.

2. Authority and Decision:

- The rectification process will be managed by the officer who issued the original order.

- The officer is required to decide on the application and issue a rectified order within three months of receiving the request.

3. Form Updates:

- FORM GST DRC-08: For rectifications under Sections 73 or 74 (ITC wrongly availed/utilized, whether due to fraud or otherwise).

- FORM GST APL-04: For rectifications under Sections 107 or 108 (appeals against adjudicating or revisional authorities’ orders).

4. Eligibility for Rectification:

- Rectifications are restricted to ITC that was wrongly availed due to non-compliance with Section 16(4) but is now eligible under Section 16(5) or 16(6).

Scenarios for Rectification and ITC Claims

| Scenario | Action may be taken by the tax authorities and/or the taxpayers |

| No Demand Notice Issued | If proceedings are ongoing for ITC violations under Section 16(4) but no demand notice under Sections 73 or 74 has been issued, authorities must consider the retrospective provisions of Sections 16(5) and (6). |

| Demand Notice Issued but No Final Order | In cases where a demand notice has been issued, adjudicating authorities must account for the retrospective provisions when passing orders under Sections 73 or 74. |

| Demand Order Issued and Appeal Filed but No Order Passed by Appellate Authority | If an order is under appeal with the Appellate Authority, the retrospective provisions must be considered when issuing final orders under Section 107. |

| Revisional Authority Proceedings Pending | If the proceedings is pending with the Revisional Authority, the retrospective provisions must be considered before passing final orders under Section 108. |

| No Appeal Filed Against Demand Notice | Taxpayers may file rectification applications under Notification No. 22/2024 within six months. |

Procedure for filing an application for rectification in GST Portal:

In case where an application for rectification of an order is issued under section 73 or section 74 of the Act:

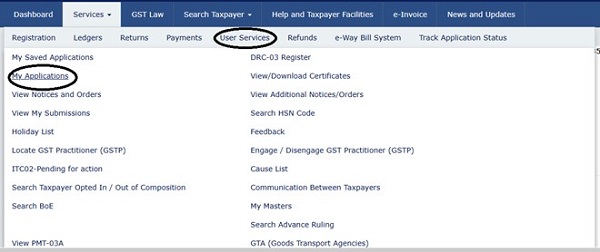

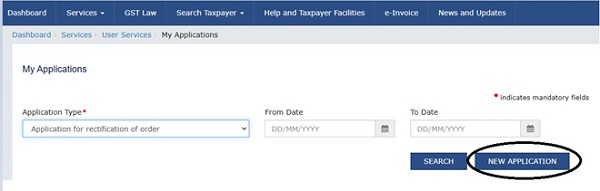

Services > User Services > My Applications > Application for rectification of order > New Application

–

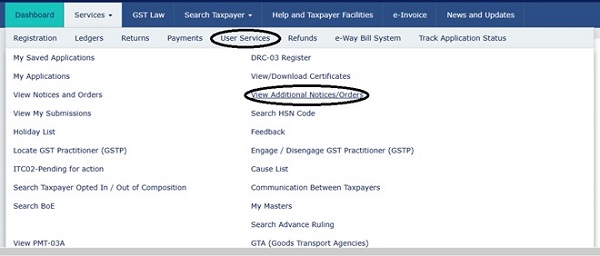

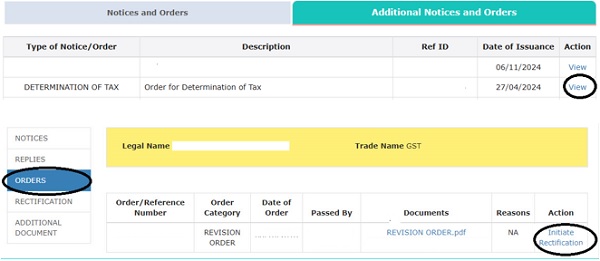

In case where an application for rectification of an order is issued under section 107 and under section 108 of the Act: Services > User Services > View Additional Notices/Orders > Click the “View” hyperlink > Orders > click the “Initiate Rectification”

–

Conclusion

The amendments introduced in Sections 16(5) and 16(6) provide a robust mechanism for addressing past ITC discrepancies under the GST framework. The special rectification procedure, coupled with clarifications from the GST Council and CBIC, ensures consistent application and procedural ease for taxpayers. Businesses are encouraged to utilize these provisions to resolve past disputes and comply with GST regulations.