Finance Ministry has issued Draft GOODS AND SERVICES TAX -INVOICE RULES, which set rules for invoice which will be issued after the implementation of GST. This rules is very important as this will tell us the minimum/compulsory content of the GST Invoice, time (when will the invoice be issued), manner if issue of invoice (no of copies) etc.

Finance Ministry has issued Draft GOODS AND SERVICES TAX -INVOICE RULES, which set rules for invoice which will be issued after the implementation of GST. This rules is very important as this will tell us the minimum/compulsory content of the GST Invoice, time (when will the invoice be issued), manner if issue of invoice (no of copies) etc.

This is one of the important preparatory steps as business houses, irrespective of the sizes , nature , goods/ service has to mandatory comply with the requirement from the day1 itself. This article contains the analysis and summary of the rule along with the format of Invoice.

A. Requirement of Tax Invoice V/s Bill of Supply

| Tax Invoice | Bill of Supply |

| – Registered Supplier engaged in other than composition scheme and dealing in Taxable goods / Services. | – Registered Supplier engaged in non-taxable goods and/or services or paying tax under the composition scheme. |

B. Content of the Tax Invoice & Bill of Supply (What)

| 1. | Name, address and GSTIN of the supplier | BOS | |

| 2. | date of its issue* (not preparation) | BOS | |

| 3. | consecutive serial number containing only alphabets and/or numerals, uniquefor a financial year; | BOS | |

| 4. | if registered recipient

name, address and GSTIN/ Unique ID Number, |

If unregistered and where the taxable value of supply is fifty thousand rupees or more;

name and address of the recipient and the address of delivery, along with the name of State and its code

|

BOS |

| 5. | If Goods – HSN Code

Only if notified by the Board / Commissioner |

If Services – Accounting Code | BOS |

| 6. | description of goods or services | BOS | |

| 7. | quantity in case of goods and unit or Unique Quantity Code thereof | ||

| 8. | total value of goods or services | BOS | |

| 9. | taxable value of goods or services taking into account discount or abatement, | ||

| 10. | rate of tax (CGST, SGST or IGST) | ||

| 11. | amount of tax charged in respect of taxable goods or services (CGST, SGST or IGST) | ||

| 12. | place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce | ||

| 13. | place of delivery where the same is different from the place of supply | ||

| 14. | whether the tax is payable on reverse charge | ||

| 15. | The word “Revised Invoice” or “Supplementary Invoice”, as the case may be, indicated prominently, where applicable along with the date and invoice number of the original invoice | ||

| 16. | signature or digital signature of the supplier or his authorized representative | BOS | |

C. Additional Requirement in case of Export

| 1. | Endorsement

“SUPPLY MEANT FOR EXPORT ON PAYMENT OF IGST” or |

“SUPPLY MEANT FOR EXPORT UNDER BOND WITHOUT PAYMENT OF IGST” |

| 2. | name and address of the recipient | |

| 3. | address of delivery | |

| 4. | name of the country of destination | |

| 5. | number and date of application for removal of goods for export [ARE-1]. | |

D. Manner of Issue of Invoice

I. No of Copies

| Goods | Services |

| (a) the original copy being marked as ORIGINAL FOR RECIPIENT;

(b) the duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and (c) the triplicate copy being marked as TRIPLICATE FOR SUPPLIER |

(a) the original copy being marked as ORIGINAL FOR RECEIPIENT; and

(b) the duplicate copy being marked as DUPLICATE FOR SUPPLIER. |

| Provided that the duplicate copy is not required to be carried by the transporter if the supplier has obtained an Invoice Reference Number under sub-rule. |

II. Serial number of invoices

Serial number of Invoices issued during a tax period shall be furnished electronically through the Common Portal in FORM GSTR-1.

III. What is Invoice Reference Number?

This is a reference number which will be used in lieu of invoice which can be verifiable by proper officer; this will eliminate the requirement of preparing the duplicate copy of the invoice for transporter in case of supply of goods.

A registered taxable person may obtain an Invoice Reference Number from the Common Portal by uploading on the said Portal, tax invoice in the required format GST INV-1.

The Invoice Reference Number shall be valid for a period of 30 days from the date of uploading

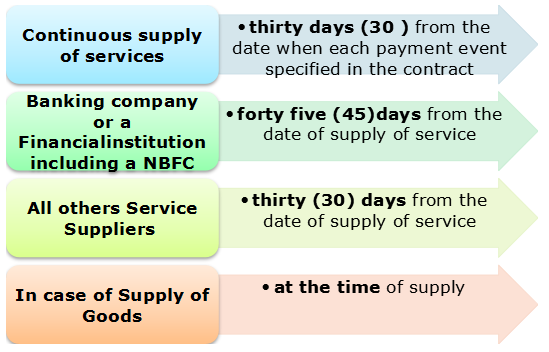

E. Time of Issue of Invoice (When)

F. Draft format of Invoice under GST Invoice Rules –GST INV-1

Form GST –INV-1

Application for Electronic Invoice reference number of an Invoice

| 1. | GSTIN | |

| 2. | Name | |

| 3. | Address | |

| 4. | Serial No. of Invoice | |

| 5. | Date of Invoice |

| Details of Receiver (Billed to) | Details of Consignee (Shipped to) |

| 1) Name

2) Address 3) State 4) State Code 5) GSTIN / Unique ID |

1) Name

2) Address 3) State 4) State Code 5) GSTIN / Unique ID |

–

| SR | Description of Goods / Services | HSN / AC | Qty | Unit | Rate per Unit | Total | Disc. Ount | Taxable Value | CGST | SGST | IGST | |||

| R

a t e |

A

M O U N T |

R

a t e |

A

M O U N T |

R

a t e |

A

M O U N T |

|||||||||

| Freight

Insurance Packing & Forwarding Charges |

||||||||||||||

| Total | ||||||||||||||

| Total Invoice value (in figure) | ||||||||||||||

| Total Invoice value (in words) | ||||||||||||||

| Amount of Tax subject to Reverse Charge | ||||||||||||||

–

| Declaration :

Signatory : Electronic Reference No. |

Signature :

Name of the Designation / Status Date – |

(Author may be contacted at caramandeep.bhatia@gmail.com or on + 91 9827152729)

Ramandeep Ji, your article is very informative. You made everything clear except that you did not provide how GST would be charged on Freight, Insurance and Delivery/Packing. So, If I want to charge Freight/packing, is GST applicable? Would the charge on freight/packing be included in the final Invoice value? Please make this clear.

Excellent Article.

Thanks for the information

The content of the Article are very informative and excellent. thanks for the sharing.

Good one