Introduction

With the increasing number of instances and cases of fake bills, dummy address registrations and multiple registrations in the same places, the GST council vide its amendment in the GST act has already introduced the power of aadhar authentication compulsory for all the class of registration subject to some exception. Section 25 of the CGST act was amended by finance act (second) 2019 for making the Aadhar authentication mandatory for a certain class of the person. The provisions and rules were earlier proposed to be implemented from 1st of April 2020, which may have got delayed due to the pandemic covid-19 situation, now the board has issued notification Notification No 62/2020 – Central Tax dated 20th August 2020 to bring them in force from 21st of August 2020. In this article, let us try to understand the overall impact of introducing the provision of Aadhar authentication and its consequences.

Provision of the ACT

Section 25 of the CGST act was amended by finance act 2019, to introduce subsection 6(A) to 6(D) for implementing the Aadhar authentication which was made effective from 01-01-2020 by NN 1/2020 dated 1-1-2020. The act requires that every person applying for registration has to go for Aadhar authentication whether the applicant is an individual or any other person. In case of other than individual, key person like Karta, Managing Director, whole-time Director, such number of partners, Members of Managing Committee of Association, Board of Trustees, authorised representative, authorised signatory and such other class of persons have to go for Aadhar authentication. In case the Aadhaar is not assigned than such person shall be offered alternate and viable means of identification, which includes physical verification of the premises.

Who are required to get Aadhar verification:

The board has come out with the notification 17/2020-C.T., dated 23-3-2020 by exercising the powers conferred by sub-section (6D) of section 25 of the CGST Act, 2017, in which they have notified the class of person to whom it will apply and to whom it will not.

- Classes of persons to whom the proof of possession of Aadhaar Number will apply are

(a) Individual;

(b) Authorised signatory of all types;

(c) Managing and Authorised partner; and

(d) Karta of an Hindu undivided family.

- Classes of persons to whom not applicable –

It is also notified that the proof of possession of Aadhaar number will not apply to a person who is not a citizen of India. Non-citizens/Non-residents even if they are authorized signatories are also exempted from aadhar authentication because as per section 3(1) of The Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016, only residents are entitled to obtain aadhar.

If we summarize than we can see that only authorized partner and signatory will be required to go for Aadhar authentication, not all the partners, directors, committee member etc. Managing director, whole-time director or other directors who are not authorized signatories, partners of the firm who are neither managing partners not authorized signatories, members of managing committees or board of trustees who are not authorized signatories need not go for aadhar authentication.

Whether Aadhar Authentication required for existing registration (already registered):

Subsection 6(A) of section 25 of CGST Act, requires every registered person shall undergo authentication, or furnish proof of possession of Aadhaar number, in such form and manner and within such time as may be prescribed.

Till date no form and manner is prescribed for an already registered person, the same is yet to be introduced. Once the manner and form is prescribed the same will be required to be done by an already registered entity.

The consequence of failure to undergo the authentication

Let us understand the same with two possibilities –

- Already registered person: –

In case of failure to undergo authentication or furnish proof of possession of Aadhaar number or furnish alternate and viable means of identification, registration allotted to such person shall be deemed to be invalid and the other provisions of this Act shall apply as if such person does not have a registration

The detailed procedure for an already registered person is yet to be introduced.

- Fresh Applicant: –

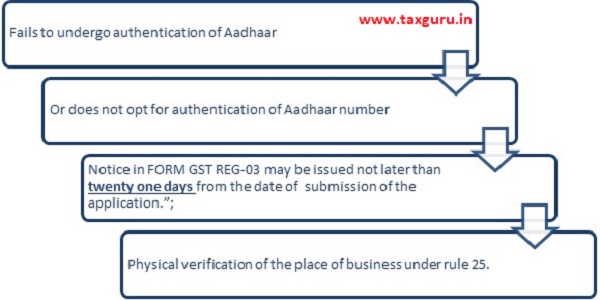

Physical verification compulsory – As per proviso to subrule (1) of rule 9 of CGST act, where a person, other than a person notified under sub-section (6D) of section 25, fails to undergo authentication of Aadhaar number as specified in sub-rule (4A) of rule 8 or does not opt for authentication of Aadhaar number, the registration shall be granted only after physical verification of the place of business in the presence of the said person, in the manner provided under rule 25.

As per proviso to sub-rule 1 of rule 9, where a person, other than a person notified under sub-section (6D) of section 25, fails to undergo authentication of Aadhaar number as specified in sub-rule (4A) of rule 8 or does not opt for authentication of Aadhaar number, the notice in FORM GST REG-03 may be issued not later than twenty-one days from the date of submission of the application.

Procedure for Physical verification under rule 25

Where the proper officer is satisfied that the physical verification of the place of business of a person is required due to failure of Aadhaar authentication “or due to not opting for Aadhaar authentication” before the grant of registration,

or due to any other reason after the grant of registration,

He may get such verification of the place of business, in the presence of the said person, done and the verification report along with the other documents, including photographs, shall be uploaded in FORM GST REG-30 on the common portal within a period of fifteen working days following the date of such verification.

The presence of the person who has failed Aadhar authentication or has not opted for Aadhar verification will be required at the time of physical verification and the photograph of the premises along with the person will be uploaded in the GST portal along in 15 working days of following the date of such verification.

There is a proviso in the rule, which gives power to the officer not below the rank of Joint Commissioner, who can in lieu of the physical verification of the place of business, carry out the verification of such documents as he may deem fit for completing the verification.

The time limit for completion of procedures

- Aadhar Authentication (In cases where a person successfully undergoes authentication of Aadhaar number)

As per rule 9 sub-rule 5(a) of CGST rules – within a period of three working days from the date of submission of the application in cases where a person successfully undergoes authentication of Aadhaar number or is notified under sub-section (6D) of section 25 (i.e. exempted from Aadhar authentication).

- Physical Verification (If Aadhar Authentication is not opted or Aadhar authentication is opted but Aadhar authentication fails)

We have seen above that notice for physical verification in FORM GST REG-03 may be issued not later than twenty-one days from the date of submission of the application. It is worth to note that the date of submission of application will be deemed to be after 15 days of submission of part B of Reg-1 as per rule 8(4A), hence the overall period for the issue of notice will get extended to 36 days (15 days plus 21 days).

There is no time limit prescribed for conducting the physical verification of premises under rule 25, however, there is time limit for issuing and uploading report i.e. 15 working days following the date of such verification.

Once the report is uploaded by the officer and there is no other clarification pending, the proper officer has to issue registration within seven working days from the date of the receipt of the clarification, information or document as per sub-rule 5(d) of rule 9 of CGST act.

Process for Aadhar Authentication

The verification will be done by sending a link on the registered mobile number and email address. On clicking the verification link, a window for Aadhaar Authentication will open where Aadhaar Number was entered and the OTP shall be received by applicants on the mobile number linked with Aadhaar.

Rejection of Application

As per sub-rule 4 of rule 9 CGST rules, where no reply is furnished by the applicant in response to the notice issued under sub-rule (2)9 or where the proper officer is not satisfied with the clarification, information or documents furnished, he may, for reasons to be recorded in writing, reject such application and inform the applicant electronically in FORM GST REG-05*.

It should be noted that earlier the word “Shall” was used in place of “May”, the amendment has made the rejection of application optional which was earlier mandatory on account of non-furnishing of reply and non-satisfactory explanation.

Conclusion and Disclaimers :

I have tried to compile rules and law of GST on the subject that may be useful on the topic of “Aadhar Authentication” in easy and simple language. Hope you may find useful, though I have tried my best to make this article error-free in case any arise than it is purely unintentional and you are requested to take appropriate professional advice before acting based on the above document. Your feedbacks are welcome at my email id ca.ramandeep@gmail.com.

CA Ramandeep Singh Bhatia is practising professional and also faculty NACIN & IDTC ICAI.

While linking PAN and AADHAAR there is no problem to link. But at the time of GST registration after completing the process AADHAAR authentication failed. What will be the reason? And how to sort out the issue.

Contact +91 7717768987 for any assisstance regarding GST registration