Article explains What is the need of Form 15CA and Form 15CB, What is Form 15CA and Form 15CB, Payment / Remittances don’t require Form 15CA & Form 15CB, Applicability of Form 15CA and Form 15CB w.r.t Taxability under IT Act, Summary of Section 9 and Documents required for Form 15CA and Form 15CB which includes Details of Remitter, Details of Remittee, Details of Remittance, Bank Details of Remitter & Documents required for DTAA Benefit.

Page Contents

1. What is the need of 15CA and 15CB?

- Earlier, the person making a remittance to Non-Resident was required to furnish a certificate in specified format circulated by RBI.

- Basic purpose was to collect the taxes at a stage when the remittance is made as it may not be possible to collect the tax from the Non-Resident at a later stage.

- Thus to monitor and track the transactions in an efficient manner, it was proposed to introduce e-filling of information in the certificates.

- Section 195 of Income tax act, 1961 mandates the deduction of Income tax from payments made to Non Resident. The person making the remittance to non – resident needs to furnish an undertaking (in form 15CA) accompanied by a Chartered Accountants Certificate in Form 15CB.

2. What is Form 15CA and 15CB?

- As per Section 195 of Income tax Act, 1961, every person liable for making a payment to non-residents shall deduct TDS from the payments made to non-residents if such sum is chargeable to Income tax then the withholding tax need to be deducted and form 15CA and 15CB are the declaration for the same.

- A person making the remittance (a payment) to a Non Resident or a Foreign Company has to submit the form 15CA. This form is submitted online. In some cases, a Certificate from Chartered Accountant in form 15CB is required after uploading the form 15CA online.

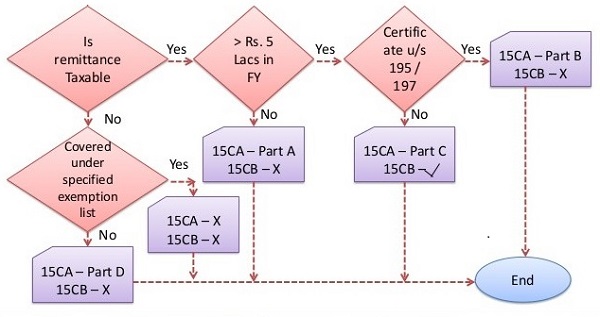

- The furnishing of information for payment to non- resident , not being a company, or to a foreign company in Form 15CA has been classified into 4 parts –

PART A: – Where the remittance or the aggregate of such remittance does not exceed 5 lakh rupees during the F.Y. (whether taxable or not).

PART B: – Where an order /certificate u/s 195(2)/ 195(3)/197 of Income Tax Act has been obtained from the A.O. (Whether Nil rate or Lower rate Certificate).

PART C: – Where the remittance or the aggregate of such remittance exceed 5 lakh rupees during the FY.

PART D: – Where the remittance is not chargeable to tax under Domestic law.

- 15CB is the Tax Determination Certificate where the CA examines the remittance with regard to chargeability provisions under Section 5 and 9 of the Income Tax Act along with the provisions of Double Tax Avoidance Agreements.

- In form 15CB, A CA certifies details of the payment, TDS rate and TDS deduction as per Section 195 of the Income Tax Act, if any DTAA is applicable, and other details of nature and purpose of the remittance.

- Upload of Form 15CB is mandatory prior to filling Part C of Form 15CA. To prefill the details in Part C of form 15CA, the Acknowledgement Number of e- verified form 15CB should be verified.

3. Payment / Remittances don’t require 15CA & 15CB?

- Individual is not required to furnish the information in Form 15CA and 15CB for remittance which requires no RBI approval.

- List of payments (33 items) mentioned in Rule 37BB which does not require compliances and reporting through the submission of 15CA and 15CB. Those nature of remittance are as under:

| Sl. No. | Nature of Payment |

| 1 | Indian investment abroad – in equity capital (shares) |

| 2 | Indian investment abroad – in debt securities |

| 3 | Indian investment abroad- in branches and wholly owned subsidiaries |

| 4 | Indian investment abroad – in subsidiaries and associates |

| 5 | Indian investment abroad – in real estate |

| 6 | Loans extended to Non-Residents |

| 7 | Advance payment against imports |

| 8 | Payment towards imports- settlement of invoice |

| 9 | Imports by diplomatic missions |

| 10 | Intermediary trade |

| 11 | Imports below Rs.5,00,000- (For use by ECD offices) |

| 12 | Payment- for operating expenses of Indian shipping companies operating abroad. |

| 13 | Operating expenses of Indian Airlines companies operating abroad |

| 14 | Booking of passages abroad -Airlines companies |

| 15 | Remittance towards business travel. |

| 16 | Travel under basic travel quota (BTQ) |

| 17 | Travel for pilgrimage |

| 18 | Travel for medical treatment |

| 19 | Travel for education (including fees, hostel expenses etc.) |

| 20 | Postal Services |

| 21 | Construction of projects abroad by Indian companies including import of goods at project site |

| 22 | Freight insurance – relating to import and export of goods |

| 23 | Payments for maintenance of offices abroad |

| 24 | Maintenance of Indian embassies abroad |

| 25 | Remittances by foreign embassies in India |

| 26 | Remittance by non-residents towards family maintenance and savings |

| 27 | Remittance towards personal gifts and donations |

| 28 | Remittance towards donations to religious and charitable institutions abroad |

| 29 | Remittance towards grants and donations to other Governments and charitable institutions established by the Governments. |

| 30 | Contributions or donations by the Government to international institutions |

| 31 | Remittance towards payment or refund of taxes. |

| 32 | Refunds or rebates or reduction in invoice value on account of exports |

| 33 | Payments by residents for international bidding. |

4. Applicability of 15CA and 15CB w.r.t Taxability under IT Act?

- Taxability –

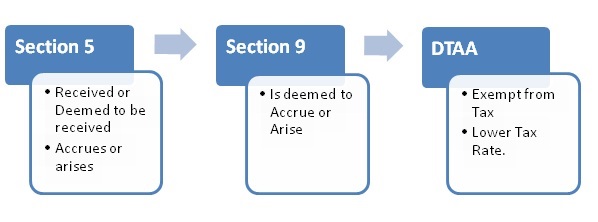

Section 5 of IT Act itself clearly defines the scope of taxable Income but the confusion arises when it comes to Section 9, so following is the summary of Sec 9 just to understand the whole matrix :-

-

Summary of Section 9 –

| Sr. No. | Nature of Income | Taxability |

| 1. | Business Income | Taxable if direct or indirect business connection in India or property or asset or source in India or transfer of a capital asset situated in India. |

| 2. | Capital Gain | Taxable if Shares/Property is situated in India or derives its value substantially from assets in India. |

| 3. | Salary Income | If earned in India. |

| 4. | Interest Income | If sourced in India (if payer is Resident). |

| 5. | Royalties | If incurred for business in India irrespective of the residential status of the payer. |

| 6. | FTS | If incurred for business in India irrespective of the residential status of the payer. |

- Applicability of Form 15CA and 15CB –+

5. Documents required for Form 15CA and 15CB:-

♥ Details of Remitter

- Name of the Remitter

- Address of the Remitter

- PAN of the Remitter

- Principal Place of Business

- E-mail Address and Phone No. of Remitter

- Status of the Remitter (Firm/ Company/ Other)

- Digital Signature of Remitter for submission of Form 15CA (Since now the Form needs to be filed electronically)

♥ Details of Remittee

- Name and Status of the Remittee

- Address of the Remittee

- Principal Place of Business

- Country of the Remittee

♥ Details of Remittance

- Country to which the Remittance is made

- Currency

- Amount of Remittance in Indian Currency

- Proposed Date of Remittance

- Nature of Remittance as per Agreement (Invoice Copy)

♥ Bank Details of Remitter

- Name and Bank of Remitter

- Name of Branch of the Bank

- BSR Code of the Bank

♥ Documents required for DTAA Benefit

- Tax Residency Certificate (TRC) from the Remittee (Tax Registration of the Country in which remittee is registered).

- Form 10F duly filled by the Authorized person of the remittee (Self Declaration).

- No PE (Permanent Establishment) declaration. This is mandatory if the Income is a business Income.

(Republished with Amendments)

what is the use of form 15CA, & 15CA Part D

Part D of 15 CA is required to be filed when we make any foreign payment which is not chargeable to tax under domestic law

15CA is a declaration made by Remitter. It has 4 parts depending upon the difference circumstances. 15CB is a certificate from a CA received by banks to ensure that applicable taxes has been deducted before the foreign remittance is made if the proposed amount is chargeable to tax in India.

Thanks for an informative blog. I have only pension income and interest in same bank NRO saving account. I pay tax and file regularly and bank takes TDS on current pension. But bank insists on form 15CA &CB both when I try outward remittance even when I remit to self under item # 26 for family maintenance and savings. Is my pension saving liable to tax or not ? Shall be grateful for a reply.

Thanks for the excellent well written article that clarifies most doubts in the minds of people planning to do remittances. Demonstrates your knowledge on the subject.

Thanks a ton!!!

Dear Shefali, As Nandha Gopal said, it is very well written article giving clarification on many items. As and NRI, I would like to transfer some money annually from my NRO account – which is my Pension account. I submitted my remittance request for ‘Remittance by non-residents towards family maintenance and savings’ but my banks is asking me to submit Form 15CA and 15CB. The bank already deducts TDS on my Pension and I have also declared my income while filing taxes in US. Do I still need any 15CA/CB (which I thought are not required for transferring from my Indian NRO account to my foreign US bank account. Could you please clarify? Thanks. Ravi

If you receive Government Pension , and if you are resident and citizen of USA, such pension is taxable only in USA and not in India as per US Treaty. In such cases no TDS on such Pension is not deductible. You only need to show such income in US returns. If you not a citizen of US, you need not offer such pension to tax in US and you have to offer it to tax in India only.

You just need to submit 15CA to initiate this transfer and 15CB is not required. Another point is that if you are a resident and a citizen of US, your Govt Pension is taxable only in US as per DTAA with US. For which you have to submit documents to deductor to exclude you from TDS. You need not submit return in India as such income is not taxable in India but only in US.

one time publication charges to non resident will be tax free?

Am a senior citizen having some bank Bal and investments. I want to gradually yransfer/ remit the funds to my nri son in Singapore say 25000 sing dollar every fy from this year.

Do I need to fill form 15 CA and 15cb

If you are a resident Indian you can transfer funds to your son abroad under LRS upto $2.5L without permission from RBI under family maintenance of clos relatives. Banks may ask you 15CA and 15CB as a part of their procedure. RBI has not issued any guidelines for banks to ask for 15CA and 15CB. However they have to ensure that the same has been reported by the remitted to income tax and funds sought to be remitted has suffered tax in India.

Can one remit funds from NRO account at Bank in India to his own a/ c at other country (Canada) for own maintenance etc & what is procedure.

You can transfer USD 1Million per FY from your NRO Account to your NRE or Foreign Bank Account. The amount sought to be made must be permissible credits to NRO . Loans etc credited to NRO cannot be remitted. Similarly, Amount sought to be remitted must have suffered tax in India. 15CA is required. 15CB is not required. However banks might ask for it for them to be safe.

The form reads Form 15CA part A as

(To be filled up if the remittance is chargeable to tax under the provisions of the Income-tax Act,1961 and the remittance or the aggregate of such remittances, as the case may be, does not exceed five lakh rupees during the financial year)

Hence it is pertaining to the limit of Rs. 5 lacs for the remitter made in the financial year.

I am NRI. I have sold my house to indian resident who deducted TDs 22.88% of total value and deposited with IT Deptt.,and rest amount deposited in my NRO account. The TDs amount deposited is more than tax to be paid.Now I want to transfer amount lying in NRO account. Which part of 15ca to be filled. Can I transfer NRO amount to abroad without filing 15ca and 15 cb?

You can tranfer the sale proceeds subject to certain conditions laid down under FEMA regarding the acquisition of property from Indian source of foreign source. You have to submit 15CA only. However the banks may ask for the deposit of TDS or Advance Tax as a proof of exempting you from 15CB

I am an NRI. I accidentally transferred money about 8.64L from an NRE account to an NRO account. I made a FD of Rs. 9.5 L in the NRO account from this transfer. I did not know the difference between the accounts (now I do, lesson learnt) that I would have to pay 30% TDS on the FD interest.

One CA told me that I can get the refund on the interest when we file taxes and another CA is saying that he will file 15 CA and we can transfer the entire 9.5 L after paying the taxes and will have to lose the refund. Which CA is correct? I’m very confused.

Thanks a ton for viewing my request.

Hi Rashmi, did you get the clarification you were looking for?

TDS on NRO FD deductible at the lower of DTAA or as per IT Act . If you are in UAE and you can provide TRC to Bank , Bank will deduct TDS @ 12.5% only and not 30%. In your present case If your tax bracket is less than 30% you can file IT return in India and claim the refund.

Can LRS be used by a resident Indian to buy life insurance policy in foreign currency from a foreign insurer?

How much are the charges for helping with 15CA part A?

Hi,

The Charges are Rs. 2000 for the same..

Thanks – crisp and effective one.It’s nice to have this kind of page

Thanks a ton!!

Hi ,

I am NRI .

My father who is retired bank emp and Live in india, want to send me some of his saving as Gift . (Please note that he regularly paid His tax in India in all his saving).

My Question to you

1- If my father is giving his already taxed money to me as Gift then also he need to submit 15CA/CB ?

2- These SBI Emp are like robot although he tried to explain them as per IT policy 15CA not needed in his case they are not ready to understand . What he can do ? any suggestion

Thanks in advance

-Anand

Hi,

Yes, you are not required to file in this case ..

But if they don’t agree then you had to file the same…

Under LRS, a Resident Indian can purchase foreign exchange upto USD2.5 Lakhs per year for various purposes including maintenance of close family member outside India for which approval of RBI upto that amount is not required. 15CA and 15CB may be required by bank as a part of their tax compliances for which RBI has not issued any guidelines in this regard.

An NRI has send his residential property in India in the year 2017 and invest in the Capital gain Bonds to save the LTCG.Now the Bonds have been matured and maturity has already been credited his NRO A/c. Now he wants to repatriate the maturity amount to USA. My Issue is as Follows:

a) Whether 15CA & CB is required or not.

b) If yes who is the remitter and remitee in 15CA.

c) Whether Tax will be collected on Interest on Bonds. The Interest has not been shown in the earlier ITRs.

i have made Rent Payment to NRI in INR & deducted TDS @ 31.20%. my question is

1. do i have to fill Form 15CA?

2. if yes what would be the relevant purpose code as per RBI to be filled?

pls do the needful.

The law is all very well but it is a joke, the banks do whatever they please. My 81 year old mother (individual only, no business transactions) is now living with me in Australia and I have incurred medical expenses for her. She wants to transfer about Rs 4 lakhs to my a/c in Australia from her NRO a/c in India under the gift category (sl no. 27 in the article) which is also tax-free for the receiver under Indian law since I am the daughter of the remitter. State Bank of India simply won’t do the remittance without 15CA/15CB. What about all the exemptions? Note further that both myself and my mother have regularly paid all Indian income tax including advance tax and there are no pending disputes.

is it mandatory to gross up ?

we paid sea freight to foreign company’s indian agent in USD to indian branch of bank a/c. query is , on whose name form a2 & 15ca should be raised??

Dear All,

Indian Co. paying salary of Rs. 13000 (Indian Rupees) to its employee in Nepal working in Nepal. Whether such salary is laible to TDS and do we need to file form 15 CA?

Please advice. Its urgent

Hi,

I have received over 10 lac from matured insurance policy surrender process. I want to move that to US to my account. what is the process in getting the money moved to my US bank account? Do I need to go through the 15CA and 15CB forms? thank you in advance.

A TENANT MAKES PAYMENT OF RENT TO NRI MONTHLY AND THE AGGREGATE RENTAL PAYMENT DOES NOT EXCEED RS 5 LAKHS HE ALSO DEDUCTS TDS .NOW WHEN MY CLIENT IS FILING FORM 15 CA PART A. HE IS FACING PROBLEM IN SELECTING THE NATURE OF REMITTANCE AND THE PURPOSE CODE OF RBI…

A TENANT MAKES RENT TO NRI MONTHLY AND THE AGGREGATE RENTAL PAYMENT DOES NOT EXCEED RS 5 LAKHS.NOW WHEN MY CLIENT IS FILING FORM 15 CA PART A. HE IS FACING PROBLEM IN SELECTING THE NATURE OF REMITTANCE AND THE PURPOSE CODE OF RBI…

Shaufali

Pl clarify if rent payment is made to nRi in INR to his local account via bank transfer after TDS is deducted @31.2 pc whether 15 CA 15 CB are required

My company is registered in India, and they need to get some quality certification documents (ISO/CE) from another company in Taiwan. My company will be paying for these documents.

Can you tell me what kind of forms need to be filled before remittance? Also, how much % TDS will be deducted?

NRI has sold property & received funds in NRO A/c.

Lower Deduction Certificate was obtained from IT Officer in Aug-18.

Now want to transfer funds from NRO to Foreign.

Whether in Form 15CA Part B or Part C to be filled ?

A NRI has sold property in India and received sale proceeds in NRO A/c.

Now want to transfer these funds to abroad.

1. What will be the RBI purpose code to be used in 15 CB ?

2. Buyer has deducted. Whether TDS amount to be mentioned in 15 CB as there is no reference of buyer as funds are being transferred from own NRO a/c to foreign

3. Whether it is to be mentioned as taxable or not. There is net Long term capital loss.

Any Tax to be deducted under 15CA when making payment to foreign vendors for Charges for issuing Certification like ISO etc. Reply urgently required by return.

Hi ,

I’m a proprietor in India and using some services in USA company and now i have to pay . Can you please suggest , will it be taxable ?.

Do I need to pay GST for that?

Form CA/CB?

Hope to hear from you soon

I HAVE SOME CAPITAL GAINS AS A PRODUCT OF SALE OF A PIECE OF LAND, THIS WILL FALL INTO LONG TERM CAPITAL GAIN. THIS IS PUT IN NRO A/C. I WANT TO TRANSFER THE AMT. INTO NRE A/C. WHAT AND HOW CAN I GO AHEAD FOR THIS, AS THIS IS ALLOWABLE BY RBI SINCE 7TH MAY 2012. CAN YOU HELP ME PLEASE?

HI,

This is Amit Gupta

Please advise if A pvt ltd company makes foreign payment against purchase of goods then has it to deduct tds and at what percent.

Also does it need to furnish form 15CA ad 15CB ?

payment is being made in foreign currency but to a company in india. Is form 15CA required for the same?

My friend is trying to remit the money saved in Yes Bank to his bank account in Japan. He is a Japanese and he opened his account in Yes bank because he was going to do his Amway Business in India but Amway India was closed for foreigners and now he has no need to keep an account in Yes bank. He was told that he submits the form 15CA 15CB. As he lives in Japana basically, how can he make it ?

I am sending a Donation of Rs 45000/- to a friend in Indonesia. It is not Business Related and does not exceed 5 lakhs . Bank is asking me to fill out Form 15 CA/CB. Is this necessary or not ?

Am sending a Donation of Rs 49000/- to a friend in Indonesia. Bank has asked me to fill out 15 CA/CB form. Is this necessary ? Form 15 CA/CB clearly states that the amount should be in an excess of 5 lakhs or more in a Financial Year or if the amount is Business related.

Can you define the word “payment” used in this rule?

Is this rule applicable only when there is a remittance of the dues to an account outside India or is it applicable also in the case when a payment is done into a local NRO account of the beneficiary?

Will appreciate an urgent reply.

PART A to be filled up only when the remittance is chargeable to Tax! Please rectify your article, it may confuse people!!

Hi,

I am Running a Pvt Ltd co. and nature of business is education consultant but we received fees behalf of university in India and then remit to Kazak please let me know whats the compliance and i need to submit 15CB or not ?

Very well explained,

Thank you

Individual is not required to furnish the information in Form 15CA and 15CB for remittance which requires no RBI approval.

If you would have mentioned about those remittance which do not require RBI approval then the blog might have be more clear for the readers.

Anyway very beautifully explained.

Hi

I am a UK resident. I made an investment in property back in 2005. Which I sold in 2010 then the same funds were invested in Mutual funds in India. The TDS was deducted when I withdraw funds.

Now I want to transfer funds back to the UK within the guideline of RBI. The bank is asking me to submit form CA/CB?

The list of 33 Items of RBI does not seem to cover the Technical Fee/ Subscription to Professional Bodies in USA, for say Continuation of Professional Licence / membership. The remittance for Professional Fee is certainly not Taxable. Please clarify since the bank is asking for form 15CA, and 15CB, which I think is a futile exercise.

J S S

In Classification of 15CA you have mentioned that the amount is only service remittance or with goods import.Please give me clear explanation.

Very good brief and graphical presentation.

MOM

PLEASE LET ME KNOW HOW MUCH U CHARGE FOR UPDATE KYC IN MCA FOR A PVT.LTD CO.AND WHAT ARE THE DOCUMENTS REQUIRED.

we have received a payment from a company in Nepal for a tour, but due to some problem the order got cancelled .

Now we want to remit back to the company who sent us the money

please advise what to do

If a residential property sale proceeds is paid by a “resident” (buyer) to a NRI (non-resident, seller), and full TDS is deducted by the buyer prior to the payment, and a TDS chalan is also issued stating details of both buyer and the non-resident seller, and then the seller deposits such proceeds to his NRO Ruppee account in India (no outward remittance is made), do we still need to file Form 15 CA and Form 15 CB? Please clarify. Thanks.

Is tds applicable if a company pays bis certification chages to china

Hi,

Can you please let me know which part of form 15CA is to be filed when remittance is not taxable as we are taking dtaa agreement benefit

Very good info indeed. But how will you file 15CA prior to 15CB if PART C of 15CA need to be filled?

please tell also about tds provisions with regards to this. and about grossing up.