Article explains What is the need of Form 15CA and Form 15CB, What is Form 15CA and Form 15CB, Payment / Remittances don’t require Form 15CA & Form 15CB, Applicability of Form 15CA and Form 15CB w.r.t Taxability under IT Act, Summary of Section 9 and Documents required for Form 15CA and Form 15CB which includes Details of Remitter, Details of Remittee, Details of Remittance, Bank Details of Remitter & Documents required for DTAA Benefit.

Page Contents

1. What is the need of 15CA and 15CB?

- Earlier, the person making a remittance to Non-Resident was required to furnish a certificate in specified format circulated by RBI.

- Basic purpose was to collect the taxes at a stage when the remittance is made as it may not be possible to collect the tax from the Non-Resident at a later stage.

- Thus to monitor and track the transactions in an efficient manner, it was proposed to introduce e-filling of information in the certificates.

- Section 195 of Income tax act, 1961 mandates the deduction of Income tax from payments made to Non Resident. The person making the remittance to non – resident needs to furnish an undertaking (in form 15CA) accompanied by a Chartered Accountants Certificate in Form 15CB.

2. What is Form 15CA and 15CB?

- As per Section 195 of Income tax Act, 1961, every person liable for making a payment to non-residents shall deduct TDS from the payments made to non-residents if such sum is chargeable to Income tax then the withholding tax need to be deducted and form 15CA and 15CB are the declaration for the same.

- A person making the remittance (a payment) to a Non Resident or a Foreign Company has to submit the form 15CA. This form is submitted online. In some cases, a Certificate from Chartered Accountant in form 15CB is required after uploading the form 15CA online.

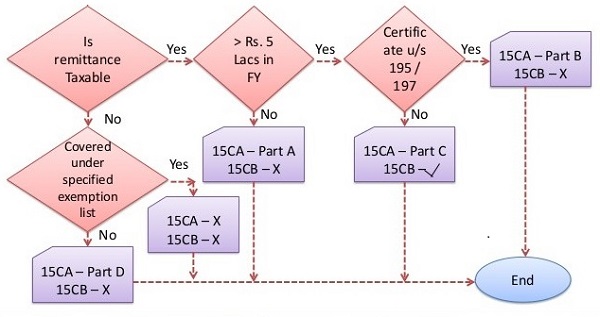

- The furnishing of information for payment to non- resident , not being a company, or to a foreign company in Form 15CA has been classified into 4 parts –

PART A: – Where the remittance or the aggregate of such remittance does not exceed 5 lakh rupees during the F.Y. (whether taxable or not).

PART B: – Where an order /certificate u/s 195(2)/ 195(3)/197 of Income Tax Act has been obtained from the A.O. (Whether Nil rate or Lower rate Certificate).

PART C: – Where the remittance or the aggregate of such remittance exceed 5 lakh rupees during the FY.

PART D: – Where the remittance is not chargeable to tax under Domestic law.

- 15CB is the Tax Determination Certificate where the CA examines the remittance with regard to chargeability provisions under Section 5 and 9 of the Income Tax Act along with the provisions of Double Tax Avoidance Agreements.

- In form 15CB, A CA certifies details of the payment, TDS rate and TDS deduction as per Section 195 of the Income Tax Act, if any DTAA is applicable, and other details of nature and purpose of the remittance.

- Upload of Form 15CB is mandatory prior to filling Part C of Form 15CA. To prefill the details in Part C of form 15CA, the Acknowledgement Number of e- verified form 15CB should be verified.

3. Payment / Remittances don’t require 15CA & 15CB?

- Individual is not required to furnish the information in Form 15CA and 15CB for remittance which requires no RBI approval.

- List of payments (33 items) mentioned in Rule 37BB which does not require compliances and reporting through the submission of 15CA and 15CB. Those nature of remittance are as under:

| Sl. No. | Nature of Payment |

| 1 | Indian investment abroad – in equity capital (shares) |

| 2 | Indian investment abroad – in debt securities |

| 3 | Indian investment abroad- in branches and wholly owned subsidiaries |

| 4 | Indian investment abroad – in subsidiaries and associates |

| 5 | Indian investment abroad – in real estate |

| 6 | Loans extended to Non-Residents |

| 7 | Advance payment against imports |

| 8 | Payment towards imports- settlement of invoice |

| 9 | Imports by diplomatic missions |

| 10 | Intermediary trade |

| 11 | Imports below Rs.5,00,000- (For use by ECD offices) |

| 12 | Payment- for operating expenses of Indian shipping companies operating abroad. |

| 13 | Operating expenses of Indian Airlines companies operating abroad |

| 14 | Booking of passages abroad -Airlines companies |

| 15 | Remittance towards business travel. |

| 16 | Travel under basic travel quota (BTQ) |

| 17 | Travel for pilgrimage |

| 18 | Travel for medical treatment |

| 19 | Travel for education (including fees, hostel expenses etc.) |

| 20 | Postal Services |

| 21 | Construction of projects abroad by Indian companies including import of goods at project site |

| 22 | Freight insurance – relating to import and export of goods |

| 23 | Payments for maintenance of offices abroad |

| 24 | Maintenance of Indian embassies abroad |

| 25 | Remittances by foreign embassies in India |

| 26 | Remittance by non-residents towards family maintenance and savings |

| 27 | Remittance towards personal gifts and donations |

| 28 | Remittance towards donations to religious and charitable institutions abroad |

| 29 | Remittance towards grants and donations to other Governments and charitable institutions established by the Governments. |

| 30 | Contributions or donations by the Government to international institutions |

| 31 | Remittance towards payment or refund of taxes. |

| 32 | Refunds or rebates or reduction in invoice value on account of exports |

| 33 | Payments by residents for international bidding. |

4. Applicability of 15CA and 15CB w.r.t Taxability under IT Act?

- Taxability –

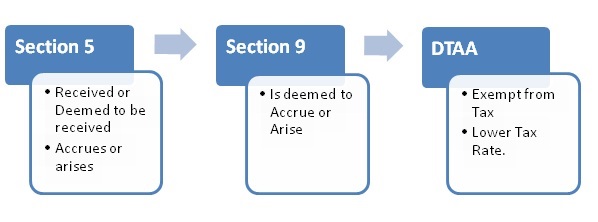

Section 5 of IT Act itself clearly defines the scope of taxable Income but the confusion arises when it comes to Section 9, so following is the summary of Sec 9 just to understand the whole matrix :-

-

Summary of Section 9 –

| Sr. No. | Nature of Income | Taxability |

| 1. | Business Income | Taxable if direct or indirect business connection in India or property or asset or source in India or transfer of a capital asset situated in India. |

| 2. | Capital Gain | Taxable if Shares/Property is situated in India or derives its value substantially from assets in India. |

| 3. | Salary Income | If earned in India. |

| 4. | Interest Income | If sourced in India (if payer is Resident). |

| 5. | Royalties | If incurred for business in India irrespective of the residential status of the payer. |

| 6. | FTS | If incurred for business in India irrespective of the residential status of the payer. |

- Applicability of Form 15CA and 15CB –+

5. Documents required for Form 15CA and 15CB:-

♥ Details of Remitter

- Name of the Remitter

- Address of the Remitter

- PAN of the Remitter

- Principal Place of Business

- E-mail Address and Phone No. of Remitter

- Status of the Remitter (Firm/ Company/ Other)

- Digital Signature of Remitter for submission of Form 15CA (Since now the Form needs to be filed electronically)

♥ Details of Remittee

- Name and Status of the Remittee

- Address of the Remittee

- Principal Place of Business

- Country of the Remittee

♥ Details of Remittance

- Country to which the Remittance is made

- Currency

- Amount of Remittance in Indian Currency

- Proposed Date of Remittance

- Nature of Remittance as per Agreement (Invoice Copy)

♥ Bank Details of Remitter

- Name and Bank of Remitter

- Name of Branch of the Bank

- BSR Code of the Bank

♥ Documents required for DTAA Benefit

- Tax Residency Certificate (TRC) from the Remittee (Tax Registration of the Country in which remittee is registered).

- Form 10F duly filled by the Authorized person of the remittee (Self Declaration).

- No PE (Permanent Establishment) declaration. This is mandatory if the Income is a business Income.

(Republished with Amendments)

Hi – I am NRI and have bank NRO and NRE accounts. I wish to transfer less than 5 lakhs Rs. from NRO to NRE in financial year 2022 (april -march).

– do I need to fill form 15CA only OR also 15CB certified by chartered accountant?

– Can I file form 15CA to income tax dept. online through web portal?

Thanks

Hi,

if the amount that is going to be transferred is less than 5L and that is not taxable in the hands of recipient ,( in your case it is not taxable), only 15CA is required. You can fill in 15CA online under your account in IT Portal.

Hi sir,

Can Anyone explain does the 15 CB in required for below 5 Lakhs payment for month .

Hi, the concept of 15CB is that a CA certify whether appropriate tax has been deducted and paid before the remittance takes place. If such remittance in an year exceeds the threshold.limit, yes of course, 15CB is required.

I am a NRI resident. My father decided to sell his property and give the proceeds to me as gift. His CA already asked him to pay advance tax and he has the receipt. CA is still waiting for Financial year ie March to file taxes. I want to repatriate the funds from currently in my NRO account to outside India. bank is asking for form 15CA/B to be filled by CA. I am confused whether there will be tax implication again or can we fill form part D directly and proceed with the remittance? Same someone please confirm what will be correct procedure here ?

Clarification required in respect of the threshold limit of ₹5lakhs for submitting 15CB towards outward remittances. The limit for ₹5lakhs is per remitee or for the remitter in aggregate?

Hi Everybody. I am NRI Indian Pensioner getting my pension transferred from NRO ac to NRE ac as per procedure laid down in procedure in pensionersportal.gov.in as NRI. Pension is paid us 192 and not us 195.

Can anybody tell me applicability of Form15CA and Form15CB. Thanks in advance

sec 195 is not applicable on the income taxable under the head salary. here , Pension is chargable under the head of salary therefore you are not required to file 15 CA or 15 CB

I am a NRI resident. My father decided to sell his property and give the proceeds to me as gift. His CA already asked him to pay advance tax and he has the receipt. CA is still waiting for Financial year ie March to file taxes. I want to repatriate the funds from currently in my NRO account to outside India. bank is asking for form 15CA/B to be filled by CA. I am confused whether there will be tax implication again or can we fill form part D directly and proceed with the remittance? Same someone please confirm what will be correct procedure here ?

One of the Vietnam customer (X )is a joint stock company transferred a sum of USD 70,000 to an Indian supplier ( Y ) a PVT Ltd company. The purpose of this transfer is towards advance for supply of corn from India to Vietnam.

Y is unable to supply and he agrees to refund the advance to X but Y purforths the following information

a. Y needs to submit 15 CA and 15 CB and this takes more than a week. In fact it has taken more than 10 days literally.

b. Then after submitting these forms, banker of Y needs to get RBI approval before proceeding for payment.

I feel that Y is purposefully delaying the payment process by telling these unreasonable timeline.

Please advise the true picture what Y says is correct or not.

what happens if i enter a wrong address of the remittee in form 15ca

Is it necessary for an NRI to file forms CA and CB for repatriation of money say $50,000 from his NRO account in India to his account in USA

For 15CA PART IV, HOW IT IS DECIDED WHETHER THE AMOUNT IS TAXABLE OR NOT. FOR EXAMPLE A COMPANY PAYING SALES COMMISSION ABROAD, SAYS THE AMOUNT IS NOT TAXABLE. HOW?

It is looked into whether the amount proposed to be remitted outside India is chargeable to tax in India in the hands of recipient. If not 15CA Part D is used without 15CB. If it is taxable 15CA part A,B,C with 15CB is used. Chargeability of an Income in the hands of recipient non resident in India depends upon many factors including the DTAA with the other country.

Transfer of funds from ones own NRO account to NRE account requires form 15CB? The fund is already taxed in the previous years .

Not Required. If funds in NRO suffered tax, it can be be transfered to own NRE A/c or to own bank outside India. Only 15CA is required. However bank may ask for 15CB. To proceed with the transaction, even a certificate from CA instead of 15CB would suffice the requirement.

should company generate form 15CA if payment made through Credit Card?

Not Required. However if you could provide the details of payment it would of great help to clarify.

My brother had an insurance plan with an Indian insurance company – he died suddenly before the policy matured. He was an American citizen but of Indian origin. The insurance company is reluctant to pay the claim amount to his widow (an American citizen by birth ) as it says he was paying the premia thru an NRO account. What is the way out for retrieving the claim amount? Can’t the insurance company transfer the amount to his widow after using Form 15CA CB?

The policy amount would be credited only to the NRO account of Insured or to his Nominees

Bank Account if nomination exists. The stand of insurance company is not valid. If the nomination exists and applicable tax has been deducted and subject to the provisions of FEMA, nominee is entitled to get the amount transferred to his/her bank account. If you could provide more information, would be of great help to assist you.