Latest Articles

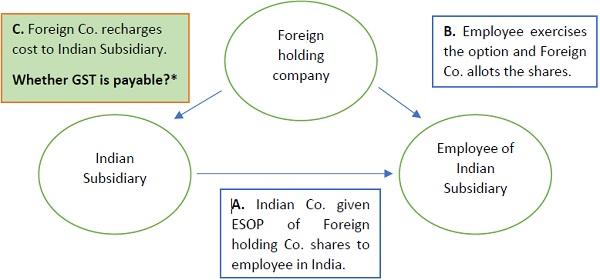

Summary of Clarifications/Circulars issued by CBIC on 26 June 2024

Goods and Services Tax : Summary of CBIC's June 26, 2024 clarifications on GST issues: place of supply, ITC claims, e-commerce, insurance, and more, as per...

3 अपराधिक कानूनों का विश्लेषण

Corporate Law : भारतीय न्याय संहिता 2023, क्रिमिनल प्रोसीजर कोड और ए...

Circular Simplified: ITC availment Time Limit on Supplies from Unregistered Persons

Goods and Services Tax : Understand CGST Act's Section 16(4) time limits for claiming ITC on RCM supplies from unregistered persons, clarified in SEBI's Ci...

53वीं जीएसटी काउंसिल सिफारिशों पर 16 सीबीआईसी सर्कुलरों का सारांश

Goods and Services Tax : जानिए 53वीं जीएसटी काउंसिल की सिफारिशों पर सीबीआई�...

Sec 54 & 54F exemptions aren’t just for Property Owners: Here’s How you and your spouse/Legal Heirs can benefit

Income Tax : Discover how Section 54 & 54F exemptions extend beyond property owners to include spouses and legal heirs. Explore recent ITAT rul...

Latest News

CBIC’s Exchange Rate Automation Module (ERAM) Effective from July 4, 2024

Custom Duty : Discover how CBIC's new Exchange Rate Automation Module (ERAM) simplifies trade with 22 currency exchange rates online. Learn more...

Consultation Paper on Interim Recommendations for Harmonizing ICDR & LODR Regulations

SEBI : Explore the final recommendations of the Expert Committee on ICDR and LODR regulations for easing business processes and harmoniza...

SEBI Consultation Paper on disclosure of Risk Adjusted Return by Mutual Funds

SEBI : SEBI seeks public input on mandatory disclosure of Risk Adjusted Return by Mutual Funds to aid investors in making informed decisi...

India and USA extend Transitional Approach on Equalisation Levy 2020

Finance : Learn about the extension of India-USA agreement on Equalisation Levy 2020 until June 30, 2024, amidst OECD/G20 negotiations on di...

FATF adopts Mutual Evaluation Report of India

Finance : Discover India exceptional performance in the FATF Mutual Evaluation 2023-24, placing it in the 'regular follow-up' category and b...

Latest Judiciary

Validity of Section 148 notice by Jurisdictional AO instead of Faceless AO

Income Tax : Analysis of Swarn Singh Vs ITO (ITAT Amritsar) on validity of notice u/s 148 by Jurisdictional Assessing Officer (JAO) vs Faceless...

Gujarat HC Grants Relief against Coercive Tax Recovery by GST Department

Goods and Services Tax : The Gujarat High Court granted interim relief to P.R. Trading, halting coercive GST recovery labeled as voluntary. The matter is s...

ITAT allows taxation of excess stock & unexplained marriage expenses as business Income

Income Tax : Discover the ITAT Chennai verdict on Santhilal Jain Vijay Kumar Vs ITO, addressing taxation on excess stock and unexplained marria...

Reopening a case does not require final proof of suppression but rather prima facie material

Income Tax : Read the detailed analysis of the Rajasthan High Court's judgment in Jugal Kishore Lohiya vs Principal Chief Commissioner of Incom...

Alleged circular transactions & Bogus Invoicing: HC upheld validity of reassessment proceedings

Income Tax : Explore the detailed analysis of Chetak Enterprises Ltd. Vs ACIT Rajasthan High Court judgment on reopening assessments under Sect...

Latest Notifications

ROC Andhra Pradesh issues notice for Removal of 93 LLP Names

Corporate Law : Registrar of Companies Andhra Pradesh issues notice for removal of 93 LLP names from the register. Learn more about the notice and...

Continuous Private Placement Offers Without Closing Previous Ones: MCA Penalizes

Company Law : The MCA has penalized Richesm Healthcare Limited for making private placement offers without closing previous ones. Learn more abo...

MCA Imposes ₹10 Lakh Penalty for Missing Allottees’ Address & Occupation in PAS-3 List

Company Law : Adjudication order for Hadapsar Urban Multiple Nidhi Ltd under Section 454(3) read with 39 of The Companies Act, 2013. Detailed an...

Violation of SBO Rules & Section 90: MCA imposes Penalty on Aries Hotels

Company Law : MCA imposes a penalty on Aries Hotels Pvt Ltd for non-compliance with Section 90 of the Companies Act, 2013. Details on adjudicati...

Non-Filing of MGT-14: MCA Penalty Imposed on Company & its Directors

Company Law : Learn about the MCA penalty imposed on Hadapsar Urban Multiple Nidhi Limited for non-filing of MGT-14 for board resolution passed ...

Latest Downloads

FAQs

Discover a comprehensive FAQ on Ind AS 115, covering revenue recognition principles, key concepts, and implementation challenges. Gain insights into how this standard impacts financial statements.

Learn who can file ITR-7, how to file it, required information, and mandatory schedules. Detailed guide for assessees under various sections.

Learn how to compute Adjusted Net Bank Credit (ANBC) for Priority Sector Lending (PSL) targets, including adjustments for PSLC, TLTRO 2.0, HTM securities, and more.

Discover RBI’s rules on carrying cash & foreign currency when traveling to/from India. FAQs cover limits, exceptions, and compliance guidelines for hassle-free travel.

Get clear insights on registering a finance company or unit under the IFSCA (Finance Company) Regulations, 2021. Comprehensive FAQs to guide prospective entities through the process.