R.K Rengaraj, Advocate

Introduction:

Solar power in India is a fast developing industry. The country’s solar installed capacity reached 30.071 GW as of 31 July 2019. India has the lowest capital cost per MW globally to install the solar power plants. India is planning to achieve 20 Giga Watt capacity before year 2022. The Indian MNRE conducts very useful seminars to promote the solar project and encourages investors and gives its helping hand by offering subsidy schemes. On GST side, the current situation is, paying 5% GST upto 70% of the project cost, being the material cost and 18% for remaining 30% installation cost. Some confusions are still persisting in the industry as divergent views have been taken on the rate for solar on the composite orders in the Advance Rulings by Karnataka and Maharashtra State Authorities.

Background:

The rate of tax for renewable energy devices and parts of solar power was notified vide Notification No.1/2017-Central Tax (Rate) New Delhi, the 28th June, 2017 Schedule I (2.5% CGST)

234 Notification no. 1/2017-Central Tax (rate). GST rate for several renewable energy devices & parts for their manufacture (bio gas plant/solar power based devices, solar power generating system (SGPS) etc) [falling under chapter 84, 85 or 94 of the Tariff] would continue to be 5 per cent.

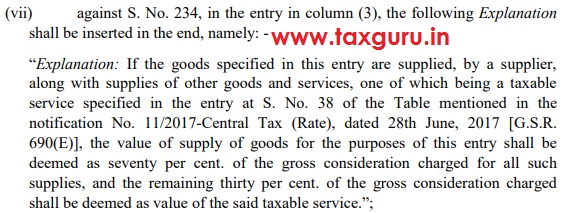

Thereafter against serial no.234 an explanation was added by Notification No. 24/2018-Central Tax (Rate) New Delhi, the 31st December, 2018.

This Notification no. 24/2018-Central Tax (Rate), came into force on 31 December 2018, and it added an explanation to entry 234: “If the goods specified in this entry are supplied, by a supplier, along with supplies of other goods and services, one of which being a taxable service specified in the entry at S. No. 38 of the table mentioned in the notification No. 11/2017-Central Tax (Rate), dated 28 June 2017, the value of supply of goods for the purposes of this entry shall be deemed as 70% of the gross consideration charged for all such supplies, and the remaining 30% of the gross consideration charged shall be deemed as value of the said taxable service.”

And vide Notification No. 27/2018-Central Tax (Rate) New Delhi, the 31st December, 2018, the rate of tax EPC and installation was fixed as 18%

Disparity in AAR rulings:

The Goods and Services Tax (GST) Council has offered the much awaited clarity for solar power project developers by defining the tax applicability on goods and services that develop a solar project. Project developers were confused as there were contradictory advance rulings that defined the applicable tax on composite orders where both services and goods were offered.

There were contradictory advance tax rulings pertaining to the tax applicability in cases where both goods and services were offered under a composite contract. While paying taxes, the costs were front loaded on the goods. The tax incidence on goods stood at 5 per cent, while the incidence on services was 18 per cent.

From the industry it is learnt that it wanted a bifurcation with 90 per cent of the value earmarked for goods and 10 per cent for services. It is expected that they will continue to pursue the GST council for the same. The industry is of the view that applying 18% tax would derail India’s plan to add 150 to 200 GW of green power by 2022. “To its credit, the government did try to provide a solution, however, it couldn’t meet industry needs,

A decision was supposed to be taken in the last GST council meeting chaired by the new finance minister, Ms Nirmala Seetharaman.

Conclusion: In view of the important needs of alternative new eneryg, India needs a vibrant industry revolution by inviting FDI in solar and wind energy sector. To support the project developers, the total project cost should be levied 5% GST as composite supply which includes the supply of solar devices, parts and accessories and installation charges. Or as required by the industry it should be reviewed as 90:10 instead of 70:30 now applicable.

The author is a director in Ms Lore Tax Professionals Private Ltd., Coimbatore and can be reached at renga42002@yahoo.co.in

i wish to install a Solar power plant with batteries according to the vendor i have to pay 5% tax for panels , 18% for inverter and installation , 28% for batteries.

another vendor says it is 5% for the whole system

which is correct?

Hi Sir/ Maam,

Is there any update and clarity on GST rate on Product & material and Services are required for setting up of Solar Power Plant.

I am working in Purchase Department with Biggest Solar Power Project Developer and Purchasing multiple Equipment/ Products / Material ( Like Transformers, Cables, Switchgear Panels, UPS etc.) from multiple Manufacturers/ Suppliers or Contractors as required for setting up a Solar PV Projects. Due to non availability of clear cut instruction and notification, i am unable to get Invoice from each Supplier with 5%GST..

Request to share update and feedback along with clear cut guidelines/ Instruction of Govt on GST for Material/ Product and Services related to Solar Projects to give comfort to Suppliers/ manufacturers to get Invoice for their Product with 5%GST.

Looking forward for earliest response…

Hi Sir/ Maam,

Is there any update and clarity on GST rate on Product & material and Services are required for setting up of Solar Power Plant.

I am working in Purchase Department with Biggest Solar Power Project Developer and Purchasing multiple Equipment/ Products / Material ( Like Transformers, Cables, Switchgear Panels, UPS etc.) from multiple Manufacturers/ Suppliers or Contractors as required for setting up a Solar PV Projects. Due to non availability of clear cut instruction and notification, i am unable to get Invoice from each Supplier with 5%GST..

Request to share update and feedback along with clear cut guidelines/ Instruction of Govt on GST for Material/ Product and Services related to Solar Projects to give comfort to Suppliers/ manufacturers to get Invoice for their Product with 5%GST.

Looking forward for earliest response…

SIR, GST ON SOLAR IS NOW 90-10 OR 70-30 PLZ EXPLAIN

Good Article. Details explained in a simple manner even the interested layman can understand easily.