GST Newsletter for December 2021

GST Council Secretariat, New Delhi

Existing GST rates in textile sector to continue beyond 1st January, 2022

The 46 meeting of the GST Council was held on 31.12.2021, in New Delhi under the Chairpersonship of Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman.

The GST Council has recommended to defer the decision to change the rates in textiles which were recommended in the 45 GST Council meeting. Consequently, the existing GST rates in textile sector would continue beyond 1st January, 2022.

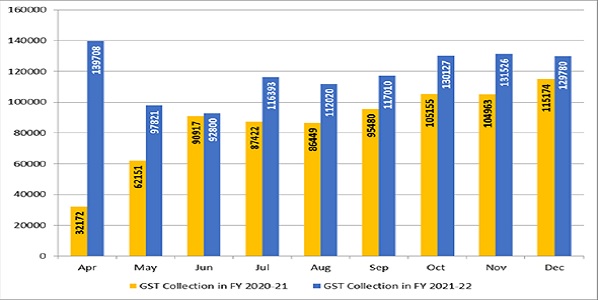

GST Revenue collection for December, 2021

Rs.1, 29,780 crore gross GST Revenue collection for December 2021

The gross GST revenue collected in the month of December 2021 is ` 1,29,780 crore of which CGST is Rs.22,578 crore, SGST is Rs.28,658 crore, IGST is Rs.69,155 crore (including Rs.37,527 crore collected on import of goods) and cess is Rs.9,389 crore (including Rs.614 crore collected on import of goods).

The government has settled Rs.25,568 crore to CGST and Rs.21,102 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States in the month of December 2021 after settlements is Rs.48,146 crore for CGST and Rs.49,760 crore for the SGST.

The revenues for the month of December 2021 are 13% higher than the GST revenues in the same month last year and 26% higher than the GST revenues in December 2019. During the month, revenues from import of goods was 36% higher and the revenues from domestic transaction (including import of services) are 5% higher than the revenues from these sources during the same month last year.

The GST collection in the month is close to Rs.1.30 lakh crore despite reduction of 17% in the number of e-way bills generated in the month of November, 2021 (6.1 crore) as compared to the month of October, 2021 (7.4 crore) due to improved tax compliance and better tax administration by both Central and State Tax authorities.

The average monthly gross GST collection for the third quarter of the current year has been Rs.1.30 lakh crore against the average monthly collection of Rs.1.10 lakh crore and Rs.1.15 lakh crore in the first and second quarters respectively. Coupled with economic recovery, anti-evasion activities, especially action against fake billers have been contributing to the enhanced GST. The improvement in revenue has also been due to various rate rationalization measures undertaken by the Council to correct inverted duty structure. It is expected that the positive trend in the revenues will continue in the last quarter as well.

The chart below shows trends in monthly gross GST revenues during the current year.

Central Tax Notifications

> Notification no. 37/2021-Central Tax dated 01.12.2021 which seeks to make amendments (Ninth Amendment, 2021) to the CGST Rules, 2017.

- The Government vide the said notification has extended the tenure of National Anti-Profiteering Authority (NAPA) to 5 years and has also amended FORM GST DRC03. Pertinently, with the amendment of Rule 137 of CGST Rules 2017 the tenure of the National Anti-Profiteering Authority has been extended to five years, the amendment comes into effect from 30 November 2021. Further, vide the said notification, a new cause of payment has been added in Form DRC-03 for payment of tax ascertained through Form GST DRC-01A.

> Notification no. 38/2021-Central Tax dated 21.12.2021 which seeks to bring sub-rule (2) and sub-rule (3), clause (i) of sub-rule (6) and sub-rule (7) of rule 2 of the CGST (Eighth Amendment) Rules, 2021 into force w.e.f. 01.01.2022.

- The Government vide the abovementioned notification has notified certain specific sub-rules of Rule 2 Central Goods and Services Tax (Eighth Amendment) Rules, 2021, introduced vide GST (Goods and Services Tax) Notification No. 35/2021–Central Tax dated 24th September 2021. The major amendments to come into effect are mentioned as follows:

- Rule 10B of CGST Rules stands amended from 1st January 2022, the said rule provides for mandatory Aadhaar authentication for a registered person in order to make him/her eligible for:

– Filing of Revocation Application as per Rule 23

– Refund Filing application as per rule 89

– Refund as per rule 96 on IGST paid exports

- Rule 23 has been revised in order to incorporate compulsory Aadhaar authentication for filing of revocation applications.

- Rule 89 has been amended in order to make Aadhaar authentication mandatory for furnishing the refund application.

- Rule 96 has been amended in order to incorporate compulsory Aadhaar authentication for receiving a refund in case of duty paid exports.

> Notification no. 39/2021-Central Tax dated 21.12.2021 which seeks to notify 01.01.2022 as the date on which provisions of section 108, 109 and 113 to 122 of the Finance Act, 2021 shall come into force.

- The Government vide the said notification has brought into force certain clauses of Finance Act, 2021 with effect from 1st January, 2022. A brief information about the changes are as follows:

- Section 7 of the CGST Act hereby stands amended retrospectively w.e.f 1st July, 2017 to tax supplies between an association and its members.

- Section 16(2) (aa) has been incorporated to provide that ITC would be available only when the details of the invoice or debit note has been furnished by the supplier in the statement of outward supplies and on communication of such details to the recipient of such invoice or debit note in the manner specified under section 37.

- Explanation 1 to Section 74 has been amended in order to dissever the provisions of penalty under Sec 129 & Sec 130 from Sec 74.

- Explanation to Section 75 shall be inserted which states that “self-assessed tax” shall include the tax payable in respect of details of outward supplies furnished under section 37, but not included in the return furnished under section 39.’.

- The ambit of powers of provisional attachment of property under Section 83 has been expanded thereby including any proceedings under Chapter XII (Assessment), Chapter XIV (Inspection, Search, Seizure & Arrest) or Chapter XV (Demands & Recovery).

- Section 107 has been amended in order to provide that an appeal against an order Sec 129(3) shall be filed only when a sum equal to twenty-five per cent. of the penalty has been paid by the appellant.”

- Section 129 of the CGST Act relating to detention, seizure and release of goods and conveyances in transit has been amended. Penalty of 200% of tax shall be payable instead of 100%. Time-limit to issue notice and order by the proper officer has been provided in the section itself.

- Section 130 has been amended in order to remove the non obstante clause from sub-section (1) sub-section (3) has been omitted from said section.

- Section 151 has been substituted in order to enlarge the scope of the same. Further, the Commissioner’s power to collect statistics has been substituted with the power to call for information.

- Section 152 has been amended to allow the information collected under Sec 150 or Sec 151 to be used for the purpose of any proceedings under this Act only after giving an opportunity of being heard to the person concerned.

- Para 7 of Schedule II to the CGST Act deeming the supply of goods by an unincorporated association or body of persons to members has been omitted retrospectively w.e.f 1st July, 2017.

> Notification No. 40/2021-Central Tax dated 29.12.2021 which seeks to make amendments (Tenth Amendment, 2021) to the CGST Rules, 2017.

The Government issued the abovementioned notification in order to notify the Central Goods and Services Tax (Tenth Amendment) Rules, 2021. Few of the key changes to come into effect vide the said notification are enlisted below:

The Government issued the abovementioned notification in order to notify the Central Goods and Services Tax (Tenth Amendment) Rules, 2021. Few of the key changes to come into effect vide the said notification are enlisted below:

Due date for GSTR-9 and GSTR-9C for the F.Y 2020-21 has been extended from 31st Dec, 2021 to 28th Feb, 2022.

Central Tax Rate Notifications

| Sl. No. | Notification No. | Dated | Subject |

| 1. | 18/2021- Central Tax (Rate) | 28.12.2021 | Seeks to amend Notification No 1/2017- Central Tax (Rate) dated 28.06.2017. |

| 2. | 19/2021- Central Tax (Rate) | 28.12.2021 | Seeks to amend Notification No 2/2017- Central Tax (Rate) dated 28.06.2017. |

| 3. | 20/2021- Central Tax (Rate) | 28.12.2021 | Seeks to amend Notification No 21/2018- Central Tax (Rate) dated 26.07.2018. |

| 4. | 21/2021- Central Tax (Rate) | 31.12.2021 | Seeks to supersede notification 14/2021- CT(R) dated 18.11.2021 and amend Notification No 1/2017-CT (Rate) dated 28.06.2017. |

| 5. | 22/2021- Central Tax (Rate) | 31.12.2021 | Seeks to supersede notification 15/2021- CT(R) dated 18.11.2021 & amend Notification No 11/ 2017- CT (Rate) dated 28.06.2017. |

Compensation Cess Rate Notification

> Notification no. 02/2021-Compensation Cess (Rate) dt 28-12-2021 which seeks to amend Notification No 1/2017- Compensation Cess (Rate) dated 28.06.2017.

The Government in exercise of the powers conferred by subsection (2) of section 8 of the Goods and Services Tax (Compensation to States) Act, 2017 (15 of 2017), on the recommendations of the Council, notified certain amendments in the notification number 1/2017-Compensation Cess (Rate), dated the 28th June, 2017. This notification shall come into force on the 1st day of January, 2022.

Circulars

> Circular no. 167/23/2021-GST dated 17-12-2021.

The GST Council in its 45th meeting held on 17th September, 2021 recommended to notify‚ Restaurant Service‛ under section 9(5) of the CGST Act, 2017. Accordingly, the tax on supplies of restaurant service supplied through e- commerce operators shall be paid by the e-commerce operator. In this regard notification No. 17/2021 dated 18.11.2021 has been issued. The Government vide the abovementioned circular has issued clarifications in furtherance of certain representations that have been received by the Government requesting for clarification regarding modalities of compliance to the GST laws in respect of supply of restaurant service through e-commerce operators (ECO).

> Circular no. 168/24/2021-GST dated 30-12-2021.

The Government vide the said notification has issued clarifications regarding mechanism for filing of refund claim by the taxpayers registered in erstwhile Union Territory of Daman & Diu for period prior to merger with U.T. of Dadra & Nagar Haveli.

GST Portal Updates

> Module wise new functionalities deployed on the GST Portal for taxpayers

Various new functionalities are implemented on the GST Portal, from time to time, for GST stakeholders. These functionalities pertain to different modules such as Registration, Returns, Advance Ruling, Payment, Refund and other miscellaneous topics. Various webinars are also conducted as well informational videos prepared on these functionalities and posted on GSTNs dedicated YouTube channel for the benefit of the stakeholders.

To view module wise functionalities deployed on the GST Portal and webinars conducted/ Videos posted on our YouTube channel, refer to table below:

Sl. No. |

Taxpayer

|

Click link below |

1. |

November, 2021 |

New Functionalities for Taxpayers on GST Portal- November, 2021 |

2. |

July-Septe-mber, 2021 |

New Functionalities for Taxpayers on GST Portal (July-September, 2021) |

3. |

April-June, 2021 |

https://tutorial.gst.gov.in/downloads/news/newfunctionalities_compilationaprjun2021.pdf |

4. |

January-March, 2021 |

https://tutorial.gst.gov.in/downloads/news/newfunctionalitiescompilation_janmar2021.pdf |

5. |

October-

|

New functionalities on GST Portal (October-December, 2020) |

6. |

Comp-ilation of

|

https://tutorial.gst.gov.in/downloads/news/gstn_youtube_videos_posted_2020.pdf |

> Mandatory Aadhaar authentication for registered person

The Central Government vide Notification No. 38/2021-CT dated 21.12.2021 has notified January 1, 2022 as the implementation date for Rule 10B of CGST Rules, 2017.

In the said rule, it is mandatory for the registered person to undergo Aadhaar authentication for the below purposes,

1. Filing of application for revocation of cancellation of registration in FORM GST REG-21 under Rule 23 of

CGST Rules, 2017

2. Filing of refund application in FORM RFD-01 under Rule 89 of CGST Rules, 2017

3. Refund of the IGST paid on goods exported out of India under Rule 96 of CGST Rules, 2017.

The taxable person, who have not yet authenticated their Aadhaar, may like to go through this authentication process before filing the above two applications and enabling GST system to validate and transmit the IGST refund data from GST system to ICEGATE system.

If Aadhaar number has not been assigned to the concern person for Aadhaar authentication as specified above, such person may undergo e-KYC verification by furnishing the following:

(a) She/he will feed Aadhaar Enrolment ID and upload the acknowledgement; and

(b) She/he shall also upload any one of the following documents:

i. Bank passbook with photograph; or

ii. Voter identity card issued by the Election Commission of India; or

iii. Passport; or

iv. Driving license issued by the Licensing Authority under the Motor Vehicles Act, 1988 (59 of 1988):

Provided further that such person shall undergo the Aadhaar authentication within a period of thirty days from allotment of the Aadhaar number.

Aadhaar authentication or e-KYC verification before filing of refund may be completed by navigating to “Dashboard > My Profile > Aadhaar Authentication Status”

Updates from State

> Special drive to dispose GST Refund

A refund drive was conducted by the Excise and Taxation Department, Haryana from 8th November, 2021 to 8th December, 2021 to dispose/ process all pending refund cases pending over 45 days’ time period by the field formations across the State of Haryana.

In these 30 days, a total of 199 refund applications amounting to Rs. 107.88 Crore has been processed /disposed, ln percentage terms 77.44% of total count of pendency and 80% of the amount involved in these refund cases have been disposed in this drive since 8th November, 2021.

It is reiterated that the Government of Haryana shall strive to continue its commitment towards its taxpayers and provide all refunds within the time period stipulated under GST Act, 2017.

> Punjab Registers 2nd Highest GST Cash Collection Since Rollout of Central Tax Regime

The Goods and Services Tax (GST) cash collection in November, 2021 grew by 32% to Rs 1845 crore in Punjab, the second highest since the Central tax regime came into force. This collection is second only to that in April, 2021 but also the growth rate experienced is third highest in the country across the major States after Odisha and Kerala.

An official spokesperson of the Taxation Commissionerate said that the GST revenue receipts for the State of Punjab in November, 2021 stood at Rs 1377.77 crore against Rs 1067 crore for the corresponding period of previous year i.e. November, 2020 registering a strong growth of 29%. This is very much in line with the trend in economic recovery.

He said that the GST revenue up to the month of November, 2021 has witnessed a high growth of nearly 54% as compared to corresponding period last year. The high growth in GST revenue can be attributed to compliance improvement on account of both policy and administrative measures undertaken by the State Government as well as the strict enforcement measures adopted in coordination with the Central tax enforcement agencies.

The deployment of effective data analysis based on machine learning and intelligent on-road detention has played an important role in detections of large tax evasion cases relating to fake invoices and enhanced compliance.

The tax collection from VAT and CST during the month of November, 2021 is Rs 949.44 crore and Rs 20.19 crore respectively. As compared to the same period last year, VAT and CST revenue collection have displayed respective growth of 28.73% and 11.49% this year. The robust growth in VAT revenue is predominantly attributable to increase in average tax rate in October, 2021 over October, 2020.

As a result of consistent efforts from the Taxation department to register new eligible taxpayers under PSDT Act, the professional tax has also shown growth of 18% during November, 2021 with collection of Rs.12.34 crores over Rs.10.45 crores during November, 2020.

****

Printed & Published by GST COUNCIL SECRETARIAT

5th Floor, Tower-II, Jeevan Bharati Building, Connaught Place, New Delhi 110 001, Ph: 011-23762656, www.gstcouncil.gov.in

DISCLAIMER: This newsletter is in-house efforts of the GST Council Secretariat. The contents of this newsletter do not represent the views of GST Council and are

for reference purpose only.