GOVERNMENT OF INDIA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES,

MUMBAI, MAHARASHTRA

100, “EVEREST”, MARINE DRIVE, MUMBAI -02.

Website: www.mca.gov.in

E-Mail ID: roc.mumbai@mca.gov.in

Order No. ROC/MUM/NV AUTO/241861/SEC. 454 r.w 42/2023/168 to 173 DATE: 01 May 2023

ORDER FOR PENALTY UNDER SECTION 454 OF nit COMPANIES ACT, 2013 READ WITH COMPANIES (ADJUDICATION OF PENALTIES) RULES, 2014 FOR VIOLATION OF SECTION 42 OF THE COMPANIES ACT, 2013.

IN THE MATTER OF M/S. NV AUTOSPARES PRIVATE LIMITED (U34300MH2005PTC241861)

| 1. | Adjudicating Officer | : Shri. B. Mishra, ICLS, ROC Mumbai |

| 2. | Presenting Officer | : Ms. Rujuta Bankar, ICLS, AROC Mumbai |

| 3. | Authorised representative for

Complainant |

:- Mr. Tarun Arore Chartered Accountant. |

| 4. | Authorised representative for Respondent | :- Mr. Bharat Gadhavi Advocate. |

APPOINTMENT OF ADJUDICATING OFFICER: –

The Ministry of Corporate Affairs vide its Gazette Notification No. A-42011/112/2014-Ad.11 dated 24.03.2015 has appointed the Adjudicating Authority as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (hereinafter known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 (Notification No. GSR 254(E) dated 31.03.2014) for adjudging penalties under the provisions of Act.

COMPANY: –

M/s. NV AUTOSPARES PRIVATE LIMITED (herein referred to as The Company) was incorporated on 01.06.2005 under CIN U34300MH2005PIC241861 as private company under provisions of Companies Act, 1956. The Registered Office of the Company is presently situated at Plot No. 3611 & 2, MIDC, Satpur, Nashik, Maharashtra, 422007, India registered under ROC Mumbai, Maharashtra. The Company falls under the jurisdiction of the ROC Mumbai.

The provisions of Section 42 of the Companies Act, 2013 (hereinafter referred to as ‘the Act‘) arc reproduced below:

Section 42: Issue of Shares on Private Placement basis:

(1) A company may subject to the provisions of this section, make a private placement of securities.

(2) A private placement shall be made only to the selected group of persons who have been identified by the Board (hereinafter referred to as she ‘Identified Persons’) whose number shall not exceed fifty or such higher number as may be prescribed [exiling the qualified institutional buyers and employees of the Company being offered securities under a scheme of employees stock option in terms of provisions of clause (b) of sub-section (1) of Section 62, in a financial year subject to conditions as may be prescribed

(3) A company making private placement shall issue private placement offer and application in such form and manner as may be prescribed to identified persons, whose name and addresses are recorded by the company in such manner as may be prescribed:

Provided that the private placement offer and application shall not carry any right of renunciation.

(4) Every identified person willing to subscribe to the private placement issue shall apply in private placement and application issued to such person along with subscription money paid either by cheque or demand draft or other banking channel and not by cash.

Provided that company shall not utilize monies raised through private placement unless allotment is made and the return of allotment is filed with registrar in accordance with sub-section (8).

(5) No fresh offer or invitation under this section shall be made unless the allotments with respect to any offer or invitation made earlier have been completed or that offer or invitation has been withdrawn or abandoned by the company.

Provided that subject to maximum number of identified persons under sub-section 2A company may at any time make more than one issue of securities to such class of identified persons as may be prescribed.

(6) A company making an offer or invitation under this section shall allot its securities within sixty days .from the date of receipt of the application money for such securities and if company is not able to allot the securities within that period, it shall repay the application money to the subscribers within fifteen days from the expiry of sixty days and if the company fails to repay the application money within the aforesaid period, it shall be liable to repay that money with interest at the rate of twelve percent per annum from the expiry of sixtieth day:

Provided that monies received on application under this section shall be kept in a separate bank account in a scheduled bank and shall not be utilised for any purpose other than —

(a) For adjustment against allotment of securities: on

(b) For the repayment of monies where the company is unable to allot securities

(7) No company issuing securities under this section shall release any public advertisement or utilise any media, marketing or distribution channels or agents to inform the public at large about such an issue.

(8) A company making any allotment of securities under this section shall file with registrar a return of allotment within fifteen days from the date of allotment in such manner as may be prescribed, including a complete list of allottees, with their full names. addresses. number of securities allotted and .such other relevant information as may be prescribed

(9) If company defaults in filing the return of allotment within the period prescribed under sub-section (8), the company, its promoters and directors shall be liable to a penalty for each default of one thousand rupees .Ibr each day during which default continues but not exceeding twenty-five lakh rupees.

(10) Subject to sub-section (11). if a company makes an offer or accepts monies in contravention of this section. the company its promoters and directors shall be liable for a penalty which may extend to the amount raised through the private placement or two crores, whichever is Iowan and the company shall also refund all monies with interest as specified in sub-section (6) to subscribers within a period of thirty days of the order imposing the penalty.

(11) Notwithstanding. anything contained in sub-section (9) and sub-section (10). any private placement issue not made in compliance of the provisions of sub-section (2) shall be deemed to be public offer and all the provisions of this Act and the Securities Contracts (Regulations) Act, 1956 (42 of 1956) and the Securities and Exchange Board of India Act, 1992 (15 of 1992) shall he applicable.

1. This office has received a complaint dated 10.02.2022 through M/s Arora Bedi and Associates [Chartered Accountants] on behalf of Shri. Girish N Pawar (Complainant no. I), M/s Kinder Universe Pvt. Ltd. (Complainant no. 2), Shri. Sanjay Katira (Complainant no. 3) and M/s Safalya Consultancy Pvt. Ltd (Complainant no. 4). against N V Autospares Pvt. Ltd. (Respondent No. I) and Mr. Kailas Ahire (Respondent No. 2) and Mrs. Alka Ahire (Respondent No. 3). This office has taken up the matter with the company vide its letter dated 25.02.2022. The complainants in their complaint have inter-alia alleged that the Company and its officers in default have accepted money on private placement basis in contravention of provisions of section 42 of the Companies Act, 2013 and Rules made there under. The brief facts of the complaint are as under.

A. Submissions of the Complainant:

a. The Company during FY16-17 and FY 17-18 was reeling under financial pressure as a result of which the Company’s account with Central Bank of India, Nasik (‘Central Bank’ for short) was classified as Non Performing Asset on 0110.2017.

b. The Company was solely banking with Central Bank and was utilizing both Term Loan and Working Capital finance for business operations. Further, due to the financial pressure and liquidity mismanagement, the Company was unable to pay statutory dues. Due to the liquidity crisis, the Company was unable to pay trade creditors. The financial deficit on account of the above outstanding (all including) was to the extent of Rs.19,04.02,849.

c. The Bank account of the Company was placed under lien and/or Debillree category owing to the above outstanding, NPA classification and non-payment of statutory dues.

d. Given the circumstances, the Company was searching for investors. They approached Complainant no. I who was looking for the business potential in the Company. Complainant no. 1 was convinced that the business of the Company could come back on track and thus agreed to invest money. However, given the size of the infusion required. it was difficult for him to infuse the money by himself. Therefore. the Company was advised to look for other investors who could possibly invest money along with the Complainant no. 1.

e. The Company continued to scout for the investors who could infuse money along with Complainant no. 1. It was successful in scouting the Complainant No. 2 to 4 as potential investor. Pursuant to the initial discussions between the Respondents and Complainant No. 2 to 4, several joint discussions were held between the Complainants and the Respondents. The Complainants agreed to invest money on two conditions i.e., (1) that some percentage of shares be initially transferred to the Complainants and (2) out of the total amount that is required to be infused, a portion of infusions should be made by Respondent No. 2 and 3.

f. Accordingly, pursuant to condition no. I the Complainant No. 1 acquired 49,400 equity shares (9.88 %.of paid-up share capital) from Respondent No. 2 & 3 by remitting Rs. 65,00,000/-. It is undisputed that this transfer of shares took place on 18/09/2018.

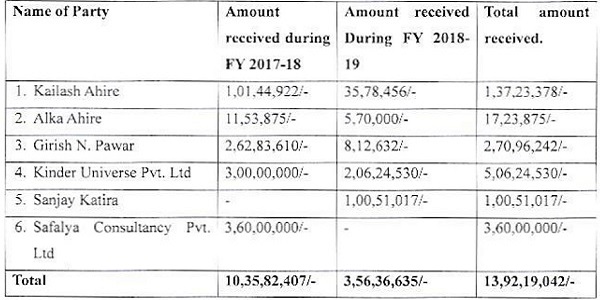

g. Further pursuant to condition no. 2 Complainants 1 to 4 along with Respondent No. 2 and 3 paid the following sums towards share application money over the span of two years viz. FY 2017-18, 2018-19.

h. This money was remitted in the following manner: The bank account of the Respondent No. 1 was frozen and/or placed under debit freeze category by Central Bank. Therefore, the Respondents and Complainants approached the bank and entered into the One Time Settlement Agreement. It is undisputed that the entire outstanding of the Central Bank was settled at Rs.8.80 crone and ninety-nine percent (99%) of the OTS amount was paid directly by the Complainants. Until the NPA was cleared and OTS was honoured. Central Bank could not have issued the NOC to allow the Respondent No. 1 to open new current account. Therefore, after the terms of the OTS were adhered to and the settlement amount was paid to the Central Bank, the Respondent No. I resolved to open new account with the Punjab National Bank, to accept the monies as per the provisions of the Section 42(6) of the Companies Act, 2013. The vendors/creditors and statutory liabilities were paid via the said New Bank Account. The amount remitted by the Complainants towards the equity shares was utilized without any allotment and issuance of shares to the subscribers/allottees. Apart from the above remittances in the said New Bank Account, certain statutory payments and payments to creditors were made directly by the Complainants.

i. The Complainants have alleged that they were promised that in lieu of the above remittances the Company shall issue the equity shares. The Complainants also alleged that they were further promised that the formalities and modalities of issuing shares under the provisions of the Companies Act, 2013 i.e., valuation. compliance of Section 42 and rules made thereunder, shall be taken care by the Respondent No. 1. The Complainants claimed that were principally scouted by the Respondents and thus the promises, unequivocal acceptance and reciprocal promises were agreed and entered into. It was agreed between the Complainants and the Respondents. that for the monies the Complainants shall be allotted proportionate equity shares in the company by the Respondent No. I. Upon the remittances/transfers and direct payments, the Respondent No. I recorded the amount paid as ‘Share Application Money Pending Allotment’ in financial statements pertaining to FYI8-19, FY19-20 and FY20-21. The Respondent No. 2 & 3 bridged approximately 11% of the total amount received as Share Application Money by Respondent No. I Company. Rs.13,92,19,042 in total were infused in the Respondent No. 1 and out of the total Rs.12,37,71,789 was infused by the Complainants over the period of FY18-19 and FY I 9-20. (As shown in table above)

j. The Complainants claim that whenever they demanded the Share Certificates in lieu of the infusion made, the Respondents gave evasive replies. The Complainants were not served with the copies of the audited financial statements of the Company. The Complainant No.1 who also happens to he the shareholder in the Company, alleged that he was neither called for the any shareholders’ meeting nor was ever provided with the copies of the financial statements. The Complainants were able to procure the copies of financial statements for FY18-19 sometime in November 2021. The audited financial statements for FY18-19 revealed that the money so infused/paid like Complainants was shown as ‘Share Application Money Pending Allotment’. Thereafter, the shareholders vide request letterstmail dated 18/11/202), 21/11/2021 and 27/11/2021 sought the inspection of the books of accounts and records of the Respondent No. 1. The shareholders were communicated vide the Company’s letter dated 24/11/2021 that they shall be intimated about the inspection in due course of time. However, no inspection was provided to the shareholders’/Complainants despite several reminders.

K. Thereafter the Respondents on 08/01/2022 filed the financial statements vide AOC-4 for FY19-20 and FY20-21 respectively, The Complainants allege that on perusal of the financial statements they saw that the entire money received from them was shown as Share Application Money Pending Allotment.

B. On consideration of the complaint Adjudication proceeding under section 454 of the Companies Act, 2013 was initiated by issuing Notice Dated 06/01/2023 to the Company and its Directors for contravention of section 42 of the Companies Act, 2013 for invitation for subscription of securities on private placement. In response to the aforesaid notice, the respondents after seeking extension of time submitted their reply dated 21.02.2023 by way an affidavit through Tejesh Dande & Associates Advocates, authorised representative of Respondents.

C. Submissions of the Respondents:

The respondents in their affidavit in reply to the notice dated 06/01/2023 and during the hearing held on 23/03/2023 have interalia submitted as under.

a. The Complaint is not maintainable on the point of limitation as according to the Complainant the so-called infusion of money in the Respondent Company has taken place in FY2018-19 and 2019-2020, however it appears that the complaint is filed on 10.02.2022. The complainants arc coming before this Hon’ ble Authority after 4 years and claiming that they realised about the non-allotment of shares in November 2021.

b. In order to fit a case u/s 42 of the Companies Act, it is essential that the offer from company would come in written format, however, the entire complaint is silent about any offer from Respondent No.1’s side.

c. The respondent has stated that the transcction of payment of bank loans and government dues and ect. is completely an independent transaction. The settlement of bank and NOC issued are a matter of record, however, the money which was utilised for the said repayment and the claim u/s 42 of the Companies Act arc having no relevance to each other.

d. The complainants through their legal attorneys Zastriya, Attorneys and Legal Consultants issued the demand notices dated 04/03/2020 thereby demanding Rs.13,34,98,628 and threatened the Respondents to proceed under the provisions of the Insolvency and Bankruptcy Code, 2016 in case the money is not returned. In the aforesaid notice the transaction was shown as financial assistance and no mentioned was made of Private Placement.

e. The private placement can only be made to a selected group of persons who have been identified by the Board, however in the present complaint no such process of identification was ever done by Company.

f. 76000 Equity shares of the Company have already been transferred to the name of Complainant No. 1 as well as one Mr. Satish K. Agrawal. Therefore, Complainant No. 1 claim has already been settled against this transfer of shares.

g. The auditor of the Company and company secretary were working under the control and instructions of the Complainants and as per their instructions it was mentioned in financial statement of Respondent No. 1 that “Share application money pending allotment”, however, the said entry was made without any notice and consent of Respondent No.2 and 3 who are the Directors of Respondent No. 1 Company.

D. Hearing and Oral Submission made by Authorised Representatives.

CA Tarun Arora, Authorised Representative on behalf of Shri. Girish N Pawar (Complainant no. I ), MIs Kinder Universe Pvt. Ltd. (Complainant no. 2), Shri. Sanjay Kataria (Complainant no. 3) and M/s Safalya Consultancy Pvt. Ltd (Complainant no. 4) and, Adv. Bharat Gadhavi Authorised Representative on behalf of N V Autospares Pvt. Ltd. (Respondent No. 1) and Mr. Kailas Ahire (Respondent No. 2) and Mrs. Alka Ahire (Respondent No. 3) attended the hearing in the office of the Adjudicating Authority on 23.03.2023.

During the hearing the complainants reiterated the submissions made by them in their written complaint and further submitted that, the onus to complete the procedural requirements was on the company. Further, he stated that Complainant No. 1 was not provided with copies of the Annual reports of the company being the shareholder of the Company. He submitted correspondence made with the company to be taken on record to back his statement. I Ie also brought to the notice of the Adjudicating Authority that the Company did not file Annual Returns & Balance Sheet for the FY 2018-2019 & 2019-2020 with in prescribed time frame as mentioned in Section 92 & 137 of the Act.

The Authorised Representative on behalf of the Respondents submitted that the complaint is not maintainable on grounds of limitation as the said infusion of funds in happened in the FY 2018-19. Further he submitted that without prejudice to the rights and contentions of the respondents the respondents wish to explore possibility of settlement and he therefore prayed for adjournment of the hearing. He also submitted that the complainants had earlier issued a demand notice to the company under Section 7 of Insolvency and Bankruptcy Code. Ile stated that in the said notice the transaction was shown as financial assistance and no mention of Share allocation was made. Ile submitted, the legal notice received from the complainants to be taken on record.

The arguments of both the parties have been taken on record and dealt with in Sil . in findings of the Adjudicating Authority.

E. Findings:

Having perused the documents on records, complaints, written replies and the submissions made during the hearing, I make following observations:

a. On the issue of limitation it is observed that the complaint is within limitation. The complainant has relied upon judgment of Hon’ble Apex Court in Asset Reconstruction Company (India) Limited V. Bishal Jaiswal & ANR. In Civil Appeal No. 323 of 2021 wherein the Hon’ble Apex Court was called upon to adjudicate on whether the disclosures made in the Balance Sheet, Notes to Account, Auditor’s Report, Board Report amounts to admission/acknowledgement of liabilities. The Hon’ble Supreme Court in Bishal Jaiswal (Supra) after considering the position in various judgments, upheld that an acknowledge of liability in the Balance Sheet by a company registered under Companies Act, 1956 extends the period of limitation under Limitation Act, 1963.

b. The issuance of demand notice envisaging action under the provisions of Insolvency and Bankruptcy Code. 2016 was within the scope of law. For the same the complainant have relied upon Mr. Kushan Mitra V. Mr. Amit Goel & Othrs. In Company Appeal (AT) (Insolvency) No. 128 of 2021 and I.A 2340 of 2021 and 2413 of 2021 wherein the Hon’ble NCLAT noted the following:

20. For all the aforenoted reasons, we are of the considered view that Share Application Money in the event of non-allotment of shares, attracts interest under Section 42(6) of the Companies Act, 2013 and therefore falls within the ambit of definition of ‘Financial Debt’ as defined under Section 509 of the Code…

c. It is observed on the facts of the case that the Board has failed to identify the select group of person to whom the private placement offer was made. Thereby the company violated the provisions of section 42 (2) of the Act.

d. It is also observed that, company has failed to issue Private Placement Offer Letter and application in the prescribed form PAS-4 thereby violating the Section 42 (3) of the Act r.w. Rule 14(3) of Companies (Prospectus and Allotment of Securities), Rules 2014.

e. Company has failed to place on record the approval of the shareholders to the proposal to make art offer or invitation to subscribe to securities through Private Placement. Failure to obtain approval of shareholders violated the Section 42 (2) & (3) of the Act r.w. Rule 14(1) of Companies (Prospectus and Allotment of Securities), Rules 2014.

f. It is also observed form Financial Statement filed by the company for the FY 2018-19 that the company in its Balance Sheet has shown Share Application money amounting to Rs. 10,35,82,407/-. The corresponding amount for the FY. 2019-20 is Rs. 13,92,19,042/-. This indicates that the Company has accepted further Share Application Money amounting to Rs. 3,56,36,635/-. This is corroborated by the observation made by the Independent Auditor in the “Annexure A” to the Independent Auditors’ Report for the FY. 2019-2020 for the Financial Year ended 31/03/2020 in Point No. ix. Thereby it can be inferred that the Company has made a further offer or invitation without completing the earlier offer. No documents have been placed on record by the Company indicating that earlier offer had been withdrawn or abandoned by the Company. Further acceptance of share application of money has violated the provisions of section 42 (5) of the Act.

g. The Directors of the Company have admitted in the Board Report that the company has accepted a sum of Rs. 10,35,82,407 in the FY 2018-19 & Rs. 3,56,36,635/- in the FY 2019-2020 towards Share Application Money. Neither Shares were allotted, nor the amount was refunded to the respective persons. The Board stated that it will decide later about the allotment or refund of money. The company failed to allot securities within sixty days of acceptance of money. Company also failed to repay the application of money to the subscriber within fifteen days from the expiry of sixty days. Thus, the company has violated the provisions of section 42 (6) of the Act as the Company despite accepting and acknowledging the receipt has not allotted its securities within sixty days from the date of receipt of the application money for such securities nor company has repaid the application money to the subscribers within fifteen days form the expiry of sixty days.

h. The details of bank statement submitted by the Complainants indicate that the Complainants have paid money directly to the Central Bank of India in pursuance of the One ‘lime Settlement for the dues payable by the Company. After the settlement of dues with Central Bank of India, the Respondent Company opened a separate new bank account wherein the monies were also received by the company. This indicates that the company violated the provisions of Section 42 (6) of the Act as the company has failed to open a separate bank account in a scheduled bank in order to accept share application money.

i. The Respondent Company in its Financial Statement for the FY 2018-19 & 2019-20 has unequivocally and unconditionally admitted that the monies were received towards the issuance of shares, failing the issuance of which the II% of monies were classified as ‘Share Application Money Pending Allotment’.

j. The Respondent No. 1 company accepted the monies in contravention to the various provisions of section 42 without following due procedure laid down in the provisions of section 42 of the Companies Act. 2013 & Rules made thereunder.

k. The finding is also supported by the observations made by the independent Auditor:-

The auditors of the Company Krishnamurthy Jain & Suryawanshi Chartered Accountants have also qualified the same in Auditors Report:

FY2018-2019:

…during the year company has accepted a sum of Rs.10,35,82,407 towards share application money details of which are given in the notes of the accounts separately, but neither share are allotted nor the amount is refunded to the respective persons

FY2019-2020:

…during the year company has accepted a sum of Rs. 3,56,36,635 towards share application money details of which are given in the notes of the accounts separately, but neither share are allotted nor the amount is refunded to the respective persons

The directors of the Company have taken note of the remarks/qualification made by the auditor in audit report and stated the following in the Directors Report for the FY 2018-19 & 2019-20:

`The management has taken steps towards this remark. The Management will decide later about allotment or refund of money.’

1. In the present case neither complainants nor the respondents could submit Private Placement offer letter cum application form. Company in its Financial Statement has admitted to receipt of Share Application of Money and the Independent Auditor has also pointed out the same in his Audit Report. Money has been accepted by the company from time to time. The money has been paid directly by the complainant to the Central Bank and dues to the other regulating authorities and panics was paid through new account. The said money appears to be utilized for the purpose of settling the dues of the company with Central Bank and statutory authorities

F. Order:

Section 42 (10) is reproduced as under:

if a company makes an offer or accepts monies in contravention of section, the company, its promoters and directors shall be liable for a penalty which may extend to the amount raised through the private placement or two crores, whichever is lower, and the company shall also refund all monies with interest as specified in sub-section (6) to subscribers within a period of thirty days of the order imposing the penalty,

Having considered the facts and circumstances of the case and submissions made by Authorised Representatives of both the parties and based on the findings above and in exercise of the powers vested under Section 454(3) of the Companies Act, 2013, I order the following:

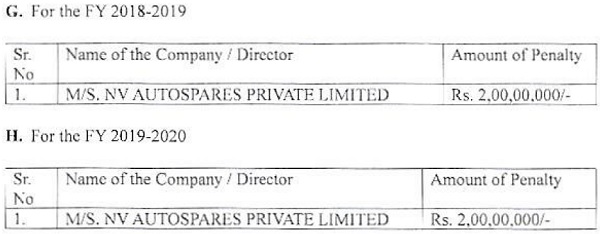

The penalty under Section 42(10) of’ the Act is imposed:

G.. For the FY 2018-2019

a. The company is directed to refund all the monies to the complainants along with interest at the rate of twelve per cent per annum as per the provisions of section 42(6) of’ the Act, within 30 days from the date of order as per the provisions of section 42(10) of the Act.

b. The penalty amount shall be remitted by the company through MCA21 portal within 60 days from the date of Order. The Company needs to file INC-28 as per the provisions of the Act, attaching the copy of’ adjudication order along with payment challans.

c. Any person aggrieved by the order of Adjudicating Authority under sub-section (3) of Section 454 may prefer an appeal to the Regional Director having jurisdiction in matter.

d. Every appeal under sub-section (5) of Section 454 shall be filed within 60 days from the date on which the copy of order made by the Adjudicating Authority is received by the aggrieved person and shall be in such form, manner and be accompanied by such fee as may be prescribed.

e. As per section 454(8)(i), where a company fails to comply with the Order made under sub-section (3) or Sub-section (7) as the case may be, within a period of 90 days from the date of receipt of the copy of the Order, the Company shall be punishable with fine which shall not be less than twenty-five thousand, but which may extend to five lakh rupees.

f. Where an officer of a company or any other person who is in default fails to comply with the order made under sun-section (3) or sub-section (7), as the case may be, within a period of 90 days from the date of receipt of the order, such officer shall be punishable with imprisonment which may extend to six months or with the fine which shall not be less than twenty five thousand rupees but which may extend to one lakh or with both.

g. This order is without prejudice to the rights available to this office to initiate separate actions including but not limited to the penal actions for contraventions of related, incidental and/or continuing offences/contraventions.

h. The delay for issuance of the order if any is due to complexity of the issue and time taken by the respondents to submit their replies and examinations of the issues involved.

Date :- 1st May 2023. Place :- Mumbai.

(Benudhar Mishra)

Adjudicating Officer and

Registrar of Companies,

Mumbai, Maharashtra.