As per Section 92(1)(f) of the Companies Act, 2013: Every company shall prepare a return (hereinafter referred to as the annual return) in the prescribed form containing the particulars as they stood on the close of the financial year regarding – meetings of members or a class thereof, Board and its various committees along with attendance details meetings of members or a class thereof Board and its various committees along with attendance details. However, upon examination of the filed E-Forms with this office, it is observed that the Company has not filed annual return since incorporation, therefore no record is available regarding the number of board meetings taken place. Hence, it is implied that the Company has not conducted the board meetings. Therefore, it appears that the provision of section 173(1) of the Companies Act, 2013 has been contravened by the company and its directors/officers in default which inter alia states that: -every company shall hold the first meeting of the Board of Directors within thirty days of the date of its incorporation and thereafter hold a minimum number of four meetings of its Board of Directors every year in such a manner that not more than one hundred and twenty days shall intervene between two consecutive meetings of the Board.”

Hence, the company and its directors/officers in default have violated the provisions of section 173(1) of the Companies Act, 2013 w.r.t non-holding of board meeting since incorporation.

ROC has not received any reply from the company and its directors. Hence, the provisions of Section 173(1) of the Companies Act 2013 has been contravened by the company and its directors/officers and therefore they are liable for penalty u/ s. 450 of the Companies Act 2013 for the Financial Year 2014-2015 to 2021-2022.

Having considered the facts and circumstances of the case and after taking into account the provisions of Rule-11 of Companies (Adjudication of Penalties) Rules, 2014 (as amended), I hereby impose a penalty of Rs. 80,000 (Eighty Thousand) each on Company and Directors, viz., Shri Prem Sagar and Smt. Prabhawati Devi and Rs. 20,000 on director, viz., Shri Neeraj Kumar.

Government of India

Ministry Of Corporate Affairs

Office of the Registrar of Companies, Bihar-Cum-Official Liquidator, High Court, Patna

4th Floor, ‘A’ Wing, Maurya Lok Complex

Dakbunglow Road, Patna-800001

No. ROC/PAT/SCN/173/22447/2532-2536 Dated:30.01.2023

Order for penalty for violation of section 173 of the Companies Act, 2013

In the Matter of

HOLY FLOWER COLD STORAGE PRIVATE LIMITED

CIN: U74999BR2014PTCO22447

Appointment of Adjudication Officer:-

1. The Ministry of Corporate Affairs vide its Gazette Notification No. A-42011/112/2014- Ad. H dated 24.03.2015 has appointed the undersigned as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (herein after known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 for adjudging penalties under the provisions of this Act.

Company:-

2. Whereas, Company M/ s. Holy Flower Cold Storage Private Limited, CIN: U74999BR2014PTCO22447 (herein after known as Company) is a company incorporated on 20.06.2014 under the provisions of Companies Act, 1956/ 2013 in the state of Bihar and having its registered office situated at 3, Circular Road Patna ,Bihar- 800001,India as per MCA website.

Facts about the case:-

3. As per Section 92(1)(f) of the Companies Act, 2013: Every company shall prepare a return (hereinafter referred to as the annual return) in the prescribed form containing the particulars as they stood on the close of the financial year regarding – meetings of members or a class thereof, Board and its various committees along with attendance details meetings of members or a class thereof Board and its various committees along with attendance details. However, upon examination of the filed E-Forms with this office, it is observed that the Company has not filed annual return since incorporation, therefore no record is available regarding the number of board meetings taken place. Hence, it is implied that the Company has not conducted the board meetings. Therefore, it appears that the provision of section 173(1) of the Companies Act, 2013 has been contravened by the company and its directors/officers in default which inter alia states that: -every company shall hold the first meeting of the Board of Directors within thirty days of the date of its incorporation and thereafter hold a minimum number of four meetings of its Board of Directors every year in such a manner that not more than one hundred and twenty days shall intervene between two consecutive meetings of the Board.”

Hence, the company and its directors/officers in default have violated the provisions of section 173(1) of the Companies Act, 2013 w.r.t non-holding of board meeting since incorporation.

4. Whereas, this office has issued show cause notice for default under section 173(1) of the Companies Act, 2013 vide this office letter no. ROC/PAT/SCN/sec. 173(1)/22947/2334-2337 dated 23.12.2022.

5. However, this office has not received any reply from the company and its directors. Hence, the provisions of Section 173(1) of the Companies Act 2013 has been contravened by the company and its directors/officers and therefore they are liable for penalty u/ s. 450 of the Companies Act 2013 for the Financial Year 2014-2015 to 2021-2022.

Section 450 states that:- “If a company or any officer of a company or any other person contravenes any of the provisions of this Act or the rules made thereunder, or any condition, limitation or restriction subject to which any approval, sanction, consent, confirmation, recognition, direction or exemption in relation to any matter has been accorded, given or granted, and for which no penalty or punishment is provided elsewhere in this Act, the company and every officer of the company who is in default or such other person shall be liable to a penalty of ten thousand rupees, and in case of continuing contravention, with a further penalty of one thousand rupees for each day after the first during which the contravention continues, subject to a maximum of two faith rupees in case of a company and fifty thousand rupees in case of an officer who is in default or any other person”.

6. Further Section 446B states that “if penalty is payable for non-compliance of any of the provisions of this Act by a One Person Company, small company, start-up company or Producer Company, or by any of its officer in default, or any other person in respect of such company, then such company, its officer in default or any other person, as the case may be, shall be liable to a penalty which shall not be more than one-half of the penalty specified in such provisions subject to a maximum of two lakh rupees in case of a company and one lath rupees in case of an officer who is in default or any other person, as the case may be”.

7. As per clause 85 of section 2 of the Companies Act, 2013, small company means a company whose paid up capital and turnover shall not exceed rupees four crore and rupees forty crore respectively. As per MCA portal, paid up capital of the company- Hotel Holy Crest Bodhgaya Private Limited is Rs. 100,000 and as regard to turnover, the company has not filed its balance sheet since incorporation, hence turnover could not be ascertained. Therefore, the benefits of small company cannot be extended to this company while adjudicating penalty.

ORDER

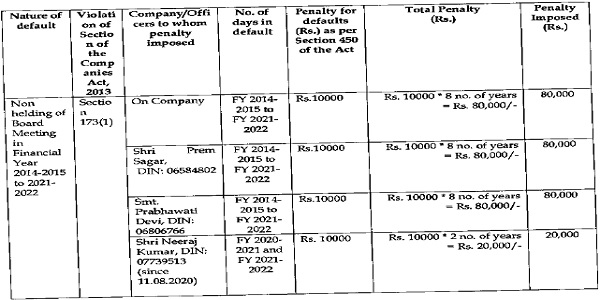

8. Having considered the facts and circumstances of the case and after taking into account the provisions of Rule-11 of Companies (Adjudication of Penalties) Rules, 2014 (as amended), I hereby impose a penalty of Rs. 80,000 (Eighty Thousand) each on Company and Directors, viz., Shri Prem Sagar and Smt. Prabhawati Devi and Rs. 20,000 on director, viz., Shri Neeraj Kumar, as per Table Below for violation of section 173(1) of the Companies Act, 2013 for the financial years 2014-2015, 2015-2016, 2016-2017, 2017-2018, 2018-2019, 2019-2020, 2020-2021 and 2021-2022:

9. The noticee shall pay the amount of penalty individually for the company and its directors (out of own porket) by way of e-payment (available on Ministry website mca.gov.in) under “Pay miscellaneous fees” category in MCA fee and payment Services within 90 (ninety) days of this order. The Challan/SRN generated after payment of penalty through online mode shall be forwarded to this office.

10. Appeal against this order may be filled in writing with the Regional Director (ER), Ministry of Corporate Affairs, Kolkata, within a period of 60 (sixty) days from the date of receipt of this order, in Form ADJ (available on Ministry website www.mca.gov.in) setting forth the grounds of appeal and shall be accompanied by a certified copy of this order {Section 454(5) and 454(6) of the Act read with Companies (Adjudication of Penalties) Rules, 2014

11. Your attention is also invited to section 454(8) of the Act in the event of non-compliance of this order.

(Aparajit Barua)

Adjudicating Officer &

Registrar of Companies-Cum-

Official Liquidator, Patna