The Ministry of Corporate Affairs (MCA) issued an order adjudicating penalties under Section 454 of the Companies Act, 2013, against Samsung Display Noida Private Limited (SDNPL) and its directors for violating Section 90 of the Act. The hearings took place on April 25, 2024, and May 10, 2024. Represented by Advocate Mohit Maheswari, SDNPL failed to comply with the significant beneficial ownership (SBO) declaration requirements.

Company Incorporation and Shareholding: SDNPL, incorporated on July 5, 2019, is a wholly owned subsidiary of Samsung Display Co. Ltd. (SDC), Korea. The shareholding structure as per the latest filings is:

- Samsung Display Co. Ltd, Korea: 99.99%

- Mr. Jin Suk Lee: Negligible (as a nominee of SDC, Korea)

Legal and Compliance Issues: Upon examination, the Registrar of Companies (RoC) found that SDNPL had not filed e-form BEN-2, required for declaring SBO. SDNPL’s response, based on self-evaluation, claimed no individual met the SBO criteria due to the dispersed ownership in SDC, Korea and its ultimate parent company, Samsung Electronics Co., Ltd. (SEC), Korea, both listed on the Korean Stock Exchange. SDNPL argued that no single individual or group held a 10% or greater beneficial interest or control in the reporting company through the holding and ultimate holding companies.

Registrar’s Observations: The RoC found that SDNPL’s evaluation did not consider the nature of indirect holdings or the exercise of control through distributable dividends and significant influence. The RoC issued a Show Cause Notice (SCN) on April 15, 2024, to SDNPL, its directors, and key management personnel (KMP), highlighting non-compliance with Section 90 and the SBO Rules.

Response to SCN and Further Findings: SDNPL’s response reiterated its earlier stance, emphasizing that no individual or group held significant stakes in either the immediate or ultimate holding companies. However, the RoC found the response unsatisfactory as it failed to address the essence of Section 90, which involves identifying individuals with beneficial interests or significant influence, even indirectly.

Additional Hearings and Evidence: SDNPL was given another hearing date on May 10, 2024, but did not fully comply with the requirements. The RoC sought details about promoters, directors, KMP, and shareholders of major Samsung entities. SDNPL’s responses remained incomplete, particularly regarding the Ultimate Beneficial Owner (UBO) disclosures required for banking purposes.

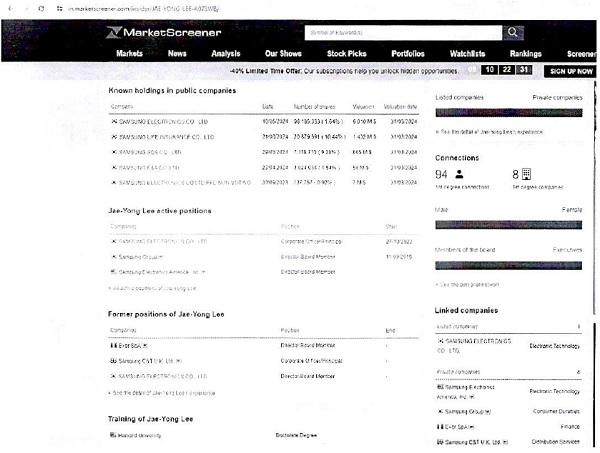

Public Domain Information: Publicly available information revealed that SEC, Korea, has a controlling interest in SDNPL and 232 subsidiaries, with ownership of voting rights. Late Mr. Lee Kun Hee’s family, including his son Lee Jae-Yong, held significant stakes in SEC, Korea and other entities, indicating indirect control over SDNPL. Despite minority shareholding, Lee Jae-Yong was appointed Executive Chairman of SEC, Korea, highlighting his significant influence over the company.

Conclusion and Penalty: The RoC concluded that SDNPL failed to identify and declare its SBO as required by law. The company did not take necessary steps to identify individuals exercising significant control or influence, directly or indirectly. Consequently, the default under Section 90 and the SBO Rules was established, leading to penalties for SDNPL and its officers.

Penalty Calculation and Final Order: The penalty calculation considered the period from the decriminalization of the default on December 21, 2020, to the issuance of the SCN on April 15, 2024, totaling 1212 days. The order emphasized the need for transparency in corporate ownership and compliance with statutory requirements to ensure accountability and prevent undue influence in corporate governance.

GOVERNMENT OF INDIA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF REGISTRAR OF COMPANIES,

Uttar Pradesh

37/17, Westcott Building, The Mall,

Kanpur — 208001 (U.P.)

Phone : 0512 — 2310443/2310227

Order No. 03/07/SBO/UP/2024/Samsung Display/ Dated: 12.06.2024

ORDER OF ADJUDICATION OF PENALTY UNDER SECTION 454 OF THE COMPANIES ACT, 2013 READ WITH RULE 3 OF THE COMPANIES (ADJUDICATION OF PENALTIES) RULES, 2014 FOR VIOLATION OF PROVISIONS OF SECTION 90 OF THE COMPANIES ACT, 2013.

IN THE MATTER OF SAMSUNG DISPLAY NOIDA PRIVATE LIMITED

(CIN : U32301UP2019FTC118844)

Date of hearing(s): 25.04.2024 and 10.05.2024

Present on behalf of Applicants: Mr. Mohit Maheswari, Advocate (Enrolment No. D/1828/2023) appeared on 25.04.2024 and none appeared on 10.05.2024.

The Ministry of Corporate Affairs vide its gazette notification no A-42011/112/2014-Ad.II dated 24.3.2015, appointed the Registrar of Companies, Uttar Pradesh as the Adjudicating Officer in exercise of the powers conferred by Section 454(1) of the Companies Act, 2013 (hereinafter known as “the Act”) read with Companies (Adjudication of Penalties) Rules, 2014 for adjudging penalties under the provisions of this Act.

2. Whereas the company viz. SAMSUNG DISPLAY NOIDA PRIVATE LIMITED (hereinafter as –the reporting company’) was incorporated under the provisions of the Companies Act, 2013 on 05.07.2019, and has its registered office situated at B/1D Sector 81, Phase II, Noida, Gautam Buddha Nagar, Uttar Pradesh, 201305, India.

The shareholding details of ‘the reporting company’ as per list of shareholders attached to e-form MGT-7 for FY 2022-23 is as follows: –

| Shareholding details | |||

| SI. No. | Name of shareholder(s) | Number of Equity

shares (face value of Rs. 10 each) |

% Holding |

| 1. | Samsung Display Co. Ltd, Korea (SDC, Korea) | 3,49,99,999 | 99.99 |

| 2. | *Mr. Jin Suk Lee | 01 | Negligible |

| Total | 3,50,00,000 | 100 | |

* As a nominee of Samsung Display Co. Ltd.

As per reply of the company dated 24.04.2024, there is no change in the shareholding of SDC, Korea in SDN since incorporation of SDN.

At the time of incorporation, the details of subscribers were as follows:

| Sl. No. | Name of subscriber(s) | Number of Equity

shares (face value of Rs. 10 each) |

% Holding |

| 1. | Samsung Display Co. Ltd, Korea (SDC, Korea) through its Authorized Representative:

Mr. Jaeho Shin |

3,49,99,999 | 99.99 |

| 2. | *Mr. Jeeyong Chung | 01 | Negligible |

| Total | 3,50,00,000 | 100 |

* As a nominee of Samsung Display Co. Ltd.

3. That the provisions of Section 90 of the Companies Act, 2013 reads:-

Section 90:- (1) Every individual, who acting alone or together, or through one or more persons or trust, including a trust and persons resident outside India, holds beneficial interests, of not less than twenty-five per cent. or such other percentage as may be prescribed, in shares of a company or the right to exercise, or the actual exercising of significant influence or control as defined in clause (27) of section 2, over the company (herein referred to as “significant beneficial owner”), shall make a declaration to the company, specifying the nature of his interest and other particulars, in such manner and within such period of acquisition of the beneficial interest or rights and any change thereof as may be prescribed:

Provided that the Central Government may prescribe a class or classes of persons who shall not be required to make declaration under this sub-section.

(2) Every company shall maintain a register of the interest declared by individuals under subsection (1) and changes therein which shall include the name of individual, his date of birth, address, details of ownership in the company and such other details as may be prescribed.

(3) The register maintained under sub-section (2) shall be open to inspection by any member of the company on payment of such fees as may be prescribed.

(4) Every company shall file a return of significant beneficial owners of the company and changes therein with the Registrar containing names, addresses and other details as may be prescribed within such time, in such form and manner as may be prescribed.

(4A) Every company shall take necessary steps to identify an individual who is a significant beneficial owner in relation to the company and require him to comply with the provisions of this section.

(5) A company shall give notice, in the prescribed manner, to any person (whether or not a member of the company) whom the company knows or has reasonable cause to believe—

(a) to be a significant beneficial owner of the company;

(b) to be having knowledge of the identity of a significant beneficial owner or another person likely to have such knowledge; or

(c) to have been a significant beneficial owner of the company at any time during the three years immediately preceding the date on which the notice is issued, and who is not registered as a significant beneficial owner with the company as required under this section.

(6) The information required by the notice under sub-section (5) shall be given by the concerned person within a period not exceeding thirty days of the date of the notice.

(7) The company shall–

(a) where that person fails to give the company the information required by the notice within the time specified therein; or

(b) where the information given is not satisfactory,

apply to the Tribunal within a period of fifteen days of the expiry of the period specified in the notice, for an order directing that the shares in question be subject to restrictions with regard to transfer of interest, suspension of all rights attached to the shares and such other matters as may be prescribed.

(8) On any application made under sub-section (7), the Tribunal may, after giving an opportunity of being heard to the parties concerned, make such order restricting the rights attached with the shares within a period of sixty days of receipt of application or such other period as may be prescribed.

(9) The company or the person aggrieved by the order of the Tribunal may make an application to the Tribunal for relaxation or lifting of the restrictions placed under sub-section (8), within a period of one year from the date of such order:

Provided that if no such application has been filed within a period of one year from the date of the order under sub-section (8), such shares shall be transferred, without any restrictions, to the authority constituted under sub-section (5) of section 125, in such manner as may be prescribed;

(9A) The Central Government may make rules for the purposes of this section.

(10 If any person fails to make a declaration as required under sub-section (1), he shall be liable to a penalty of fifty thousand rupees and in case of continuing failure, with a further penalty of one thousand rupees for each day after the first during which such failure continues, subject to a maximum of two lakh rupees.

(11) If a company, required to maintain register under sub-section (2) and file the information under sub-section (4) or required to take necessary steps under sub-section (4A), fails to do so or denies inspection as provided therein, the company shall be liable to a penalty of one lakh rupees and in case of continuing failure, with a further penalty of five hundred rupees for each day, after the first during which such failure continues, subject to a maximum of five lakh rupees and every officer of the company who is in default shall be liable to a penalty of twenty-five thousand rupees and in case of continuing failure, with a further penalty of two hundred rupees for each day, after the first during which such failure continues, subject to a maximum of one lakh rupees.

(12) If any person willfully furnishes any false or incorrect information or suppresses any material information of which he is aware in the declaration made under this section, he shall be liable to action under Section 447,

4. (i) That Section 2(27) of the Act defines ‘control’:

“control” shall include the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner.

(ii) That Section 2(1) of the Companies (Significant Beneficial Owners) Rules, 2018 of the Act defines ‘significant influence’ as the power to participate, directly or indirectly, in the financial and operating policy decisions of the reporting company but is not control or joint control of those policies.

5. That Rule 2(1)(h) of the Companies (Significant Beneficial Owners) Rules, 2018 of the Act defines

“Significant Beneficial Owner” in relation to a reporting company means an individual referred to in sub-section (1) of section 90, who acting alone or together, or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting company, namely: -(i) holds indirectly, or together with any direct holdings, not less than ten per cent. of the shares; (ii) holds indirectly, or together with any direct holdings, not less than ten per cent. of the voting rights in the shares; (iii) has right to receive or participate in not less than ten per cent. of the total distributable dividend, or any other distribution, in a financial year through indirect holdings alone, or together with any direct holdings; (iv) has right to exercise, or actually exercises, significant influence or control, in any manner other than through direct holdings alone:

Explanation I. – For the purpose of this clause, if an individual does not hold any right or entitlement indirectly under sub-clauses (i), (ii) or (iii), he shall not be considered to be a significant beneficial owner.

Explanation II – For the purpose of this clause, an individual shall be considered to hold a right or entitlement directly in ‘the reporting company, if he satisfies any of the following criteria, namely.’

(i) the shares in ‘the reporting company’ representing such right or entitlement are held in the name of the individual;

(ii) the individual holds or acquires a beneficial interest in the share of ‘the reporting company’ under sub-section (2) of section 89 and has made a declaration in this regard to ‘the reporting company’.

Explanation III. – For the purpose of this clause, an individual shall be considered to hold a right or entitlement indirectly in ‘the reporting company, if he satisfies any of the following criteria, in respect of a member of ‘the reporting company, namely: -(i)where the member of ‘the reporting company’ is a body corporate (whether incorporated or registered in India or abroad), other than a limited liability partnership, and the individual, -(a) holds majority stake in that member; or (b) holds majority stake in the ultimate holding company (whether incorporated or registered in India or abroad) of that member.

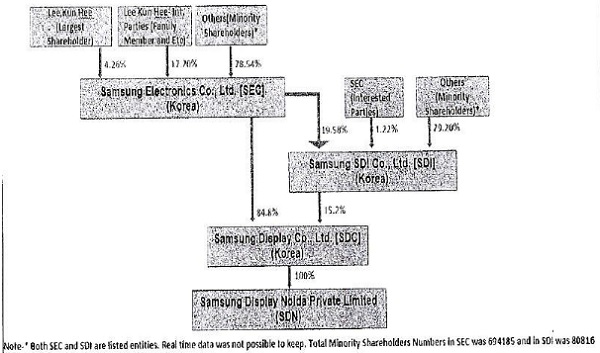

6. The reporting company being a wholly owned subsidiary of Samsung Display Co., Limited, Korea (“SDC Korea”) and on examination of the filings made by ‘the reporting company’ in MCA- 21 Registry, there is no e- form BEN-2 which has been filed by the reporting company, and thus there was reason to believe that ‘the reporting company’ ought to have made compliance with Section 90 of the Companies Act, 2013 i.e. declaration of beneficial ownership by filing e-form BEN-2 of ‘the reporting company’, till the time of issuance of notice under Section 206(1) of the Act, 2013 vide letter No. 03/07/SBO/UP/2024/Samsung Display/7022-7025 dated 13.02.2024. The reporting company submitted its reply vide letter dated 22.02.2024 duly signed by its Whole-time Director i.e., Mr. Joogon Seok (through email dated on 22.02.2024) wherein the details of shareholding in ‘the reporting company’ along with the corporate structure of ‘the reporting company’ post incorporation in July 2019 was submitted. The reporting company stated that they are 100% owned by SDC, Korea and 84.8% of SDC, Korea shareholding is held by Samsung Electronics Co., Ltd, Korea (“SEC, Korea”) and 15.2% is held by Samsung SDI Co. Ltd., Korea (“SDI, Korea”). Further both SEC, Korea and SDI, Korea are listed on the Korean Stock Exchange. The reporting company submitted its corporate structure of the company and the extract of the chart is as follows:

Reference A: Details of Corporate Structure as submitted by the Reporting Company

Further, the reporting company in its reply stated that a self-evaluation for the identification of the SBO through their holding companies located outside India i.e., SDC Korea and SEC Korea was made on the data based on the shareholding pattern as on 31.12.2022. Since both SDC ,Korea and SEC, Korea are listed companies at Korean Stock Exchange, accordingly the reporting company concluded that no individual SBO who directly or indirectly, acting alone or together holds the majority in SDC, Korea (the holding company) and SEC, Korea (the Ultimate parent company), hence no individual falls under the category of SBO under Section 90 read with SBO Rules, made thereunder and there has been no change in the shareholding pattern of the reporting company since incorporation.

7. On examination of the submission(s) made by the reporting company, it was observed that the reporting company’s reason and reply was completely based on the self-evaluation for the shares held for beneficial interests, of not less than 10% of the reporting company by an individual, of the holding company and of the ultimate holding company i.e. SEC, Korea. The reporting company did not take into consideration the nature of indirect holding(s) or exercise of rights (in ‘the reporting company’) by virtue of rights on distributable dividend and any other distribution, exercise of control or exercise of significant influence.

8. On the observation made at Para 7 above, there existed sufficient reason(s) that ‘the reporting company’ ought to have also declared its Significant Beneficial Owner in terms of Section 90 r/w the Companies (Significant Beneficial Owners) Rules, 2018 of the Companies Act, 2013, (herein after referred as SBO Rules), hence forward a Show Cause Notice (SCN) was issued to ‘the reporting company’, its directors and KMP for non-compliance of Section 90 r/w SBO rules made thereunder, vide letter No. 03/07/SBO/UP/2024/Samsung Display/248-253 dated 15.04.2024.

9. Response of the reporting company to SCN issued under Section 90 of the Act:

The reporting company and its directors/ KMP on the date of hearing appeared through their authorized representative Mr. Mohit Maheswari, Advocate (Enrolment No. D/1828/2023) who physically submitted the response of the company to the Registrar vide letter dated 24.04.2024, which was duly signed by the Whole-time Director of ‘the reporting company’ i.e., Mr. Joogon Seok. The authorized representative of ‘the reporting company’ emphasized on the response submitted by ‘the reporting company’, where the company denied the non-compliance for the Show Cause Notice so issued by the Registrar u/s 90 r/w the SBO Rules made thereunder under the Act. The response of the company submitted for the SCN issued was similar in nature of the previous response submitted and taking on the grounds referring to the shareholding pattern of ‘the reporting company’ thereby steady on the defense measure under Rule 2(1)(h) of the Companies (Significant Beneficial Owners) Rules, 2018 of the Act and the Explanation I & III to it, in support of its stance that Section 90 of the Act is not applicable and the reporting company is a separate and independent legal entity and is being managed completely by its Board of Directors. Further, no individual has neither majority stakes nor more than 10% stakes neither in the immediate Holding company or in the Ultimate Holding Company of ‘the reporting company’.

10. The response submitted by ‘the reporting company’ dated 24.04.2024, was examined and it was observed that the response was not acceptable as it was not in consonance with the essence of Section 90 of the Act, which reads “…………. with respect to every individual who acting alone or together, or through one or more persons or trust, including a trust and persons resident outside India, holds beneficial interests, of not less than 10% in shares of a company or the right to exercise, or the actual exercising of significant influence or control as defined in clause 27 of section 2 over the company……………… “. Thus, the reporting company did not take necessary measures or steps to identify an individual who is SBO in relation to company with the nature of indirect holding(s) or exercise of rights (in ‘the reporting company’) by virtue of shares, voting rights in shares, rights on distributable dividend and any other distribution, exercise of control and exercise of significant influence. The efforts of the company u/s 90 (4A) and (5) of the Act were found to be inattentive.

Henceforth, ‘the reporting company’ was given one more date of hearing on 10.05.2024 along with further clarifications and information and documents so required by the Registrar. The clarifications raised by the Registrar basically required the details of the promoters, directors, KMP, shareholders etc. of certain major companies of Samsung where the promoters of the Samsung Group had cross holdings viz. Samsung SDI Co. Ltd, Korea, Samsung SDI (Hong Kong) Ltd, Samsung C&T Corporation, Korea and Samsung Electronics Company Limited, Korea, details of the chairperson of the board meetings of aforementioned companies along with the details of the Ultimate Beneficial Owner (UBO) disclosed to the Banks in India for ‘the reporting company’ and to furnish the UBO details filed by the holding company in the host country.

11. That as per Reserve Bank of India vide Master Direction DBR.AML.BC.No.81/14.01.001/2015-16 issued Master Direction – Know Your Customer (KYC) Direction, 25.02.2016 which states:-

“3 (iv). Beneficial Owner (BO)

a. Where the customer is a company, the beneficial owner is the natural person(s), who, whether acting alone or together, or through one or more juridical person, has/have a controlling ownership interest or who exercise control through other means.

Explanation- For the purpose of this sub-clause-

1. “Controlling ownership interest” means ownership of/entitlement to more than 25 per cent of the shares or capital or profits of the company.

2. “Control” shall include the right to appoint majority of the directors or to control the management or policy decisions including by virtue of their shareholding or management rights or shareholders agreements or voting agreements.

b. Where the customer is a partnership firm, the beneficial owner is the natural person(s), who, whether acting alone or together, or through one or more juridical person, has/have ownership of/entitlement to more than 15 per cent of capital or profits of the partnership.

c. Where the customer is an unincorporated association or body of individuals, the beneficial owner is the natural person(s), who, whether acting alone or together, or through one or more juridical person, has/have ownership of/entitlement to more than 15 per cent of the property or capital or profits of the unincorporated association or body of individuals.

Explanation: Term ‘body of individuals’ includes societies. Where no natural person is identified under (a), (b) or (c) above, the beneficial owner is the relevant natural person who holds the position of senior managing official.

d. Where the customer is a trust, the identification of beneficial owner(s) shall include identification of the author of the trust, the trustee, the beneficiaries with 15% or more interest in the trust and any other natural person exercising ultimate effective control over the trust through a chain of control or ownership.

Part IV – Identification of Beneficial Owner

34. For opening an account of a Legal Person who is not a natural person, the beneficial owner(s) shall be identified and all reasonable steps in terms of Rule 9(3) of the Rules to verify his/her identity shall be undertaken keeping in view the following:

a. Where the customer or the owner of the controlling interest is a company listed on a stock exchange, or is a subsidiary of such a company, it is not necessary to identify and verify the identity of any shareholder or beneficial owner of such companies.

b. In cases of trust/nominee or fiduciary accounts whether the customer is acting on behalf of another person as trustee/nominee or any other intermediary is determined. In such cases, satisfactory evidence of the identity of the intermediaries and of the persons on whose behalf they are acting, as also details of the nature of the trust or other arrangements in place shall be obtained.

12. In response to the clarifications raised as mentioned at para- 10 above, ‘the reporting company’ submitted its incomplete reply through e-mail dated 10.05.2024 and none appeared for the hearing on the day of hearing so fixed. On examination of the response submitted, the company yet again stated that the SDC, Korea and SEC, Korea are listed companies in Korea and are run by professional management. Chairman of these companies are independent directors / professional management and they have never been on the Board of Directors of the reporting company or its immediate holding company i.e. SDC, Korea.

Further, it was informed that the reporting company has one current account No.0522429015 at Citi Bank N.A, New Delhi. The reporting company, instead of sharing the UBO disclosure so filed with the Citi Bank N.A, at the time of opening an Account, has shared email correspondences with the Citi Bank N.A which are inconclusive with respect to declaration of UBO. The correspondence between Samsung Display Noida Private Limited and the employee of Citi Bank is only for the ownership structure of the reporting company. As per RBI’s master direction the disclosure of Beneficial owner is mandatory for opening an account of a Legal Person who is not a natural person.

13. Information accessed from public domain:

a. The reporting company submitted response on 10.05.2024, wherein the company has shared the Consolidated Financial Statements of Samsung Electronics Company Ltd., Korea and its list of subsidiaries as of 31st December 2023. It discloses that SEC, Korea is ‘the controlling company’ and has 232 subsidiaries and has 100% ownership of Samsung Display Noida Private Ltd. The term “Ownership” clarified by SEC, Korea at the foot notes, defines ownership of the voting rights in each of its entities including subsidiaries ownerships. As such it is recognized and documented that SEC, Korea has 100% ownership of the voting rights in Samsung Display Noida Private Ltd.

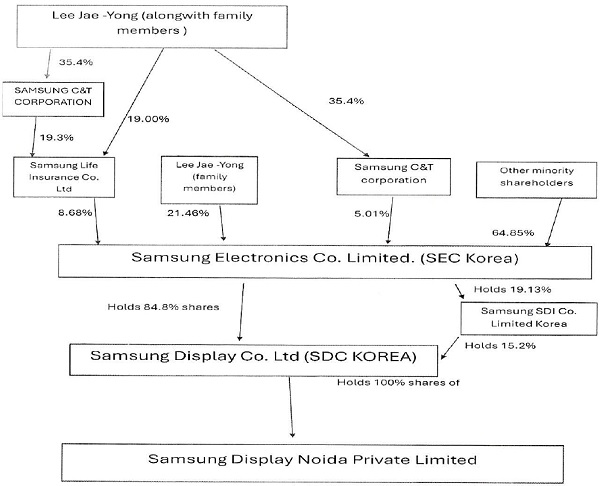

b. In Reference A above, the details of the corporate structure of the reporting Company as submitted by it has been reproduced. As per the said structure, the late Mr. Lee Kun Hee and his family holds around 21.46% shares of the SEC, Korea directly and the remaining 78.54% shares are held by other minority shareholders. A further investigation into the shareholding pattern as available on the website of SEC, Korea and Korean Stock Exchange, revealed that Mr. Lee Jae-Yong son of late Mr. Lee Kun Hee, along with his family, also holds a significant stake in two other entities of the group i.e., Samsung Life Insurance Co, Ltd and Samsung C&T, which holds around 8.64% and 5.01% shares respectively in SEC Korea.

The reporting company did not furnish the full details of the minority shareholders to the Registrar despite been given opportunities. As such on the basis of information available in the public domain the present / updated shareholding structure is represented below:

#Samsung Electronics Co. Ltd. (SEC, Korea) has mentioned in its Annual Report for the year 31.12.2023 that it owns 100% ownership* rights in Samsung Display Noida Private Limited.

(*) Ownership represents the Company’s ownership of the voting rights in each entity, including subsidiaries’ ownerships.

Reference B: Details of Corporate Structure as per information on the Public Domain

14. Further, on the available information in public domain SEC, Korea, is a large family- owned company in South Korea. From the shareholding details discussed in para 13, it is aptly clear that the Late Mr. Lee Kun Hee and his family are the largest shareholders of the SEC, Korea, holding, directly and indirectly, more than 25% of its shareholding and voting rights with remaining shareholding being held by public shareholders. It is important to note that in a publicly listed company, where the shareholding is highly distributed among public shareholders, person(s) holding 25% or more of such a company individually or collectively with others will be in a position to exercise control or significant influence over the said company. This can very well be established in the case of the reporting Company by the fact that inspite of not holding majority shareholding in the SEC, Korea, its Board of Directors on the recommendation of its Board Chairman and other independent directors, appointed Mr. Lee Jae-Yong, the son of late Mr. Lee Kun Hee, as its Executive Chairman w.e.f., October 27, 2022 (Press release as available on news.samsung.com). If the submission made by the reporting company that no individual(s) exercises control over the SEC, Korea, and it is managed by an independent and professional board of directors is relied upon, then there appears to be no reason behind the appointment of Mr. Lee Jae-Yong as the Executive Chairman in October 2022, specifically considering that there is already a Chairman of the Board of Directors of SEC, Korea as per their Articles of Incorporation. Further, the Articles of Incorporation of the SEC, Korea provides for the appointment of a Chairman of the Board of Directors only but due to a lack of accurate information in the public domain, it is also not clear as to how and why Mr. Lee Jae-Yong has been appointed as the Executive Chairman and what powers he exercises over the Board of Directors of SEC, Korea.

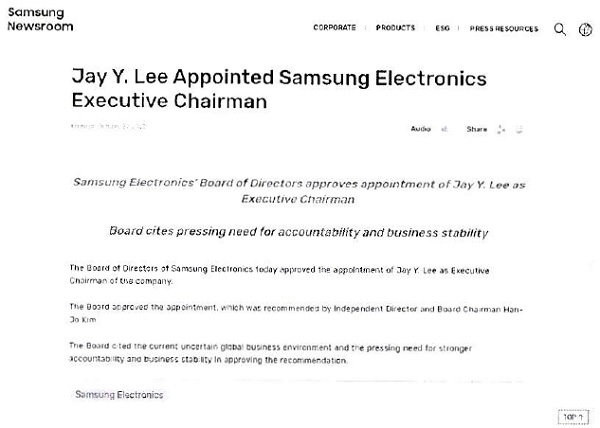

Reference C: Press release by SEC Korea on the appointment of Mr. Lee Jae-Yong

15. It appears that the Samsung Group controls more than 80 subsidiaries globally. Approximately 19 of Samsung’s subsidiaries are publicly traded on the Korean stock market. Samsung is a large family-owned company in South Korea. As per articles in public domain, Samsung is led by Lee Jae-Yong, a direct descendant of the company’s founder. Lee Jae-Yong (also known as Jay Y.Lee) stepped up as Samsung Executive Chairman in October, 2022. The Lee family owns enough shares in each subsidiary, both directly and indirectly, to steer the entire company. For example, SEC, Korea is partially owned by two other subsidiaries; Samsung Life Insurance and Samsung C&T. Although Samsung’s Chairman Mr. Lee Jae-Yong has a much smaller individual stake than either of those subsidiaries, however, Lee holds a large stake in the subsidiaries through cross-ownership and he has control over Samsung Electronics indirectly which is the crown jewel of Samsung Group. Samsung’s subsidiaries’ ownership in each other helps the Lee family to keep control globally. (Source: androidauthority.com/who-owns-samsung-3249908-3249908/)

–

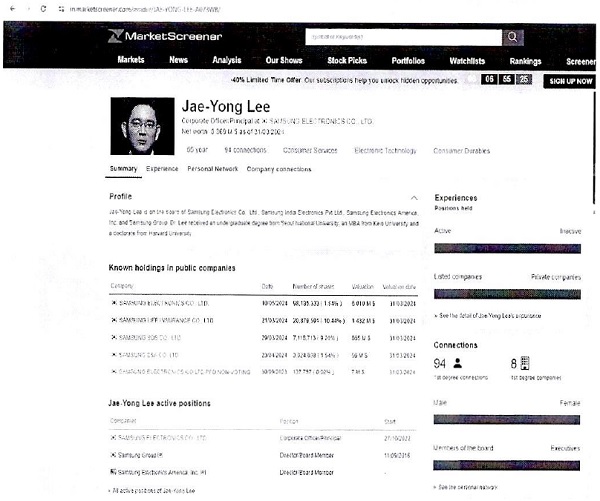

Reference D: Details of shareholding of Mr. Lee Jae-Yong

16. Section 90 of the Act r/w Rules made thereunder deals with the concept of disclosure of Significant Beneficial Owner (SBO) in a company. Section 90 provides a dual test of objective and subjective for identification of a ‘Significant Beneficial Owner’. The section along with the rules provide for determination of the SBO either through a concept of threshold limit in the shares of the company or through exercise of significant influence or a control in the company, thus Section 90 and the SBO Rules made thereunder does not restrict the threshold limit in shares only, to establish the SBO in a company, when there also exists significant influence or control by any individual directly or indirectly . From the information available in the public domain as mentioned and observations made aforesaid, it gives the impression that Mr. Lee Jae-Yong along with his family exercises indirect control or has significant influence over SEC, Korea.

Therefore considering Mr. Lee Jae-Yong being appointed as the Executive Chairman of SEC, Korea, ‘the reporting company’ ought to have declared SBO under the law of the land i.e u/s 90 of the Companies Act, 2013 r/w Rules made thereunder by taking necessary steps to identify an individual who is a significant beneficial owner, in relation to the reporting company and should have required him to comply with the provisions of this section by way of giving notice seeking information in accordance with Section 90(5) of the Act in form BEN-4. From the details submitted by the reporting company vide its various replies to the Registrar, it is clear that all required information and documentary evidences have not been submitted before this office. Further, it also appears from the material placed in this Order that the reporting company has failed to exercise the necessary due diligence to ascertain the SBO in terms of the provisions of Section 90 of Act r/w SBO Rules.

17. The reporting Company, in its reply, self-confessed that it had reasons to believe that there is no individual as SBO u/s 90 of the Act as SDC, Korea (the Holding Company) and SEC, Korea (the Ultimate Holding Company) as they are listed companies in Korea Stock Exchange and are run by independent Board and professional management. The Chairman of these companies are either independent directors or professionals, and they have never been on the Board of Directors of the reporting company or its immediate Holding Company, i.e., SDC, Korea. Hence the reporting company stated that no action u/ s 90(5) of the Act for issuance of BEN-4 to the immediate Holding Company was required. It is noted that under sub-rule 2 of rule 2A of the SBO Rules made thereon, a duty has been cast on the reporting company to give Form BEN 4 seeking the information as required under Section 90(5) of the Act, to all members other than individuals who hold not less than 10% of its shares or voting rights or right to participate in dividend. Considering that the reporting company is a wholly owned subsidiary of SDC, Korea, and has SEC, Korea as the ultimate parent company, it was bound by the law of the land at the first instance to serve Form BEN 4 to the immediate Holding Company irrespective of the fact as to whether there is an SBO or not. The reporting company has failed to discharge its obligation u/s 90 (5) of the Act r/w sub-rule 2 of Rule 2A of the SBO Rules made thereon. As a result of this failure, the Reporting Company has absolved the immediate Holding Company from the statutory obligation cast under Section 90 to ascertain and inform the reporting company of its position on the presence of an individual as an SBO under Section 90 of the Act.

18. The reporting company has not taken necessary action to identify an individual(s) who is /are SBO in relation to company and require them to comply with the provisions of Section 90 of the Act, thus the subjected company and its officers who is in default have violated the provisions of Section 90(4A) of the Companies Act, 2013.

19. Adjudication of Penalty:

Taking in consideration the above facts based on the submissions made by the reporting company and the documentary information and evidences filed by them in response to the SCN issued by the Registrar on various dates and also taking into consideration the interpretation of the word “control” and “significant influence” and as issued by the Regulatory Authorities, it becomes evident that the company in spite of being given the fair opportunity has failed to prove the that it does not have the significant beneficial ownership or interest in the Indian corporate entity i.e. the reporting company.

Further, it is evident from the shareholding pattern of the corporate structure of Samsung Group and factual position as on ground, it appears that in spite of micro shares being held by Mr. Lee Jae-Yong individually, he has been appointed as Executive Chairman of the ultimate holding company i.e. SEC, Korea, for reasons known only to the Board of the SEC, Korea.

Going by the fact that this certainly does not seem to be a logical explanation except the fact that Mr. Lee Jae-Yong has been bestowed by the Board of SEC, Korea with unbridled power to take decisions in spite of the company having a full-fledged Chairman (as per Articles of incorporation of SEC, Korea available at public domain) speaks of nothing but a proxy-control-vested through legally remote mechanism and hence, in the direction of, to influence the management decision of SEC, Korea.

Having arrived at this conclusion I am inclined to conclude that the default u/s 90 r/w SBO Rules under the Companies Act, 2013, stands established.

The default period is counted from the date of decriminalization of default w.e.f. 21.12.2020 till the date of issuance of the Show Cause Notice i.e. 15.04.2024 for violation of Section 90 (4A) and (5) r/w SBO Rules made thereunder and the default period is for 1212 days.

A. Calculation of Penalty imposed for violation of Section 90 r/w SBO Rules made there under of the Companies Act, 2013:-

| Violation Section |

Penalty imposed on & Period | Calculation of penalty amount (in Rs.) | Penalty imposed as per Section 90(10)/ 90(11) of CA, 2013(in Rs.) |

| A | B | C | D |

| Section 90(4A) of CA, 2013 | Samsung Display Noida Private Limited (company) Default of 1212 days i.e. from 21.12.2020 to 15.04.2024 | 1,00,000 + 1212 x 500 = 7,06,000 Subject to maximum 5,00,000 | 5,00,000 |

| Seung Kyu Lee (Director from 22.03.2023 to till date) Default of 391 days i.e. from 22.03.2023 to 15.04.2024 |

25,000 + 391 x 200 = 1,03,200 Subject to maximum 1,00,000 | 1,00,000 | |

| Joogon Seok (Director from 01.10.2023 to till date) Default of 198 days i.e. from 01.10.2023 to 15.04.2024 |

25,000 + 198 x 200 = 64,600 Subject to maximum 1,00,000 | 64,600 | |

| Tarun Kumar Rastogi (Ex, CS, KMP from 20.11.2019 to 30.11.2023) Default of 1075 days i.e. from 21.12.2020 to 30.11.2023 |

25,000 + 1075 x 200 = 2,40,000 Subject to maximum 1,00,000 | 1,00,000 | |

| Hemant Gupta (CS, KMP from 15.12.2023 to till date) Default of 123 days i.e. from 15.12.2023 to 15.04.2024 | 25,000 + 123 x 200 = 49,600 Subject to maximum 1,00,000 | 49,600 | |

| TOTAL PENALTY | 8,14,200 | ||

B. On the findings mentioned above by the Registrar, in respect of the violation under Section 90 r/w SBO Rules of the Act, the company Samsung Display Noida Pvt. Limited, its “officers’ are further directed pursuant to Section 454(3) (b) of the Companies Act, 2013 to determine all the individuals who fall under the definition of ‘significant beneficial owner’ in the letter and spirit of the Act, in respect of the reporting company and file the relevant e-form BEN-2 with respect to all such individuals within a period of 90 days from the date of this Order.

The company and its officers shall pay the said amount of penalty through online www.inca.gov.in (under Misc. Head) or by way of Demand Draft in favour of “Pay & Accounts Officer, Ministry of Corporate Affairs, New Delhi, payable at Delhi, within 90 days receipt of this order and intimate this office with the proof of penalty so paid. The Demand Draft shall be forwarded to this office address.

Appeal against this order may be filed in writing with the Regional Director (Northern Region), Ministry of Corporate Affairs, CGO Complex, Lodi Road, New Delhi, within a period of sixty days from the date of receipt of this order, in Form AM setting forth the grounds of appeal and shall be accompanied by a certified copy of this order. [Section 454(5) & 454(6) of the Act, read with Companies (Adjudication of Penalties) Rules, 2014].

Attention is also invited to Section 454(8) of the Companies Act, 2013, in the event of noncompliance of this order. In case appeal is made, 0/o the Registrar of Companies, U.P may be informed alongwith the penalty imposed and the payments made.

(Seema Rath)

Registrar of Companies & Adjudicating Officer

Uttar Pradesh, Kanpur

No. 03/07/SBO/UP/2024/Samsung Display/ 1557