Author discusses Provisions related to Step wise Incorporation of Producer Company with FAQs under Companies Act, 2013 read with Companies (Incorporation) Amendment Rules, 2020 and other relvant Notifications, Circulars and most importantly Companies Amendment Act, 2017). Editorial includes Incorporation Form ‘SPICE+’ and ‘AGILE’.

Section 465 of the Companies Act, 2013:

- The Companies Act, 1956 and the Registration of Companies (Sikkim) Act,1961 (hereafter in this section referred to as the repealed enactments) shall stand repealed

- The provisions of Part IX A of the Companies Act, 1956 shall be applicable mutatis mutandis to a Producer Company in a manner as if the Companies Act, 1956 has not been repealed until a special Act is enacted for Producer Companies ( 1st Proviso to Section 465(1))

Therefore, there are no separate provisions under the Companies Act, 2013 regarding producer Company. As mentioned above it still govern by chapter IXA of Companies Act, 1956.

Definition of the Producer Company:

“Producer Company” means a body corporate having objects or activities specified in section 581B and registered as Producer Company under the Companies Act, 1956.

Allowed Activities for Producer Companies:

A producer company is basically a body corporate registered as Producer Company under Companies Act, 2013 and shall carry on or relate to any of following activities classified broadly: –

(a) Production, harvesting, processing, procurement, grading, pooling, handling, marketing, selling, export of *primary produce of the Members or import of goods or services for their benefit.

(b) Rendering technical services, consultancy services, training, education, research and development and all other activities for the promotion of the interests of its Members;

(c) Generation, transmission and distribution of power, revitalization of land and water resources, their use, conservation and communications relatable to primary produce;

(d) Promoting mutual assistance, welfare measures, financial services, insurance of producers or their primary produce;

Who will bear the cost incurred to incorporate the Company?

A. The promoters should pull the amount needed for incorporation of a company. Amount (loan) given by the promoters in the initial stage will be reimbursed by the company.

The payment however needs to be approved by the members in the first general meeting of the Producer Company

RESPONSIBILITIES FOR THE INCORPORATION

It is the responsibility of the initiator to take certain steps for the incorporation of the company. S/he, along with other promoters, have to get drafted the ‘Memorandum and Articles of Association’, file them with ‘the Registrar of Companies’ along with other documents and papers9, carry out corrections, if any, required by the ‘Office of the Registrar’ and finally collect the ‘Certificate of Incorporation’. Initiator also has to mobilize as well as invite people to be shareholders of the company.

process of incorporation SPICE+

PRE- INCORPORATION:

1. Normal Conditions:

- At Least 10 Producer: Producer who will promote/ incorporate the Company. Promoters may be individual or producer institutes.

- At Least 5 Directors: Directors should be individual only.

- Generally, in most of the cases, Promoters and Directors are the same in Companies.

SPICe+ would have two parts viz.:

A. Part A – Name Approval

B. Part-B- Incorporation of Company

A Producer Company should be named using the following suffix “Producer Company Limited” appropriately indicating its status of Producer Company. The word “private” is not used in the name and the absence of which does not indicate that the company is a “public”.

STEP – I:

PART A-for Name reservation for new companies

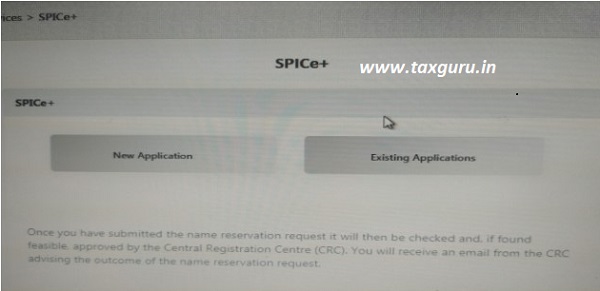

A. Login on MCA Website

Applicant have to login into their account on MCA Website. (Pre-existing users can use earlier account or new users have to create a new account.)

After Login the following screen will appear:

B. Steps: II Click on New Application and following window will open:

(This form can’t be downloaded; it has to be filled on real time basis)

Details required to be mentioned in online form:

(i) Type of Company (i.e. Producer)(below table taken from MCA link: http://www.mca.gov.in/MinistryV2/SPICePlusFAQs.html

(ii) Class of Company (whether Private, Public, OPC)

(iii) Category of Company (whether Company limited by shares, limited by Guarantee or unlimited)

(iv) Sub-category Union Government, State Government, Non-Government Company, Subsidiary of Company incorporated outside India)

(v) Main Division of Industrial Activity (enter number belonging to Industrial Activity)

(vi) Description of main division

(vii) Particulars of Proposed or Approved Name. (User has to enter the name he wants to reserve, for incorporation of a new company. Users are requested to ensure that the proposed name selected does not contain any word which is prohibited under Section 4(2) & (3) of the Companies Act, 2013 read with Rule 8 of the Companies (Incorporation) Rules, 2014. Users are also requested to read and understand Rule 8 of the Companies (Incorporation) Rules, 2014 in respect of any proposed name before applying for the same. For Name Search: http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do)

Stakeholders are requested to also check the Trademark search to ensure that the proposed name is not in violation of provisions of Section 4(2) of the Companies Act, 2013, failing which it is liable to be rejected. For Trade Mark Search: http://www.ipindia.nic.in/index.htm

Note: Two fields are available ie the two proposed names can be entered

(i) Choose File (Any attachment)

This option is available to upload the PDF documents. It is not mandatory to attach any document except in case where a name which requires the approval of a Sectoral Regulator or NOC etc, if applicable, as per Companies(Incorporation) Rules, 2014. Only one file is allowed, if have multiple then scan into one document. The attachment size cannot exceed 6 MB for both Part A and Part B taken together.

Steps: III Fill the given Information and save the application as follows:

- Fill the Information

- Save the Application

- Submit the Application

After Submit below given window will open:

C. Here stake holder having two options:

Option 1: Submit Name application and make payment of the same for name approval. Payment of Rs. 1,000/-

Option 2: Click on “Proceed for Incorporation”

After click on “Proceed for Incorporation” below given window will open:

NOTE: * Approval of Name through “PART-A” is an optional way. Companies can also directly apply for the Information after continuation with PART B form.

It is advisable to go through PART-A route

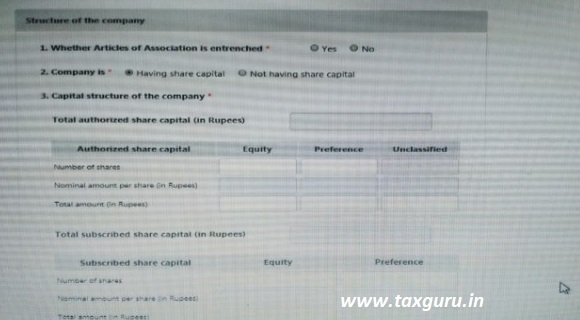

Part B- Incorporation of Company

Before start to fill Part – B promoters have to prepare following documents:

STEP – II: Preparation of Documents for Incorporation of Company:

After approval of name in PART-A or for Incorporation of Company applicant have to prepare the following below mentioned Documents;

√ DIR-2- Declaration from first Directors along with Copy of Proof of Identity and residential address.(On Plain Paper and make sure address on all ID proof should be same)

√ NOC from the owner of the property.(on plain paper and NOC from the person whose name mentioned on utility bill)

√ Proof of Office address (Conveyance/ Lease deed/ Rent Agreement etc. along with rent receipts);

√ Copy of the utility bills (not older than two months)

√ In case of subscribers/ Director does not have a DIN, it is mandatory to attach:Proof of identity and residential address of the subscribers

√ All the Subscribers should have Digital Signature.

**No need of any stamp paper for Incorporation of Company.

STEP – III: Fill the Information in Form:

Once all the above-mentioned documents/ information is available. Applicant has to fill the information in the e-form “Spice+”.

Features of SPICe+ form:

√ Web based: This is web-based form, that means this form can’t be download. It will be filled on MCA website online only.

√ Online Information:This form once online information filed will be save there only and can be access in dash board of the Log in ID.

√ Fill details of PAN & TAN:

It is mandatory to mention the details of PAN & TAN in the Incorporation Form Spice+. Link to find out of Area Code to file PAN & TAN are given in Help Kit of SPICE+.

√ Attachment of Documents:In web-based form only promoters have to attach documents pdf files.

√ Download PDF form:After complete filing of information in web-based form. Download PDF file of the form from dashboard.

√ Process after Downloading of PDF:Below given steps have to use for incorporation of company.

STEP – IV: Preparation of MOA & AOA (Electronic or Physical):

As there are minimum 10 subscribers therefore, MOA & AOA of Producer company shall be always physical MOA & AOA. MOA & AOA of producer company shall never be e-MOA or e-AOA.

After proper filing of SPICE+ form applicant has to move on drafting/ preparation of information in INC-33 (MOA) and INC-34 (AOA).

Drafting of Memorandum of Association (MOA) and Article of Association (AOA) is generally a step subsequent to the availability of name made by the registrar It should be noted that the main objects should match with the objects shown in Spice+ (Objects for Producer Company are restricted).

These two documents are basically the charter and internal rules and regulations of the Company. Therefore, it must be drafted with utmost care and with the advice of the professional. The Directors/ promoters with the help of professional draft MOA and AOA.

AOA (Draft Attached at the end):

Article of Association contains the internal regulations of the Company so care should be taken while drafting it.

STEP – V: Fill details of GST, EPFO, ESIC, BANK Account in AGILE PRO:

After proper filing of SPICE+ form applicant has to move on filling of information in the AGILE PRO form Dashboard Link. All the information which are common in PART-B and AGILE PRO shall be auto fill in AGILE Pro. It is also web based form.

- GST:If Company wants to apply for GST it has to select YES in the form and fill the information in the form.

- EPFO/ ESIC:It is mandatory to apply for ESIC and EPFO.

- However, as per their concerned department company not required to file return till the date applicability of provisions of same on such company.

- Bank Account:It is mandatory to open bank account through this form. Bank account branch shall be assigned according to nearest branch to the Registered office of the Company.

STEP – VI: Fill details of INC-9:

INC-9 shall also be generated web-based and need affixation of Directors/ subscribers on the same. It shall not be generated web-based in one situation when atleast one directors/ subscriber not having DIN and PAN both.

STEP – VII: Download PDF of all the web-based forms-:

After filing of all web-based form i.e.

- Spice+

- Agile Pro

- INC-9

Download PDF of such forms from dash board given link. After downloading of PDF affix DSC on all the forms accordingly.

STEP – VIII: Filing of forms with MCA-:

Once all forms ready with the applicant, upload all three document as Linked form on MCA website and make the payment of the same.

STEP – IX: Certificate of Incorporation-:

Incorporation certificate shall be generated with CIN, PAN & TAN details over it.

Certificate of Incorporation:

- The Registrar of the Companies, on being satisfied that all the documents for the incorporation of a company is submitted, he is obliged to register the memorandum, the articles and other documents, if any, and issue a ‘certificate of incorporation’ within thirty days, which is a conclusive proof of its formation in terms of Part IX A.

- The incorporation of Producer Company is effective from the date mentioned in the certificate of registration granted by the Registrar of Company.

- On incorporation, a company becomes a juristic person, i.e. a person in the eyes of law. It has perpetual succession i.e. its members may come and go but the company goes on till it is wound up by following the process of law.

- It has a common seal, which is affixed on all the documents executed on behalf of the company in the presence of a director and be signed by the authorized signatory or signatories.

- It is empowered to hold all properties in its own name and has its own right. It can sue others and can be sued by other and enter into contracts in its own name.

Annual General Meeting

1. First AGM shall be conducted within 90 days from the date of incorporation.

2. The Registrar may permit extension of the time for holding Annual General Meeting (not being the first annual general meeting) by a period not exceeding 3 months.

KEY POINTS OF SPICE+:

a) Stakeholders will not be required to even enter the SRN of the approved name as the approved Name will be prominently displayed on the Dashboard and a click on the same will take the user for continuation of the application through a hyperlink that will be available on the SRN/application number in the new dashboard.

b) From 15th February 2020 onwards, RUN service would be applicable only for ‘change of name’ of an existing company

c) The approved name and related incorporation details as submitted in Part A, would be automatically Pre-filled in all linked forms also viz., AGILE-PRO, INC-9

d) Registration for EPFO and ESIC shall be mandatory for all new companies incorporated w.e.f 15 February 2020 and no EPFO & ESIC registration nos. shall be separately issued by the respective agencies

e) Registration for Profession Tax shall also be mandatory for all new companies incorporated in the State of Maharashtra w.e.f 15th February 2020

f) All new companies incorporated through SPICe+ (w.e.f 15th February 2020) would also be mandatorily required to apply for opening the company’s Bank account through the AGILE-PRO linked web form.

g) Declaration by all Subscribers and first Directors in INC-9 shall be auto-generated in pdf format and would have to be submitted only in Electronic form in all cases, except where:

(i) Total number of subscribers and/or directors is greater than 20 and/or

(ii) Any such subscribers and/or directors has neither DIN nor PAN.

POINTS TO REMEMBER WHILE FILLING THE INFORMATION IN FORM:

- Maximum details of directors are TWENTY (20).

- Maximum THREE (3) directors are allowed for filing application of allotment of DIN while incorporating a Company.

- Person can apply the Name also in this form.

- Applying for PAN/TAN/EPFO/ESIC/Bank Account will be compulsory for all fresh incorporation applications filed in the new version of the SPICe plus form.

- Company can apply for GST, also through AGILE PRO form.

- In case of companies incorporated, with effect from the 26th day of January, 2018, with a nominal capital of less than or equal to rupees fifteen lakhs or in respect of companies not having a share capital whose number of members as stated in the articles of association does not exceed twenty, ROC fee on SPICE+ shall not be applicable

FEATURES – SINGLE WINDOW FORM:

Earlier if a Person wants to incorporate Company then it has to apply for the DIN, Approval of the Name Avaibility, Separate form for first Director, Registered office address, PAN, TAN etc. But this form is a single window for Incorporation of Company.

This form can be used for the following purposes:

♦ Application of DIN (upto 3 Directors)

♦ Application for Avaibility of Name

♦ No need to file separate form for first Director (DIR-12)

♦ No need to file separate form for address of registered office (INC-22)

♦ No need to file separate form for PAN & TAN

♦ No need to file separately for GST,

♦ No need to file separate form for EPFO, ESIC, Profession tax

♦ No need to file separate application with bank for Bank account number..

QUICK QUESTION – SPICE+

i. How to file the SPICe+ form in case of more than 7 subscribers in the Company?

In case of incorporation of a company having more than 7 subscribers, MOA & AOA shall be filled with SPICE+ in the respective format as specified in Table A to J in Schedule I without filing form INC 33 and INC 34.

(Means Physical attachment of MOA & AOA in e-form INC 32)

ii. Whether Companies are required to make payment of Stamp Duty in case of incorporation of Company with authorized Capital of Rs. 10 Lakh or below?

Yes, Company has to pay the Stamp Duty. Because Stamp Duty is state’s matter. Companies Act, has given exemptions for the ROC fees not for the stamp duty.

iii. How many DIN can be apply through SPICE+ Form?

Maximum 3 (Three) DIN can be apply through SPICE+ form.

If applicant want to incorporation Company with more than 3 Directors and more than 3 persons doesn’t have DIN. In such situation applicant have to incorporate Company with 3 Directors and have to appoint new directors later on after incorporation.

iv. Whether there is need to file any separate form for PAN & TAN?

No need to file any separate form. Details in relation to Area Code and other details shall be mention in the form SPICE+ itself and PAN & TAN shall be generate with Certificate of Incorporation.

Important Provisions Relating To Producer Company:

| i. | The members have necessarily to be primary producers |

| ii. | Name of the company shall end with the words “Producer Company Limited”. |

| iii. | The limit of maximum number of members is not applicable to these Companies |

| iv. | On registration, the producer company shall become as if it is a Private Limited Company for the purpose of application of law and administration of the company |

| v. | Minimum No. of 10 member (individual). |

| vi. | Share capital of a Producer Company shall consist of equity shares only |

| vii. | Minimum 5 and not more than 15 directors |

| viii. | Producer Company can carry only activity prescribed under the Act. |

| ix. | Only of individuals, then voting rights shall be based on a single vote for every member. |

| x. | A full time chief executive should (CEO) be appointed by the board. |

CAUTION TO BE TAKEN BY PROFESSIONALS

1. Obtain engagement letter from subscriber:– As per certification in e-form DIR-12 & INC-22, a professional declares that he has been engaged for the purpose of certification Therefore it is advisable to obtain an engagement letter.

2. Verification of original records pertaining to registered office:– As per certification in e-form INC-22, a professional declares that he has verified all the particulars(including attachments) from original records.

3. Ensure all attachments are clear enough to read:– As per certification in e-form DIR-12 & INC-22, a professional declares that all attachments are completely and legibly attached.

4. Ensure registered office of the company is functioning for the business purposes of the company: – –As per certification in e-form INC-22, a professional declares that he has personally visited the registered office.

5. Take a declaration to the effect that all the original documents have been handed over after incorporation. Since as per section 7(4) copies all documents/information as originally filed should be preserved at the registered office of the company, therefore a professional should take a declaration while handing over the incorporation documents.

6. MCA Circular 10/2014: – According to this circular ROC/RD in case of omission of material fact or submission of false/incomplete/ misleading information can after giving opportunity to explain refer the matter toe-governance division of MCA, which in turn may initiate proceedings under section 447 and/or ask the respective professional institute to take requisite disciplinary action.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. IN NO EVENT SHALL I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM, ARISING OUT OF OR IN CONNECTION WITH THE USE OF THE INFORMATION.

(Republished with amendments)

very insightful and helpful

How to get farmership certificate for producer company incorporation…please let me know

Mr. Divesh is not answering to any one of the query. Such a bad professional

plz send a draft MOA and AOA of producer Company

It is mandatory to have 5 directors for a Producer Company. But since only 3 DIN’s can be applied in SPICE+. Then, should we be incorporating with 3 directors? Would that not be wrong?

Request your help.

I want to know whether a person (become a member) of producer company doesn’t have ID proof like,Driving Licence/Passport/Voter ID. but he/she has Adhar Card only.

then Can we use adhar card as id proof of member.pls suggest me if any other option is here.

Is there any format of Producer certificate of all subscribers certified by tehsildar/ agriculture officer/ patwari/ SDM/ district administrator and Khasra/ Khatauni should be attached

Is it true that the Affidavit from Subscribers has been replaced by given only deceleration on simple paper.

s there any format of Producer certificate of all subscribers certified by tehsildar/ agriculture officer/ patwari/ SDM/ district administrator and Khasra/ Khatauni should be attached.

is there any format of Producer certificate of all subscribers certified by tehsildar/ agriculture officer/ patwari/ SDM/ district administrator and Khasra/ Khatauni should be attached.

is there any format of Producer certificate of all subscribers certified by tehsildar/ agriculture officer/ patwari/ SDM/ district administrator and Khasra/ Khatauni should be attached.

Nice article. Keep Sharing

Dear Sir,

Your article is very useful. but links are not opening..Can u send me Draft MOA and AOA of Farmers Producer company