In a recent case under the Companies Act, 2013, the Ministry of Corporate Affairs (MCA) imposed a substantial penalty of ₹3 lakhs on M/s. My Wheels Private Limited for its failure to maintain a registered office as required by law. This case sheds light on the legal obligations of companies and the consequences of non-compliance with statutory provisions.

Background: M/s. My Wheels Private Limited, a registered company, was found to be in violation of Section 12(3)(c) of the Companies Act, 2013. The violation stemmed from the absence of the company’s address and Corporate Identification Number (CIN) on its letterhead, a breach of the statutory requirement.

Adjudication Proceedings: The MCA initiated adjudication proceedings against the company under Section 454 of the Companies Act, 2013, to impose penalties for this non-compliance. An adjudicating officer was appointed to examine the case and determine the appropriate penalties.

Show Cause Notices: The company received a show cause notice under Section 12(3)(c) of the Companies Act, 2013, which required it to explain the violation and justify its actions. The company and its officers in default were given an opportunity to present their case.

Ex-Parte Order: Despite the opportunity to respond, the company and its officers failed to appear during the hearing. Consequently, an ex-parte order was issued, holding the company liable for the violation and the penalties associated with it.

Penalty Imposition: The adjudicating officer concluded that the company and its officers were indeed liable for the violation, as per Section 12(8) of the Companies Act, 2013. Subsequently, a penalty of ₹3 lakhs was imposed on the company and its officers in default.

Implications and Consequences: The case serves as a stark reminder of the importance of complying with legal requirements related to the maintenance of a registered office. Failure to do so can result in significant penalties. The penalties are to be paid by the company and its officers personally.

Additionally, the company must remit the penalty amount through the Ministry of Corporate Affairs portal within 60 days from the date of the order. Failure to comply within this period may lead to further fines.

It’s worth noting that non-compliance with such orders may result in fines ranging from ₹25,000 to ₹5 lakhs for the company and potential imprisonment of officers for up to six months or fines between ₹25,000 and ₹1 lakh, or both.

Conclusion: This case highlights the significance of maintaining a registered office and adhering to statutory requirements. The penalty imposed serves as a deterrent for companies that may overlook their legal obligations. Non-compliance can lead to financial repercussions and legal consequences. Companies and their officers must ensure strict adherence to statutory provisions to avoid such penalties and legal proceedings.

*****

In the matter of Companies Act, 2013

And

In the matter of adjudication proceeding under sub-section (3)(c) of Section 12 of the

Companies Act, 2013.

And

In the matter of M/s. My Wheels Private Limited

(CIN-U50100MP2015PTC034842)

Date of hearing 21″ September, 2023

1. Appointment of adjudicating officer:

The Ministry of Corporate Affairs vide its Gazette Notification No. A-42011/112/2014-Ad.II dated 24.03.2015 appointed undersigned as adjudicating officer in exercise of the powers conferred by Section 454 of the Companies Act, 2013 (hereinafter known as “Act” ) read with Companies (Adjudication Of Penalties) Rules, 2014 for adjudicating penalties under the provisions of this Act.

2. Company:

M/s. My Wheels Private Limited (CIN-U50100MP2015PTC034842) hereinafter known as company] is a registered company with this office under the provisions of the Companies Act, 2013 having its registered office situated at 6-7, Malviya Nagar, Bhopal 462001, M.P. as per the MCA website.

| SI. No. | Particulars | Details |

| 01. | Paid-up capital (F.Y. 2016-17) | 4,00,00,000 |

| 02. | Turnover (F.Y. 2016-17)s | 99,88,740 |

| e. Revenue from operation | 63,08,472 | |

| f. Other income | 36,80,268 | |

| 03. | Holding company | NO |

| 04. | Subsidiary company | NO |

| 05. | Whether company registered under Section | NO |

| 06. | Whether company registered under any other Special Act. | NO |

3. Facts about the case:

Whereas, inspection u/ s. 206(5) of the Companies Act, 2013 conducted by the IO. During the inspection of company, it is observed from the notice for AGM and reply of company that address and CIN are not mentioned on the letterhead of the company that address and CIN are not mentioned on the letterhead of the company which is violation of Section 12(3)(c ) of the Companies Act, 2013. Therefore, it seems that the company has not complying the provisions of Section 12(3) (c ) of the Companies Act, 2013, resulting into violation of Section 12(3) read with Section of Act which attracted penal provisions of Section 12(8) of the Companies Act, 2013.

4. Subsequently, this office had issued show cause notice U/s. 12(3)(c)of the Companies Act, 2013 to the company and its officers in default vide No. ROC-G/Adj.Pen./u/ s. 12(3)(c) /My Wheels/ 1684-1686 dated 28.07.2023 and the notice as issued to company and officer in default were delivered. Further, reply was received in this office via post dated 14.08.2023 by Mrs Manju Garg on behalf of the Company.

5. Thereafter, “Notices of Inquiry” vide No. ROC-G/Adj. Pen. /U / s. 12(3)(c) My Wheels /2022-2024 dated 11.09.2023 were issued to the company and its officers in default and the notice as issued to company and officer in default were delivered. Further, reply was received in this office via post dated 22.09.2023 by Mrs Manju Garg on behalf of the Company. However, the reply was also not written on letterhead of the Company. As per [Rule 3(3), companies (Adjudication of Penalties) Rules, 2014 and the date of hearing was fixed on 21st september, 2023 at 11.30 A.M in the office of Registrar of Companies, Madhya Pradesh, Sanjay Complex, A-Block, 3rd Floor, Jayendraganj, Gwalior.

6. Order:

However, on the date of hearing, no one appeared on behalf of the Company and Director. Hence, the order was declared Exparte. Having considered the facts and circumstances of the case and after taking into account the factors above and concluded that the company and its officers in default are liable for penalty as prescribed under Section 12(8) of the Act for default is made in complying with the requirements of Section 12(4) of the act of the company viz. My Wheels Private Limited for 737 days from (06.09.2021 date of Order directed by DGCoA to 21.09.2023 date of hearing) in terns of Section 12(1) of the Act.

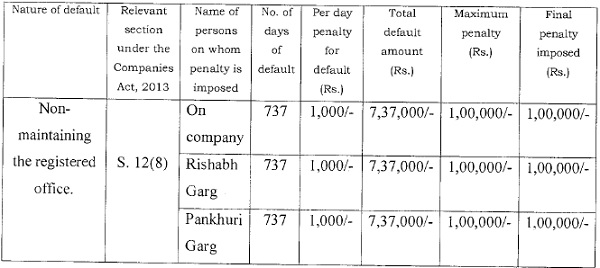

7. Accordingly, I am inclined to impose a penalty as prescribed under Sub-section 8 of section 12 of the Companies Act, 2013. The details of the penalty imposed on the company and officers in default are shown in the table below:

I am of this opinion that penalty is commensurate with the aforesaid failure committed by the notice and penalty so imposed upon the officers-in-default shall be paid from their personal sources/income. It is further directed that penalty imposed shall be paid through the Ministry of Corporate Affairs portal only as mentioned under Rule 3(14) of Company (Adjudication of Penalties) (Amendment) Rules, 2019 under intimation to this office.

8. The penalty amount shall be remitted by the company through MCA21 portal within 60

days from the date of order. The company needs to file INC-28 as per the provisions of the act, attaching the copy of adjudication order along with payment challans.

9. Any person aggrieved by the order of adjudicating authority under Section (3) of Section 454 may prefer an appeal to the Regional Director having jurisdiction in the matter.

10. Every appeal under sub-section (5) of Section 454 shall be filed within 60 days from the date on which the copy or order made by the adjudicating authority is received by the aggrieved person and shall be in such form, manner and be accompanied by such fee as may be prescribed.

11. As per Section 454(8) (i) where a company fails to comply with the order made under sub-section (3) or sub-section (7) as the case may be within a period of 90 days from the date of receipt of the copy of the order, the company shall be punishable with fine which shall not be less than twenty-five thousand, but which may extend to five lakh rupees.

12. Where an officer of a company or any other person who is in default fails to comply with the order made under sub-section (3) or sub-section (7) as the case may be within a period of 90 days from the date of receipt of the order, such officer shall be punishable with imprisonment which may extend to six months or with the fine which shall not be less than twenty five thousands rupees but which may extend to one lakh or with both.

13. This order is without prejudice to the rights available to this office to initiate separate actions including but not limited to the penal actions for contraventions of related, incidental and/ or continuing offences/contraventions.

14.In terms of the provisions of sub-rule 3 of the Companies (Adjudication of Penalties) Rules, 2014 copy of the order is being sent to M/s. My Wheels Private Limited, 6, 7, Malviya Nagar, Bhopal 462001, M.P, Sh. Rishabb Garg S/o. Sh. Saurabh Garg, Director ,7/88, Arera Colony, Shahpura, R.S. Nagar, Bhopal 462016, M.P. , Pankhuri Gupta D/o. Sh. Saurabh Garg, Director , 2, Anand Lok, Andrewsganj, South Delhi 110049, Regional Director, North-Western Region, Ministry of Corporate Affairs, Ahmedabad and will also be uploaded on MCA website.

The adjudication notice stand disposed off with this order.

(Mukesh /Kumar Soni, ICLS)

Registrar of Companies,

Madhya Pradesh, Gwalior.

Order Reserved on 21.09.2023

Order Pronounced on 04.10.2023

Place: Gwalior, Madhya Pradesh.