The Finance Act 2023 introduced significant changes to India’s income tax structure, notably amending Section 115BAC to make the new tax regime the default for Assessment Year (AY) 2024-25. This change affects individuals, Hindu Undivided Families (HUFs), Associations of Persons (AOPs) excluding cooperative societies, Bodies of Individuals (BOIs), and Artificial Juridical Persons (AJPs). While the new regime is now the default, eligible taxpayers can opt out and choose the old regime if they prefer. This article addresses frequently asked questions (FAQs) to help taxpayers understand the implications and choices available between the new and old tax regimes.

FAQs on New vs. Old Tax Regime (AY 2024-25)

1. Overview

The Finance Act 2023 has amended the provisions of Section 115BAC w.e.f AY 2024-25 to make new tax regime the default tax regime for the assessees being Individual, HUF, AOP (not being cooperative societies), BOI or Artificial Juridical Person. However, the eligible taxpayers have the option to opt out of new tax regime and choose to be taxed under old tax regime. The old tax regime refers to the system of income tax calculation and slabs that existed before the introduction of the new tax regime.

In case of “non-business cases“, option to choose the regime can be exercised every year directly in the ITR to be filed on or before the due date specified under section 139(1).

In case of taxpayers having “income from business and profession” and who want to opt out of new tax regime, the assessee would be required to furnish Form 10-IEA on or before the due date u/s 139(1) for furnishing the return of income. Also, for the purpose of withdrawal of such option i.e. opting out of old tax regime shall also be done by way of furnishing Form No.10-IEA.

New tax regime is the default tax regime. However, taxpayers can opt for the old regime. New vs. Old Tax Regime> FAQs

1) What is the difference between the old and new tax regime?

Ans: The tax slabs and rates are different in old and new tax regimes. Various deductions and exemptions are allowed in Old tax regime. The new regime offers lower rates of taxes but permits limited deductions and exemptions.

2) Which is better between the old tax regime and the new tax regime?

The option to choose between two regimes may vary from person to person. It is advisable to do a comparative evaluation and analysis under both regimes and then choose as per requirement. Taxpayers can broadly estimate and compare tax liability under the new and the old tax regime using Income and Tax Calculator on the Income Tax Portal.

3) Is it necessary for the employee to intimate the tax regime to the employer?

Yes, the employee has to intimate the employer regarding his intended tax regime during the year. If the employee does not make an intimation, it shall be presumed that the employee continues to be in the default tax regime and has not exercised the option to opt out of the new tax regime. Thus, the employer shall deduct tax in accordance with the rates provided under section 115BAC.

However, the intimation made to the employer would not amount to exercising the option in subsection (6) of section 115BAC for opting out of the new tax regime. The employee shall be required to do so separately before the due date specified under section 139(1) for filing of return of income.

4) I am a salaried taxpayer. Can I claim HRA exemption in the new regime?

Under the old tax regime, House Rent Allowance (HRA) is exempted under section 10(13A) for salaried individuals. However, this exemption is not available in the new tax regime.

5) Am I eligible for Rs. 50,000 standard deduction in the new tax regime?

Yes, Standard deduction of Rs.50,000 or the amount of salary, whichever is lower, is available for both old and new tax regimes from AY 2024-25 onwards.

6) In the new tax regime can I claim deductions under chapter-VIA like section 80C, 80D, 80DD, 80G etc. while filing the ITR for AY 2024-25?

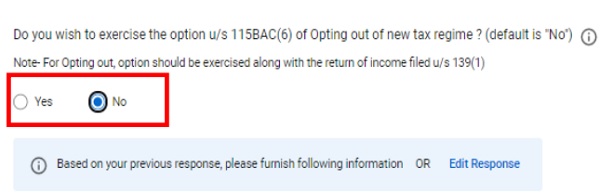

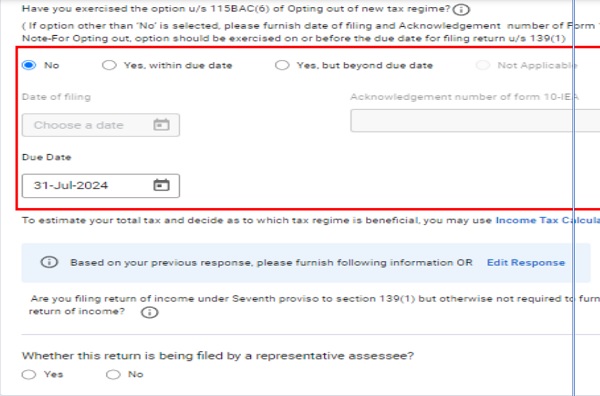

In new tax regime, Chapter-VIA deductions cannot be claimed, except deduction u/s 80CCD(2)/80CCH/80JJAA as per the provision of Section 115BAC of the Income Tax Act, 1961. In case, taxpayer wants to claim any deductions (as applicable), then taxpayer needs to choose the old tax regime by selecting “Yes” option in ITR 1 / ITR 2 (or) “Yes, within due date” option in ITR 3 / ITR 4 / ITR 5 in the field provided for “opting out option” under Schedule ‘Personal Information’ or ‘Part-A General’ in the respective ITR.

in ITR 1 / ITR 2

Or in ITR 3 and ITR 4

7) Can I claim deduction of Interest on borrowed capital of Rs. 2,00,000/- for self occupied property under Income from House Property in the new tax regime?

In the new tax regime, “Interest on borrowed capital for Self-occupied property” is not allowed as a deduction from Income from House property as per the provision of Section 115BAC of the Act, 1961. In case, the Taxpayer wants to claim deduction of interest on borrowed capital for SOP, then taxpayer must choose ‘Old Tax Regime’ by selecting “Yes” in ITR 1 / ITR 2 or “Yes, within due date” option in ITR 3 / ITR 4 / ITR 5 in the field provided for “opting out option” in the ITR Form.

8) I am a senior citizen. In the old tax regime there are special advantages in tax rates for senior citizens. Are there any such advantages in new tax regime?

In the old tax regime , the basic exemption limit for senior citizens is Rs. 3,00,000/- and for super senior citizens, it is Rs. 5,00,000/-. In the new tax regime, no income tax is payable upto the total income of Rs. 7 lakh.

9) Is there any difference in tax rebate under section 87A in old and new tax regime?

In the old tax regime in case of a resident individual, whose total income does not exceed Rs. 5,00,000/- there is rebate of 100 percent of income tax subject to a maximum of Rs. 12,500/-. In the new tax regime, the rebate is increased to Rs. 25,000/- or 100 percent of income tax where the total income does not exceed Rs. 7,00,000/-.

10) While filing ITR for FY 2023-24 (AY 2024-25), I want to opt for the old tax regime instead of the default new tax regime, should I file Form 10-IEA before filing his income tax return (ITR)?

Form 10-IEA is a declaration made by the return filers for choosing the ‘Opting Out of New Tax Regime’. An Individual, HUF, AOP (not being co-operative societies), BOI or Artificial Juridical Person with business or professional income must submit Form 10-IEA if they wish to pay income tax as per the old tax regime. On the other hand, taxpayers who do not have income from business or profession can simply tick the “Opting out of new regime” in the ITR form without the need to file Form 10-IEA. Simply put, only those who file ITR-3, ITR-4 or ITR-5 have to submit Form 10-IEA if they have business income (other than coop societies). Individuals and HUFs filing their returns in Forms ITR-1 or 2 are not required to submit Form 10-IEA.

11) I am filing ITR in new regime for AY 2024-25. Can I switch between old and new tax regime in the next years?

An Individual, HUF, AOP (not being co-operative societies), BOI or Artificial Juridical Person with business or professional income will not be eligible to choose between the two regimes every year. Once they opt out of new tax regime, they have only one chance for switching to new regime. Once they switch back to the new regime, they won’t be able to choose old regime anytime in future. An individual with non business income can switch between the new and old tax regimes every year. Within the same year, again it is emphasized that the choice of old tax regime can be made only before the due date of filing the return u/s 139(1) of I T Act.

12) I am having business income and have opted in and opted out from the new regime in the previous years. So, will I be in old regime for the AY 2024-25?

Please note that new tax regime is default regime for AY 2024-25. Any actions in any previous years with respect to choice of regimes will not be applicable from AY 2024-25. You are required to submit Form 10-IEA again in case you want to opt for the old regime.

13) I have business income, I have wrongly filed Form 10-IEA but want to file the return under new tax regime. As there is no option to withdraw Form 10-IEA in that case whether my return can be filed under new tax regime?

Once Form 10IEA is filed for AY 2024-25, then it cannot be revoked / withdrawn in same AY. If you wish to re-enter into new tax regime then you can file Form 10IEA for withdrawal option in the next assessment year. Again it is emphasised that that the choice of old tax regime can be made only before the due date of filing the return u/s 139(1) of I T Act.

14) I am filing ITR-5. I want to opt out of new tax regime? Whether Form 10-IFA or Form 10-IEA would be applicable to me?

Form 10-IEA is applicable to AOP’s (other than Co-operative society) or BOI or AJP, who are filing return of Income in ITR-5 for AY 2024-25.

Form 10-IFA is applicable to new manufacturing co-operative Societies resident in India filing ITR 5, if they wish to avail New Tax Regime under Section 115BAE for AY 2024-25.