CS D Hem Senthil Raj

Note on Median Remuneration Calculation as per Companies Act, 2013 and The Companies (Appointment and Remuneration) Rules, 2014

Overview:

As per Section 197 (12) read with Rule 5 (1) (i) of The Companies (Appointment and Remuneration) Rules, 2014, the listed companies are required to provide the disclosure of the ratio of the remuneration of each director to the median remuneration of the employees of the company for the financial year in the Board’s Report.

Definition of Median:

“Median” definition as per the Rules:

Means the numerical value separating the higher half of a population from the lower half and the median of a finite list of numbers may be found by arranging all the observations from lowest value to highest value and picking the middle one.

If there is an even number of observations, the median shall be the average of the two middle values.

Calculating the Median Remuneration of the Employees:

Step1: Consolidate the salary data of all the employees in ascending order (Financial Year).

Step2: Salary shall be inclusive of all perquisites and allowances calculated on the basis of cost to the company.

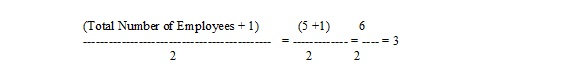

If the number of employees is “ODD” then the median remuneration shall be the salary payable to the resulting employee after incorporating the below formula:

(Total Number of Employees + 1)

———————————–

2

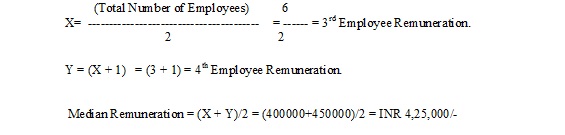

If the number of employees is “EVEN” then the median remuneration shall be the salary payable to the resulting employee after incorporating the below formula:

X = (Total Number of Employees) ÷ 2

Y = (X + 1)

Median Remuneration = (X + Y) ÷ 2

Practical Example – If the Number of Employees is (“Odd”)

| S.No | Name of the Employee | Amount (INR) |

| 01 | A | 3,00,000 |

| 02 | B | 3,50,000 |

| 03 | C | 4,00,000 |

| 04 | D | 4,50,000 |

| 05 | E | 5,00,000 |

Median Remuneration shall be the remuneration payable to the employee number:

The Median remuneration in the above scenario shall be INR 4,00,000/-

Practical Example – If the Number of Employees is (“Even”)

| S.No | Name of the Employee | Amount (INR) |

| 01 | A | 3,00,000 |

| 02 | B | 3,50,000 |

| 03 | C | 4,00,000 |

| 04 | D | 4,50,000 |

| 05 | E | 5,00,000 |

| 06 | F | 5,50,000 |

Median Remuneration shall be:

The Median remuneration in the above scenario shall be INR 4,25,000/-

The Median remuneration in the above scenario shall be INR 4,25,000/-

DRAFT FORMAT OF DISCLOSURE TO BE MADE IN BOARD’S REPORT:

Format 1:

Ratio of remuneration of each director to the median remuneration of the employees of the Company for the Financial Year:

The information required pursuant to Section 197 read with Rule 5 (1) (i) of The Companies (Appointment and Remuneration) Rules, 2014 in respect of ratio of remuneration of each director to the median remuneration of the employees of the Company for the Financial Year are as follows:

| S. |

NoName of the DirectorRemuneration Per Annum (INR)Median Remuneration Per Annum (INR)Ratio (Remuneration of Director to Median Remuneration)Remarks

Note: In case of remuneration is not payable to Director, in such a case a company shall provide the above details in ‘Nil’ format.

Format: 2

Ratio of remuneration of each director to the median remuneration of the employees of the Company for the Financial Year:

The information required pursuant to Section 197 read with Rule 5 (1) (i) of The Companies (Appointment and Remuneration) Rules, 2014 in respect of ratio of remuneration of each director to the median remuneration of the employees of the Company for the Financial Year, will be made available for inspection at its registered office of the Company during the working hours for a period of twenty one days before the date of annual general meeting of the company pursuant to Section 136 of the Companies Act, 2013 and members, if any interested in obtaining the details thereof, shall make specific request to the Company Secretary and Compliance officer of the Company in this regard.

FAQ’s:

Whether it is necessary to include the Salary of Contract Laborers/Contract Employees of the Company for calculating the median remuneration?

The Rules does not provide any clarifications relating to including the details of the employees of the Company, however we feel that it could be more reliable, if the company take into account of only the salary of permanent employees of the Company for arriving at the median remuneration of the employee.

Whether it is necessary to include the details of permanent employees, who are serving the Company in the position of employee for less than twelve months?

As per the Rules, the Company is required to arrive at the median remuneration of the employees of the Company on financial basis and it is not necessary for the Company to include the details of employees serving the company below the period of twelve months.

Dear Sir

How Ratio to median is calculated

Permanent employees under this category is inclusive or exclusive of subsidiary employees? and if it is Foreign Subsidiary is it inclusive or exclusive?

Sir,

if any employee is not stayed for whole year is that employee counted for median employee calculation purpose.

if KMP also not stayed in company for whole year is we count there salary for this purpose.

Regards,

Pratima

Median Salary ?

In a company , median salary is where half the number of employees are getting more and the other half are getting less than that salary number

Till a few years ago , all limited companies had to get the annual salary of their top management ( directors ) , approved by the Department of Company Affairs . And while approving , DCA applied some internal ” guidelines ” ( – who should earn how much, and no more ! )

Companies learned to guess , as to what figure would pass the muster !

I believe , nowadays , this is left for the shareholders to decide

A few years earlier , companies were required to publish in their Annual Reports , a section called ” Employees Details ”

In this section , they were required to publish full details ( Name / Birth Date Edu. Qualification / Date of joining / Current Exp / Past Exp / current salary etc ) of all the employees drawing more than Rs 3000/- per month

In a few years time , in case of a few large companies , this section ran into hundreds of pages , as salaries kept rising

So the limit got progressively raised to Rs 6000/- pm and later to Rs 12,000/- pm , until one day this requirement got dropped

No doubt , this section was most sought-after by Headhunters / Bridegroom seekers , and avidly researched by all employees across the companies to find out where they stood in comparison with their colleagues !

Then , in 1978 , came Bhoothlingam Committee report

It recommended ( which got accepted by DCA ) that the compensation differential between the lowest and the highest salary in a company should not exceed 10 times !

But that committee never laid down any ” Upper Limit ” for the salaries of the lowest paid workers – which kept rising , month after month , since the DA ( Dearness Allowance ) was linked to Consumer Price Index , which kept galloping !

On the other hand , Companies were not able to raise the annual salaries of their directors , because of ceiling imposed by DCA !

As a result , this differential ( of no more than 10 times ) , kept shrinking !

I remember having projected the annual growth rate of the salary of the lowest paid worker in L&T ( where I worked ) , to estimate that it would overtake the Chairman’s salary , within a few years !

Now contrast this with what Business Line ( 06 July , 2015 ) reported as follows :

———————————————————————————–

Name of Top Honcho …….. Ratio { Own Salary / Median Employee Salary }

————————————————————————————

* Y C Deveshwar…………………………… 439

* Mukesh Ambani………………………….. 205

* Aditya Puri………………………………… 117

* Vishal Sikka……………………………….. 116

* Chanda Kochar…………………………….. 97

* Azim Premji………………………………… 89

* Sikha Sharma……………………………… 74

* Deepak Parekh…………………………….. 19

————————————————————————————————————————————————————————-

I hope this ” market determined ” and ” democratically arrived at ” managerial remuneration will continue without outside intervention

What companies want to pay their lowest paid workers and their highest paid top honchos , should be left to their shareholders

But when it comes to the salaries of High Court / Supreme Court Judges or Government Secretaries , is it not a travesty of justice that , after 25 years of service , they get paid , less than the starting salary of some 24 + fresh graduate MBAs ?

In a company called , ” India Inc. ” , we , the citizens are the shareholders

It is high time we start rewarding our ” Top Honchos ” , commensurate with their responsibilities !

———————————————————————————

hemen parekh

08 July 2015

How ratio to median is calculated

Good writing.

what is basic reason behind calculating median Remuneration? With an examples.