Hello there, as we all know that GST has arrived and still there are various rumors and havoc regarding Invoicing under the GST regime. Through this post, I would like to share some important points regarding Invoicing.

1. There is “NO FORMAT PRESCRIBED”by the Government. Only a “FEW PARTICULARS”have been mandated in the format which is listed herein below –

- Serial number of tax invoice (serial number should not exceed 16 character and it should be consecutive serial number containing alphabets or numbers or special characters or any combination thereof, unique for a financial year);

- Name, address and GSTIN of the supplier;

- Date of issue of tax invoice;

- Name, address and GSTIN or UIN, if registered, of the recipient;

- Name and address of the recipient and the delivery address of the consignment, along with name of the State and State code, in case the recipient is unregistered person and the value of goods exceeds INR 50,000;

- Description of goods or services;

- HSN code of goods or Accounting code of services;

- Quantity of goods and units or unique quantity code needs to be mentioned correctly;

- Total value of supply of goods or services;

- Taxable value of supply of goods or services taking into account discount or abatement;

- Rate of tax i.e. central tax, state tax, integrated tax or union territory tax or cess;

- Amount of tax charged in respect of taxable goods or services (central tax, state tax, integrated tax or union territory tax or cess);

- In case of supply in the course of inter-state trade or commerce, place of supply along with name of the State and State Code has to be mentioned;

- In case delivery place is different from place of supply, address of the delivery needs to be mentioned;

- Whether tax is payable on reverse charge basis, has to be mentioned;

- Signature or Digital Signature of the supplier or the authorized representative.

2. There are mainly 3 types of Invoices under GST as:

- TAX INVOICE– For taxable supplies either within state or outside state and the person is required to collect and pay the the tax on such supplies.

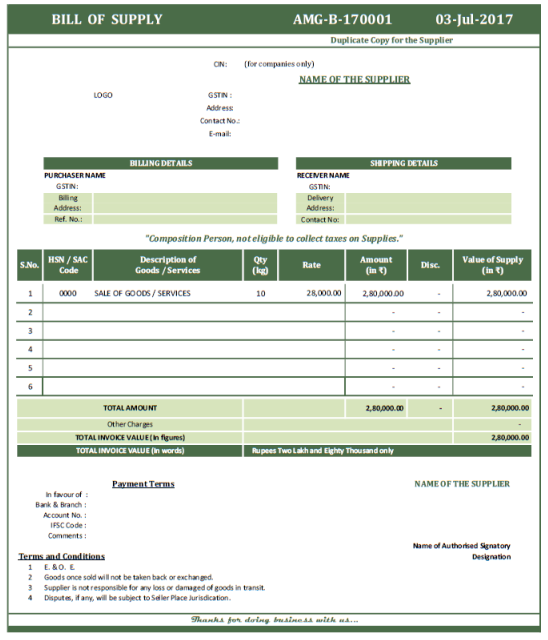

- BILL OF SUPPLY– The supplies on which the person is not required to collect and pay the tax. These mainly comprise of ‘registered person supplying exempted goods or service or both’, ‘Composition Dealers’ and ‘Exporters’. Bill of Supply Format is give below.

- PAYMENT VOUCHER– This voucher is required to be issued when the tax is payable by the receiver of goods or services or both. It covers ‘Importers’ and ‘Reverse Charge Mechanism’ of paying taxes.

3. The manner of issuing Invoices in GST is as follows :-

- TAX INVOICE for Supply of Goods is to be issued in 3 copies as :

- Original Copy for the Recipient

- Duplicate Copy for the Transporter

- Triplicate Copy for the Supplier.

- TAX INVOICE for Supply of Services is to be issued in 2 copies as :

- Original Copy for the Recipient

- Duplicate Copy for the Supplier.

- BILL OF SUPPLY for both goods and services can be issued as:

- Original Copy for the Recipient

- Duplicate Copy for the Supplier.

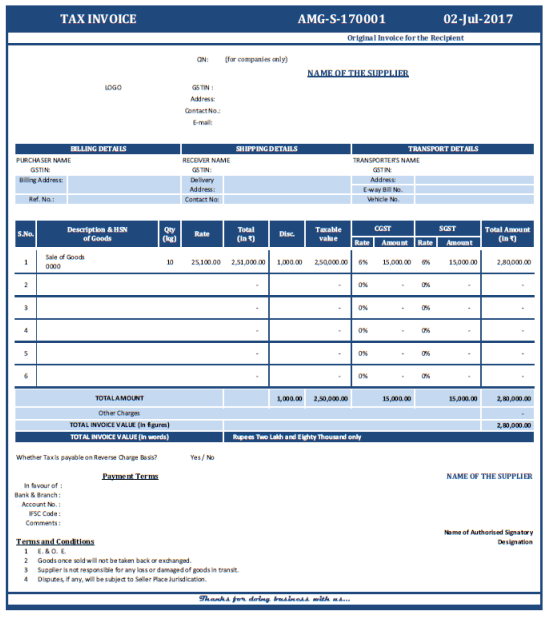

4. Format of TAX INVOICE under GST Regime for Local (State) Taxable Supply of Goods:-

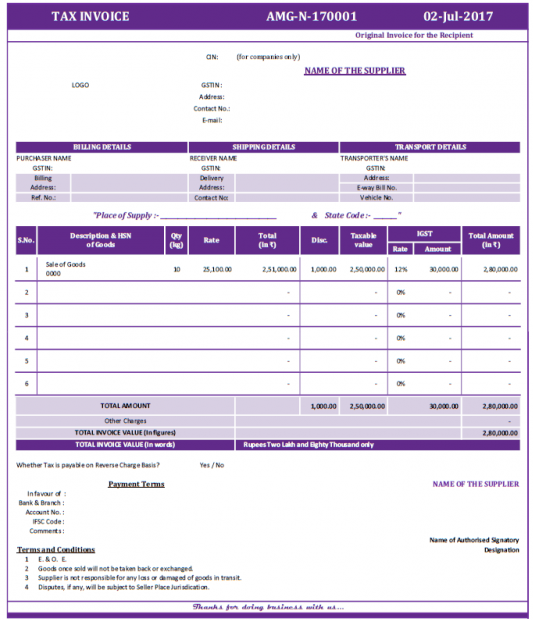

5. Format of TAX INVOICE under GST Regime for Inter-State (National) Taxable Supply of Goods:-

6. Format of BILL OF SUPPLY under GST Regime for Composition Dealers:-

In case of EXPORTERS, the declaration will read as follows: “SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”.

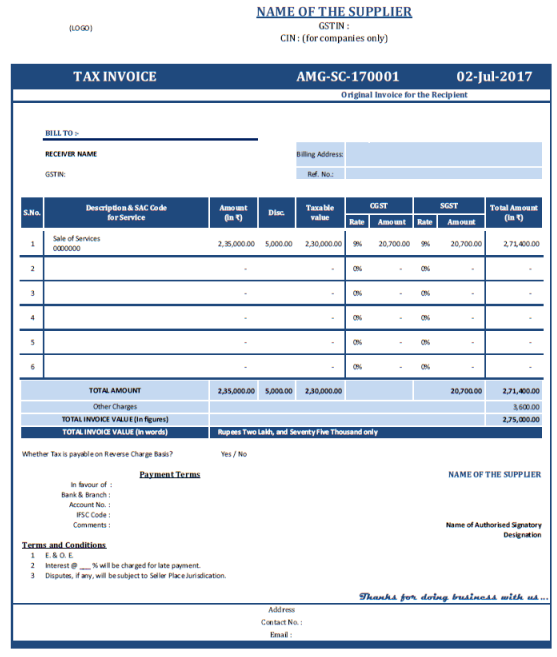

7. Format of TAX INVOICE under GST Regime for Local (State) Taxable Supply of Services :-

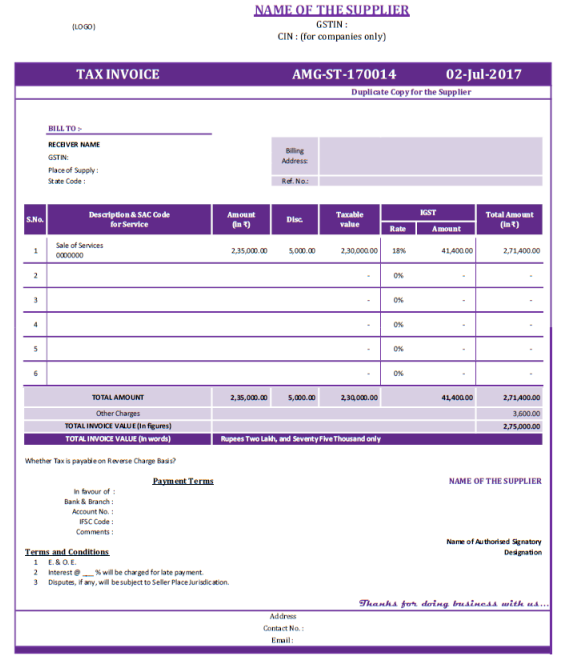

8. Format of TAX INVOICE for Inter-State (National) Taxable Supply of Services:-

9. HSN Codes in the invoices are to be shown as follows, referred in notification no. 12/2017 – central tax dated 28th June, 2017 :

- Turnover upto Rs. 1.50 Crore : Not Required

- Turnover more than Rs. 1.50 Crore up to Rs. 5.00 Crore : 2-digit Code (i.e. Chapter number only)

- Turnover more than Rs. 5 Crore : 4-digit Code (i.e. Chapter+Sub.Chapter)

(Republished With Amendments)

I am a raw natural honey seller which is gst exempted goods .

So, what type of bill should i generate for my customer ?

Invoice or bill of supply ?

Is it mandatory to raise tax invoice and Bill of supply separately..? Can we raise single invoice showing taxable and non taxable amount in two different columns..? So that number of bills can be reduced.

Thanks

Amit pawar

Hi,

Kindly let us know if we are GTA and Bill of Supply issued to GTA in which service provided where consignment issued by client . shoukd we mention our category i.e. GTA on our Invoices

we are getting tax invoice in case of interstate purchase as the place of supply -Uttar Pradesh 09 it is correct or not

i am in the composite scheme if i deal someone to 100 Rs include all tex so if i make bill of 99+1(1% GST) so is it okay because i make deal of 100 Rs

I WANT TO ALL THIS INVOICE

Hlo sir.

I m an unregistered gst retailer. And i m getting good by paying gst for my shop. And i m paying 4th hat tax to the dealer. And now i m unable to get the tax from the consumer. Is there any way by which i give the demanded bill to the consumer without charging tax from them.

Hi Sir,

I wanted to know that what kind of invoice will be used for content writing services (Tax invoice or Bill of supply). I have a blog that has income from Google Adsense, and the viewership is in US, Europe and Australia. The payment comes from Google Asia Pacific. Also payments are recieved from clients in these countries for sponsored articles on my blog through paypal.

Also I want to know if seperate billbook with seperate invoice number serial will do or there will be one billbook for both export of services and services offered in India like website designing.

I have taken a GST for my hotel but there is some confusion in billing there are few questions on my mind that i need to ask:-

1. We are charging 12 % GST for tariffs more than 1000 and issuing tax invoice.

Below 1000 which type of invoice to be issued?

Someone suggested me to have two type of bill book one is Tax Invoice and other is Bill of Supply and both books serial number will starts from 1.

is it right or not?

2. I have a Non AC with no liqour restaurant and i am not charging any tax on restaurant sale as well as on room service. So kindly suggest me what tax i need to charge. There is one more thing that no hotels and restaurants charging GST and if i will add GST on my rate then my rates will be higher from the market.

I have Pvt.Ltd. Company and have obtained GST Number as my CA advised it. We supply services within the state only. Our Turnover is less than 20 Lacs. I would like to know-

1. Do I have to necessarily charge GST on all services providing to clients because I have registered under GST or I can simply opt out?

2. Can I give Bill of Supply (without mentioning GST) or I have to give Tax Invoice (with GST charges)

At some places, I might lose my customers If I will charge 18% GST

Please Help!

Goods manufactured and supply of goods to retail shop. Actual quantity will be known only at the time of delivery to retailer shop on B2C category. How to remove goods from manufacturer location? What kind of document is required to carry the bulk quantity from manufacturer location? ofcource billing will be raised at retailer shop after delivery of goods.

dear sir

I have registered on 22-8-2017 in composition scheme, in a restaurant service, my tax paid liability from 1-7-2017 or date of certificate please explane, second I have paid monthly rent above 50000/- GST Paid in RCM and get credit against tax payable on supply..

Hi all,

I have Pvt.Ltd.Company and have obtained GST Number as my CA advised it. We supply services in state and out of state. Our Turnover is less than 75 Lacs .. Would like to know-

1. Whether I required GST as some people said, if your Turnover is less than 20 Lacs annually then you dont require it.

2. Though Now I have opted GST, but my Turnover is less than 20 Lacs per annum, would I come under composition scheme or not.

Our Services are in and out of state too..Pl suggest.

sir i want to know that im registered in composition scheme and supply of taxable and non taxable goods than separate bill of supply issues for the both or single bill of supply can be used for both type of goods

how can i determined my tax liability @1% only paid on taxable good supply or total supply

can you said to me how can i sale MS 200 ltrs drum to unregistered person of gst past i issued the Retail Invoice ANd charge Vat 5% and TCS 1 %

also any format available of Invoice for sale scarp drum

Dear Sir

can you said to me how can i our scarp 200 M.S drum sale to unregistered person(Like Purchase Bhangar) and what is the invoice format

Is there any particular invoice format for a person whose goods are exempted, so the dealer has not applied for GST number?

billing & shipping details are mostly same in all cases so i have to fill both & what is ref no mentioned in billing details

also bill of supply format you have provided does not mention whether tax is payable on reverse charge basis

billing & shipping details are mostly same in all cases so i have to fill both & what is ref no mentioned in billing details

also bill of supply does not mention whether tax is payable on reverse charge basis

For GTA services which type of invoice should be prepared since tax not applicable (RCM), you said bill of supply for exporters, suggest and provide format if any under RCM type

Hi,

Please give the format of tax invoice & Payment voucher if a registered dealer purchased from un-registered dealer.

Since, if we purchased from un registered person, the recipient him self need to issue tax invoice and payment voucher, right ?

Please share format of purchase invoice, purchase from unregistered dealer

What is the use of “Amount of Tax subject to Reverse Charges” in a Tax Invoice for saling the goods

Hi,

I work as a freelancer and have been paying service tax for a while. Which format is applicable to me now?

Is it “BILL OF SUPPLY under GST Regime”? If yes, where do i get GSTIN from?

Thanks in advance

Sir i am a registered dealer ,i pay freight for purchase goods..from unregistered transporter..if i deposit gst on freight..can i take input credit of same.

Bill series for Tax Invoice & Bill Of supply should be same or separate series should be maintained? .

Dear Sir,

i am under composition scheme so need actual billing format to final customer.

Sir,

let me know whether invoice nos are numerical is enough or alpha numerical is mandatory in GST

sir will the provisional registration number will be final GSTIN for composion dealer also

i am gst regd dealer, want to sell to a unregistered dealer.then which invoice i have to issue them

we are un registered service provider as a Inter state goods transport agency…..Require a Invoice format for billing of freight charges on reverse Mechanisam..pl any advice.

Thanks.

The Editor/GST Consultant,

Sir,

There is no clear instructions as to whether Service Tax is applicable for Job Worker who raises Bill on the Principal for Job Work (Manufacture) done. Earlier under VAT Rules, Service Tax is exempted. Under present GST Rules only movement of Goods without Tax is discussed and is silent on levy of service charges on Job Work. Please clarify.