Goods and Services Tax Network (GSTN) has launched Form GST DRC-03A to address issues arising when taxpayers pay outstanding demands using Form GST DRC-03, rather than the “Payment towards Demand” feature on the GST portal. When DRC-03 is used incorrectly, the electronic liability register does not register the demand as closed, even though the payment has been made. To resolve this, Form DRC-03A was introduced under Notification No. 12/2024, issued on July 10, 2024. This form allows taxpayers to link payments made under Form DRC-03—where the reason for payment is marked as “Voluntary” or “Others”—directly with specific demand orders. To use Form DRC-03A, taxpayers must enter the Application Reference Number (ARN) of the DRC-03 along with the relevant demand order number on the portal. Once entered, the system auto-populates details from both the DRC-03 and the corresponding demand order, allowing for seamless adjustment of payments against pending demands. After the adjustment, entries in the taxpayer’s liability ledger will automatically update to reflect the demand status accurately. A detailed advisory and FAQs have been provided on the GST portal to guide taxpayers through the process. In case of technical issues, taxpayers can raise a ticket under the “DRC-03A-Filing” category on the Grievance Redressal Portal. The new DRC-03 Register feature further supports taxpayers by helping them track remaining DRC-03 balances after adjustments.

Goods and Services Tax

Government of India, States and Union Territories

Advisory for Form GST DRC-03A

Nov 5th, 2024

1. It has been observed that some taxpayers have paid the demanded amount vide DRC 07/DRC 08/MOV 09/MOV 11/APL 04 through DRC-03 instead of using payment facility ‘Payment towards demand’ available on GST portal. This led to a situation where demand has been paid by the taxpayer, however the demand is not closed in the electronic liability register. To address this issue, the government has notified a new form named GST DRC-03A which was notified vide Notification No. 12/2024 dated. 10th July 2024.

2. Accordingly, GSTN has developed the new Form GST DRC-03A on GST portal which is available now to adjust the paid amount through DRC-03 against the corresponding demand order. Therefore, it is advised to the taxpayers to use the DRC-03A form to link the payment made vide DRC-03 with the demand order. Only DRC-03 forms where the cause of payment is either ‘Voluntary’ or ‘Others’ can be used in the Form GST DRC-03A.

3. Taxpayers will be required to enter the ARN of the DRC-03 along with the relevant demand order number on the portal. Upon entering the ARN and selecting the demand order number of any outstanding demand, the system will auto-populate relevant information of the DRC-03 form as well as from the specified demand order against which the payment is to be adjusted.

4. Once the adjustment is made, corresponding entries will automatically be posted in the taxpayer’s liability ledger to reflect the updated status of demands.

5. For detailed process, please click on Detailed Advisory.

6. Taxpayer may refer to the FAQs on the same topic.

7. In case taxpayers face any technical issue, a ticket shall be raised under category ‘DRC-03A-Filing’ on Grievance Redressal Portal: https://selfservice.gstsystem.in

Thanking You,

Team GSTN

***

DRC-03A (Frequently Asked Questions)

Q- What is Form GST DRC-03A?

A- Form GST DRC 03A has been introduced in the GST portal to adjust payments made through Form GST DRC 03 against any outstanding demand in electronic liability register.

Q- Who can file DRC-03A?

A- Taxpayers against whom demand is raised in Form GST DRC 07/DRC 08/MOV 9/MOV 11/APL 04 and for which the payment has been done through Form GST DRC-03 under ‘Voluntary’ or ‘Others’ categories can file Form GST DRC-03A.

Q- Which demand orders can be adjusted through Form GST DRC-03A filing?

A- Any outstanding demand order (DRC-07/DRC 08/MOV 09/MOV 11/APL 04) which has not yet been completely paid can be adjusted through Form DRC-03 A filing.

Q- What details do taxpayers need to enter while filing Form GST DRC- 03A?

A- Taxpayers need to enter the ARN of Form GST DRC-03 and the demand order number is to be selected using a drop-down. The details of the demand order and the payment done through FORM GST DRC-03 will be displayed.

Q- Can a taxpayer adjust the amount paid in Form GST DRC 03 partially against a demand using Form GST DRC 03A?

A- Yes, a taxpayer can adjust amount paid in Form GST DRC-03 partially against a single demand order or multiple demand orders. The taxpayer has to fill the tables available in Form GST DRC 03A accordingly.

Q- Can a taxpayer use multiple Form GST DRC-03s to adjust a single demand and vice-versa?

A- Yes, a taxpayer can adjust multiple Form GST DRC-03s against a single demand order & a single Form GST DRC-03 can also be used for adjustment against multiple demand orders.

Note – The taxpayer has to file separate DRC-03A for each DRC-03 if multiple DRC-03 are to be adjusted against a single demand order.

Q- What is DRC 03 Register and its purpose?

A- DRC 03 Register is available in GST portal to to help the taxpayer in ascertaining the accurate remaining balance of DRC-03 after adjustments made against a demand through DRC-03A.The path to access the DRC-03 register in GST system is User Service à DRC-03 Register

Note: DRC 03 register is presently available for DRC 03s which are used in DRC 03A form

PROCESS OF FILING DRC-03A

a. Login to the portal – Click on Services – User Services – My Applications – FORM GST DRC-03A

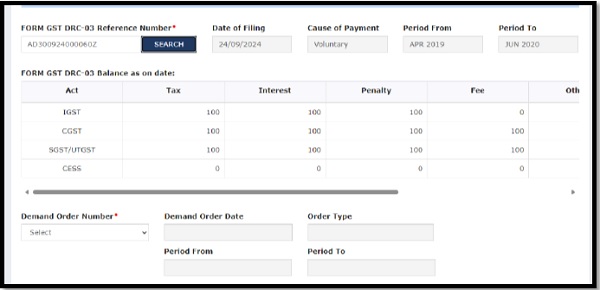

b. Enter FORM GST DRC-03 number and click on the Search button. The following details related to DRC-03 will be visible:

– Date of Filing

– Cause of Payment

– Period From & To

– FORM GST DRC-03 balance as on date

c. Select “ Demand Order No.” from the drop-down box. It will display all the outstanding demands against which payment has not been done. Select the relevant Demand Order no. from the drop-down box. On selection, following details will be displayed:

– Demand Order Date

– Order Type

– Period From & To

– Demand Outstanding as on date

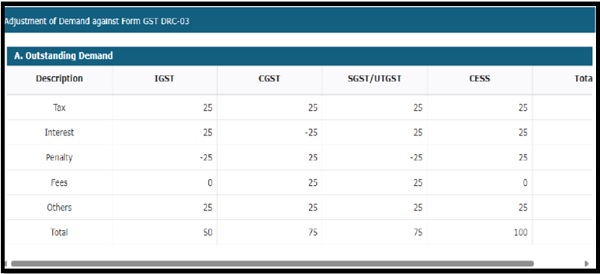

d. Taxpayer to click on the tab “Adjustment of Demand”. A new page will be opened and following tables will be displayed on the page. The taxpayer has to enter or edit the details shown in the tables below.

Table A : Outstanding Demand

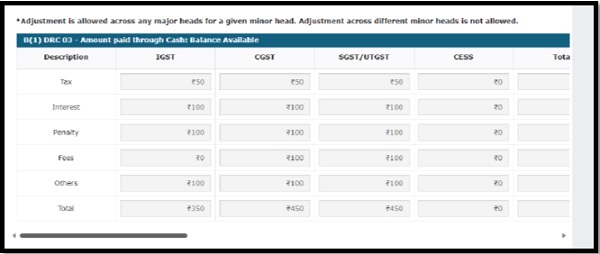

Table B1 (DRC 03 – Amount paid through Cash: Balance Available)

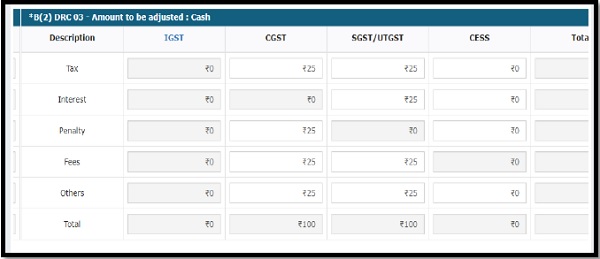

Table B2 (DRC 03 – Amount to be adjusted : Cash)

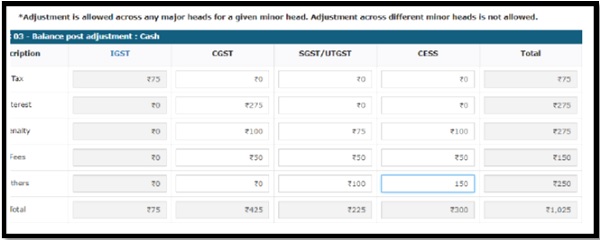

Table B3 (DRC-03: Balance post adjustment- Cash)

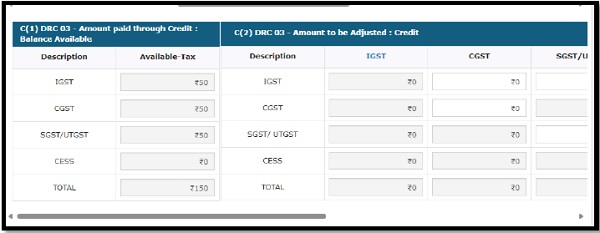

Table C(1) (DRC 03 – Amount paid through Credit : Balance Available) & Table C(2) DRC 03 – Amount to be Adjusted : Credit

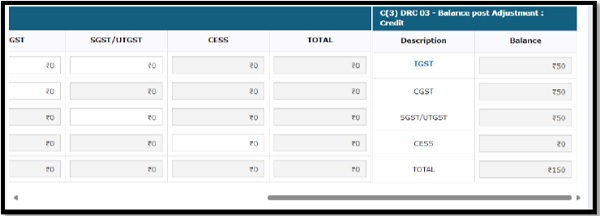

Table C(3) DRC-03 Balance post Adjustment: Credit

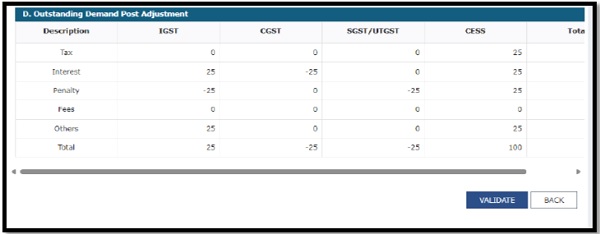

Table D. Outstanding Demand post Adjustment

e. The details mentioned in Table A, B, C & D are to be verified by the taxpayer. After verification, click on the Validate button.

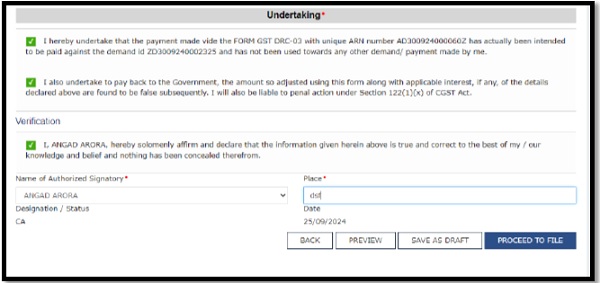

f. Taxpayer can also upload any supporting document (if required). Subsequent to that, the taxpayer has to sign the Undertaking & Verification as shown below.

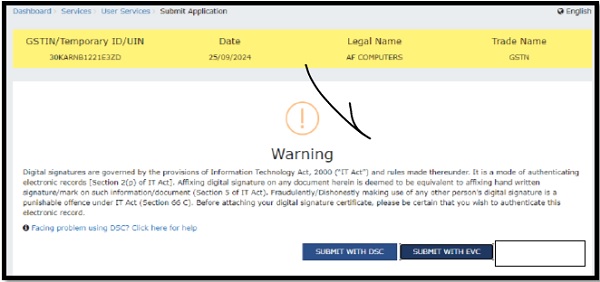

g. The taxpayer can then Preview or Save Draft or Proceed to file. After clicking on Proceed to File button, the following page will be displayed and taxpayer can submit the form using DSC/EVC.

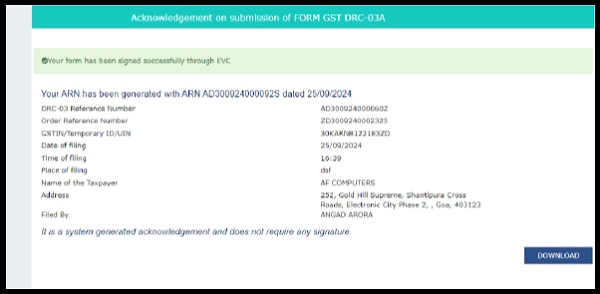

h. On successful submission, Acknowledgment will be issued.

i. As per the details submitted in the DRC-03A form, corresponding entries will be posted into ledger. Also, a single DRC-03 can be used to adjust payments against multiple demand orders, and vice-versa.

j. In case of any technical issue, the taxpayer can raised a ticket on Grievance Redressal Portal : https://selfservice.gstsystem.in