Securities and Exchange Board of India (SEBI) issued a new circular on September 4, 2023, with significant implications for issuers and investors alike. The circular introduces a new format for the abridged prospectus accompanying public issues of non-convertible debt securities and non-convertible redeemable preference shares. Aimed at simplifying and clarifying disclosures, this revision has various components that stakeholders should be aware of.

Securities and Exchange Board of India

Circular No. SEBI/HO/DDHS/PoD1/CIR/P/2023/150 Dated: September 04, 2023

To

Issuers who have listed and/ or propose to list debt Securities and Non-convertible

Redeemable Preference Shares

All Recognized Stock Exchanges

All Recognized Depositories

Merchant Bankers and Brokers registered with SEBI

Registrars to an Issue

All Registered Debenture Trustees

Madam/ Sir,

Sub: New format of Abridged Prospectus for public issues of Non-Convertible Debt Securities and/or Non-convertible Redeemable Preference Shares’

1. Section 2(1) of the Companies Act, 2013 defines an abridged prospectus as a memorandum containing such salient features of a prospectus as may be specified by the Securities and Exchange Board of India by making regulations in this behalf.

2. Further, Section 33(1) of the Companies Act, 2013 states that no form of application for the purchase of any of the securities of a company shall be issued unless such form is accompanied by an Abridged Prospectus.

3. As per Regulation 2(1)(a) of SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (“NCS Regulations”) “abridged prospectus” means a memorandum accompanying the application form for a public issue containing such salient features of a prospectus as specified by the Board.

4. Further, in terms of Regulation 32(3) of the NCS Regulations, abridged prospectus shall be in the format as specified in Part B of Schedule I of the NCS Regulations.

5. In order to further simplify, provide greater clarity and consistency in the disclosures across various documents and to provide additional but critical information in the abridged Prospectus, the format for disclosures in the abridged Prospectus has been revised and is placed at Annex-I of this Circular.

6. Further, instructions to investors for completing the application form is specified in Annex-II. Issuer/ Merchant Bankers/ syndicate members like brokers who are involved in the public issue shall disclose the same on their websites during the period a public issue is kept open.

7. This Circular shall be applicable for all public issues opening on or after October 1, 2023. Accordingly, for public issues that open on or after October 1, 2023, the format of an Abridged Prospectus shall be as per Annex-I of this Circular instead of Part B of Schedule I of the NCS Regulations.

8. A copy of the Abridged Prospectus shall be made available on the website of issuer, merchant bankers, registrar to an issuer and a link for downloading Abridged Prospectus shall be provided in issue advertisement for the public issue.

9. Further, the issuer/ Merchant Bankers shall insert a Quick Response (QR) code on the last on the last page of the Abridged Prospectus. The scan of such QR code on the Abridged prospectus would lead to the Prospectus. Further, the issuer entity/ Merchant Bankers shall insert a QR code on the front page of the documents such as front outside cover page, advertisement, etc. as deemed fit by them. The scan of the QR code would lead to the prospectus or abridged prospectus as applicable.

10. The Issuer /Merchant Bankers shall ensure that the disclosures in the Abridged Prospectus are adequate, accurate and do not contain any misleading or misstatement.

11. Furthermore, the Issuer/ Merchant Bankers shall ensure that the qualitative statements in the Abridged Prospectus shall be substantiated with quantitative factors. Also, no qualitative statement shall be made which cannot be substantiated with quantitative factors.

12. The Stock Exchanges are directed to bring the provisions of this circular to the notice of listed entities and also to disseminate the same on their website.

13. This circular is issued in exercise of powers conferred by Section 11(1) of the Securities and Exchange Board of India Act, 1992 and Regulation 55 read with Regulation 32(3) of the NCS Regulations to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

14. The contents of this circular will appropriately be added to Chapter II (Application form and Abridged Prospectus) of the Master Circular dated August 10, 2021, for issue and listing of Non-convertible Securities, Securitised Debt Instruments, Security Receipts, Municipal Debt Securities and Commercial Paper, as updated.

15. A copy of this circular is available on SEBI website at sebi.gov.in under the categories “Legal Framework-Circulars”.

Yours faithfully,

Pradeep Ramakrishnan

General Manager

Department of Debt and Hybrid Securities

+91 – 022 2644 9246

pradeepr@sebi.gov.in

Annex-I

ABRIDGED PROSPECTUS

THIS ABRIDGED PROSPECTUS CONSISTS OF XX PAGES.

PLEASE ENSURE THAT YOU HAVE RECEIVED ALL THE PAGES

You are encouraged to read greater details available in the Prospectus (link to download Prospectus)

Please ensure that you read the Prospectus and the general instructions contained in this Memorandum before applying in the Issue. Unless otherwise specified, all capitalized terms used in this form shall have the meaning ascribed to such terms in the Prospectus. The investors are advised to retain a copy of Abridged Prospectus for their future reference.

You may obtain a physical copy of the Application form from our Registered Office, the Lead Managers(LM), Syndicate members, Registrar to the Issue, the Designated Branches of Self Certified Syndicate Banks. You may also download the Prospectus from the websites of SEBI, Lead Managers and Stock Exchanges that is www.sebi.gov.in; www.nseindia.com; www.bseindia.com; websites of LMs (to be specified).

NAME OF THE ISSUER and ISSUER’s LOGO

Date of Incorporation: xxxx , CIN.- xxxx

| Registered Office |

Corporate Office | Company Secretary and Compliance Officer |

Email and Telephone |

Website |

BRIEF DESCRIPTION OF THE ISSUE

| • | Security Name: | • | Type of Instrument: |

| • | Nature of Instrument: (Secured/ Unsecured) | • | Base Issue Size |

| • | Option to retain oversubscription (Amount) | • | Face Value |

| • | Details of Coupon/ Dividend (fixed or floating or other structure/rate/ frequency) | • | Redemption date; Tenor |

| • | Rating of the instrument | • | Name of Merchant Banker |

| • | Name of the Debenture Trustee | • | Name of the Credit Rating Agency |

| • | Issue opening date | • | Issue closing date |

| • | Name of the stock Exchange(s) where it will be listed | • | Any other information |

GENERAL RISKS

Investors are advised to read the section titled “Risk Factors” at page XXX of the Prospectus and on page XX of this Abridged Prospectus carefully before taking an investment decision in relation to this Issue. For taking an investment decision, investors must rely on their own examination of the Issuer and the Issue, including the risks involved. The Prospectus has not been and will not be approved by any regulatory authority in India, including the Securities and Exchange Board of India (“SEBI”), any Registrar of Companies or any Stock Exchange in India nor does SEBI guarantee the accuracy or adequacy of the contents of the Prospectus.

ISSUER’S ABSOLUTE RESPONSIBILITY

The Issuer, having made all reasonable inquiries, accepts responsibility for and confirms that the Prospectus does contain and will contain all information with regard to the Issuer and the Issue, which is material in the context of the Issue; that the information contained in the Prospectus will be true and correct in all material respects and is not misleading in any material respect; that the opinions and intentions expressed herein are honestly held and that there are no other material facts, the omission of which makes the Prospectus as a whole or any such information or the expression of any such opinions or intentions misleading in any material respect at the time of the relevant Issue.

| CREDIT RATING | ||

| Name of Credit Rating Agency(ies) |

Rating(s) obtained | Date(s) of the press release of the Credit Rating Agency |

LISTING

Please mention the Stock Exchange(s) on which the instrument is proposed to be listed and detail thereof

| PROMOTERS OF THE ISSUER | |||

| Sr. No. | Name | Individual/ Corporate | Experience and Educational Qualification |

| Experience:

Educational Qualification |

|||

Details of the promoters should not exceed 500 words while explaining their experience and educational qualifications.

| BOARD OF DIRECTORS | ||||

| Sr. No. | Name | Designation (Independent/ Whole-time/ Executive/ Nominee) |

Experience and Educational Qualification |

Other

Directorships |

| 1 | Indian Companies: Foreign Companies: | |||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

For further details, please refer to page no. [●] of the Prospectus.

BUSINESS OVERVIEW

| Company Overview : |

| Product/ Service Offering: |

| Geographies Served: |

| Intellectual Property, if any: |

| Client Profile or Industries served: |

| Manufacturing plant, if any |

| Employee Strength : |

Note: (1) The quantitative statements shall be substantiated with quantitative factors

(2) No qualitative statements shall be made which cannot be substantiated with quantitative factors

(3) Information provided in the table should not exceed 1000 words

RISK FACTORS

(Minimum 6 and Maximum 10 risk factors to be specified)

The below mentioned risks are prominent [*] risk factors each (headings only) as per the Prospectus, including

3 each pertaining to the Issuer and the NCDs.

Please read the risk factors carefully, see section titled “Risk Factors” on page no. [●] of the Prospectus.

SUMMARY OF OUTSTANDING LITIGATIONS, CLAIMS AND REGULATORY ACTIONCTIONS

1. Total number of outstanding litigations against the Company and amount involved:

Name of the |

Criminal Proceedings |

TaxProceedings |

Statutory or Regulatory Proceedings |

Disciplinary actions by

|

Material CivilLitigations |

Aggregate amount involved (Rs. in

|

Company |

||||||

By the Company |

||||||

Against the Company |

||||||

Directors |

||||||

By the Directors |

||||||

Against the Directors |

||||||

Promoters |

||||||

By the Promoters |

||||||

Against the Promoters |

||||||

Subsidiaries |

||||||

By the Subsidiaries |

||||||

Against the Subsidiaries |

B. Brief details of top 5 material outstanding litigations against the company and amount involved

| Sr. No. | Particulars | Litigation filed by | Current status | Amount involved |

C. Any litigation or legal action pending or taken by a Government Department or a statutory body or regulatory body during the three years immediately preceding the year of the issue of the issue document against the promoter of the company, if any (200-300 word limit in total).

D. Brief details of outstanding criminal proceedings against promoters (200-300 word limit in total To be provided as mentioned in the Prospectus (es) (only headings)

DECLARATION BY THE ISSUER

We, hereby, declare that all applicable provisions in connection with the issue, including under the Companies Act 1956, Companies Act 2013, and the directions/ regulations issued by Government of India or SEBI or any other competent authorities in this respect from time to time, as the case may be, have been complied with and no statement made in the Prospectus is contrary to the such requirements. We, further certify that the Prospectus does not omit disclosure of any material information that may make the statements made herein, in the light of the circumstances in which they were made, misleading and that all statements in the Prospectus are true and correct in all material respects.

Date:

Place:

FINANCIAL HIGHLIGHTS

Key operational and financial parameters on consolidated and standalone basis as per clause 3.3.10 of Schedule

I (Disclosure for Issue of Securities) of SEBI (Issue and listing of Non-Convertible Securities) Regulations, 2021,

as amended:

For detailed financial statements of our Company, please refer to page no. [●] of the Prospectus.

OBJECTS OF THE ISSUE

The Net Proceeds raised through the Issue will be utilized for following activities in the ratio provided as below:

1. For the purpose of [●] – [●] % of the amount raised and allotted in the Issue

2. For General Corporate Purposes- [●] % of the amount raised and allotted in the Issue

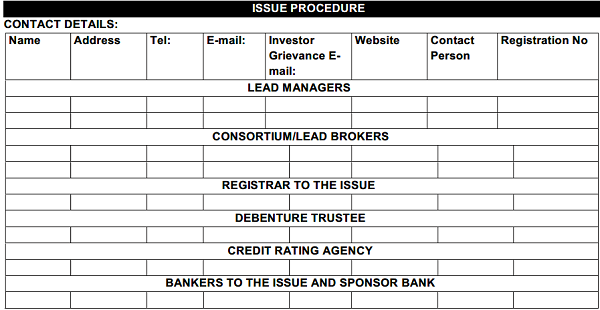

ISSUE PROCEDURE

ESCROW COLLECTION BANKS

Only names to be included

SELF CERTIFIED SYNDICATE BANKS:

Annex-II

Instructions For Completing the Application Form

1. Applications cannot be made by:

The following categories of persons, and entities, shall not be eligible to participate in the Issue and any Applications from such persons and entities are liable to be rejected:

a) Minors without a guardian name (A guardian may apply on behalf of a minor. However, Applications by minors must be made through Application Forms that contain the names of both the minor Applicant and the guardian; It is further clarified that it is the responsibility of the Applicant to ensure that the guardians are competent to contract under applicable statutory/regulatory requirements);

b) Persons Resident Outside India, Foreign nationals (including FIIs, FPIs, Qualified Foreign Investors) and other foreign entities;

c) Foreign Venture Capital Investor;

d) Overseas Corporate Bodies; and

e) Person ineligible to contract under applicable statutory/ regulatory requirements.

f) Any other category of Applicants not provided for under “Issue Procedure- Who are eligible to apply?” on page [●] of the Prospectus

2. General Instructions for completing the Application Form:

a) Application Forms are to be completed in full, in BLOCK LETTERS in ENGLISH and in accordance with the instructions contained in the Prospectus and the Application Form. Incomplete Application Forms are liable to be rejected. Applicants should note that the Members of the Syndicate, or the Trading Members, as appropriate, will not be liable for errors in data entry due to incomplete or illegible Application Forms.

b) Applications are required to be for a minimum of such Bonds as specified in the Prospectus.

c) Thumb impressions and signatures other than in the languages specified in the Eighth Schedule in the Constitution of India must be attested by a Magistrate or a Notary Public or a Special Executive Magistrate under official seal.

d) Applications should be in single or joint names and not exceeding three names, and in the same order as their Depository Participant details (in case of Applicants applying for Allotment of the Bonds in dematerialized form) and Applications should be made by Karta in case the Applicant is an HUF. Please ensure that such Applications contain the PAN of the HUF and not of the Karta. If the Application is submitted in joint names, the Application Form may contain only the name of the first Applicant whose name should also appear as first holder of the depository account held in joint names.

e) Applicants applying for Allotment in dematerialized form must provide details of valid and active DP ID, Client ID and PAN clearly and without error. Invalid accounts, suspended accounts or where such account is classified as invalid or suspended may not be considered for Allotment of the Bonds.

f) If the ASBA Account holder is different from the ASBA Applicant, the Application Form should be signed by the ASBA Account holder also, in accordance with the instructions provided in the Application Form.

g) Applications for all the Series of the Bonds may be made in a single Application Form only.

h) It shall be mandatory for subscribers to the Issue to furnish their Permanent Account Number and any Application Form, without the PAN is liable to be rejected, irrespective of the amount of transaction.

i) All Applicants should check if they are eligible to apply as per the terms of the Shelf & Tranche with Prospectus and applicable laws.

j) For Applicants, the Applications in physical mode should be submitted to the SCSBs or a member of the Syndicate or to the Trading Members of the Stock Exchanges on the prescribed Application Form. SCSBs may provide the electronic mode for making Application either through an internet enabled banking facility or such other secured, electronically enabled mechanism for Application and blocking funds in the ASBA Account;

k) Application Forms should bear the stamp of the Member of the Syndicate, Trading Member of the Stock Exchanges, Designated Intermediaries and/or Designated Branch of the SCSB. Application Forms which do not bear the stamp will be rejected.

l) Applicant should correctly mention the ASBA Account number and UPI ID in case applying through UPI Mechanism and ensure that funds equal to the Application Amount are available in the ASBA Account before submitting the Application Form and ensure that the signature in the Application Form matches with the signature in the Applicant’s bank records.

m) The Applicants should ensure that they have been given a TRS and an acknowledgement as proof of having accepted the Application Form;

n) Applicants may revise/ modify their Application details during the Issue Period, as allowed/permitted by the Stock Exchanges, by submitting a written request to the Designated Intermediary, as the case may be. However, for the purpose of Allotment, the date of original upload of the Application will be considered in case of such revision/modification. In case of any revision of Application in connection with any of the fields which are not allowed to be modified on the electronic Application platform of the Stock Exchanges as per the procedures and requirements prescribed by each relevant Stock Exchanges, Applicants should ensure that they first withdraw their original Application and submit a fresh Application. In such a case the date of the new Application will be considered for date priority for Allotment purposes.

o) In case of an HUF applying through its Karta, the Applicant is required to specify the name of an Applicant in the Application Form as ‘XYZ Hindu Undivided Family applying through PQR’, where PQR is the name of the Karta;

p) All Applicants need to tick the Series of Bonds in the Application Form that they wish to apply for.

q) ASBA Applicants need to give the correct details of their ASBA Account including bank account number/ bank name and branch/ UPI ID in case of applying through UPI Mechanism.

r) ASBA Applicants should ensure that their Application Form is submitted either at a Designated Branch of a SCSB where the ASBA Account is maintained or with the Members of the Syndicate or Trading Members of the stock exchange(s) at the Specified Cities, and not directly to the Escrow Collecting Banks (assuming that such bank is not a SCSB) or to the Company or the Registrar to the Issue;

In case of ASBA Applications through Syndicate ASBA, before submitting the physical Application Form to the Members of the Syndicate or Trading Members of the stock exchange(s), ensure that the SCSB where the ASBA Account, as specified in the ASBA Form, is maintained has named at-least one branch in that Specified City for the Members of the Syndicate or Trading Members of the stock exchange(s), as the case may be, to deposit ASBA Forms. A list of such branches is available at…….. (website link to be provided)

s) ASBA Applicants should ensure that the Application Form is signed by the ASBA Account holder in case the ASBA Applicant is not the account holder.

t) ASBA Applicants should ensure that they receive an acknowledgement from the Designated Branch or the concerned Members of the Syndicate or Trading Members of the stock exchange(s), as the case may be, for the submission of the Application Form.

3. Rejection of Applications:

a) Applications submitted without blocking of the entire Application Amount. However, the Company may allot bonds up to the value of Application monies paid, if such Application monies exceed the minimum Application size as prescribed hereunder.

b) In case of partnership firms, the Application Forms submitted in the name of individual partners and/or accompanied by the individual’s PAN rather than the PAN of the partnership firm;

c) Applications by persons not competent to contract under the Indian Contract Act, 1872;

d) GIR number furnished instead of PAN;

e) Applications by OCBs;

f) Applications for an amount below the minimum Application size;

g) Applications providing details of an inoperative demat account;

h) Applications of more than five ASBA forms per ASBA Account;

i) UPI Mandate request is not approved by the investor within the prescribed timelines;

j) In case of Applications under power of attorney or by limited companies, corporate, trust etc., relevant documents are not submitted;

k) Applications accompanied by Stock invest/ money order/postal order/cash;

l) Signature of sole Applicant missing, or, in case of joint Applicants, the Application Forms not being signed by the first Applicant (as per the order appearing in the records of the Depository);

m) In case no corresponding record is available with the Depositories that matches three parameters namely, DP ID, Client ID and PAN or if PAN is not available in the Depository database;

n) With respect to ASBA Applications including UPI applications, inadequate funds in the ASBA Account to enable the SCSB to block the Application Amount specified in the ASBA Application Form at the time of blocking such Application Amount in the ASBA Account or no confirmation is received from the SCSB for blocking of funds;

o) Applications by persons prohibited from buying, selling or dealing in shares, directly or indirectly, by SEBI or any other regulatory authority;

p) Applications not uploaded on the terminals of the stock exchange(s);

q) Applications uploaded after the expiry of the allocated time on the Issue Closing Date, unless extended by the stock exchange(s), as applicable;

r) Application Forms not delivered by the Applicant within the time prescribed as per the Application Form and the Prospectus and as per the instructions in the Application Form;

s) Applications by Applicants whose demat accounts have been ‘suspended for credit’ pursuant to the circular issued by SEBI on July 29, 2010 bearing number CIR/ MRD/DP/22/2010;

t) Applications tendered to the Trading Members of the stock exchange(s) at centers other than the centers mentioned in the Application Form;

u) SCSB making an ASBA Application(a) through an ASBA Account maintained with its own self or (b) through an ASBA account maintained through a different SCSB not in its own name, or (c) through an ASBA Account maintained through a different SCSB in its own name, which ASBA Account is not utilized for the purpose of applying in public issue

v) Application Amount paid being higher than the value of Bonds applied for. However, the Company may allot Bonds up to the number of Bonds applied for, if the value of such Bonds applied for, exceeds the Minimum Application Size;

w) Application Amounts paid not tallying with the number of Bonds applied for;

x) Applications for amounts greater than the maximum permissible amounts prescribed by applicable regulations

y) Applications by persons/entities who have been debarred from accessing the capital markets by SEBI;

z) In case of ASBA Applicants, payment of Application Amount in any mode other than through blocking of Application Amount in the ASBA Accounts shall not be accepted under the ASBA process

BASIS OF ALLOTMENT:

1) Reservations shall be made for each of the Categories in the below mentioned format:

| Particulars | Category I | Category II | Category III | Category IV |

| % of the issue size | [●]% | [●]% | [●]% | [●]% |

| Size in Amount | [●] lakh | [●] lakh | [●] lakh | [●] lakh |

a) Determined on the basis of date of upload of the Applications on the electronic Application platform of the relevant stock exchanges.

b) Under subscription: If there is any under subscription in any Category the spill over to other categories shall be in the following order: Category IV; ii. Category III; iii. Category II; and iv. Category I.

c) For all Categories, all Applications uploaded on the same day on the online Application platform of the relevant stock exchanges would be treated at par with each other.

d) Allotments in case of oversubscription: In case of an oversubscription in any of the Categories, Allotments to the maximum extent, as possible, will be made on a first-come first-serve basis and thereafter on proportionate basis, i.e. full Allotment of Bonds to the Applicants on a first come first basis up to the date falling 1 (one) day prior to the date of oversubscription and proportionate allotment of Bonds to the Applicants on the date of oversubscription (based on the date of upload of each Application on the online Application platform of the relevant stock exchanges, in each Portion). The method of proportionate allotment is as described below:

i Allotments to the applicants shall be made in proportion to their respective Application size, rounded off to the nearest integer,

ii If the process of rounding off to the nearest integer results in the actual allocation of Bonds being higher than the Issue size, not all applicants will be allotted the number of Bonds arrived at after such rounding off. Rather, each Applicant whose Allotment size, prior to rounding off, had the highest decimal point would be given preference;

iii In the event, there are more than one Applicant whose entitlement remains equal after the manner of distribution referred to above, the Company will ensure that the basis of allotment is finalized by draw of lots in a fair and equitable manner.

e) Applicants applying for more than one Series of Bonds:

i If an Applicant has applied for more than one Series of Bonds, and in case such Applicant is entitled to allocation of only a part of the aggregate number of Bonds applied for, the Series-wise allocation of Bonds to such Applicants shall be in proportion to the number of Bonds with respect to each Series, applied for by such Applicant, subject to rounding off to the nearest integer, as appropriate, in consultation with the Lead Managers and the Designated Stock Exchange.

ii All decisions pertaining to the basis of allotment of Bonds pursuant to the Issue shall be taken by the Company in consultation with the Lead Managers, and the Designated Stock Exchange and in compliance with the aforementioned provisions of the Prospectus. Any other queries/issues in connection with the Applications will be appropriately dealt with and decided upon by the Company in consultation with the Lead Managers.

iii The Company shall allocate and allot [●] (depending upon the category of applicants) to all valid applications, wherein the Applicants have not indicated their choice of the relevant Bond Series.

iv The Company has the discretion to close the Issue early irrespective of whether any of the Portion(s) are fully subscribed or not. The Company shall allot Bonds with respect to the Applications received till the time of such pre-closure in accordance with the Basis of Allotment as described hereinabove and subject to applicable statutory and/or regulatory requirements.

INVESTOR WITHDRAWALS:

Applicants are allowed to withdraw their Applications at any time [●].

TERMS OF THE ISSUE:

1. Minimum Subscription: If the Company does not receive the minimum subscription of 75 % of the Base Issue, i.e. [●] prior to the Issue Closing Date, the entire subscription amount shall be unblocked within Eight Working Days from the date of closure of the Issue. If there is delay in the unblocking of Application Amounts beyond the time prescribed above, the Company will pay interest for the delayed period at rate of 15% per annum for the delayed period.

2. Right to Recall or Redeem prior to Maturity: Please refer to page no. [●] of the Prospectus.

3. Security: The NCDs will be secured by [●] charge over the [●] assets of the Issuer as set out in the Debenture Trust Deed to the extent of at least 100% of the principal amounts outstanding and interest due thereon in respect of the NCDs until all amounts on the NCDs are repaid in full pursuant to the terms of the Debenture Trust Deed. For details please refer to page no. [●] of the Prospectus.

DEBT TO EQUITY RATIO:

The Debt-Equity ratio of the Company as of [●]:

| Description | Standalone | Consolidated | ||

| Pre Issue | Post Issue | Pre Issue | Post Issue | |

| Debt | ||||

| Total Debt | ||||

| Shareholder’s funds | ||||

| Total Shareholder’s funds | ||||

| Debt Equity Ratio (No of Times) | ||||

BIDDING AND/ OR COLLECTION CENTRE DETAILS

The banks which are registered with SEBI under the Securities and Exchange Board of India (Bankers to an Issue) Regulations, 1994 and offer services in relation to ASBA, including blocking of an ASBA Account, a list of which is available [link to the website] or at such other website as may be prescribed by SEBI from time to time

List of Self Certified Syndicate Bank under the ASBA process is available on the SEBI website [link to the website]