False & misleading Youtube videos – Sharpline stock – Price manipulation – SEBI passes interim order

SEBI passes Interim Order in the matter of Stock Recommendations using YouTube in the scrip of Sharpline Broadcast Limited vide youtube channels namely Midcap calls and Profit Yatra, Which are alleged to peddled false and misleading news to recommend that investors should buy the Sharpline stock for extraordinary profits.

WTM/AN/ISD/ISD-SEC-1/24334/2022-23

SECURITIES AND EXCHANGE BOARD OF INDIA

INTERIM EX PARTE ORDER

Under Sections 11(1), 11(4) and 11B (1) of the Securities and Exchange Board

of India Act, 1992

In respect of:

| Noticee No. | Name of the Noticee | PAN |

| 1. | Manish Mishra | AMPPM6823L |

| 2. | Manjari Tiwari | ADTPT3189M |

| 3. | Jatin Manubhai Shah | AEGPS5807M |

| 4. | S L Gupta | AAEPG4790M |

| 5. | Angad Ishwarlal Rathod | CIUPR1814B |

| 6. | Heli Jatin Shah | BXYPS2148P |

| 7. | Daivik Jatin Shah | BXYPS2715J |

| 8. | Gaurav Gupta | AKHPG5185D |

| 9. | Arpan Gupta | AMCPG5914F |

| 10. | Kailash Agarwal | AAEPA6579Q |

| 11. | Renuka Aggarwal | AAUPW5249D |

| 12. | Gunjan Agarwal | AAEPA6620L |

| 13. | Bhim Singh Chaudhary | CGZPS8373K |

| 14. | Suman Lata | AEOPL7774E |

| 15. | Bimla Chaudhary | APNPC1421R |

| 16. | Nitesh Agarwal | ACNPA7007Q |

| 17. | Rajesh Kumar Singh | ANLPS7727A |

| 18. | Subhash Agarwal | AAEPA6699R |

| 19. | Vivek Rana | DCBPR5043G |

| 20. | Ashok Kumar Agrawal | AFEPA2109P |

| 21. | Anshu Aggarwal | AMFPA0593B |

| 22. | Anshul Aggarwal | AFUPA3575P |

| 23. | Hemant Dusad | AFYPD4892E |

| 24. | Anshul Aggarwal Co HUF | AAQHA3574F |

(Collectively referred to as “Noticees”)

In the matter of Stock Recommendations using YouTube in the scrip of

Sharpline Broadcast Limited

BACKGROUND:

1. Securities and Exchange Board of India (hereinafter referred to as “SEBI”) received certain complaints wherein it was inter alia alleged that there was price manipulation and offloading of shares by certain entities in the scrip of Sharpline Broadcast Limited (hereinafter referred to as “Sharpline”). The said complaints alleged that YouTube videos with false content, backed by paid marketing campaign worth crores of rupees for additional reach, were being uploaded to lure investors. Once these unsuspecting investors entered the scrip, the said entities offloaded their holding at an inflated price.

2. Based on the aforesaid complaints, SEBI conducted a preliminary examination in the matter to look into possible violations of provisions of the Securities and Exchange Board of India Act, 1992 (hereinafter referred to as “SEBI Act”) and various regulations framed thereunder including SEBI (Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market) Regulations, 2003 (hereinafter referred to as “PFUTP Regulations”), by certain entities for the period April 12, 2022 to August 19, 2022 (hereinafter referred to as “Examination period”).

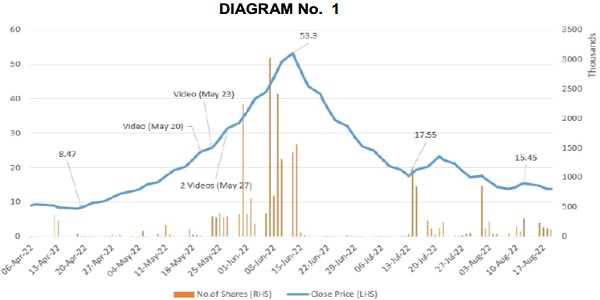

3. The price and volume movement in the scrip during the Examination period is given below:

4. Based on the price volume diagram no. 1 above, the Examination period has been divided into 3 patches. The period covered under each patch is as follows:

TABLE 1

| Patch | Period |

| Patch 1 | April 12, 2022 to May 19, 2022 |

| Patch 2 | May 20, 2022 to June 14, 2022 |

| Patch 3 | June 15, 2022 to August 19, 2022 |

5. SUMMARY OF THE CASE BASED ON PRELIMINARY EXAMINATION:

5.1. The company, Sharpline was incorporated in 1990 and has its registered office at New Delhi. Sharpline is engaged in the business of launching television channels & to carry out the business of T.V. news, films, music, serials etc.

5.2. Sharpline was listed on BSE on September 07, 2021 but the first trade in the scrip took place only on March 15, 2022. Thereafter, there was a spurt in the price and volume of Sharpline between April 2022 to mid-May 2022. A significant portion of the volume during this period was the result of the trades executed by some of the Noticees to this case.

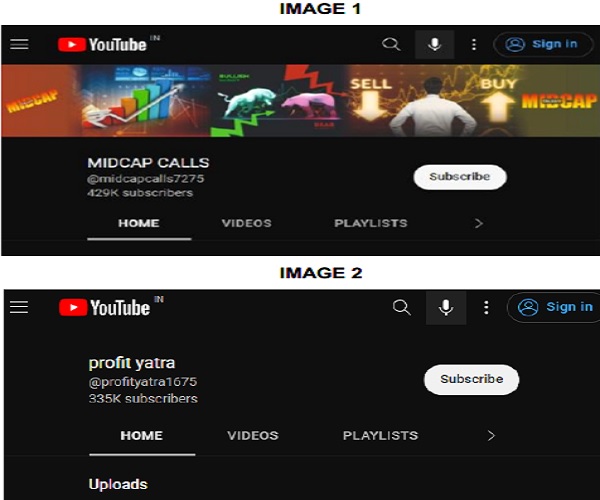

5.3. During second half of May 2022, false and misleading videos (“YouTube Videos”) about the company were uploaded on two YouTube channels namely, “Midcap calls” and “Profit Yatra” (“YouTube Channels”/ “Channels”). These YouTube videos peddled false and misleading news to recommend that investors should buy the Sharpline stock for extraordinary profits. These YouTube Channels had lakhs of subscribers and the misleading videos had crores of viewership aided by promotion through paid advertising campaigns. Subsequently, the misleading YouTube videos ceased to be available for public viewing.

5.4. Subsequent to the release of the misleading YouTube videos, there was an increase in the price and trading volume of the Sharpline scrip. The volumes appear to have been contributed by large number of retail investors likely influenced by the misleading YouTube videos. During this period, certain non-promoter shareholders who held more than 1% of shareholding in Sharpline offloaded their entire holdings at inflated prices and booked profits.

5.5. The Noticees in this case can be broadly classified as follows – Noticee nos. 1 and 2 are the creators of the YouTube Channels – “Midcap calls” and “Profit Yatra” respectively, and are classified as a Misleading Message Disseminators (“MMDs”). Some of the Noticees are Net Sellers and profit makers (“NSs”) i.e., persons who held shares of Sadhna at the start of the Examination period, and who traded in and net sold shares during the said period. Other Noticees are Volume Creators (“VCs”) i.e., persons other than those classified as NSs, who both bought and sold shares of Sadhna during the Examination period, hence contributing to a rise in trading volumes and interest in the scrip. Connection between all the Noticees across the MMDs, NSs and VCs has been established based on several facts on record including familial relationships, KYC details, common address & email IDs, call data records and fund transfers. These are elaborated in the subsequent paragraphs of this Order.

5.6. Prima facie, across the MMDs, NSs and VCs, the Noticees have collectively helped create trading volumes and interest in the scrip, spread false and misleading YouTube videos, and hence induced unsuspecting investors to buy the Sharpline scrip at elevated prices, thereby prima facie violating the provisions of the SEBI Act and PFUTP Regulations. Collectively, the NSs and some of the VCs have booked extraordinary profits as a result of this scheme.

ROLE OF NOTICEES AND OTHER CONNECTED PERSONS:

6. The persons who are relevant to this case and their role, as per the facts available on record, are listed in Table 2 below:

TABLE 2

| S. No. | Entity Name | Role |

| 1. | Manish Mishra | Creator of YouTube Channel – ‘Midcap Calls’ (MMD 1) and Profit maker |

| 2. | Manjari Tiwari | Creator of YouTube Channel – ‘Profit Yatra’ (MMD 2) and Profit maker |

| 3. | Jatin Manubhai Shah | Volume Creator and Profit maker (VC 1) / Dealer for Noticee nos. 5 and 6 |

| 4. | S L Gupta | Volume Creator and Profit maker (VC 2) |

| 5. | Angad Ishwarlal Rathod | Volume Creator (VC 3) |

| 6. | Heli Jatin Shah | Volume Creator and Profit maker (VC 4) |

| 7. | Daivik Jatin Shah | Volume Creator and Profit maker (VC 5) |

| 8. | Gaurav Gupta | Net Seller (NS 1) |

| 9. | Arpan Gupta | Net Seller (NS 2) |

| 10. | Kailash Agarwal | Net Seller (NS 3) |

| 11. | Renuka Aggarwal | Net Seller (NS 4) |

| 12. | Gunjan Agarwal | Net Seller (NS 5) |

| 13. | Bhim Singh Chaudhary | Net Seller (NS 6) |

| 14. | Suman Lata | Net Seller (NS 7) |

| 15. | Bimla Chaudhary | Net Seller (NS 8) |

| 16. | Nitesh Agarwal | Net Seller (NS 9) |

| 17. | Rajesh Kumar Singh | Net Seller (NS 10) |

| 18. | Subhash Agarwal | Net Seller and Volume Creator (NS 11) |

| 19. | Vivek Rana | Net Seller and Volume Creator (NS 12) |

| 20. | Ashok Kumar Agrawal | Net Seller and Volume Creator (NS13) |

| 21. | Anshu Aggarwal | Net Seller and Volume Creator (NS 14) |

| 22. | Anshul Aggarwal | Net Seller and Volume Creator (NS 15) / Dealer for Noticee nos. 12, 13, 15, 17, 18, 19, 20, 22 and 23 |

| 23. | Hemant Dusad | Net Seller and Volume Creator (NS 16) |

| 24. | Anshul Aggarwal Co HUF | Net Seller and Volume Creator (NS 17) |

| 25. | Anshu Mishra | Connected with MMDs and VC 3 |

| 26. | Rakesh Kumar Gupta | Connected with NS 1, 5 & 11 and VC 2 |

7. The period wise role of the Noticees is explained in Table 3 below:

TABLE 3

| Patch | Period | Role of Noticees |

| Patch 1 | April 12, 2022 to May 19, 2022 | Net Sellers and Volume creators viz., NS 11, 12, 13, 14, 15, 16 and 17 along with volume creators i.e., VC 1 and VC 2 contributed to increase in volume of the scrip. |

| Patch 2 | May 20, 2022 to June 14, 2022 | YouTube videos that recommended buying the shares of Sharpline, with false news about the company and high target price, were uploaded by Misleading Message Disseminators i.e., MMD1 and MMD 2 in their respective YouTube Channels. Volumes were created by Volume Creators viz., VC 1, VC 3, VC 4 and VC 5 during the same period. MMDs and NS 1 to 17 who were public shareholders holding nominal share capital in excess of INR 2 lakhs in Sharpline offloaded their holdings at an inflated price. |

| Patch 3 | June 15, 2022 to August 19, 2022 | Period post uploading of videos. |

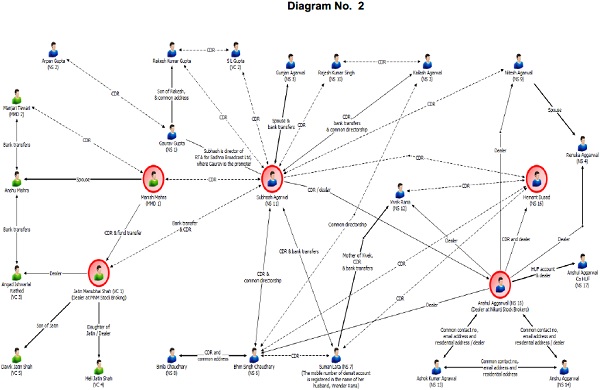

CONNECTION BETWEEN NOTICEES AND OTHER CONNECTED ENTITIES:

8. According to the material available on record i.e. KYC details, bank statements, Ministry of Corporate Affairs (“MCA”) records and Call data records (“CDRs”) received from Telecom Service Providers (“TSPs”), it appears that the Noticees are connected with each other. The pictorial representation of connection between Noticees and other connected entities is provided below:

(Continued on the next page)

9. The basis of connection between Noticees and other connected entities is detailed as under:

TABLE 4

|

S. No. |

Name of Noticee/ connected entity(1) |

Connected with

(2) |

Basis of Connection

(3) |

| 1. | Manish Mishra (MMD 1) | 1. Manjari Tiwari (MMD 2)

2. Anshu Mishra 3. Subhash Agarwal (NS 11) 4. Jatin Manubhai Shah (VC 1) |

1. Connected with creator of Profit Yatra – Manjari Tiwari (MMD 2), Subash Agarwal (NS 11) and Jatin Manubhai Shah (VC 1) through CDR.

2. Husband of Anshu Mishra as per KYC documents. 3. Additionally, connected with Jatin Manubhai Shah (VC 1) through fund transfers. |

| 2. | Manjari Tiwari (MMD 2) | 1. Manish Mishra (MMD 1)

2. Anshu Mishra |

1. Connected with creator of Midcap Calls – Manish Mishra (MMD 1) through CDR.

2. Connected with Anshu Mishra through fund transfers. |

| 0. | Jatin Manubhai Shah (VC 1) | 1. Manish Mishra (MMD 1)

2. Subhash Agarwal (NS 11) 3. Angad Ishwarlal Rathod (VC 3) 4. Heli Jatin Shah (VC 4) 5. Daivik Jatin Shah (VC 5) |

1. Connected with Creator of Midcap Calls – Manish Mishra (MMD 1), through fund transfers and CDR.

2. Connected with Subhash Agarwal (NS 11) through CDR. 3. Dealer for MNM Stock Broking Pvt. Ltd. who executed the trades of Angad Ishwarlal Rathod (VC 3) and Heli Jatin Shah (VC 4) in the scrip of Sharpline. 4. Father of Heli Jatin Shah (VC 4) and Daivik Jatin Shah (VC 5). |

| 4. | S L Gupta (VC 2) | 1. Subhash Agarwal (NS 11)

2. Rakesh Kumar Gupta |

1. Connected with entities in column (2) through CDR. |

| 5. | Angad Ishwarlal Rathod (VC 3) | 1. Jatin Manubhai Shah (VC 1)2. Anshu Mishra |

1. Connected with Jatin Manubhai Shah (VC 1), who was the dealer for MNM Stock Broking Pvt. Ltd., for execution of Angad Ishwarlal Rathod (VC 3)’s trades in the scrip of Sharpline.

2. Connected with Anshu Mishra through fund transfers. |

| 6. | Heli Jatin Shah (VC 4) |

1. Jatin Manubhai Shah (VC 1) |

1. Connected with Jatin Manubhai Shah (VC 1), who was the dealer for MNM Stock Broking Pvt. Ltd. for execution of Heli Jatin Shah (VC 4)’s trades in the scrip of Sharpline.

2. Daughter of Jatin Manubhai Shah (VC 1). |

| 7. | Daivik Jatin Shah (VC 5) | 1. Jatin Manubhai Shah (VC 1) |

1. Son of Jatin Manubhai Shah (VC 1). |

| 8. | Gaurav Gupta (NS 1) | 1. Subhash Agarwal (NS 11)

2. Arpan Gupta (NS 2) 3. Rakesh Kumar Gupta |

1. Gaurav Gupta (NS 1) is the promoter of Sadhna Broadcast Limited and Subhash Agarwal (NS 11) is the director of Skyline Financial Services Private Limited

– RTA of Sadhna Broadcast Limited and Sharpline Broadcast Limited. 2. Mobile number and email id of Gaurav Gupta (NS 1) is linked to the demat account of Sharpline Broadcast Limited. 3. Connected with Arpan Gupta (NS 2) through CDR. 4. Son of Rakesh Kumar Gupta as per KYC records. |

|

9. |

Arpan Gupta (NS 2) | 1. Gaurav Gupta (NS 1) | 1. Connected with Gaurav Gupta (NS 1) through CDR. |

| 10. | Kailash Agarwal (NS 3) | 1. Subhash Agarwal (NS 11)

2. Rajesh Kumar Singh (NS 10) 3. Bhim Singh Chaudhary (NS 6) |

1. Connected with Subhash Agarwal (NS 11) and Rajesh Kumar Singh (NS 10) in column (2) through CDR.

2. Additionally, connected with Subhash Agarwal (NS 11) through fund transfers and common directorship in Skyline Financial Services Private Limited. 3. Connected with Bhim Singh Chaudhary through common directorship in Skyline Financial Services Private Limited. 4. Director of Skyline Financial Services Private Limited – RTA of Sharpline Broadcast Limited and Sadhna Broadcast Limited, as per the Annual Reports of the said companies. |

|

11. |

Renuka Aggarwal (NS 4) | 1. Nitesh Agarwal (NS 9)

2. Anshul Aggarwal (NS 15) |

1. Wife of Nitesh Agarwal (NS 9).

2. Connected with Anshul Aggarwal (NS 15), who was the dealer for Nikunj Stock Brokers Ltd. for execution of Renuka Aggarwal (NS 4)’s trades in the scrip of Sharpline. |

| 12. | Gunjan Agarwal (NS 5) | 1. Subhash Agarwal (NS 11) | 1. Wife of Subhash Agarwal (NS 11). |

| 13. | Bhim Singh Chaudhary (NS 6) | 1. Bimla Chaudhary (NS 8)

2. Suman Lata (NS 7) 3. Subhash Agarwal (NS 11) 4. Hemant Dusad (NS 16) 5. Anshul Aggarwal (NS 15) 6. Kailash Agarwal (NS 3) |

1. Connected with Bimla Chaudhary (NS 8) through CDR and common address.

2. Connected with entities at S. no. 1 to 4 in column (2) through CDR. 2. Connected with Anshul Aggarwal (NS 15), who was the dealer for Nikunj Stock Brokers Ltd., for execution of Bhim Singh Chaudhary (NS 6)’s trades in the scrip of Sharpline. 3. Additionally, connected with |

|

14. |

Suman Lata (NS 7) | 1. Subhash Agarwal (NS 11)

2. Hemant Dusad (NS 16) 3. Bhim Singh Chaudhary (NS 6) 4. Vivek Rana (NS 12) |

1. Connected with entities in column (2) through CDR.

2. Additionally, connected with Subhash Agarwal (NS 11) through fund transfers. 5. Mother of Vivek Rana (NS 12). |

| 15. | Bimla Chaudhary (NS 8) | 1. Connected with Bhim Singh Chaudhary (NS 6) | 1. Connected with Bhim Singh Chaudhary (NS 6) through CDR and common address. |

| 16. | Nitesh Agarwal (NS 9) | 1. Subhash Agarwal (NS 11)

2. Anshul Aggarwal (NS 15) 3. Renuka Aggarwal (NS 4) |

1. Connected with Subhash Agarwal (NS 11) through CDR.

2. Connected with Anshul Aggarwal (NS 15), who was the dealer for Nikunj Stock Brokers Ltd., for execution of Nitesh Agarwal (NS 9)’s trades in the scrip of Sharpline. 3. Husband of Renuka Aggarwal (NS 4). |

| 17. | Rajesh Kumar Singh (NS 10) | 1. Kailash Agarwal (NS 3)

2. Subhash Agarwal (NS 11) |

1. Connected with entities in column (2) through CDR. |

| 18. | Subhash Agarwal (NS 11) | 1. Gunjan Agarwal (NS 5)

2. Manish Mishra (MMD 1) 3. Jatin Manubhai Shah (VC 1) 4. Kailash Agarwal (NS 3) 5. Bhim Singh Chaudhary (NS 6) 6. Nitesh Agarwal (NS 9) 5. Rajesh Kumar Singh (NS 10) 7. Anshul Aggarwal (NS 15) 8. Rakesh Kumar Gupta 6. Suman Lata (NS 7) 9. Hemant Dusad (NS 16) |

1. Husband of Gunjan Agarwal (NS 5).

2. Connected with entities at S. no. 2 to 11 in column (2) through CDR. 3. Director of Skyline Financial Services Private Limited – RTA of Sharpline Broadcast Limited and Sadhna Broadcast Limited, as per the Annual Reports of the said companies. 4. Additionally, connected with Bhim Singh Chaudhary (NS 6) and Kailash Agarwal (NS 3) through common directorship in Skyline Financial Services Pvt. Ltd. 5. Additionally, connected with Suman Lata (NS 7), Kailash Agarwal (NS 3) and Gunjan Agarwal (NS 5) through fund transfers. 6. Additionally, connected with Anshul Aggarwal (NS 15) who was the dealer for Nikunj Stock Brokers Ltd. for execution of Subhash Agarwal (NS 11)’s trades in the scrip of Sharpline. |

| 19. | Vivek Rana (NS 12) | 1. Suman Lata (NS 7)

2. Hemant Dusad (NS 16) 3. Anshul Aggarwal (NS 15) |

1. Son of Suman Lata (NS 7).

Additionally, connected with her through fund transfers. 2. Connected with Hemant Dusad through CDR. 3. Connected with Anshul Aggarwal (NS 15), who was the dealer for Nikunj Stock Brokers Ltd. for execution of Vivek Rana (NS 12)’s trades in the scrip of Sharpline. |

| 20. | Ashok Kumar Agrawal (NS 13) | 1. Anshul Aggarwal (NS 15)

2. Anshu Aggarwal (NS 14) |

1. Connected with entities in column (2) through common residential address, contact no. and email address, as per KYC records.

2. Additionally, connected with Anshul Aggarwal (NS 15), who was the dealer for Nikunj Stock Brokers Ltd. for execution of Ashok Kumar Agrawal (NS 13)’s trades in the scrip of Sharpline. |

| 21. | Anshu Aggarwal (NS 14) | 1. Anshul Aggarwal (NS 15)

2. Ashok Kumar Agrawal (NS 13) |

1. Connected with entities in column (2) through common residential address, contact no. and email address, as per KYC records.

2. Additionally, connected with Anshul Aggarwal (NS 15), who was the dealer for Nikunj Stock Brokers Ltd., for execution of Anshu Aggarwal (NS 14)’s trades in the scrip of Sharpline. |

| 22. | Anshul Aggarwal (NS 15) | 1. Subhash Agarwal (NS 11)

2. Anshu Aggarwal (NS 14) 3. Hemant Dusad (NS 16) 4. Ashok Kumar Agrawal (NS 13) 5. Anshul Aggarwal Co HUF (NS 17) 6. Vivek Rana (NS 12) 7. Bhim Singh Chaudhary (NS 6) 8. Hemant Dusad (NS 16) 9. Renuka Aggarwal (NS 4) |

1. Connected with Subhash Agarwal (NS 11) and Hemant Dusad (NS 16) through CDR.

2. Connected with Anshu Aggarwal (NS 14) and Ashok Kumar Agrawal (NS 13) through common residential address, contact no. and email, as per KYC records. 3. Karta of Anshul Aggarwal Co HUF (NS 17). 10. Dealer for Nikunj Stock Brokers Ltd. who executed the trades of entities in column (2) in the scrip of Sharpline. |

| 23. | Hemant Dusad (NS 16) | 1. Anshul Aggarwal (NS 15)

2. Bhim Singh Chaudhary (NS 6) 3. Suman Lata (NS 7) 4. Subhash Agarwal (NS 11) 5. Vivek Rana (NS 12) |

1. Connected with entities in Column (2) through CDR.

2. Additionally, connected with Brokers Ltd., for execution of |

| 24. | Anshul Aggarwal Co HUF (NS 17) | 1. Anshul Aggarwal (NS 15) | 1. HUF of Anshul Aggarwal (NS 15). |

| 25. | Anshu Mishra | 1. Manish Mishra (MMD 1)

2. Manjari Tiwari (MMD 2) 3. Angad Ishwarlal Rathod (VC 3) |

1. Wife of Manish Mishra (MMD 1).

2. Connected with creator of Profit Yatra – Manjari Tiwari (MMD 2) and Angad Ishwarlal Rathod (VC 3) through fund transfers. |

| 26. | Rakesh Gupta Kumar | 1. Gaurav Gupta (NS 1)

2. Subhash Agarwal (NS 11) 4. S L Gupta (VC 2) |

1. Father of Gaurav Gupta (NS 1) as per KYC records.

2. Connected with entities at S. no. 2 and 3 in column (2) through CDR. |

10. CONNECTION BETWEEN NOTICEES AND OTHER ENTITIES THROUGH CDRS:

10.1. The CDRs reveal that certain Noticees and other connected entities regularly communicated with each other. An analysis of the CDRs between the Noticees /other connected entities reveal the following:

TABLE 5

| S. No. | Entity (A) | Entity (B) | No. of calls |

Duration in Seconds | Period |

| 1. | Manish Mishra (MMD 1) (886XXXX117) | Manjari Tiwari (MMD 2) (750XXXX797) | 12 | 4608 | 07/04/2022 to 02/08/2022 |

| 2. | Manish Mishra (MMD 1) (997XXXX000) | Manjari Tiwari (MMD 2) (750XXXX797) | 10 | 7798 | 18/05/2022 to 21/07/2022 |

| 3. | Manish Mishra (MMD 1) (886XXXX117) | Jatin Manubhai Shah (VC 1) (982XXXX486) | 537 | 27569 | 27/04/2022 to

30/09/2022 |

| 4. | Manish Mishra (MMD 1) (886XXXX117) | Subhash Agarwal (NS 11) (999XXXX515) | 75 | 6182 | 29/04/2022 to 29/09/2022 |

| 5. | Subhash Agarwal (NS 11) (999XXXX515) | Bhim Singh Chaudhary (NS 6) (981XXXX969) | 137 | 9165 | 30/04/2022 to 26/08/2022 |

| 6. | Subhash Agarwal (NS 11) (999XXXX515) | Anshul Aggarwal (NS 15) (981XXXX378) | 112 | 9318 | 29/04/2021 to 13/08/2022 |

| 7. | Subhash Agarwal (NS 11) (999XXXX515) | Hemant Dusad (NS 16) (931XXXX774) | 67 | 5754 | 27/04/2022 to 04/08/2022 |

| 8. | Subhash Agarwal (NS 11) (999XXXX515) | Suman Lata (NS 7) (981XXXX709) | 83 | 18139 | 30/04/2022 to 12/08/2022 |

| 9. | Subhash Agarwal (NS 11) (999XXXX515) | Nitesh Agarwal (NS 9) (999XXXX076) | 127 | 33024 | 27/04/2022 to 14/08/2022 |

| 0. | Subhash Agarwal (NS 11) (999XXXX515) | Kailash Agarwal (NS 3) (981XXXX490) | 16 | 1085 | 08/05/2022 to 04/08/2022 |

| 1. | Subhash Agarwal (NS 11) (999XXXX515) | Jatin Manubhai Shah (VC 1) (982XXXX486) | 2 | 125 | 24/06/2022 to 28/06/2022 |

| 2. | Subhash Agarwal (NS 11) (999XXXX515) | Rajesh Kumar Singh (NS 10) (981XXXX796) | 4 | 147 | 20/06/2022 to 22/06/2022 |

| 3. | Subhash Agarwal (NS 11) (999XXXX515) | S L Gupta (VC 2) (981XXXX638) | 1 | 59 | 27/05/2022 to 27/05/2022 |

| 4. | Subhash Agarwal (NS 11) (999XXXX515) | Rakesh Kumar Gupta (981XXXX355) | 4 | 134 | 28/04/2022 to 20/07/2022 |

| 5. | Rakesh Kumar Gupta (981XXXX355) | S L Gupta (VC 2) (981XXXX638) | 8 | 527 | 13/07/2022 to 22/08/2022 |

| 6. | Rajesh Kumar Singh (NS 10) (981XXXX796) | Kailash Agarwal (NS 3) (981XXXX490) | 66 | 2872 | 16/04/2022 to 22/06/2022 |

| 18. | Hemant Dusad (NS 16) (931XXXX774) | Bhim Singh Chaudhary (NS 6) (981XXXX969) | 3 | 181 | 19/05/2022 to 28/05/2022 |

| 19. | Hemant Dusad (NS 16) (931XXXX774) | Suman Lata (NS 7) (981XXXX709) | 6 | 188 | 21/04/2022 to 09/06/2022 |

| 20. | Bhim Singh Chaudhary (NS 6) (981XXXX969) | Suman Lata (NS 7) (981XXXX709) | 4 | 154 | 01/06/2022 to 24/06/2022 |

| 21. | Vivek Rana (NS 12) (991XXXX998) | Suman Lata (NS 7) (981XXXX709) | 7 | 228 | 10/05/2022 to 19/07/2022 |

| 22. | Gaurav Gupta (NS 1)(987XXXX394) | Arpan Gupta (NS 2) (989XXXX610) | 10 | 567 | 04/05/2022 to 06/08/2022 |

| 23. | Bhim Singh Chaudhary (NS 6)(981XXXX969) | Bimla Chaudhary (NS 8) (901XXXX827) | 82 | 3957 | 29/04/2022 to 30/09/2022 |

10.2. The said communication leads to the prima facie conclusion that the Noticees and certain other entities are connected with each other.

11. VIDEOS UPLOADED ON YOUTUBE AND ROLE OF CHANNEL:

11.1. A brief description of the YouTube channels as noted from the material available on record is as follows:

11.1.1. The YouTube Channels – ‘Midcap calls’ and ‘Profit Yatra’, were created on January 23, 2022 and September 25, 2021, respectively. The Home page of the said YouTube channels has no description about the channels or its creators.

11.1.2. It was observed that ‘Midcap Calls’ had 3.82 lakh subscribers and ‘Profit Yatra’ had 2.72 lakh subscribers as on November 2022. As on December 14, 2022, ‘Midcap Calls’ had 4.29 lakhs subscribers and ‘Profit Yatra’ had 3.35 lakhs subscribers. Thus, the viewership of the two YouTube Channels is large and continues to increase. Screenshot of the YouTube channels’ homepages can be seen below.

11.1.3. The YouTube Channels earlier allowed only one-way communication from the creators of the channel to upload videos or post messages while subscribers and viewers can only view such video or message. Subscribers and viewers are disabled from posting any comments on the videos uploaded on the said channels.

11.1.4. It is observed that as on date the videos recommending buying the scrip of Sharpline are not available for public viewing.

11.2. In order to ascertain the identity of the administrator/creator of these channels, information about these channels were sought from Google LLC (i.e., Holding company of “YouTube”), vide SEBI letter dated August 10, 2022. Google LLC, vide emails dated August 16, 2022 and November 17, 2022 provided the requisite information about the creators of the channels along with their names, mobile numbers, email addresses, date of upload of videos and view count, as given below:

TABLE 6

S. No. |

Date of upload |

View

|

Channel Name |

Administrator |

|

Mobile No. |

1 |

May 20, 2022 |

35,25,316 |

Midcap Calls |

Manish Mishra |

manishmishraXX10XX@gmail.com |

9XX6000XX0 |

2 |

May 27, 2022 |

88,76,153 |

||||

3 |

May 23, 2022 |

25,78,851 |

Profit Yatra |

Profit Yatra |

profityatraXX@gmail.com |

7XX6798XX7 |

4 |

May 27, 2022 |

71,44,835 |

maanishmishraXX@gmail.com |

(Note-1: Mobile nos. and email ids have been masked to maintain privacy. Note-2: ‘Profit Yatra’ is recorded as both the Channel name and the administrator name on YouTube.)

11.3. The mobile numbers of the creators of YouTube Channels, namely, Midcap Calls and Profit Yatra, were found to be registered in the names of Mr. Manish Mishra (MMD 1) and Ms. Manjari Tiwari (MMD 2), respectively. From the CDR of Manjari Tiwari (MMD 2), it is observed that there have been calls between Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) and the details regarding the same has been mentioned in Table 5. Further, from the bank account statement of Anshu Mishra (wife of Manish Mishra), it was observed that Anshu Mishra has received money from Manjari Tiwari (MMD 2) on 3 three instances amounting to INR 5 lakhs. Thus, prima facie Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) are connected entities.

11.4. Further, it is noted that one of the email id linked with ‘Profit Yatra’ Channel is similar to the email id linked to ‘Midcap Calls’ Channel and also mentions the name of Manish Mishra (MMD 1). Considering that the same scrip was being recommended in both the YouTube Channels, the similar email id raises a suspicion that the ‘Profit Yatra’ Channel may be indirectly operated or influenced by Manish Mishra (MMD 1).

11.5. It is observed that the channels publishing these videos have a large following and the videos uploaded by them were viewed by lakhs of users as shown in Table 6 above.

11.6. The YouTube videos subsequently appear to have been disabled forpublic viewing on the said YouTube Channels. However, two videos which were earlier available on the ‘Profit Yatra’ Channel, as downloaded, are available on record. A screenshot of the video at S. No. 4 is given below:

11.7. The video at S. No. 4 which was uploaded in the YouTube Channel – Profit Yatra, as downloaded, can be viewed by scanning the QR code mentioned below: –

11.8. Relevant extracts of the statements and recommendations made in the videos referring to Sharpline Broadcast Limited are reproduced below:

11.8.1. “The company is going to be taken over by Adani group since the company has license to create OTT platforms, TV channels and news channels and Adani group would like to acquire all the licenses at one go. The recent change in directorships in the company is indicative that Adani group would be taking over the company.”

11.8.2. “The company also had large contracts owing to which company is making huge profits. The company has signed a big contract with Sony Pictures and Zee to create 4 big films and 9 web series. The company will earn approx. INR 250 crores from this deal. In the said deal, the investment will be done by Sony and Zee, but the content rights are with Sharpline Broadcast Ltd. Therefore, there is no risk to the company but will have stake in profits.”

11.8.3. “The company is a sister company of Sadhna Broadcast Ltd. which has many devotional channels.”

11.8.4. “The company is debt free. The company is fundamentally strong and technical indicators like RSI and MACD are in bullish mode.”

11.8.5. “The company has already given good returns. Just 6 months ago, the price was INR 6 and now the price is around INR 30.”

11.8.6. “The current price of the share is INR 30 and it will become INR 240 within the next 3 months and INR 750 within the next one year.”

11.9. BSE sought clarification from the company with reference to the information being circulated on social media. The company refuted the claims made in the aforesaid videos, vide its letter dated June 10, 2022. This statement of the company was also published on BSE website on June 10, 2022. An extract of the statement made by the company is reproduced below:

“With reference to Clarification sought by the Exchange on 10th June, 2022 on various stock recommendation of our company along with news such as Launch of new OTT platform like Amazon, Sony & Zee Tie up worth Rs. 250 crores and Adani Group to Takeover the company, etc. is being circulated in the social media like you tube channel/telegram, etc. As per provisions of Regulation 30 of the SEBI (Listing Obligation and Disclosure Requirements) Regulations, 2015, we hereby wish to inform you that whatever is circulating is false and misleading on Social Media, we have no connection/link regarding this fake news. We are not in agreement with the matter so circulated…”.

11.10. Bank account statement of the creator of the YouTube Channel – ‘Midcap Calls’, Manish Mishra (MMD 1) was analysed and the following sample debit transactions were found in his bank account with Kotak Mahindra Bank:

TABLE 7

| Sr. No. |

Date | Narration of the transaction | Amount |

| 1 | 20-05-2022 | PG GOOGLEADS | 999,999.00 |

| 2 | 21-05-2022 | PG GOOGLEADS | 999,997.00 |

| 3 | 23-05-2022 | PG GOOGLEADS | 500,000.00 |

| 4 | 23-05-2022 | PG GOOGLEADS | 300,000.00 |

| 5 | 25-05-2022 | PG GOOGLEADS | 200,000.00 |

| 6 | 25-05-2022 | PG GOOGLEADS | 799,999.00 |

| 7 | 26-05-2022 | PG GOOGLEADS | 999,999.00 |

| 8 | 27-05-2022 | PG GOOGLEADS | 999,999.00 |

| 9 | 28-05-2022 | PG GOOGLEADS | 999,998.00 |

| 10 | 30-05-2022 | PG GOOGLEADS | 200,000.00 |

| 11 | 30-05-2022 | PG GOOGLEADS | 400,000.00 |

| 12 | 31-05-2022 | PG GOOGLEADS | 500,000.00 |

| 13 | 02-06-2022 | PG GOOGLEADS | 899999.00 |

| 14 | 07-06-2022 | PG GOOGLEADS | 999995.00 |

| 15 | 13-06-2022 | PG GOOGLEADS | 999999.00 |

| 16 | 14-06-2022 | PG GOOGLEADS | 999999.00 |

11.11. Multiple such debit transactions for the period January 2022 to September 2022 amounting to INR 4,72,24,967 (Rupees four crore seventy-two lakh twenty-four thousand nine hundred and sixty-seven only), which appears to be payment to Google AdSense (Google delivers targeted ads to their content or audience) for promoting videos uploaded on YouTube, were observed in the bank account statement of the Manish Mishra (MMD 1). The transactions mentioned in Table 7 above which were made in Patch 3 of the examination period done amounts to INR 1,17,99,983 (Rupees one crore seventeen lakh ninety-nine thousand nine hundred and eighty-three only). Therefore, it appears that funds for promoting the Channels – ‘Midcap Calls’ and ‘Profit Yatra’ created by Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) respectively, were inter alia utilized from the aforesaid bank account of Manish Mishra (MMD 1). The above mentioned four videos have a combined view count of 2,21,25,155. There was thus a prima facie deliberate attempt to widely disseminate the content of the videos uploaded on the Channels owned by the MMDs.

11.12. It was observed that the videos contained false and deceptive statements about the growth story and future prospects of the company. The videos recommended investors to buy the scrip to earn substantial profits. Considering the direct and indirect connection between Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) (through CDR and fund transfers), it appears that Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) were working in tandem to coordinatedly upload deceptive videos and market them actively online with a deliberate attempt to increase volumes and price of the scrip of Sharpline. Disabling the comments section on the YouTube Channels, prima facie appears to be an attempt to avoid any negative counter view to the messages disseminated through the YouTube videos. By suggesting an abnormally high target price for the scrip, the videos prima facie appears to be egging on the viewers/ potential investors to acquire shares of Sharpline immediately. Further, it can be inferred that the large expenditure towards advertising the YouTube Channels was, inter alia, designed to lure investors to view the YouTube Channels / videos. As a result, the number of subscribers of the said YouTube Channels increased rapidly and the number of viewers of the YouTube videos for both the YouTube Channels together added up to more than two crores.

11.13. Also, Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) bought and sold shares after uploading of videos in their YouTube Channels, contrary to the buy recommendations in their YouTube Channels thereby taking advantage of the increase in price caused by the unsuspecting retail investor entering the scrip of Sharpline to book profit at inflated prices. This prima facie leads to the conclusion that the videos were uploaded on YouTube were intended to mislead and induce retail investors to deal in the scrip of Sharpline Broadcast Limited.

ANALYSIS OF TRADING PATTERN:

12. As stated earlier the examination period is categorized into 3 patches. Activity during these patches and the pre-examination period are summarized below:

TABLE 8

| Patch | Period | Activity |

| Pre-examination period | January 01, 2022 to April 11, 2022 | During the pre-examination period, the scrip was traded on 7 days and the trading volume was very low. The first trade in the scrip was on March 15, 2022 pursuant to its listing on September 07, 2021. |

| Patch 1 | April 12, 2022 to May 19, 2022 | Generation of volume in the scrip and rise in price. |

| Patch 2 | May 20, 2022 to June 14, 2022 | YouTube videos that recommended buying the shares of Sharpline, with false news about the company and suggesting a very high target price, were uploaded. The price, volume and number of entities who traded in the scrip increased multifold. Certain entities and public shareholders of Sharpline holding nominal share capital in excess of INR 2 lakhs offloaded their holdings at a higher price. |

| Patch 3 | June 15, 2022 to August 19, 2022 | Period post uploading of videos witnessed a fall in the price and volume in comparison to Patch 2. |

13. The summary of price and volume movement during each of the above mentioned patches is provided below:

TABLE 9

Period |

Price (in Rs)/ Volume (qty.) |

Opening Price & volume on first day of the period |

Closing Price & volume on last day of the period (INR) |

Low Price & Volume during the period (INR) |

High Price & Volume during the period (INR) |

No. of days in which the scrip traded out of total trading days |

No. of shares traded during the period

|

Average no of Trades per day during

|

Pre-exami nation period |

Price |

7(15/03/2022) |

9.35(07/04/2022) |

7(15/03/2022) |

9.35(07/04/2022) |

7 out of 68 |

115 |

1.57 |

Volume |

500(15/03/2022) |

50(07/04/2022) |

30(28/03/2022) |

500(15/03/2022) |

||||

Patch 1 |

Price |

9.81(12/04/2022) |

23.42(19/05/2022) |

8.07(18/04/2022) |

23.42(19/05/2022) |

25 out of 25 |

53261 |

35.84 |

Volume |

365000(12/04/2022) |

17638(19/05/2022) |

1(26/04/2022) |

365000(12/04/2022) |

||||

Patch 2 |

Price |

24.59(20/05/2022) |

50.65(14/06/2022) |

23.37(23/05/2022) |

55.95(14/06/2022) |

18 out of 18 |

913590 |

2643 |

Volume |

9720(20/05/2022) |

155619414/06/2022) |

9720(20/05/2022) |

3036904(07/06/2022) |

||||

Patch 3 |

Price |

48.15(15/06/2022) |

13.819/08/2022) |

13.55(19/08/2022 |

48.15(15/06/2022) |

46 out of 46 |

128018 |

609 |

Volume |

65848(15/06/2022) |

129774(19/08/2022) |

8581(01/07/2022 |

1135687(14/07/2022) |

Patch-wise analysis

14. Pre-examination period: January 01, 2022 to April 11, 2022

14.1. The company was listed on BSE on September 7, 2021. However, the Sharpline scrip remained thinly traded during the “Pre-examination’ period. During this period, the shares of the company was traded only on 7 trading days with an average daily volume of 115 shares and total volume of 805 shares. There were no trades in the scrip from January 01, 2022 to March 14, 2022. The opening price of the scrip was INR 7 on March 15, 2022 which then increased by 33% to closing price of INR 9.35 on April 07, 2022. A price band of 5% was applicable during this period. During the 7 days when the shares of Sharpline were traded, the scrip hit the upper limit of this price band even though the number of trades and volumes were very low.

15. Patch 1: April 12, 2022 to May 19, 2022 (Generation of volume in the scrip and rise in price)

15.1. There was a spurt in volume from April 12, 2022. The daily average volume for the period from April 12, 2022 to May 19, 2022, increased from an average daily volume of 115 shares during the pre-examination period to 53,261 shares in Patch 1.

15.2. During this period, the price of the scrip increased by 150% from the closing price of INR 9.35 on April 07, 2022 to the closing price of INR 23.42 on May 19, 2022. A price band of 5% was applicable during the period. Out of 25 days when the scrip was traded, the scrip hit the upper circuit of 5% on 23 days and lower circuit on 2 days.

15.3. It is also observed that the price movement had taken place through first trade of the day on all the 25 days.

15.4. Further, based on trade log, it is observed that during this period, 343 unique entities transacted on the buy side and 139 entities transacted on the sell side. In total, 361 unique entities traded in the securities appearing either as a buyer or a seller, or both. The top volume generators during patch 1 are as under:

TABLE 10

| S. No. |

Name of entity | Buy qty. | Sell qty. | Net

Volume |

Total Volume by entity | % of total Volume |

| 1 | S L Gupta (VC 2) | 2,00,000 | 1,00,000 | 1,00,000 | 3,00,000 | 11% |

| 2 | Gladis Menezes | 57,501 | 49,501 | 8,000 | 1,07,002 | 4% |

| 3 | Divya Kanda | 40,458 | 40,523 | -65 | 80,981 | 3% |

| 4 | Subhash Agarwal (NS 11) | 20,000 | 59,165 | -39,165 | 79,165 | 3% |

| 5 | Hitesh Shashikant Jhaveri | 39,282 | 39,048 | 234 | 78,330 | 3% |

| 6 | Anshul Aggarwal Co HUF (NS 17) | – | 75,050 | -75,050 | 75,050 | 3% |

| 7 | Omolara Textiles Private Limited | – | 69,145 | -69,145 | 69,145 | 3% |

| 8 | Ashok Kumar Agrawal (NS 13) | – | 65,000 | -65,000 | 65,000 | 2% |

| 9 | Anshul Aggarwal (NS 15) | – | 65,000 | -65,000 | 65,000 | 2% |

| 10 | Hemant Dusad (NS 16) | – | 65,000 | -65,000 | 65,000 | 2% |

| 11 | Jatin Manubhai Shah (VC 1) | 60,520 | – | 60,520 | 60,520 | 2% |

| 12 | Glaston Mario Menezes | 57,504 | – | 57,504 | 57,504 | 2% |

| 13 | Sonal Vimalkumar Shah | 27,001 | 27,001 | 0 | 54,002 | 2% |

15.5. From the analysis of Patch 1, it is observed that the aforementioned 13 entities contributed to 42% of the total volume traded during the period. On analyzing the connections between the entities, it is found that entities at Sr. No. 1, 4, 6, 8, 9, 10 and 11 are connected with each other. The basis of their connection is described in Table 4 above.

15.6. It was also observed that that highest volume creator in Patch 1 – SL Gupta (VC 2) bought 1,62,960 shares from the other connected entities at S. No. 4, 6, 8, 9 and NS 12 on the first two trading days of patch 1 when the trading volume was low. Further, it was noted that Anshul Aggarwal (NS 15) was the dealer for the connected entities at S. No. 4, 6, 8, 9 and NS 12 for execution of their sell trades.

15.7. S L Gupta (VC 2) sold 1,00,000 shares in Patch 1 out of which 27,151 shares were bought by the other volume creator and connected entity, Jatin Manubhai Shah (VC 1). Further, Anshu Aggarwal (NS 14) sold 25,000 shares and Renuka Aggarwal (NS 4) bought 5,000 shares in Patch 1.

15.8. The combined trading activity of the aforesaid connected entities contributed to 29.28% of the total volume of the scrip during patch 1.

16. Patch 2: May 20, 2022 to June 14, 2022 (Uploading of videos and offloading of shares by Net Sellers)

16.1. The daily average volume for the period from May 20, 2022 to June 14, 2022, increased from 53,261 shares in Patch 1 to 9,13,590 shares in Patch 2. The daily number of trades increased from 36 trades in Patch 1 to 2,643 trades in Patch 2.

16.2. During this period, the price of the scrip increased by 116% from the closing price of INR 23.42 on May 19, 2022 to closing price of INR 50.65 on June 14, 2022. A price band of 5% was applicable during this period. Out of the 18 days when the scrip was traded, the scrip hit the upper circuit of 5 % on all days.

16.3. It is observed that the price movement had taken place through first trade of the day on all the 18 days.

16.4. Further, based on the trade log, it is observed that during this period, 20,421 unique entities transacted on the buy side and 3,291 unique entities transacted on the sell side. In total, 20,542 unique entities traded in the securities either as a buyer or a seller, or both. The number of buyers during Patch 2 was around 60 times the number of buyers in Patch 1.

16.5. It is observed that pursuant to uploading of videos making recommendations to buy the shares of Sharpline on May 20, 2022, May 23, 2022 and May 27, 2022 on YouTube channels “Midcap Calls” and “Profit Yatra” the number of participants, especially the number of buyers increased significantly. Further, significant increase is observed in average daily volume traded and the average daily number of trades during the period.

16.6. The top gross buyers and gross sellers in patch 2 are given below:

TABLE 11

| S. No. |

Name the entity | Buy qty. (Patch 2) | Sell qty. (Patch 2) | Net volume | Total volume by entity | % of total volume traded (Patch 2) |

| 1 | Jatin Manubhai Shah (VC 1) |

10,91,137 | 11,51,657 | -60,520 | 22,42,794 | 6.82 |

| 2 | Setu Securities Pvt. Ltd. | 7,78,693 | 7,49,195 | 29,498 | 15,27,888 | 4.65 |

| 3 | Sachinkumar Bhagvandas Sahu | 7,40,002 | 7,40,022 | -20 | 14,80,024 | 4.50 |

| 4 | Angad Ishwarlal Rathod (VC 3) | 5,20,623 | 5,10,630 | 9,993 | 10,31,253 | 3.14 |

| 5 | Gaurav Gupta (NS 1) | – | 5,00,000 | -5,00,000 | 5,00,000 | 1.52 |

| 6 | Heli Jatin Shah (VC 4) | 4,72,939 | 4,72,939 | 0 | 9,45,878 | 2.88 |

| 7 | Arpan Gupta (NS 2) | – | 4,08,455 | -4,08,455 | 4,08,455 | 1.24 |

| 8 | Sheth Brother | 3,90,559 | 3,85,559 | 5,000 | 7,76,118 | 2.36 |

| 9 | Alpha Leon Enterprises LLP | 2,11,873 | 3,47,514 | -1,35,641 | 5,59,387 | 1.70 |

| 10 | Bp Equities Pvt. Ltd. | 3,30,229 | 3,14,707 | 15,522 | 6,44,936 | 1.96 |

| 11 | Darshan Jaysukhlal Mehta | 2,90,003 | 2,90,003 | 0 | 5,80,006 | 1.76 |

| 12 | Daivik Jatin Shah (VC 5) | 2,60,000 | 2,60,000 | 0 | 5,20,000 | 1.58 |

| 13 | Nikunj Kaushik Shah |

2,41,007 | 2,41,007 | 0 | 4,82,014 | 1.47 |

16.7. On analyzing the connections between the entities, it is found that entities at S. No. 1, 4, 5, 6, 7 and 12 are connected. The basis of their connection is detailed in Table 4 above. The aforesaid connected entities together contributed 17.17% of the total volume of the scrip during Patch 2.

16.8. It was noted that both the MMDs had bought and sold shares in the scrip of Sharpline pursuant to uploading of videos in their YouTube channels. Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) bought and sold 27,770 shares and 9,295 shares respectively.

16.9. Further, it was noted that Jatin Manubhai Shah (VC 1), who is prima facie connected with Manish Mishra (MMD 1) on the basis of CDR and fund transfers, has contributed to significant increase in volume in Patch 1 and Patch 2. Jatin Manubhai Shah (VC 1) had bought 60,250 shares of Sharpline in Patch 1 (out of which 27,181 shares were bought from S L Gupta (VC 2)) and 10,91,137 shares in Patch 2 and then sold his entire holding i.e., 11,51,657 in Patch 2 after the videos were uploaded.

16.10. Further, it is noted that Jatin Manubhai Shah (VC 1) was the dealer for entities at S. No. 4 and 6 who are also volume creators in Patch 2. Heli Jatin Shah (VC 4) bought 40,000 shares from Gaurav Gupta (NS 1) during this patch. Heli Jatin Shah (VC 4) and Daivik Jatin Shah (VC 5) sold all the shares they had bought in Patch 2. SL Gupta (VC 2) sold 95,000 shares in the beginning of June 2022, after the videos were uploaded.

16.11. It was observed from the shareholding pattern of the company for the quarter ending March 2022 and June 2022 that there is a significant decline in the number of individual shareholders holding nominal share capital in excess of INR 2 Lakhs and their respective holding between the quarter ending March 2022 and June 2022. Correspondingly, the number of small shareholders have increased from 517 to 20,009. The trading details of net sellers holding nominal share capital in excess of INR 2 lakhs in patch 1 vis-à-vis patch 2 are given below:

TABLE 12

| Sr. No. |

Name | Holding as on Mar 31,2022 |

Buy qty. (Patch 1) |

Sell qty. (Patch 1) |

Buy qty. (Patch 2) |

Sell qty. (Patch2) |

Avg. Sell Price (Patch2) |

Holding after patch 2 |

| 1 | Gaurav Gupta (NS 1) | 500000 | – | – | – | 500000 | 51.41 | 0 |

| 2 | Arpan Gupta (NS 2) | 599660 | – | – | – | 408455 | 52.91 | 191205* |

| 3 | Kailash Agarwal (NS 3) | 225000 | – | – | – | 225000 | 39.17 | 0 |

| 4 | Renuka Aggarwal (NS 4) | 220000 | 5000 | – | – | 225000 | 29.88 | 0 |

| 5 | Gunjan Agarwal (NS 5) | 223100 | – | – | – | 223100 | 29.87 | 0 |

| 6 | Bhim Singh Chaudhary (NS 6) | 222500 | – | – | – | 222500 | 37.96 | 0 |

| 7 | Suman Lata (NS 7) | 222000 | – | – | – | 222000 | 40.87 | 0 |

| 8 | Bimla Chaudhary (NS 8) | 222000 | – | – | – | 222000 | 39.09 | 0 |

| 9 | Nitesh Agarwal (NS 9) | 221000 | – | – | – | 221000 | 31.11 | 0 |

| 10 | Rajesh Kumar Singh (NS 10) | 234000 | – | 35000 | – | 199000 | 37.44 | 0 |

| 11 | Subhash Agarwal (NS 11) | 222820 | 20000 | 59165 | – | 183645 | 28.5 | 10 |

| 12 | Vivek Rana (NS 12) | 222000 | – | 40000 | – | 182000 | 29.3 | 0 |

| 13 | Ashok Kumar Agrawal (NS 13) | 225635 | – | 65000 | – | 160635 | 44.52 | 0 |

| 14 | Conrado Traders Private Limited | 173000 | – | 25000 | 3000 | 151000 | 44.69 | 0 |

| 15 | Omolara Textiles Private Limited | 174345 | – | 69145 | – | 105200 | 43.53 | 0 |

| 16 | Anshu Aggarwal (NS 14) | 125300 | – | 25050 | 62450 | 162700 | 41.74 | 0 |

| 17 | Anshul Aggarwal (NS 15) | 130200 | – | 65000 | – | 65200 | 40.51 | 0 |

| 18 | Hemant Dusad (NS 16) | 130000 | – | 65000 | – | 65000 | 36.5 | 0 |

| 19 | Anshul Aggarwal Co HUF (NS 17) | 125400 | – | 75050 | – | 50350 | 39.06 | 0 |

*-Arpan Gupta (NS 2) sold his remaining shares at an average sell price of INR 18.4 in Patch 3.

16.12. On analysing the connections between the entities, it is found that all the entities except entities at Sr. No. 14 and 15 are related / connected with each other. The basis of their connection is described in Table 4 above. Further, it is observed that by the end of Patch 3, all the connected Net Sellers had sold their entire holding in the scrip of Sharpline.

16.13. Further, it is noted that Anshul Aggarwal (NS 15) was the dealer for entities at S. No. 4, 6, 9, 11, 12, 13, 16, 18 and 19 for execution of their sell trades during Patch 2.

16.14. A consolidated table listing the entities who had traded in Patch 1 and Patch 2 is given below.

TABLE 13

|

Patch 1 – Volume Creators |

Patch 2 – Volume Creators | Patch 2 – Net Sellers |

| Anshul Aggarwal (NS 15) | Alpha Leon Enterprises LLP | Anshu Aggarwal (NS 14) |

| Anshul Aggarwal Co HUF (NS 17) | Angad Ishwarlal Rathod (VC 3) | Anshul Aggarwal (NS 15) |

| Ashok Kumar Agrawal (NS 13) | Arpan Gupta (NS 2) | Anshul Aggarwal Co HUF (NS 17) |

| Divya Kanda | Bp Equities Pvt. Ltd. | Arpan Gupta (NS 2) |

| Gladis Menezes | Daivik Jatin Shah (VC 5) | Ashok Kumar Agrawal (NS 13) |

| Glaston Mario Menezes |

Darshan Jaysukhlal Mehta | Bhim Singh Chaudhary (NS 6) |

| Hemant Dusad (NS 16) | Gaurav Gupta (NS 1) | Bimla Chaudhary (NS 8) |

| Hitesh Shashikant Jhaveri | Heli Jatin Shah (VC 4) | Conrado Traders Private Limited |

| Jatin Manubhai Shah (VC 1) | Jatin Manubhai Shah (VC 1) | Gaurav Gupta (NS 1) |

| Omolara Textiles Private Limited |

Nikunj Kaushik Shah | Gunjan Agarwal (NS 5) |

| S L Gupta (VC 2) | Sachinkumar Bhagvandas Sahu | Hemant Dusad (NS 16) |

| Sonal Vimalkumar Shah | Setu Securities Pvt Ltd | Kailash Agarwal (NS 3) |

| Subhash Agarwal (NS 11) | Sheth Brother | Nitesh Agarwal (NS 9) |

| Omolara Textiles Private Limited | ||

| Rajesh Kumar Singh (NS

10) |

||

| Renuka Aggarwal (NS 4) | ||

| Subhash Agarwal (NS 11) | ||

| Suman Lata (NS 7) | ||

| Vivek Rana (NS 12) | ||

Note: Entities in the cells highlighted are related to the other highlighted entities in the same patch. Entities in cells with gridded lines are common in both the patches.

16.15. From the table above, on comparison of the entities who have traded in Patches 1 & 2, it is observed that the entities namely, Anshul Aggarwal (NS 15), Anshul Aggarwal Co HUF (NS 17), Ashok Kumar Agrawal, Hemant Dusad (NS 16) and Subhash Agarwal (NS 11), who are volume creators, and net sellers & profit makers in Patch 2, had also contributed to the increase in volume in Patch 1.

17. Patch 3: June 15, 2022 to August 19, 2022

17.1. The daily average volume decreased from 9,13,590 shares per day on June 15, 2022 to 1,28,018 shares per day on August 19, 2022 during Patch 3. The daily number of trades decreased from 2,643 trades per day to 609 trades per day.

17.2. During this period, the price of the scrip decreased by 72.75% from the closing price of INR 50.65 on June 14, 2022 to closing price of INR 13.8 on August 19, 2022. Out of the 46 days when the scrip was traded, on 32 days, the scrip was down by more than 4.5% and on 4 days it was up by more than 4.5%.

17.3. It is observed from the trade log for the period that 8,322 unique entities transacted on the buy side and 5,050 unique entities transacted on the sell side. In total, 11,326 unique entities traded in the securities appearing either as a buyer or a seller, or both.

17.4. From the above, it can be inferred that price, volume and number of traders in the scrip increased in Patch 2 when the video recommendations were published to lure public investors, and decreased in Patch 3 pursuant to the VCs and NSs exiting the market.

18. In view of the aforesaid discussion, it can be prima facie concluded that NSs, MMDs and VCs were involved in a scheme/device to manipulate the volume of Sharpline through the trades of NSs and VCs and through buy recommendation made via YouTube videos which were, prima facie, intended to induce small investors to deal in Sharpline so as to take advantage of the resultant increase in price and volume of Sharpline.

CHANGE IN SHAREHOLDING PATTERN OF SHARPLINE:

19. The shareholding pattern of Sharpline during the examination period was as given in the Table below:

TABLE 14

| Particulars | As on March 31, 2022 | As on June 30, 2022 | ||

| No. of shareholders | % | No. of shareholders | % | |

| Total Promoter Holding | 3 | 43.30 | 3 | 43.30 |

| Non-Promoter Holding | 634 | 56.70 | 20,121 | 56.70 |

| Individual shareholders holding nominal share capital up to INR 2 Lacs | 571 | 0.67 | 20,009 | 41.89 |

| Individual shareholders holding nominal share capital in excess of INR 2 Lacs | 26 | 48.88 | 10 | 14.14 |

| Others | 37 | 7.15 | 102 | 0.67 |

20. It was observed from the shareholding pattern for the quarter ended March 31, 2022 and June 30, 2022 that the number of individual shareholders up to INR 2 lakhs increased from 571 holding 0.67% of the share capital of the company in the quarter ended on March 31, 2022 to 20,009 shareholders holding 41.89% in the quarter ended on June 30, 2022. Further, the number of shareholders holding nominal share capital in excess of INR 2 lakhs decreased from 25 holding 48.88% of total shareholding as on March 31, 2022 to 10 holding 14.14% of the total shareholding as on June 30, 2022.

21. The fact that there was an increase in the number and shareholding percentage of small public shareholders and the corresponding decrease in number and shareholding percentage of public shareholders holding nominal share capital in excess of INR 2 lakhs, prima facie indicate that the shares have been offloaded by shareholders holding nominal share capital in excess of INR 2 lakhs to small public shareholders.

PRICE – VOLUME OF SHARPLINE DURING THE EXAMINATION PERIOD

22. On analysis of the price and volume movement in the scrip during the examination period provided at diagram no. 2 earlier in this Order, it is observed that the closing price of the scrip of Sharpline was INR 8.47 on April 19, 2022 and the traded volume was 260 shares on that day. Subsequently, the closing price reached its all-time high of INR 53.3 on June 13, 2022 and the traded volume was 14,25,108 shares on that day. It is noted that the highest closing price of Sharpline reached on June 13, 2022 was around 529% higher than the closing price on April 19, 2022 and the traded volume on June 13, 2022 was around 5,408% higher than the traded volume on April 19, 2022. Further, it is noted that the traded volume in the scrip of Sharpline was very low until NS 11, NS 12, NS 13, NS 15 and NS 17 sold their shares to VC 2 during the first 2 days of Patch 1. Moreover, no material relevant price sensitive corporate announcements were made during the examination period. Therefore, prima facie, it appears that the increase in the price and volume of Sharpline during the examination period was on account of false and misleading videos uploaded on YouTube that recommended buying the shares of Sharpline and the volumes created by certain NSs and VCs depicting a false and misleading appearance of trading.

VIOLATION OF SEBI ACT AND PFUTP REGULATIONS

23. It will be relevant here to consider the applicability of Section 12A (a), (b) and (c) of SEBI Act and Regulations 3(a), 3(b), 3(c), 3(d), 4(1), 4(2)(a), 4(2)(d), 4(2)(k) and 4(2)(r) of PFUTP Regulations to the facts of this case. The text of the said provisions is reproduced below:

SEBI Act:

Section 12A. No person shall directly or indirectly—

(a) use or employ, in connection with the issue, purchase or sale of any securities listed or proposed to be listed on a recognized stock exchange, any manipulative or deceptive device or contrivance in contravention of the provisions of this Act or the rules or the regulations made thereunder;

(b) employ any device, scheme or artifice to defraud in connection with issue or dealing in securities which are listed or proposed to be listed on a recognized stock exchange;

(c) engage in any act, practice, course of business which operates or would operate as fraud or deceit upon any person, in connection with the issue, dealing in securities which are listed or proposed to be listed on a recognized stock exchange, in contravention of the provisions of this Act or the rules or the regulations made thereunder;

PFUTP Regulations:

Regulation 3. Prohibition of certain dealings in securities

“No person shall directly or indirectly

(a) buy, sell or otherwise deal in securities in a fraudulent manner;

(b) use or employ, in connection with issue, purchase or sale of any security listed or proposed to be listed in a recognized stock exchange, any manipulative or deceptive device or contrivance in contravention of the provisions of the Act or the rules or the regulations made there under;

(c) employ any device, scheme or artifice to defraud in connection with dealing in or issue of securities which are listed or proposed to be listed on a recognized stock exchange;

(d) engage in any act, practice, course of business which operates or would operate as fraud or deceit upon any person in connection with any dealing in or issue of securities which are listed or proposed to be listed on a recognized stock exchange in contravention of the provisions of the Act or the rules and the regulations made there under.

Regulation 4. Prohibition of manipulative, fraudulent and unfair trade practices

(1) Without prejudice to the provisions of regulation 3, no person shall indulge in a manipulative, fraudulent or an unfair trade practice in securities markets.

(2) Dealing in securities shall be deemed to be a manipulative, fraudulent or an unfair trade practice if it involves any of the following, namely: —

(a) knowingly indulging in an act which creates false or misleading appearance of trading in the securities market;

.

.

(d) inducing any person for dealing in any securities for artificially inflating, depressing, maintaining or causing fluctuation in the price of securities through any means including by paying, offering or agreeing to pay or offer any money or money’s worth, directly or indirectly, to any person;

.

.

(k) disseminating information or advice through any media, whether physical or digital, which the disseminator knows to be false or misleading in a reckless or careless manner and which is designed to, or likely to influence the decision of investors dealing in securities;

.

(r) knowingly planting false or misleading news which may induce sale or purchase of securities.

24. The factual matrix detailed in preceding paragraphs prima facie reveal a concerted attempt to artificially create turnover in a previously dormant scrip. This, prima facie, appears to have been done for artificially elevating the price of the scrip which enabled exit by MMDs and certain shareholders at elevated prices.

25. This concerted attempt appears to have rested on the coordinated efforts of the Noticees in this case. The role of the participants/noticees who enabled other participants/noticees to sell shares at artificially inflated prices are summarized below:

25.1. Volume Creators & Net Sellers

25.1.1. Noticees who are closely linked with Misleading Message Disseminators (MMDs) were Volume Creators in the scrip. Many of the Net Sellers of the securities who were the beneficiaries of the artificially inflated volumes are also observed to have engaged directly in volume creation. The sudden interest in an otherwise inactive scrip and a reversal of positions within a span of just 2-3 months resulting in complete liquidation of holdings, suggest that the earlier ‘volume creation’ was not a reflection of genuine interest in beneficial ownership. Prima facie, therefore, the volume creation can only be described as an act to create misleading appearance of high trading volumes and interest.

25.1.2. It is pertinent to note that most of the net sellers were large shareholders holding more than 1% each of the shares in Sharpline. As noted in paragraph 22 above, the traded volume in the scrip of Sharpline was very low until certain Net Sellers namely, NS 11, NS 12, NS 13, NS 15 and NS 17 sold their shares to VC 2 during the first 2 days of Patch 1. The abrupt liquidation of Net Sellers holdings completely subsequent to the dissemination of misleading information about Sharpline is also suspicious.

25.2. Misleading Message Disseminators (MMDs):

25.2.1. MMD 1 and MMD 2 are closely linked with each other and were found to have uploaded misleading videos recommending buying shares of Sharpline Broadcast Limited. Both the YouTube Channels uploaded videos with the same false news about Sharpline and prima facie such misleading videos were designed to induce investors to invest in the scrip. Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2), who were instrument for the creation of such videos, repeatedly bought and sold shares after the videos were uploaded. Prima facie, the false and misleading content of the videos, the pattern of trades by MMDs and the Noticees closely linked with MMD 1 (namely VC 1 to VC 5) pursuant to the upload of videos and his connection with the other Noticees in this Order leads to the conclusion that Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) enabled the execution of this fraudulent scheme along with other Noticees.

25.3. Directors of RTA of Sharpline:

25.3.1. The RTA of Sharpline Broadcast Limited is Skyline Financial Services Pvt. Ltd. Three directors of the RTA i.e., Bhim Singh Chaudhary (NS 6), Subhash Agarwal (NS 11) and Kailash Agarwal (NS 3) are noted to be Net Sellers in this case.

25.4. Broker – Dealer:

25.4.1. Noticee nos. 3 and 22 who played the role of volume creators and/ or Net Seller in this prima facie fraudulent scheme also appear to have been the Dealer associated with MNM Stock Broking Pvt. Ltd. and Nikunj Stock Brokers Ltd. respectively, for the trades executed by the Noticee nos. 5, 6, 12, 13, 15, 17, 18, 19, 20, 21 and 23.

26. The videos uploaded on the YouTube Channels are false and misleading. The company had itself publicly clarified that none of the statements made in the videos were true. Also, there were no material corporate announcements that would justify the sudden interest in the scrip. Further, the price targets stated in the videos of the scrip of Sharpline suggested irrational price escalation. The comments section for the YouTube videos in question remained disabled, suggesting that the creators/uploaders did not want any discussion regarding the videos that could possibly have countered the misleading messages disseminated.

As noted earlier in this Order, as per available evidence, during the relevant point in time, Manish Mishra (MMD 1) alone transferred more than INR 4,00,00,000 (Rupees Four Crore) to Google LLC to promote both the YouTube Channels inter alia containing the YouTube videos under examination. Thus, the noticees who owned the YouTube Channels i.e. Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) prima facie appear to have gone to great lengths to promote the videos uploaded on their channels including the aforesaid videos and sold all their shares after uploading the videos in their YouTube Channels. Despite the recommendation to buy in their YouTube Channels, the MMDs have liquidated their shares in Sharpline and allegedly made profits. Therefore, prima facie, such videos were designed to create excitement in the scrip.

27. The aforesaid questionable videos and the suspicious volume creation read together with the close connection between the noticees, leads me to the prima facie conclusion that the noticees were engaged in a coordinated scheme to induce unsuspecting investors to acquire securities in Sharpline, leading to an unnatural increase in the prices of the scrip, and finally sold shares at inflated prices thereby making illegal gains at the cost of the new investors. This coordinated scheme is, prima facie a violation of Section 12A(a), (b) and (c) of the SEBI Act read with Regulation 3(a), (b), (c), (d) and Regulation 4(1) and 4(2)(a), (d), (k) and (r) of the PFUTP Regulations.

PROCEEDS GENERATED BY THE NET SELLERS

28. The Noticee – NSs and VCs offloaded their shares at inflated prices after the videos were uploaded on YouTube. The artificial inflation in share price post the YouTube videos was supported by the fraudulent scheme which commenced from Patch 1 (as per the preliminary examination), which included volume creation of about 29% of the total volume, by some of the connected Noticees. Consequently, to ascertain the illegal profits made by such Noticee – NSs, the notional ‘buy’ price is determined based on the weighted average price of the scrip during the pre-examination period i.e., January 01, 2022 to April 11, 2022, which is INR 7.52. In case of VCs, the average buy price is taken as the cost of acquisition. The Noticee Net Sellers held shares of Sharpline at the start of the Examination period and the Noticee VCs and MMDs bought and sold Sharpline shares during the Examination period. In both the cases, the shares sold by them in Patch 2 i.e., after the videos were uploaded are taken into account for illegal profits calculation. Accordingly, the alleged illegal profits made after the videos were uploaded, is computed and recorded in the table below:

TABLE 15

|

NS/VC /MMD |

Name of the NS/VC/MMD | Sale Consideration (INR) | Cost of Acquisition (INR) | Profit in Patch 2 (in INR) |

| NS 1 | Gaurav Gupta | 2,57,04,250 | 37,55,000 | 2,19,49,250 |

| NS 2 | Arpan Gupta | 2,16,11,857 | 30,67,497 | 1,85,44,360 |

| NS 3 | Kailash Agarwal | 88,13,485 | 16,89,750 | 71,23,735 |

| NS 4 | Renuka Aggarwal | 67,23,325 | 17,69,300 | 49,54,025 |

| NS 5 | Gunjan Agarwal | 66,63,950 | 16,75,481 | 49,88,469 |

| NS 6 | Bhim Singh Chaudhary | 84,46,835 | 16,70,975 | 67,75,860 |

| NS 7 | Suman Lata | 90,72,587 | 16,67,220 | 74,05,367 |

| NS 8 | Bimla Chaudhary | 86,77,540 | 16,67,220 | 70,10,320 |

| NS 9 | Nitesh Agarwal | 68,74,660 | 16,59,710 | 52,14,950 |

| NS 10 | Rajesh Kumar Singh | 74,50,725 | 14,94,490 | 59,56,235 |

| NS 11 | Subhash Agarwal | 52,33,966 | 13,79,174 | 38,54,792 |

| NS 12 | Vivek Rana | 53,31,890 | 13,66,820 | 39,65,070 |

| NS 13 | Ashok Kumar Agrawal | 71,51,108 | 12,06,369 | 59,44,739 |

| NS 14 | Anshu Aggarwal | 67,91,165 | 22,32,799 | 45,58,366 |

| NS 15 | Anshul Aggarwal | 26,40,990 | 4,89,652 | 21,51,338 |

| NS 16 | Hemant Dusad | 23,72,400 | 4,88,150 | 18,84,250 |

| NS 17 | Anshul Aggarwal Co HUF | 19,66,833 | 3,78,129 | 15,88,704 |

| MMD1 | Manish Mishra | 10,60,950 | 9,48,832 | 1,12,117 |

| MMD2 | Manjari Tiwari | 4,95,424 | 3,99,512 | 95,912 |

| VC 1 | Jatin Manubhai Shah | 4,94,91,156 | 4,76,40,894 | 18,50,262 |

| VC 2 | SL Gupta | 39,68,225 | 8,36,831 | 31,31,394 |

| VC 3 | Angad Ishwarlal Rathod | 2,57,94,039 | 2,57,43,558 | 50,481 |

| VC 4 | Heli Jatin Shah | 2,06,89,369 | 2,05,87,675 | 1,01,694 |

| VC 5 | Daivik Jatin Shah | 1,12,10,500 | 1,10,78,500 | 1,32,000 |

| Total | 11,93,43,690 | |||

| Add – Arpan Gupta sold 1,91,205 shares at an avg. sell price of INR 18.4 in Patch 3 | 20,80,441 | |||

| Grand Total | 12,14,24,131 | |||

29. I note that in fact, many of the Noticees in this case appear to have engaged in the same modus operandi in at least one other scrip as well, which are addressed separately through other orders. For instance, with respect to another scrip – Sadhna Broadcast Limited (“Sadhna”)-

(i) Manish Mishra (MMD 1) is noted to have played the role of MMD therein by publishing misleading messages about Sadhna through two YouTube Channels other than those mentioned in this Order and was as Volume Creator and Profit maker in Sadhna;

(ii) Net Seller – Gaurav Gupta (NS 1) is a promoter & Net Seller in Sadhna and was a director of a Net Seller company in Sadhna – Sadhna Bio Oils Pvt. Ltd.;

(iii) Net Seller – Arpan Gupta (NS 2) is a director of Sadhna Broadcast Limited and a director of a Net Seller company in Sadhna – Sadhna Bio Oils Pvt. Ltd.;

(iv) Director of Sharpline’s RTA and Net Seller – Subhash Agarwal (NS 11) is a director of Sadhna’s RTA and played the role of Information Carrier between Manish Mishra (MMD) and other Net Sellers in Sadhna;

(v) Director of Sharpline’s RTA and Net Seller – Bhim Singh Chaudhary (NS 6) is a director of Sadhna’s RTA and was a Net Seller in Sadhna;

(vi) Jatin Manubhai Shah (VC 1) was a Volume Creator in Sadhna and acted as a dealer for alleged fraudulent trades carried out by other noticees in Sadhna;

(vii) Heli Jatin Shah (VC 4) was a Volume Creator in Sadhna;

(viii) Daivik Jatin Shah (VC 5) was a Volume Creator in Sadhna and is a director of Net Seller company in Sadhna – Karavan Tradelink OPC Private Limited; and,

(ix) Angad Ishwarlal Rathod (VC 3) was a Volume Creator in Sadhna.

30. I note that the proceeds from the prima facie fraudulent trades could not have been generated by the Net Sellers, unless the Noticees (i.e. MMDs and VCs) had played their respective roles in the alleged manipulative scheme in violation of SEBI Act and PFUTP Regulations. Based on the probable conclusions drawn from the preliminary examination, I find that all of the Noticees have participated in perpetration of the alleged fraudulent scheme. However, as noted in paragraph 29 above, certain Noticees are observed to have played a more significant role in the alleged fraudulent scheme and are also seen to be repeat offenders adopting similar modus operandi in at least one other scrip. The factual matrix leads me to conclude that these Noticees bear a higher and overall liability for the alleged fraudulent scheme which resulted in gain for the Noticees at the cost of several thousand small investors who entered the scrip of Sharpline at artificially inflated prices. The observations at paragraphs 25 and 29 above also prima facie suggests that these Noticees were effectively the orchestrators and ultimate beneficiaries of the alleged fraudulent scheme.

31. In view of the above and pending further investigation inter alia into the role of all the Noticees in the alleged fraudulent scheme, I find the following – while all the Noticees are individually liable to disgorge the illegal gains individually made by them, the Noticees listed at paragraph 29 above i.e., Noticee nos. 1, 3, 5, 6, 7, 8, 9, 13 and 18 are jointly and severally liable for all of the illegal gain cumulatively made by all the Noticees as tabulated in Table – 15 above.

NEED FOR INTERIM DIRECTIONS

32. As the securities market regulator, it is SEBI’s bounden duty to safeguard the interests of investors and protect the integrity of the securities market. Fraudulent and manipulative practices distort fair price discovery thereby defeating one of the basic purposes of an organized securities market. Further, such activities cause monetary loss to investors who have been unfairly induced to trade thereby upending confidence in the integrity of the securities market. This has a negative effect on the securities market and its development. The aforesaid paragraphs have brought out the connection /relation between the Noticees. The material available on record leads me to prima facie conclude that fraudulent and unfair trading activity has been carried out by NSs through the coordinated involvement of MMDs and VCs.

33. I note that the elaborate modus operandi adopted by the Noticees, including the egregious misuse of patently false and misleading YouTube videos, had led to sharp increase in the number of small shareholders (i.e., from 517 to 20,009 shareholders) who ended up buying shares from the Noticee Net Sellers at inflated prices. The financial impact that the fraudulent activity has had on small investors is undoubtedly a matter of grave concern. The pattern of false YouTube video uploads and artificial interest created in the scrip, lay bare the noticees’ utter disregard for the law. Persons who engage in such coordinated manner of fraudulent trading have the propensity to continue to manipulate the securities market causing loss to unsuspecting small shareholders. It is observed that even as on February 20, 2023, both the YouTube Channels have one video recommending the same stock. Considering the alleged illegal conduct in the extant matter, there is a high probability that the creators of the said YouTube Channels might be executing the same modus operandi vis-à-vis other scrips also. It has been noted that Manish Mishra (MMD 1) engaged in manipulation by operating as an MMD and also as a VC in at least one other scrip as on date i.e., Sharpline Broadcast Limited through two other YouTube Channels created and operated by him. Therefore, as on date, MMD 1 has at least 4 YouTube Channels to disseminate misleading information. The viewership of all these channels cumulatively number more than 5 crores. As on February 20, 2023, these channels continue to disseminate messages about other scrips making similarly worded outlandish claims. The YouTube Channels have lakhs of subscribers who are therefore susceptible to being defrauded if the Channel creators – Manish Mishra (MMD 1) and Manjari Tiwari (MMD 2) continue to upload videos with false and deceptive information.

34. The repeat involvement of the noticees mentioned at paragraph 29 above, in similar activity raises serious concern that these entities are acting with impunity. The involvement of persons such as directors of the RTA for Sadhna and a dealer of a stock broker is all the more disconcerting. Being associated with registered intermediaries, the said Noticees are expected to maintain high standards of good conduct in the securities market. On the contrary, these Noticees have misused their position to engage in a prima facie fraudulent conduct. The possibility that these Noticees would be able to continue facilitating such schemes is an area of concern that needs to be immediately addressed.

35. Considering all of the above, pending detailed investigation, I find it necessary to pass interim preventive directions against the Noticees.

36. Further, as noted in the preceding paragraphs, the Noticee NSs and certain VCs through the coordinated involvement of MMDs and VCs, are alleged to have made illegal gains by way of the alleged fraudulent and manipulative scheme. Considering the probability that the said Noticees may divert the alleged unlawful gains before investigation is concluded and directions for disgorgement, if any, are passed, non-interference at this stage would result in irreparable injury to interest of the securities market and the investors. Considering the facts and circumstances of the case and the prima facie conclusion that a manipulative scheme has been employed, I am convinced that, pending detailed investigation, the balance of convenience lies in passing interim directions against the Noticees inter alia for impounding and retaining the alleged unlawful gains.

ORDER:

37. In view of the above, pending investigation, in order to protect the interests of investors and the integrity of the securities market, I, in exercise of the powers conferred upon me under Sections 11(1), 11(4) and 11B (1) read with Section 19 of the SEBI Act hereby issue by way of this interim ex-parte order, the following directions, which shall be in force until further orders: –

37.1. All the Noticees are restrained from buying, selling or dealing in securities either directly or indirectly, in any manner whatsoever until further orders. If the Noticees have any open position in any exchange traded derivative contracts, as on the date of this Order, they may close out / square off such open positions within 3 months from the date of this Order or at the expiry of such contracts, whichever is earlier. The said entities are permitted to settle the pay-in and pay-out obligations in respect of transactions, if any, which have taken place before the close of trading on the date of this Order;

37.2. The liability for the illegal gain made by each Noticee mentioned in Table no. 15 above shall be borne by them individually. In view of the observations made at paragraph 31 above, the liability for the total illegal gain in Table no. 15 shall be borne by Noticee nos. 1, 3, 5, 6, 7, 8, 9, 13 and 18, jointly and severally. Accordingly, the proceeds in the bank accounts of Noticees, to the extent of their liability shall be impounded.

37.3. The Noticees are directed to open an escrow account with a Scheduled Commercial Bank and deposit the impounded amount mentioned therein within 15 days from the date of service of this Order. The escrow account/s shall be an interest bearing escrow account and a lien shall be created in favour of SEBI. Further, the monies kept therein shall not be released without permission from SEBI;

37.4. The banks where Noticees are holding bank accounts, individually or jointly, are directed to ensure that till further directions, except for compliance of direction at paragraph 37.2 above, no debits are made in the said bank accounts without the permission of SEBI. The banks are directed to ensure that all the directions at paragraph 37.2 and 37.3 are strictly enforced. On production of proof of deposit of entire amount mentioned in 37.2 above, SEBI shall communicate to the banks to defreeze the accounts.

37.5. All the Noticees are directed not to dispose of or alienate any assets, whether movable or immovable, or create any interest or charge on any of such assets held in their name, jointly or severally, including money lying in bank accounts except with the prior permission of SEBI until the impounded amount is deposited in the escrow account.

37.6. All the Noticees are directed to provide a full inventory of all assets held in their name, jointly or severally, whether movable or immovable, including details of all bank accounts, demat accounts and mutual fund investments, or any interest or charge on any of such assets, immediately but not later than 15 days from the date of receipt of this order;

37.7. The Depositories are directed to ensure, that till further directions, no credits or debits are made in the demat accounts of Noticees, held individually or jointly.