Case Law Details

Abu Dhabi Investment Authority Vs DCIT (ITAT Mumbai)

Abu Dhabi Investment Authority (ADIA) faced a crucial tax dispute with the Income Tax Department in Mumbai. The dispute revolved around the denial of tax treaty benefits under the India-UAE Double Taxation Avoidance Agreement (DTAA) for certain income earned in India during the assessment year 2019-20.

The crux of the matter lay in ADIA’s claim for tax exemption on its income in India under Article 24 of the India-UAE DTAA. The ITAT Mumbai examined whether ADIA qualified as a government entity, thus making its income exempt from Indian taxation.

The dispute arose primarily from the Income Tax Department’s contention that ADIA’s identity was questionable, citing a mobile number provided in the return of income, which was flagged as fraudulent on True Caller. This led the department to challenge ADIA’s status as a government entity entitled to tax treaty benefits.

However, the ITAT Mumbai found the department’s reasoning flawed. It ruled that the mere presence of a mobile number tagged as fraudulent on True Caller couldn’t be used to discredit ADIA’s claim. Instead, the tribunal emphasized the need to verify crucial details such as ADIA’s registration, residency certificate, and the nature of its operations.

In a significant victory for ADIA, the ITAT Mumbai upheld its claim for tax treaty benefits under Article 24 of the India-UAE DTAA. The tribunal emphasized that ADIA’s status as a government entity entitled it to tax exemption in India. This ruling sets a precedent for similar cases and underscores the importance of thorough verification before disputing tax treaty benefits.

In conclusion, the case of Abu Dhabi Investment Authority vs. DCIT (ITAT Mumbai) highlights the importance of substantiating claims with concrete evidence and the risks associated with relying on superficial factors like caller ID tags.

FULL TEXT OF THE ORDER OF ITAT MUMBAI

The aforesaid appeal has been filed by the assessee against order dated 31-07-2023, passed by ld. CIT (A)-55 Mumbai for quantum of assessment passed u/s. 143(1)/154 for the assessment year 2019-20.

2. The effective ground raised by the assessee reads as under:-

“Ground No. 3: Denial of benefit under the Double Taxation Avoidance Agreement (‘DTAA’) between India-UAE (‘treaty’) with respect to income earned by the Appellant in India

3.1 On the facts and in the circumstances of the case and in law, the Ld. CIT(A) erred in denying the benefits of the DTAA between India and UAE with respect to capital gains and interest income earned by the Appellant during the impugned year.

3.2 While doing so, the Ld. CIT (A) erred in:

a) Disregarding the fact that the Appellant is a ‘Government within the meaning of Article 24(2) of the DTAA between India and UAE and therefore, eligible for treaty benefits in respect of its entire income earned in India under Article 24(1) of the said treaty;

b) Disregarding the fact that the Appellant is categorically recognised as a ‘Resident of UAE in terms of Article 4 of the DTAA between India and UAE;

c) Treating the Appellant as a private assessee, as against Government as defined under Article 24 of the DTAA between India and UAE and determining the treaty benefits considering it as a private company with respect to the income earned in India.

The Appellant prays that the claim of the Appellant be allowed the benefit under Article 24 of the DTAA between India and UAE and accordingly, the entire income of the Appellant in India be exempt from tax.”

3. Abu Dhabi Investment Authority holds a valid registration, as a Category 1 Foreign Portfolio Investor (FPI) obtained in accordance with the Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations 2019 (the ‘FPI Regulations”). ADIA is a tax resident of United Arab Emirates (UAE) and holds a valid Tax Residency Certificate for calendar year 2018 and 2019. For the assessment year under consideration, the Appellant had electronically uploaded its return of income on 30 October 2019, declaring total income of Rs 365,40,12,280 and claiming a tax refund of Rs 1,18,99,120. During the year under consideration, the Appellant had the following streams of income-

|

Particular |

Amount (Rs.) |

| Interest income from securities debt | 3,65,40,12,282 |

| Dividend income from companies Indian | 6,99,68,88,663 |

| Long-term capital gain | 12,20,13,91,189 |

| Short-term capital gain | 2,90,65,91,616 |

The return of income was processed by the Assistant Director of Income Tax Centralized Processing Centre (CPC) (hereinafter referred to as ‘Ld AO, CPC), Income Tax, Department, Bengaluru, and a intimation under section 143(1) of the Act was issued on 31 March 2021, wherein the Ld AO had made addition to the total income and raised tax demand of Rs 1,46,14,53,649/- (including interest). In response to the aforesaid intimation, the Appellant had filed a request with CPC on the income tax portal to reprocess the return of income on 29 April 2021. On reprocessing the return, CPC issued a rectification order dated 24 May 2021 under section 154 of the Act. In the said rectification order the Ld AO has erroneously shown a total income of Rs 9,41,82,13,620/- and raised tax demand of Rs 1,89,51,00,510. In so far as loss on long term capital gain and loss on short term capital gain which was treated as gains and the intimation u/s. 154, accepted the contention of the assessee that there was an error on the part of the CPC, because the assessee had declared total long term capital loss of Rs. (-) 1220.14 crores and short term capital loss of Rs. (-) 290.66 crores. However, in so far as interest amount of Rs. 365.40 crores which was claimed exempt u/s. 24 of India-UAE DTAA which was denied, same was upheld and was held by him that it is taxable @ 20%.

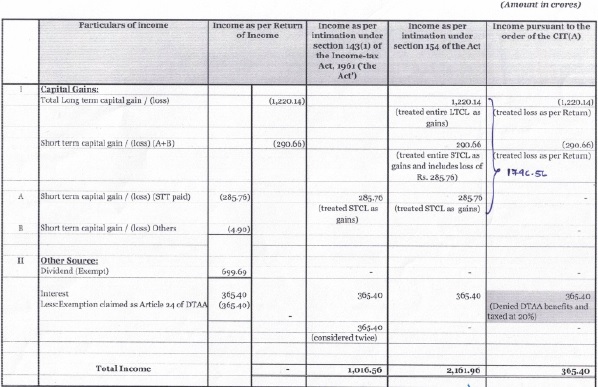

3.1 In a summary manner, the details of income shown in the return of income, income determined and the intimation u/s. 143(1), income determined as per intimation u/s. 154 and income pursuant to the order of CIT(A) is as under:-

4. As noted above, ld. CIT (A) has corrected serious lapse and error made by the CPC by treating long term and short term capital gain. The only issue now is assessee had interest income which has been claimed as exempt by virtue of benefit provided under Article 24 of the DTAA as per Article 24(1), and especially Article 24(2)(b)(ii) of India UAE-DTAA provides any income including material gain earned from India is not taxable in India. The said Article reads as under:-

“[1 Notwithstanding the provisions of Article 13, the Government of one Contracting State shall be exempt from tax, including capital gains tax, in the other Contracting State in respect of any income derived by such Government from that other Contracting State.]

2 For the purposes of paragraph (1) of this Article, the term “Government”-

(a) in the case of India, means the Government of India, and shall include:

(i) the political sub-divisions, the local authorities, the local administrations, and the local Governments,

(ii) the Reserve Bank of India,

(iii) any such institution or body as may be agreed from time to time between the two Contracting State.

(b) in the case of UAE means the Government of United Arab Emirates, and shall include;

(i) the political sub-divisions, the local authorities, the local administrations, and the local Governments,

(ii) The Central Bank of the United Arab Emirates, Abu Dhabi Investment Authority and Abu Dhabi Fund for Economic Development.

(iii) any such institution or body as may be agreed from time to time between the two Contracting States.”

Thus, it was claimed that Abu Dhabi Investment Authority is exempt from taxation in India. However, Ld. CIT (A) held that assessee could not make out a case that it is the same company which is mentioned in Article 24(2)(b). His reason and the basis for denying the benefit was that in the return of income, the mobile no. was given ‘9999999999 ‘and from the true caller it was mentioned that it is a fraud having several spam reports. Based on his presumption, he has doubted the entire claim of the assessee that it is an authority provided in Article 24. The relevant observation in the impugned appellate order reads as under:-

“From perusal of Article 24, it is seen that Abu Dhabi Investment Authority is exempt from taxation in India. However from perusal of the return of the income of the appellant, it is seen that (1) it was incorporated on 20.03.1976, (ii) the appellant has taken PAN in India which is AAACA4380N, (iii) the address provided is Corniche Street, PO Box No. 3600, Abu Dhabi, United Arab Emirates, (iv) the type of company is shown as foreign company, (v) it is mentioned as private company and (vi) contact No. is 9999999999.

During the appellate proceedings, the appellant has not made out a case that the appellant company is the same company which is mentioned in the Article 24(2)(b) of the India-UAE DTAA. The AR has also not explained the profile as well as business activities of the appellant company The contact No. 9999999999 has been mentioned in ITR as well as Form No. 35. The contact No. prima facie appeared to be wrong. From search carried out in ‘True caller’ it was noticed that mobile no. 9999999999 is in the name of Raj Esh Rk J ‘ and it was reflected as “Likely fraud” having 6884 spam reports. Further it is not explained that how the income earned by the appellant company in India is the income earned by the Government of UAE or the institutions mentioned therein it seriously raised doubt about the appellant company being the company name of which appeared in Article 24(2)(b)(ii) of India- UAE DTAA. Thus, from the details available in the ITR for A.Y.2019-20, I am constrained to consider the appellant company as a private company and not the institute mentioned in the Article 24(2)(b) of the DTAA.”

Thereafter, he proceeded to tax the interest income of Rs. 3,65,40,12,800/- @ 20%. He further held that even short term capital loss and long term capital loss are also taxable in India and allowed to be carried forward for the subsequent year.

5. Before us, the learned counsel submitted that from the bare perusal of the return of income itself, it can be seen the share holder is the Department of Finance of Abu Dhabi and its address is that of building and address of Government of Abu Dhabi. Further, even the email address mentioned in the return of income including the PAN mentions that assessee was Abu Dhabi Investment Authority and is a tax resident of United Arab Emirate. In so far as mobile number is concerned, he submitted that since return of income is not uploaded if the mobile number is not mentioned and since assessee does not have any mobile number in India, therefore, like all the assessee in such circumstances been mention 9999999999. Apart from that ld. CIT (A) did not even confront this issue to the assessee whether assessee is an Authority mentioned Article 24(2)(b). Thus, such an order of ld. CIT(A) cannot be upheld. On the other hand, Ld. D.R. submitted that matter may be restored to the file of CIT (A) to examine the tax residency certificate an applicability of Article 24.

6. After going through the order of ld. CIT (A) and the material referred to before us, we find that ld.CIT(A) has denied the benefit of Article 24 disbelieving the assessee is not Abu Dhabi Investment Authority as mentioned in Article 24(2)(b)(ii) on a very flimsy ground. The reason given by him is that mobile number was mentioned “9999999999” which he tried to find it from True Caller that it is a fraud number and therefore the Abu Dhabi Investment Authority is a fraud company rather it is not company belonging to Abu Dhabi Government. Once, all the other details have been provided, and if that is doubted, then, he should have verified the PAN and the address provided in the return to see whether it is an Abu Dhabi Government owned company i.e. Abu Dhabi Investment Authority. If he was incapable of himself verifying then, he should have asked from the assessee itself. It is really surprising that first appellate authority will deny the status of the Government owned authority simply by looking the mobile number in the true caller. Such an approach is to be frowned upon and is liable to be rejected at the threshold. If the assessee i.e. Abu Dhabi Investment Authority had shown its valid registration as category of foreign portfolio investor obtained with SEBI and holds a valid residency certificate and given the particulars of income, then, we do not find any reason to doubt that it is not authority as mentioned in Article 24.

7. Accordingly, we hold Abu Dhabi Investment Authority is liable to benefit provided under Article 24 which provides that Government of one contracting state shall be exempt from tax in other contracting states in respect of any income derived by such income from that other contracting states. Since Abu Dhabi Investment Authority has been specifically mentioned in Article 24(2)(b)(ii), therefore, none of its income is taxable in India. In the result, charging of interest of Rs. 365.40 crores is held to be nontaxable in India.

8. In the result, the appeal of the assessee is allowed.

Order pronounced on 26th February, 2024