IN THE PREVIOUS ARTICLE , I HAVE LISTED OUT ALL MAJOR DEDUCTIONS FOR AY 2019-20. After Budget 2019 speech , Here is summary of Income Slabs & deductions under Income Tax which will be applicable from 1-4-2020 i.e for AY 2020-21 RETURN FILLING. This chart of Deductions & Slab rates will help you to plan your Income & Investments and help you to minimize your Tax FOR AY 2020-21. Article contains List of All popular deductions with latest limits applicable to coming Income tax return filling season i.e for AY 2020-21.

This chart of Deductions & Slab rates will help you to plan your Income & Investments and help you to minimize your Tax before March 2020. This summary will cover maximum issues related to coming return filling season. I hope this will be helpful in your Tax planning.

A good news – under House property , Now 2 residential house can be claimed from AY 20-21 as self -occupied ( No notional Rent)

FINANCIAL YEAR 2019-2020 / ASSESSMENT YEAR 2020-2021

SUMMARY OF SLAB & DEDUCTIONS UNDER INCOME TAX

This chart of Deductions & Slab rates will help you to plan your Income & Investments and help you to minimize your Tax before March 2020. This summary will cover maximum issues related to coming return filling season.

| CATEGORY | <60 | <80 | >80 |

| BASIC EXEMPTION LIMIT | ₹ 2,50,000 | ₹ 3,00,000 | ₹ 5,00,000 |

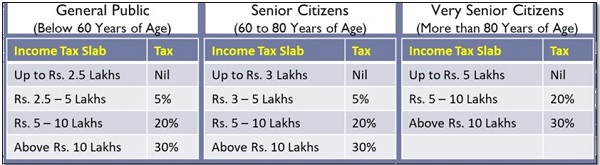

A. INCOME TAX SLABS FOR FY 2019-20 / AY 2020-21

1. Education + Health Cess of 4%

2. Tax Rebate : Tax rebate maximum upto Rs. 12500 for Total income upto Rs. 5,00,000

CONSIDERING REBATE , LETS RECALCULATE THE MAXIMUM TOTAL INCOME AT WHICH , THERE IS NO TAX

| CATEGORY | <60 | <80 | >80 |

| Basic Exemption Limit | ₹ 2,50,000 | ₹ 3,00,000 | ₹ 5,00,000 |

| Recalculating The Maximum Total Income At Which , There Is No Tax | |||

| Total Income After Deductions | ₹ 5,00,000 | ₹ 5,00,000 | ₹ 5,00,000 |

| Tax On Total Income | ₹ 12,500 | ₹ 10,000 | ₹ 0 |

| Less: Rebate 87A | -₹ 12,500 | -₹ 10,000 | ₹ 0 |

| Actual Tax Liability | ₹ 0 | ₹ 0 | ₹ 0 |

| So, Effective Tax Exemption Limit At Which , There Is No Tax | ₹ 5,00,000 | ₹ 5,00,000 | ₹ 5,00,000 |

B. POPULAR DEDUCTIONS UNDER INCOME TAX AVAILABLE TO ALL INDIVIDUALS

PLAN MAXIMUM DEDUCTIONS / INVESTMENTS BEFORE MARCH 2020 TO MINIMIZE YOUR TAXABLE INCOME & ALSO TAX

| 24 | 24 => Home loan interest | ₹ 2,00,000 |

| 80C | 80C => LIC / PPF / KVP / EPF / SSY / NSC / HOME LOAN PRINCIPAL / SCHOOL FEES/ ELSS/STAMP DUTY | ₹ 1,50,000 |

| 80CCD(1B) | 80CCD(1B) => NPS | ₹ 50,000 |

| 80DD | 80DD => Exp of disabled dependent | 75000/125000 |

| 80U | 80U => own Physical Disability | 75000/125000 |

| 80TTA | 80TTA = > Interest on Savings Account. Only available to Persons other than Senior citizen / Very senior citizen | ₹ 10,000 |

| 80TTB | 80TTB = > Interest on Savings Account. and Interest on deposits with Post Offices, Banks, Co-operative bank. Only available to senior citizen & Very senior Citizen | ₹ 50,000 |

| 80G | 80G => Donation / Contributions made to certain relief funds and charitable institutions Contributions made to certain relief funds and charitable institutions (Only if paid by cheque/ Bank Mode) | 50% of Donation or 10% Total income. W.E.IS HIGHER |

| 80GG

|

80GG => deduction for the rent paid (Available to all Individuals except to those who gets HRA from Employment).

Eligibility will be least amount of the following :- |

|

| 1) Rent paid minus 10 percent the adjusted total income. | ||

| 2) Rs 5,000 per month | ||

| 3) 25 percent of the adjusted total income | ||

| 80D | 80D => Mediclaim For self, spouse and dependent children ( Only if paid by cheque/ Bank Mode ) | 25000/50000 |

| Up to ₹ 25,000 [₹ 50,000 if specified person is a senior citizen or very senior citizen | ||

| 80D | 80D => Mediclaim For Parents ( Only if paid by cheque/ Bank Mode ) | 25000/50000 |

| Upto Rs. 25,000 shall be allowed [Rs. 50,000 if parent is a Senior citizen / Very Senior Citizen | ||

| Note for 80D | Within overall limit, deduction shall also be allowed up to ₹ 50,000 towards medical expenditure incurred on the health of specified person provided such person is a senior citizen and no amount has been paid to effect or to keep in force an insurance on the health of such person. | |

| 80DDB | Where an assessee actually paid any amount for the medical treatment of such severe disease for himself or a dependant, in case the assessee is an individual; or for any member of a Hindu undivided family , the assessee shall be allowed a deduction of the amount as below

for Age<60 – 40,000/- or the amount actually paid, whichever is less. for Age>60 , Rs.1,00,000 or amount actually paid, whichever is less (the assessee has to obtain the prescription for such medical treatment from a neurologist, an oncologist, a urologist, a haematologist, an immunologist or such other specialist,) |

|

| Note for 80DDB | Section 80D covers Mediclaim/medical exp. for any disease , whereas 80DDB covers only Exp for specified severe disease | |

| Section 80EE | INTEREST FOR HOME LOAN 1. SD vaule 50 lacs 2. Loan sanction in FY 16-17 3. HE SHOULD NOT OWN ANY HOUSE BEFORE 4 LOAN < 35 LACS 5 MAX 50000 OVER SECTION 24 i.e 200000 |

|

| Section 80EEA | INTEREST FOR HOME LOAN 1. SD vaule 45 lacs 2. Loan sanction in FY 19-20 OR 20-21 3. HE SHOULD NOT OWN ANY HOUSE BEFORE 4 . Must not claim Deduction in 80EE 5. MAX 150000 OVER SECTION 24 i.e 200000 |

|

| Section 80GGC | Donations made by any individual to political parties if paid by bank mode

Limit – 100% of Donation or 10% Adjusted Total income ..Whichever is Higher |

|

C. ALLOWANCES AND DEDUCTIONS ONLY ALLOWED TO SALARIED INDIVIDUALS

| 1 | HRA EXEMPTION | A salaried individual having a rented accommodation can get the benefit of HRA (House Rent Allowance). However, if you aren’t living in any rented accommodation and still continue to receive HRA, it will be taxable. HRA exemption available to Lower of following three |

| a.Total HRA received from your employer | ||

| b. Rent paid less 10 percent of (Basic salary +DA) | ||

| c. 40 percent of salary (Basic+DA) for non-metros and 50 percent of salary (Basic+DA) for metros | ||

| 2 | STANDARD DEDUCTION | Rs. 50,000 Standard deduction for Assessee who has Salary/ Pension Income |

LET’S FIND BREAK-EVEN INCOME , WHERE YOU HAVE NO TAX TO PAY

ASSUMPTION – THESE CALCULATIONS ARE DONE KEEPING IN MIND SALARIED PERSONS

| FINANCIAL YEAR 2019-2020 / ASSESSMENT YEAR 2020-2021 | ||||

| <60 | <80 | >80 | ||

| GROSS INCOME | 9,35,000 | 10,00,000 | 10,00,000 | |

| DEDUCTIONS FROM INCOME | LESS | |||

| STANDARD DEDUCTION | 50,000 | 50,000 | 50,000 | |

| 24 | 2,00,000 | 2,00,000 | 2,00,000 | |

| 80C | 1,50,000 | 1,50,000 | 1,50,000 | |

| 80TTA | 10,000 | |||

| 80TTB | 50,000 | 50,000 | ||

| 80D | 25,000 | 50,000 | 50,000 | |

| NET INCOME WHERE THERE WONT BE ANY TAX | TOTAL INCOME | 5,00,000 | 5,00,000 | 5,00,000 |

| TAX ON ABOVE INCOME | 12,500 | 10,000 | – | |

| REBATE AS PER 87A | -12,500 | -10,000 | – | |

| ACTUAL TAX LIABILITY | 0 | 0 | 0 | |

Author can be reached at ca.harshilsheth@gmail.com

(Article is been further updated on 06.03.2020)

we submit TDS returns march 2019- march2020 13 months in F.Y. 2019-2020. now we can add the march 2020 in F.Y. 2020-2021.

Sir pls clear my confusion.

I am Having two home loans.

first home loan 20lakhs, sanctioned in 2016-17, possession taken in 2018-19.

Second home loan 25 lakhs, sanctioned in 2018-19. possession taken in 19-20.

first home loan interest estimated for 2020-21 is 1.52 lakhs

second home loan interest estimated for 2020-21 is 2.02 lakhs

second home loan Pre-EMI (only interest as per disbursement, no principle paid till possession) is – 1.8 lakhs.

pls let me know for present financial year what will be my tax rebate?

All type Itr Deductions section what sir please share

For AY 20-20 (FY19-20) my income from company dividends is Rs 95996 and from Mutual Funds it is 2971/-

How much income tax I will attract on the above

Sir ,My CGHS contribution is Rs.7800/ yearly , and have Life Insurance policy of Rs. 48000/-for the yr premium .Husband is Sr Citizen, Will my total deduction 55800/ under 80D Please clarify

I have two 16 B form. One is from my defence pension and another from my present employer , both 16 B shown standard deduction 50,000/. Now how should i fill in itr 1 ?

I am a defence pensioner and also receiving disabled pension./DA Under which head of deductions, I can file income tax for disabled pension and its DA. Also one more querry, both disabled pension and its DA are exempted or only disabled pension is exempted

MY TAXABLE INCOME FROM PENSION IS RS 534200 .AFTER ALL AVAILABLE DEDUCTION FOR A.Y.20-21.MAI I CLAIM TAX REBATE FOR INCOME OF 500000 AND PAY TAX FOR 34200.MY AGE IS 65 YEARS.

What is the standard deduction applicable to a family pensioner above75 but less than 80 years

DEAR SIR ,

SECTION 80E IS FOR INTEREST ON EDUCATIONAL LOAN,HOW EVER IN YOUR ARTICLE YOU MENTION 80E FOR INTEREST ON HOME LOAN.

sir

sec 80tta and 80ttb how to used sir and available for seinior citizen for 80ttb

Dear Sir, i have invested in mutual fund of different schemes in FY 19-20,since i have invested in this year what will be balancesheet value i will show as on 31st narch 2020? should i put value as on 31st march 2020 or the amount invested?

Very nice article and self explanatory!

Excellent article.

can you share this article in pdf file format? can be highly useful. you may use your watermark. that’s alright.

In A,Y 2020-21 I have paid Rs16230 towards payment of Medical Insurance of self and my family.I have also paid Rs 50335 for medical insurance of my parents(one of them is senior citizen) . Plz guide me how much rebate can I claim?

This is very useful and makes it easy to understand the tax system.

When re you updating the FY2020-2021 tax system?

I have paid the premium of 1,20,000 for the period of 3 years. so what was my tax benefits for 3 years

Very good information.

Very very useful information. Liked very much

I WANT TO INVEST IN INFRA BONDS ONLINE MARKET THROUGH MY DE MAT ACCOUNT FOR RS.20000/- . SHALL I GET U/S.80 CCF REBATE FOR RS.20000/-.

Is there any deduction under Section 80CCF for investment in infrastructure bonds upto 20000 for a.y. 2020-21

I am a salaried individual. My mother is undergoing treatment for malignant brain tumor from PGIMER chandigarh. I apply for reimbursement of treatment costs from my employer and get reimbursement for 70 to 80 percent of actual costs for which the employer has specially instructed mr to provide my pan details. I want to know that whether I am eligible to claim deduction under section 80ddb and also what proofs i need to retain with me for any future queries. Please provide detailed answer as I am confused about it. Thanks in advance

What are tax rebates/deductions available for an HIV Positive patient having salary income only.

I want to know about 80D –

My Health insurance Policy Premium – 18000,

In this year expenditure of medical tests – Self – Rs. 6000,

Daughter – Rs. 4000.

Then I want to know how much amount I will show in 80D on my ITR.

How much deduction in education loan paid on interest for exemption in income tax

I take vrs From semi gov.job.at the age of 55 year on oct-18.My query about other income due to(1) extra duty for electoral roll corrections.gov.pay us RS.1000/- per month.(2)Interest on saving with employee credit soc.(3)share dividend income (4)lic money back policy’s installment. Above income not showing in form no -16.So I want to desclose above income in filling of it returns of this year.pl.guide me that which income is exempt or taxable.

IF Tax payer is about 86 year old and he had no mediclam policy then can he eligible of 80 D ? if yes, then what is the limit ?

Dear harshilji

Summary of Slab & Deductions under Income Tax AY 2020-21 part -B B. POPULAR DEDUCTIONS UNDER INCOME TAX AVAILABLE TO ALL INDIVIDUALS

80C 80C => LIC / PPF / KVP / EPF / SSY / NSC / HOME LOAN PRINCIPAL / SCHOOL FEES/ ELSS/STAMP DUTY ₹ 1,50,000

DISCUSS BRIEFLY STAMP DUTY WORD WITH ACTUAL STAMP DUTY DEDUCTIABLE AGAINST WHICH HOME LOAN/ ANY TYPE OF STAMP DUTY

You missed to add RS 50,000/- additional deduction under 80DD (NPS) which is over & above 80C limit. If salaried person having income of RS 9,85,000/- & age is below 60 years then tax will be zero. Plz make the correction

Sir,

What are the items falling under 80 C

krishnamoorthi.k

Whether u/s 80TTA exemption for interest on deposits with post office, bank, co-op. banks available. Information provided above is very very useful.

Sir, I am Sr. Citizen getting bank interest 3.5 lakha

For the FY 2019 (AY 2020-21) have to submit 15 H form before 31 Ist March 2019 not to deduct tax at source.

How to fill up 15 H form not to deduct tax by bank?

Hopping your responds will be appreciated.

Regards

IF I PAID MEDICLAIM RS.75000/- FOR THREE YEARS THEN WILL BE DEDUCTABLE 25000/- PER YEAR….?

It is very important information for submitting individual assessment

It is very useful information who are submitting self assessment