Case Law Details

Rameshwar Prasad Shringi Vs PCIT (ITAT Jaipur)

Assessing officer has carried out exhaustive enquiries and verifications regarding source of cash deposits in the bank account during the financial year relevant to impugned assessment year. The bank statements, the cash book, the ledger accounts, the financial statements for the year under consideration and for the earlier years, the tax returns for the year under consideration and for the earlier years have been called and examined by the Assessing officer. And we find that it is not a case where all these documentation were called for and merely placed on record and the assessment was completed. Rather, the Assessing officer has examined these documentation and raised pointed queries and sought explanation from time to time regarding each and every transaction where cash deposits have been made in the bank accounts as to nature and source of such deposits and such enquiry has not been limited to transactions undertaken during the year under consideration and reflection thereof in the bank and cash book, rather, the Assessing officer has examined the transactions pertaining to cash deposits in the subsequent period i.e, financial year 2016-17 and has asked specific questions regarding deposit of cash during the demonization period as well as earlier financial year and has called for cash ledger and availability of cash in hand during the financial year 2015-16 and 2016-17 to determine the linkage thereof with the transactions undertaken and reflected during the year under consideration.

Now coming specifically to the explanation submitted by the assessee in support of the cash deposits as realization from the advances and investments recorded in the books of accounts of the earlier years, we again find that the Assessing officer has raised specific questions and examined the financial statements and income tax returns right from A.Y 2008-09 onwards wherein the assessee has surrendered an amount of Rs 1,96,37,930/- to tax which includes an amount of Rs 1,59,00,000/- in respect of unexplained advances/investment in the name of assessee and his family members in various schemes of land/plot. Once the said amount was surrendered and offered to tax, the assessee reflected the said amount of Rs 1,59,00,000/-under the head “sundry advances and investments” in his regular books of accounts for the financial year 2007-08 relevant to assessment year 2008-09. The said advances were thereafter regularly reflected in terms of outstanding balances net of recoveries from time to time in the financial statements and balance sheets for the subsequent financial years which were also placed on record and examined by the Assessing officer. If we look at the balance sheet of the financial year 2014-2015 which is the immediately preceding financial year, we note that these advances were standing in the books of assessee at Rs 85,00,000/- which again lends credence to the explanation that out of total advances of Rs 1,59,00,000/-, there were recovery to the extent of Rs 74,00,000/- in the earlier years and the advances to the tune of Rs 85,00,000/- were outstanding at the beginning of the current financial year 2015-16 out of which the advances to the tune of Rs 75,00,000/- were recovered during the year under consideration with remaining advances of Rs 10,00,000/- continues to remain outstanding as on the close of the current financial year 2015-16. The recovery so made from earlier advances as well as cash receipts from other activities represent cash in hand of Rs 85,80,796/- as on the close of the current financial year which has been explained as source of cash deposits during the demonetization period in the subsequent financial year 2016-17. Further, it is noted that the tax returns for all these earlier assessment years including that of the subsequent Assessment Year 2017-18 have been filed by the assessee and accepted by the Revenue which is again a clear affirmation on part of the Revenue that the financial statements represent true and fair view of assessee’s affairs and which have thus not been disputed by the Revenue. In such a scenario, where the past affairs of the assessee as reflected in his financial statements and also disclosed in the tax returns have not been disputed by the Revenue, the assessments have been completed and no adverse material is available on record, it is beyond any reasonable belief that the Assessing Officer will have any apprehension that the debtors and advances so reflected and accepted in the earlier years are not genuine and have to be enquired again afresh in terms of identity, creditworthiness and genuineness of their individual transactions.

In such a scenario, where the assessee has shown recovery from old outstanding advances and debtors and provided the necessary financial and tax filing records and the Assessing officer having examined the same thoroughly, we are of the considered view that the necessary enquiries and examination as reasonably expected have been carried out by the Assessing officer in discharge of his quasi-judicial function and he has taken a prudent, judicious and reasonable view in accepting the explanation of the assessee in support of the cash deposits after considering the entire material available on record and the order so passed u/s 143(3) of the Act cannot be held as erroneous in so far as prejudicial to the interest of Revenue. The impugned order passed by the ld PCIT u/s 263 is accordingly set aside and the order of the Assessing officer is sustained.

FULL TEXT OF THE ORDER OF ITAT JAIPUR

This is an appeal filed by the assessee against the order of ld. Pr.CIT, Udaipur dated 11.03.2021 relevant for A.Y 2016-17 wherein the assessee has raised the following grounds of appeal:-

“1. The Ld. Pr. CIT erred in law as well as on the facts of the case in invoking the provisions of Sec. 263 of the Act and therefore, the impugned order dated 11.03.2021 u/s 263 of the Act kindly be quashed.

2. The ld. Pr. CIT erred in law as well as on the facts of the case in assuming jurisdiction u/s 263 of the Act without recording a specific and categorical finding that the subjected assessment order passed u/s 143(3) dated 10.12.2018 is erroneous and prejudicial to the interest of the revenue, in absence of which the entire proceedings u/s 263 is vitiated.

Therefore, the impugned order dated 11.03.2021 u/s 263 of the Act kindly be quashed.

3. The ld. Pr. CIT erred in law as well as on the facts of the case in assuming jurisdiction u/s 263 of the Act by wrongly and incorrectly holding that the AO failed to examine and verify the claimed recoveries made in cash from the Sundry Debtors and erred in cancelling/ setting aside the subjected assessment order passed u/s 143(3) dated 10.12.2018, with a direction to the AO to examine the identity & creditworthiness of the debtors, genuineness of the transactions w.r.t. recovery of advances o f cash amount of Rs. 85 Lakh and also to make necessary additions wherever required.

The assumption of jurisdiction u/s 263 and the impugned direction, being contrary to the provisions of law and facts on record hence, the proceedings initiated u/s 263 of the Act and the impugned order dated 11.03.2021 deserves to be quashed.

4. The ld. Pr. CIT erred in law as well as on the facts of the case in assuming jurisdiction u/s 263 of the Act by wrongly and incorrectly invoking Explanation 2 to S. 263 as if the same conferred unbridled power upon the Pr. CIT even though the facts and circumstances of the case did not justify the application of the said Explanation.

5. The ld. Pr. CIT erred in law as well as on the facts of the case in wrongly setting aside the assessment order dated 10.12.2018 despite there being complete application of mind by the AO on the subjected issues and it was nothing but a case of change of opinion and/or suspicion, based on which, assumption of jurisdiction u/s 263 is not permissible. The impugned order dt. 11.03.2021 therefore lacks valid jurisdiction u/s 263 o f the Act and hence, the same kindly be quashed. ”

2. Briefly stated, the facts of the case are that the assessee filed his return of income on 17.03.2017 declaring total income of Rs. 5,49,620/- which was selected for scrutiny through manual scrutiny guidelines issued by the CBDT. Thereafter, notices u/s 143(2) and 142(1) were issued by the Assessing calling for necessary information and documentation. Taking into consideration the submissions and information/documentation filed by the assessee, the assessment was completed accepting the returned income vide order passed u/s 143(3) dated 10.12.2018.

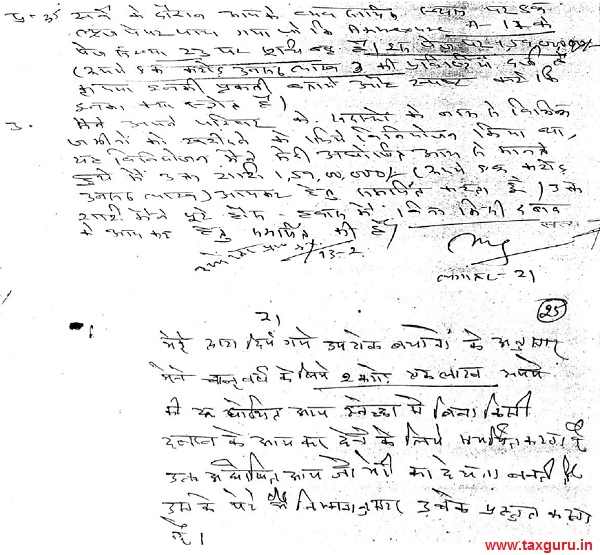

3. Thereafter, the ld. Pr. CIT, Udaipur called for the assessment records and after review thereof, issued a show cause to the assessee dated 29.01.2021 the contents thereof read as under:-

“On examination of assessment record, it is seen that in your case, the ITR for A.Y. 2016-17 has been filed on 17.03.2017 i.e. after the date o f demonetization. As a home work for F.Y. 2016-17 i.e. A.Y. 2017-18, you have shown recovery of sundry advances of Rs. 85,00,000/- as a cash in the month of March, 2016. But the AO during the course of assessment proceeding has not made any enquiry about the persons from whom the sundry advances of Rs. 85,00,000/- are claimed to have been recovered by you in cash in the month of March, 2016. The name and addresses of the persons who as per your claim have paid these amounts of Rs. 85,00,000/-to you are not available on record. The genuineness of this transaction o f Rs. 85,00,000/- being sundry advances recovered from the persons have also not been verified by the AO. Thus, it shows that there was lack o f enquiry on the part of AO as he failed to make enquiry in respect of the persons to whom earlier advances of Rs. 85,00,000/- were claimed to have been given by you and from whom such advances of Rs. 85,00,000/- were claimed to have been received by you in the month of March, 2016 and because of this lack of enquiry, the assessment order in your case for A.Y. 2016-17 is found to be erroneous in so far as it is prejudicial to the interest of Revenue. ”

4. In response to the show-cause, the assessee filed his submissions and necessary information/ documentation which were considered but not accepted by the ld PCIT and the assessment order passed u/s 143(3) was held as erroneous and prejudicial to the interest of the Revenue and the assessment order was set aside and the Assessing Officer was directed to examine the matter afresh after providing reasonable opportunity to the assessee. Against the said findings and order of the ld PCIT, the assessee is in appeal before us.

5. During the course of hearing, the ld. AR raised various contentions as are contained in his written submissions and the contents thereof read as under:

“1. Legal Position on Sec.263 – Judicial Guideline: Before proceeding, we may submit as regards the judicial guideline, in the light of which, the facts of this case are to be appreciated.

1.1 The pre-requisites to the exercise of jurisdiction by the CIT u/s 263, is that the order of the Assessing Officer is established to be erroneous in so far as it is prejudicial to the interest of the Revenue. The CIT has to be satisfied of twin conditions, namely

(i) The order of the Assessing Officer sought to be revised is erroneous; and

(ii) it is prejudicial to the interests of the Revenue. If any one of them is absent

i.e. if the assessment order is not erroneous but it is prejudicial to the Revenue, Sec.263 cannot be invoked.

This provision cannot be invoked to correct each and every type of mistake or error committed by the Assessing Officer; it is only when an order is erroneous as also prejudicial to revenue’s interest, that the provision will be attracted. An incorrect assumption of the fact or an incorrect application of law will satisfy the requirement of the order being erroneous. The phrase ‘prejudicial to the interest of the Revenue’ has to be read in conjunction with an erroneous order passed by the AO. Every loss of Revenue as a consequence of the order of the AO cannot be treated as prejudicial to the interest of the Revenue. For example, if the AO has adopted one of the two or more courses permissible in law and it has resulted in loss of revenue, or where two views are possible and AO has taken one view with which the CIT does not agree, it cannot be treated as an erroneous order prejudicial to the interest of the Revenue, unless the view taken by the AO is totally unsustainable in law. Kindly refer Malabar Industrial Co. Ltd. v/s CIT (2000) 243 ITR 83 (SC).

1.2 Also kindly refer CIT v/s Max India Ltd. (2007) 295 ITR 282 (SC) wherein it is held that:

“The phrase “prejudicial to the interests of the Revenue” in S. 263 of the Income Tax Act, 1961, has to be read in conjunction with the expression “erroneous” order passed by the Assessing Officer. Every loss of revenue as a consequence of an order of the Assessing Officer cannot be treated as prejudicial to the interests of the Revenue. For example, when the Assessing Officer adopts one of two courses permissible in law and it has resulted in loss of revenue, or where two views are possible and the Assessing Officer has taken one view with which the Commissioner does not agree, it cannot be treated as an erroneous order prejudicial to the Revenue, unless the view taken by the Assessing Officer is unsustainable in law. “

Ratio of these cases fully apply on the facts of the present case in principle. 2. Due application of mind:

2.1 It is submitted that the AO had raised very specific and relevant queries/called for explanation and evidences w.r.t. cash recoveries made from the Sundry Advances (debtors), to the extent he was supposed to act in law. The AO after making a detailed enquiry relating to the issue in hand and examination of books of account, in particular cash book for the current year (PB 23-26) and other records being Balance Sheets starting right from A.Y. 2008-09 to 2015-16 (PB 23-50) took a possible view that the assesse was having sufficient cash available immediately prior to the subjected cash deposits (i.e. 08.11.2016 and onwards) and completed the subjected assessment without any variation. The relevant para of the assessment order, wherein the AO has examined each any every documents submitted by assessee during scrutiny proceedings, is reproduced below:

“The case was selected for scrutiny through manual scrutiny guidelines issued by the CBDT. The first notice u/s 143(2) issued on dated 28.07.2017 by the DCIT, Central Circle Kota which was served upon the assesse and hearing was fixed on 16.08.2017. Further, notice u/s 142(1) issued on 28.08.2017 and 23.10.2017 along with questionnaire/ Annexure-A requiring certain details/information, which was served upon assesse. Thereafter, notice u/s 142(1) issued on 21.12.2017. Notice under sub-section (1) of section 142 issued on 07.06.2018 through e-proceeding. In response to that, Shri P.Khandelwal, FCA and AR of the assessee attended the proceeding and filed written submission, which is placed on record. Later no, notice have been issued through e-proceedings portal. AR/assesse complied on e-proceedings portal and uploaded all the replies.”

2.2 This is also evident from queries raised and the replies given thereto, reproduced hereunder:

2.2.1 Through the Notice/s u/s 142(1) dated 07.06.2018 (PB 10) & dated 23.10.2017 (PB 03), following informations were called for:

“1. Submit copies of your Capital A/C, P & L A/C, and Balance Sheet.

Similar queries were raised and explanation called for vide Notice u/s 142(1) dated 23.10.2017 through Pr. 12

2. Explain the credit entries and all cash deposits in the bank accounts. Explain the purpose of the debit entries and all cash withdrawals in the following format for all bank accounts: –

Name of the Bank

Account Number

| S. No. | Date | Amount of Debit entry/cash withdrawal | Purpose of Debit entry | Amount of Credit entry/cash deposit | Explanation of Credit entry. |

Similar queries were raised and explanation called for vide Notice u/s 142(1) dated 23.10.2017 through Pr. 4.

3. Kindly furnish the details of additions made to your Capital Account. Kindly furnish evidences to substantiate these additions.

Similar queries were raised and explanation called for vide Notice u/s 142(1) dated 23.10.2017 through Pr. 13.

4. Kindly explain whether any function/ceremony (marriage, birthday party etc.) was organized in your family during this AY. If yes, furnish details of the expenses incurred for the same with proper evidences and get the verified with your regular books. ”

Similar queries were raised and explanation called for vide Notice u/s 142(1) dated 23.10.2017 through Pr. 15, 16, 17& 18.

x x x

7. Kindly explain the source of all the movable and immovable held by you during the financial year 2015-16 with supporting documents. If any other immovable properties purchased and sold, kindly explain the same with books of accounts. ”

Similar queries were raised and explanation called for vide Notice u/s 142(1) dated 23.10.2017 through Pr. 8,9,10 & 11.

8. It is also requested to upload all the previous replies on e-proceedings portal.

- If you have deposited cash amounts in demonetized currency during the period beginning from 8th November, 2016 to 30th December, 2016 and cash in hands shown during the financial year 2015-16. Kindly submit cash ledger account of FY 2015-16 and 2016-17. ”

2.2.2 Reply dated 07.07.2018 filed to the above notice/s (PB 13), was as under: “With reference to you notice we hereby submit following documents:

1. Copy of P&L A/c and Balance Sheet are being submitted.

2. There is no addition in Capital except income earned during the year. Income can be verified from the Income & Expenditure Account. ”

x x x x

“5. Uploaded all previous replies.

6. The assesse has deposited demonetized currency during 8.11.2016 to 30.12.2016, cash is verifiable from the Balance Sheet as at 31.03.2016.

7. Ledger account for explanation of bank entries. ”

2.2.3 Reply dated 25.10.2018 submitted to the above notice/s (PB 14), was as under:

“1. Computation of Income-Shri Rameshwar Pd. Shringhi, M/S RP Shringh i & Sons and M/S Khandelwal Shringhi & Co. for AY 2016-17.

x x x x

3. A survey u/s 133A of the I.T Act, 1961 was carried out on 13/14.02.2008 No incriminating documents relating to the assesse found during the survey. Computer hard disk impounded during the survey consists of regular accounting of the assesse and his family concerns/members.

2.2.4 Reply dated 12.11.2018 submitted to the above notice/s (PB 15), was as under:

“1. Scan copy of Cash Book for the year 2015-16.

2. The assesse has deposited SBN of Rs. 85,00,000/- with SBBJ Gumanpura, Kota on 16.11.2016. We further clarify that the assesse surrendered and declared income of Rs. 1,96,37,930/- during the survey proceedings on 13/02/2008. Out of such amount, Rs 1,59,00,000/- were in the nature of Sundry Advances and Investments. Cash realization from the Advances and Investments were recorded in the cash book for the year 2015-16, hence cash in hand as on was of Rs. 85,80,796/- which is verifiable from the Cash Book. In support of evidences, we are also submitting Income & Expenditure for the year 2007-08 and Balance Sheet as at 31.03.2008, Income Tax Asstt. Order U/s 143(3) of the IT Act, 1961 with notice of demand, Copy of ITR, Computation of Income for the AY 2008-09. ”

2.2.5 Reply dated 22.11.2018 submitted to the above notice/s (PB 16), was as under:

“1. Copy of ITR, Balance Sheet and income & Expenditure Account for F.Y. 2014-15.*A.Y. 2015-16).

2. It is already clarified that the assesse surrendered and declared income of Rs. 1,96,37,930/- during the survey proceedings on 13/02/2008. Out o f such amount, Rs. 1,59,00,000/- were in the nature of Sundry Advances and Investments as per Balance Sheet as at 31.03.2008. Cash hand/Sundry Advances/Investments of Rs. 85.00 Lakhs or more have been continuously appearing on assets side of the Balance Sheets from F.Y. 2009 to F.Y. 2015. Copy of ITR, Balance Sheet and income & Expenditure Account for A.Y. 2009-10 to A.Y. 2015-16 are enclosed herewith in support of availability of funds with the assesse which was deposited during the F.Y. 2016-17. The assesse has been regularly filing I tax Returns since A.Y. 2008-09. The assesse has already deposited tax on declared income of Rs. 1,96,37,930/- in A.Y. 2008-09 and case was completed/ assessed under scrutiny scheme. Copy of order has already submitted with the previous letter dated 12.11.2018.

The assesse was having sufficient cash in hand with him out of which cash of Rs. 85,00,000/- was deposited in bank. ”

2.3 The ld. AR attended time to time, produced books of account, copies of accounts of Sundry Advances (debtors), and filed various other details as required, stated above and also those even though not required, which were duly examined.

The AO made all the inquiries, sought clarifications on all the relevant issues to the extent he was supposed looking to the nature of the issue involved, the past accepted history of the case and the evidences and material already available therein together with the material provided during the assessment proceedings. Moreover, Assessing Officer has recorded a categorical finding that entries in bank account were verifiable from cash book produced by assessee. Thus, ld. AO framed the assessment in accordance with the available judicial guideline.

Hence, it cannot be said that the impugned assessment order was erroneous and therefore prejudicial to the interest of the revenue, for want of enquiry by the AO.

3. Beyond the scope of enquiry contemplated u/s 263:

3.1 It is submitted that the AO raised very specific and relevant queries/called for explanation and evidences w.r.t. cash recoveries from the Sundry Advances (Debtors), to the extent he was supposed to act in law. Hence, the allegation and the expectation of the Ld. CIT from the AO acting as quasi-judicial authority, is clearly beyond the scope of S. 263, in as much as he was supposed, only to the extent of examination of the fact of availability of sufficient cash in hand lying immediately before 08.11.2016.

The facts are not denied that it was an undisclosed income, offered at the time of survey, which could be available in any form, be it Cash, Sundry Advances (Debtors) or fixed Assets. The Deptt. never doubted nor rebutted the assertion of the assesse that such undisclosed income of Rs. 85.00 lacs were lying with the Sundry Advances (Debtors) and no evidence was required earlier in support thereof. No similar requirement of furnishing name and address of the Sundry Advances (Debtors) and genuineness of such fact, was made in the past. Admittedly, the same state of affairs continued till A.Y. 2015-16. Thus, the fact of the existence of the Sundry Advances (Debtors) of Rs. 85. 00 lacs is well established and well admitted. Therefore, if now the assessee claims to have made recoveries in cash from those Sundry Advances (Debtors), the AO was not supposed to make further investigation for the simple reason that even assuming the assesse failed to furnish the same then too the AO could not have made any addition to the income in relation thereto. There was otherwise nothing on record relating to the previous years (and/or during the subjected previous year) proving that such income stood invested in fixed assets or stood utilized elsewhere in such a manner that it was not possible to claim it as available in the subjected year. It is not the case made out in the captioned SCN that despite there being some adverse evidences or circumstances arousing suspicion therefore further enquiry was called for e.g. the funds lying with the Sundry Advances (debtors) were, in fact, stood blocked (i.e. remain invested in a fixed asset or the like) wherefrom, it was not factually possible to liquidate so as to create a source of cash in hand prior to the cash deposits.

3.2 Requisite Details already available – allegation on Factually Incorrect:

3.2.1 The allegation by the Ld. CIT that the AO did not enquire about the name and addresses of various Sundry Advances (debtors) from whom claimed recoveries were made and also the genuineness of the transactions were not examined, appears factually incorrect, in as much as, one cannot presume that the Assessing Officer while passing the scrutiny Asst. Order, must not have seen or looked upon the past asst. records. It is pertinent to note that the assesse in its replies made specific reference to the income surrendered of Rs. 1,96,37,930/- in the course of survey carried out u/s 133A on 13 & 14 .02.2008 and the breakup of the undisclosed income surrendered towards different heads of outgoings, investments, assets etc. was also explained through various questions & answers, while recording the statements of the assesse, summarized in an at a glance chart titled as “Statement Showing Undisclosed Income,” (PB 29) filed before the AO during the asst. proceedings for A.Y. 2008-09 and also again during the subjected asst. proceedings for A.Y. 2016-17.

3.2.2 Out of Rs. 1.96 Cr. surrendered and included in the return of income of A.Y.2008-09 filed at total income for Rs. 1,98,65,480/- on 30.07.2008, the assesse at the S. No. 7 in chart (PB 29) explained the utilization. Earlier, when the statements of the Appellant were recorded u/S. 133A on dated 13/14.02.2008 wherein itself, the assesse had explained the availability of such undisclosed income of Rs. 1.96 Cr. broadly specifying the form of assets viz. cash in hand, cash in bank or debtors, investment etc. vide answer to question no. 35 that the amount of Rs. 1.59 Cr. was the “I made advances (to the outsiders) for purchase of lands in the name of Unexplained Investment in the name of myself or my family members in various schemes of Land/Plot etc.”

The relevant extracts being answered to Q. 35 is being reproduced hereunder in verbatim:

However, such debtors (viz Rakesh & others named in impounded paper Ann A/7 Pg 23) could not purchase/ invest hence, advance were realized when needed.

Such assets kept changing its form year to year in the balance sheet and it was duly explained to the Ld. CIT.

3.2.3 This amount having been included in the regularly maintained Books of Account was duly included in the Balance Sheet of A.Y. 2008-09, under the head “Sundry Advances & Investments” (PB 33). The assessment for A.Y. 200809 stood completed vide order dated 31.08.2010 u/s 143(3) (PB 27). Thereafter, again in the Balance Sheet for the year ending 31.03.2009 (A.Y.2009-10), this amount of Rs. 1.59 Cr. stood reduced to Rs. 1,04,56,250/-, under the head “Sundry Advances & Investments” and again thereafter in the Balance Sheet filled (in the return of income) for the next year i.e. A.Y. 2010-11 (PB 39-42) the sundry advances stood reduced to Rs. 15 lac only and to one debtor Shri Rakesh at Rs. 59 lac was shown. The reduction in the amount of advances was due to the cash recoveries made from the Sundry Advances (Debtors). Notably, the assessment for A.Y. 2010-11 also stood completed and was not disturbed till the passing of the subjected assessment order, meaning thereby, the realization from the debtors was accepted.

3.2.4 Thereafter, again in the Balance Sheet filled (in the return of income) for the A.Y. 2011-12 the sundry advances increased to Rs. 82 lacs and thereafter to Rs. 92 Lacs (PB 44-47). The assessment for A.Y. 2011-12 also stood completed and continues to hold good, meaning thereby the debtors of Rs. 82 lacs and thereafter to Rs. 92 lacs stood accepted. Every time, when there is increase/decrease in the Sundry Advances (Debtors) and increase in the cash/bank balances in the intervening period (i.e. A.Y. 2008-09 to A.Y. 2016-17), these facts have itself established that there did exist the Sundry Advances (Debtors) detailed above, fact of recoveries made from them, the amount recovered was utilized one way or the other and the fact that finally at the end of the previous year related to A.Y. 2015-16, the assesse was having closing balance of cash in hand of Rs. 85,80,796/- as on 31.03.2016 (PB 66), and was carried over to the next year A.Y 2016-17 i.e. on 1.04.2016 (PB 61-66) which, remained available till the first deposit made on 08.11.2016 and thereafter.

3.2.5 It is now well settled that where assesse has regularly maintained books of accounts is an admissible evidence under Indian Evidence Act, 1872. This holds good more particularly, when the Ld. CIT did not disbelieve or did not doubt or even did not reject the same. Since, availability of the opening balance of the particular amount in the regularly maintained cashbook, which were duly and admittedly submitted before the AO in the subjected assessment proceedings, hence, there was no reason as to why the AO should have doubted.

4. Fairly speaking, from the point of a quasi-judicial authority (the AO), the past history of the case which included the fact of survey, making of surrender a larger amount of income, being utilized in the debtors or investments etc., maintaining books which were available in the Hard disk during survey and thereafter filed through balance sheet in some of the years, filing of balance sheets now, during original assessment proceedings of all the years from A.Y. 2008-09 to A.Y 2015-16, accounts not rejected and therefore, having a binding value, which included cash book in particular, furnishing of cash book of the current year with the opening balances as on 01.04.2016, predecessor AOs having accepted similar claim/s of recovery from the debtors in the past as well, there being no indication even remotely to raise a suspicion warranting an inquiry, were all the sufficient facts, material & evidences, to take a possible decision of availability of cash in hand.

He was not supposed to examine with a microscope the exact date, time and place of the recovery of cash from the debtors. If the ld. CIT finds an error in the Assessment Order of this year, in fact, he should have done this in the earlier year/s to see the availability of the funds and/or the utilization or when the assessee claimed similar realization of cash from the debtors. This shows a double standard on the part of the revenue in as much as they happily accepted the tax on the surrendered income, on one hand, but once the citizen wants to take advantage or utilize the income so surrendered, the revenue is not even allowing the citizen peacefully, the other. The revenue kept silence all these years but the moment the assessee made a claim of availability of its own tax suffered income, they started crying.

Further S. 69/ 69A requires an explanation from the assessee and once given, it has to be objectively tested. A good proof cannot be converted into no proof. Moreover, discretion conferred upon the AO has to be exercised judiciously as held in CIT vs Smt. P.K. Noorjahan (1999) 237 ITR 0570 (SC):

“As pointed out by the Tribunal, in the corresponding clause in the Bill which was introduced in Parliament, the word “shall” had been used but during the course of consideration of the Bill and on the recommendation of the Select Committee, the said word was substituted by the word “may”. This clearly indicates that the intention of Parliament in enacting s. 69 was to confer a discretion on the ITO in the matter of treating the source o f investment which has not been satisfactorily explained by the assessee as the income of the assessee and the ITO is not obliged to treat such source of investment as income in every case where the explanation offered by the assessee is found to be not satisfactory. The question whether the source of the investment should be treated as income or not under s. 69 has to be considered in the light of the facts of each case. In other words, a discretion has been conferred on the ITO under s. 69 to treat the source of investment as the income of the assessee i f the explanation offered by the assessee is not found satisfactory and the said discretion has to be exercised keeping in view the facts and circumstances of the particular case. In the instant case, the Tribunal has held that the discretion had not been properly exercised by the ITO and the AAC in taking into account the circumstances in which the assessee was placed and the Tribunal has found that the sources of investments could not be treated as income of the assessee. The High Court has agreed with the said view of the Tribunal. There is no error in the said finding recorded by the Tribunal. There is thus no merit in these appeals and the same are accordingly dismissed.— CIT vs. Smt. P.K. Noorjehan (1980) 15 CTR (Ker) 138 : (1980) 123 ITR 3 (Ker): 42R.1622, affirmed. ”

Thus, it was fully established beyond all reasonable doubts that there was sufficiency of cash available and in absence of any evidence of utilization thereof elsewhere, the same could be deposited in the bank.

5. Past Assessments completed – Not disturbed – Binds the parties: All the assessments of the past/intervening period starting from A.Y. 2008-09 to A.Y. 2015-16 stood completed either under scrutiny u/s 143(3) or u/s 143(1). If the Deptt. could not find any fault in the passing of the assessments orders of any of the earlier years, there appears no justification at all as to why the Deptt. should have a suspicion as to the fact of the existence of the Sundry Advances (debtors) and the fact of recovery from them and the genuineness of the transactions. The Deptt. by its own admissions has established these facts and therefore, there was no requirement as to why the AO should have again specifically required to provide name and addresses of the Sundry Advances (debtors) and to establish the fact of recovery made from them.

Needless to say that all these facts and figures and the records referred to hereinabove, were part of the assessment record of the earlier years as stated above. Since the Deptt. had no problem on these issues in the past then why the Deptt. should suspect the existence of the debtors now. The only irresistible conclusion is that when the assessee has taken the advantage to explain the source of the subjected cash deposits (and rightly so) the revenue is suspecting same. This double standard cannot be permitted.

6.1 It is not the case of CIT that there was a complete/total lack of inquiry. He himself admits at many places in the Assessment order and in particular in para 6.5 when he admits that “...merely on the basis of certain details and cashbook...” and the further fact that he did not factually denied or rebutted the factual aspect of the assesse’s contention of filing of ROI with the Balance Sheets etc. Law is well settled that the Assessment order cannot be held to be erroneous simply on the allegation of inadequate enquiry. Unless there is an established case of total lack of enquiry. Kindly refer CIT vs. Sunbeam Auto Ltd. (2011) 332 ITR 167 (Del) (DPB 60-63), wherein Delhi High Court was considering the aspect, when there is no proper or full verification, and it was held that one has to see from the record as to whether there was application of mind before allowing the expenditure in question as revenue expenditure. Learned counsel for the assessee is right in his submission that one has to keep in mind the distinction between “lack of inquiry” and “inadequate inquiry”. If there was any inquiry, even inadequate that would not by itself give occasion to the CIT to pass orders under section 263 of the Act, merely because he has a different opinion in the matter. It is only in cases of “lack of inquiry” that such a course of action would be open.

6.2 In CIT vs. Chemsworth Pvt. Ltd. (2020) 275 Taxman 408 (Kar) (DPB 6466), it was held that:

Revision—Erroneous and prejudicial order—AO taking plausible view—AO completed the assessment without considering expenditure which was not allowable under s. 14A—CIT held that non-consideration of disallowable expenditure under s. 14A was erroneous and is prejudicial to the interest of the Revenue—Not correct—CIT has held hat the enquiry conducted by the AO was inadequate and has assumed the revisional jurisdiction— Assessee has filed all the details before the AO and AO has accepted the contention of the assessee that no expenditure was attributable to the exempt income during the relevant assessment year—Thus, while recording the said finding, the AO has taken one of the plausible views in allowing the claim of the assessee— Therefore, CIT could not have set aside the order of assessment merely on the ground of inadequacy o f enquiry—Order passed by the CIT was not sustainable in law hence, the Tribunal rightly set aside the impugned order of the CIT.

The ld. CIT is completely silent on this aspect.

7. Supporting Case Laws on availability of funds: The Hon’ble High Courts and the Tribunals in different factual situations have considered the availability of the cash when the Dept. failed to establish that such cash which was made available in hands of the assessee because of the withdrawal from the banks or sale proceeds of the jewellery and so on, utilised elsewhere, held that no addition can be made.

In the instant case, the AO was having regularly maintained cash book on day to day basis and opening cash in hand showing sufficient cash balance immediately prior to the subjected bank deposits and more particularly, when all along in the past the availability of the cash, bank balances, investments and debtors stood accepted by the Dept. as stated above, the AO was not supposed to doubt the explanation of the assessee until and unless there was some contrary evidence available on record, arousing his suspicion.

Direct Decisions Supporting the Factual Matrix:

7.1 The following decision is a direct authority supporting the assessee’s case on similar factual matrix.

Shivcharan Dass vs. CIT (1980) 126 ITR 0263 (P&H) (DPB 1-4) held:

“The HUF of which the assessee was the Karta declared a sum of Rs. 20,000 under the Voluntary Disclosure Scheme in October, 1951. According to the assessee, the said amount remained with his wife till her death in 1956. Thereafter Rs. 10,000 each was deposited with bank in the names of each of his two then major daughters. The Revenue sought to add the amount of Rs. 20,000 in assessee’s hands as income from undisclosed sources. There was no provision analogous to the provisions o f s. 69 of the IT Act, 1961 in the IT Act, 1922 which governs the present case. If the amount of Rs. 20,000 disclosed under the Disclosure Scheme had been found to be deposited or utilised by the assessee or the HUF in some other manner, in that case, a legitimate inference could be drawn that the amount in dispute was from undisclosed sources as the amount so disclosed under the Disclosure Scheme had been found to be otherwise utilised by the assessee or by the HUF, but the finding on this aspect of the case is otherwise. Therefore, the assessee prima facie discharged its initia l burden. Before the Department rejects such evidence, it must either show an inherent weakness in the explanation or rebut it by putting to the assessee some information or evidence which it has in its possession. The Department cannot, by merely rejecting unreasonably a good explanation, convert good proof into no proof.—Sreelekha Banerjee & Ors. vs. CIT (1963) 49 ITR 112 (SC) : TC42R.1145 relied on. ”

7.2 In another case of PCIT vs. Dilip Kumar Swami [2019] 106 taxmann.com 59 (Raj) (DPB 5-7) it was held that Assessee filed his return declaring certain taxable income – In course of assessment, Assessing Officer noted that assessee had deposited certain amount in his bank account – On being enquired about source of said deposit, assessee explained that it represented amount received from various purchasers against sale of goods i.e., tractors and accessories thereof – Assessing Officer accepted assessee’s explanation and completed assessment – Commissioner taking a view that cash deposits not being satisfactorily explained, passed a revisional order setting aside assessment – Tribunal, however, set aside revisional order so passed – It was noted that order passed by Assessing Officer that deposits stood reconciled was preceded by a proper inquiry – It was also found that assessee had produced statement of bank account, copies of bills issued to purchasers of tractors as also books of account showing entries of deposits made in bank – Moreover, Assessing Officer had recorded a categorical finding that entries in bank account were verifiable from cash book and also bills produced by assessee – Whether in view of aforesaid, Tribunal was justified in setting aside revisional order passed by Commissioner – Held, yes.

The principal propounded in the above case directly applies in the present case. Other Decisions:

7.3 Kindly refer CIT v/s P.V. Bhoopathy (2006) 205 CTR 495 (Mad) (DPB 8- 11) held:

“Appeal (High Court)—Substantial question of law—Income from undisclosed sources—AO did not accept various sources of income explained by the assessee and made additions under ss. 68 and 69 in respect of difference between the investments and the sources accepted by him—Tribuna l accepted the explanation of the assessee vis-a-vis availability of funds with the assessee from the sale proceeds of jewellery belonging to his mother- in-law, receipt from a party and also the amount of opening balance and savings from earlier years and deleted all the additions—Findings recorded by the Tribunal are purely findings of fact—There is no reason to interfere with the same—No substantial question of law arises—CIT vs. Pradeep ShantaramPadgaonkar (1983) 143 ITR 785 (MP) relied on ”

7.4 Also refer CIT vs Kulwant Rai (2007) 210 CTR 380 (Delhi) para 16-17

Read held “Search and seizure—Block assessment—Computation o f undisclosed income—Cash found during search—Assessee had withdrawn Rs. 2 lakh from bank some time back and there is no material with the Department to show that this money had been spent and was not available with the assessee—Tribunal has found that the withdrawals shown by the assessee are far in excess of cash found during the course of search— In the absence of any material to support the view that the entire cash withdrawals must have been spent by the assessee, Tribunal was justified in holding that the addition was not sustainable—Order of the Tribunal does not give rise to a substantial question of law ”

In this case, cash was found on search carried out on 04.02.2001 and was explained to be out of the cash withdrawal in Dec-2000.

7.5 Also refer Anand Prakash Soni v/s DCIT (2006) 101 TTJ 97 (Jd) para 5-6

“Search and seizure—Block assessment—Computation of undisclosed income—Cash found during search—Assessee is entitled to furnish cash flow statement to explain the transactions when no books of account are maintained—In such circumstances it becomes the duty of the AO to verify the balance sheet and cash flow statement with the necessary materia l including the details already filed along with the returns in the past— Assessee explained that the cash found at the time of search was withdrawn from the bank some time back which was partly used for purchasing gold and part of the amount was given by the assessee to his wife—There is nothing to suggest the utilization of the withdrawal amount elsewhere—Said withdrawal is duly reflected in the cash flow statement and closing cash balance is more than the amount found at the time of search—Thus, addition cannot be sustained ”

7.6 Kindly refer CIT v/s Rajasthan Financial Corporation (1996) 134 CTR 145 (Raj). (DPB 52-55) held that:

“Once Assessing Officer has made enquiries during the course of assessment proceedings on the relevant issues and the assessee has given detailed explanation by a letter in writing and the Assessing Offer allowed the claim being satisfied with the explanation of assessee, the decision of the Assessing Officer cannot be held to be erroneous simply because in his order not make an elaborate discussion in that regard. ”

7.7 In CIT v/s Ganpat Ram Bishnoi (2005) 198 CTR (Raj) 546 (DPB 56- 59) held that from the record of the proceedings, in the present case, no presumption can be drawn that the AO had not applied its mind to the various aspects of the matter. In such circumstances, without even prima facie laying foundation for holding that assessment order is erroneous and prejudicial to interest in any matter merely on spacious ground that the AO was required to make an enquiry, cannot be held to satisfy the test of existing necessary condition for invoking jurisdiction u/s 263. Jurisdiction u/s 263 cannot be invoked for making short enquiries or to go into the process of assessment again and again merely on the basis that more enquiry ought to have been conducted to find something.

8. Even the amendment (Expl. 2(a)) does not confer blind powers: It is held that despite there being an amendment, enlarging the scope of the revisionary power of the ld. PCIT u/s 263 to some extent, it cannot justify the invoking of the Expl. 2(a) in the facts of the present case. Before referring to that Explanation, one has to understand what was the true meaning of the Explanation in the context of application of mind by a quasi-judicial authority.

In the case of Narayan Tatu Rane Vs. ITO Itat, (2013) 7 NYPTTJ 1493 (Mum) (DPB 12-21) it was held that newly inserted Explanation 2(a) to Sec. 263 does not authorize or give unfettered powers to Commissioner to revise each and every order, if in his (subjective) opinion, same has been passed without making enquiries or verification which should have been made. As submitted above here also the AO was not supposed to have required the name and address of debtors (because the same were already available, established or even assuming not so, was not required in the facts of the case). The genuineness of the transaction was already established and accepted by the Deptt. in the past hence, on that count also, the assessment order was not erroneous.

9. Benefit of telescoping available:

9.1 Another aspect of the matter to be looked into is that even one need not go into the factual nexus between the income surrendered on one hand in A.Y. 2008-09 and the availability of the resultant funds for onward deposit in the bank, on the other because the law of telescoping is well established that some undisclosed income once surrendered and got taxed, the benefit of the availability (telescoping) of the same towards the other outgoing/investments/expenditure etc. must be allowed as was held long back in the case of Anantharam Veerasinghaiah & co. v. CIT [1980] 123 ITR 457 (SC) (DPB 22-25) followed by Rajasthan High Court in the case of ITO v. Tyaryamal Balchand [1987] 32 Taxman 64 (Raj.) (DPB 26-30), more particularly in absence of any evidence of utilization of such income elsewhere.

9.2 AO acted as per decisions: Since this is the law laid down by Hon’ble Apex Court and followed by Hon’ble Rajasthan High Court and the ratio laid down therein is binding upon the subordinate authorities, the AO was fully justified in having accepted the explanation of the assesse towards the source of the cash deposits in the bank account with the help of the income surrendered in A.Y. 2008-09 (PB 20) (though, in addition there are plethora of evidences already available on record to support such contention otherwise on merit also, as submitted above).

9.3 In the case of Vinod Bhandari vs. Pr. CIT (2020) 34 NYPTTJ 626 (Indore) (DPB 31-51) it was held that if there are two funds and one is already taxed and other has not been taxed and there are remittances during accounting year for certain sum, source of which is not indicated, then presumption is that remittances should have been made from fund which has already suffered tax – Held, yes – Assessee, a medical practitioner, surrendered income of Rs. 7 crores in his personal capacity during course of survey proceedings on account of various hundis found and impounded from possession of assesse. Further, there was a direct nexus of cash so received on maturity of hundis with cash deposited in bank account – Whether, on facts, assessee was entitled for telescoping benefit of income surrendered during year to cash deposited in bank account.

10 Adverse Observations and Objections raised by the Ld. CIT:

Preamble: At the outset, the facts are evident from the record submitted before the Ld. CIT in response to SCN u/s 263 in the shape of detailed written submissions (pg. 1-16) as also detailed paper book containing as many as 67 pages in support of the contentions raised before the CIT. The Ld. CIT firstly reproduced the submissions filed before him in verbatim and thereafter, he summarized assessee’s submissions at pg. 13 pr. 6.1 onwards till pr. 6.3 of the impugned order. His finding starts from pg. 15 pr. 6.4 onwards, which are being dealt hereunder para-wise.

10.1.1 Para 6.4: The crux of the CIT’s findings are that AO erred in merely accepting the assessee’s submissions as stated and in also accepting the cashbook furnished without verifying the existence of the debtors and into the genuineness of the transactions w.r.t recovery of the cash of Rs. 85,00,000/-.

At the outset it is submitted that it is not a case of mere acceptance of submissions and claims made by the assesse but the same was fully and adequately supported by voluminous evidences, starting from the generic or the nucleus source i.e. 1.96 crore (or Rs. 1.59 cr.) in F.Y. 2007-08 (A.Y. 2008- 09) continuing with the assesse, finally culminating into cash realization from the debtors and appearing as opening cash balance in the cashbook as on 01.04.2016. The Ld. CIT admitted the fact of filing cashbook and the appearance of opening balance therein however, he did not whisper a single word if he could find any defect in the cashbook of this year or in the books of account maintained in the previous year/s.

10.1.2 The AO being a quasi-judicial authority, is all entitled by the law to take its own decisions and cannot be guided or instructed by any superior authority as per u/s 119 of the Act. Even the Explanation to S. 263 was not applicable (as submitted later). The identity, name & address etc. were already established by the assessee, when he referred to the destination of the income surrendered during survey u/s 133A on dated 13/14.08.2008 and the same is also available in the documents impounded. Unfortunately, however, despite the request of the assessee to AO vide letter dated 02.03.2021, certified copies have not been supplied although existence of the same is not denied. Thus, the AO, having the past assessment records including the survey records, was fully justified in taking a possible view. It is not the case of the CIT that some of debtor/s has denied taking any loan from the assesse, nor it his case that cash so available as on 01.04.2016 till the date of deposit stood diverted/utilized elsewhere because he neither doubted nor rejected the cashbook nor brought any contrary evidence, therefore, it is completely fallacious to find the defect in a possible decision taken or made by the quasi-judicial authority in this case.

10.1.3 It may clarified that the Ld. CIT by expecting the AO to doubt the existence of the debtors this year, wanted the AO to revisit/review the correctness of the earlier assessments years starting from A.Y. 2008-09 to 2014-15 and such assessments having been accepted and assessed without any variation at all, were binding upon him, meaning thereby the correctness of the claim of availability of the debtors, investments and the genuineness of such claim, stood fully established, not warranting any further investigation. Yet, the Ld. CIT wanted the AO to invoke S. 263 or to make a review of its predecessor’s order/s though he had become ex-functus officio after passing those assessments order/s which was not legally permissible.

Pertinently, those assessments have not been disturbed so far by the time of the passing of the subjected Assessment Order dated 10.12.2018 u/S. 143(3), hence, those assessments held good and has all the binding value upon the parties. The Hon’ble Raj HC in the case of Parmeshwar Bohra (2008) 301 ITR 0404 has held:

“There is a clear finding and about which there is no dispute that the amount added in the income of the assessee as unexplained investment or cash credit in the asst. yr. 1993-94 was the same amount which was credited in the books of account of the assessee for previous year ending on 31st March, 1992. The Tribunal has categorically come to a finding, and that finding is not under challenge, that this is not a case of cash credit entered in the books of account of the assessee during the year but it is a case in which the assessee has invested the capital in the business and this amount was shown as a closing capital as on 31st March, 1992 and on 1st April, 1992 it was an opening balance. It does not require any elaborate argument that a carried forward amount of the previous year does not become an investment or cash credit generated during the relevant year 1993-94. This alone is sufficient to sustain the order of the Tribunal in deleting the amount from the assessment for asst. yr. 1993-94. ”

10.2 Para 6.5 – Further objection of the Ld. CIT was that every year is a separate year and not binding unless, that particular assessment year is not scrutinized. What comes out is that Ld. CIT is ignoring the binding evidentiary value of the past completed assessments because of the simple fact that those assessments were not completed under scrutiny. Firstly, on the very face of it, this is a mis-conception and purported mis-reading and this argument is completely mis-placed in as much as firstly, it is not the choice of the assesse to get the assessment completed either under scrutiny or as a summary assessment u/s 143(1). The decision solely rests with the department only and if they chose to complete the assessment in a particular manner the fact remains is that the assessments of earlier year/s stood completed by accepting and assessing what was claimed. Such admission is not only of the income declared but also of the other facts as stated in the evidences enclosed with the ROI. Therefore, the submission that the dept. not having completed the assessments under scrutiny did not have evidentiary value is completely fallacious.

Secondly, such argument may hold good in the matters of estimation of income particular from trading etc. in the cases where S.145(3) has been invoked where because of change in the facts, AO of the current year is free to make estimations without getting influenced by the declarations made in the past.

Thirdly, rest of the points are nothing but repetition of what was argued in Pr. 6.4.

10.3 Para 6.5 & 6.6– Non-Applicability of Explanation 2: Kindly refer our detailed submissions under para 3 beyond the scope of enquiry, 3.2 requisite details already available and para 3.5 & 6 wherein, this particular aspect has been elaborately discussed and answered together with some case laws making the explanation not applicable. The Ld. CIT however, did not judicially appreciate the legal and factual aspect. Hence, instead of repeating, we are further relying upon some more decisions as under:

10.4 Para 6.7 – Decisions cited by Ld. CIT – Not Applicable:

Certain decisions not applicable – The Ld. CIT has relied upon the following decisions against the assesse however, those decisions were based upon peculiar facts available in those cases only, which are not available in our case and hence, they are completely distinguishable.

10.5 Para 6.9 – Identity and the creditworthiness of the debtors and genuineness of the transactions not furnished:

At the outset, it is again a misconception on the part of the ld. CIT in as much as such requirements if the AO was examining the issue in hand u/s 68 of the act which is not the case are relevant only here. The issue involved was only cash deposits in the bank account which could legally be investigated under S. 69A but not under S. 68. Otherwise also, the creditworthiness and the identity are to be seen of the creditors and not the debtors.

Since the assessee has already filed voluminous details and assessments of the past years have already been completed remaining undisturbed, this is the biggest evidence against the department and unless the Dept./Ld. CIT could have demolished or rebutted these evidences, what is established is the opening cash balance as on 01.04 2016. Even the fact of recovery need not to got established by the AO to the for simple reason that such cash had already been realized prior to F.Y. 2015-16 and A.Y. 2016-17 and such evidences not having been rebutted and assessment not disturbed, the department cannot go backward to disbelieve the claimed availability of cash. The ratio laid down in Parmeshwar Bohra (2008) 301 ITR 0404 even though rendered in the context of S. 68, directly support the assesse.

Further argument in para 6.9 is that the law does not forbid the AO to verify debtors from whom recoveries were made but then above contention adequately answers this objection also of the CIT.

10.6 Para 6.10 – The Ld. CIT again repeats the same arguments which we have already answered here and also in our detailed submissions. Thus, the AO evidently acted completely in accordance with law, duly and fully applying his mind by calling for all the relevant details and the has taken a possible view and did not find any contrary material or suspicious or anything raising his suspicion.

11. Rule of Consistency ignored: After going through the principle laid down by the Hon’ble Apex High Court and other High Courts, it will be clear that the contention of the ld. CIT was completely fallacious and ignoring the rule of consistency.

11.1 Godrej & Boyce Manufacturing Company Ltd. Vs. Dy. Commissioner of Income-Tax & ANR. [Civil Appeal No. 7020 of 2011]

“38. In the present case, we do not find any mention of the reasons which had prevailed upon the Assessing Officer, while dealing with the Assessment Year 2002-2003, to hold that the claims of the Assessee that no expenditure was incurred to earn the dividend income cannot be accepted and why the orders of the Tribunal for the earlier Assessment Years were not acceptable to the Assessing Officer, particularly, in the absence of any new fact or change o f circumstances. Neither any basis has been disclosed establishing a reasonable nexus between the expenditure disallowed and the dividend income received.

That any part of the borrowings of the assessee had been diverted to earn tax free income despite the availability of surplus or interest free funds available (Rs. 270.51 crores as on 1.4.2001 and Rs. 280.64 crores as on 31.3.2002) remains unproved by any material whatsoever. While it is true that the principle of res judicata would not apply to assessment proceedings under the Act, the need for consistency and certainty and existence of strong and compelling reasons for a departure from a settled position has to be spelt out which conspicuously is absent in the present case. In this regard we may remind ourselves of what has been observed by this Court in Radhasoami Satsang vs. Commissioner of Income-Tax[6].

“We are aware of the fact that strictly speaking res judicata does not apply to income tax proceedings. Again, each assessment year being a unit, what is decided in one year may not apply in the following year but where a fundamental aspect permeating through the different assessment years has been found as a fact one way or the other and parties have allowed that position to be sustained by not challenging the order, it would not be at all appropriate to allow the position to be changed in a subsequent year. “

11.2 DCIT v/s Gujarat Narmada Valley Fertilizers Co. Ltd. (2013) 84 CCH 271 GujHC: (2013) 215 TAXMAN 72 (Gujarat)

Preliminary expenses—Amortization of certain preliminary expenses— Assessee claimed deduction u/s. 35D—AO restricted deduction on ground that only eligible expenses were allowed to be spread over u/s. 35D and therefore, expenses only to extent that had nexus to eligible projects were admissible— However, Tribunal, noted that in last seven years, no such disallowances were made and directed such benefit to be granted—Held, since last several years, AO had granted such claim on same consideration—Following rule of consistency, Tribuna l therefore, correctly held that such claim could not have been suddenly disallowed—Revenues’appeal dismissed

12. Supporting Case Laws on S. 263:

12.1 Kindly refer CIT v/s Rajasthan Financial Corporation (1996) 134 CTR 145 (Raj). (DPB 52-55) held that:

“Once Assessing Officer has made enquiries during the course o f assessment proceedings on the relevant issues and the assessee has given detailed explanation by a letter in writing and the Assessing Offer allowed the claim being satisfied with the explanation of assessee, the decision of the Assessing Officer cannot be held to be erroneous simply because in his order not make an elaborate discussion in that regard. ”

12.2 In CIT v/s Ganpat Ram Bishnoi (2005) 198 CTR (Raj) 546 (DPB 56- 59) held that from the record of the proceedings, in the present case, no presumption can be drawn that the AO had not applied its mind to the various aspects of the matter. In such circumstances, without even prima facie laying foundation for holding that assessment order is erroneous and prejudicial to interest in any matter merely on spacious ground that the AO was required to make an enquiry, cannot be held to satisfy the test of existing necessary condition for invoking jurisdiction u/s 263. Jurisdiction u/s 263 cannot be invoked for making short enquiries or to go into the process of assessment again and again merely on the basis that more enquiry ought to have been conducted to find something.

12.3 In Gabriel India Ltd. [1993] 203 ITR 108 (Bom), law on this aspect was discussed in the following manner (page 113): “ . . . From a rending of sub- section (1) of section 263, it is clear that the power of suomotu revision can be exercised by the Commissioner only if, on examination of the records of any proceedings under this Act, he considers that any order passed therein by the Income-tax Officer is „erroneous in so far as it is prejudicial to the interests of the Revenue‟ . It is not an arbitrary or unchartered power, it can be exercised only on fulfilment of the requirements laid down in sub-section (1). The consideration of the Commissioner as to whether an order is erroneous in so far as it is prejudicial to the interests of the Revenue, must be based on materials on the record of the proceedings called for by him. If there are no materials on record on the basis of which it can be said that the Commissioner acting in a reasonable manner could have come to such a conclusion, the very initiation of proceedings by him will be illegal and without jurisdiction. The Commissioner cannot initiate proceedings with a view to starting fishing and roving enquiries in matters or orders which are already concluded. Such action will be against the well-accepted policy of law that there must be a point of finality in all legal proceedings, that stale issues should not be reactivated beyond a particular stage and that lapse of time must induce repose in and set at rest judicial and quasi-judicial controversies as it must in other spheres of human activity.

12.4 In another case of Narain Singla v. PCIT [2015] 62 taxmann.com 255 (Chandigarh – Trib.) (DPB 67-76) it was held that when Assessing Officer was fully aware of matter, he had appraised evidences filed by assessee and then had formed a view to accept same, Commissioner was unjustified in invoking jurisdiction under section 263. Whether if there was an enquiry, even inadequate, that would not, by itself, give occasion to Commissioner to pass order under section 263, merely because he has a different opinion in matter; it is only in case of ‘lack of inquiry’ that such a cause of action can be open.

12.5 In another case of Sanspareils Greenlands (P.) Ltd. v. CIT [2018] 99 taxmann.com 222 (Delhi – Trib.), it was held that Assessee-company, engaged in manufacture, purchase, sale and export of sports goods, claimed expenditure towards payments made to cricket players under head ‘advertisement and publicity’ – Assessing Officer, after making enquiries and considering explanation furnished by assessee allowed said expenditure – Subsequently, Commissioner, exercising power under section 263, disallowed expenditure claimed by assessee on ground that Assessing Officer had failed to make an inquiry in this regard – It was noted that it was not department’s case that no information regarding payments made to cricketers was called for by Assessing Officer – Relevant details and documents were furnished by assessee during assessment proceedings which formed part of record – Hence, no inference could be drawn that Assessing Officer had not examined issue although he had not expressed it in as many terms as might be considered appropriate by Commissioner – Whether section 263 does not visualize a case of substitution of judgment of Commissioner for that of Assessing Officer unless decision is held to be erroneous – Held, yes – Whether, once impugned issue was considered and examined by Assessing Officer, Commissioner could not set aside order without recording a contrary finding; therefore, impugned action of Commissioner under section 263 was patently illegal and was liable to be quashed.

12.6 In case of Rajmal Kanwar v. CIT-I [2017] 82 taxmann.com 119 (Jaipur-Trib.) (DPB 77-88) it was held that orders prejudicial to interest of revenue-Assessment year 2011-12 – Where Assessing Officer had made sufficient enquiries, considered survey records and surrender made by assessee and after considering submissions of assessee completed assessment proceedings under section 143(3), assessment order could not be held to be an erroneous order which was prejudicial to interest of Revenue.

12.7 In the case of Abdul Hamid v. Income-tax Officer [2020] 117 taxmann.com 986 (Gauhati – Trib.) it was held that only probability and likelihood to find error in assessment order is not permitted u/s 263.

In view of the above submissions and the judicial guideline, the impugned order passed u/s 263 deserves to be quashed.”

5. Per contra, the ld. Pr CIT/DR relied on the findings of the ld. Pr. CIT in the impugned order passed u/s 263 of the Act and our reference was drawn to the findings of the ld. Pr. CIT at para 6.4, 6.5 & 6.9 and 6.10 of his order which reads as under:-

“6.4 The entire submission of the assessee as discussed in preceding paragraphs of this order is not found to be acceptable after considering the facts and circumstances of the case. First of all it is mentioned that the claim of the assessee is that during the F.Y 2015-16, recoveries of cash amount of Rs. 85,00,000/- were made from the debtors to whom earlier such amounts of advances were given, but such claim or submission of the assessee is not supported by any evidences, facts and figures and this is a mere claim without any basis. The AO has merely accepted the submission of the assessee without making any independent enquiries in respect of the debtors from whom substantial cash amounts of Rs. 85,00,000/- are claimed to have been recovered by the assessee which were earlier given to them in the form of advances and that to in A.Y. 2008-09. The mere submissions of the assessee that out of surrendered and declared income of Rs. 1,96,37,930/- during the survey proceedings on 13.02.2008, an amount of Rs. 1,59,00,000/- were the advances and investment and cash realization from the advances and investment were recorded in the cash book for the year 2015-16 and hence cash in hand as on was of Rs. 85,80,796/- has merely been accepted by the AO without verifying the correctness of statement of the assessee. Rather, the AO has merely accepted this submission of the assessee without making any enquiry and verification and he has relied upon the cash book of the assessee. The existence of the debtors from whom recovery of substantial cash amounts of Rs. 85,00,000/- are claimed to have been made by the assessee has not been enquired into. The details regarding identities of the debtors i.e. the name and addresses and also the genuineness of transactions with regard to recoveries of such cash amounts of Rs. 85,00,000/- have neither been obtained by the AO from the assessee during the course of assessment proceeding nor any specific queries on this issue have been raised by him.

6.5 The fact is that the complete details of the debtors (i.e. their name and addresses) from whom recoveries of Rs. 85,00,000/- are claimed to have been are not found to be available either in the assessment records or in the submission of the assessee and which is vital aspect of the case and this aspect cannot be ignored in any way. This is more particularly in view of the fact that each year is a separate assessment year and the case of the assessee for any particular assessment year required to be scrutinized after considering the facts and merits of the case for such year only. Merely on the basis of certain details and cash book etc. filed by the assessee it cannot be said that the assessee was having cash amount of Rs. 85,00,000/- which were realized from the advances and investment and were recorded in the cash book for A.Y. 2015-16. If merely books of accounts and submission of the assessee are relied upon without making independent enquiries in respect of the debtors and without verifying the genuineness of transactions in respect of realization of substantial amounts of cash from the debtors, then the very purpose of making scrutiny of the case of the assessee for the year under consideration will be defeated. It is not examined by the AO as to whether the debtors are actually existing and they are assessed to tax and are filing their regular returns of income. The credit worthiness of the debtors are not examined. The nature of advances made to the debtors are not verified. Any confirmations from the debtors have not been obtained by the AO either from the assessee or from the debtors itself. On verification of assessment records of the assessee, it is seen that the AO has merely accepted the submission and records of the assessee and he has not applied his mind and he has not made any necessary verification which should have been made and this failure on the part of the AO has rendered the assessment order not only erroneous, but also prejudicial to the interest of Revenue.”

“6.9 One of the arguments of the assessee is that in the balance sheet filled in the return of income for A.Y. 2011-12, the sundry advances increased to Rs. 82 lacs and thereafter to Rs. 92 lacs. As per the assessee the moment there is increase/decrease in the sundry advances (debtors) and increase in the cash/bank balances in the intervening period (i.e. A.Y. 2008-09 to A.Y. 2016-17), this fact has itself established that there did exist the sundry advances (debtors) and recoveries were made from them. As per the assessee existence of sundry advances (debtors) of Rs. 85 lacs is well established. If argument of the assessee is that there did exist the sundry advances (debtors) then it is not understandable as to why details i.e. identity of such debtors are not disclosed and details regarding creditworthiness of such debtors and genuineness of transactions are not furnished. Another argument of the assessee is that this amount of Rs. 85 lacs was an undisclosed income offered at the time of survey, this could be available in any form, be it cash, sundry advances (debtors) or fixed assets. As per the assessee the department never doubted nor rebutted the assertion of the assessee that such undisclosed income of assessee is lying in sundry advances (debtors) and no evidence was required earlier in support thereof. As per the assessee therefore, if now the assessee claims to have made recoveries in cash from those sundry advances (debtors), the AO was not supposed to make further investigation for the simple reason that even assuming that the assessee failed to furnish the same then too the AO could not have made any addition to the income in relation there to.

But this argument of the assessee is not acceptable as the law does not forbid the AO to verify the debtors from whom recoveries of advances of substantial amounts of Rs. 85,00,009/- are claimed to have been made in cash and rather it was necessary for the AO to verify this vital aspect of the case.

6.10 In view of the facts and legal position as discussed in preceding paragraphs of this order, it is held that the AO has failed to examine and verify the claim of the assessee with regard to advances made to the debtors in cash and the claim of the assessee with regard to recoveries of such sundry advances of cash amount of Rs. 85 lacs as made from the debtors by way of calling for relevant details and documents from the assessee and also by way of making independent inquiries with such debtors and this failure on the part of the AO has rendered the assessment order u/s 143(3) of the act erroneous in so far as it is prejudicial to the interest of Revenue. Thus, the assessment order u/s 143(3) of the I.T. Act for A.Y 2016-17 is hereby cancelled/set aside and the AO is directed to examine the identity of the debtors, genuineness of transaction with regard to advances of Rs. 85,00,000/- made to the debtors and recovery of advances of cash amount of Rs. 85,00,000/- made from such debtors (as claimed by the assessee) and is also directed to examine the creditworthiness of the such debtors. On the basis of outcome of such examination and verification, the AO is directed to make necessary addition, wherever required, in accordance with the provisions of Income Tax Act, to the total income of the assessee. However, the AO is directed to ensure that reasonable opportunity of being heard is granted to the assessee before passing the order.”

6. Further, the ld PCIT/DR has placed reliance on the following decisions:-

| S. No. |

Description of the case | Page No. |

| 1 | [1963] 49 ITR 112 (SC) Sreelekha Banerjee Vs. CIT | 1-10 |

| 2 | [2012] 20 taxmann.com 462 (Punj. & Har.) Zaveri

Diamonds v. CIT, Ludhiana |

11-20 |

| 3 | [2012] 25 taxmann.com 552 (SC) Zaveri Diamonds vs. CIT | 21-22 |

| 4 | [2000] 109 Taxman 66 (SC) Malabar Industrial Co. Ltd. vs. CIT | 23-28 |

| 5 | Denial Merchants P. Ltd. vs. Income Tax Officer on 29 November, 2017 | 25-30 |

7. We have heard the rival contentions and perused the material available on record. The legal proposition laid down by various Courts regarding the exercise of powers u/s 263 have to be seen in light of facts and circumstances of the present case. In this case, it is noted that the Assessing Officer had issued notice u/s 142(1) dated 23.10.2017 where, inter-alia, he had asked the assessee to furnish the details of all his bank accounts explaining the credit entries and all cash deposits as well as debit entries and all cash withdrawals along with the copy of the bank statements. In response, the assessee vide his submission dated 16.11.2017 submitted the copies of all his bank account statements as well as ledger accounts in the books of accounts maintained by him in respect of three bank accounts maintained by him during the period under consideration. It is further noted that the Assessing Officer thereafter issued another notice u/s 142(1) dated 07.06.2018 wherein the assessee was again asked to explain the credit entries and all cash deposits in the bank account as well as debit and all cash withdrawal in the bank account. Further, the assessee was asked specifically to explain as to whether “you have deposited any cash amount in demonetized currency during the period beginning from 8th November, 2016 to 30 December, 2016 and cash in hands shown in the F.Y 2015-16 and F.Y 2016-17”. In his response dated 07.07.2018, the assessee submitted that he had deposited demonetized currency during the period 8.11.2016 to 30.12.2016 which was verifiable from the Balance Sheet as on 31.03.2016 and copies of ledger account for explanation of bank entries undertaken during the year under consideration was submitted as per earlier submissions. Thereafter, the assessee vide his submission dated 12.11.2018 submitted the scanned copy of the cash book for the F.Y 2015-16 and also submitted explanation regarding amount of cash deposited on 16.11.2016 and the explanation so furnished by the assessee reads as under:-

‘2. The assessee has deposited SBN of Rs. 85,00,000/- with SBBJ Gumanpura, Kota on 16.11.2016. We further clarify that the assessee surrendered and declared income of Rs. 1,96,37,930/- during the survey proceedings on 13/02/2018. Out of such amount, Rs. 1,59,00,000/- were in the nature of Sundry Advances and Investments. Cash realization from the Advances and Investments were recorded in the Cash Book for the year 2015-16, hence cash in hand as on was of Rs. 85,80,796/- which is verifiable from the Cash Book. In support of evidences, we are also submitting Income & Expenditure for the year 2007-08 and Balance Sheet as at 31.03.2008, Income Tax Asstt. Order u/s 143(3) of the Income Tax Act, 1961 with notice of demand, Copy of ITR, Computation of Income for the A.Y 2008-09. ”

8. It is noted that the Assessing Officer again sought further documentation and explanation regarding availability of cash in hand and in response, the assessee vide submission dated 22.11.2018 submitted copy of the his ITRs and balance sheets and income and expenditure accounts right from F.Y 2008-09 to F.Y 2014-15 and the explanation regarding deposit of cash was again submitted which reads as under:-

‘2. It is already clarified that the assessee surrendered and declared income of Rs. 1,96,37,930/- during the survey proceedings on 13/02/2008. Out of such amount, Rs. 1,59,00,000/- were in the nature o f Sundry Advances and Investments as per Balance Sheet as at 31.03.2008. Cash hand/Sundry Advances/Investments of Rs. 85.00 Lakhs or more have been continuously appearing on assets side of the Balance Sheets from F.Y 2009 to F.Y 2015. Copies of ITR, Balance Sheet and Income & Expenditure for A.Y 2009-10 to A.Y 2015-16 are enclosed herewith in support of availability of funds with the assessee which was deposited during the F.Y 2016-17. The assessee has been regularly filing Income Tax Returns since A.Y 2008-09. The assessee has already deposited tax on declared income of Rs. 1,96,37,930/- in A.Y 2008-09 and case was completely/assessed under scrutiny scheme. Copy of order has already submitted with the previous letter dated 12.11.2018.