Page Contents

FAQs on pre-validate bank account on Income Tax Website

Q.1 Why do I need to pre-validate my bank account(s)?

Ans. Only a pre-validated bank account can be nominated to receive Income Tax refund.

Further, a pre-validated bank account may also be used by the individual taxpayer for enabling EVC (electronic verification code) for e-Verification purpose. e-Verification can be used for Income Tax Returns and other Forms, e-Proceedings, Refund Reissue, Reset Password and secured login to e-Filing account.

Q.2 Can a non-individual taxpayer use EVC for e-Verification?

Ans. Enabling or disabling EVC is applicable only to individual taxpayers. Other categories of taxpayers cannot use their pre-validated bank account for generating EVC to e-Verify their Income Tax Returns and Forms.

Q.3 Can I validate and nominate multiple bank accounts for refund?

Ans. Yes. You can pre-validate multiple bank accounts, and can nominate more than one bank account for Income Tax refund.

Q.4 Can I nominate one bank account for Income Tax refund, and EVC-enable a separate bank account?

Ans. Yes, but both bank accounts should have the status Validated.

Q.5 Can EVC be enabled for multiple bank accounts?

Ans. No. EVC can be enabled for only one bank account at any point of time. If you try to enable EVC for another pre-validated account, then a message will be displayed, asking for your confirmation to disable EVC for the existing account. Accordingly, either one of the bank accounts will be EVC enabled.

Note: EVC can be enabled only for banks integrated with e-Filing. The list of e-Filing integrated banks can be found on the Login with Net Banking page.

Q.6 What are the prerequisites for a successful pre-validation?

Ans. For successful pre-validation, you must have a valid PAN registered with e-Filing, and an active bank account linked with the PAN.

Q.7 How do I know that the pre-validation is successful? What should I do if it is unsuccessful?

Ans. The status of the validation request will be sent to your mobile number and email ID registered with the e-Filing portal. If the validation fails, the details are displayed under Failed Bank Accounts. The failed bank accounts can be re-submitted for validation in case of failed bank pre-validation: Click Re-Validate for the bank in the Failed Bank Accounts section.

Q.8 Can I pre-validate my Loan / PPF account?

Ans. No. You can only pre-validate the following accounts for refund:

- Saving Bank Accounts,

- Current Accounts,

- Cash Credit Accounts,

- Over Draft Account,

- NRO Account.

If you try pre-validating any other account type, the bank validation will fail, and the system will display an Invalid Account error.

Q.9 What will happen if I change my mobile number / email ID registered with the bank, which I have already pre-validated?

Ans. In such a case, you will see a ! warning symbol next to your mismatched contact details (mobile number / email ID) in your Added Bank Accounts section. If you wish to EVC-enable that bank account, you will need to update your contact details on the e-Filing portal to match your details registered with the bank.

Q.10 How much time does it take to pre-validate my bank account once I have submitted my details?

Ans. The pre-validation process is automatic. Once your request is submitted, it is sent to your bank. The validation status is updated in your e-Filing account within 10 – 12 working days.

Manual on pre-validate bank account on Income Tax Website

1. Overview

The My Bank Account service is available to all registered taxpayers on the e-Filing portal (post-login), who have a valid PAN and a valid bank account. This service allows you to:

- Add a bank account and pre-validate it

- Remove a closed or deactivated bank account

- Nominate a validated bank account to receive Income Tax refund

- Remove a bank account from nomination so as not to receive tax refund in that account

- Enable or disable EVC for the validated bank account (only for individual taxpayers)

- Revalidate bank accounts for which pre-validation has failed

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- PAN must be linked with the bank account which is to be pre-validated

- Active bank account:

- linked with PAN

- linked with registered mobile number (mandatory) and email ID (optional)

- Valid mobile number:

- registered with e-Filing

- linked with active bank account

3. Step-by-Step Guide

Step 1: Log in to the e-Filing portal using your user ID and password.

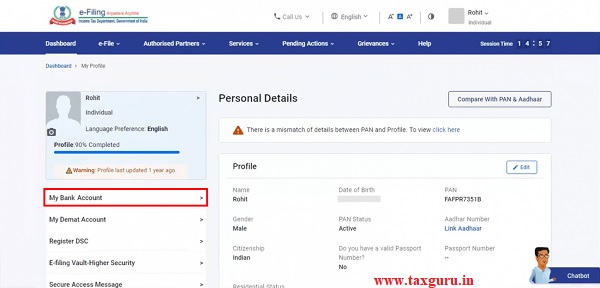

Step 2: Go to the My Profile page from the Dashboard.

Step 3: Click My Bank Account.

On the My Bank Accounts page, the Added, Failed and Removed Bank Accounts tabs will be displayed.

To learn how to use the different facilities under the My Bank Account service, refer to the following sections:

| Add and Pre-Validate a Bank Account | Refer to Section 3.1 |

| Remove a Bank Account | Refer to Section 3.2 |

| Nominate or Remove Bank Account from Nomination for Refund | Refer to Section 3.3 |

| Enable and Disable EVC | Refer to Section 3.4 |

| Re-Validate a Bank Account | Refer to Section 3.5 |

3.1 Add and Pre-Validate a Bank Account

A. By logging in to the e-Filing portal using PAN / Aadhaar

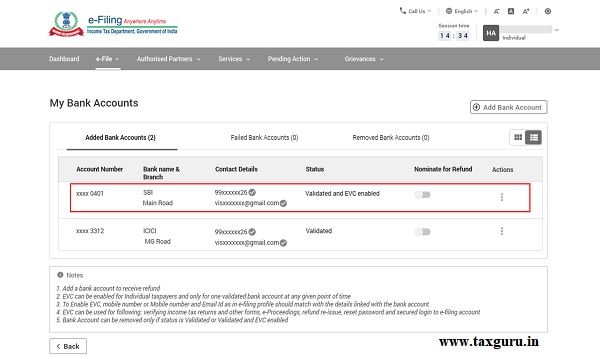

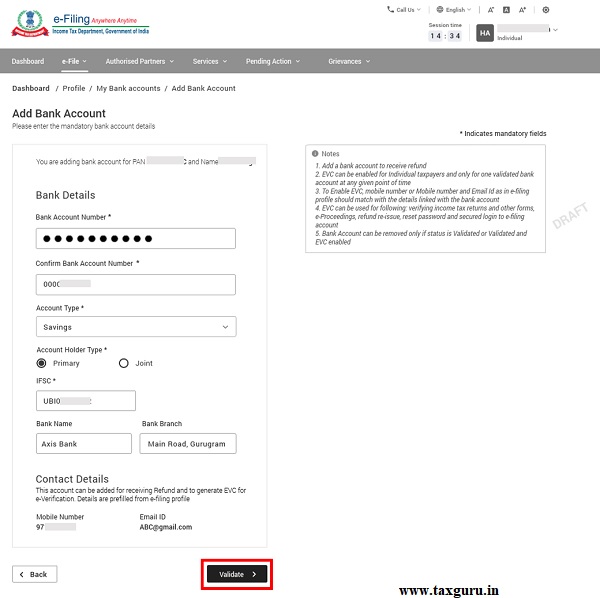

Step 1: On the My Bank Accounts page, click Add Bank Account.

Step 2: On the Add Bank Account page, enter the Bank Account Number, Account Type and Holder Type, and IFSC. Bank Name and Branch get auto-populated based on IFSC. Your mobile number and email ID will be pre-filled from your e-Filing profile, and will not be editable.

Step 3: Click Validate.

On successful validation, a success message is displayed. You will also receive a message on your mobile number and email ID registered on the e-Filing portal.

B. By logging in to the e-Filing portal using Net Banking

Step 1: Log in to the e-Filing portal using your Net Banking account.

Step 2: On login through Net Banking, the e-Filing portal will verify if the bank account used for login exists under the Added Bank Accounts tab. If the bank account is not already added, a confirmation message with the masked account number and IFSC is displayed, asking you to confirm if you want to add the account to e-Filing portal. Click Continue.

On confirmation (for both methods A and B), the bank account details are included under the Added Bank Accounts tab with the status as follows:

- Validated(if EVC is enabled for any existing bank account) OR

- Validated and EVC enabled(if PAN, Account Number, IFSC, and mobile number are successfully validated by the bank, and if EVC is not enabled for any other bank account).

3.2 Remove Bank Account

Step 1: Click Remove Bank Account under the Action column for the desired bank account.

Step 2: Select a reason from the dropdown for removing the bank account. If you select Others, enter the reason in the textbox and click Continue.

On successful removal of the bank account, a success message is displayed.

3.3 Nominate or Remove Bank Account from Nomination for Refund

A. Nominate a bank account for refund

Step 1: To nominate a bank account for refund, click the Nominate for Refund toggle / switch (the switch will be positioned on the left) for the bank account you wish to nominate for refund.

Step 2: Click Continue to confirm that you want to nominate the selected bank account.

On success, the switch will move to the right.

B. Remove a bank account from nomination for refund

Step 1: To remove a bank account that is nominated for refund, click the Nominate for Refund toggle / switch (it will be positioned on the right) for the bank account you wish to remove from nomination.

Step 2: Click Continue to confirm that you want to remove nomination of the selected bank account.

On success, the switch will move to the left.

3.4 Enable and Disable EVC

A. Enable EVC

Step 1: Click Enable EVC under the Actions column on the bank account for you wish to enable EVC.

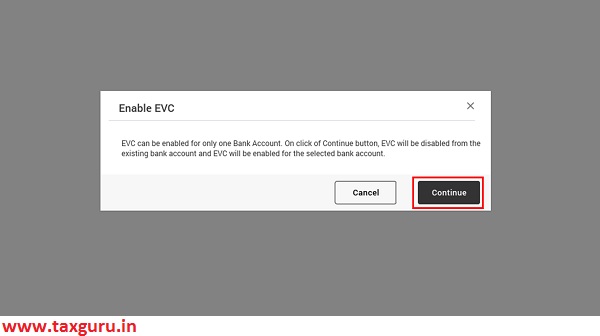

Step 2: A confirmation message is displayed. Click Continue.

Note:

- EVC can be enabled for a validated bank account only if the following conditions are fulfilled:

- Your mobile number (mandatory) and email ID (optional) should be verified by the bank.

- Your mobile number registered with e-Filing should the same as the one verified by the bank. To ensure they match, either update your mobile number in your e-Filing profile to be the same as the one linked with the bank, or update your mobile number with your bank to be the same as the one in your e-Filing profile.

- EVC should not be enabled for any other bank account.

- Your bank should be integrated with e-Filing. The list of banks integrated with e-Filing can be found on the e-Filing Login with Net Banking

- If you wish to only pre-validate your bank account and not enable EVC, your e-Filing mobile or email do not need to match the contact details verified by your bank.

If the above conditions are fulfilled, EVC is successfully enabled for the selected bank account, and the status is updated to Validated and EVC enabled:

Step 3: If EVC is already enabled for one bank account, and you try to enable EVC for another bank account, a message is displayed notifying you of the same. Click Continue in the message, and EVC will be enabled for the bank account if the conditions specified in Step 2 are fulfilled. In such a case, EVC will be disabled for the bank account that was previously enabled.

Note: If you click Cancel or close the message, EVC will remain enabled for the existing bank account.

B. Disable EVC

Step 1: Click Disable EVC under the Actions column on the bank account for which you wish to disable EVC.

Step 2: A confirmation message is displayed. Click Continue.

On success, EVC is disabled for selected account, and the status is updated to Validated.

3.5 Re-Validate Bank Account

Step 1: In case the validation for a bank account failed earlier, you will see its details under the Failed Bank Accounts tab. Click Re-Validate under the Action column for the bank account you need to revalidate.

Step 2: On the Add Bank Account page, your details will be pre-filled. Update the details if necessary.

On success, the bank account is added under the Added Bank Accounts tab, and the status is updated to Validation in progress.

Then, your contact details are verified with the bank details. If the details are verified by the bank, your bank account gets validated. You can check the validation status in the Status column of the Added Bank Accounts tab.

If the validation still fails, take the following action based on the reason of failure (for integrated banks):

| Reason for Failure | Action to be Taken |

| PAN not linked with bank account | Contact branch to link your PAN with the bank account, then click Re-Validate to submit request. Contact branch for further information. |

| Name mismatch | Contact branch to update the name as per PAN. Then, re-validate, update the details and submit request for re-validation. |

| Bank Account Number mismatch | Click Re-Validate, enter the correct bank account number and submit the request for re-validation. |

| Account number does not exist | Click Re-Validate, enter the correct bank account number and submit the request for re-validation. |

| Invalid IFSC | Click Re-Validate, enter the correct IFSC and submit the request for re-validation. |

| Bank account closed / inactive | Click Re-Validate, and try with a different bank account number. Contact your branch for further information. |

| Bank account dormant | Click Re-Validate, and try with a different bank account number. Contact your branch for further information. |

In case an account is held in one of the non-integrated banks, the following action should be taken:

| Reason for Failure | Action to be Taken |

| PAN not linked with bank account | Link the PAN with bank account and click Re-Validate to submit request. Contact your branch for further information. |

| PAN mismatch | Link the correct PAN to the bank account and click Re-Validate to submit request. Contact your branch for further information. |

| Invalid account type | Click Re-Validate, select the correct bank account type, and submit the request for validation. |

| Invalid IFSC | Click on Re-Validate, enter the correct IFSC, and submit the request for validation. |

| Account closed | Click Re-Validate and try with a different bank account number. Contact your branch for further information. |

| Zero balance Account / Inactive account | Click Re-validate and try with a different bank account number. Contact your branch for further information. |

| Litigated Account | Click Re-Validate and try with a different bank account number. Contact your branch for further information. |

| Account holder name invalid | Click Re-Validate and update the details. Contact branch to update the Name as per PAN. |

| Account frozen or blocked | Click Re-Validate and try with a different bank account number. Contact your branch for further information. |

I have entered the bank account details in profile. and it is showing as validation in progress. how many days it will take for validation.

I have added my ICICI bank account in income tax portal after submission I am getting the status as Validation in Progress since last 10 days. I called customer service they said wait and no reply on my email. Not sure what is the problem and why such a delay if any error they should show the error message.

Please guide how to fix this issue.

I filed my return on 17-08-2021. I got the acknowledgement but no refund has been credited

I tried to validate my bank account but status is showing

“Validation cannot be done”,

So, What is wrong ??

While selecting bank for refund,in my itr out of 6 banks two banks are without tick mark in which I want refund of 2021-2022 whereas other four banks show tick marks which r not refund banks.clarify.one bank is evc enabled hvng no tick mark but it is refund bank.it is causing confusion whether I should refile?

Refund cannot be credited on account with status 65.Please add valid bank account. EVC cannot be enabled for this account.

i have a Bank Account in BOB, which are Successfully Validated in IT portal yet Error Displaying that ” Refund cannot be credited on account with status 65.Please add valid bank account. EVC cannot be enabled for this account.” What suggest to do to resolve this Error?

Hi, have you solved the issue?

Even I am facing same issue.

Will refund credit to bank of baroda account? Can you please help

how to prevalidate bank account without email id

There are lot many issues I identified with the incometax.gov.in portal.

Name in Profile information is not matching with PAN and ADHAR. I am wondering whey they get it from.

If you are a NRI, then the phone numbers will not match. Even though you select the correct country code, this portal always take it as +91 (India) as default while saving and displaying in profile view. So, you never ever receive text message in your mobile.

Adding and Validating bank account is a mystery. If you have successfully Add, Validate a bank account you are a gold medalist in Olympics.

During filing PART A general information section show my DOB is incorrect even though portal Profile, PAN and AADHAR DOB are matching. I don’t know who has developed and maintaining this website.

Digital India evolving. Happy Independence Day everyone. Enjoy your time with Incometax portal.

while filing ITR 1, A.Y 2021-22 when entering bank account details it shows validation in process how much time it require to validation of bank account? please send me how to solve.Since 10 June 2021

I am trying to submit my ITR . Details of new bank account is added ,shows validated , but this added account is not reflected in preview of ITR .

There is no Refund in my case, yet on submission shows error of bank account.Please help/guide me in the matter and oblige.

I am facing the same issue, how did you solve the issue

While Validating the ITR1, I am getting an Error – “Bank Name …” due to which I could not submit the return.

On clicking Error description, system is not allowing me to do any “Edit/Removing” of that bank. The status of that Bank is “Validation Pending”..

Please guide how to overcome this issue?

Thanks for posting extremely useful information.

May GOD bless you.Please continue helping people.

I am finding a problem as under:

Mobile number in my SBI NRO A/C and the mobile in ITR filing portal are not same.I have attempted multiple times for changing my mobile number which is Australia mobile number in ITR portal and receiving PIN/ code only in email AC,but no PIN / OTP on my new mobile number.Hence not able to change mobile number in ITR filing portal .Can you please guide.

Thanks

I added the bank account on 14 June 2021 in the new income tax portal and the portal still shows “validation in progress”. HaveI take action and need not ake any action. thanks

I had Andhra Bank Account during last year. The same is shifted to UBI. Now, AB account is showing under Validation in progress for the past one month and status is not changing. Due to this, I am unable to remove the bank account. Even, I added new UBI details and validated, Still, old one is not getting delete option as it is showing “Validation in progress”. Matter is ONE month old. Please advise.

S2S PROBLEM METTER 20 DAYS OLD NO REPLY VALIDATION IN PROGRESS

When the ITR2 utility complained of my bank account not being pre-validated, I logged into the tax portal and looked at the bank account status. It was “not validated”. I clicked on the validate button and the status immediately changed to “validated”. I thought the problem was solved, but the ITR utility did not detect the correction and has continued to flag my bank account as “not pre-validated”. It’s been three days since I got the status “validated” at the tax portal. What could be the solution, can anyone suggest something?

Acount type is wrongly selected as cash credit instead of saving bank and sent for validation on 4th July 21 still it is showing as validation in progress. I have to change the account type as saving bank account. How can be possible and how much time it will take to change

Thanks

RAJANI Samant

My Kotak Bank got updated EVC enabled with no error.

my ICICI bank shows error against mobile number.

Bank says my mobile number is correct.

my Union Bank gives error against email id. Got the email updated with bank, Still it fails saying technical issue.

while filing IT return A.Y 2021-22 when entering bank account details it shows validation in process how much time it require to validation of bank account? please send me how to solve