The National Financial Reporting Authority (NFRA) has issued penalties and debarments in the case of audit firm M/s Venkatesh & Co. for professional misconduct in the audit of Coffee Day Enterprises Limited (CDEL) for FY 2019-20. The NFRA investigated the firm’s actions following a Securities and Exchange Board of India (SEBI) report revealing a Rs 3,535 crore fund diversion from seven CDEL subsidiaries to Mysore Amalgamated Coffee Estate Limited (MACEL), a promoter-owned entity. The auditors, including CA Dasaraty V. and CA Desikan G., failed to address clear red flags of fraud outlined in a Central Bureau of Investigation (CBI) report, such as loans and advances without commercial justification and evergreening of debts. Despite issuing a disclaimer of opinion on the recoverability of Rs 3,512 crore from MACEL, the auditors did not follow the necessary procedures to mitigate fraud risk, including verifying statutory approvals for loans and guarantees. NFRA found the auditors negligent in adhering to standards, failing to conduct proper audit procedures, and delivering contradictory audit reports. As a result, NFRA imposed a Rs 2 crore fine on Venkatesh & Co., Rs 10 lakh on CA Dasaraty V., and Rs 5 lakh on CA Desikan G. Additionally, the auditors are barred from practicing for 10 years and 5 years, respectively. This order will take effect 30 days from its issuance on October 10, 2024.

Government of India

National Financial Reporting Authority

7th – 8th Floor, Hindustan Times House,

Kasturba Gandhi Marg, New Delhi

Order File No. 023/2024 Date: 10th October, 2024

In the matter of Mis Venkatesh & Co., CA Dasaraty V. and CA Desikan G., uls 132 (4) (c) of the Companies Act, 2013.

1. This Order disposes of the Show Cause Notice (‘SCN’ hereafter) no. NF- 23/1412022 dated 17.01.2024 issued to Mis Venkatesh & Co., Chartered Accountants, Firm No: 004636S (‘Firm’ hereafter), an audit firm registered with the Institute of Chartered Accountants of India (‘ICAI’ hereafter), CA Dasaraty V. ICAI Membership No-026336 (‘EP’ hereafter) and CA Desikan G. ICAI Membership No- 219101 (‘EQCR’ hereafter), who are members of ICAI and were members of Engagement Team for the statutory audit of Coffee Day Enterprises Limited (‘CDEL’ hereafter) for the Financial Year (‘FY’ hereafter) 2019-20. The Firm and the EP are collectively called as the Auditor/s or Principal Auditor/s).

2. This Order is divided into the following sections:

A. Executive Summary

B. Introduction & Background

C. Major lapses in the Audit

D. Omission and Commission by the Audit Firm

E. Finding on the Articles of Charges of Professional Misconduct

F. Penalty & Sanctions

A. EXECUTIVE SUMMARY

3. NFRA suo moto examined the professional conduct of the statutory auditors of Coffee Day Enterprises Limited under Section 132(4) of the Companies Act 2013 (‘the Act’ hereafter), pursuant to the Securities and Exchange Board of India (‘SEBI’ hereafter) shared its investigation report regarding diversion of funds worth Rs 3,535 crores from seven subsidiary companies of Coffee Day Enterprises Limited to Mysore Amalgamated Coffee Estate Limited (‘MACEL’ hereafter), an entity owned and controlled by the promoters of CDEL. Coffee Day Enterprises Limited is listed on stock exchanges. A Show Cause Notice was issued to to Mis Venkatesh & Co., the auditor for the FY 2019-20; CA Dasaraty V., the EP for the audit engagement and CA Desikan G, the EQCR.

4. Late Shri V. G. Sidhartha (VGS – the then Chairman of CDEL) reportedly committed suicide in July 2019 after leaving a note about financial irregularities in Coffee Day Group. Thereafter, as per direction of the Board of Directors of CDEL, the matter was investigated by retired Deputy Inspector General of Central Bureau of Investigation (DIG of CBI) and a legal firm. The Auditors had access to the investigation report of retired DIG of CBI, which had a number of red flags of fraud committed in the company. This investigation report spoke about loans/advances made by the subsidiaries of CDEL to MACEL (a promoter company which was 91 % held by father of VGS) without any commercial sense, evergreening of loans/advances given to MACEL and VGS keeping pre-signed blank cheques of CDEL’s subsidiaries to facilitate diversion of funds and evergreening of loans/advances. These all constitutes red flags of fraud in CDEL.

5. The Auditors had given disclaimer of opinion on Consolidated Financial Statements (CFS) about inter aha appropriateness of transections with and recoverability of Rs 3,512 crores from MACEL, a promoter entity. NFRA’s examination revealed that the CDEL’s Auditors for the FY 2019-20 inter alia ignored all the red flags of frauds available in the above stated investigation report and chose not to exercise statutory access to the books of accounts and records of CDEL’s subsidiaries. Further, there were many red flags in the CFS, which were ignored by the Auditors. They failed to meet the relevant requirements of the Standards on Auditing (‘SA’ hereafter) and provisions of the Companies Act 2013 and also demonstrated a serious lapse and absence of due diligence on the part of the Auditors and EQCR in following matters.

5.1 The Auditors failed to exercise professional judgement & skepticism, thus failed to evaluate fraud risk during audit of (a) fraudulent diversion of Rs 3,512 crores through subsidiaries of CDEL to a promoter’s entities named MACEL; (b) evergreening of loans through structured circulation of funds; and ( c) provision made for doubtful land advances of Rs 245 crores given to related parties and others. Diversion of funds to promoter entity without commercial sense and evergreening of loan were clearly visible from the investigation report of DIG of CBI mentioned above; (Section C-1 of this order).

5.2 The Auditors also failed to perform any audit procedure to verify whether CDEL passed special resolution in the general meeting before giving loan of Rs 1,841.46 crores and guarantee of Rs 100 crores to subsidiaries. They also failed to verify whether loan taken by subsidiaries from CDEL and money raised by the subsidiary on the strength of CDEL’s guarantee were used for the principal business activity of these subsidiaries (Section C-11 of this order).

5.3 The Auditors accepted this audit engagement as statutory auditor of CDEL from FY 201920 without first performing mandatory procedures and started audit activities even before

5.4 The Auditors failed to exercise due diligence and were grossly negligent in preparation of the Independent Auditor’s Reports by giving contradicting opinions, wrongly including Key Audit Matter in the Audit Reports despite disclaiming audit opinions, and wrongly included Emphasis of Matter paragraph in respect of the matters not presented and disclosed in the financial statements. (Section C-IV of this order).

5.5 The EQCR failed to perform an engagement quality control review to provide an objective evaluation of the significant judgments made by the engagement team and the conclusions reached in formulating the report (Section C-V of this order). The Firm and the EP failed to ensure that EQCR performed his duties as per Standards.

6. Based on investigation and proceedings under section 132 (4) of the Companies Act 2013 and after giving the Auditors opportunity to present their case, NFRA found the Audit Firm and its partners who performed the audit as Engagement Partner and Engagement Quality Control Reviewer, guilty of professional misconduct. It was seen that despite having all material on record and having the right of access of records of CDEL’s subsidiaries, the Auditors did little in terms of audit procedures to alleviate the fraud risk. They deliberately chose to shy away from discharging their statutory duty to report the fraud and to protect public interest. Therefore, this Order imposes a monetary penalty of Rs Two crores upon M/s Venkatesh & Co.; Rs Ten lakhs upon CA Dasaraty V.; and Rs Five lakhs upon CA Desikan G. In addition, CA Dasaraty V. and CA Desikan G are debarred for a period of Ten years and Five years respectively from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate. This Order will be effective from a period of 30 days from issuance of this Order.

B. INTRODUCTION & BACKGROUND

7. National Financial Reporting Authority (‘NFRA’ hereafter) is a statutory authority set up under section 132 of the Companies Act 2013 (‘Act’ hereafter) to monitor implementation and enforce compliance of the auditing and accounting standards and to oversee the quality of service of the professions associated with ensuring compliance with such standards. NFRA is empowered under section 132 (4) of the Act to investigate for the prescribed classes of companies1, the professional or other misconduct and impose penalty for proven professional or other misconduct of the individual Chartered Accountants or firms of Chartered Accountants.

8. The Statutory Auditors, whether individuals Chartered Accountants or firm of Chartered Accountants, are appointed by the members of companies as per the provision of section 139 of the Act. The Statutory Auditors, including the EP and the Engagement Team (‘ET’ hereafter) that conduct the Audit are bound by the duties and responsibilities prescribed in the Act, the rules made thereunder, the Standards on Auditing (‘SA’ hereafter), including the Standards on Quality Control (‘SQC’ hereafter) and the Code of Ethics, the violation of which constitutes professional or other misconduct, and is punishable with penalty prescribed under section 132 (4) (c) of the Act.

9. NFRA started its scrutiny, on receipt of information from SEBI in April 2022 about its investigation regarding the diversion of funds worth Rs 3,535 crores (as on 31-07-2019) from seven subsidiary companies of CDEL to MACEL, an entity owned and controlled by the promoters of CDEL.

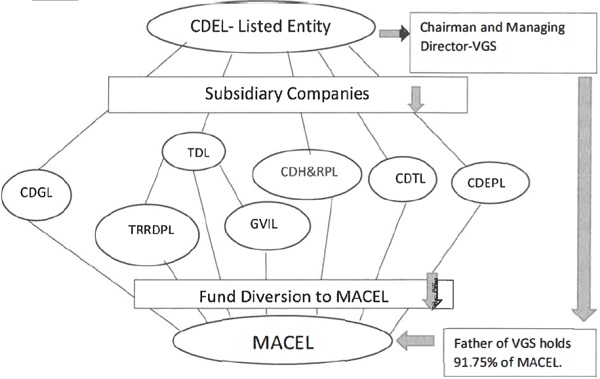

10. Late V. G. Siddhartha (‘VGS’ hereafter) was Chairman & Managing Director of CDEL; and Late S.V. Gangaiah Hegde, father of VGS was holding 91.75% shares of MACEL during relevant period.

11. As per the investigation made by the SEBI and examination by NFRA, the outstanding balance payable by MACEL to subsidiary companies of CDEL, which represented the funds diverted from the subsidiaries, was Rs 2,549 crores as on 31.03.2019. In order to hide the diversion of funds, MACEL, in March 2019, issued cheques of Rs 1,706.51 crores2 without adequate balance in its bank account, on the basis of which the subsidiaries reduced the outstanding balance to Rs. 842.49 crore as on 31.03.2019, as depicted in Table 1 below3. CDEL’s subsidiaries made mere book entries for these cheques received from MACEL as repayment of loans given but did not encash the cheques before 31.03.2019. These cheques indeed, were not intended to be encashed before the year end and were issued by MACEL for giving false indication of repayments of its loans at the end of the accounting year and to understate the subsidiaries’ loans to related parties. The Modus operandi appears to be similar to what was found in the case of ICAI versus P.K. Mukherji by the Hon’ble Supreme Court4.

(Note-* Lending to MACEL was understated in the books of the subsidiaries, by accounting for cheques issued by MACEL in March 2019 without MACEL having requisite bank balance. These cheques were used by the lenders (CDEL’s subsidiaries) to show recovery of related party loans in their books of accounts, even though MACEL did not have adequate bank balance or approved bank credit limit to support these cheques. These cheques were later shown as cleared in the next financial year, i.e., FY 2019-20 (year of audit in this case) by evergreening loans/advances by CDEL’s subsidiaries through orchestrated circulation of funds among related parties).

12. The linkage of the entities described in Table-1 is depicted in the Chart -1 given below: Chart-1

13. The examination of the Consolidated Financial Statements of CDEL and financial statements of MACEL, shows that except for CDGL, MACEL did not have any business transactions with 6 of the 7 subsidiary companies. MACEL was used as a conduit to transfer funds from CDEL’s subsidiaries to the personal accounts of VGS, his relatives and entities controlled by him and/or his family members, as loans and advances that were never returned to CDEL/MACEL.

14. The modus operandi of the alleged diversion of funds discovered by the SEBI during its investigation was that “VGS used to ask the Authorized Signatories to sign a bunch of cheques which were kept in his possession and used them as and when required”. Such pre signed blank cheques of bank accounts of various Coffee Day Group companies were used for the diversion of funds. In FY 19-20, VGS expired and the diversion of funds as detailed above was exposed.

15. CDEL is the parent Company of the Coffee Day Group. The Company owns and operates a resort and renders consultancy services. The Company is also engaged in the trading of coffee beans. The Company, primarily through its subsidiaries, associates and joint venture companies is engaged in business in multiple sectors such as Coffee-retail and exports, Leasing of commercial office space, Financial services, Integrated Multimodal Logistics, Hospitality and Information Technology (IT) / Information Technology Enabled Services (ITeS).

16. M/s Venkatesh & Co. was appointed as the statutory auditor of CDEL for the FY 2019-20, following the resignation of M/s BSR & Associates CA Dasaraty V. served as the Engagement Partner (EP), and CA Desikan G. was the Engagement Quality Control Reviewer (EQCR).

17. following the death of VGS in July 2019, the Board of Directors of CDEL appointed Shri Ashok Kumar Malhotra (Retired Deputy Inspector General of CBI) and Mis Agastya Legal LLP to investigate the circumstances leading to the statements made in the purported letter dated 27.07.2019 of VGS and to scrutinize books of accounts of CDEL and its subsidiaries. Their investigation report dated 24.07.2020 revealed inter alia unusual movement of funds from subsidiaries of CDEL to MACEL without any commercial sense, understatement and evergreening of loans, signing of blank cheques etc. Mis BSR & Associates LLP resigned as CDEL’s statutory auditor on 17.07.2020, after the close of FY 2019-20, citing a low level of audit fees as the reason for their resignation. Subsequently, on 05.08.2020, Mis Venkatesh & Co. accepted the engagement as statutory auditor for CDEL. However, the Firm began audit activities prior to receiving a no-objection letter from the outgoing auditor, which was issued on 06.08.2020, without performing the mandatory audit procedures, which was one of the charges in the SCN and which is discussed in the later part of this Order (Section C-III). The Auditors submitted their audit report on 25.11.2020.

18. After detailed scrutiny of the information shared by SEBI, NFRA suo motu initiated proceedings under section 132(4) of the Act and the Audit File of CDEL for Financial Year 2019-20 was called for. Based on an examination of the Audit File and other materials on record, each of which was shared with the noticees, a Show Cause Notice (‘SCN’ hereafter) dated 17.01.2024 under section 132( 4) of the Act, was issued and served upon the Auditors, charging them with the following professional misconducts

A. Failure to disclose a material fact known to them which is not disclosed in a financial statement, but disclosure of which is necessary in making such financial statement where the Statutory Auditors are concerned with that financial statement in a professional capacity.

B. Failure to report a material misstatement known to them to appear in a financial statement with which the Statutory Auditors are concerned in a professional capacity.

C. Failure to exercise due diligence and being grossly negligent in the conduct of professional duties.

D. Failure to obtain sufficient information which is necessary for expression of an opinion or its exceptions are sufficiently material to negate the expression of an opinion, and

E. Failure to invite attention to any material departure from the generally accepted procedures of audit applicable to the circumstances.

F. Failure to first communicate with the outgoing auditor before accepting a position as auditor previously held by another chartered accountant.

The EQCR was also charged with professional misconduct mentioned as para ( c) above.

19. The Auditors and EQCR were initially allowed 30 days’ time to submit reply to SCN. They sought one month extension of time for submitting response to SCN, which was allowed. They sought further extension of four weeks, which was also allowed up to 14.04.2024. After availing extension of time, they vide emails dated 13.04.2024 submitted separate replies to SCN and the Firm submitted additional reply vide email dated 22.04.2024. In the interest of natural justice, opportunity of personal hearing was also given to the Auditors and the EQCR on 13.05.2024. The Auditors and EQCR vide email dated 08.05.2022 sought extension of one month which was allowed and the personal hearing was rescheduled on 10.06.2024. The Auditors and EQCR again sought time till June end which was also allowed and personal hearing was again rescheduled on 03.07.2024. They attended the personal hearing on 03.07.2024 along with their legal counsel Mr. M. R. Venkatesh and sought time to file additional replies. They submitted additional replies on 15.07.2024. This Order is based on examination of the facts of the matter, charges in the SCN, written replies, arguments made during personal hearing and other materials available on record. This Order discusses only those Charges which have been proved.

C. MAJOR LAPSES IN THE AUDIT

20. Before taking up the charges individually, we note that the main thrust of the Principal Auditors’ reply has been that they had given Disclaimer of Opinion in their audit report demonstrating exercise of professional skepticism and judgement; and that they were the Auditors of the listed company viz CDEL and not of any subsidiary. According to them, there was no failure on their part to evaluate fraud risk in CDEL as there was no diversion of funds from CDEL and the funds were allegedly diverted from subsidiaries of CDEL to MACEL. It would not be out of place for us to note that the Standalone Financial Statements of CDEL reveal investments totaling Rs 1,866 crores in its subsidiaries and loans amounting to Rs 1,751 crores to these subsidiaries. These subsidiaries extended loans to various related parties. Notably, CDEL’s investments in subsidiaries and loans to them constituted 97% of the SFS balance sheet, which had a total size of Rs 3,711 crores.

21. We note that the Auditors gave a Disclaimer of Audit Opinion on CFS, on the basis of inter alia not obtaining audit evidence about appropriateness of transactions with MACEL and recoverability of Rs 3,512 crores from MACEL, a promoter entity. It is important to note that following the suicide of CDEL’s Chairman (VGS), in July 2019, an investigation led by a former CBI official and Agastya Legal LLP uncovered significant financial irregularities like questionable loans to MACEL, understated balances, the use of pre-signed cheques, and diversion of funds for the private investments of promoters. The Auditors had access to this investigation report dated 24.07.2020 which clearly detailed the irregularities in CDEL’s financial statements. Specifically, the substantial loans and advances extended to a promoter entity, purportedly for supply of goods, were disproportionately high (110 times) of the value of goods purchased. Additionally, CDEL and its subsidiaries engaged in large-scale evergreening of loans by circulating funds among group companies to mask the diversion of funds to MACEL. The Auditors disclaimed their audit opinion on this matter but kept silent about fraud in these transactions. With such a detailed report in hand with supporting evidences the auditors had a statutory duty to report this fraud under section 143(12) of the Act, as per SAs, and under the Companies (Auditor’s Report) Order (CARO) even if the auditors issue a Disclaimer of Audit Opinion. The lapses in audit are discussed below in detail.

I. Lapses in audit of fraudulent diversion of funds to MACEL & other parties and evergreening of loans through structured circulation of funds [This matter pertains to Standalone Financial Statements (SFS) as well as Consolidated Financial Statements (CFS))

22. The Firm and EP were charged with violation of section 143(9)5, 143(12)6 of the Act, the Companies (Auditor’s Report) Order 2016 (CARO), SA 2007, SA 2408, SA 3159, SA 33010 and SA 55011 as they did not exercise professional skepticism and judgement to identify and assess the fraud risk arising due to (a) diversion of funds to MACEL to the tune of approx. Rs 3,535 crores; (b) evergreening of loans through structured circulation of funds; and ( c) diversion of Rs 245 crores to other parties in the name of land advances. Further, they did not report such fraud to the Central Government as required under section 143 (12) and also in the Independent

Auditor’s Reports and the CARO.

23. The Firm and the EP denied this charge and replied as under:-

a. The Firm was statutory auditor of CDEL only and not any of its subsidiaries.

b. There was no reason to suspect fraud in financial reporting of CDEL. Further, findings of the investigation report of Agastya Legal LLP (investigation report) supplied by CDEL to the Firm did not give any reason to believe that any fraudulent transactions had occu1Ted in CDEL.

c. They had given disclaimer of opinion in their audit report demonstrating exercise of professional skepticism and judgement.

d. There was no failure on their part to evaluate fraud risk in CDEL. There was no diversion of funds from CDEL and funds were allegedly diverted from subsidiaries of CDEL. Source of lending by subsidiaries of CDEL to MACEL was not CDEL.

e. They had no obligation to evaluate fraud risk in any of the group companies other than CDEL.

f. They had no access to the books of subsidiaries of CDEL audited by other auditors.

g. They had communicated with TCWG’2, Audit Committee and management about these transactions.

h. Disclaimer of opinions given by Auditors of subsidiaries of CDEL had been incorporated by them in consolidated audit report as per Guidance Note of ICAI regarding reporting of fraud u/s 143(12) of the Act’3.

i. While responding to the charge relating to evergreening of loans, they admitted the occurrence of various transactions between CDGL and MAGEL but stated that there was no evergreening ofloans in CDEL in FY 2019-20. They further stated that the investigation report pointed out evergreening ofloans in subsidiaries of CDEL only.

j. While responding to the charge relating to failure to evaluate fraud risk in recognition of provision of doubtful land advance of Rs 245 crores, they replied that there was no provision in the books of CDEL; land advances were given by the subsidiaries of CDEL not audited by them; and qualifications by such auditors were incorporated in the consolidated audit report.

We have considered the replies. The facts of the matter and our evaluation of the Auditors’ reply are given hereunder.

24. Diversion of Rs 3,535 crores to MACEL: The Consolidated Financial Statements of CDEL include substantial transactions and balances with a related party viz MAC EL, 91. 75% of which was owned by the father of the then Chairman & Managing Director of CDEL. These transactions and balances are summarized in Table 2 below, which has been derived from the CFS of CDEL, and the relevant serial numbers of the notes to the CFS are referred in the first column of this Table.

Table-2 Transections and balances with MACEL as per CFS of CDEL (Rs in crores)

principal auditor would normally be entitled to rely upon the work of component auditors unless there are special circumstances to make it essential for him to visit the component and/or examine the books of accounts and other records of the said component. The large quantum of funds given to MAC EL is given in Table 2 above. Further, the investigation report of Mr. Ashok Kumar Malhotra and Agastya Legal LLP available to the Auditors, clearly highlighted several red flags like unusual movement of funds from subsidiaries of CDEL to MACEL without any commercial sense, evergreening of loans, signing of blank cheques etc. Further, SFS of CDEL show investments of Rs 1,866 crores in its subsidiaries and Loans of Rs 17 51 crore to its subsidiaries. These investments and loans were 97% of the SFS balance sheet size of Rs 3,711 crores which was under full scope of audit by the Auditors. These subsidiaries provided unusual loans to promoter group entity. It is critical to note that the proviso to section 143(1) of the Act gives an auditor right of access to the records of all subsidiaries and associates of a holding company. Accordingly, the principal auditor is expected to examine the books of accounts and records of subsidiaries and associates wherever found necessary in situations similar to those of the audit under examination. Therefore. we do not agree with the Auditors defence that that they had no obligation to assess fraud risk within subsidiaries.

b. Post suicide by the group Chairman (VGS), CDEL appointed Mr. Ashok Kumar Malhotra, retired Deputy Inspector General of Central Bureau of Investigation and Agastya Legal LLP to investigate inter alia the books of accounts of CDEL and its subsidiaries. The Auditors had access to their investigation report, which detailed the movement of funds from subsidiaries of CDEL to MACEL and contained various red flags like (a) absence of commercial sense to lend huge funds to MACEL; (b) understatement of outstanding balance from MACEL by issue of cheques on balance sheet date which were cleared in subsequent year out of fresh funds provided by CDEL’s subsidiaries in subsequent year; (c) use of pre-signed blank cheques; and (d) use of diverted funds for funding private investment of promoters14. Such red flags and large scale movement of funds from a listed company through its subsidiaries to the promoter’s company were reason enough for the Auditors to evaluate the possibility of fraud within the Group compames.

c. Further, in respect of transactions and balances with MACEL, the Auditors reported in the Independent Auditor’s Report on CFS for the FY 2019-20 as follows:

“We are unable to comment on the appropriateness of the transactions, including regulatory non-compliances, if any, and the recoverability of the amounts due in the absence of requisite evidence not being made available to us and its impact to the Consolidated Financial Statement. ” (emphasis added)

The above opinion shows that the CDEL’ s management did not provide to the Auditors the evidence about business rationale or appropriateness of these transactions and recoverability of Rs 3,512 crores dues from MACEL and it was evident from the material available with the Auditors that these transactions were outside the normal course of business of CDEL and its subsidiaries. The investigation report of retired DIG of CBI has mentioned about absence of commercial sense to lend huge funds to MACEL at para 8.3.7 of the report, which is quoted hereafter “However, the question that no one seems to have put forth is why a Company with a paid-up capital of less than Rs 10 lacs be advanced gargantuan sums of money aggregating to several Crores of rupees, while the legality of these transactions may well and truly be unquestionable, the fact of the matter remains that these transactions did not make any commercial sense to us. In retrospect, an analysis of the transaction between the Company and its subsidiaries on one hand and MACEL on the other, clearly brings about the fact that these transactions though couched in all legalities, disclosure norms and meeting the imperial standards of all regulations probably did not meet the simple test of commercial expediency”. (Emphasis added). Despite such a clear report in hand, the Auditors did not evaluate fraud risk and thus failed to comply with the above SAs in respect ofloans and supplier advance given to MACEL by subsidiaries of CDEL.

The Auditors’ stand that they had no obligation to assess fraud risk related to these transactions, is also contradictory to the Audit report and audit work papers. The Auditors’ disclaimer of opinion stating that they were “unable to comment on the appropriateness of the transactions” clearly shows that they wanted to obtain audit evidence regarding the appropriateness of the transactions. In the background of evidence available with the auditors regarding absence of commercial sense of loans given to MACEL, the appropriateness of transaction has direct link with the risk of fraud committed in the company. Thus, the Audit report contradicts the Auditors’ reply that they had no obligation to assess fraud risk. Secondly, the Audit file15 shows that the Auditors had sought from CDEL management the loan agreement between MACEL and all the Group entities of CDEL, which undermines the Auditors’ defense that they had no obligation to assess fraud risk within subsidiaries, as their efforts to obtain loan agreements were intended to evaluate fraud risk in the transactions with MACEL. The absence of evidence regarding the appropriateness of transactions itself constitutes a red flag for potential fraud. The Auditors’ failure to address this red flag in their evaluation of fraud risk indicates a lack of necessary professional skepticism.

d) We now go on to see the facts and figures available to the Auditors, which should have impelled him to report fraud. As detailed in Table 2, the CDEL Group purchased clean and raw coffee from MACEL amounting to Rs 28.71 crores during FY 2019-20. However, during the same period, the CDEL Group extended loans and advances totaling Rs 3,172.25 crores to MACEL, which is 110 times (Rs 3,172.25 crores / Rs 28.71 crores) of the value of goods purchased, indicating a disproportionate relationship between the financial transactions and the level of operation with MACEL. This disparity was a strong pointer of potentially fraudulent activity. Historical data reveals that the value of raw coffee supplied by MACEL to CDGL ranged from Rs 39 to 71 crores from FY 2015-16 to FY 2018-19. The substantial loans and advances made to a promoter group under the pretext of goods supply is unusual for a listed company like CDEL. The Auditors’ reply that there was no reason to suspect fraud, is just not acceptable given the background and the circumstances when they took up this Audit. The absence of an inquiry into such a significantly high advance and the absence of evaluation of fraud risk reflect a complete absence of professional skepticism and due diligence on the part of the Auditors.

e. Further, according to CDEL’s Standalone Financial Statements, the company extended loans totaling Rs 1,832.02 crores to its subsidiary, Tanglin Developments Ltd. (TDL), with Rs 1,746.10 crores outstanding as of 31.03.2020. The financial statements of TDL indicate that: (a) Rs 609 crores was recoverable from MACEL; (b) Rs 511 crores were recoverable from GVIL’6, which in tum was to recover Rs 3 70 crores from MACEL; ( c) Rs 954.26 crores were recoverable from TRRDPL’7, which was to recover Rs 1.050.31 crores from MACEL18• Further, CDGL’9 had a recoverable amount of Rs 1,222.60 crores from MACEL. The above details clearly indicate that CDEL’s funds were channeled to MACEL through various layers of subsidiaries. As mentioned in paragraph 24(a) of this Order, section 143(1) of the Act allows the Auditor right of access to the books of accounts and records of all these subsidiaries. Further, TDL’ s net assets constituted 20% of consolidated net assets of CDEL and CDGL’s revenue constituted 60% of consolidated revenue of CDEL. It is thus clear that CDGL and TDL constituted a significant portion of the CDEL’s Consolidated Financial Statements. Therefore, the Auditors had an obligation to investigate the diversion of funds from these companies to MACEL. However, the Auditors did not exercise their right to examine books of accounts and records of CDEL’s subsidiaries. Therefore, the Auditors’ reply that CDEL did not transfer any funds to MACEL is not accepted.

f. At this juncture, we list out the requirements of the Standards, which mandate an assessment of fraud. According to the Auditing Standards, the Auditors were required to:

- exercise professional skepticism and due professional care and evaluate the business rationale of these transactions20.

- perform risk assessment procedures to provide a basis for the identification and assessment of Risks of Material Misstatement (RoMM) at the financial statements and assertion levels21.

- to respond to the identified RoMM (As per para 5 of SA 330).

- to perform audit procedures and related activities to identify the risk of material misstatement associated with related party relationships and transactions22.

SA 240 prescribes auditor’s responsibilities relating to fraud in audit of financial statements. Para 10 of SA 240 provides that the objectives of auditor are to identify and assess the RoMM in the Financial Statements due to fraud, obtain audit evidence and respond to identified or suspected risk. Para 12 of SA 240 requires the auditor to maintain professional skepticism recognizing the possibility of existence of material misstatement due to fraud. Para 32 ( c) of SA 240 further requires an auditor to evaluate the business rationale ( or lack thereof) of the significant transactions that are outside the normal course of business or otherwise appear unusual and evaluate whether such transactions may have been entered into to engage in fraudulent financial reporting or to conceal misappropriation of funds.

g) The investigation report of retired DIG of CBI came on July 2020, thereafter the Auditors were appointed in Aug 2020. The Auditors had access to this investigation report which contained clear details about diversion of funds to promoter entity without commercial sense, evergreening of loans and signing of blank cheques. The Auditors performed audit for four months and issued audit report on 25.11.2020. Thus, they had four months to evaluate fraud and communicate with Those Charged With Governance (TCWG), the Audit Committee and Management regarding the suspicious fraudulent transactions. SA 260 (Communication with Those Charged with Governance) required the Auditors to communicate with TCWG at planning stage about inter alia the significant risks identified by them (paragraph 15); significant matters arising during the audit [paragraph 16 (c & e)]; and to communicate with TCWG on timely basis (paragraph 21). The Auditors did not communicate with TCWG during four months of the audit period but only communicated on 25.11.2020 i.e. the date of signing of the audit report. The Auditors replied that Disclaimer of Opinions given by component auditors were highlighted in the presentation given to TCWG and reply thereon was obtained from the management; and queries were made regarding loans/advances made by CDEL group to MACEL. This reply is not accepted for the following reasons. The Audit file contains only a single document – a presentation of audit opinions from subsidiary auditors- which does not clearly indicate whether it was presented to TCWG or the Audit Committee. Furthermore, the document lacks details about the discussion’s content and timing. There is no documented evidence of communication with TCWG from the beginning of the audit to the conclusion of the audit. This lack of communication is a violation of paragraphs 14 to 16 of SA 260 (Communication with Those Charged with Governance).

25. Evergreening of loans through structured circulation of funds among group companies – CDEL and its subsidiaries were involved in large scale evergreening ofloans through structured circulation of funds among group companies to understate diversion of funds to MACEL. This is explained hereafter:

a) Examination of bank statement of CDGL with Yes Bank shows evergreening of loans through structured circulation of funds between CDGL and MACEL. For example, CDGL received four cheques of Rs 65.50 crores in March 2019 from MACEL, which were cleared on 04.04.2019 by evergreening of loan through circulation of funds between MACEL and CDGL. Table -3, an extract of the CDGL’s bank account with Yes Bank, demonstrates that three payments amounting to Rs 65.50 crore were received from MACEL on 4th April 2019 and three payments of Rs.65.50 crore were made by CDGL to MACEL on the same day, the receipts and payments matching exactly.

Table 3: Bank Statement of CDGL with Yes Bank

b) Evidence of evergreening of loans through circular transactions is also apparent in the bank statements of CDGL with Induslnd Bank. Had the Auditors reviewed CDGL’ s bank statements for April 2019, they would have uncovered this manipulation. Similar patterns of loan evergreening through structured fund circulation were observed in other subsidiaries, including TDL, GVIL, and TRRDPL. This issue was highlighted in the investigation report by Mr. Ashok Kumar Malhotra. Despite this, the Auditors failed to apply adequate professional skepticism and did not examine the bank statements of these subsidiaries, particularly those with significant transactions. The reply of the Auditors that evergreening happened in subsidiaries only and not in CDEL, is very concerning. By stating this the Auditors are absolving themselves of any action due on their part when there is a report of an inquiry done at the behest of the Audi tee company, wherein evergreening in the groups accounts is proved. This is tantamount to the Auditors refusing to see the result of an inquiry directly implicating the accounts they have consolidated. It is noted that as per proviso to section 143( 1) of the Act, the Auditors had the right of access to the records of subsidiaries. Further, as per para 10 of SA 600, this was a special circumstance to verify bank statements of subsidiaries as red flag of evergreening was available in the investigation report mentioned above. But the Auditors chose to remain silent on this issue. This clearly shows an obstinate refusal to deal \Vith the issue thereby establishing their gross negligence.

26. Provision for doubtful advance for Rs 245 crores in CFS: CDEL has inter alia made provision for doubtful advance for Rs 245 crores in respect of following land advances23 in consolidated financial statements audited by the Auditors:-

- Rs 100 crores given by TDL to Kiran Hegde (Director of TRRDPL);

- Rs 45 crores given by GVIL to Razia Sultana; and

- Rs 100 crores given by Coffee Day Kabini Resorts Ltd to Si cal Bangalore Logistics Limited.

The Auditors of TDL and GVIL have also reported above transactions in their audit reports24. Despite the fact that provision for doubtful advance was made for such huge amount of land advances and was unusual, the Auditors did not evaluate fraud risk. This provision contributed substantially to the consolidated loss of Rs 1,226 crores before exceptional item, share of profit of equity accounted investees and tax. The Auditors replied that:

a. The Firm was statutory auditor of CDEL only and not any of its subsidiaries.

b. There was no reason to suspect fraud in financial reporting of CDEL. Further, findings of the investigation report of Agastya Legal LLP supplied by CDEL to the Firm did not give any reason to believe that any fraudulent transactions had occurred in CDEL.

c. They had given disclaimer of opinion in their audit report demonstrating exercise of professional skepticism and judgement.

d. There was no failure on their part to evaluate fraud risk in CDEL. There was no diversion of funds from CDEL and funds were allegedly diverted from subsidiaries ofCDEL. Source oflending by subsidiaries of CDEL to MACEL was not CDEL.

27. The Auditors reliance on the claim that they were not required to evaluate fraud risk in subsidiaries as provision for significant amount was made by the subsidiaries in respect of land advance given to related parties is an oxymoron I reveals a flawed understanding of the work and responsibility of a principal Auditor. This was also a special circumstance envisaged in paragraph 10 of SA 600 discussed earlier in this Order. Therefore, the Auditors were required to evaluate fraud risk in these transactions also. Despite knowing that such unusual transactions had caused significant loss to the shareholders of a listed company, the Auditors did not perform their statutory duty diligently and were then seeking refuge under SA 600. It is important to note that any loss to a holding company on account of any fraudulent transaction in a subsidiary, is ultimately borne by the stakeholders of the holding company who solely rely on the auditor of the holding company. In many cases financial statements of subsidiaries are not available in public domain. Thus, it is all the more the responsibility of the auditor of the holding company to exercise scepticism, more so in such a case where there are sufficient red flags indicating fraud.

28. Responding to the charge relating to the failure to report this fraud to the Central Government under section 143(12) of the Act, the EP replied that he acted as per guidance note issued by ICAI on reporting of fraud by the statutory auditors, according to which the auditor of parent company is not required to report on the fraud in the subsidiaries if the same has not been reported by the statutory auditors of subsidiaries. It is evident that the fraud had been committed in the CDEL itself as proved in paragraph 24 (e) of this Order since CDEL’s funds were channelised to promoter company through its subsidiaries. The instant case falls in this category as fraud was committed by VGS who was Chairman of CDEL and the Auditors had noted this diversion of funds to promoters company. Therefore, it is clear that the Auditors were required to report this fraud under section 143(12) of the Act.

29. It was further contended by the Auditors that the dues from MACEL were fully captured in the financial statements, consequently the charge of misstatement in the financial statements of CDEL does not arise. It is relevant to quote the definition of misstatements given in para 4(a) of SA 450, as “A difference between the amounts, classification, presentation, or disclosure of a reported financial statement item and the amount, classification, presentation, or disclosure that is required for the item to be in accordance with the applicable .financial reporting framework. Misstatements can arise from error or fraud. When the auditor expresses an opinion on whether the financial statements give a true and fair view or are presented fairly, in all material respects, misstatements also include those adjustments of amounts, classifications, presentation, or disclosures that, in the auditor’s judgment, are necessary for the financial statements to give a true and fair view or present fairly, in all material respects”. (Emphasis supplied). The term ‘Fraud” is defined in SA 240 as “An intentional act by one or more individuals among management, those charged with governance, employees, or third parties, involving the use of deception to obtain an unjust or illegal advantage”. The diversion of Rs 3,512 crores to MACEL without any business purpose resulted in the overstatement of receivables in the consolidated balance sheet of CDEL. Thus, the Auditors understanding of the issue as displayed in his reply is appalling.

30. The above analysis clearly shows absence of professional skepticism and due diligence; and absence of appropriate audit procedure to report in the Independent Auditor’s Report, a diversion of funds which had already been detected. Granting of abnormal amount of loans and advance to MACEL and land advance to other related parties without any business rationale; and evergreening of loans through structured circulation of funds were clear indications of diversion of funds. It is also evident from above analysis that despite having adequate evidence that an offence of fraud had been committed in the company, the Auditors failed to evaluate and report the fraud to the Central Government under Section 143 (12) of the Act. On the contrary, they reported25 that no material fraud by or on the company had been noticed or reported during the course of audit. Accordingly, the charge that the Auditors had violated section 143 (12) of the Act, the Companies (Auditors Report) Order 2016, SA 200, SA 240, SA 315, SA 330 and SA 550 stands proved.

31. Notwithstanding the above, it is important to note that the Auditors had given a Disclaimer of Opinion on the basis of inability to obtain sufficient appropriate audit evidence in respect of inter alia appropriateness of the transactions with MACEL and recoverability of money from MACEL. A Disclaimer of Opinion is to be given when the auditor is unable to obtain sufficient appropriate audit evidence to conclude that the financial statements as a whole are free from material misstatements (paragraph 6 of SA 705 – Modifications to the Opinions in the Independent Auditor’s Report). We find it surprising that while the Auditors had access, under the law, to all records and financial statements of CDEL’s subsidiaries and the investigation report of Mr Ashok Kumar Malhotra dated 24.07.2020. They did not put in effort to gather and get sufficient appropriate audit evidence. This investigation report dated 24.07.2020 had detailed the fraud in terms of diversion of funds to promoter entity without commercial sense, evergreening of loans and signing of blank cheques. The Auditors performed the audit from Aug 2020 to Nov 2020, i.e., for four months. During these four months, the Auditors did not make any effort to inquire/communicate with TCWG, Audit Committee and management about these issues or report the fraud as per law.

II Lapses in audit of CDEL’s compliance with section 185 of the Act (This matter pertains to SFS only)

32. The Auditors were charged with violation of clause (iv) of the Companies (Auditor’s Report) Order 2016 (CARO hereafter) as they did not report CDEL’s violation of section 185 of the Act in respect of loans of Rs 1832.02 crores given to Tanglin Developments Ltd (TDL) and guarantee of Rs 100 crores given by CDEL to lenders of Coffee Day Hotels and Resorts Private Limited (CDH&RPL) (Both are wholly owned subsidiaries). There is no record that (a) these transactions were approved by special resolutions of the members; and (b) proceeds of such loans were used for principal business activities of such subsidiaries.

33. The Firm and the EP denied this charge and the main contentions in their reply are as follows:

a. Section 185 of the Act does not apply to these transactions as loans were given to subsidiaries in which none of the directors of CDEL had any interest.

b. No part of the funds given by CDEL to TDL was diverted to MACEL. The source of the loan given to TDL was the sale price of Mindtree shares held by CDEL. A part of the sale proceeds was utilised to repay the loan of TRRDPL (TDL’s subsidiary). These transactions were verified by the EP with supporting documents.

c. They verified the guarantees, guarantee working and loan agreements.

34. We have considered the replies and proceed to evaluate the same as under:

a. Clause (iv) of the CARO requires the auditor to report inter alia in respect of loans, investments, guarantees, security, whether provisions of sections 185 of the Companies Act have been complied with, giving details thereof in case of non-compliance. In this case, the Auditors reported that the Company has complied with the provisions of Section 185 of the Act with respect to loans advanced and investments made and securities and guarantees given.

b) Section 185(2) of the Act provides that:

“A company may advance any loan including any loan represented by a book debt, or give any guarantee or provide any security in connection with any loan taken by any person in whom any of the director of the company is interested, subject to the condition that-

a. a special resolution is passed by the company in general meeting:

Provided that ……………… ; and

b. the loans are utilised by the borrowing company for its principal business activities.

Explanation-For the purposes of this sub-section, the expression “any person in whom any of the director of the company is interested” means-

(a) ………… ;or

b. any body corporate at a general meeting of which not less than twenty-five per cent. of the total voting power may be exercised or controlled by any such director, or by two or more such directors, together; or

c. any body corporate, the Board of directors, managing director or manager, whereof is accustomed to act in accordance with the directions or instructions of the Board, or of any director or directors, of the lending company”. (emphasis added).

c. TDL and CDH&RPL were 100% owned by CDEL26, thus it is clear that CDEL’s Board of Directors were controlling 100% voting powers of these subsidiaries. Thus, it is clear that Board of CDEL had an interest in TDL and CDH&RPL. It also shows that the Board of Directors of these subsidiaries was also accustomed to act as per directions or instructions of the Board of Directors of CDEL. It is further corroborated from para 8.6. 7 of the investigation report of retired DIG of CBI available with the Auditors, which states that (i) in case of TRRDPL, the company did not have any operations and the fund deployment was directly handled by VGS; (ii) TRRDPL used to borrow funds from NBFCs and Banks and these were deployed by VGS; (iii) the cheque signatories of TRRDPL were VGS or any two persons, as the signatories had their own busy schedules, VGS would instruct them to leave some signed but blank cheques at the office which have been subsequently used by VGS to transfer funds from TRRDPL to MACEL and a similar practice was observed in TDL, CDECON, GVIL, CDTL, CDGL and CDHRPL. Thus, it is clear that VGS was virtually controlling the entire group companies and the BODs of subsidiaries were defunct. It leaves no doubt that section 185 was applicable to these transactions.

d. With respect to utilization of funds, the details given in paragraph 24( e) of this Order show that TDL did not utilize the proceeds ofloans given by CDEL for its principal business activities but diverted the funds to MACEL through its subsidiaries. This is also corroborated from the preceding para that funds were diverted by TRRDPL to MACEL by using pre-signed blank cheques. Thus, the Auditors’ reply that funds of CDEL were not diverted to MACEL is not accepted.

e. With respect to verification of guarantee of Rs 100 crores provided to the lender of CDH&RPL, perusal of the audit work papers27 quoted by the Auditors in their replies shows that this work paper contains details of the guarantees and calculation of guarantee commission etc., but this work paper does not have evidence that the Auditors had verified whether CDEL passed special resolution before providing guarantee and whether CDH&RPL had utilised the proceeds of loans for its principal business activities. Thus, the Auditors’ reply on this part of the charge is also not accepted.

35. In view of the above, it is proved that the Auditors did not exercise due diligence and wrongly

reported that CDEL had complied with section 185 of the Act, and thus violated CARO.

III. Lapses in acceptance of audit engagement (This matter pertains to SFS as well as CFS)

36. The Auditors were charged that they had accepted this audit engagement as statutory auditor of CDEL from FY 2019-20 without performing mandatory audit procedures and without first communicating with resigning auditor, thus they were charged to have violated para 28(a) and 29 of SQC 128, para 12 of SA 22029 and para 12 & A21 of SA 30030.

37. The Firm and the EP denied this charge and replied as under:

a. They had been informally sounded out about this assignment in the last week of July 2020 therefore, they had prepared client acceptance form in early August 2020. The audit requirement file prepared on 01.08.2020 is a basic requirement file (common template) that is kept ready to save time at the time of audit commencement.

b. After receipt of communication about appointment, they obtained No Objection Certificate from outgoing auditor on 06.08.2020, which did not specify any objection.

c. The audit was accepted after proper evaluation and there was no allegation of fraud as per publicly available information and investigation report.

We have considered the replies and its evaluation is given hereafter.

38. The Firm was required to establish policies and procedures for the acceptance and continuance of client relationships and specific engagements, designed to provide it with reasonable assurance that it will undertake or continue relationships and engagements only where it has considered the integrity of the client and does not have information that would lead it to conclude that the client lacks integrity. With regard to the integrity of a client, matters that the firm considers include the identity and business reputation of the client’s principal owners, key management, related parties and those charged with its governance; and indications that the client might be involved in money laundering activities31•

39. They were further required to communicate with the predecessor auditor in compliance with relevant ethical requirements; major issues including the application of accounting principles or of auditing and reporting standards; and the audit procedures necessary to obtain sufficient appropriate audit evidence regarding opening balances32.

40. The sequence of events described below indicates that the Auditors accepted the audit of CDEL in haste without completing mandatory activities :

- On 17.07.2020, i.e. after the close of FY under question, the outgoing auditor of CDEL resigned citing low level of audit fee.

- On 01.08.2020, the Auditors prepared the client acceptance form and ‘LRR Audit requirements_ O 1082020. pdf’. This is not a common template but the Auditors had recorded on 01.08.2020 in this AWP that they had obtained documents relating to 18 specific requirements like financial statements with detailed sub-schedules and trial balances for the year ended 31st March 2019 and three quarters of FY 2019-20; books of accounts in SAP/ERP/tally/in – house software etc.; details of related party transactions with concerned; to enable remote access to books of accounts for auditors with separate login credentials; and financials of subsidiaries etc. They had also obtained documents about 12 general requirements like memorandum and article of association; particulars board of directors; PAN, TAN, GST registration certificates of HO and branches etc.; internal audit reports for Ql of FY 2019-20; and standard operating procedures / accounting manual. Therefore, the Auditors reply is not correct that this document contain only basic requirements, in fact they had started the audit on 01.08.2020.

- On 03.08.2020, CDEL intimated the Auditors about their proposal to appoint the Firm as statutory auditor of CDEL from FY 2019-20.

- On 04.08.2020, the Auditors wrote to the outgoing auditor seeking their no-objection.

- On 05.08.2020, the Auditors accepted this engagement by signing an engagement letter with CDEL for acting as statutory auditor of CDEL. Thus, it is clear that the Auditors did not wait for receipt of NOC from outgoing auditor for more than one day.

- On 06.08.2020, the outgoing auditor issued a no-objection letter.

- On 25.11.2020, the audit report was signed.

41. Audit Work Paper (A WP) ‘2.2 client acceptance form.pdf’ was signed on 01.08.2020 by the EP and the EQCR. It is a simple list of27 questions which are answered as ‘yes’ or ‘no’ without recording the basis for arriving at such a conclusion. For example, row no. 23 – ‘Likelihood of fraud’ is marked as ‘No’ without recording basis of concluding as to why there was no likelihood of fraud. In this client acceptance form the Auditors finally concluded that there were no concerns about the management’s integrity, business environment or any other limitations or concerns due to which the firm may not accept the audit engagement. However, there is no evidence in the Audit Files as to how they evaluated acceptance of this audit engagement especially in view of the facts that information of financial irregularities in CDEL was in public domain before they accepted the audit of CDEL. Further, there is no record in the Audit file of their discussion with the previous auditor regarding such reported financial irregularities.

42. From the above, it is clear that the Auditors (a) did not perform. procedures to evaluate integrity of CDEL’s promoters despite knowing about financial irregularities committed by CDEL’s promoters; and (b) accepted the appointment as statutory auditor of CDEL and also started audit activities even before getting the no-objection letter from the outgoing auditor. Thus, it is proved that the Auditors did not exercise due diligence before accepting the audit engagement of CDEL, and violated paragraphs 28 & 29 of SQC J, paragraphs 12 of SA 220 & paragraphs 12 & A21 of SA 300.

IV. Lapses in forming audit opinion (This matter pertains to SFS as well as CFS)

43. The Auditors were charged with failure to exercise due diligence and for gross negligence in preparation of the Independent Auditor’s Reports and violation of para 19 (c), 28 & para 29 of SA 70533 and para 8 (a) & 9 (c) of SA 70634 due to following-

a. In the Disclaimer of opinion section, they reported that they were unable to obtain Sufficient Appropriate Audit Evidence (SAAE), whereas in the Auditor’s responsibilities sections, they reported that they obtained SAAE, which are contradictory;

b. They had given ‘Disclaimer of Opinion’; as well as the ‘Key Audit Matter’ (KAM) in the Independent Auditor’s Reports on both, the Standalone Financial Statements (SFS) and Consolidated Financial Statements (CFS). But as per the provisions of SA 705, KAM is not allowed if auditor disclaims audit opinion;

c. In the ‘Emphasis of Matters’ (EOM) paragraphs, they had reported on matters which were neither presented nor disclosed in the financial statements whereas an EOM paragraph on such matters is not permitted as per SA 706; and

d. They had given disclaimer of opinion in the Independent Auditor’s Reports on SFS and CFS as they could not obtain SAAE, but their audit report starts with the phrase “we have audited … “, which gives the impression that they had obtained SAAE and completed the audit. It is important to understand that Audit cannot be performed without obtaining SAAE, therefore their audit report is contradictory.

44. The Firm and the EP’s denial of this charge is evaluated as under:

a) In respect of the charge relating to contradiction between the audit opinion and the auditors responsibilities statement, they stated that the “Auditor’s responsibility for the Audit” lays down the responsibility of the auditor and not a description of what the auditor has actually done. This reply is not accepted in view of para 28 of SA 705 which states that:

“When the auditor disclaims an opinion on the financial statements due to an inability to obtain sufficient appropriate audit evidence, the auditor shall amend the description of the auditor’s responsibilities required by paragraphs 39 41 of SA 700 (Revised) to include only the following: (Ref Para. A25)

( a) A statement that the auditor’s responsibility is to conduct an audit of the entity’s financial statements in accordance with Standards on Auditing and to issue an auditor’s report;

(b) A statement that, however, because of the matter(s) described in the Basis for Disclaimer of Opinion section, the auditor was not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the financial statements; and

(c) The statement about auditor independence and other ethical responsibilities required by paragraph 28(c) of SA 700 (Revised)”. (emphasis added).

In the instant case the audit reports on SFS and CFS show that SA705, quoted above which required them to specifically mention the fact that they were not able to obtain sufficient appropriate audit evidence, was not done. On the contrary they wrongly reported that they had obtained sufficient appropriate audit evidence.35 despite giving a disclaimer of opinion both on the SFS and the CFS. This is an evidence of gross negligence.

b. The Auditors admitted the charge relating to wrong reporting of KAM in respect of the matters included in the Disclaimer of Opinion section of the audit report but stated that the intention behind including KAM in the audit report was to highlight the issues of magnitude that had come up during the audit. This reply is not accepted in view of para 29 of SA 705 which states that:

“Unless required by law or regulation, when the auditor disclaims an opinion on the financial statements, the auditor’s report shall not include a Key Audit Matters section in accordance with SA 701 or an Other Information section in accordance with SA 720 (Revised). “36 ( emphasis added).

The Auditors had given Disclaimer of Opinion in the Independent Auditor’s Reports in respect of four matters in SFS and nine matters in CFS, and also included Key Audit Matters section in the Independent Auditor’s Reports in respect of two matters in SFS and eight matters in CFS. This gave a wrong impression to the users of financial statements that financial statements were more credible than these were. In view of the provisions quoted above, the Auditors were prohibited to include KAM paragraphs in the audit reports as they had disclaimed audit opinions.

c. In respect of the charge relating to wrong inclusion of matter in EOM paragraph which were neither presented nor disclosed in the financial statements, the Auditors replied that those EOM paragraphs were included as matter of abundant caution to alert the shareholders about the issues of magnitude that had arisen for consideration and better information. This reply is not accepted in view of para 8 ( a) of SA 706 which states that:

“If the auditor considers it necessary to draw users’ attention to a matter presented or disclosed in the financial statements that, in the auditor’s judgment, is of such importance that it is fundamental to users’ understanding of the financial statements, the auditor shall include an Emphasis of Matter paragraph in the auditor’s report provided: (a) The auditor would not be required to modify the opinion in accordance with SA 705 (Revised) as a result of the matter. ” (Emphasis added).

Para 9 ( c) of SA 706 states “When the auditor includes an Emphasis of Matter paragraph in the auditor’s report, the auditor shall indicate that the auditor’s opinion is not modified in respect of the matter emphasized. ”

The ‘Emphasis of Matter’ sections of the Independent Auditor’s Reports has 4 points in SFS and 11 points in CFS. On EOM section, it is found that following matters were not presented or disclosed in SFS/CFS, therefore EOM paragraph on these issues in the Auditors’ report was not appropriate:

- Independent Auditor’s Report on SFS – Point (a) of EOM section pertains to Rs 3,535 crores recoverable from MACEL and point (c) of EOM section pertains to a notice received from Registrar of Companies Karnataka.

- Independent Auditor’s Report on CFS – Point (1) of EOM section pertains a notice received from Registrar of Companies Karnataka.

Further in respect of both the audit reports (SFS & CFS), the auditors did not indicate that the audit opinions were not modified in respect of the matters emphasized.

d) In respect of the charge relating to wrong mentioning of the pares “we have audited …. ” in the audit report despite giving Disclaimer of Opinion, the Auditors replied that there is no violation of the spirit and object of SA 705 as no reasonable reading of the audit report would lend itself to the understanding that the auditor had obtained SAAE in relation to the matters disclaimed. This reply is not accepted in view of para 19 (c) of SA 705 which states:

“When the auditor disclaims an opinion due to an inability to obtain sufficient appropriate audit evidence, the auditor shall amend the statement required by paragraph 24(b) of SA 700 (Revised), which indicates that the financial statements have been audited, to state that the auditor was engaged to audit the financial statements. ” (Emphasis applied).

The Auditors had given Disclaimer of Opinions on SFS and CFS, thus they were required to report that they were engaged to audit the financial statements. However, they had indicated in the audit reports that “We have audited the standalone financial statements. “. “We have audited the consolidated financial statements……………….. ” in audit report for SFS and CFS respectively. Thus, their audit reports are contradictory as the phrase “we have audited” gives the impression that they had performed the audit whereas in Disclaimer of Opinion section of the audit reports, they had reported that “we are unable to obtain sufficient appropriate audit evidence …. “. It is important to understand that Audit cannot be performed without obtaining Sufficient Appropriate Audit Evidence.

45. From the above, it is proved that the Auditors did not exercise due diligence and were negligent in preparing the Independent Auditor’s Reports and violated para 19 (c), 28 & 29 of SA 705, and para 8 (a) and 9 (c) of SA 706.

V. Lapses in the Engagement Quality Control Review (This matter pertains to SFS as well as CFS)

46. The Firm, EP and EQCR were charged with violation of paras 60 to 73 of SQC l and paras 19 to 21 of SA 220 as there is no record in the Audit Files that the EQCR performed an engagement quality control review providing an objective evaluation of the significant judgments made by the engagement team and the conclusions reached in formulating the report in respect of charges mentioned at points I to IV above.

47. Para 60 to 73 of SQC 1 provides detailed prescription regarding establishing policies and procedures about Engagement Quality Control Review; Nature, Timing and Extent of the Engagement Quality Control Review; and Documentation of the Engagement Quality Control Review. Further, paras 19 to 21 of SA 220 provides prescriptions about the responsibilities of EP and EQCR regarding engagement quality control review.

48. It may be noted that the EQCR did not give specific reply to the charges mentioned at points I to IV above. However, while denying this charge, the Firm, the EP and the EQCR have stated that the approach of the Firm towards EQCR as mentioned in their quality control manual was complied with and EQCR had gone through the relevant working papers and discussed with the EP to arrive at the appropriateness of the conclusions.

49. This reply is not accepted as the violations and non-compliances with the Act and SAs, as proved in this Order, had not been pointed out by the EQCR. The EQCR is bound to perform an objective evaluation of the significant judgments made by the engagement team, and the conclusions reached in formulating the auditor’s report. However, the same is not done in this case. This proves that the EQCR failed to highlight the significant non-compliances with the requirements of the Act and SAs.

50. Further, on perusal of the Audit File, no evidence was found of any review work done by EQCR except for one general confirmation signed by EQCR on 27.11.2020 stating that:

a. “The Engagement team for the above audit has properly evaluated the firms independence for this audit;

b. Significant risks were identified and there were proper responses to the same;

c. Engagement team’s judgement of materiality and risks were adequate;

d. No differences of opinion in the engagement team during the audit in respect of important matters are noticed,·

e. No material misstatements were identified,·

f. Matters identifies as significant audit findings were communicated to the management;

g. Adequate documentation support are available for the conclusions reached; and

h. The report issued appears to be appropriate based on the conclusions. “

51. The above are general statements made by the EQCR without specifying, what was reviewed; when it reviewed; which were the significant matters; which were identified risks and how the risks were responded; what was materiality level and what were the significant findings. The work if done, by the EQCR is not evident here. This certificate by the EQCR appears to be a mere formality to show compliance with SAs.

52. Furthermore, this certificate was signed on 11.2020 after signing of the Audit Report on 25.11.2020. This is a clear violation of para 19( c) of SA 220 which provides that the auditor will not date the audit report until the completion of engagement quality control review. Para 61 of the SQC 1 states that the firm’s policies and procedures should require the completion of the engagement quality control review before the report is issued. To this charge, the Auditors and EQCR replied that the audit report was signed after the EQCR had reviewed the working papers remotely, however, due to the prevalence of covid in his family, his signature was obtained on 27.11.2020.

53. NFRA asked the auditors to provide evidence of remote working, to which they responded on 4th June 2024 and provided a medical certificate according to which EQCR and his wife were COVID infected during this period. This part of the reply is also not accepted as there is no evidence that EQCR did the work or completed his review before issue of audit report i.e. even email confirmation from EQCR is not available. Thus, there is no evidence of any work done by the EQCR, the only document relied upon, is dated after the date on which the Audit report was signed. This proves that the audit report was issued without completion of EQCR review. This has posed a significant challenge for the audit process. The primary concern is that this discrepancy in timing has raised questions about the reliability of the audit. The review by EQCR must be completed before the issuance of the audit report to ensure that any issues identified are addressed promptly and that the final audit opinion reflects the highest standards of quality and accuracy. In this case, the EQCR certificate is delayed and therefore, raises questions on credibility of the audit as to whether the audit was conducted in full accordance with professional standards. Para 19 of the SA 220 states that the EP shall not date the auditor’s report until the completion of the engagement quality control review. It was essential for the Firm also to establish robust procedures that ensure the timely completion of the review by the EQCR, thereby reinforcing the reliability of the audit outcomes and maintaining stakeholder confidence.

54 From the above, it is proved that the Firm violated paragraphs 60 to 73 of SQC 1 and Firm, EP and EQCR violated paragraphs 19 to 21 of SA 220.

D. OMISSIONS AND COMMISSIONS BY THE AUDIT FIRM

55. Mis Venkatesh & Co. was appointed as statutory auditor of CDEL vide letter dated 03.08.2020. The powers and duties of the statutory auditors have been prescribed in Section 143 of the Act. The duties include conducting the statutory audit and making a audit report thereon and presenting to the shareholders of the company after taking into account the provisions of the Act, the accounting and auditing standards (subsection 2); stating in her/his report and expressing opinion on matters listed in subsection 3; stating the reasons, if any, the matters required to be included in the audit report under this section is answered in the negative or with a qualification (subsection 4); complying with the auditing standards (subsection 9); and reporting to the Central Government matters which he believes involve the offence of fraud (subsection 12). The Independent Auditors Re1 orts were issued on 25.11.2020 on behalf of Mis Venkatesh & Co. Therefore, the Firm is responsible for all the misconducts committed by the EP and the EOCR.

56. The Firm denied this charge and stated that the entire statutory audit was conducted properly which makes it clear that the quality control systems, policies and procedures were in proper order.

57. We do not agree with the contention of the Firm in this regard. Mis Venkatesh & Co. is the legal entity appointed under Section 139 of the Act as the auditor of CDEL. Hence the report issued by the legal entity, signed by EP, is the primary responsibility of the legal entity issuing the report under the Act. We have proved the shortcomings in the Audit Report in the previous sections of this Order. Hence, apart from the individuals delegated by the Firm to carry out this audit, the Firm (as the appointed statutory auditor has the primary responsibility) is also answerable for its report issued under the Act, as further explained in the following paragraphs.

58. Paragraph 2 of SA 220 stipulates that Quality control systems, policies and procedures are the responsibility of the audit firm. Under SQC 1, the firm has an obligation to establish and maintain a system of quality control to provide it with reasonable assurance that:

a. The firm and its personnel comply with professional standards and regulatory and legal requirements; and

b. The reports issued by the firm or engagement partners are appropriate in the circumstances.

- SQC 1 establishes standards and provides f:,ruidance regarding a firm’s responsibilities for its system of quality control for audits and reviews of historical financial information, and for other assurance and related service engagements. Paragraph 5 of SQC 1 says that the SQC l applies to all firms.

59. The requirements of Sub-Sections 9 and l O of Section 143 of the Act; and SQC-1 and SAs, which are subordinate legislations, lay down the following in clear terms:

a. Responsibility for the overall quality of all the audit engagements, by ensuring that the firm’s personnel comply with applicable laws, SAs and ethical requirements and issues reports appropriate to the situation, rests with the firm.

b. Within the above framework, the individual engagement partners are personally responsible for the quality of specific engagements to which they are assigned by the firm as per its policies.

6. When a firm is appointed as an auditor under Section 139, all the responsibilities cast under the Act are primarily on the firm. As mandated by Section 132, the responsibility of overseeing the quality of service of the professions associated with ensuring compliance with auditing standards rests with NFRA. Monitoring and enforcing compliance with standards of auditing (SA) is another statutory duty cast on NFRA.

61. Section 132 (4) of the Act empowers NFRA to investigate the matters of professional or other misconduct committed by any member or firm of chartered accountants, registered under the Chartered Accountants Act, 1949. Violation of the Act, SAs or SQC 1 are professional misconduct, as envisaged by the Act.

62. Thus, after a detailed examination of facts and circumstances, we observe that the failure in this audit engagement was due to violations of SAs, and the Act. Hence the role of the Audit Firm, whose responsibilities are mandated by the Act, is equally important as that of EP and EQCR Partners, whose responsibilities are delineated in the SAs and SQC -1. Given the fact that the Audit Firm is the legal body appointed as the auditor and EP mandatorily takes responsibility for the individual audits subject to firm-level supervision, both have joint and several responsibilities for the Audit. Section 132 (4) of the Act emanates from this basic premise. However, there is not adequate evidence of effective supervision and oversight by Mis Venkatesh & Co. Providing the ET with a quality policy and tools are not good enough to establish effective supervision as envisaged in SQC-1. Had the Audit Firm discharged its supervisory responsibilities timely and effectively such major lapses in the audit could have been avoided. Therefore, Mis Venkatesh & Co. is responsible for the misconducts committed by the EP and EQCR.

63. Due to these fraudulent transactions the consolidated financial statements of CDEL were grossly misstated. The Auditors in audit reports issued by the Audit Firm had disclaimed the opinion. Their contention about disclaiming the audit opinion is not logical as an auditor is required to comply with Laws and auditing standards even ifhe disclaims his opinion. Further, the Auditors were required to comply with section 143(12) of the Act and CARO even in case of Disclaimer of Opinion. Had the Auditors properly discussed the audit procedures with the component auditors in relation to the significant fraud risks, advised them accordingly, and exercised due professional skepticism throughout the audit, (as required by SA 200), they could have identified and reported fraud in this case. However, despite having information about fraudulent transactions, the Auditors did not evaluate fraud risk. This negligent approach contradicts the basic objectives of an audit as outlined in Section 143 of the Act and SA 200.

The lack of professional skepticism in challenging the management about clearly visible fraud is not expected from an auditor of a listed company. Such omissions and commissions by an experienced audit firm cannot be taken lightly, as these are detrimental to the public interest.