Case Law Details

Experion Hospitality Pvt Ltd. Vs ITO (Delhi High Court)

Delhi High Court held that once the nature and source of receipts have been satisfactorily explained/proved and AO has not contradicted the explanation/information given by the assessee, there lies no cause for initiating the reassessment action. Accordingly, reassessment proceedings u/s. 148 quashed.

Facts- The present Writ Petitions under Article 226/227 of the Constitution of India are directed against separate notices issued by the respondents under Section 148 of the Income Tax Act, 1961 for the Assessment Years 2008-09 and 2011-12 and proceedings initiated pursuant thereto, including orders passed by the respondent, dismissing the objections filed by the petitioner. The grounds for reopening the assessment in these cases are result of the very same investigation and enquiry carried out by the DIT (Intell. & Cr. Inv.).

Conclusion- Held that the impugned reassessment proceedings had been initiated primarily for the reason that Gold Singapore does not appear to be carrying out any business activities in Singapore and has been floated to act as a conduit for further investments in Indian companies, but in the assessment order dated 22.04.2021, the Assessing Officer has accepted the transaction of share application money/share capital received from Gold Singapore without any addition in that regard and also accepted the status of the holding company i.e. Gold Singapore. The identity and creditworthiness of Gold Singapore and the genuineness of the transaction has been accepted by the Department while framing assessments for AY 2012-13, 2015-16 and 2020-2021. The transaction of investment of share capital in the petitioner company has been duly examined in subsequent assessment years and accepted in completed assessments/reassessments under Section 143(3) of the Act. Once the nature and source of receipts have been satisfactorily explained/proved and AO has not contradicted the explanation/information given by the assessee, there lies no cause for initiating the reassessment action for the impugned AYs 2008-09 & 2011-12.

FULL TEXT OF THE JUDGMENT/ORDER OF DELHI HIGH COURT

1. The present Writ Petitions under Article 226/227 of the Constitution of India are directed against separate notices issued by the respondents under Section 148 of the Income Tax Act, 1961 [“the Act”] for the Assessment Years [“AY”] 2008-09 and 2011-12 and proceedings initiated pursuant thereto, including orders passed by the respondent, dismissing the objections filed by the petitioner. The grounds for reopening the assessment in these cases are result of the very same investigation and enquiry carried out by the DIT (Intell. & Cr. Inv.). The reasons recorded for reopening the assessment in the batch of writ petitions are also similar except for certain distinguishing facts. The grounds for challenge are also more or less similar and therefore it is considered appropriate to dispose of all the five petitions by way of a common judgment.

2. For the purpose of the disposal of the present petition, the facts in WP(C) 10542/2015 are being noted extensively. The essential differences are also noted separately.

WP(C) 10542/2015 (Experion Hospitality Pvt. Ltd. Vs. Income Tax Officer & Ors.)

3. Petitioner is a private limited company engaged in the business of real estate development. Petitioner filed return of income declaring loss of Rs. 9,91,81,724/- for the AY 2008-09. The return of income was accepted under Section 143(1) of the Act.

4. The Assessing Officer [“AO”] after scrutiny, passed the Assessment Order under Section 143(3) without making any addition/ disallowance to the returned income.

5. Notice dated 31.03.2015 was issued by respondent No. 1 under Section 148 of the Act, proposing to assess the income of the petitioner for the aforesaid AY. Petitioner filed reply dated 27.04.2015 stating that the return filed on 30.09.2008 under Section 139(1) for the AY 2008-09 be considered as return filed in response to the above notice issued under Section 148 and also made a specific request for providing the reasons to believe that income chargeable to tax for the said AY had escaped assessment within the meaning of Section 147 of the Act.

6. Respondent No. 1, acceding to the request made by the petitioner, supplied the copies of the reasons recorded along with notice dated 17.09.2015 issued under Section 143(2) of the Act, stating that M/s. Gold Hotels & Resort Pte. Ltd. referred as Gold Singapore has made an investment of Rs. 39.271 crores in the petitioner’s company and this income has escaped assessment.

7. Petitioner filed objections to the initiation of the impugned reassessment proceedings which were dismissed on 23.10.2015 by respondent No. 1.

WP(C) 10543/2015 M/s. Experion Developers Pvt. Ltd. Vs. Income Tax Officer & Anr.

8. Petitioner M/s. Experion Developers Pvt. Ltd. [“EDPL”] (formerly known as Gold Developers Pvt. Ltd.), also a private limited company, engaged in the business of real estate development, filed return of income declaring loss of Rs. 88,70,133/- for the AY 2008-09 and the return of income was accepted under Section 143(1) of the Act.

9. Respondent No. 1 issued the impugned notice dated 31.03.2015 under Section 148 of the Act, proposing to reassess the income of the petitioner for the AY 2008-09. On the request of the petitioner, respondent No. 1 supplied the copy of reasons along with notice dated 17.09.2015 issued under Section 143(2) of the Act, stating that M/s. Gold Hotels & Resort Pte. Ltd. referred as Gold Singapore has made an investment of Rs. 142.422 crores in the petitioner’s company and which amount has escaped assessment.

10. Objections to the initiation of the impugned reassessment proceedings filed by EDPL were dismissed vide order dated 23.10.2015.

WP(C) 11140/2015 (M/s. Experion Developers Pvt. Ltd. Vs. Assistant Commissioner of Income Tax & Ors.

11. Petitioner M/s. Experion Developers Pvt. Ltd. [“EDPL”] is the successor-in-interest of erstwhile M/s. Experion Developers (International) Pvt. Ltd. [“EDIPL”] has challenged the notice under Section 148 of the Act dated 31.03.2015 for the AY 2008-09.

12. Gold Developers Pvt. Ltd. (International) Pvt. Ltd. filed return of income on 30.09.2008 declaring income of Rs. 50,17,805/-, which was accepted under Section 143(1) of the Act. This Court approved the scheme of amalgamation of EDIPL with petitioner EDPL w.e.f. 01.04.2012.

13. Notice under Section 148 of the Act dated 31.03.2015 was issued in the name of EDIPL, proposing to reassess the income for AY 200809.

14. Respondent No. 1 supplied the copies of reasons along with notice issued under Section 143(2) of the Act, stating that M/s. Gold Hotels & Resort Pte. Ltd. has made an investment of Rs. 409.581 crores in EDIPL, which income had escaped assessment.

15. Objections filed by the petitioner were dismissed by the respondent vide order dated 28.10.2015.

WP(C) 10288/2018 (Experion Developers Pvt. Ltd. [Successor-in-interest of erstwhile Experion Developers (International) Pvt. Ltd.] Vs. Assistant Commissioner of Income Tax Circle 8 & Ors.

16. In this matter, petitioner Experion Developers (International) Pvt. Ltd. [“EDIPL”] filed return of income on 29.09.2011 for the AY 201112, declaring loss of Rs. 95,748/-, which stood accepted under Section 143(1) of the Act.

17. Pursuant to the scheme of amalgamation approved by this Court vide order dated 20.12.2012, EDIPL amalgamated with EDPL w.e.f. 01.04.2012.

18. The original assessment of EDPL for AY 2011-12 was completed vide order dated 30.05.2014 passed under Section 143(3) of the Act.

19. Respondent No. 1 issued notice under Section 148 of the Act dated 31.03.2018 for the aforesaid AY.

20. The reasons for initiating the reassessment was that M/s. Gold Hotels & Resort Pte. Ltd. had made an investment of Rs. 31.834 crores in the assessee company and which income had escaped assessment.

21. The objections filed by the petitioner were rejected vide order dated 28.08.2018.

WP(C) 10324/2018 (Experion Hospitality Pvt. Ltd. (earlier known as Gold Resorts & Hotels Pvt. Ltd. Vs. Assistant Commissioner of Income Tax & Ors.

22. Petitioner Experion Hospitality Pvt. Ltd. (earlier known as Gold Resorts & Hotels Pvt. Ltd.) filed a return of income for the AY 201112, declaring the loss of Rs. 1,68,72,208/-. Notice under Section 142(1) of the Act was issued by respondent No. 2, calling for various details of the petitioner.

23. Petitioner submitted details of the share application money received and shares issued during the AY 2011-12 and also informed that the funds were received from Gold Singapore towards Share application Money.

24. Assessment Order under Section 143(3) of the Act was passed, thereby, reducing the loss to Rs. 71,67,587/-.

25. Respondent No. 1 issued a notice under Section 148 of the Act, proposing to reassess the income of the petitioner for the AY 2011-12. The reasons recorded for reassessment included the information received from DIT (Intell. & Cr. Inv.) regarding funds received by assessee from foreign entities. It also included the report from the First Secretary (Economic) in High Commission of India at Singapore vide letter dated 31.10.2011 stating that an entity M/s. Gold Hotels & Resort Pte. Ltd. has made large investments in Indian entity EHPL and thus there were reasons to believe that an amount at least Rs. 2.327 crores has escaped assessment for the AY 2011-12.

26. The objections filed by the petitioner were dismissed vide order dated 28.08.2011.

Reasons for Reopening

27. The reasons recorded for reopening the assessment in WP(C) 10542/2015 are reproduced herein below:-

“Reason for reopening or assessment u/s 147of the Act in the case of M/s. Experion Hospitality Pvt. Ltd for A.Y 2008-09. PAN – AACCG5418P.

Information has been received from DIT (Intell. & Cr. Inv.), New Delhi regarding funds received by the assessee from foreign entities. According to report in commercial intelligence received by Jt. Secy. (FT&TR)-II, CBDT from The First Secretary (Economic) in High Commission of India, at Singapore, vide letter dated 31.10.2011, an entity M/s Gold Hotels & Resort Pte. Ltd., a Singapore based company, had made large investments in Indian entity namely, M/s. Experion Hospitality Pvt. Ltd. (formerly known as Gold Resorts and Hotels Pvt. Ltd.).

According to the report, it was observed that :-

1. During the year the investing company M/s Gold Hotels & Resort Pte. Ltd., hereinafter referred as Gold Singapore has made an investment of Rs. 39.271 crores in the assessee company.

2. Gold Singapore is owned by one share holder M/s Gemwood Invest Holdings Limited having address in British Virgin Island.

3. The Directors of Gold Singapore are

| Name | Nationality | Address |

| Arvind Tiku | Indian National | 329, River Valley Road # 25-02, Yong Ann Park, Singapore 238361 |

| Yap Chee Keong Michael |

Singapore Citizen | 77 Marine Drive # 9-48 Singapore 440077 |

4. Gold Singapore had not filed the annual accounts in Singapore and its business premises consisted of just one room which was found closed most of the times.

5. It is possible that the amounts may have been shown as credits/loans raised from other countries mostly tax heavens to form a circuitous route.

On the basis of enquiries conducted by DIT(Intell. & Cr. Inv.), New Delhi, the observations are as follows:-

1. The movement in share capital in Gold Singapore shows that the funding came from Darley Investment Service Inc. (Darley) and Merix International Ventures Limited through a complex series of financial arrangements involving many entities finally to M/s Gemwood Invest Holdings Ltd.

2. The assessee maintained bank account with ING Vysya Bank, Delhi in which substantial remittances had been received.

3. Arvind Tikoo the Director and the main person behind the group was evasive in most of his replies, on the plea that he is an NRI, his PAN is AONPT3527L and had not filed any return of income in India.

4. A close look at the statements reveal that most of the companies in the list remitting funds to the Indian Companies on behalf of Gold Singapore are located in different Jurisdictions mostly tax heavens such as British Virgin Island, Dutch Antilles etc.

In view of the report received, the Singapore Company (Gold Singapore)apparently does not appear to be carrying out any regular business activities in Singapore and has been floated to act as a conduit to funnel investments into Indian companies. A series of transactions have been undertaken through a complex legal arrangements among entities spread across various jurisdictions to fund investments made in India. The origin of fund is from companies located in tax heavens with dubious antecedents.

As per data on ITD and as verified by TA/ Sr. TA the case was assessed u/s143(3) of the Act for the A.Y 2008-09. The above report/information was not in the possession of Assessing Officer nor disclosed by the assesse during the assessment proceedings.

In this case four years has elapsed but the period in which transaction has taken place is less than six years and income chargeable to tax which is believed to have escaped assessment is above Rs. 1 lac. Since the assessment was completed u/s 143(3) sanction of Ld. Pr. CIT-3, New Delhi is solicited u/s 151 (1) of the IT Act, 1961 for issuing of notice u/s 147/148 of the Act.

Therefore, I have reasons to believe that to the income to the extent of Rs. 39.271 crores has escaped assessment for the A.Y 2008-09, on account of failure on the part of the assessee to fully and truly disclose all necessary facts necessary for assessment.”

Submissions:

28. Learned Standing Counsel, representing the Revenue, has submitted that the Department had initiated the reassessment proceedings for AY 2012-13 on the same reasons and that the challenge before the High Court by way of writ petition vide WP(C) 11302/2019, and WP(C) 11303/2019 [2020 SCC OnLine Del 2588] was dismissed by the Coordinate Bench of this Court vide judgment dated 13.02.2020 and the Special Leave Petition preferred against the said judgment was also dismissed by the Supreme Court vide order dated 20.08.2020. It has thus been submitted that the present batch of writ petitions challenging the initiation of reassessment action on similar reasons are also therefore liable to be rejected.

Additional Facts & Submissions:

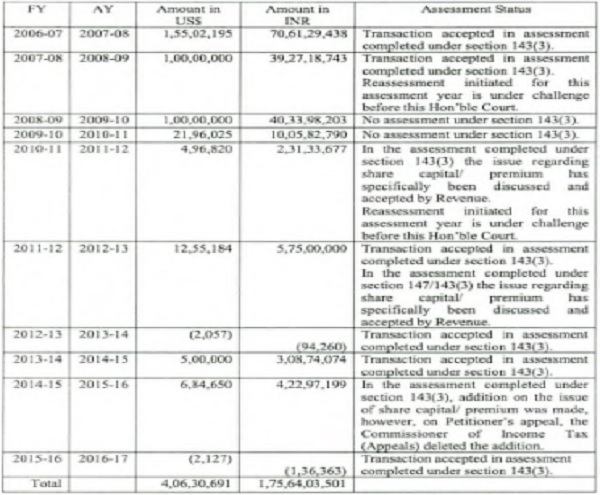

29. During the pendency of the petitions, petitioners placed on record certain additional facts by filing an additional affidavit. Petitioners presented the status of assessments conducted by the department in subsequent assessment years to show that the identity and creditworthiness of Gold Singapore and genuineness of transactions of share application money/capital has been examined and accepted by the Department without any addition/adverse remarks. The status of assessments noted in the additional affidavit is extracted below:-

30. Petitioner made significant disclosures in the additional affidavit. However, despite affording opportunity, respondent chose not to file reply to the facts placed on record in the additional affidavit.

31. Learned counsel for petitioner, while relying upon the additional affidavit, submits that capital infusions from the same party had been made year after year and subsequent years and they all had been accepted by the Revenue and have attained finality and even in one case, which went up to the Supreme Court and where the Supreme Court upheld the reassessment proceedings, the subsequent reassessment order deletes the addition made in respect of capital infusion. Hence, in view of the admitted position, the reason for reassessment in the impugned assessment years does not survive.

32. Admittedly, petitioners had challenged the notices under Section 148 of the Act for the AY 2012-13 in WP(C) 11302/2019 and WP(C) 11303/2019 like in this case and the grounds for reopening the assessment in both the writ petitions were a result of an investigation and enquiry conducted by DIT (Intell. & Cr. Inv.) New Delhi. The reasons recorded for reopening the assessment in WP(C) 11303/2019 as noted in Para No. 7 of the judgment are as under:-

“Reasons for reopening

7. Along with the notice issued under Section 148 of the Act, the respondent also furnished copy of the recorded reasons which disclose that an information has been received from DIT (Intell. & Cr. Inv.), New Delhi on 30.03.2015 regarding funds received by the assessee from a foreign entity. The DIT (Intell. & Cr. Inv.), New Delhi has carried out the investigation and detailed inquiry regarding the funds received by the Experion Group Company in India from it’s parent company which did not have sufficient funds of its own to make such investments. The recorded reasons for reopening the assessment in W.P.(C) – 11303/2019 are as under;

1. Brief Details

Inv), New, Delhi on 30.03.2015 regarding funds received by the assessee from foreign entities The DIT has carried out investigation and detailed enquiry regarding funds received by, Experion Group companies in India, From their parent company, which did not have sufficient funds of its own to make such investments. These inquiries were conducted after commercial intelligence was received by Jt. secy. (Ft & TR)- II, CBDT from The First Secretary (Economic) in High commission of India, at Singapore, vide letter dated 31/10/2011, that an entity M/s Gold Hotels & Resort Pte. Ltd, a Singapore based company, had made large investments in Indian entity namely, M/s. Experion Developers Pvt. Ltd. and M/s. Experion Developers International Pvt. Ltd. (formerly known as Gold Developers International .Pvt. Ltd.)(Now merged with M/s. Experion Developers Pvt. Ltd.)

According to the report, it was observed that:

1. During the year under consideration, the company M/s Gold Hotels & Resort Pte. Ltd , hereinafter referred as Gold Singapore has made an alleged investment of Rs. 36.910 crores in the assessee company EDPL and Rs. 183 crores in the company that has amalgamated into this company namely, EDIPL.

2. As per the information, Gold Singapore is owned by only one share holder M/s Gemwood lnvest Holdings Ltd. having address in British Virgin Island.

3. The Directors of Gold Singapore include the following:

| Name | Nationality | Address |

| Arvind Tiku | Indian National | 329, River Valley Road # 25-02, Yong Ann Park, Singapore 238361 |

| Yap Chee Keong Michael | Singapore Citizen | 77 Marine Drive # 9-48 Singapore 440077 |

4. The equity of the investing company i.e. M/s Gold Hotels & Resort Pte Ltd., Singapore is around 50,00,000 USD as against the investment made by it of about 180 Million USD over many years, in Indian companies namely Gold Developers Pvt. Ltd (now known as M/s. Experion Developers Pvt. Ltd), Gold Resorts & Hotels Pvt. Ltd (Now known as M/s. Experion Hospitality Pvt. Ltd) and Gold Developers International Ltd (Earlier known as M/s. Experion Developers International Pvt Ltd & Now merged with M/s Experion Developers Pvt Ltd). The equity of the company is very small compared to the amount invested.

5. Gold Singapore does not have sufficient funds or creditworthiness to make such investments and its business premises consisted of just one room which vas found closed most of the times.

6. It is stated in the information that the amounts may have been shown as credits. / loans/ share application money raised from other countries mostly tax heavens to form a circuitous route, and on analysis by the Assessing officer, it is actually found that over a period of time, the credits into the books of accounts of the investing entity have been made as share application money or advances and the fact that the share application money remains outstanding over a long time itself is not how a genuine investment is normally made, because shares are normally issued after the application is made, or the amount is refunded back.

On the basis of enquiries conducted by DIT (Intell. & Cr. Inv.), New Delhi, the observations are as follows:-

1. The movement in share capital in Gold Singapore shows that in the initial years, the funding came from Darley Investment Service Inc, (Darley) and Merix International Ventures Limited. Darley and Merix. Subsequently transferred their share in Gold Singapore through a complex series of financial arrangments involving many entities finally to M/s. Gemwood Invest Holdings Ltd.

2. When the Directorate issued summons to Sh. Arvind Tikoo the Director and the main person behind the group, the reply was evasive in most of his replies, on the plea that he is an NRI, the foreign assets were not disclosed. His PAN No. is AONPT3527L and he had not filed any return of income in India.

On the analysis of the report received, it can be noted that the Singapore Company (Gold Singapore) apparently does not appear to be carrying out any regular business activities in Singapore and has been floated to act as a conduit to funnel funds into Indian Companies. Therefore, the source of investment into the assessee company (which is wholly owned subsidiaries of Gold Singapore) raises serious doubts and suspicion on the genuineness of these investments. A series of transactions have been undertaken through a complex legal arrangements among entities spread across various jurisdictions to fund investments made in India. The origin of fund in the hands of companies located in tax heavens with dubious antecedents and background of shareholders /promoters needs to be further investigated. Moreover, the assessee company is the beneficiary of these credits which have been made in their books of accounts.

From the above detailed and specific information, pertaining to the assessee company, and independent examination of the entire material available on the record and application of mind, I have reason to believe that an amount at least of Rs.31.834 Crores has escaped assessment in case the of M/s. Experion Developers Pvt. Ltd. (formerly known as Gold Developers Private Ltd) and amount of Rs.183 crores has escaped assessment in case the of M/s. Experion Developers International Pvt. Ltd. (formerly known as Gold Developers International Private Ltd) (Now merged with M/s. Experion Developers Pvt. Ltd.) for the AY 2012-13 within the meaning of section 147/148 of Income Tax Act, 1961. This information is new material which has been brought on record. As per data on ITD the case of the assessee company was assessed u/s 143(3) of the Act for the A.Y. 2012-13. Since the then assessing officer was not aware of the fact that the investments into the assessee companies has been made from an entity which does not have funds of its own to invest such huge amounts, and that the investing entity has only been used as a conduit to route funds through complex transactions via low tax jurisdiction like Dutch Antilles, British Virgin Islands, Luxemburg etc., the income has escaped assessment due to the failure of the assessee to disclose fully and truly all the material facts necessary for its assessment. Thus, this specific condition for reopening is hereby fulfilled in the instant has failed to disclose such material facts on its own earlier. The case is square & covered under provisions of section 147 of income tax Act, 1961. It is also stated that the reassessment proceedings are proposed to be initiated in the case of Experion Developers Private Limited, for funds received by it as an independent entity as well as the successor in interest of amalgamated company Experion Developers International Private Limited, which in AY 2012-13 was a separate entity.

In this case, since more than four years have elapsed from the end of the assessment year under consideration. Hence, necessary sanction to issue notice under section 148 of the act is being obtained separately from Pr. Commissioner of Income Tax, Delhi03, New Delhi as per the provisions of section 151 of the Act.

(Emphasis supplied).”

33. As we see the reasons for initiating reassessment action for the AY 2008-09, 2011-12 and 2012-13, they are almost similar. The challenge to the notice under Section 148 of the Act for AY 2012-13 did not fructify, inasmuch as, the writ petition was dismissed by the Coordinate Bench of this Court vide judgment dated 13.02.2020. However, thereafter, assessment order dated 22.04.2021 was framed for the AY 2012-13, which is extracted below:-

“ASSESSMENT ORDER

The assessee has filed its original return of income for A.Y. 2012-13 on 29.09.2012 declaring total loss of Rs. 3,93,18,429/-. The case of the assessee was selected under scrutiny and assessment was completed u/s 143(3) of the IT Act on 19.03.2015 at an income of Rs.23,60,539/- after making addition of Rs.4,16,78,968/- on account of disallowance of expenses. During the year assessee was engaged in the business of construction 7 development of projects which includes hotels, resorts, motels, inns, guest house cottage etc.

2. An information was received from DIT(Intelligence & Criminal Investigation), New Delhi regarding fund received by the assessee from foreign entities. As per information during the year under consideration, the foreign Singapore based entity M/s Gold Hotels & Resorts Pte. Ltd. (in short “Gold Singapore”) has made investment of Rs. 5.75 crores in assessee company. In addition to that, the same foreign entity has made investment of Rs.36.910 crores company M/s Experion Developers Pvt. Ltd. (in short “EDPL) and Rs. 183 crores in the company M/s Experion Developers International Pvt. Ltd. (in short “EDIPL”).

As per information, total equity share capital of the investing company i.e Gold Singapore was around 50,00,000 USD as against investment made by it of about 180 million USD over many years in Indian company i.e. M/s Experion Developers Pvt. Ltd.(in short “EDPL”) & M/s Experion Developers International Pvt. Ltd.(in short “EDIPL”). As per report sent by High Commission of India, Singapore, Gold Singapore does not have sufficient funds or creditworthiness to make such investments and secondly, its business premises consisted of just one room which was found closed most of the times.

3. From the above information and on being satisfied that identity & creditworthiness of the foreign entity i.e. Gold Singapore who had invested Rs. 5.75 crores in the both Indian assessee/entities was doubtful and after recording the reason to believe, the case of the assessee is reopened for assessment proceeding u/s 147 of the IT Act, 1961. Accordingly, notice u/s 148 of the IT Act was issued on 31.03.2019 and assessee filed ITR in response of notice u/s 148 of the IT Act, on 26.04.2019, declaring loss of Rs.3,93,18,429/-. Statuary notice u/s 143(2) was issued on 23.10.2019 and duly served upon the assessee through e-proceeding. Thereafter, notice u/s 142(1) of the IT Act was issued on 23.10.2019 & 06.04.2021 through e-proceedings, requesting the assessee to furnish certain details and documents. In compliance to the above assessee has furnished the relevant details/information through e- proceedings and explained its income.

4. During the course of assessment proceedings, the assessee-company was requested to substantiate the identity of the subscriber, genuineness of the transaction and to establish the capacity to subscribe the share capital or creditworthiness of the share subscriber. In compliance to the same, the assessee company has submitted their submission in their support.

4.1 Assessee was requested vide notice u/s 142(1) of the IT Act dated-14.04.2021 to explain the following:-

(i). As per report sent by High Commission of India, dated 31.10.2011, it is revealed during enquiries that M/s Experion Holdings PTE Ltd. (earlier known as Gold Hotels & Resorts PTE Ltd.), consists of just one room which was found closed most of times. In this regard, you are requested to explain as to how they are carrying out their business without any office or manpower. You are further requested to explain as to why M/s Experion Holdings PTE Ltd. should not be treated as bogus or shell entity.

4.1 In respect of query raised vide notice u/s 142(1) dated-14.04.2021, they explained that the office of the foreign entity has been shifted from earlier premises situated at 50, Raffeles Place, #15-05/06, Singapore Land Tower, Singapore-048623 of M/s Gold Hotels & Resorts Pte. Ltd., to 3, Church Street, # 16-04/05, Samsung Hub, Singapore-049483. In support of their claim, they have submitted a copy of lease agreement with lessee & the copy of submission made before the Accounting and Corporate Regulatory Authority(ACRA), Singapore in respect of change of address to 3, Church Street, # 16-04/05, Samsung Hub, Singapore-049483.

5. During the assessment proceeding, a reference has been made to Singapore Tax Authority through FT & TR vide letter no. Pr.CIT-3/FT&TR/2019-20/2155 dated 23.12.2019, to verify the creditworthiness of subscriber of equity share capital raised by the assessee-company from M/s Experion Holding PTE Ltd. situated at 3, Church Street, Singapore. The reply from the Singapore Tax Authority is still awaited.

6. In view of the above submissions and the details filed by the assessee-company, the income assessed u/s 143(3) of the IT Act is accepted as under:-

| I | Return loss as per original return u/s 139 of the IT Act dated-29.09.2012. | (Rs. 3,93,18,429/-) | |

| II | All adjustment made in earlier assessments u/s 143(3) of the IT Act. | Rs.4,16,78,968/ | |

| III | Last Assessed Income(I+II) | Rs.23,60,539/- | |

| IV | Addition/disallowances: | NIL | |

| V | Adjustment | NIL | |

| VI | Assessed income u/s 147of the I.T. Act, 1961 | Rs.23,60,539/- |

7. Assessed at Rs.23,60,540/- u/s 147/143(3) of the I.T. Act, 1961. Calculated tax and interest charged as per law. Given credit for prepaid taxes. Copies of the order and demand notice are being issued to the assessee.”

34. Similarly, for the AY 2020-21, Gold Singapore received interest income from the petitioner company and the same was offered to tax in India by Gold Singapore. After due verification, the assessment order dated 28.09.2022 under Section 143(3) of the Act was framed and the returned income of Gold Singapore was accepted by the Department. The assessment order so framed is reproduced below:-

“ASSESSMENT ORDER

M/s Gold Hotels & Resorts PTE Ltd (now known as Experion Holdings PTE Ltd) (hereinafter referred to as ‘the assessee’) has filed its return of income for the concerned Assessment Year on 15.02.2021 declaring taxable income of Rs.61,75,36,840/- which was offered to tax @ 15% under India-Singapore DTAA.

2. The case of the assessee was selected for scrutiny under CASS. Notice u/s 143(2) was served within the statutory time limit. Scrutiny proceedings were carried out through E-assessment.

3. Notices u/s 142(1) with questionnaire were issued during the proceedings and the assessee’s responses to them were duly considered. The assessee is a tax resident of Singapore. It provides financial intermediation services. During the year, the assessee has received interest on Compulsory Convertible Debentures(CCDs) made by it to its Indian Associated Enterprise Experion Developers Private Limited. This income, amounting to Rs. 61,75,36,840/- has been offered to tax at the rate applicable to interest income in Article-11of the India-Singapore tax treaty.

4. After considering the material on record and the replies and information furnished by the assessee, the returned income is accepted. Assessed u/s 143(3) of the Income Tax Act,1961 on total income of Rs. 61,75,36,840/-.

5. Issue copy of the order and demand notice to the assessee, charge interest as per the provisions of the Act. Give credit for prepaid taxes if any.”

35. As regards AY 2015-16, petitioner had received funds from its parent company Gold Singapore in identical manner, as received during AY 2008-09. Vide assessment order dated 30.12.2017, the amount of share premium received by the petitioner from Gold Singapore was added in the hand of the petitioner as taxable under Section 68 of the Act. However, on appeal, the Commissioner of Income Tax (Appeals) deleted the additions made under Section 68 of the Act vide a detailed order dated 09.09.2019.

36. The impugned reassessment proceedings had been initiated primarily for the reason that Gold Singapore does not appear to be carrying out any business activities in Singapore and has been floated to act as a conduit for further investments in Indian companies, but in the assessment order dated 22.04.2021, the Assessing Officer has accepted the transaction of share application money/share capital received from Gold Singapore without any addition in that regard and also accepted the status of the holding company i.e. Gold Singapore. The identity and creditworthiness of Gold Singapore and the genuineness of the transaction has been accepted by the Department while framing assessments for AY 2012-13, 2015-16 and 2020-2021. The transaction of investment of share capital in the petitioner company has been duly examined in subsequent assessment years and accepted in completed assessments/reassessments under Section 143(3) of the Act. Once the nature and source of receipts have been satisfactorily explained/proved and AO has not contradicted the explanation/information given by the assessee, there lies no cause for initiating the reassessment action for the impugned AYs 2008-09 & 2011-12.

37. In view of the aforesaid, we are of the opinion that the reasons for initiation of the impugned assessment proceedings do not survive and therefore the impugned notices issued under Section 148 of the Act and the proceedings initiated pursuant thereto are quashed.

38. Writ petitions accordingly stand disposed of.