Case Law Details

India Opportunity Fund I F.C.R De Regimen Comun Vs DCIT (ITAT Mumbai)

ITAT Mumbai held that capital gain arising out of sale of shares not taxable in the hands of foreign company since holding is less than 10% hence Article 14(4) of DTAA between India and Spain cannot be applied.

Facts- The assessee is a VC Fund Incorporated under the laws of Spain and is tax resident thereof. The assessee is engaged in investing business in sectors such as Internet, communication, technology, engineering, health & clean technologies. The assessee did not have any permanent establishment or any office in India.

The assessee filed the return of income for AY 2021-22 on 15.03.2022 declaring income of Nil. In the computation of income, the assessee has shown Long Germ Capital Gain (LTCG) of Rs. 27,62,12,014/- and a Short Term Capital Loss (STCL) of Rs. 65,80,977/- on sale of shares of IMI Investments Two Ltd. and claimed the same as exempt u/s. 90/91 of the Act and Article-14 of India-Spain DTAA. However, AO brought to tax the net capital gain amounting to Rs. 26,96,31,037/- as LTCG. Being aggrieved, the present appeal is filed.

Conclusion- The value of immovable property as a percentage of total assets of the assessee does not exceed 50% either based on book value or as per the Fair Market Value. Therefore, Article-14(4) of India-Spain DTAA cannot be applied in assessee’s case on this count.

Held that it is an undisputed fact that assessee is holding only 9.65% of the shares indirectly in IMI Investments Two Ltd and therefore it cannot be said that such holding is towards any controlling interest. It is also relevant to mention here that as per UN Model Convention commentary, the provisions of Article 14(4) come into effect to prevent the case of indirect transfer of ownership of immovable property by transfer of shares owning these properties. Considering these facts and the decision of the coordinate bench in our view there is merit in the submission of ld AR that Article 14(4) of DTAA between India and Spain cannot be applied in assessee’s case. In view of these discussions we hold that Article-14(4) of the DTAA between India and Spain cannot be applied in assessee’s case and therefore, the capital gain arising out of transfer of shares of the IMI Investments Two Ltd. cannot be taxed in India. Accordingly, we direct the AO to delete the addition made in this regard.

FULL TEXT OF THE ORDER OF ITAT MUMBAI

This appeal by the assessee is against the final order of assessment passed by the Deputy Commissioner of Income Tax (International Tax), Circle-2(2)(1), Mumbai [in short ‘the AO’] passed under section 143(3) r.w.s. 144C(13) of the Income Tax Act, 1961 (the Act) dated 17.10.2023 for Assessment Year (AY) 2021-22. The assessee raised the following grounds of appeals:

“1. The order passed by the Ld. AO., under sec. 143(3) of the Income-tax Act, 1961 (“the Act”) is bad in law and is based upon incorrect appreciation of facts and the law relevant thereto.

2. The Ld. AO has erred in fact in alleging that the Appellant has failed to counter his findings. The fact is that during the course of assessment proceedings, the Ld AO never shared his reservations mentioned in his speaking order passed under sec. 197 of the Act.

3. The DRP also failed to acknowledge the fact that the speaking order under sec. 197 of the Act (passed in response to the application of Nil / Lower Withholding Tax certificate) was not even shared with the Appellant. Hence, in the absence of any knowledge of the contents of such purported order, it is impossible for the Appellant to address the issues purportedly raised while rejecting the application under sec. 197 of the Act.

4. The Ld. AO has erred in treating the ‘data centre equipment as an immovable property when the same is not an immovable property.

5. The Ld. AO has erred in fact in alleging that the refund had been issued to the Appellant. The fact is that no refund was issued to the Appellant due to absence of a bank account in India.

6. The Ld. AO has not accepted the valuation reports submitted by the Appellant, and at the same time, has not even provided any valuation report of its own (by referring the case to the valuation officer).

7. All the above grounds are without prejudice to each other”

2. The assessee is a VC Fund Incorporated under the laws of Spain and is tax resident thereof. The assessee is engaged in investing business in sectors such as Internet, communication, technology, engineering, health & clean technologies. The assessee did not have any permanent establishment or any office in India. The assessee filed the return of income for AY 2021-22 on 15.03.2022 declaring income of Nil. In the computation of income, the assessee has shown Long Germ Capital Gain (LTCG) of Rs. 27,62,12,014/- and a Short Term Capital Loss (STCL) of Rs. 65,80,977/- on sale of shares of IMI Investments Two Ltd. and claimed the same as exempt under section 90/91 of the Act and Article-14 of India-Spain DTAA. The return was selected for scrutiny and the statutory notices were duly served on the assessee. The Assessing Officer (AO) called on the assessee to furnish details pertaining to LTCG and STCL declared by the assessee in the computation of income. The assessee made a detailed submission before the AO with regard to the capital structure of the assessee and how the capital gain is not taxable in India as per the DTAA between India and Spain. The AO did not accept the submissions of the assessee stating that the assessee has not provided any evidence in support of the claim and how the assessee is entitled for the benefit as per Article-14 of the India-Spain DTAA. The AO while holding so mainly relied on the findings recorded against the application filed by the assessee under section 197 of the Act. Accordingly, the AO brought to tax the net capital gain amounting to Rs. 26,96,31,037/- as LTCG in the hands of the assessee. The reasons for bringing the LTCG to tax in India is that as per Article-14(4) the share of immovable property is more than 50% of the total assets of the assessee company and that any gain from alienation of shares of the company whose property consists principally immovable property, is taxable in India. The assessee raised its objections before the Dispute Resolution Panel (DRP) against the draft assessment order passed by the AO in this regard. Before the DRP, the assessee submitted the valuation report from Jones Lang Lasalle Property Consultant (I) Pvt. Ltd. (JLL) in order to support the claim that the value of immovable property as compared to the overall assets of the company is only 23.99% and therefore Article-14(4) of the DTAA is not applicable in assessee’s case. The DRP did not accept the valuation report submitted by the assessee and held that

“The value adopted by the assessee based on the valuation report for intangibles and immovable properties is unacceptable based on the discussion as above. As the assessee has inflated the value of intangibles substantially attributing huge importance to their revenue earning capacity, the same needs to be discarded for the purpose of ascertaining the proportion of immovable properties in the total assets. Hence the book value of the intangible assets is reasonable and basis the same, the value of immovable properties is more than 50 per cent of the total assets and hence can be considered as principally constituting the total property of the company Nxt Gen Data centre& Cloud Technologies Private Limited. Hence the provisions of Article 14(4) of the India Spain DTAA is attracted and long term capital gains is taxable in India.”

3. The AO passed the final order pursuant to the directions of the DRP in which the LTCG of Rs. 26,96,31,037/- was brought to tax in the hands of the assessee. The assessee is in appeal against the final order of assessment passed by the AO.

4. The ld. Authorized Representative (AR) to begin with drew our attention to the relevant Article No.14 of the DTAA between India and Spain which read as under:

“1. Gains derived by a resident of a Contracting State from the alienation of immovable property, referred to in Article 6, and situated in the other Contracting State may be taxed in that other State.

2. Gains from the alienation of movable property forming part of the business property of a permanent establishment which an enterprise of a Contracting State has in the other Contracting State or of movable property pertaining to a fixed base available to a resident of a Contracting State in the other Contracting State for the purpose of performing independent personal services, including such gains from the alienation of such a permanent establishment (alone or together with the whole enterprise) or of such fixed base, may be taxed in that other State.

3. Gains from the alienation of ships or aircraft operated in international traffic or of movable property pertaining to the operation of such ships or aircraft shall be taxable only in the Contracting State of which the alienator is a resident.

4. Gains from the alienation of shares of the capital stock of a company the property of which consists, directly or indirectly, principally of immovable property situated in a Contracting State may be taxed in that State.

5. Gains for the alienation of shares of the capital stock of a company forming part of a participation of at least 10 per cent in a company which is a resident of a Contracting State may be taxed in that Contracting State.

6. Gains from the alienation of any property other than that mentioned in paragraphs 1, 2, 3, 4 and 5 shall be taxable only in the Contracting State of which the alienator is a resident.”

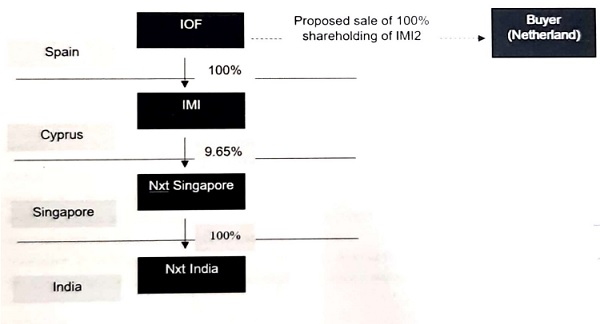

5. The ld. AR further drew our attention to the capital structure of the assessee as tabulated below:

6. The ld. AR submitted that as per the above capital structure the percentage of holding of the ultimate parent company is less than 10% in assessee and therefore, sub-clause-(5) of Article-14 is not applicable in assessee’s case. Further, the shareholding is that of preferential share capital and therefore, the said sub- clause cannot be applied in assessee’s case even otherwise. The ld. AR further submitted that the immovable property held by the assessee is used for the purpose of business and therefore sub-clause-(4) of Article-14 cannot be invoked in assessee’s case. In this regard the ld. AR further submitted that the intention behind sub-clause-(4) of Article-14 is to bring to tax the gain from transfer of immovable property which is indirectly done through sale of shares. The ld. AR also submitted that even otherwise in assessee’s case the value of immovable property is less than 50% and therefore the said property cannot be said to be ‘principally’ situated in India. In this regard, the ld. AR drew our attention to the following table to submit that the valuation of the immovable property is less than 50% even if the valuation adopted by the AO is to be considered.

| Book Value | FMV | Ld. AO’s adj. FMV |

|

| Immovable property | 60.64 | 188.29 | 196.32 |

| Other assets | 208.14 | 208.14 | 208.14 |

| Total assets | 268.78 | 396.43 | 404.16 |

| Immovable as a % of total assets | 22.56 | 47.50 | 48.54 |

| IPs forming part of other assets | 4.91 | 388.58 | Rejected |

| Total assets, factoring-in the FMV IP | 780.1 | ||

| Immovable as a % of total assets | 24.14 |

7. With regard to the valuation of immovable property done by JLL which is rejected by AO/DRP the ld. AR submitted that JLL is a reputed property valuer and has adopted scientific method to value the immovable property of the assessee. Our attention was drawn to the valuation report of JLL (page 23& 24) to submit that JLL has considered various criteria for the purpose of valuing the immovable property and the lower authority are not correcting in rejecting the valuation report of JLL.

8. The ld. Departmental Representative (DR) furnished detailed written submission which is being taken on record. The main contention of the revenue in the written submission is that the valuation report of the immovable property is not reliable and therefore, the contention of the assessee that the value of immovable property is less than 50% cannot be accepted. According, the revenue is contenting the Article-14(4) is clearly applicable in assessee’s case and therefore, the gain arising out of transfer of shares in IMI Investments Two Ltd. is taxable in India in the hands of the assessee.

9. We heard the parties and perused the material on record. During the year under consideration the assessee has transferred the shares in IMI Investments Two Ltd. and claimed the same as exempt under the Act as well as the DTAA between India and Spain. It is noticed from the capital structure extracted in the earlier part of this order that the shareholding is only 9.65% in IMI Investments Two Ltd. and this fact has not been disputed by the revenue. As per Article-14(4) the gains from alienation of shares of the capital stock of a company (the assessee in this case) the property of which consists, directly or indirectly principally of immovable property situated in a contracting state (India) may be taxed in that State (India). Therefore, the revenue is contending that the immovable property owned by the assessee is more than 50% and therefore, the gain arising on the transfer of shares would result in capital gain in India. The revenue in this regard rejected the valuation report submitted by the assessee and also the valuation done with regard to the overall other assets owned by the assessee. However, from the table extracted in the earlier part of this order, we notice that the value of immovable property as a percentage of total assets of the assessee does not exceed 50% either based on book value or as per the Fair Market Value. Therefore, we see merit in the submission of the ld. AR that Article-14(4) of India-Spain DTAA cannot be applied in assessee’s case on this count. Further, we notice that the Co-ordinate Bench of the Tribunal in the case of JCIT Vs. Merrill Lynch Capital Market Espana SA SV (ITA No. 6108/Mum/2018 dated 11.10.2019) has considered the issue of applicability of section Article-14(4) of DTAA between India and Spain and held that

i. Article 14(4) is only an extension of Article 14(1) which deals with the taxability of gains arising on sale of immovable property, to nullify the impact of corporate structures used for ownership of immovable properties.

ii. Interpretation of Article 14(4) must essentially remain confined to the shares effectively leading to control of the company or which gives the right to enjoy the underlying immovable property owned by the company, and such property is what the company principally holds.

iii. In the present case, since the taxpayer held approximately 7% (sold approximately 2%) stake in the companies, the question of holding controlling interest or even significant interest in these companies does not arise.

10. In the given case it is an undisputed fact that assessee is holding only 9.65% of the shares indirectly in IMI Investments Two Ltd and therefore applying the ratio of the above decision it cannot be said that such holding is towards any controlling interest. It is also relevant to mention here that as per UN Model Convention commentary, the provisions of Article 14(4) come into effect to prevent the case of indirect transfer of ownership of immovable property by transfer of shares owning these properties. Considering these facts and the decision of the coordinate bench in our view there is merit in the submission of ld AR that Article 14(4) of DTAA between India and Spain cannot be applied in assessee’s case. In view of these discussions we hold that Article-14(4) of the DTAA between India and Spain cannot be applied in assessee’s case and therefore, the capital gain arising out of transfer of shares of the IMI Investments Two Ltd. cannot be taxed in India. Accordingly, we direct the AO to delete the addition made in this regard.

11. In the result, the appeal of the assessee is allowed.

Order pronounced in the open court on 27-08-2024.