Article explains Who should file GSTR 9 annual return, What is the due date of GSTR-9, Details required in the GSTR-9 form, When NIL GSTR-9 RETURN can be filed and Issue with Figures in GSTR-9.

The Annual return under GST (FORM GSTR-9) is active on the GST portal now.

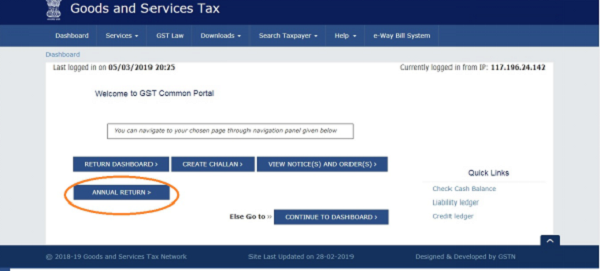

Once you login, you will be able to see the annual return below the return dashboard icon.

You can also see that in Services>Returns>annual return.

Then select the Financial year. (Only FY 17-18 is available now).

Page Contents

Who should file GSTR 9 annual return?

All the registered taxable persons under GST must file GSTR 9 form. However, the following persons are not required to file GSTR 9

- Taxpayers opting Composition scheme as they must file GSTR-9A

- Casual Taxable Person

- Input service distributors

- Non-resident taxable persons

- Persons paying TDS under section 51 of GST Act.

What is the due date of GSTR-9?

GSTR-9 due date is on or before 30th June of the subsequent financial year.

For instance, for FY 2017-18, the due date for filing GSTR 9 is 30th June 2019*.

Details required in the GSTR-9 form?

| Sl no | Parts of the GSTR-9 | Information required |

| 1 | Part-I | Basic details of the taxpayer. This detail will be auto-populated. |

| 2 | Part-II | Details of Outward and Inward supplies declared during the financial year (FY). This detail must be picked up by consolidating summary from all GST returns filed in previous FY. |

| 3 | Part-III | Details of ITC declared in returns filed during the FY. This will be summarised values picked up from all the GST returns filed in previous FY. |

| 4 | Part-IV | Details of tax paid as declared in returns filed during the FY. |

| 5 | Part-V | Particulars of the transactions for the previous FY declared in returns of April to September of current FY or up to the date of filing of annual returns of previous FY whichever is earlier. Usually, the summary of amendment or omission entries belonging to previous FY but reported in Current FY would be segregated and declared here. |

| 6 | Part-VI | Other Information comprising details of: |

| -GST Demands and refunds, | ||

| -HSN wise summary information of the quantity of goods supplied and received with its corresponding Tax details against each HSN code, | ||

| -Late fees payable and paid details and | ||

| -Segregation of inward supplies received from different categories of taxpayers like Composition dealers, deemed supply and goods supplied on approval basis. |

When “NIL” GSTR-9 RETURN can be filed?

- Not made any outward supply (commonly known as sale)

- Not received any inward supplies (commonly known as purchase) of goods/services

- No liability of any kind

- Not claimed any Credit during the Financial Year

- Not received any order creating demand

- Not claimed any refund.

Issue with Figures in GSTR-9

- As we are aware that the GST has not been stabilised as there have been changes in the Rates During the year.

- The issue with reverse Charge Mechanism was applicable from 1st july and later on in October it was suspended.

- The invoice which displays in GSTR-2A & the same bill are not been taken in books or may be taken with full amount in case of expense for which credit has not been claimed. For Example: GST on courier Charges.

- The most Probable issue is the Purchase bills taken in books but same not uploaded by seller as in defaulting in the filling GST Returns. How such credit to be Reconciled with GSTR-9 as Some point the Figures in GSTR-9 is Auto Populated.

Well done dear.

Good Article

Good One.