New Definition of MSME

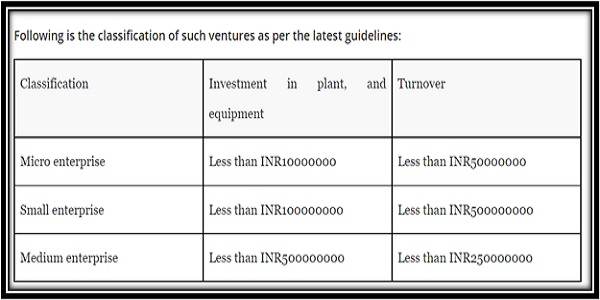

To qualify either as a Micro, Small or Medium Enterprise, your business needs to have an investment amount and annual turnover that is below the minimum threshold for each enterprise.

What Documents Required for Udyam Registration Certificate?

If you wish to register to apply for an MSME Certificate, below mentioned documents you need to collect before initiation. These documents are –

Application form filled with all required personal and business details and passport-sized photographs.

- KYC documents for applicant verification such as a voting card, Aadhar card, driving license, or a utility bill that has your address on it.

- PAN Card for business use.

- Certificate of business establishment (Form INC 20 A for the company).

- Income documents such as an income certificate.

- Blank cheque for Bank details.

- Number of Employees

- Agreement of rent or lease, if applicable.

- Investment in P&M

- Mobile Number and email id of the concerned person

- ITR Statements if applicable

- NIC Code

- Catergory of Individual: SC ST etc.

- Any other necessary documents that the bank may deem important.

After you gather all these documents with you, all you need to do is go to the assigned website and file for the Udyam Registration Certificate.

Benefits of the Udyam Registration Certificate

There are several benefits to having an Udyam Registration Certificate that makes getting it worth your while for your business and enterprise.

These benefits are –

- Facilitates access to loans that have lower interest rates.

- Assists you in getting your business government tenders.

- Helps you get business licenses, business approvals, and account registrations much more easily.

- Compensates you of all the amount that you may have spent on ISO certificates.

- The overall cost of setting up your company or filing for a patent decreases drastically.

- Registered companies under the MSME certificate get various subsidies on tariffs, including benefits in Trademark Regd.

- Your company can get a 15% subsidy if you import fully automatic machinery under your bank loan.

Process of Udyam Registration

Figure 1 Process of Registration

***